- Home

- »

- Advanced Interior Materials

- »

-

U.S. Sealing Tapes Market Size, Share, Industry Report 2030GVR Report cover

![U.S. Sealing Tapes Market Size, Share & Trends Report]()

U.S. Sealing Tapes Market (2025 - 2030) Size, Share & Trends Analysis Report By Materials Type (Polypropylene, Polyvinyl Chloride), By Adhesive Type (Acrylic, Rubber-Based, Silicone), And Segment Forecasts

- Report ID: GVR-4-68040-671-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Sealing Tapes Market Summary

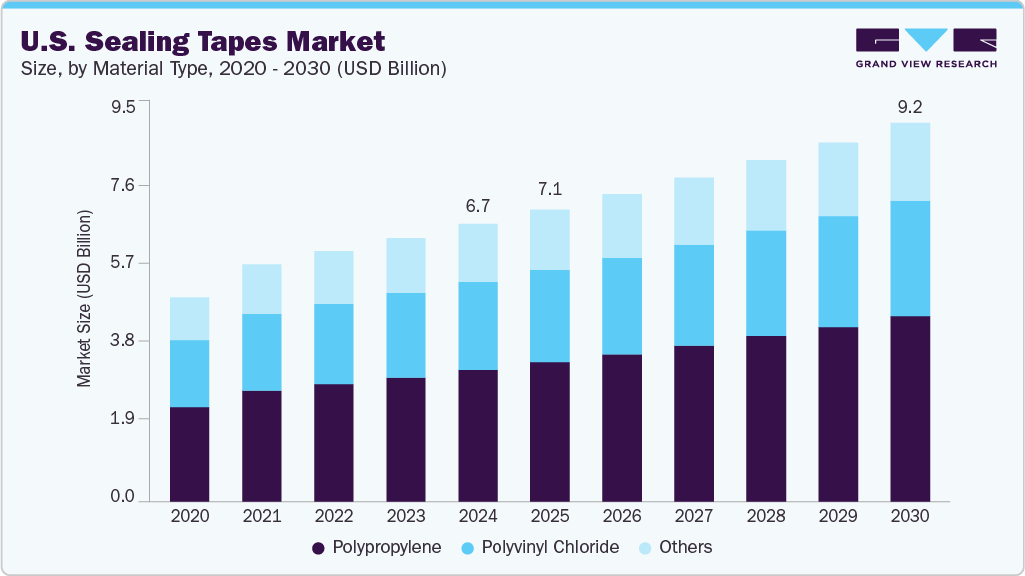

The U.S. sealing tapes market size was estimated at USD 6.74 billion in 2024 and is projected to reach USD 9.19 billion in 2030, growing at a CAGR of 5.3% from 2025 to 2030. This is attributed to their versatile applications in construction, automotive, healthcare, and electronics sectors.

Key Market Trends & Insights

- By material type, the polypropylene segment led the market with a revenue share of 47.5% in 2024.

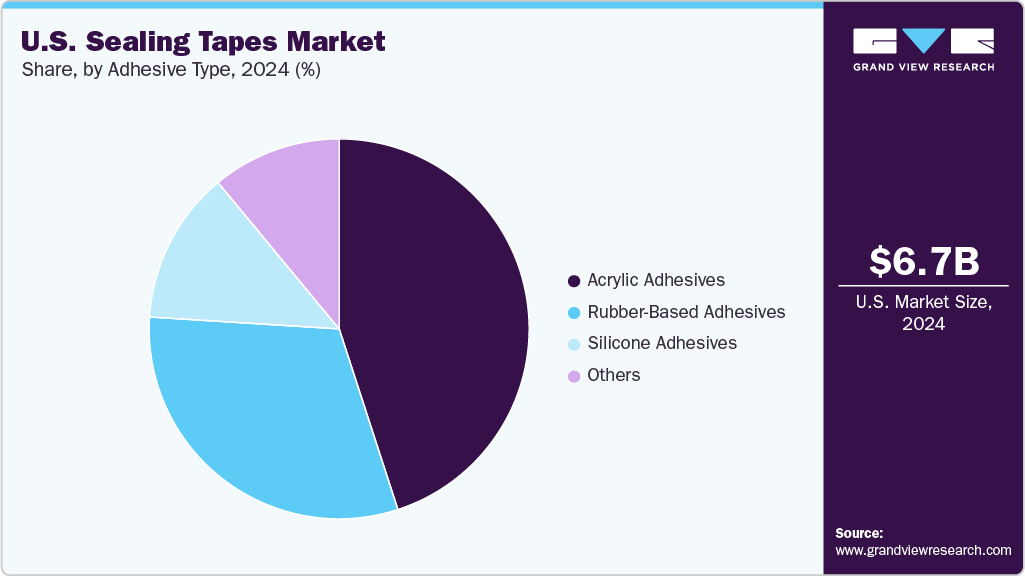

- By adhesive type, the acrylic adhesives segment dominated the market with a revenue share of 44.9% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 6.74 Billion

