- Home

- »

- Medical Devices

- »

-

U.S. Regulatory Affairs Market Size, Industry Report, 2033GVR Report cover

![U.S. Regulatory Affairs Market Size, Share & Trends Report]()

U.S. Regulatory Affairs Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (In-house, Outsourced), By Service, By Product, By Indication, By Product Stage, By Company Size, By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-278-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Regulatory Affairs Market Summary

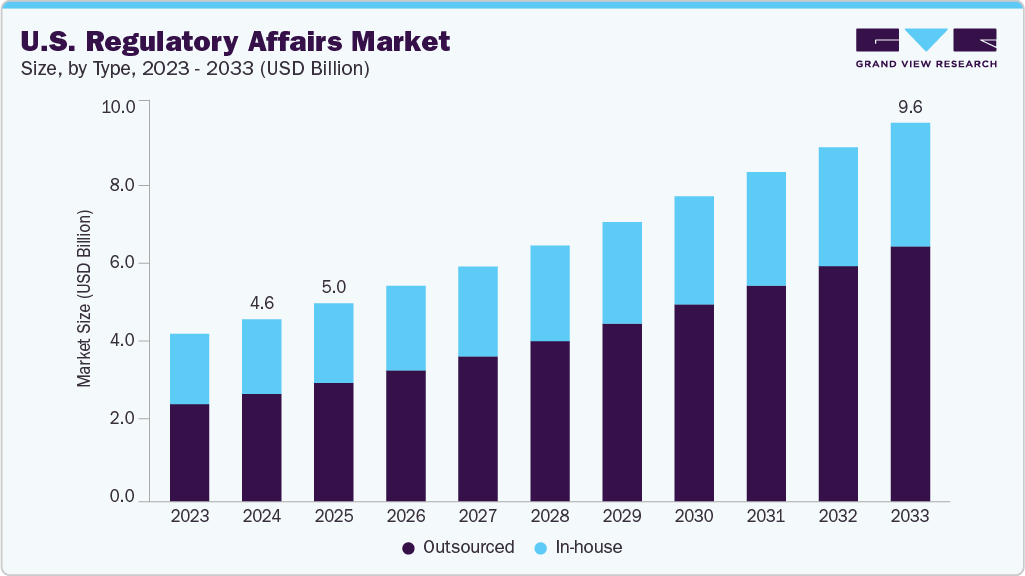

The U.S. regulatory affairs market size was estimated at USD 4.65 billion in 2024 and is projected to reach USD 9.65 billion by 2033, growing at a CAGR of 8.43% from 2025 to 2033. Continuous advancements in biopharmaceutical innovation drive the growth, increased FDA submission volumes, and the complexity of drug and device pipelines.

Key Market Trends & Insights

- Based on type, the outsourced segment held the highest market share in 2024

- By service, the product registration & clinical trial applications segment held the highest market share of 36.45% in 2024.

- Based on product, the medical devices segment held the highest market share in 2024.

- By indication, the oncology segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.65 Billion

- 2033 Projected Market Size: USD 9.65 Billion

- CAGR (2025-2033): 8.43%

The upsurge in orphan drugs, oncology treatments, and combination therapies has required more comprehensive regulatory guidance throughout the development lifecycle, thereby accelerating market demand. Besides, the rising frequency of regulatory interactions like pre-IND meetings and rolling submissions has highlighted the importance of regulatory affairs as a foundational aspect of the industry. Moreover, the stringent compliance requirements under GxP standards and evolving post-marketing surveillance frameworks further highlight the necessity for a strong regulatory infrastructure.The growing technological advancements, with a notable focus on automation, digital submission systems, and AI-driven regulatory intelligence for effective regulatory operations, are anticipated to drive the growth of the U.S. regulatory affairs industry. Moreover, the U.S FDA's prioritization of eCTD 4.0 has prompted organizations to streamline their submission platforms and improve document lifecycle management. Cloud-based RegTech tools have significantly enhanced labeling compliance, version control, and change management. In addition, the integration of natural language processing and machine learning algorithms aims to streamline regulatory content generation, minimize manual errors, and accelerate readiness for audits and inspections.

