- Home

- »

- Medical Devices

- »

-

U.S. Preclinical CRO Market Size And Share Report, 2030GVR Report cover

![U.S. Preclinical CRO Market Size, Share & Trends Report]()

U.S. Preclinical CRO Market (2024 - 2030) Size, Share & Trends Analysis Report By Service (Bioanalysis & DMPK Studies, Toxicology Testing), By Model Type, By Technology, By End-use, By State, And Segment Forecasts

- Report ID: GVR-4-68040-257-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Preclinical CRO Market Size & Trends

The U.S. preclinical CRO market size was estimated at USD 3.6 billion in 2023 and is projected to grow at a CAGR of 7.1% from 2024 to 2030. The rising trend of outsourcing and the increasing focus of life science companies on their core competencies is driving the market growth. In addition, collaborations of biopharmaceutical companies with CROs are expected to positively impact the U.S. market for preclinical CRO. In August 2023, Crown Bioscience, a JSR Life Sciences company, announced its collaborative efforts with HanX Biopharmaceutical Co., Ltd., involving the use of a diverse range of preclinical modeling techniques for supporting the successful FDA Investigational New Drug (IND) application, have been published in Scientific Reports.

One of the primary drivers of outsourcing is that biopharmaceutical & life sciences companies do not have to make high capital investments for specific operations. Companies can outsource their noncore functions to CROs so that they can focus on their core operations, thereby increasing their productivity and operational efficiency. Currently, there is a notable trend of outsourcing preclinical testing functions to CROs or preclinical service providers in nations to reduce cost and increase focus on core R&D functions. This is especially common among small- and midsized life science companies that do not have an established R&D facility. These companies outsource preclinical testing activities to small- and midsized CROs to focus more on the clinical drug development process.

As personalized medicine is growing and the outdated one-size-fits-all model fades, there is a rising emphasis on making clinical trials more accessible and less taxing for patients. In response, technology has emerged as a crucial component in this domain. CROs are leading in adopting cutting-edge technologies and tools. This proactive approach not only helps them stay competitive but also enables them to provide clients with a comprehensive range of solutions.

Key companies are adopting several strategic technologies to expand their product reach in the market. For instance, in December 2023, Charles River Laboratories International, Inc. (CRL) formed a partnership with CELLphenomics through a mutual agreement. This collaboration will grant clients of Charles River access to CELLphenomics' exclusive 3D tumor model platform, PD3D. Consequently, Charles River's range of 3D in vitro testing services will expand, allowing for enhanced optimization of oncological strategies tailored to its clientele. This advancement is expected to significantly boost the company's Discovery and Safety Assessment (DSA) segment.

Personalized medicine and advanced therapeutics often involve highly specialized treatments tailored to individual patients or specific genetic profiles. This complexity requires extensive preclinical research to understand the mechanisms of action, safety profiles, and efficacy of these treatments. As a result, pharmaceutical and biotechnology companies increasingly rely on preclinical CROs to efficiently conduct these specialized studies.

Market Concentration & Characteristics

The market growth stage is medium and the pace of growth is accelerating. A high degree of innovation, owing to the increasing focus of pharmaceutical and biotechnology companies to outsource their operations to CROs to develop innovative technologies and services characterize the U.S. preclinical CRO market.

The market is also characterized by a high level of merger and acquisition (M&A) activity by the leading players as this strategy enables companies to increase their capabilities, expand their service portfolios, and improve their competencies. For instance, in July 2022, Eurofins Scientific acquired DiscoveryBioMed, a CRO focused on developing novel human bioassays utilizing cells from normal and diseased human tissues.

The regulatory framework offers both opportunities and challenges to the market. Compliance with regulatory requirements, particularly Good Laboratory Practice (GLP) standards, is vital in the U.S. preclinical CRO market. CROs must adhere to rigorous quality assurance and quality control processes to ensure data integrity, reproducibility, and regulatory acceptance of study results.

CROs offer specialized services to different companies based on their requirements. These personalized services offered by the CROs have better outcomes and results, which increase the inclination of the companies to outsource their requirements from the CROs. However, the companies and institutions exploring alternatives that leverage internal expertise can pose a threat to the services offered by preclinical CROs.

