- Home

- »

- Clothing, Footwear & Accessories

- »

-

U.S. Safety Eyewear Market Size And Share Report, 2030GVR Report cover

![U.S. Safety Eyewear Market Size, Share & Trends Report]()

U.S. Safety Eyewear Market (2023 - 2030) Size, Share & Trends Analysis Report By Product Type (Prescription, Non-prescription), By Application (Oil & Gas, Construction, Mining, Industrial Manufacturing, Military), And Segment Forecasts

- Report ID: GVR-4-68040-059-9

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

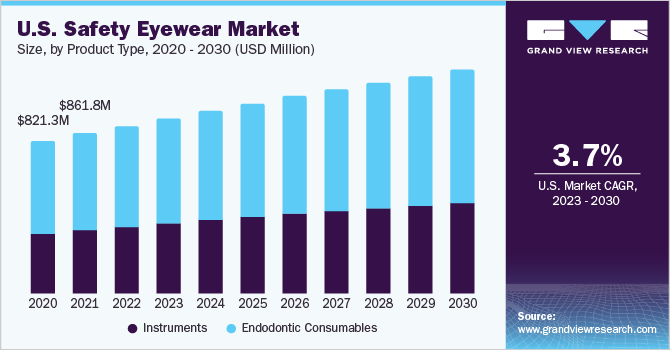

The U.S. safety eyewear market size was valued at USD 903.5 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 3.7% from 2023 to 2030. The rising implementation of safety regulations is contributing to market growth. The U.S. has implemented numerous workplace safety regulations through authorities such as the occupational safety and health administration (OSHA). These organizations aim to protect the workforce from injuries and loss of life in hazardous work conditions. Safety regulations have greatly reduced the risk of loss of life in many occupations by taking legal punitive action against defaulters. Safety standards also extend to devices and equipment used by the workforce on a regular basis, such as clothes, boots, gloves, helmets, and eyewear.

The Occupational Safety and Health Administration, a large regulatory agency of the United States Department of Labor, has spelled out standardizations that every manufacturer needs to follow while manufacturing personal protection equipment (PPE). The directive aims to ensure that the PPE meets quality levels and safety standards by setting safety requirements, along with conditions for its placement on the market and free movement within the European market. The directive covers any equipment, device, or appliance that is designed to be held or worn by an individual for protection against health and safety hazards. These favorable regulations are expected to drive the use of personal protective equipment, including safety eyewear, in the forecast period.

Caring for eyes at the workplace is not restricted only to industrial laborers. People who spend long hours working on laptops or computers can experience varying levels of discomfort in their eyes. Spending long hours focusing on a screen can cause fatigue, eye strain, and headaches. It could also leave the eyes red, causing them to become dry due to a lack of blinking. According to Baucsh+Lombhis, this is owing to the fact that mobile screens, computer screens, and other digital displays reduce the blink rate of a person by as much as 66%. Continued usage of smartphones, computers, and other screens can also cause sleep disturbances, pain in the neck, wrist, and back, digital dementia, chronic tiredness, and many other ailments, which could drive the need for safety eyewear.

Despite the introduction of smart eyewear and other technologies that help correct visual impairment, blindness remains a major risk for people exposed to such work conditions. To safeguard their workforce, many companies-especially those with a contractual workforce-are now providing safety eyewear, in addition to other basic safety equipment. This will continue to benefit the market. In addition, various stringent regulations have been laid by the U.S. Department of Labor and OSHA in U.S., which has positively impacted the demand for safety eyewear. Rising awareness regarding employee safety has also augmented market growth. According to the National Institute for occupational safety and health (NIOSH), the majority of eye injuries are caused due to scraping of the eye or small objects or particles striking the eye such as wood chips, metal silvers, cement chips, and dust.