The investment trends showcased increasing private equity and corporate venture capital flow towards regulatory outsourcing providers and RegTech platforms. Significant funding rounds have been noted in companies that specialize in digital submissions, regulatory strategy consulting, and quality documentation. Larger CROs and CDMOs are strategically acquiring smaller companies to expand their regulatory affairs capabilities and improve integrated service offerings. Whereas, pharmaceutical and biotech companies have enhanced the budget allocations for regulatory digitalization, compliance automation, and workforce development to accelerate time-to-market while mitigating regulatory risks.

The regulatory landscape is constantly evolving, with the U.S. FDA issuing updated guidelines across numerous therapeutic areas and technology platforms. Structured interactions under initiatives like the U.S. FDA’s Real-Time Oncology Review and Project Orbis have been introduced to expedite approvals. Simultaneously, global regulatory strategies are increasingly incorporating regulatory harmonization efforts via the ICH and mutual recognition agreements. Expectations for enhanced transparency and data integrity are rising, with particular emphasis on traceability and structured data submissions under programs such as SPL and IDMP.

However, despite its strong growth potential, the market faces challenges such as a shortage of experienced regulatory professionals, rising operational costs, and the frequent changes in guidance that create compliance uncertainty. Smaller companies often struggle with limited internal regulatory expertise and budget constraints, which can delay early engagement with regulatory agencies and result in submission setbacks. In addition, increased scrutiny and lengthening review timelines in specific therapeutic areas have led to increased risk aversion. Besides, the organizations also encounter challenges between legacy systems and modern RegTech platforms, slowing the pace of digital adoption and limiting the overall impact of innovation. Such factors are expected to drive the demand for outsourcing regulatory affairs services to specialized service providers in the U.S.

Opportunity Analysis

The U.S. regulatory affairs market is expected to witness substantial growth opportunities owing to the rise of complex therapeutics such as biologics, cell and gene therapies, and digital health solutions. As regulatory pathways become increasingly specialized, there is a rising demand for sophisticated regulatory strategies and submission expertise. Besides, one of the significant opportunities lies in digital transformation, such as RegTech solutions, which emerge as essential tools for automating compliance, tracking submissions, and providing real-time regulatory intelligence. Furthermore, outsourced regulatory affairs services are expected to grow lucratively, especially among emerging biotech and mid-sized pharmaceutical companies, for cost-effective solutions. The evolving guidance from the U.S. FDA regarding AI/ML-enabled medical devices, personalized medicine, and expedited approval pathways also creates new possibilities for consultants and technology providers. Companies that can offer integrated, technology-enabled regulatory services with specific therapeutic and geographic focuses will likely gain a competitive edge. As the skilled labor shortages continue to be a challenge, the integration of automation with subject matter expertise will be crucial in meeting the needs across both pre- and post-approval stages of development.

Technological Advancements

The U.S. regulatory affairs industry is experiencing significant transformations driven by five key technology platforms improving compliance, efficiency, and responsiveness. One important advancement is the usage of AI-driven regulatory intelligence platforms, which allow organizations to monitor, analyze, and interpret real-time regulatory updates from the U.S. FDA and other global agencies. This proactive approach enables companies to stay ahead of regulatory changes. At the same time, the implementation of eCTD 4.0 has become a crucial focus, with platforms that enhance metadata tagging, lifecycle management, and enable two-way communication with regulators. Such upgrades help to streamline submission processes and minimize delays caused by back-and-forth communications. Cloud-based Regulatory Information Management (RIM) systems also play a vital role in providing centralized access, ensuring version control, and facilitating cross-functional collaboration among regulatory teams spread across different regions, which is essential for maintaining audit readiness and effectively managing product lifecycle data.

Moreover, Natural Language Processing (NLP)-enabled regulatory writing tools are increasingly being adopted to automate content creation for clinical summaries, risk assessments, and other submission documents. This automation enhances consistency and helps to accelerate timelines for submissions. Further, automated labeling and change management platforms reduce manual errors by allowing synchronized global updates and ensuring real-time compliance with evolving labeling regulations. This ultimately helps in reducing market access delays and minimizing regulatory risks. Such factors are expected to offer lucrative market growth opportunities over the estimated time period.

