- Home

- »

- Medical Devices

- »

-

U.S. Oral Solid Dosage CDMO Market, Industry Report 2033GVR Report cover

![U.S. Oral Solid Dosage CDMO Market Size, Share & Trends Report]()

U.S. Oral Solid Dosage CDMO Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Tablets, Capsules, Powders), By Mechanism (Immediate, Delayed), By Drug Potency, By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-831-5

- Number of Report Pages: 262

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Oral Solid Dosage CDMO Market Summary

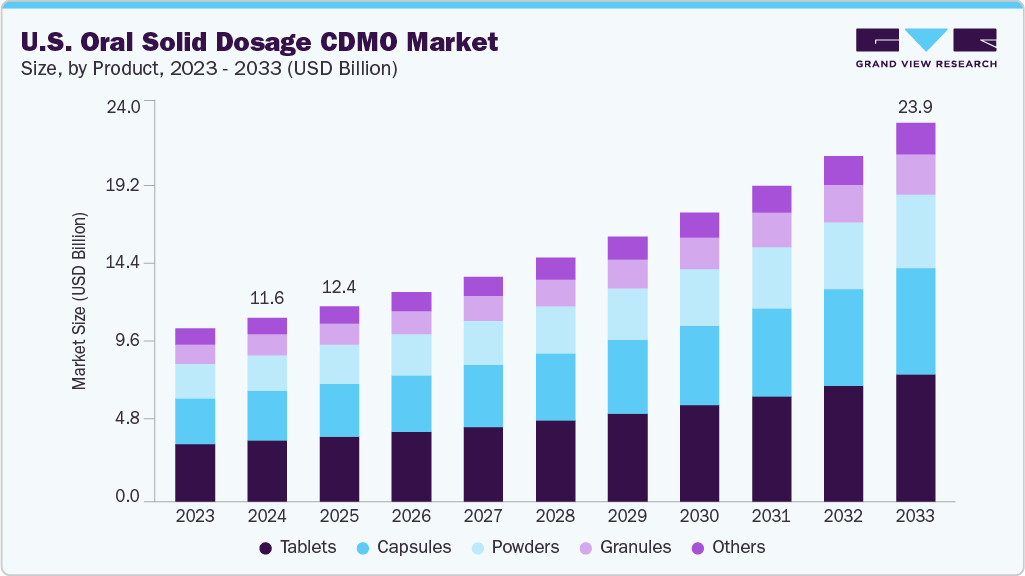

The U.S. oral solid dosage CDMO market size was estimated at USD 11.62 billion in 2024 and is projected to reach USD 23.99 billion in 2033, growing at a CAGR of 8.63% from 2025 to 2033. The market growth is driven by an increasing focus on complex formulations, along with a growing emphasis on cost efficiency and speed-to-market.

Key Market Trends & Insights

- By product, the tablet segment led the market with the largest revenue share of 32.97% in 2024.

- By mechanism, the controlled release segment led the market with the largest revenue share in 2024.

- By drug potency, the low potent drugs segment led the market with the largest revenue share in 2024.

