- Home

- »

- Plastics, Polymers & Resins

- »

-

U.S. Seed Packaging Market Size, Industry Report, 2030GVR Report cover

![U.S. Seed Packaging Market Size, Share & Trends Report]()

U.S. Seed Packaging Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (Paper & Paperboard, Plastic, Jute, Fabric), By Product (Pouches, Containers, Bags, Bottles & Jars), By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-614-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Seed Packaging Market Size & Trends

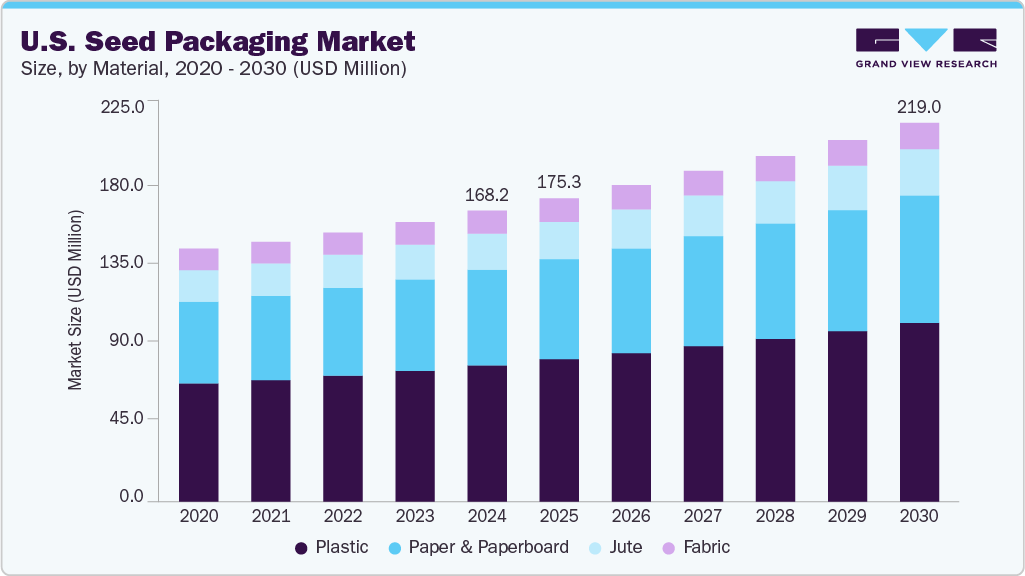

The U.S. seed packaging market size was valued at USD 168.2 million in 2024 and is expected to expand at a CAGR of 4.6% from 2025 to 2030. The growing demand for home gardening and sustainable agriculture, driven by urbanization and eco-conscious trends in the U.S., drives the seed packaging market. Additionally, technological advancements in seed coating & packaging, enhancing shelf life, and compliance with U.S. regulatory standards are also contributing to the growth of the seed packaging industry.

The adoption of advanced farming practices, including precision agriculture, biotechnology, and high-yield crop varieties, has led to a higher demand for packaged seeds that are well-preserved, traceable, and easily transportable. This transformation has elevated the need for innovative seed packaging solutions that maintain seed integrity, enhance shelf life, and provide clear labeling to meet regulatory and informational standards.

The growing emphasis on sustainable and eco-friendly packaging materials in response to federal and state-level environmental regulations is also shaping the market dynamics. Many U.S. seed producers and distributors are transitioning from traditional plastic materials to biodegradable films and recyclable paper-based pouches. This trend is supported by environmentally conscious consumers and agricultural cooperatives that prefer eco-label certified products. The U.S. Department of Agriculture (USDA) and Environmental Protection Agency (EPA) have introduced policies promoting sustainable agriculture, indirectly encouraging seed companies to adopt greener packaging practices to align with evolving compliance standards.

Additionally, the market is witnessing increased demand for small-format and resealable seed packaging, particularly from the home gardening and urban farming segments. With the rise of e-commerce platforms such as Amazon and Etsy, hobbyist gardeners and small-scale organic farmers now have easier access to various seeds in compact, attractive, and resealable packs.