Pricing Model Analysis

The U.S. regulatory affairs market offers diverse pricing models tailored to project complexity, client type, and service scope. Milestone-based pricing is commonly applied to large regulatory projects, such as IND filings or NDA submissions, where payments are tied to specific deliverables. It offers budget control and aligns incentives with progress. Fixed-fee models are used for clearly defined tasks like labeling compliance or gap assessments, providing cost certainty and simplified billing.

Value-based pricing is gaining traction in high-impact engagements, especially for accelerated approval strategies where compensation is linked to outcomes such as reduced review time or faster market access. This model encourages shared risk and performance alignment. Moreover, subscription or retainer-based pricing supports long-term regulatory partnerships by offering continuous advisory services for a fixed monthly or quarterly fee. It is favored by early-stage biotechs and small to mid-sized pharma companies seeking flexible, ongoing access to regulatory expertise without the need for full-time internal staff. Such factors are expected to drive the market over the estimated time period.

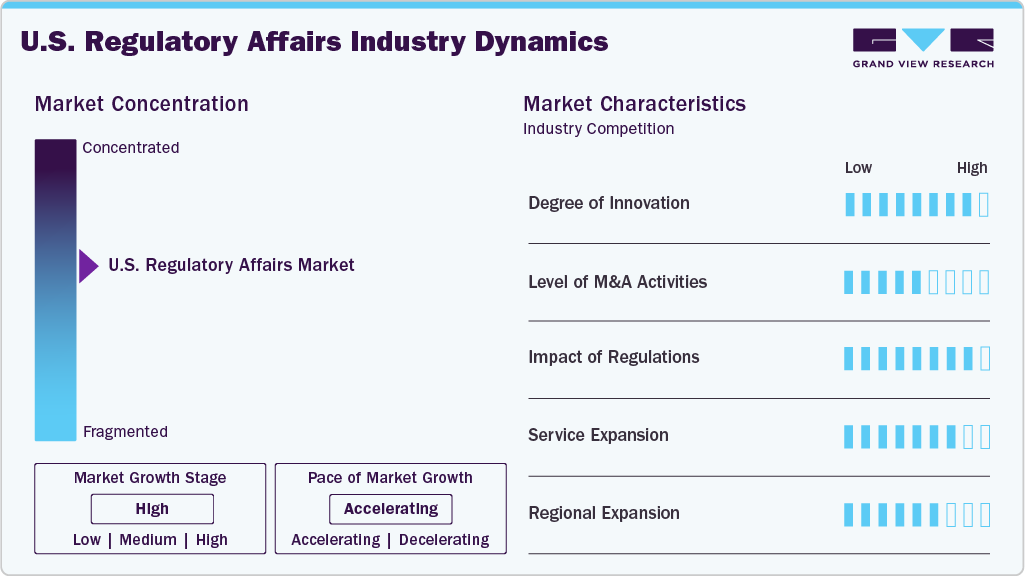

Market Concentration & Characteristics

The U.S. regulatory affairs market growth stage is moderate, and growth is accelerating. The market is characterized by the degree of innovation, level of M&A activities, regulatory impact, service expansion, and regional expansion.

Innovation in U.S. regulatory affairs is driven by AI, RegTech platforms, and automation tools that streamline submissions, labeling, and compliance tracking, enabling faster approvals and adaptive regulatory strategies for emerging therapies like gene editing and AI-driven diagnostics.

Regulatory complexity continues to rise, driven by evolving U.S. FDA guidance, post-market surveillance requirements, and expedited approval frameworks. This significantly impacts how companies structure compliance strategies, allocate resources, and engage with regulatory bodies throughout the drug and device lifecycle.

M&A activity remains moderate with strategic acquisitions by CROs, CDMOs, and regulatory consultancies aiming to enhance capabilities in digital regulatory solutions, rare disease expertise, and accelerated pathway navigation, particularly in high-growth areas such as cell and gene therapies.

Service portfolios are expanding to include real-time regulatory intelligence, global submission management, risk-based monitoring, and digital regulatory writing, with providers investing in end-to-end solutions to support accelerated approvals, lifecycle compliance, and emerging therapeutic modalities.

U.S.-based regulatory companies are expanding internationally, leveraging FDA expertise to support multinational trials, simultaneous filings, and regulatory harmonization across the EU, Asia-Pacific, and Latin America, driven by increased demand for global market access and cross-border compliance strategies.