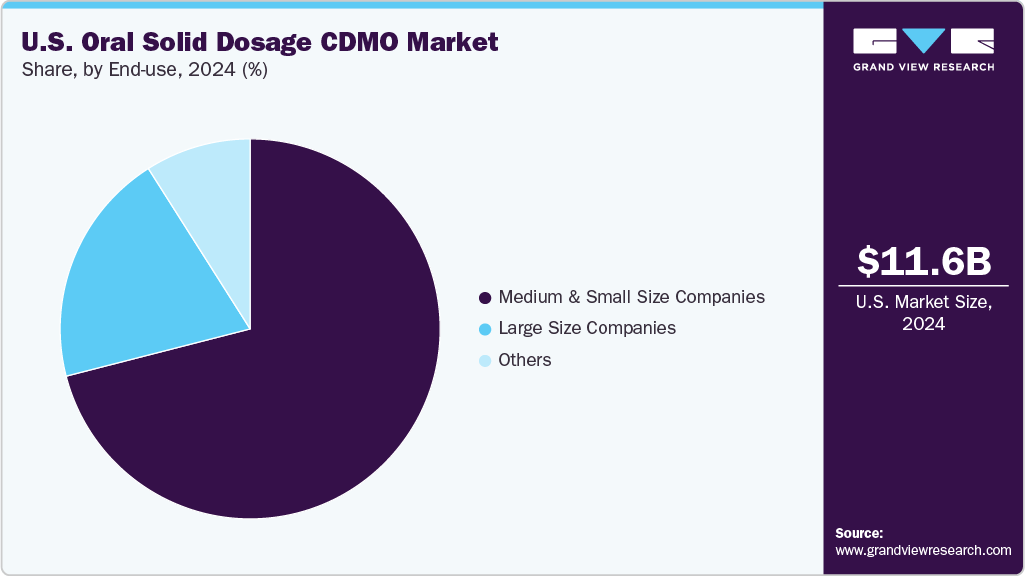

- Based on end use, the medium & small size companies segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 11.62 Billion

- 2033 Projected Market Size: USD 23.99 Billion

- CAGR (2025-2033): 8.63%

In addition, increasing regulatory compliance and quality assurance standards, as well as the expansion of small and virtual pharma companies, are propelling market growth. The growing prevalence of poorly soluble APIs and advanced targeted drug delivery systems has driven significant demand for specialized expertise in oral solid dosage (OSD) formulations. U.S. contract development and manufacturing organizations (CDMOs) that can manage complex formulations such as controlled-release tablets, fixed-dose combinations, and nanotechnology in drug delivery are attracting outsourcing contracts from global pharmaceutical companies. For instance, in August 2025, Piramal Pharma Solutions inaugurated a dedicated OSD suite in Pennsylvania, investing millions to support fixed-dose combination production and enhance operational efficiency through advanced granulation, compression, tableting, and coating capabilities. Thus, by offering these sophisticated services, CDMOs help clients overcome formulation challenges, improve therapeutic efficacy, and ensure product stability, differentiating themselves, optimizing facility capacity, and building long-term partnerships with innovators seeking high-value solutions.

Further, pharmaceutical companies face pressure to reduce time-to-market, operational costs, and ensure high-quality standards for their products. Outsourcing oral solid dosage (OSD) manufacturing to U.S.-based CDMOs allows companies to utilize specialized expertise, optimize resources, and streamline supply chains, enabling faster and more efficient product development. For instance, in September 2024, Thermo Fisher Scientific invested USD 22 million to expand OSD development and manufacturing at Cincinnati, Ohio, and Bend, Oregon, enhancing early-stage R&D, formulation, and testing capabilities within its CDMO and CRO network. Furthermore, by collaborating with CDMOs, companies can avoid the costs of building and maintaining in-house facilities and regulatory capabilities. Therefore, CDMOs that provide comprehensive services, from formulation development and scale-up to commercial manufacturing and packaging, offer a strategic advantage for accelerating product launches.

Moreover, stringent FDA regulations and evolving global quality standards are major drivers for outsourcing oral solid dosage (OSD) manufacturing to U.S. CDMOs. Maintaining in-house regulatory expertise and infrastructure is expensive and complex, prompting pharmaceutical companies to rely on partners with proven compliance track records. In addition, CDMOs adhering to cGMP, FDA inspection readiness, and international quality requirements provide risk mitigation, audit preparedness, and consistent product safety. This regulatory excellence builds client trust and positions CDMOs as preferred outsourcing partners. As a result, companies gain recurring contracts, long-term collaborations, and enhanced market credibility.

