- Home

- »

- Consumer F&B

- »

-

U.S. Non-alcoholic Beverages Market Size Report, 2030GVR Report cover

![U.S. Non-alcoholic Beverages Market Size, Share & Trends Report]()

U.S. Non-alcoholic Beverages Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Carbonated Soft Drink, Bottled Water), By Distribution Channel (Food Service, Retail), And Segment Forecasts

- Report ID: GVR-4-68040-200-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Non-alcoholic Beverages Market Trends

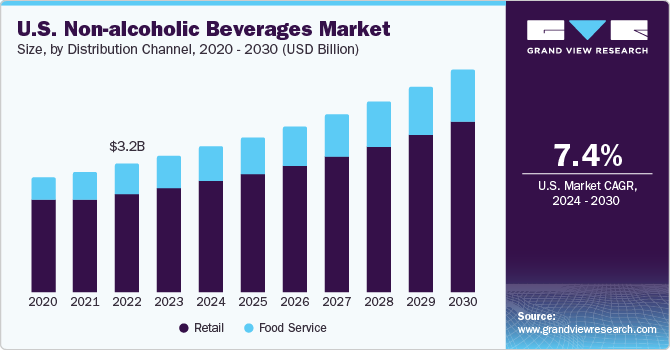

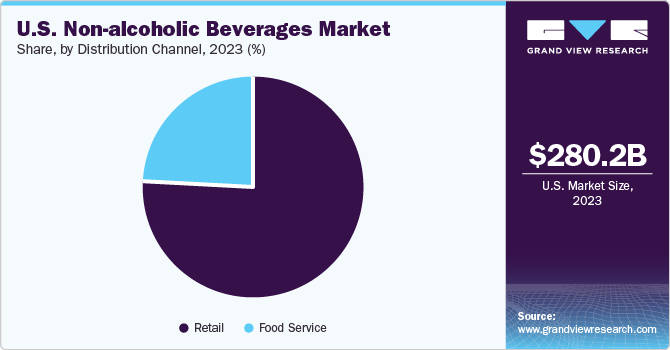

The U.S. non-alcoholic beverages market size was estimated at USD 280.2 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 7.4% from 2024 to 2030. Growing inclination of people towards non-alcoholic beverages have pushed players to embrace the new trend and thus have been actively curating and revamping the existing product portfolios.

The ripple effect of consumers rooting for non-alcoholic drinks and beverages has stimulated the development of a completely new segment of premium, complex-tasting soft drinks, specifically curated as per adult-consumer taste palates.

Carbonated drinks have remained a popular choice amongst consumers in the U.S. as it is a lucrative drink, and due to its taste and non-alcoholic characterstic. Carbonated or soft drinks are available in numerous flavors and kinds comprising cola, orange, lemon, and others, and are preferred by every age group. In past couple of years, surging consumer concentration on health and wellness has resulted in an augmented demand for low or zero-calorie and sugar-free drinks. Consequently, in order to adjust to the fluctuating consumer choices, key players have widened their product portfolios and introduced new products. For example, in April 2022, The Coca-Cola Company, a carbonated soft drink producer, unveiled a limited and exclusive-edition beverage under the name Coca‑Cola Zero Sugar Byte.

A preference for bottled water in comparison with normal drinking water, especially among the youth, boosts the sales of these products. Considering this trend, numerous restaurants are offering several options for bottled water. Another prime reason boosting the non-alcoholic beverage industry is the shifting demographics and a change in drinking habits among younger generations. Youth such as the Millennials and Generation Z specifically are displaying an inclination towards balance and moderation, thus avoiding extreme alcohol consumption. This demographic trend has augmented the development of innovative and varied non-alcoholic beverage choices, alternating from alcohol-free beer and wine to craft mock tails, addressing to a more refined and sophisticated palate.

