- Home

- »

- Alcohol & Tobacco

- »

-

U.S. Organic Wine Market Size, Share, Industry Report, 2030GVR Report cover

![U.S. Organic Wine Market Size, Share & Trends Report]()

U.S. Organic Wine Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Red Wine, White Wine), By Packaging (Bottles, Cans), By Distribution Channel (On-Trade, Off-Trade), And Segment Forecasts

- Report ID: GVR-4-68040-605-9

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Organic Wine Market Size & Trends

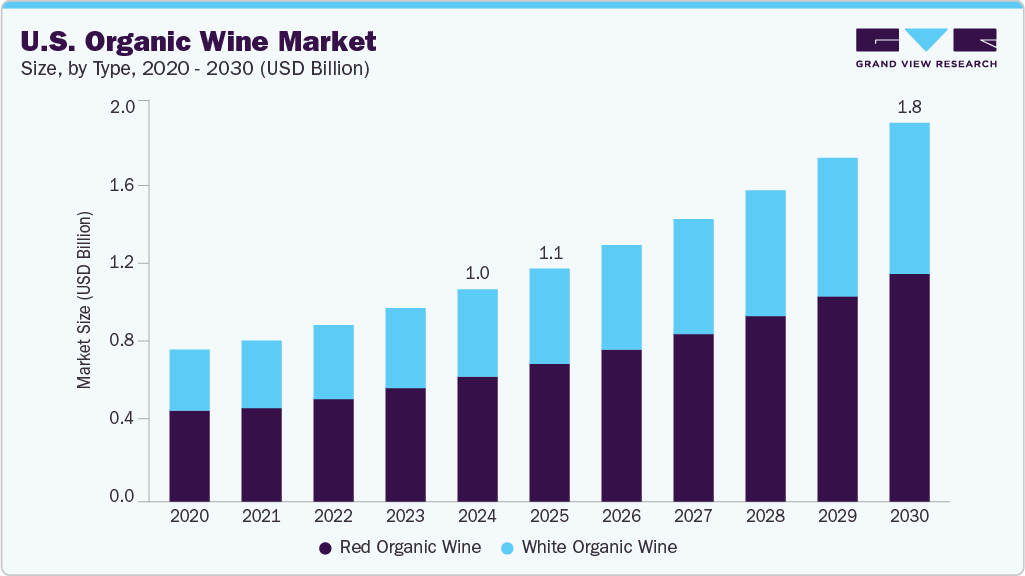

The U.S. organic wine market size was estimated at USD 1,012.5 million in 2024 and is projected to grow at a CAGR of 10.2% from 2025 to 2030. The growth is attributable to increasing consumer health consciousness and sustainability concerns. Consumers are aligning their drinking habits with wellness goals, favoring wines produced without synthetic pesticides and fertilizers, which are perceived as healthier and safer. This shift is supported by a growing vegan and chemical-free lifestyle trend, encouraging demand for organic wines that meet these criteria. For instance, the USDA’s National Organic Program provides certification that assures consumers of product authenticity, boosting market confidence.

Another significant driver is the rising environmental awareness among American consumers, who prefer products that minimize ecological impact. Organic wine production promotes biodiversity, soil health, and water conservation, resonating with environmentally conscious buyers. In addition, innovations in organic viticulture and winemaking have improved the taste and quality of organic wines, enabling them to compete effectively with conventional wines. This has helped expand the consumer base beyond niche markets.

The U.S. organic wine industry also benefits from strong regulatory frameworks and certification programs that ensure strict adherence to organic standards. These programs enhance transparency and build consumer trust, which is critical in a market where authenticity and quality are paramount. Moreover, the expansion of organic wine offerings in mainstream retail and e-commerce channels has increased accessibility, allowing more consumers to explore and purchase organic wines conveniently.