Opportunity Analysis

The U.S. oral solid dosage (OSD) CDMO industry presents significant growth opportunities driven by rising demand for generic and specialty drugs, complex formulations, and outsourcing of regulatory-compliant manufacturing. Pharmaceutical companies increasingly seek long-term collaborations that promote shared expertise, risk-sharing, and resource optimization. This shift fosters continuous innovation, enabling faster development of complex, patient-centric formulations.

In addition, the growing demand for advanced technologies, such as continuous manufacturing, modified-release systems, and high-potency API (HPAPI) capabilities, creates strong opportunities for U.S. CDMOs. Furthermore, advancements in formulation science aimed at improving the bioavailability of poorly soluble compounds drive investment in specialized manufacturing infrastructure.

The evolving U.S. regulatory framework presents significant opportunities for CDMOs specializing in oral solid dosage (OSD) forms. The FDA has been tightening oversight on cGMP compliance, advanced manufacturing, and impurity control. CDMOs that proactively adopt quality-by-design and advanced analytical systems gain a competitive edge. For instance, in October 2025, the FDA launched a pilot program that prioritizes the review of domestically manufactured generic drugs, encourages investment in U.S.-based production, and offers faster approvals and reduced inspection delays. This initiative supports reshoring trends and positions compliant CDMOs as key partners for both domestic and global pharmaceutical companies.

