- Home

- »

- Plastics, Polymers & Resins

- »

-

U.S. Recycled Polyester Market Size, Industry Report, 2030GVR Report cover

![U.S. Recycled Polyester Market Size, Share & Trends Report]()

U.S. Recycled Polyester Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Cotton Spinning Material, Filling Material, Non-woven), By Application (Apparel, Home Textiles, Automotive Interior, Construction Material), And Segment Forecasts

- Report ID: GVR-4-68040-702-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Recycled Polyester Market Summary

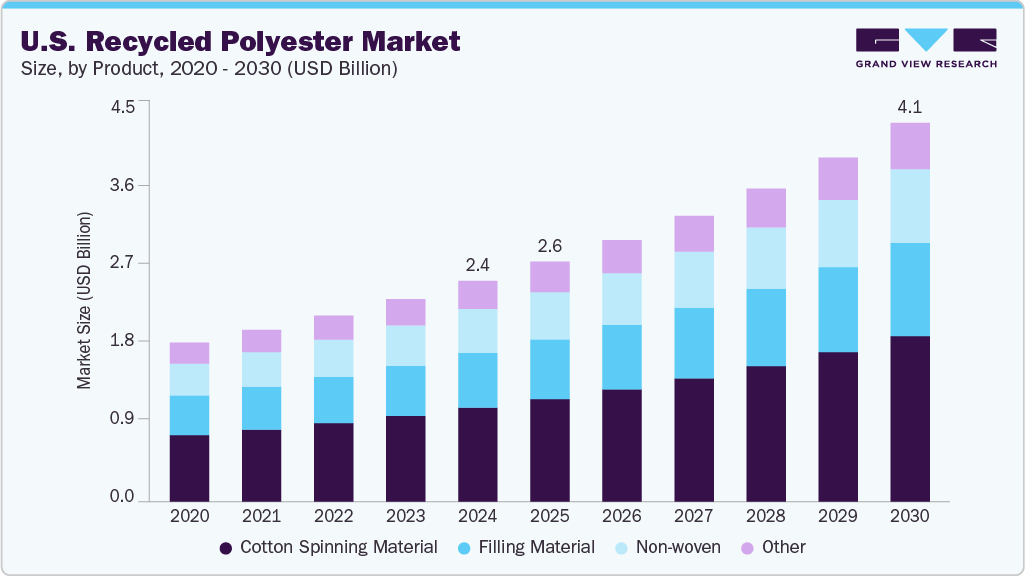

The U.S. recycled polyester market size was estimated at USD 2,407.8 million in 2024 and is projected to reach USD 4,130.5 million by 2030, growing at a CAGR of 9.6% from 2025 to 2030. The U.S. recycled polyester market is witnessing strong growth, fueled by regulatory mandates, innovation, and rising consumer demand for sustainable products.

Key Market Trends & Insights

- By product, the cotton spinning material segment held the highest market share of 42.5% in 2024.

- The filling material segment is expected to grow at a significant CAGR of 9.4% from 2025 to 2030.

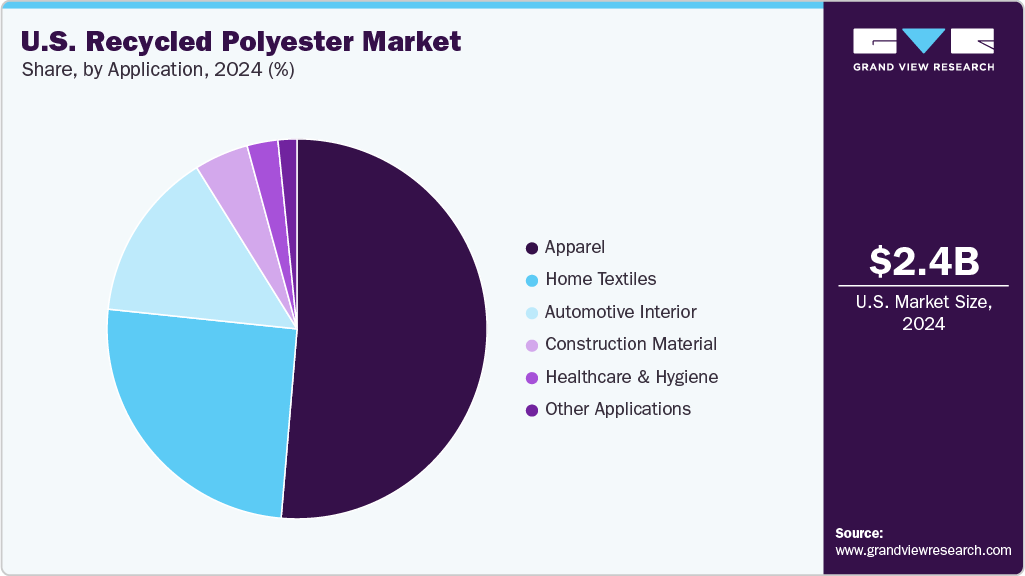

- Based on applications, the apparel segment held the highest market share of 51.3% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2,407.8 Million

- 2030 Projected Market Size: USD 4,130.5 Million

- CAGR (2025-2030): 9.6%

Policies such as Extended Producer Responsibility (EPR) and plastic reduction laws are driving the integration of recycled content across industries. Local authorities are reinforcing these efforts by promoting recycled polyester as a viable alternative to conventional plastics.There is a notable shift in consumers’ preferences towards environmentally sustainable products, due to rising environmental awareness and demand for ethical manufacturing practices. Especially in the fashion industry, brands increasingly integrate recycled materials into their products. Brands such as Adidas, Patagonia, and H&M are embracing sustainability to reduce environmental impact by using ocean plastic and recycled polyester to create garments and footwear.