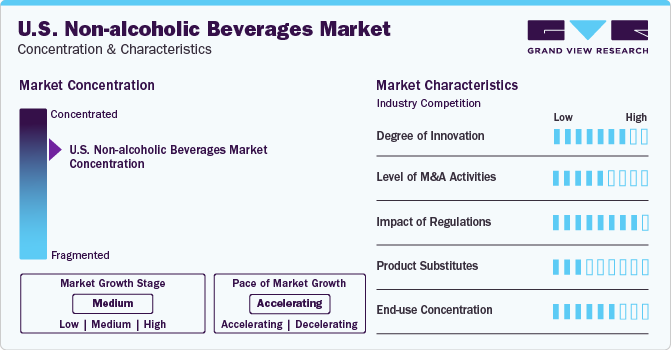

Market Concentration & Characteristics

Packaging and production are undergoing major transformation in terms appearance and sustainability factor. Biodegradable bottles, water-saving processes, as well as locally obtained ingredients are considered as a priority while manufacturing these bottles. Customers are inclined towards choosing eco-friendly products over those, which are harmful for the environment. Consumer demand for organic and natural products is affecting innovation. Beverages with lesser artificial flavors and additives, sweeteners, and preservatives are gaining demand.

Numerous market players are engaged in merger and acquisition activities to introduce novel products and fulfil the demand of their customers. Through these M&A initiatives, these players can extend their regional influence and enter new territories.

The U.S. non-alcoholic beverages market is substantially affected by food safety protocols, which compel companies to follow specific guidelines. In order to assure the absence of injurious contaminants, government organizations such as the U.S. Food and Drug Administration (FDA) impose these norms for non-alcoholic beverages, aligning with the wider regulations that govern food safety.

Developing product that has gained significant attention is functional beverages. These beverages offer more than just refreshment, providing additional health advantages such as boosted hydration, vitamins, antioxidants, and other bioactive compounds. The functional beverage market comprises products such as herbal teas, infused waters, and wellness shots, leaving customers with an expanded range of choices that bode well with their preference of health-conscious products.

Other substitute that is well liked by the masses in the market is the plant-based beverage category. With a rising number of customers adopting vegetarianism, veganism, or flexitarian diets, plant-based substitutes have turned out to be preferred choices. Plant-based milks, such as soy, almonds, oats, and coconut milk, have gained expanded acceptance as an alternative to traditional dairy items.

Product Insights

The carbonated soft drinks segment accounted for the largest revenue share of 33.7% in 2023. Carbonated soft drinks are recognized for their effervescence and broad collection of flavors, sufficing numerous taste preferences. The accessibility and obtainability of CSDs in many packaging sizes additionally contribute to their admiration, making them a go-to choice for customers seeking a quick yet satisfying thirst-quencher.

Functional beverages segment is projected to witness significant U.S. non-alcoholic beverages market growth over the forecast period owing to the rising alertness and importance of health and fitness. As consumers are turning to be more health-conscious, there is an increasing demand for beverages that provide refreshments along with comprising functional advantages as well. Functional beverages, which include products supplemented with vitamins, antioxidants, minerals, and other health-endorsing ingredients, supports the main aim of preventive healthcare and total well-being.

Distribution Channel Insights

Retail segment dominated the U.S. non-alcoholic beverages market share in 2023. Supermarkets, hypermarkets, internet retailers, and other channels all comprise as retail channel. Owing to the accessibility of multiple brands and products all under a single roof, supermarkets and hypermarkets hold the largest share. Numerous supermarkets are surging their selections in the alcohol-free market, involving Whole Foods, Target, Aldi, and Walmart.

Food service segment has been estimated to grow at a prompt speed during the forecast period. Food service is one of the preliminary distribution channels for non-alcoholic beverages. Busy lifestyle of people across the globe, paired with an augmented disposable income encourages people to eat meals in restaurants. New eateries cater to expansive tastes and beverage preferences that additionally boost this trend. A rising number of full-service restaurants are implementing all-inclusive dining options to offer better food service to its consumers. This includes examining local dietary trends and innovating their offerings to align with the same. It surges the frequency of customer visits.

Key U.S. Non-alcoholic Beverages Company Insights

Nestlé and PepsiCo non-alcoholic beverages company are some of the dominant players operating in the non-alcoholic beverages industry.

-

Nestlé has a prominent existence with a diverse portfolio that caters to widespread consumer choices. One of its flagship products is Nescafé, a globally acknowledged coffee brand that offers an assortment of coffee products such as instant coffee, ground coffee, and specialty coffee. Nestea, which is another notable brand, offers a diverse range of iced tea and ready-to-drink tea beverages.

