- Home

- »

- Homecare & Decor

- »

-

U.S. Scented Candles Market Size, Industry Report, 2030GVR Report cover

![U.S. Scented Candles Market Size, Share & Trends Report]()

U.S. Scented Candles Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Container-based, Pillar), By Distribution Channel (Hypermarkets & Supermarkets, Convenience Stores & Gift Centers, Online), And Segment Forecasts

- Report ID: GVR-4-68040-206-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Scented Candles Market Size & Trends

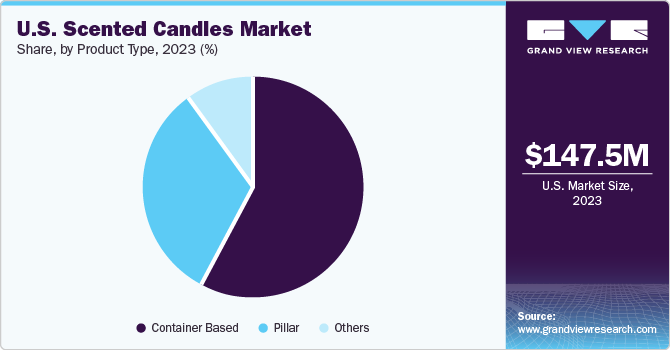

The U.S. scented candles market size was estimated at USD 147.46 million in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 4.1% from 2024 to 2030. The market growth can be attributed to both domestic as well as commercial demand. The increasing number of hotels, restaurants, resorts, hospitality destinations resuming their businesses with full capacity after pandemic phase has resulted in growing demand for associated products including scented candles. Similarly, increased disposable income in the country has been encouraging residents to spend more on home décor and products such as scented candles. Trend driven market of home décor is also influenced by societal mind-sets and desire to fit in.

U.S. scented candles market accounted for the share of 25.83% of the global scented candles market in 2023. Scented candles are popular in both commercial and residential setting across the country. Growing trend of renovating homes according to modern trends while adding aesthetic appeal and home décor elements has fuelled the demand for scented candles. Owing to its therapeutic properties, the scented candles are commonly used in businesses such as spas and luxury lounges to add extraordinary value in customer’s experience. Scents do not have any sort of limited space in terms flavors and fragrances, and this has been encouraging companies to explore newer horizons by inventing novel scents. Some of the key companies of the U.S. scented market have been investing proactively in R&D to accomplish new product development strategies.

Now, personalised and scented candles, for instance, with a photo or quote on the containers, have become trend in the market. The brands like Yankee candles are known for providing customized candles to its customers who want to use their products to create memorable and relaxing environment. The customised or personalised scented candles have gained popularity across the social media as well. As the preferences and likings of consumers shift, the candles industry is constantly evolving to match the demand of users. In addition, trends of unexpected scents, which are known to buyers, yet not often associated with candles, are attaining popularity across markets. This includes scents such as bourbon, pop tomato, basil, plum, and tea among others.

Market Concentration & Characteristics

The market is growing at an accelerating pace and the growth stage is identified as medium. The U.S. scented candles market is fragmented and is mainly characterized by many companies operating in variety of industries, while entailing scented candles as one of their business. The diverse nature of the inhabitants in the U.S., different kind of liking for fragrances, various kinds of requirements from commercial buyers, and response to newly developed fragrances from consumers in the country has boosted innovation efforts put in by the scented candles manufacturers.

The degree of innovation in the market is identified as high. The constantly changing customer demands, which tend to vary according timely trends, occasions, holidays, series of events followed by national or global incidences, and social media influences as well. These factors put the makers in a situation where they continuously have to innovate and offer novel products infused with fragrances that have higher likelihood getting overwhelming response from the consumers. The home décor trends, recent developments in fragrance market, changing dynamics of bath and bed industry also have impact on the new product development ideas in the U.S. scented candles market.