Type Insights

The outsourced segment dominated the U.S. regulatory affairs industry in 2024. The growth is driven by the growing number of biopharma and medtech companies seeking specialized expertise and cost-efficient compliance solutions. Besides, growing product complexity, continuous regulatory reforms, and resource constraints are driving demand for external regulatory partners. In addition, increasing preference for outsourcing services for submission management, regulatory strategy, labeling, and FDA meeting support further contributes to the segmental revenue growth. Also, small to mid-sized companies rely on outsourcing to navigate accelerated pathways and evolving regulations. Moreover, the service providers are witnessing increased adoption of digital platforms, enabling virtual regulatory teams and real-time collaboration. This trend is expected to drive the segment growth.

On the other hand, the in-house segment is expected to witness considerable growth over the forecast period. The in-house segment remains critical for large pharmaceutical and medtech companies that require integrated, full-time regulatory capabilities. These in-house teams manage end-to-end regulatory functions, including strategy development, submission planning, FDA liaison, and post-approval compliance. In-house models offer greater control, institutional knowledge, and alignment with R&D and commercial functions. As product pipelines diversify and regulations evolve, companies are investing in talent development, digital tools, and cross-functional integration. However, challenges persist, including high costs, talent shortages, and scalability limitations, prompting some companies to adopt hybrid models blending internal teams with selective external support.

Service Insights

The product registration & clinical trial applications segment accounted for the largest share of the U.S. regulatory affairs industry in 2024. The rising volume of novel therapies and increasing complexity in regulatory requirements drive the high revenue share growth. Sponsors must navigate a rigorous U.S. FDA approval process that includes IND submissions, clinical trial authorizations, and eventual NDA/BLA filings. The demand for regulatory expertise in early-stage planning, clinical protocol design, and real-time FDA engagement is growing, especially for therapies under accelerated pathways. Strategic regulatory input is essential to avoid delays, optimize trial design, and ensure data alignment with U.S. FDA expectations. Both in-house teams and outsourced providers play key roles in facilitating compliance, efficient product development, and approval.

On the other hand, the regulatory writing & publishing segment is anticipated to showcase the fastest CAGR during the forecast period. Regulatory writing and publishing are essential elements of the U.S. Regulatory Affairs market, ensuring that key regulatory documents are prepared, formatted, and submitted in accordance with FDA standards. This encompasses clinical study reports, Investigator Brochures, IND/NDA/BLA modules, and responses to regulatory inquiries. With the increasing volume and complexity of submissions, there is an increased demand for skilled medical writers and electronic publishing specialists who are well-versed in eCTD standards and data integrity requirements. The timelines for regulatory approval and the outcomes greatly rely on the clarity, consistency, and technical precision of these submissions. Moreover, the emergence of AI-assisted writing tools and cloud-based publishing platforms improves efficiency, minimizes manual errors, and facilitates quicker, more streamlined communications with regulatory agencies. Such factors are expected to drive the market over the estimated time period.

Product Insights

The medical devices segment accounted for the largest revenue share in 2024. The U.S. regulatory affairs market for medical devices is evolving rapidly, driven by innovation in digital health, diagnostics, and AI-enabled technologies. Regulatory teams play a critical role in navigating FDA pathways such as 510(k), De Novo, and PMA, as well as managing pre-submission meetings, risk classifications, and labeling compliance. The introduction of the U.S. FDA’s ‘Digital Health Center of Excellence’ and ongoing updates to cybersecurity, software-as-a-medical-device (SaMD), and real-world evidence guidelines are reshaping regulatory strategies. Demand for specialized regulatory expertise is rising, particularly for connected devices and combination products. Companies increasingly leverage in-house and outsourced regulatory support to streamline approvals, maintain post-market compliance, and ensure faster time-to-market.

On the other hand, the biologics segment is expected to grow significantly during the forecast period. Continuous advancements in monoclonal antibodies, biosimilars, cell and gene therapies, and mRNA-based products drive the segment’s growth. Regulatory teams are essential for navigating complex FDA pathways such as IND, BLA, and RMAT designations, with an increasing focus on CMC (Chemistry, Manufacturing, and Controls) compliance, accelerated review mechanisms, and post-market safety requirements. The evolving regulatory landscape demands deep scientific expertise and proactive engagement with the U.S. FDA to manage evolving guidance around potency assays, comparability, and immunogenicity. Both large biopharma and emerging biotech companies are investing in in-house and outsourced regulatory resources to streamline approvals, minimize regulatory risk, and manage lifecycle requirements across their biologic portfolio.