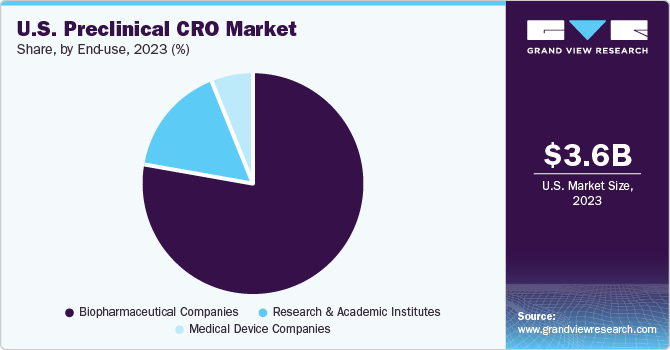

End-user concentration is a significant factor in the U.S. preclinical CRO industry as the services offered by the CROs are primarily used by some specific industries such as biopharmaceutical companies, research and academic institutes, and medical device companies. Moreover, the wide range of services offered by the CROs such as drug discovery, safety assessment, efficacy testing, and regulatory support further impacts the end-user concentration.

Service Insights

The discovery research segment dominated the market with a revenue share of 29.6% in 2023. This can be attributed to the rising outsourcing trends among pharmaceutical and biotechnology companies seeking to reduce costs and accelerate drug development. With increasing R&D expenditure, companies are relying on CROs’ specialized expertise in areas such as target identification and lead optimization. The flexibility and scalability offered by CROs, coupled with technological advancements, enable efficient and effective early-stage drug discovery. Furthermore, stringent regulatory requirements drive demand for high-quality preclinical research services provided by CROs to ensure the safety and efficacy of potential drug candidates. These factors collectively contribute to significant growth in discovery research services within the global preclinical CRO market.

The bioanalysis and DMPK studies segment is anticipated to grow at the fastest CAGR of 8.1% over the forecast period. Bioanalysis and DMPK studies are vital in the entire drug development process. Bioanalysis includes Pharmacokinetic (PK) and toxicokinetic tests, which are an integral part of Investigational New Drug (IND)-enabling studies. DMPK studies are conducted in the discovery and development phases of the drug R&D process. According to a report by the Servier Research Institute, 5.2% of overall failures are caused due to issues in preclinical pharmacokinetic testing. Bioanalysis and DMPK studies include in vivo & in vitro studies for preclinical species to overcome challenges arising during the clinical trial phase.

Model Type Insights

The small animal models segment accounted for the largest revenue share in 2023, owing to the increasing investments in CROs and extensive use of small animals in modern research activities & studies. Small animal models allow research and novel approaches with potential clinical applications in multiple areas. Mice and rats are easier to handle and maintain, have a short life cycle, and are more economical to use than larger animals. They are easy to house, scalable, cost-effective, and amenable to quantitative measures. They can be used to improve the efficiency of animal use while increasing the accuracy of results. Hence, small animal models have proven to be an important tool to take potential therapeutics from preclinical studies to humans.

The organoid models segment is expected to grow at the fastest CAGR from 2024 to 2030. This can be attributed to the increasing number of promising organoid models for drug discovery and development. In cancer research and drug discovery, these are relevant models owing to in vivo conditions; organoids are more biologically relevant to any model system and can manipulate gene sequence and niche components, which has led to rising demand for organoid models. In other diseases, these models have proven to be efficient. For instance, in February 2024, the Charcot-Marie-Tooth Association (CMTA) announced an investment of more than USD 200,000 to develop an organoid model of CMT1A, the common form of this disease. This approach would help scientists evaluate potential treatments that target defects in myelin, which is the protective sheath around peripheral nerves.

Technology Insights

The in vivo studies segment accounted for the largest revenue share in 2023. In vivo studies, as part of preclinical research, are continually evolving, driven by technological innovations, scientific discoveries, and the need for more accurate & predictive models. The development of genetically modified animals using techniques such as CRISPR/Cas9 enables researchers to create more precise and disease-relevant models for studying human diseases. These models better mimic the genetic and physiological characteristics of human conditions, leading to more clinically relevant findings.