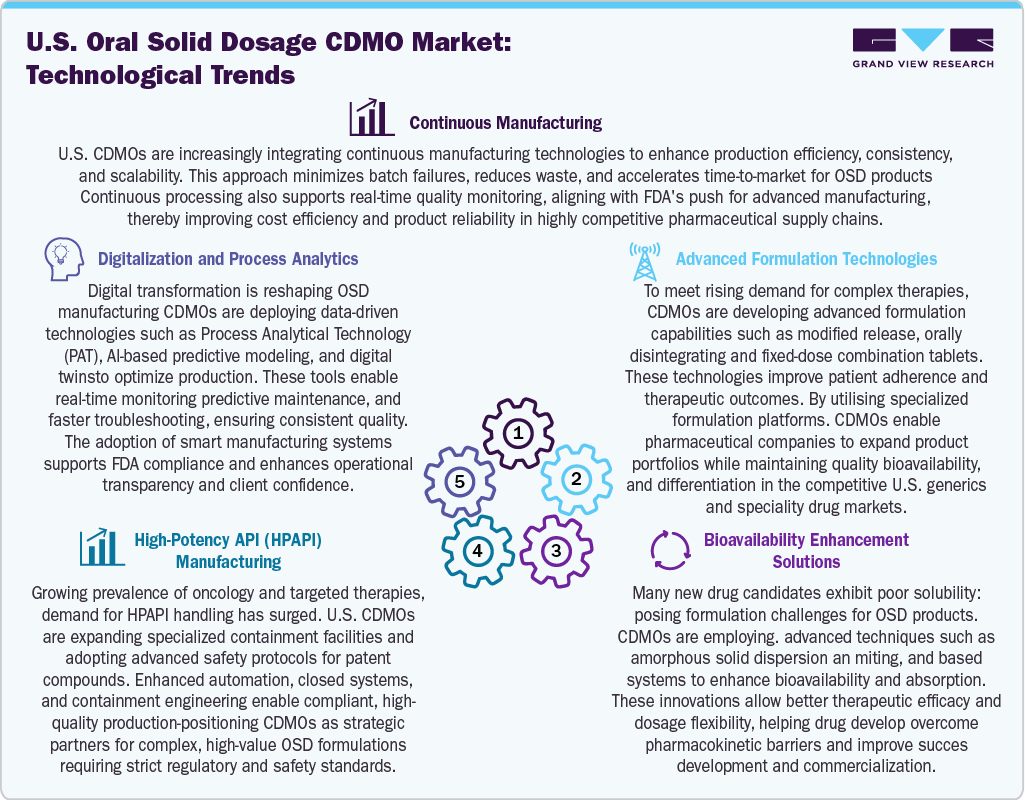

Technological Advancements

Technological advancements are transforming the U.S. oral solid dosage CDMO industry by driving innovation, quality, and efficiency. Continuous manufacturing is gaining momentum as CDMOs adopt completely automated systems to enhance consistency and reduce lead times. Advanced formulation development, including modified-release and orally disintegrating tablets, enables better patient adherence and therapeutic precision. Furthermore, to address poor solubility, CDMOs are utilizing amorphous solid dispersions, nano-milling, and lipid-based systems to improve bioavailability. Moreover, the expansion of high-potency API (HPAPI) facilities supports the production of oncology and specialty drugs under stringent containment standards. Digital transformation through Process Analytical Technology (PAT), AI-driven modelling, and digital twins allows real-time monitoring and predictive quality control. In conclusion, these innovations enhance the competitive advantage of U.S. CDMOs by enabling faster, safer, and more reliable drug manufacturing to meet diverse therapeutic needs.

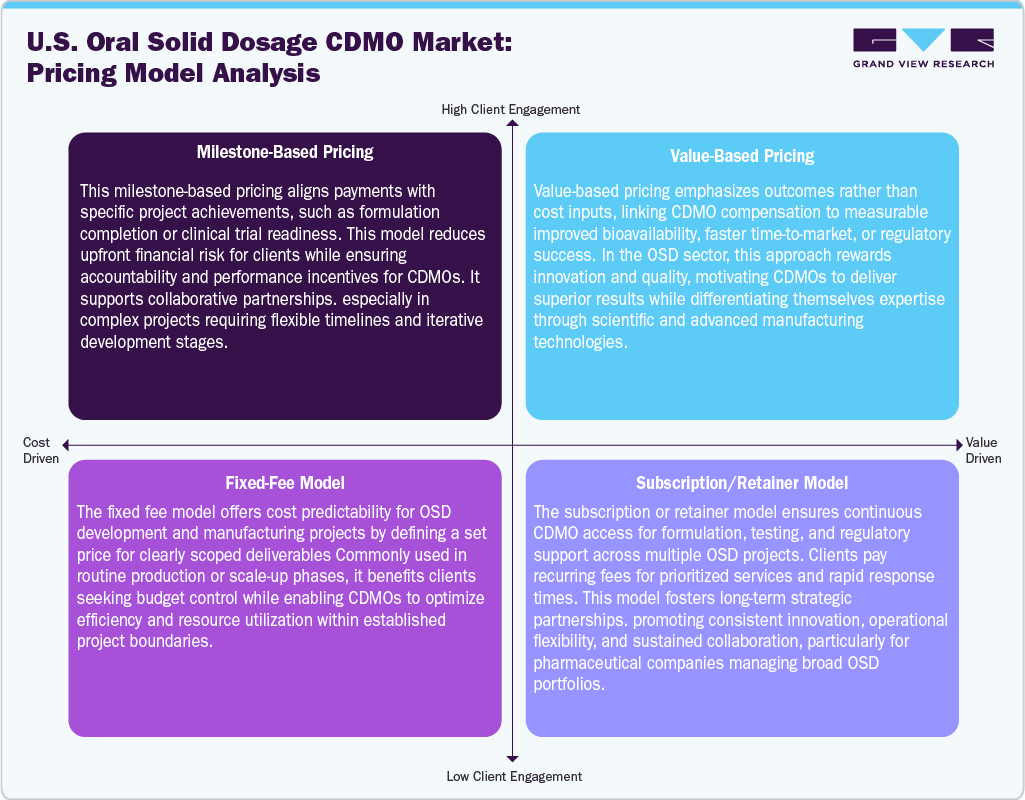

Pricing Model Analysis

Pricing models in the U.S. market are evolving to balance flexibility, performance, and value creation. Milestone-based pricing ties payments to project achievements such as formulation development, stability studies, or clinical readiness, offering clients reduced upfront costs while incentivizing CDMOs to meet defined technical or regulatory targets efficiently. This model is suitable for complex or multi-phase projects that require iterative collaboration and coordination.