Indication Insights

In 2024, the oncology segment dominated the U.S. regulatory affairs market due to an upsurge in innovative therapies, including immunotherapies, targeted treatments, and personalized medicine. Regulatory teams play a pivotal role in navigating expedited FDA pathways such as breakthrough therapy, fast track approvals, and Real-Time Oncology Review (RTOR), which are increasingly utilized to accelerate oncology drug approvals. Given the high-risk nature of oncology trials, a robust regulatory strategy is essential for designing adaptive protocols, managing safety data, and aligning submissions with evolving FDA expectations. Besides, demand is growing for specialized regulatory professionals and consultants with oncology expertise. Early engagement with the U.S. FDA and strategic usage of surrogate endpoints are critical for reducing development timelines and securing timely market access.

On the other hand, the immunology segment is estimated to witness the fastest CAGR over the forecast period. The segmental demand is driven by the development of biologics, biosimilars, and advanced therapies targeting autoimmune and inflammatory conditions. Regulatory teams are essential in navigating complex FDA pathways, including IND and BLA submissions, with emphasis on immunogenicity, safety profiling, and long-term efficacy data. Evolving FDA guidelines on biomarkers, combination therapies, and personalized immunotherapies require close regulatory alignment during early development. Increased usage of expedited programs like fast track and priority review in immunology further strengthens the need for specialized regulatory expertise.

Stage Insights

The clinical studies segment accounted for the largest share of the U.S. regulatory affairs industry in 2024. The market for clinical studies plays a crucial role in ensuring compliance from the start to the end of trials. Regulatory teams handle essential tasks such as IND submissions, FDA pre-submission meetings, protocol reviews, and ongoing safety reporting. As trial designs become more complex, including adaptive studies and decentralized models, having regulatory expertise becomes crucial to ensure that study protocols meet U.S. FDA standards and to prevent delays. There is a growing demand for quicker development timelines, particularly in fields like oncology, rare diseases, and gene therapies. This has increased reliance on regulatory support to navigate swiftly changing guidelines and incorporate real-world data. Subsequently, both sponsors and CROs are enhancing their in-house capabilities and outsourcing regulatory functions to improve the efficiency of clinical trial execution and the regulatory submission process.

On the other hand, the preclinical segment is expected to grow significantly during the forecast period. The market for preclinical development is essential in steering early-stage drug candidates toward readiness for clinical trials. Regulatory teams are responsible for compiling and submitting Investigational New Drug (IND) applications, ensuring compliance with U.S. FDA standards regarding preclinical toxicology, pharmacology, and safety data. As the drug development landscape evolves, the complexities associated with biologics, gene therapies, and innovative delivery systems have led to an increased need for regulatory expertise during the preclinical phase. Engaging early with the U.S. FDA through pre-IND meetings is crucial for mitigating risks and ensuring that studies align with regulatory expectations. Both sponsors and regulatory consultancies are investing significantly in preclinical regulatory strategies to facilitate smoother transitions into first-in-human trials, minimize attrition rates, and promote long-term regulatory success.

Company Size Insights

In 2024, the medium-sized companies segment dominated the U.S. regulatory affairs market. Medium-sized companies increasingly leverage hybrid models that combine in-house expertise with selective outsourcing. With expanding pipelines and limited internal bandwidth, these companies seek cost-effective regulatory support for submissions, labeling, and U.S. FDA engagement. Demand is high for scalable solutions, particularly in oncology, rare diseases, and digital health. Investments in RegTech platforms and external consultancies enable faster approvals and regulatory compliance. These companies prioritize agility, speed-to-market, and strategic alignment across development and commercialization phases.

On the other hand, the large companies segment is expected to grow significantly during the forecast period. Large companies are driven by extensive in-house teams managing complex global submissions, lifecycle management, and regulatory strategy across diverse portfolios. These firms invest heavily in advanced digital tools like AI-driven regulatory intelligence and eCTD 4.0 platforms to enhance efficiency and compliance. In addition, these companies focus on integrating regulatory affairs closely with R&D and commercial functions to accelerate approvals and mitigate risk. Strategic outsourcing is selectively used for niche expertise or capacity flexibility, supporting their focus on innovation, scale, and global market access.