The safety eyewear market is expected to grow in the U.S. in the coming future. Increased awareness about eye safety among U.S. workers and corporations leads to a standardized market that follows industry regulations. In addition, the introduction of new materials such as Trivex is revolutionizing the industry; these materials are made from urethane polymers and are easier to be molded into prescription eyewear than polycarbonates are generally injection mold based. Furthermore, with an increase in the number of customers purchasing through online platforms, companies now have the chance to sell their products online and reach a considerable number of consumers anywhere in the world.

A significant role is played by the e-commerce retail channels in the distribution of safety eyewear and is expected to have a significant portion of the market revenue. Online sales channels allow consumers to explore a wide range of products at a single location without having to physically visit retail stores. E-commerce retail sales are predicted to increase significantly in the next few years as a result of rising consumer expenditure, a growing population, and more internet access. Furthermore, the emergence of mobile shopping applications and the availability of secure and simple payment methods are adding to the expansion of the online retail business. These trends are expected to positively impact the safety eyewear market during the forecast period.

Product Type Insights

The non-prescription segment dominated the market with a higher share of over 60% in 2022. Non-prescription safety glasses, majorly familiar as "Plano" lenses, are designed to be used by people who do not need glasses to prevent vision issues at the worksite. In situations where visual safety is a concern, prescription safety glasses are worn in place of the user's regular glasses. Non-prescription safety glasses can be worn on top of the wearer's regular corrective lenses as an alternative to prescription safety eyewear. Non-prescription safety eyewear is used mainly by laborers (day shift), city facility management (civic) workers, police and military, and heavy machinery operators. Since the number of individuals requiring corrective lenses is lower, the market for non-prescription safety eyewear is expected to grow at a higher rate over the forecast period. In addition, low cost and greater market availability are among the major factors driving the non-prescription safety eyewear market.

The prescription segment is anticipated to register a higher CAGR of 3.9% in the forecast period. Prescription safety eyewear is mainly used by engineers, technicians, scientists, academicians, specialists/professionals, artisans, and some sports/adventure enthusiasts. The demand for corrective lenses by white-collared professionals is expected to increase in the near future. Due to their premium cost, the value of the prescription segment is expected to rise further by the end of the forecast period. Several end users such as lab technicians & scientists, physicians, dentists, orthopedics, and sports/adventure enthusiasts are exposed to UV rays at the workplace. UV safety eyewear helps completely block all UV light frequencies. Additionally, several UV safety eyewear is tinted to allow certain color frequencies to be more visible than others.

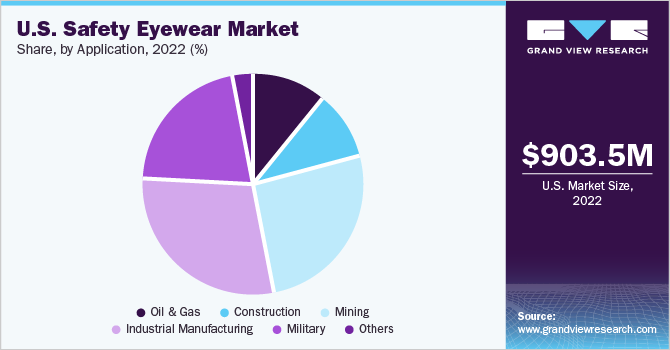

Application Insights

The industrial manufacturing segment led the market with the highest share of over 25% in 2022. Industrial manufacturing comprises a range of operations, such as processing, assembling, and finishing, which expose workers to harmful chemicals, dust particles, and dangerous light radiations. This is increasing the demand for safety wear in the industrial manufacturing industry. Operations that involve considerable risk of eye injuries in industrial manufacturing include chiseling, drilling, hammering, sanding, chipping, spraying, grinding, smelting, cutting, and welding. Moreover, there is a high possibility that workers who are engaged in making safety glasses may be exposed to hazards such as heated plastics, chemicals, high pressure, electricity, sharp cutting edges, and falls. Therefore, safety organizations have laid down several standards & guidelines.