Value-based pricing emphasizes outcomes over cost, linking compensation to measurable results such as enhanced bioavailability, reduced development timelines, or regulatory success. It rewards innovation and high performance, encouraging CDMOs to deliver differentiated, quality-driven solutions that create tangible value for pharmaceutical clients. The fixed-fee model provides cost certainty by defining a set price for specific deliverables, making it ideal for standardized services such as tablet compression, coating, or scale-up. It benefits clients with predictable budgets and allows CDMOs to streamline operations for maximum efficiency.

The subscription or retainer model fosters long-term partnerships through recurring payments, ensuring continuous access to formulation, testing, and regulatory expertise. It is suitable for companies with multiple OSD projects, guaranteeing service prioritization, flexibility, and collaborative innovation. This allows pharmaceutical firms to focus on strategic growth while utilizing the CDMO’s technical and operational excellence.

Market Concentration & Characteristics

The market growth stage is medium, and the pace of the market growth is accelerating, characterized by a high degree of innovation. Level of M&A activities, impact of regulations, service expansions, and regional expansions.

Innovation in the market is driven by the adoption of continuous manufacturing, advanced analytics, and AI-driven formulation design. CDMOs are developing novel drug delivery systems, such as controlled-release formulations and fixed-dose combinations, to enhance therapeutic outcomes and improve bioavailability. For instance, in September 2024, Adare Pharma Solutions partnered with Laxxon Medical to introduce cGMP 3D printing for oral dosage forms using SPID technology, enabling the creation of complex, customizable drug formulations with enhanced bioavailability and scalable production at its Milan facility.

The U.S. OSD CDMO market is witnessing steady consolidation through strategic mergers and acquisitions, as companies seek to expand capabilities and geographic reach. For instance, in October 2024, Ardena acquired Catalent’s FDA-approved facility in Somerset, New Jersey, enhancing its oral drug manufacturing, bioanalytical services, and integrated CDMO capabilities, thereby strengthening its presence in the U.S.

Stringent FDA guidelines and evolving global quality standards have a significant influence on the market. CDMOs must maintain cGMP compliance, robust documentation, and traceability to ensure inspection readiness. Regulatory initiatives, such as the FDA’s pilot program prioritizing domestic generic manufacturing, are encouraging investment in U.S.-based facilities and accelerating the approval process.

The CDMOs are broadening their service portfolios to include integrated solutions from formulation development to commercial manufacturing. Many are investing in advanced technologies, such as continuous manufacturing, high-potency handling, and 3D printing, to attract a diverse client base.

The market exhibits moderate end-user concentration, with large pharmaceutical firms and emerging biotech companies accounting for the majority of outsourcing demand. While big pharma drives consistent, long-term contracts for commercial-scale production, small and mid-sized enterprises rely heavily on CDMOs for early-stage formulation and scale-up. This balanced client mix provides stability and growth opportunities across various therapeutic segments.

Product Insights

In 2024, the tablets segment held the largest market share, accounting for a revenue share of 32.97%. The segment growth is driven by rising demand for cost-efficient outsourcing solutions, the growing adoption of advanced formulation & process technologies, and the increasing expansion of generic & specialty drug portfolios. Some other factors contributing to segment growth include stringent regulatory standards that require expert compliance and the growing reliance of small- and mid-sized pharma companies on CDMOs for scalability, innovation, and faster time-to-market.

For instance, according to a study published in March 2024, the oral route of administration was the most favored, chosen by 71.2% of respondents, while 42.4% of respondents favored tablets as their dosage form. In the U.S., tablets are the most popular due to their immediate-release, controlled-release, and fixed-dose combination products, catering to both brand and generic pharmaceutical companies. These tablets are preferred for patient convenience, stability, and accurate dosing, making them a key focus for outsourcing partners. Besides, U.S. CDMOs are increasingly investing in advanced tablet technologies, such as multi-layer compression, high-potency API handling, and modified-release systems, to meet complex formulation demands.