The imaging technologies segment is expected to grow at the fastest CAGR from 2024 to 2030. Imaging technologies play a crucial role in preclinical CROs by enabling the visualization and analysis of biological processes in living organisms. These technologies help evaluate drug candidates, disease progression, and the development of new therapeutic interventions. Preclinical research is revolutionizing the delivery of modern medicine and the treatment of health issues. Preclinical imaging methods contribute to this transformation by minimizing biological variability and enabling the acquisition of extensive & diverse information while significantly decreasing the number of animals needed for studies, aligning with 3R (Replacement, Reduction, and Refinement) policies.

End-use Insights

The biopharmaceutical companies segment accounted for the largest revenue share in 2023, owing to the increasing trend of outsourcing services among biopharmaceutical companies lacking expertise in the preclinical phase of drug development. Biopharmaceutical companies can outsource more product innovation due to limited financial resources than traditional pharmaceutical companies. These CROs provide outsourcing services such as preclinical services to biopharmaceutical companies, allowing them to manage their R&D costs and focus on their core competencies.

The medical device companies segment is expected to grow at the fastest CAGR over the forecast period. Commonly offered outsourcing services by CROs to the medical devices sector include clinical development & compliance studies, and regulatory affairs. However, big and specialty CROs offer preclinical services catering to the medical device industry, contributing to this segment’s growth. For instance, CROs such as Charles River Laboratories offer biocompatibility, safety testing, and pathology services in the preclinical stage of drug development. CROs can help save vital time in the trial and development phases of medical devices, enabling increased speed & enhanced success rates for the innovation of new medical devices. Such factors are anticipated to drive the segment growth.

State Insights

Massachusetts held a significant market share in 2023. This can be attributed to the high presence of pharma companies in the state. For instance, according to the Massachusetts Biotechnology Council, Massachusetts is home to 18 to 20 global pharma firms and ranked as a major state among life sciences companies globally in 2022. Moreover, it remains one of the most NIH-funded states per capita, with USD 3.3 billion, while the Boston area had 26% of Venture Capital (VC) investment nationally. Such a significant presence of pharma companies and high investments have contributed to the market’s growth in the state.

California is expected to witness growth at the fastest CAGR over the forecast period, owing to the increasing clinical trials and research studies in the state. Several state headquartered CROs support research activities through various in vivo and in vitro studies to support the biopharmaceutical and pharmaceutical companies. With constant strategic initiatives, such as innovation and acquisition, the market is anticipated to grow rapidly over the estimated period. For instance, in January 2024, Promedica International, a California Corporation (PMI), an ophthalmology-focused clinical CRO, was acquired by iuvo BioScience. The acquisition is expected to support all aspects of ophthalmic clinical research, leveraging a larger team of experts with centuries of collective experience in ophthalmology.

Key U.S. Preclinical CRO Company Insights

Some of the key players operating in the market include Laboratory Corporation of America, Eurofins Scientific SE, Charles River Laboratories International, Inc., CROWN bioscience.

-

Labcorp operates in the healthcare services industry, offering clinical diagnostics, drug development, Contract Research Organization (CRO) services, drug monitoring solutions, and technology solutions. It provides comprehensive laboratory testing, pathology services, molecular diagnostics, & genomic testing for medical conditions. The company supports pharmaceutical and biotechnology companies with clinical trials, central laboratory testing & safety assessments.

-

Eurofins Scientific SE (Eurofins) is a provider of preclinical services globally. It has a portfolio of 150,000 analytical methods for evaluating the composition, authenticity, and purity of biological substances. It also provides AgroTesting, consumer product testing, environment testing, medical device testing, and chemical registration & authorization services.

Key U.S. Preclinical CRO Companies:

- Laboratory Corporation of America

- Lonza

- WuXi AppTec, Inc.

- Eurofins Scientific SE

- Intertek Group plc

- Medpace Holdings, Inc.

- Charles River Laboratories International, Inc.

- SGA SA

- Pharmaceutical Product Development, Inc. (Thermo Fisher Scientific, Inc.)