The impact of the regulations is medium on the scented candles market in the United States. The regulations regarding the labelling on immediate containers, which includes the clear mention regarding presence of hazardous materials, if any. This is mainly done to help customers safely store and use the products and provide them with information of first aid actions to follow if an accident occurs. The threat of substitute is considered medium for this market as growing talks about if the emitted scents are healthy or not. This may result in many consumers shifting their focus to alternate products such as room freshening sprays among others.

Mergers & Acquisition activities in the U.S. scented candles market are at medium level as well. These are mainly undertaken in form for acquisitions by parent company of the brands to expand their product portfolio. Also, some of the established brands are acquired by the consumer goods industry leaders that are already operating in variety of businesses. For instance, the village candles, renowned brand in scented candles market of United States, was acquired by Stonewall kitchen in 2020.

Product Insights

The container-based scented candles market in the United States accounted for the largest revenue share of 58.46% % in 2023. Container-based scented candles are often made available to customers in variety of fragrances, numerous personalization alternatives and choices for tailor-made features. The container-based scented candles are generally used in both commercial as well as domestic spaces. In container-based products range, the companies offer the novel scents such as, mid-summer night, Cliffside sunrise fresh-cut roses, cucumber-mint, and vanilla-cream among others.

This particular type of scented candles, i.e. container-based, is made out of premium-grade paraffin wax. The containers used in the product making are developed from non-flammable materials. Later, during the process of manufacturing, these containers are filled with high-quality wax and wick. These candles have very low melting point and can burn for more than 100 hours while providing desired soothing fragrances for entire room. Many companies working in the market offer this type of scented candles through their diverse product range. On the other hand, the pillar scented candles market in the country is growing at CAGR of 3.4% and is expected to maintain its upward growth trend from 2024 to 2030.

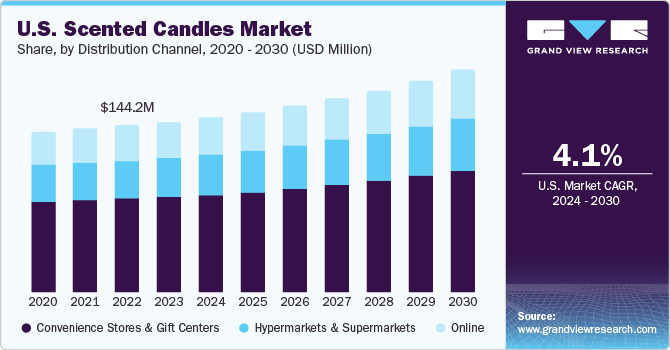

Distribution Channel Insights

The sales of scented candles through convenience stores & gift centres accounted for revenue share of 55.82% in the year 2023. The convenience stores & gift centres experience the noteworthy dip in the sale in years 2020 and 2021, mainly due to impacts created by pandemic over the consumer goods market, however, from 2022 the revenue generated by the U.S. scented candles market has been growing at significant pace. The presence of these products in hypermarkets & supermarkets has also been generating growth in demand. Though revenue generated through this channel is lower than sales through convenience stores, it is contributing to the market growth with crucial CAGR.

The online channel has been generating considerable amount of sales for scented candles and the online scented candles market for the United States is expected to grow at CAGR of 4.3% from 2024 to 2030. The online experience of shopping provides detail information about the products in market; however, it lacks the basic feature of sensing the scent offered by particular candle. This has impact over volume of sales through the online distribution channels.

Key U.S. Scented Candles Company Insights

The U.S. scented candles industry is fragmented, is comprised with presence of multiple established companies as well as many newly formed, mid-sized, small size organisations, which have been gaining the customer attention in recent past. The market competition is primarily driven by the innovation strategies adopted by the manufacturers to cater to variety of consumer expectations. The brands operating in this market have been exploring some of the very niche areas of fragrances and enabling its users to enrich their domestic as well as commercial experiences with wide range of fragrances developed with diligence and expertise of the field.

-

Yankee Candles, one of the popular brands by Newell, and market leader scented candles in the United States, launched its holiday fragrance collections named Bright Lights. The collections entails five new fragrances from winter seasonal category. This new collection made out of soy-wax includes products such as Holiday Cheer, Magical Bright Lights, Shimmering Christmas Tree, Sparking Winterberry, and Marshmallow Eggnog. These products were launched in the market through online distribution channel, company website as well as through their retail offline distribution partners such as Kohl's, Target, Meijer and one of the retail industry leader Walmart.