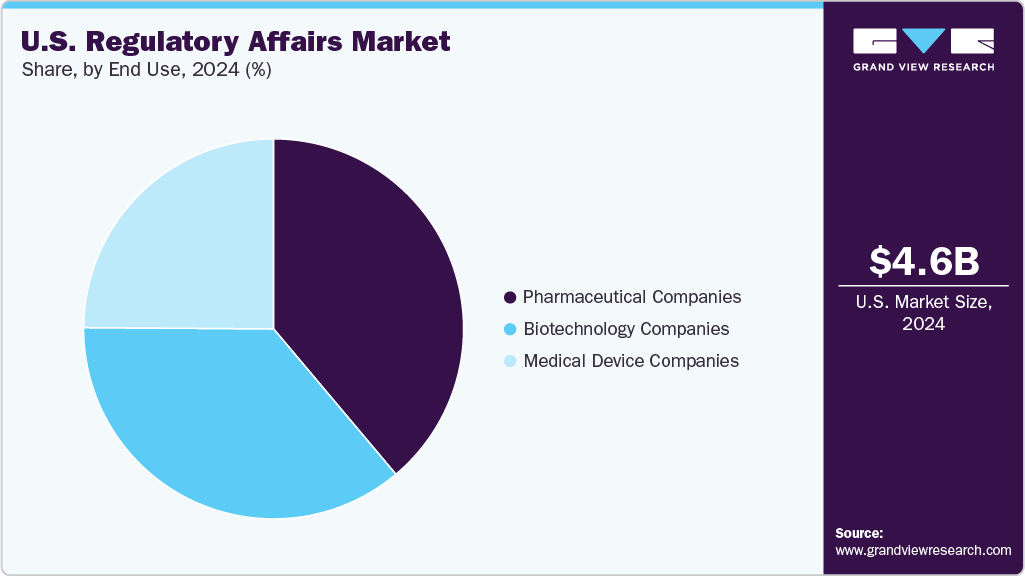

End Use Insights

The pharmaceutical companies segment dominated the U.S. regulatory affairs industry in 2024. Pharmaceutical companies prioritize a comprehensive regulatory strategy to navigate complex U.S. FDA requirements and accelerate product approvals. In-house teams handle global submissions, compliance, and post-market activities, while outsourcing is utilized for specialized support and workload management. The rise of innovative therapies and expedited pathways has intensified the demand for skilled regulatory professionals and advanced digital tools. Strategic regulatory planning is crucial for risk mitigation, faster time-to-market, and maintaining competitive advantage across diversified drug pipelines.

The biotechnology companies segment is expected to grow significantly over the forecast period. Biotechnology companies in the U.S. regulatory affairs market increasingly rely on specialized regulatory expertise to manage complex biologics, gene therapies, and personalized medicine submissions. Due to limited internal resources, several small and medium-sized biotech firms adopt a hybrid model combining in-house teams with outsourced regulatory services. Further, rapid innovation and evolving FDA guidelines drive demand for agile regulatory strategies, early agency engagement, and digital tools. Regulatory affairs functions are critical for navigating accelerated approval pathways, ensuring compliance, and supporting lifecycle management, enabling biotech companies to optimize time-to-market and competitive positioning.

Key U.S. Regulatory Affairs Company Insights

The key industry players operating in the regulatory affairs industry are actively undertaking key strategic initiatives such as service launches, mergers & acquisitions, partnerships & collaborations, and expansions to capture significant market share in the country. For instance, in September 2024, Freyr launched Human Factors Engineering (HFE) services designed to address the growing demand for user-centric designs in the medical devices industry. The rising number of large-scale product recalls and the increasing focus of authorities, such as the U.S. FDA, on the usability of products have driven the demand for user-centric designs. A newly introduced product by Freyr has been developed to assist medical device manufacturers by monitoring potential complications users face during the early development cycle.

Key U.S. Regulatory Affairs Companies:

- Accell Clinical Research, LLC.

- Charles River Laboratories

- Genpact

- ICON plc

- iuvo BioScience, LLC.