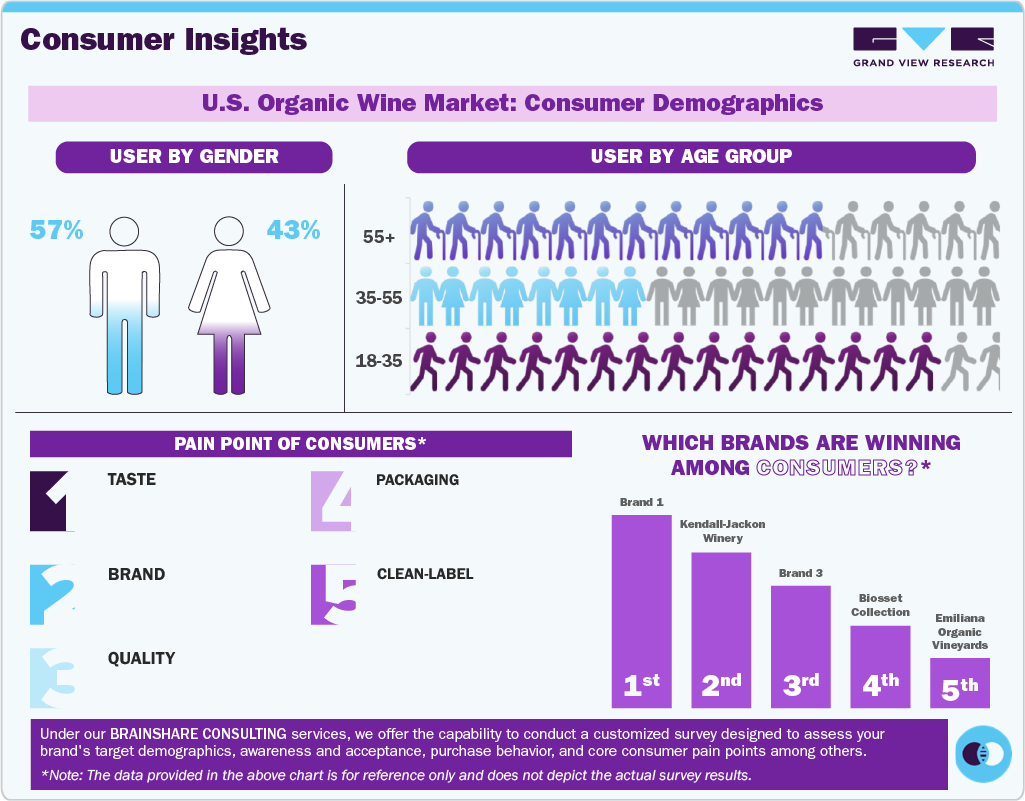

Millennials and younger consumers are key growth segments, driven by their preference for premium, sustainable, and health-oriented products. This demographic associates organic wines with higher quality and environmental responsibility, fueling demand. For instance, several U.S. wineries have launched organic wine ranges targeting this audience, reflecting the market’s evolving dynamics. Overall, the combination of health trends, environmental values, regulatory support, and consumer demographics underpins the robust growth forecast for the U.S. organic wine industry.