- 2030 Projected Market Size: USD 9.19 Billion

- CAGR (2025-2030): 5.3%

Sealing tapes are adhesive materials designed to close, secure, or protect packages, surfaces, or joints across various industries. The rise in global trade and logistics necessitates reliable sealing options to ensure product safety during transport. Innovations in tape materials, including sustainable options, further enhance performance and eco-friendliness, while the increasing emphasis on tamper-evident packaging contributes to market growth. Sealing tapes are essential materials used to secure and protect products during shipping and storage.

The expansion of the e-commerce sector is a major catalyst for growth of this market, as the increasing preference for online shopping drives the need for effective packaging solutions that ensure product safety during transit. This shift has prompted innovations in tape manufacturing, focusing on enhanced adhesives and materials that improve performance and sustainability. In addition, the emphasis on creating memorable unboxing experiences has prompted brands to prioritize high-quality packaging, further elevating the demand for these tapes.

Market Concentration & Characteristics

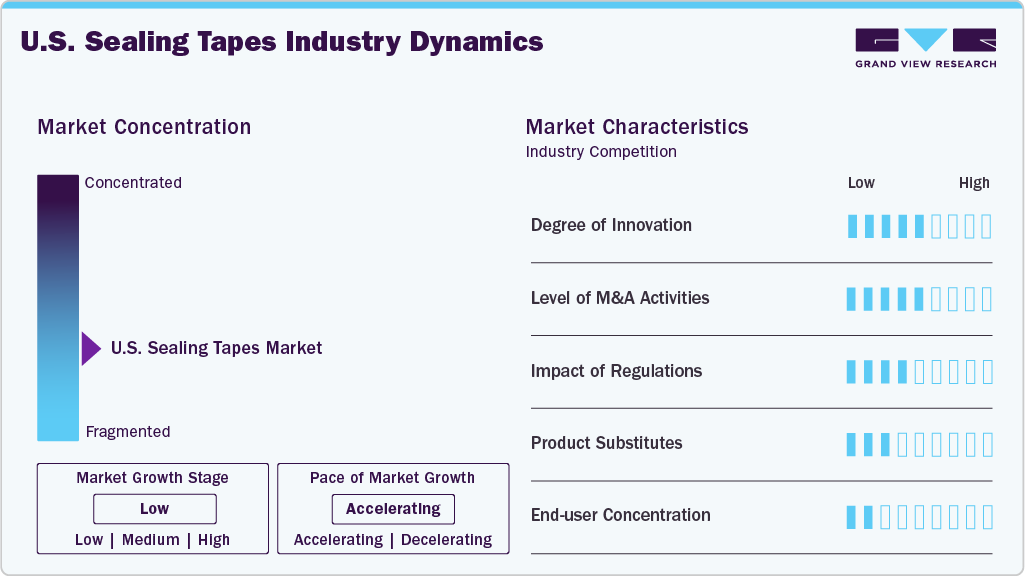

The market growth is medium, and the pace of growth is accelerating. The U.S. sealing tapes industry exhibits moderate innovation, largely driven by the demand for high-performance materials, eco-friendly adhesives, and product customization for specific end-use applications (e.g., tamper-evident, temperature-resistant, or noise-reducing tapes). Innovation is incremental rather than disruptive, focusing on material enhancements such as bioplastics, recyclable backing films, and solvent-free adhesives.

Sustainability regulations, especially those related to packaging waste and recyclability, influence innovation in adhesive formulation and film selection. However, unlike pharmaceuticals or hazardous materials, sealing tapes are not subject to heavy regulatory oversight.

The threat from service substitutes is low to moderate. While sealing tapes compete with alternatives like strapping bands, glue adhesives, heat sealing, and stapling in some packaging scenarios, these substitutes are typically use-case dependent. Tapes are preferred for their ease of use, cost-efficiency, and adaptability across materials and surfaces.

Material Type Insights

The polypropylene material segment held the largest revenue share of 47.5% in 2024. It is also projected to grow at the fastest CAGR over the forecast period. The properties of polypropylene, such as high abrasion resistance, flexibility, and water resistance, are contributing to its demand across various end-use industries. These characteristics make polypropylene an ideal choice for different packaging applications, particularly in e-commerce and logistics, where secure packaging is essential. The increasing demand for cost-effective and durable sealing solutions further enhances the preference for polypropylene, solidifying its position as a leading material in the market.