- WuXi AppTec

- Medpace

- IQVIA, Inc.

- Freyr

- PharmaLex (Cencora)

- ProPharma

Recent Developments

-

In January 2025, Canyon Labs acquired iuvo BioScience’s lab services and consulting divisions to offer comprehensive end-to-end solutions, boosting its presence in the regulatory affairs market. This strategic move enhances the ability to streamline regulatory processes, particularly within ophthalmic clinical research and pharmaceutical development.

-

In September 2023, Freyr entered into a partnership agreement with the PKG Group LLC. The partnership aimed to navigate stringent regulatory procedures and accelerate submission activities in a quick turnaround time.

U.S. Regulatory Affairs Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.05 billion

Revenue forecast in 2033

USD 9.65 billion

Growth rate

CAGR of 8.43% from 2025 to 2033

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, service, product, indication, product stage, company size, and end use

Country scope

U.S.

Key companies profiled

Accell Clinical Research, LLC.; Charles River Laboratories; Genpact; ICON plc; iuvo BioScience, LLC.; WuXi AppTec; Medpace; Freyr; IQVIA, Inc.; PharmaLex (Cencora); ProPharma

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Regulatory Affairs Market Report Segmentation

This report forecasts revenue growth at the country level and analyzes the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. regulatory affairs market report based on type, service, product, indication, product stage, company size, and end use:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

In-house

-

Outsourced

-

-

Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Regulatory Consulting

-

Legal Representation

-

Regulatory Writing & Publishing

-

Writing

-

Publishing

-

-

Product Registration & Clinical Trial Applications

-

Other Services

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Drugs

-

Innovator

-

Preclinical

-

Clinical

-

Post Market Approval (PMA)

-

-

Generics

-

Preclinical

-

Clinical

-

Post Market Approval (PMA)

-

-

-

Biologics

-

Biotech

-

Preclinical

-

Clinical

-

Post Market Approval (PMA)

-

-

ATMP

-

Preclinical

-

Clinical

-

Post Market Approval (PMA)

-

-

Biosimilars

-

Preclinical

-

Clinical

-

Post Market Approval (PMA)

-

-

-

Medical Devices

-

Diagnostics

-

Preclinical

-

Clinical

-

Post Market Approval (PMA)

-

-

Therapeutics

-

Preclinical

-

Clinical

-

Post Market Approval (PMA)

-

-

-

-

Indication Outlook (Revenue, USD Million, 2021 - 2033)

-

Oncology

-

Neurology

-

Cardiology

-

Immunology

-

Others

-

-

Product Stage Outlook (Revenue, USD Million, 2021 - 2033)

-

Preclinical

-

Clinical studies

-

Post Market Approval (PMA)

-

-

Company Size Outlook (Revenue, USD Million, 2021 - 2033)

-

Small

-

Medium

-

Large

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Medical Device Companies

-

Pharmaceutical Companies

-

Biotechnology Companies

-

Frequently Asked Questions About This Report

b. The U.S. regulatory affairs market size was estimated at USD 4.65 billion in 2024 and is expected to reach USD 5.05 billion in 2025.

b. The U.S. regulatory affairs market is expected to grow at a compound annual growth rate of 8.43% from 2025 to 2033 to reach USD 9.65 billion by 2033.

b. The product registration & clinical trial applications segment dominated the U.S. regulatory affairs market with a share of 36.45% in 2024. The segment growth is driven by the rising volume of novel therapies and increasing complexity in regulatory requirements. Besides, sponsors must navigate a rigorous FDA approval process that includes IND submissions, clinical trial authorizations, and eventual NDA/BLA filings, which is expected to fuel the market over the estimated period.

b. Some key players operating in the U.S. regulatory affairs market include Accell Clinical Research, LLC.; Charles River Laboratories; GenPact; ICON plc; iuvo BioScience, llc.; WuXi AppTec; Medpace; Charles River Laboratories; Freyr; Labcorp Drug Development among others.

b. Key factors driving the U.S. regulatory affairs market growth include advances in biopharmaceutical innovation, increased FDA submission volumes, and the complexity of drug and device pipelines. Besides, the rise in orphan drugs, oncology treatments, and combination therapies has necessitated more comprehensive regulatory guidance throughout the development lifecycle, which is expected to drive the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.