- Home

- »

- Homecare & Decor

- »

-

U.S. Pet Grooming Products Market, Industry Report, 2030GVR Report cover

![U.S. Pet Grooming Products Market Size, Share & Trends Report]()

U.S. Pet Grooming Products Market Size, Share & Trends Analysis Report By Type (Shampoo & Conditioner, Shear & Trimming Tools, Comb & Brush), By Distribution Channel (Offline, Online), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-234-2

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

U.S. Pet Grooming Products Market Trends

The U.S. pet grooming products market size was estimated at USD 4.94 billion in 2023 and is expected to grow at a CAGR of 5.4% from 2024 to 2030. Spending on grooming, accessories, and food is on the rise, which is a result of an increase in pet adoptions and humanization. The need for pet grooming products is rising as a result of growing awareness about pet health.

The U.S. pet grooming product market accounted for a share of 35.6% of the global pet grooming products market revenue in 2023. The number of households adopting pets has significantly increased in the U.S., which has led to a noteworthy rise in demand for pet supplies, especially grooming items. Pet owners look for premium grooming supplies to make sure their animals are clean, healthy, and happy. The American Pet Products Association (APPA) conducted the National Pet Owners Survey, which indicates that over 70% of American households or 90.5 million families welcomed a pet into their homes in 2021 and 2022. As a result, the notable rise in pet adoption rates in the U.S. will keep driving market expansion.

Moreover, well-known grocery companies are aggressively expanding their offerings by adding pet care facilities to their already-existing grocery stores. This strategic strategy seeks to meet the changing demands and tastes of consumers who value convenience and look for all-inclusive pet care solutions. Walmart stated in September 2023 that it would be opening a specialist pet services center, demonstrating its goal to turn into a one-stop shop for clients in need of routine grocery shopping, dog grooming appointments, and veterinary consultations. The pet services center is located next to the main store, and PetIQ staffers will staff the area with pets and provide veterinary treatment and pet supplies.

The pet grooming sector has also seen an increase in the range of services available, with grooming service providers broadening their offerings to incorporate spa services, specialty treatments, and high-end grooming encounters. In addition to drawing in more pet owners, this diversification has raised consumer spending on pet grooming services, which has fueled the market's expansion. The growing tendency of hiring professional groomers has reduced consumer demand for at-home pet grooming products, which has had an effect on market expansion and product sales. Throughout the projection period, this trend is anticipated to continue to be a major impediment to market expansion.

Market Concentration & Characteristics

The market for pet grooming products in the U.S. is quite competitive as there are numerous competitors with strong brand recognition and an extensive distribution network. Players in the market are anticipated to put more of an emphasis on innovation as R&D expenditure rises.

Certain players provide pet shampoos designed to address particular problems with pets, such fleas, ticks, or allergies. They frequently contain natural or organic components that are suitable for pets to lick or consume, and they contain compounds that are mild on the skin and fur of pets.

In response to this trend, new players in the industry have started creating and launching novel herbal and natural goods. In comparison to conventional pet skin and coat care solutions, these products are frequently considered as safer, healthier, and more efficient.

Brands can use product releases as an opportunity to interact with consumers, create buzz, and spark interest through advertising campaigns. Companies can reach new client segments and increase their presence by introducing new items.By utilizing each partner's unique skills, partnerships allow businesses to expand the range of products they offer. This may result in the creation of novel and distinctive pet grooming solutions that satisfy a wider variety of consumer tastes. Companies can access resources including manufacturing know-how, technology, and research and development capabilities through partnerships.

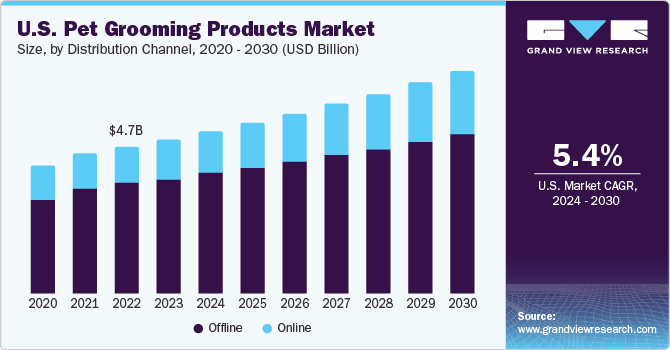

Distribution Channel Insights

The offline sales of pet grooming products in the U.S. accounted for a revenue share of 74.4% in 2023. Retail establishments, convenience stores, and supermarkets and hypermarkets are important offline distribution routes. The main reasons behind the success of offline distribution in the pet grooming goods industry have been the physical display of grooming products and the chance to verify the product qualities.