The mining segment is anticipated to grow with a faster CAGR of 3.9% over the forecast period. There have been significant improvements made for the regulation of mining because it is a significant industrial sector in many regions of the world, especially the U.S. Therefore, mining companies have been imposing strict guidelines to protect their workers from eye injuries caused at minefields. The mining industry is characterized by the presence of various sub-industries such as coal mining, iron ore mining, non-metallic mineral quarrying, gold & silver mining, and others. Thus, distinct types of safety eyewear products are required for different mining operations. For instance, safety glasses with side shields are suitable for most mining operations, while goggles are not recommended for below-ground mining operations unless a particular operation poses a risk of chemical splash hazard.

Key Companies & Market Share Insights

Key players operating in the market are adopting various steps to increase their presence in the market. These steps include strategies such as partnerships, mergers & acquisitions, global expansion, and others. Some of the initiatives include:

-

In October 2021, UVEX Group introduced the uvex i-range, a new line of 3-in-1 safety eyewear, suitable for any workplace environment or hazard. The range comprises uvex i-lite, uvex i-guard, and uvex i-guar safety eyewear. Eyewear in the uvex-i series uses uvex supravision coating technology and UV400 protection and is made with bio-based and recycled materials.

-

In June 2021, MCR Safety introduced the new Memphis safety glass series. The series features wraparound polycarbonate lenses, which filter 99.9% of UVA, UVB, and UVC ray and provides excellent coverage and unobstructed view. The lenses are also UV-cured, eco-friendly, and V-AF Anti-Fog coated. Additionally, these lenses are available in a variety of options such as grey, green filters, tinted colors, and magnification lenses.

-

In March 2021, Honeywell International Inc. introduced a new prescription safety frame to its portfolio of protective eyewear; the Honeywell Uvex Avatar RX. The new frame is made for workers who require corrective lenses and work in environments that call for industrial safety eyewear. The new frame offers customization and comfort to workers.

Some of the prominent players in the U.S. safety eyewear market include:

-

Kimberly-Clark Corporation

-

Honeywell International Inc.

-

UVEX Safety Group

-

The 3M Company

-

Honeywell International Inc.

-

UVEX Safety Group

-

MCR Safety

-

Bollé Safety

-

Medop S.A.

-

Pyramex Safety Products LLC

-

Radians Inc.

U.S. Safety Eyewear Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 1,207.5 million

Growth rate

CAGR of 3.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, application

Key companies profiled

Kimberly-Clark Corporation; Honeywell International Inc.; UVEX Safety Group; The 3M Company; Honeywell International Inc.; UVEX Safety Group; MCR Safety; Bollé Safety; Medop S.A.; Pyramex Safety Products LLC; and Radians Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

U.S. Safety Eyewear Market Report Segmentation

This report forecasts growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segment from 2017 to 2030. For this study, Grand View Research has segmented the U.S. safety eyewear market on the basis of, product, and application:

-

Product Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Prescription

-

Non-prescription

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Oil & Gas

-

Construction

-

Mining

-

Industrial Manufacturing

-

Military

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. safety eyewear market size was estimated at 903.5 million in 2022 and is expected to reach USD 945.4 million in 2023.

b. The U.S. safety eyewear market is expected to grow at a compound annual growth rate of 3.7% from 2023 to 2030 to reach USD 1,207.5 million by 2030.

b. The industrial manufacturing segment dominated the U.S. safety eyewear market with a share of 28.7% in 2022. The increasing demand for safety wear in the industrial manufacturing industry owing to the high possibility that workers who are engaged in making safety glasses may be exposed to hazards such as heated plastics, chemicals, high pressure, electricity, sharp cutting edges, and falls.

b. Some key players operating in the U.S. safety eyewear market include Kimberly-Clark Corporation; Honeywell International Inc.; UVEX Safety Group; The 3M Company; Honeywell International Inc.; The 3M Company; UVEX Safety Group; MCR Safety; Bollé Safety; Medop S.A.; Pyramex Safety Products LLC; and Radians Inc.

b. The rising implementation of safety regulations coupled with the increased awareness about eye safety among U.S. workers and corporations leads to a standardized market that follows industry regulations thus contributing to the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.