Consumer Insights

Type Insights

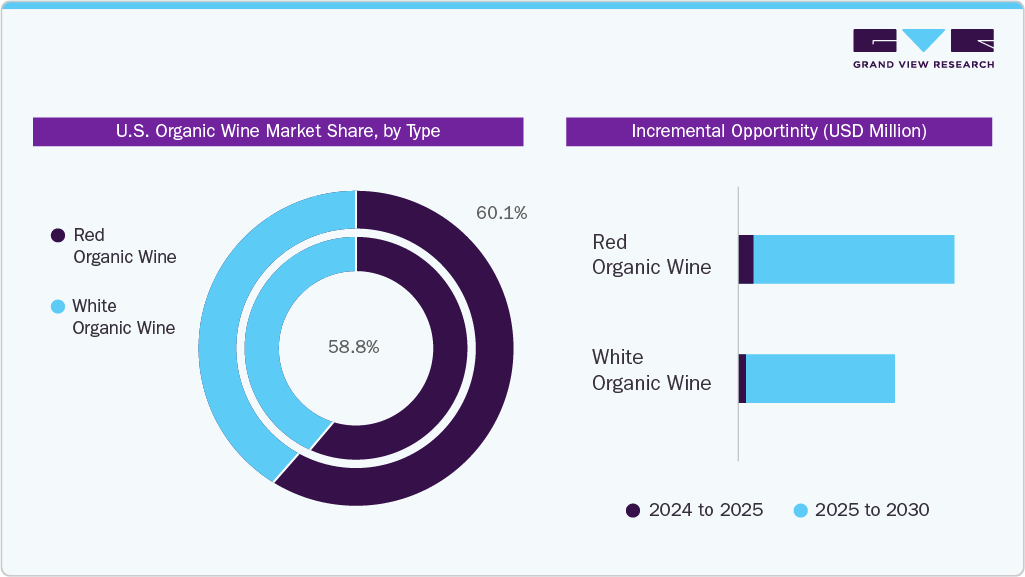

The organic red wine segment led the market with the largest revenue share of 58.8% in 2024, due to its strong consumer preference driven by perceived health benefits and rich flavor profiles. Red organic wines are favored because they are produced without synthetic pesticides and fertilizers, appealing to health-conscious buyers who associate them with antioxidants and natural ingredients. In addition, red wines often pair well with a variety of foods, making them a versatile choice for consumers. The U.S. market’s growth is supported by robust certification standards like the USDA Organic Program, which assures authenticity and quality.

The organic white wine segment is expected to grow at the fastest CAGR of 9.6% from 2025 to 2030, driven by increasing consumer demand for healthier and sustainable beverage options. Consumers are attracted to organic white wines because they are produced without synthetic chemicals, aligning with wellness trends and environmental concerns. In addition, innovations in organic viticulture and winemaking have improved the taste and quality of organic white wines, making them competitive with conventional wines. The rise of e-commerce and direct-to-consumer sales channels also enhances accessibility, allowing consumers to explore a wider variety of organic white wines conveniently. These factors collectively support robust market expansion.

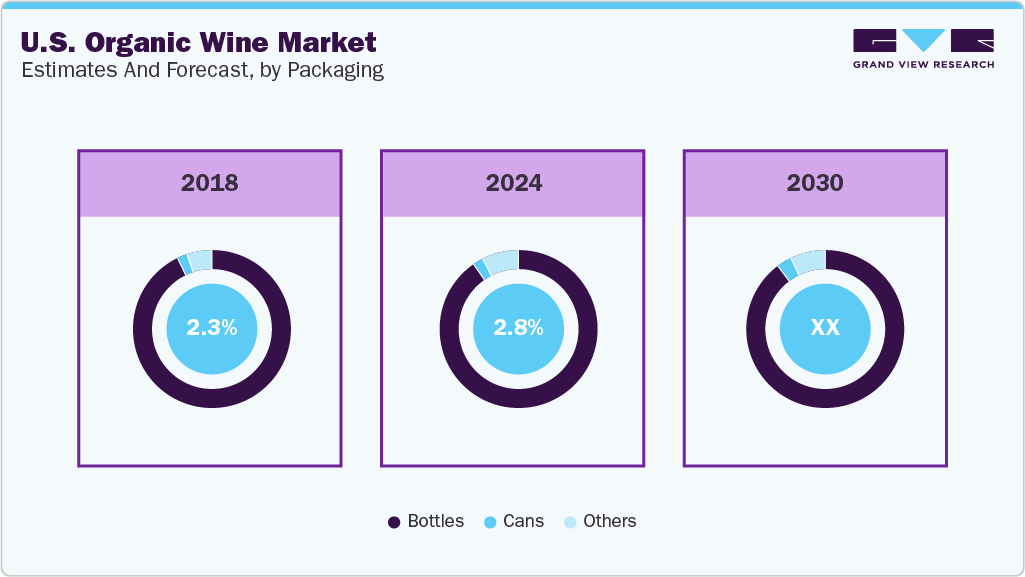

Packaging Insights

The bottled organic wine segment led the market with the largest revenue share of 90.7% in 2024, as glass bottles are widely recognized for preserving wine quality, flavor, and freshness, which is critical for premium organic wines. Consumers associate bottled wine with authenticity, tradition, and higher quality, reinforcing its dominant position in both the retail and hospitality sectors. In addition, glass is fully recyclable and aligns with the sustainability values important to organic wine buyers. The established distribution infrastructure in the U.S. also favors bottled packaging, making it the most accessible and trusted format. For instance, major organic wine brands consistently use glass bottles to meet consumer expectations and regulatory certification standards, supporting market growth.