The online sales of pet grooming products in the U.S is expected to grow at a CAGR of 7.0% from 2024 to 2030. The increasing number of tech-savvy individuals and their preference for online purchasing has led to a rise in the popularity of e-commerce platforms in terms of distribution. In addition to the rise of independent online distributors, this trend has brought in e-retailers who cater to a wide client base by providing high-quality grooming items.

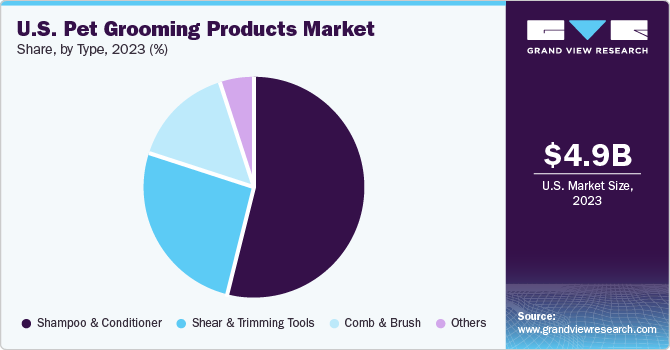

Type Insights

The pet shampoo and conditioner market in the U.S. accounted for a revenue share of 54.4% in 2023. Companion animals' fundamental hygienic needs are the main cause of their dominance. The fact that these grooming products are made especially with pet care in mind and are meant to clean, condition, and freshen companion animals' skin and hair. Furthermore, producers have created medicated shampoos with distinct ingredients to address a range of skin conditions and illnesses in pets.

The U.S. pet shear & trimming tools market is expected to grow at a CAGR of 5.5% from 2024 to 2030. The demand for electric trimmers and clippers for pets is being greatly influenced by the rising rate of pet ownership, the trend of pet humanization, and the expanding market for high-end pet items. Because they see their animals as members of the family, pet owners are prepared to spend extra on grooming supplies and services to maintain the appearance and general health of their animals. This involves spending money on top-notch electric trimmers and clippers to keep their pets' coats in good condition at home in between visits from a professional groomer.

Key U.S. Pet Grooming Products Company Insights

The companies are engaging in merger and acquisition activities with an aim to expand their business. For instance, in March 2018, BioAdaptives, Inc., a U.S.-based natural health products producer acquired Philco Animal Health Inc., which is a Canada-based veterinary product company.

Key U.S. Pet Grooming Products Companies:

- Groomer's Choice

- Himalaya Herbal Healthcare

- Spectrum Brands

- Earthbath

- Resco

- SynergyLabs

- Petco Animal Supplies, Inc.

- Coastal Pet Products

- Vet's Best

- 4-Legger

Recent Developments

-

In September 2023, at one of the biggest pet retail exhibitions in North America, SUPERZOO, Veterinary Formula, a SynergyLab subsidiary brand, unveiled a rebranding initiative and displayed a new approach to container designs for its grooming, treat, and supplement products. With its clean design, better wording, and more readable logo, the redesigned box exudes a modern look.

-

In June 2023, The Union Square flagship, a unique all-in-one center for pet health and wellness in New York City, is the newest project of Petco Health and Wellness Company, Inc. To commemorate the occasion, Petco held an adoption event and grand opening celebration in association with Petco Love. There were free pet-friendly games, freebies, and pet adoption options at the event.

U.S. Pet Grooming Products Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.20 billion

Revenue forecast in 2030

USD 7.10 billion

Growth rate

CAGR of 5.4% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, distribution channel

Country scope

U.S.

Key companies profiled

Groomer's Choice; Himalaya Herbal Healthcare; Spectrum Brands; Earthbath; Resco; SynergyLabs; Petco Animal Supplies, Inc.; Coastal Pet Products; Vet's Best; 4-Legger; World For Pets

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Pet Grooming Products Market Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. pet grooming products market report on the basis of type, and distribution channel:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Shampoo & Conditioner

-

Shear & Trimming Tools

-

Comb & Brush

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Offline

-

Online

-

Frequently Asked Questions About This Report

b. The U.S. pet grooming products market was estimated at USD 4.94 billion in 2023 and is expected to reach USD 5.20 billion in 2024.

b. The U.S. pet grooming products market is expected to grow at a compound annual growth rate of 5.4% from 2024 to 2030 to reach USD 7.10 billion by 2030.

b. Pet shampoo & conditioner dominated the U.S. pet grooming products market with a share of around 54.4% in 2023. Companion animal’s fundamental hygienic needs are the main cause of their dominance.

b. Some of the key players operating in the U.S. pet grooming products market include Groomer's Choice; Himalaya Herbal Healthcare; Spectrum Brands; Earthbath; Resco; SynergyLabs; Petco Animal Supplies, Inc.; Coastal Pet Products; Vet's Best; 4-Legger; World For Pets

b. The market growth is attributed to the rising spending on grooming, accessories, and food, which is a result of an increase in pet adoptions and humanization

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."