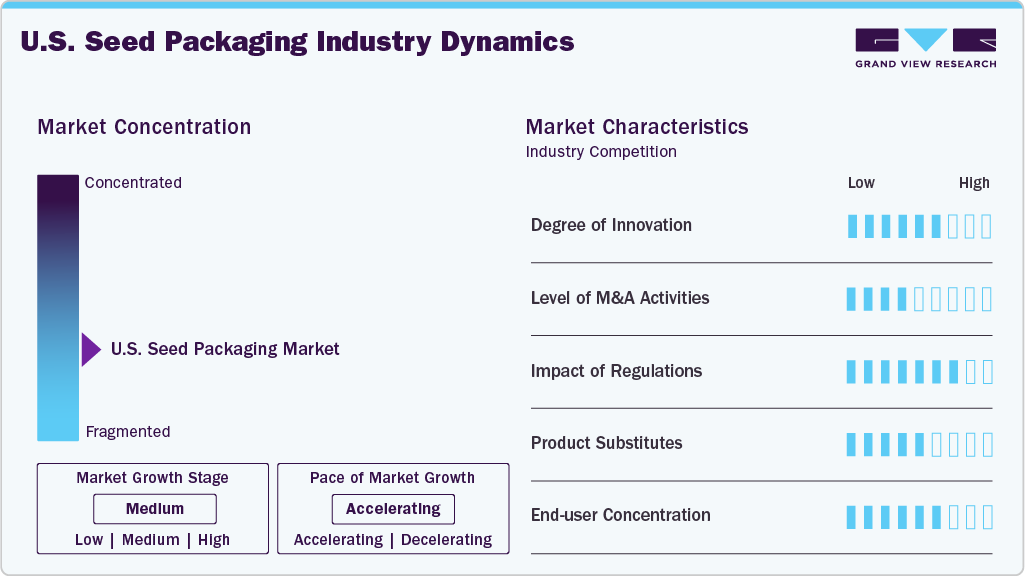

Market Concentration & Characteristics

The U.S. seed packaging market is characterized by a high level of technological integration, especially due to the advanced nature of its agricultural industry. U.S.-based seed producers operate in a highly competitive and innovation-driven environment, requiring packaging solutions that support product protection, branding, traceability, and compliance with federal regulations. As a result, seed packaging in the U.S. often features multi-layer barrier films, moisture-resistant materials, tamper-evident closures, and smart packaging technologies such as QR codes or RFID tags for inventory and tracking purposes.

The market is witnessing a steady shift toward sustainable and recyclable materials, driven by consumer preferences and state-level regulations (such as California’s environmental packaging standards). While flexible plastic films still dominate the market for their protective qualities, there is growing investment in biodegradable pouches, FSC-certified paper, and post-consumer recycled (PCR) materials. U.S. companies are also adopting closed-loop recycling initiatives and carbon-neutral packaging strategies, aligning with the nation’s broader sustainability goals and the increasing demand for environmentally responsible agricultural products.

Material Insights

In 2024, the plastic material segment accounted for the largest market revenue share, exceeding 46.0%. Plastic seed packaging is favored for its superior moisture resistance, durability, and flexibility. It is commonly used for small retail seed packets and bulk agricultural packaging. Materials such as polyethylene (PE), polypropylene (PP), and laminated films are employed to maintain seed quality during storage and transit. Features such as resealable closures, extended shelf life, and lightweight properties make plastic packaging a preferred option among commercial seed producers.

The paper & paperboard segment is projected to register the fastest compound annual growth rate (CAGR) of 5.0% during the forecast period. This growth is primarily driven by increasing demand for sustainable, eco-friendly packaging solutions. Rising regulatory restrictions on plastic use and growing consumer preference for recyclable and compostable materials are accelerating the shift toward paper-based seed packaging. Moreover, innovations in moisture-resistant coatings enhance paper packaging performance, particularly in humid storage conditions.

Product Insights

In 2024, the bags segment accounted for the largest market revenue share, exceeding 45.0%. Bags remain the most conventional and widely adopted packaging format in the seed industry, typically made from woven polypropylene, jute, or paper. They are particularly suited for bulk storage and transporting high-volume crops like wheat, corn, rice, and soybeans. Bags balance moderate protection and cost-efficiency, making them ideal for large-scale agricultural operations. Their continued dominance is driven by strong demand for economical bulk packaging solutions. Furthermore, innovations in printing and branding on bag surfaces enhance marketing visibility, especially in rural and semi-urban markets.

The pouches segment is projected to register the fastest compound annual growth rate (CAGR) of 5.0% over the forecast period. Pouches, primarily crafted from plastic films or laminated materials, offer a lightweight and flexible packaging solution. Their advantages, such as resealability, moisture resistance, and space efficiency, make them increasingly popular in the seed industry. Growing consumer preference for convenient, compact, and portable packaging in the agricultural retail sector is a key growth driver. Additionally, expanding e-commerce seed sales has further boosted demand for pouches, as their lightweight nature helps reduce shipping costs and material consumption.