The cans segment is expected to grow at the fastest CAGR of 13.4% from 2025 to 2030, due to increasing consumer demand for convenience, sustainability, and health-conscious options. Cans offer portability, lightweight packaging, and easy recyclability, which appeal to younger, eco-aware consumers seeking ready-to-drink products for outdoor and casual occasions. In addition, canned wines often have lower production and retail costs compared to bottled wines, making them attractive to budget-conscious buyers. This combination of environmental benefits, lifestyle alignment, and affordability is driving rapid growth in the U.S. canned organic wine market growth.

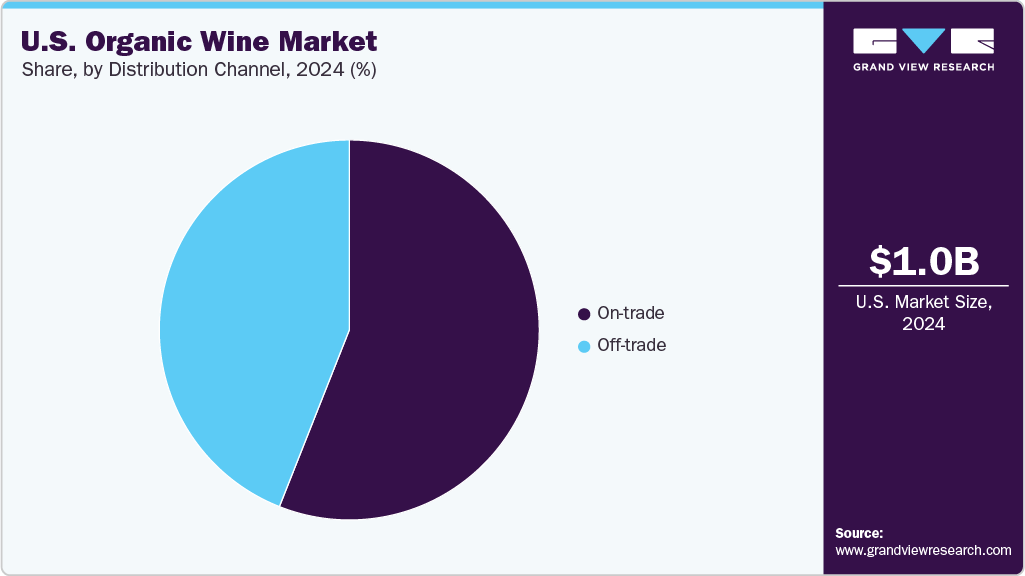

Distribution Channel Insights

The off-trade segment led the market with the largest revenue share of 61.7% in 2024, as these channels, such as supermarkets, hypermarkets, retail outlets, organic stores, and e-commerce platforms, offer consumers a wide product variety, competitive pricing, and convenient access. Off-trade outlets enable shoppers to explore diverse organic wine options across grape varieties, regions, and price points, supporting both every day and special-occasion purchases. Retailers are expanding their organic wine assortments to meet growing consumer demand for sustainable and health-conscious products. In addition, the growth of online sales has made it easier for consumers to discover and buy organic wines from home, further boosting off-trade revenues. This accessibility, combined with promotional offers and trusted certification labels, has established off-trade as the dominant distribution channel in the U.S. organic wine industry.