The capsules segment is expected to grow at the fastest CAGR during the forecast period. The segment growth is attributed to increasing requirements for flexible and patient-friendly dosage forms, growing adoption of advanced encapsulation technologies, rising outsourcing by pharma and biotech companies, growth in nutraceutical and controlled-release formulations, and regulatory emphasis on quality, safety, and efficient production standards. Some of the other factors contributing to segment growth include ease of swallowing and suitability for both immediate- and modified-release formulations. Thus, CDMOs are investing in advanced capsule manufacturing technologies, such as liquid-filled, hard gelatin, and HPMC capsules, to meet client requirements for complex formulations.

Mechanism Insights

On the basis of mechanism, the controlled release segment dominated the market in 2024. The segment growth is driven by the ability of controlled release to enhance patient compliance, reduce dosing frequency, and maintain steady drug plasma levels. The mechanism enables improved therapeutic efficacy, minimizes side effects, and offers lifecycle management opportunities for pharma companies. Moreover, the dosage forms deliver drugs at a specified rate and targeted site, maximizing therapeutic efficacy and minimizing side effects. The systems address challenges of conventional delivery, such as fluctuating plasma concentrations and patient non-compliance. Besides, most U.S. CDMOs specializing in controlled-release technologies offer a range of expertise, scalability, and innovation, thereby meeting the growing demand for complex, high-value oral drug products in the management of chronic diseases.

The immediate release segment is expected to witness a higher CAGR over the forecast period. Immediate-release (IR) mechanisms of action are preferred due to their simplicity, cost-effectiveness, and rapid therapeutic action. These formulations disintegrate and dissolve quickly, ensuring rapid absorption and a prompt pharmacological effect, which is crucial for acute treatments and patient compliance. Further, IR products are easier and faster to develop compared to complex controlled-release systems, enabling CDMOs to shorten timelines and meet urgent market needs. In addition, with the increasing prevalence of chronic and acute conditions, CDMOs offer a range of specialized capabilities in the manufacturing of immediate-release tablets and capsules, which is expected to drive segment growth over the estimated time period.

Technology Insights

On the basis of technology, the granulation technologies segment dominated the market in 2024. The segment growth is driven by increasing demand for oral solid drugs, rising need for enhanced drug stability, bioavailability & controlled release formulations. Some other factors contributing to segment growth include regulatory compliance, increased outsourcing by pharmaceutical companies for cost efficiency, scalability, advanced formulation expertise, and shifting trends toward high-potency APIs & continuous manufacturing. Further, granulation technologies support oral solid dosage forms, enabling improved flow, compressibility, and uniformity, which enhances the bioavailability & stability of APIs. Moreover, granulation-based OSD manufacturing enables the efficient handling of high-potency and poorly soluble compounds, contributing to consistent distribution, enhanced dissolution, and ensuring safe processing. Thus, growing technologies support compliance with stringent regulatory & quality standards, further ensuring the reliable large-scale manufacturing of complex oral solid dosage formulations, which is expected to drive the segment's growth.

The continuous manufacturing technologies segment is expected to witness a higher CAGR over the forecast period. Continuous manufacturing rapidly evolves oral solid dosage (OSD) production by enabling seamless, end-to-end production of oral solid dosage forms. This technology provides enhanced process control, real-time monitoring, process analytical technology (PAT), and automated control, ensuring consistent quality, reduced variability, and faster production timelines. Besides, in the U.S., regulatory agencies actively support CM adoption through guidance and streamlined approval pathways, thereby encouraging innovation and efficiency. Also, technology enables the leveraging of continuous manufacturing to benefit from higher throughput, lower costs, and improved supply chain reliability. Such factors are expected to drive the segment growth over the estimated time period.