Recycled polyester is suitable for a wide range of applications from apparel to automotive interiors due to its durability, flexibility and performance characteristics. Beyond clothing, it is found in furnishings such as curtains and carpets. The automotive sector also incorporates the use of recycled polyester in seat fabrics and interior due to its resistance to stretching and shrinking, making it a reliable material. Additionally, it contributes to sustainability goals by providing less reliance on petroleum-based materials.

Product Insights

The cotton spinning material segment dominated the market in 2024 and is expected to grow at the fastest CAGR over the forecast period. These fibers replicate cotton’s texture while offering a sustainable alternative to cotton. Growing consumer preference for eco-friendly textiles is driving demand across the apparel sector. Rising awareness around climate change, ethical production, and resource conservation influences purchasing behavior, compelling them to shift towards sustainable products. This substitution supports environmental goals without compromising fabric quality. Furthermore, integrating recycled polyester into cotton spinning processes enables cost efficiencies and enhances manufacturers' supply chain resilience.

The filling material segment is expected to grow significantly over the forecast period. The market is witnessing steady growth due to rising consumer demand for sustainable and non-allergic alternatives. Major home furnishing and apparel brands are adopting recycled polyester insulation and padding in cushions, comforters, and seat padding. Innovation in chemical recycling is enhancing the use of polyester fibers, making them suitable for high-performance filling applications. Support from regulations and corporate sustainability initiatives further accelerates the adoption of recycled polyester.

Application Insights

The apparel segment dominated the market and accounted for the largest revenue share in 2024 and is expected to maintain its leading position over the forecast period. Production of polyester apparel is affordable; it can be the sole constituent of apparel products, but when it comes to maintaining comfort, polyester is often blended with cotton or another natural fiber. Major fashion brands such as H&M are investing heavily in recycled polyester to meet environmental goals. H&M, for instance, has committed USD 600 million to purchase recycled polyester. This agreement spans seven years and aims to supply a significant portion of H&M's long-term need for recycled polyester, which is currently primarily sourced from bottle-to-fiber (rPET).

The home textiles segment is anticipated to experience the fastest CAGR from 2025 to 2030. The market is driven by rising consumer demand for sustainable and eco-friendly products. Growing preference for bedsheets, curtains, and upholstery made from recycled materials is reflecting a broader shift toward conscious consumption. Technological advancements have significantly enhanced the quality of recycled polyester, making it a viable alternative to virgin fibers in a wide range of textile applications. As a result, major brands are increasingly incorporating recycled polyester into their home textile offerings. This trend supports environmental goals and aligns with evolving consumer values. In addition, government regulations and retailer sustainability commitments are encouraging the adoption of recycled materials across the home textile industry.

Key U.S. Recycled Polyester Company Insights

Some of the key companies in the U.S. recycled polyester market include TEIJIN FRONTIER(U.S.A) INC., UNIFI, Inc., Poole Company, USFibers, Alpek Polyester, and others.

- UNIFI's is a U.S.-based textile manufacturer known for producing innovative synthetic and recycled fiber solutions for various industries including apparel, automotive, and home furnishings. REPREVE, a recycled performance fiber made from post-consumer plastic bottles and textile waste.

Key U.S. Recycled Polyester Companies:

- TEIJIN FRONTIER(U.S.A) INC.

- UNIFI, Inc.,

- Poole Company

- USFibers

- Alpek Polyester

Recent Developments

-

In August 2024, Unifi launched two globally available circular polyester products made from 100% recycled polyester feedstock, with at least 50% derived from textile waste.

-

In November 2023: Alpek Polyester USA's 270,000-square-foot bottle-to-bottle recycling plant in Reading, Pennsylvania, became fully operational.

U.S. Recycled Polyester Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2,616.8 million

Revenue forecast in 2030

USD 4,130.5 million

Growth rate

CAGR of 9.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in Kilotons, Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Volume, Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application

Key companies profiled

TEIJIN FRONTIER(U.S.A)INC., UNIFI, Inc., Poole Company, USFibers, Alpek Polyester

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Recycled Polyester Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. recycled polyester market report based on product and application outlook:

-

Product Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2030)

-

Cotton Spinning Material

-

Filling Material

-

Non-woven

-

Others

-

-

Application Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2030)

-

Apparel

-

Home Textiles

-

Automotive Interior

-

Construction Material

-

Healthcare & Hygiene

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. recycled polyester market size was estimated at USD 2.41 billion in 2024 and is expected to reach USD 2.62 billion in 2025.

b. The U.S. recycled polyester market is expected to grow at a compound annual growth rate of 9.56% from 2025 to 2030 to reach USD 4.13 billion by 2030.

b. Apparel application dominated the U.S. recycled polyester market with a revenue share of 51.34% in 2024, driven by global fashion brands’ commitment to reducing their carbon footprint and reliance on virgin synthetic fibers.

b. Some key players operating in the U.S. recycled polyester market include TEIJIN FRONTIER(U.S.A.),INC, UNIFI, Inc., LIBOLON, USFibers, Alpek Polyester Patagonia, Inc., HYOSUNG USA., Custom Polymers, and Evergreen.

b. The U.S. recycled polyester market is primarily driven by growing demand for sustainable and eco-friendly materials across industries, particularly in textiles and packaging.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.