-

In January 2024, new range of accessible yet luxurious home fragrance created by Harry Slatkin at Slatkin + Co. was exclusively launched at Dollar General. This collection is named at Club 92. The initial launch of the Club 92 included fragrances such as Very Vanilla Cupcake, Crisp Apple, Fresh Cotton Skies, Mango Key Lime, Jasmine Blossom, and Eucalyptus Mint among others.

Key U.S. Scented Candles Companies:

- Yankee Candles (Newell Brands)

- Colonial Candle

- Bridgewater Candle Company

- Jonathan Adler

- Village Candles (Stonewall Kitchen)

- Slatkin & Co

- The Estée Lauder Companies

- Bath & Body Works, Inc.

- NEST New York

- Thymes, LLC

Recent Developments

-

Newell Brands, owner of America’s popular key player in scented candles market, Yankee Candles, announced organisational realignment in January 2024. This announcement came after company’s announcement about support for Where to play / How to win choices in June of 2023 in an attempt to strengthen some of the internal aspects such as consumer understanding and brand communication as well.

-

In July 2023, Stonewall Kitchen, owner of brand Village Candles since 2020, launched collection of 100 new products through its food and home categories. The new mercury glass candles were introduced through this collection from Village Candle, which were featuring some of the country’s popular fragrances such as Balsam Fir, Royal Nutcracker and Winter Clementine as well. The product launch of July 2023 also included product such as Leaf It to Me, Shiny & Bright, Season of Lights as well as some of the Seasonal offerings by company such as Savory Stuffing, and Warm Maple Apple Crumble.

U.S. Scented Candles Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 151.39 million

Revenue Forecast in 2030

USD 192.13 million

Growth Rate

CAGR of 4.1% from 2024 to 2030

Actuals

2018 - 2023

Forecasts

2024 - 2030

Quantitative units

Revenue in USD Million/Million and CAGR from 2024 to 2030

Report Coverage

Revenue forecast; company ranking; competitive landscape; growth factors; and trends

Segments Covered

Products, distribution Channel

Country scope

U.S.

Key companies profiled

Yankee Candles (Newell Brands); Colonial Candle; Bridgewater Candle Company; Jonathan Adler; Village Candles (Stonewall Kitchen); Slatkin & Co; The Estée Lauder Companies; Bath & Body Works, Inc.; NEST New York; Thymes LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Scented Candles Market Report Segmentation

This report forecasts revenue growth at the country level and offers a scrutiny of the most recent industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. Scented Candles market report based on product, and distribution channel.

-

Product Outlook (Revenue; USD Million; 2018 - 2030)

-

Container Based

-

Pillar

-

Others

-

-

Distribution Channel Outlook (Revenue; USD Million; 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Convenience Stores & Gift Centers

-

Online

-

Frequently Asked Questions About This Report

b. The U.S. scented candles market was estimated at USD 147.46 billion in 2023 and is expected to reach USD 151.39 billion in 2024.

b. The U.S. scented candles market is expected to grow at a compound annual growth rate of 4.1% from 2024 to 2030 to reach USD 192.13 billion by 2030.

b. Container candles dominated the U.S. scented candles market with a share of around 58.46% in 2023. The container-based scented candles have been gaining popularity across the country primarily due to features offered by the product.

b. Some of the key players operating in the U.S. scented candles market include Yankee Candles (Newell Brands); Colonial Candle; Bridgewater Candle Company; Jonathan Adler; Village Candles (Stonewall Kitchen); Slatkin & Co; The Estée Lauder Companies; Bath & Body Works, Inc.; NEST New York; Thymes LLC

b. The increasing number of hotels, restaurants, resorts, and hospitality destinations resuming their businesses at full capacity after the pandemic phase has resulted in growing demand for associated products including scented candles.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.