- ICON plc

- CROWN bioscience

Recent Developments

-

In November 2023, Crown Bioscience and JSR Life Sciences, LLC announced the launch of a service offering, OrganoidXplore. This organoid panel screening platform would provide reproducible, robust, and clinically relevant output, accelerating preclinical oncology drug discovery by reshaping the landscape of cancer treatment development.

-

In September 2023, ICON plc announced a partnership with the U.S. government for COVID-19 vaccine clinical trials. It conducted Phase IIb clinical trials for the U.S. BARDA-selected vaccine candidates as part of Project NextGen.

-

In April 2022, Charles River Laboratories International, Inc. acquired Explora BioLabs Holdings, Inc. The acquisition would enhance the Charles River Accelerator and Development Lab (CRADL), providing consumers with full-service, turnkey research space. It added 15+ Vivarium facilities across the U.S. to the company’s portfolio, expanding its preclinical research business.

U.S. Preclinical CRO Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 5.9 billion

Growth rate

CAGR of 7.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, model type, technology, end-use, state

Country scope

U.S.

State scope

New Jersey; Pennsylvania; Massachusetts; Florida; North Carolina; Texas; Illinois; Indiana; Michigan; California; Rest of U.S.

Key companies profiled

Laboratory Corporation of America; Lonza; WuXi AppTec, Inc.; Eurofins Scientific SE; Intertek Group plc; Medpace Holdings, Inc.; Charles River Laboratories International, Inc.; SGA SA; Pharmaceutical Product Development, Inc. (Thermo Fisher Scientific, Inc.); ICON plc; CROWN bioscience

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Preclinical CRO Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. preclinical CRO market report based on service, model type, technology, end-use, and state:

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Bioanalysis and DMPK studies

-

In vitro ADME

-

In-vivo PK

-

-

Toxicology Testing

-

GLP

-

Non-GLP

-

-

Compound Management

-

Process R&D

-

Custom Synthesis

-

Others

-

-

Chemistry

-

Medicinal Chemistry

-

Computation Chemistry

-

-

Safety Pharmacology

-

Discovery Research

-

Target Identification & Screening

-

Target Validation & Functional Informatics

-

Lead Identification & Candidate Optimization

-

Preclinical Development

-

Other Associated Workflow

-

-

Others

-

-

Model Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Small Animal Models

-

Mice

-

Rats

-

Rabbits

-

Others

-

-

Large Animal Models

-

Pig

-

Others

-

-

Organoid Models

-

Cell Culture Models

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

In Vivo Studies

-

In Vitro Studies

-

Ex Vivo Studies

-

Imaging Technologies

-

Ultrasound Imaging

-

MRI Imaging

-

CT Imaging

-

Radionuclide Imaging

-

Other Imaging Technologies

-

-

Other Technologies

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Biopharmaceutical Companies

-

Research and Academic Institutes

-

Medical Device Companies

-

-

State Outlook (Revenue, USD Million, 2018 - 2030)

-

New Jersey

-

Pennsylvania

-

Massachusetts

-

Florida

-

North Carolina

-

Texas

-

Illinois

-

Indiana

-

Michigan

-

California

-

Rest of U.S.

-

Frequently Asked Questions About This Report

b. The U.S. preclinical CRO market size was estimated at USD 3.6 billion in 2023 and is expected to reach USD 3.9 billion in 2024.

b. The U.S. preclinical CRO market is expected to grow at a compound annual growth rate of 7.11% from 2024 to 2030 to reach USD 5.9 billion by 2030.

b. Based on end use, the biopharmaceutical companies segment dominated the U.S. preclinical CRO market with a share of 78.06% in 2023. This is attributable to the high number of preclinical trials, advanced healthcare infrastructure, stringent regulatory guidelines, and constant research and development initiatives.

b. Some key players operating in the laboratory products and services outsourcing market include Lonza; WuXi AppTec; Eurofins Scientific SE; Intertek Group plc; Medpace Holdings, Inc.; Charles River Laboratories International, Inc.; SGA SA; Thermo Fisher Scientific, Inc.; ICON plc;, Crown Bioscience.

b. Key factors that are driving the market growth include adoption of personalized medicine and advanced therapeutics, increasing outsourcing trends among biopharmaceutical companies, and surge in R&D investments among others.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.