-

PepsiCo has tactically placed itself as a pioneer with an emphasis on providing a wide range of choices, thus catering diverse consumer choices. Tropicana, a brand that falls under PepsiCo, is well-known for its fruit juices, offers consumers with a variety of fruit flavors and nutritional choices. Gatorade, another flagship brand, holds forte in sports and energy drinks, aiming at consumers involved in physical fitness activities.

Some emerging players in the market include, Jones Soda Co., Unilever, among others.

-

Jones Soda Co. involves in the creation, production, marketing, and distribution of high-quality flavored beverages in non-alcoholic classifications. The company promotes and sells its products in the U.S. and Canada, using a network of independent distributors and direct sales to national and regional retail accounts.

-

Unilever is a multinational consumer goods company that provides an expanded assortment of products across numerous categories. The company functions in various divisions - Beauty and Well-being, Personal Care, Home Care, Nutrition, and Ice Cream. Unilever runs in several nations across the globe and has a robust global presence with production facilities, distribution networks, and sales offices. The company manufactures numerous non- alcoholic beverages such as dairy-based beverages, functional beverages, and soups under sub-brands such as Liquid I.V. and Equilibra and Knorr.

Key U.S. Non-alcoholic Beverages Companies:

- Nestlé

- PepsiCo

- Unilever

- Keurig Dr Pepper Inc.

- The Coca-Cola Company

- Jones Soda Co.

- Danone S.A

- Suntory Beverage & Food Ltd

- Asahi Group Holdings, Ltd.

- Red Bull

Recent Developments

-

In April 2023, Chamberlain Coffee, a pioneering coffee lifestyle brand, declared the unveiling of its novel range of ready-to-consume plant-based cold brew lattes. The novel product is offered as cinnamon bun latte, mocha latte, vanilla latte, and traditional cold brew latte flavors. The corporation partnered up with Walmart to provide its products across the U.S.

-

In January 2023, Coca-Cola introduced a range of juice beverages intended to be consumed with and without alcohol. The Simply Mixology drinks are accessible in three flavors such as Strawberry Guava Mojito, Lime Margarita, and Peach Sour.

-

In December 2022, Nestlé launched animal-free dairy drinks under the Cowabunga brand in six San Francisco grocery stores, in the U.S. The offerings, available in two flavors—plain milk and chocolate, feature animal-free protein created by the U.S. start-up Perfect Day.

U.S. Non-alcoholic Beverages Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 298.4 billion

Revenue forecast in 2030

USD 457.0 billion

Growth rate

CAGR of 7.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel

Country scope

U.S.

Key companies profiled

Nestlé; PepsiCo; Unilever; Keurig Dr Pepper Inc.; The Coca-Cola Company; Jones Soda Co.; Danone S.A.; Suntory Beverage & Food Ltd.; Asahi Group Holdings, Ltd.; Red Bull

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Non-alcoholic Beverages Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. non-alcoholic beverages market report based on product, and distribution channel:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Carbonated Soft Drinks

-

Bottled Water

-

RTD Tea & Coffee

-

Functional Beverages

-

Juices

-

Dairy-based Beverages

-

Others

-

-

Distribution channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Food Service

-

Retail

-

Frequently Asked Questions About This Report

b. The U.S. non-alcoholic beverages market size was estimated at USD 280.2 billion in 2023 and is expected to reach USD 298.4 billion in 2024.

b. The U.S. non-alcoholic beverages market is expected to grow at a compound annual growth rate of 7.4% from 2024 to 2030 to reach USD 457.0 billion by 2030.

b. Carbonated soft drinks dominated the U.S. non-alcoholic beverages market with a share of more than 33.7% in 2023. The accessibility and obtainability of CSDs in many packaging sizes additionally contribute to their admiration, making them a go-to choice for customers seeking a quick yet satisfying thirst-quencher.

b. Some key players operating in the U.S. non-alcoholic beverages market include Nestlé; PepsiCo; Unilever; Keurig Dr Pepper Inc.; The Coca-Cola Company; Jones Soda Co.; Danone S.A.; Suntory Beverage & Food Ltd.; Asahi Group Holdings, Ltd.; Red Bull

b. Key factors that are driving the U.S. non-alcoholic beverages market growth include the growing inclination of people towards non-alcoholic beverages have pushed players to embrace the new trend and thus have been actively curating and revamping the existing product portfolios

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.