The polyvinyl chloride (PVC) segment is anticipated to record a CAGR of 4.7% during the forecast period, driven by its superior strength, flexibility, and flame-retardant properties. PVC tapes are known for their strong adhesion and resistance to environmental factors. These features make them suitable for heavy-duty applications. The rising focus on safety and tamper-evident packaging in sectors such as food and pharmaceuticals is also expected to boost the demand for PVC-based sealing solutions in the coming years.

Adhesive Type Insights

The acrylic adhesive segment held the largest revenue share of 44.9% in 2024 and is also expected to record the fastest CAGR over the forecast period. This dominance stems from its superior bonding strength, long-term durability, and resistance to UV light, temperature fluctuations, and aging. Acrylic adhesives are suitable for indoor and outdoor applications, ensuring consistent performance across various substrates. Their low VOC content and compatibility with automated systems further align with evolving environmental and production standards. These qualities and adaptability of acrylic adhesives make them ideal for use in packaging, construction, and industrial applications, outperforming other options.

The rubber-based adhesive segment is projected to record the second-fastest CAGR over the forecast period, driven by its superior initial tack, cost-effectiveness, and versatility across multiple substrates. Rubber-based adhesives perform well on rough or uneven surfaces, making them ideal for carton sealing, automotive, and construction. Their versatility and compatibility with paper and plastic backings further support their widespread adoption. Despite lower temperature and UV resistance compared to acrylic alternatives, their demand remains strong in general-purpose and short-term applications.

Key U.S. Sealing Tapes Company Insights

Some of the key companies in the U.S. sealing tapes industry include 3M, IPG (Intertape Polymer Group), Shurtape Technologies, LLC, and others.

-

3M Company is a global leader in adhesives and tapes, offering an expansive sealing tape portfolio across packaging, automotive, construction, and electrical applications.

-

Intertape Polymer Group Inc. (IPG) focuses on pressure-sensitive and water-activated tapes for industrial, e-commerce, and construction sectors. With vertically integrated operations, IPG controls key raw material inputs, delivering cost-effective, performance-oriented solutions tailored for heavy-duty sealing and bundling applications.

Key U.S. Sealing Tapes Companies

- 3M

- Adhesive Applications, Inc

- IPG (Intertape Polymer Group)

- Nitto Denko Corporation

- Avery Dennison Corporation

- Scapa

- Shurtape Technologies, LLC

Recent Developments

-

In April 2025, Avery Denison Corporation launched a new range of UV-resistant, pressure-sensitive adhesive tapes for solar panel bonding.

-

In March 2025, IPG, in collaboration with IMA Group, announced their participation in MODEX 2024, showcasing multiple packaging technologies for e-commerce, intralogistics, and e-fulfillment. They introduced the new equipment, Sealmatic, an automatic case sealer, that enhances automation in packaging processes.

-

In August 2024, Shurtape expanded its line of sustainable packaging solutions by introducing the Recycled Series Packaging Tapes, made with 90% post-consumer recycled PET film.

-

In July 2024, Avery Dennison introduced a new portfolio of pressure-sensitive adhesive tapes designed for bonding foam and fiber materials in vehicles.

U.S. Sealing Tapes Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 9.19 billion

Growth Rate

CAGR of 5.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material type, adhesive type

Country Scope

U.S.

Key companies profiled

3M; Adhesive Applications, Inc; Avery Dennison Corporation; IPG (Intertape Polymer Group); Nitto Denko Corporation; Scapa; Shurtape Technologies, LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Sealing Tapes Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. sealing tapes market report based on material type, and adhesive type:

-

Material Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Polypropylene

-

Polyvinyl Chloride

-

Others

-

-

Adhesive Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Acrylic Adhesives

-

Rubber-Based Adhesives

-

Silicone Adhesives

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. sealing tapes market size was estimated at USD 6.74 billion in 2024 and is expected to reach USD 7.09 billion in 2025.

b. The U.S. sealing tapes market is expected to grow at a compound annual growth rate of 5.3% from 2025 to 2030 to reach USD 9.19 billion by 2030.

b. The polypropylene segment led the market and accounted for the largest revenue share of 47.5% in 2024, driven by its cost-effectiveness, flexibility, and excellent resistance to moisture and abrasion, making it ideal for diverse packaging needs.

b. 3M Company, Tesa SE, Nitto Denko Corporation, Intertape Polymer Group Inc., Avery Dennison Corporation, Shurtape Technologies, LLC, Scapa Group Ltd., Lintec Corporation, Saint-Gobain Performance Plastics, and Nichiban Co., Ltd. are prominent companies in the U.S. sealing tapes market.

b. Key factors driving demand in the U.S. sealing tapes market include rapid industrialization, growth in e-commerce and packaging, rising infrastructure development, and increasing adoption of high-performance and sustainable adhesive solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.