Drug Potency Insights

Based on drug potency, the low-potency drug segment dominated the market in 2024. The segment growth is driven by the widespread use across both chronic and acute therapeutic areas, as well as the ease of handling, formulation, and manufacturing compared to high-potency active pharmaceutical ingredients (HPAPIs), which reduces the need for specialized containment and safety measures. Besides, these are easier and safer to handle during formulation and manufacturing, which further contributes to segment growth. In the U.S., CDMOs utilize established manufacturing platforms and standard quality control protocols for the large-scale production of low-potency oral solids, such as tablets and capsules. Thus, with the increasing requirement for generic, over-the-counter, and chronic therapy medications, low-potent oral solids, the segment is anticipated to witness new growth opportunities over the estimated time period.

The high-potency drugs segment is anticipated to witness the fastest growth over the projected timeframe, due to increasing demand for oncology, hormonal, and specialty therapies. These drugs require specialized facilities, containment systems, and highly trained personnel to ensure safe handling and prevent cross-contamination. In addition, CDMOs invest in advanced technologies, including isolators, closed processing systems, and dedicated equipment, which enable them to efficiently manufacture high-potency tablets and capsules that meet stringent regulatory and cGMP requirements. Such factors are expected to drive the segment growth over the estimated time period.

End Use Insights

Based on end use, the medium & small size companies segment accounted for the largest share in 2024. The segment growth is attributed to the rising need for flexible, cost-effective outsourcing solutions among medium-sized and small companies. These companies often lack in-house capabilities for complex formulation development, scale-up, and commercial manufacturing, making CDMOs essential partners. Thus, by outsourcing to experienced U.S.-based CDMOs, these companies can access advanced technologies, regulatory expertise, and efficient production without significant capital investments. This enables faster time-to-market, improved product quality, and risk mitigation. For instance, in February 2025, Jabil announced its acquisition of Pharmaceutics International, Inc., which enhances U.S. CDMO capabilities in early-stage, clinical, and commercial aseptic filling, lyophilization, and oral solid dose manufacturing.

The large-sized companies segment represented the second fastest growing segment in the market, driven by their robust financial resources, advanced technological infrastructure, and global operational capabilities. These companies can invest heavily in state-of-the-art manufacturing equipment, continuous processing technologies, and advanced formulation expertise, enabling them to handle high-volume production efficiently. Their extensive regulatory experience ensures compliance with stringent FDA and cGMP standards, attracting both domestic and international pharmaceutical clients. In addition, large CDMOs offer end-to-end services, from formulation development to commercial-scale manufacturing, reducing time-to-market and operational costs for clients. Such factors are expected to drive the segment growth over the estimated time period.

Key U.S. Oral Solid Dosage CDMO Company Insights

Key players in the U.S. market include Catalent Inc., Lonza Group Ltd., AbbVie Contract Manufacturing, Thermo Fisher Scientific Inc., and Piramal Pharma Solutions. Market share is driven by technological capabilities, regulatory compliance, and integrated development-to-commercialization services, with top companies commanding a significant portion of high-value outsourcing contracts. For instance, in January 2025, Lyndra Therapeutics announced its partnership with Thermo Fisher, utilizing Accelerator Drug Development services for long-acting oral therapies, which enable scalable manufacturing, clinical research, and supply chain efficiency, thereby accelerating patient access.

Key U.S. Oral Solid Dosage CDMO Companies:

- Lonza

- Thermo Fisher Scientific Inc.

- Cambrex Corporation

- Catalent Inc.

- Siegfried Holding AG

- Recipharm AB

- CordenPharma International

- Boehringer Ingelheim

- Piramal Pharma Solutions

- Aenova Group

- Almac Group

- Jubilant Pharmova Limited

- AbbVie Contract Manufacturing

- Quotient Sciences

- SPI Pharma

- DPT Laboratories Ltd.