The on-trade segment is expected to grow at the fastest CAGR of 9.4% from 2025 to 2030, due to increasing consumer demand for premium, health-conscious, and sustainable wine options in social and dining environments such as restaurants, bars, and hotels. Younger consumers, particularly Millennials, are driving this trend by seeking organic wines that align with their values of wellness and environmental responsibility when enjoying wine outside the home. The growing presence of organic wines on menus in prominent venues, like London’s Antidote Wine Bar and Terroirs, illustrates how the hospitality sector is responding to this demand by offering curated organic selections. In addition, strong regulatory frameworks and certification programs in the U.S. enhance consumer confidence in organic wine authenticity, encouraging on-trade establishments to expand their organic offerings. This combination of evolving consumer preferences, industry adaptation, and trusted certification is fueling steady growth in the on-trade organic wine segment.

Key U.S. Organic Wine Company Insights

Key companies in the U.S. organic wine industry maintain competitiveness by focusing on sustainable farming practices, strict organic certifications, and product innovation that caters to health-conscious consumers. They emphasize transparency in sourcing and production, leveraging clean-label trends and environmental responsibility to attract buyers. Expanding distribution through both traditional retail and direct-to-consumer channels, including e-commerce, helps these companies reach a broader audience. In addition, strategic collaborations and premiumization efforts enable them to differentiate their offerings in a growing market driven by increasing consumer demand for organic and natural wine options.

Key U.S. Organic Wine Companies:

- Bronco Wine Company

- Kendall-Jackson Winery

- King Estate Winery

- Boisset Collection - JCB (Jean-Charles Boisset)

- Emiliana Organic Vineyards

- Societa Agricola QuerciabellaSpA

- Grgich Hills Estate

- Avondale

- Frey Vineyards

- The Organic Wine Company

Recent Developments

-

In May 2023, Origins Organic Imports launched the 2022-vintage LO CA Chardonnay and LO CA Malbec in the U.S. market, introducing Argentina’s first USDA-certified organic wines that are also low-calorie, low-alcohol, low-sugar, Regenerative Organic Certified, Ecocert-approved, vegan, and gluten-free. The LO CA wines, priced at $14, contain around 30% fewer calories than standard wines, with the Chardonnay offering 75 calories per 5 oz. serving and the Malbec 79 calories, both featuring minimal residual sugar and moderate alcohol levels.

U.S. Organic Wine Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,112.0 million

Revenue forecast in 2030

USD 1,806.0 million

Growth rate

CAGR of 10.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, packaging, distribution channel

Country scope

U.S.

Key companies profiled

Bronco Wine Company; Kendall-Jackson Winery; King Estate Winery; Boisset Collection - JCB (Jean-Charles Boisset); Emiliana Organic Vineyards; Societa Agricola Querciabella SpA; Grgich Hills Estate; Avondale; Frey Vineyards; The Organic Wine Company

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

U.S. Organic Wine Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. organic wine market report based on type, packaging, and distribution channel:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Red Organic Wine

-

White Organic Wine

-

-

Packaging Outlook (Revenue, USD Million, 2018 - 2030)

-

Bottles

-

Cans

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

On Trade

-

Off Trade

-

Frequently Asked Questions About This Report

b. The U.S. organic wine market size was estimated at USD 1,012.5 million in 2024 and is expected to reach USD 1,112.0 million in 2025.

b. The U.S. organic wine market is expected to grow at a compounded growth rate of 10.2% from 2025 to 2030 to reach USD 1,806.0 million by 2030.

b. Organic red wine accounted for a revenue share of 58.8% of the U.S. revenue in 2024, due to its strong consumer preference driven by perceived health benefits and rich flavor profiles. Red organic wines are favored because they are produced without synthetic pesticides and fertilizers, appealing to health-conscious buyers who associate them with antioxidants and natural ingredients.

b. Some key players operating in the U.S. organic wine market include Bronco Wine Company, Kendall-Jackson Winery, King Estate Winery, Boisset Collection - JCB (Jean-Charles Boisset), Emiliana Organic Vineyards, Societa Agricola Querciabella SpA, Grgich Hills Estate, Avondale, Frey Vineyards, and The Organic Wine Company.

b. The growth is attributable to increasing consumer health consciousness and sustainability concerns. Consumers are aligning their drinking habits with wellness goals, favoring wines produced without synthetic pesticides and fertilizers, which are perceived as healthier and safer.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.