- Alcami Corporation

Recent Developments

-

In August 2025, Piramal Pharma Solutions mentioned a dedicated oral solid dosage suite at Sellersville, Pennsylvania, boosting production of fixed-dose combinations, improving operational efficiency, and supporting NewAmsterdam Pharma in delivering investigational therapies to patients.

-

In October 2024, Catalent announced it would sell its Somerset, NJ, oral solids development and small-scale manufacturing facility to Ardena, enhancing Ardena’s U.S. presence, while Catalent continues expanding oral solids capabilities at other strategic sites.

-

In September 2024, Thermo Fisher mentioned its investment of USD 22 million to expand oral solid dose development and manufacturing at Cincinnati, Ohio, and Bend, Oregon, enhancing early-stage R&D, formulation, and testing capabilities across its global CDMO and CRO network.

U.S. Oral Solid Dosage CDMO Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 12.37 billion

Revenue forecast in 2033

USD 23.99 billion

Growth rate

CAGR of 8.63% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, mechanism, technology, drug potency, end use

Key companies profiled

Lonza; Thermo Fisher Scientific Inc.; Cambrex Corporation; Catalent Inc.; Siegfried Holding AG; Recipharm AB; CordenPharma International; Boehringer Ingelheim; Piramal Pharma Solutions; Aenova Group; Almac Group; Jubilant Pharmova Limited; AbbVie Contract Manufacturing; Quotient Sciences; SPI Pharma; DPT Laboratories Ltd.; Alcami Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Oral Solid Dosage CDMO Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. oral solid dosage CDMO market report based on product, mechanism, technology, drug potency, and end use:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Tablets

-

Compressed Tablets

-

Orally Disintegrating Tablets (ODT)

-

Chewable Tablets

-

Bi-layer or Tri-layer Tablets

-

Sublingual or Buccal Tablets

-

Others

-

-

Capsules

-

Hard Gelatin Capsules

-

Soft Gelatin Capsules

-

-

Powders

-

Granules

-

Others

-

-

Mechanism Outlook (Revenue, USD Million, 2021 - 2033)

-

Immediate Release

-

Delayed Release

-

Controlled Release

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Granulation Technologies

-

Compression Technologies

-

Encapsulation Technologies

-

Coating Technologies

-

Continuous Manufacturing Technologies

-

Others

-

-

Drug Potency Outlook (Revenue, USD Million, 2021 - 2033)

-

High Potent Drugs

-

Moderate Potent Drugs

-

Low Potent Drugs

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Large Size Companies

-

Medium & Small Size Companies

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. oral solid dosage CDMO market size was estimated at USD 11.62 billion in 2024 and is expected to reach USD 12.37 billion in 2025.

b. The U.S. oral solid dosage CDMO market is expected to grow at a compound annual growth rate of 8.63% from 2025 to 2033 to reach USD 23.99 billion by 2033.

b. The tablets segment dominated the U.S. oral solid dosage CDMO market with a share of 32.97% in 2024. The market growth is driven by rising demand for cost-efficient outsourcing solutions, the growing adoption of advanced formulation & process technologies, and the increasing expansion of generic & specialty drug portfolios. Some other factors contributing to segment growth include stringent regulatory standards and the growing reliance of small- and mid-sized pharma companies on CDMOs for scalability, innovation, and faster time-to-market.

b. Some key players operating in the U.S. oral solid dosage CDMO market include Lonza, Thermo Fisher Scientific Inc., Cambrex Corporation, Catalent Inc., Siegfried Holding AG, Recipharm AB, CordenPharma International, Boehringer Ingelheim, Piramal Pharma Solutions, Aenova Group, Almac Group, Jubilant Pharmova Limited, AbbVie Contract Manufacturing, Quotient Sciences, SPI Pharma, DPT Laboratories Ltd., Alcami Corporation.

b. Key factors driving market growth include an increasing focus on complex formulations, along with a growing emphasis on cost efficiency and speed to market. In addition, increasing regulatory compliance and quality assurance standards, as well as the expansion of pharma companies, are propelling the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.