End Use Insights

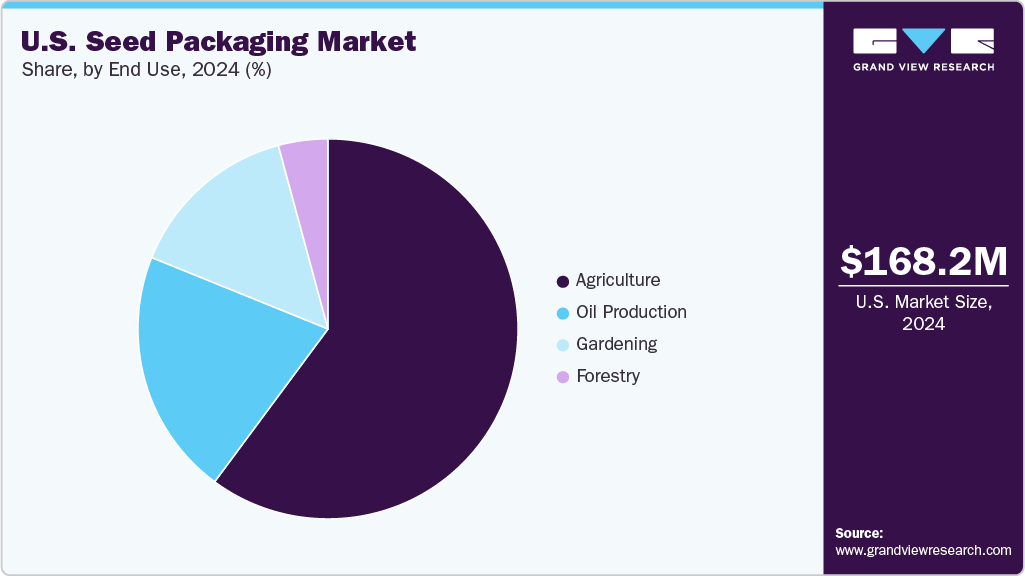

In 2024, the agriculture segment accounted for the largest market share, exceeding 60.0%. This segment encompasses large-scale commercial farming of staple crops such as wheat, corn, rice, soybeans, and cotton. The growing emphasis on high-quality seed packaging in agriculture stems from the need to preserve germination potential, protect against moisture, and extend shelf life, particularly during extended storage and transportation cycles. The rising population is intensifying the demand for higher agricultural yields, driving the need for reliable packaging solutions. Additionally, the widespread adoption of hybrid and genetically modified (GM) seeds necessitates more robust and protective packaging to safeguard seed viability. Government subsidies, food security initiatives, and the shift toward climate-resilient agriculture further support this sector's growing demand for high-performance seed packaging.

The gardening segment is expected to register the fastest CAGR of 4.9% over the forecast period. This segment primarily caters to home gardeners, nurseries, and urban farming enthusiasts. Unlike bulk agricultural packaging, gardening seed packaging typically features smaller quantities with a strong focus on visual appeal, brand differentiation, resealability, and user-friendly design. Labels often include planting instructions and organic certifications to guide consumers. The post-COVID-19 surge in interest in home gardening, coupled with the broader movement toward sustainable and organic lifestyles, significantly contributes to segment growth. Furthermore, the rise of e-commerce platforms has widened access to packaged seeds, accelerating market expansion within the gardening segment.

Key U.S. Seed Packaging Company Insights

The competitive environment of the U.S. seed packaging market is characterized by the presence of both large multinational packaging firms and specialized domestic players that cater to the diverse needs of the agriculture industry. Key players such as Amcor plc, ProAmpac, and Berry Global Inc. compete alongside regional firms such as Smith Seed Services and Deluxe Packaging, offering a wide range of solutions, including moisture-resistant pouches, laminated bags, and sustainable paper-based packaging. Competition is driven by innovation in barrier materials, compliance with USDA and EPA labeling regulations, and the increasing demand for eco-friendly and tamper-evident packaging. Companies are also focusing on customized printing and branding services to meet the marketing needs of seed producers in the highly competitive U.S. agricultural landscape.

- In September 2024, SÜDPACK’s debut at “Seed meets Technology” represents a strategic initiative to strengthen its presence in the global seed technology and packaging market. By participating in this leading international event, SÜDPACK showcased its innovative packaging solutions directly to key industry stakeholders, fostered collaborations with seed technology leaders, and gained insights into emerging trends and customer needs. This move positions SÜDPACK to expand its network, enhance brand visibility, and accelerate the adoption of its advanced packaging technologies within the horticultural sector.

Key U.S. Seed Packaging Companies:

- SÜDPACK

- Amcor plc

- Berry Global Inc.

- ProAmpac

- Jam Jams Group

- NNZ

- LC Packaging International

- JBM Packaging

- Smith Seed Services

- Deluxe Packaging

U.S. Seed Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 175.3 million

Revenue forecast in 2030

USD 219.0 million

Growth rate

CAGR of 4.6% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, product, end use

Key companies profiled

SÜDPACK; Amcor plc; Berry Global Inc.; ProAmpac; Jam Jams Group; NNZ; LC Packaging International; JBM Packaging; Smith Seed Services; Deluxe Packaging

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Seed Packaging Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. seed packaging market report based on material, product, and end use:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Paper & Paperboard

-

Plastic

-

Jute

-

Fabric

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Pouches

-

Containers

-

Bags

-

Bottles & Jars

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Agriculture

-

Oil Production

-

Gardening

-

Forestry

-

Frequently Asked Questions About This Report

b. The U.S. seed packaging market was estimated at around USD 168.2 million in the year 2024 and is expected to reach around USD 175.3 million in 2025.

b. The U.S. seed packaging market is expected to grow at a compound annual growth rate of 4.6% from 2025 to 2030 to reach around USD 219.0 million by 2030.

b. Agriculture dominated the U.S. seed packaging market in 2024 with a revenue share of over 60.0% due to the high demand for improved seed quality and efficient distribution across large-scale farming operations.

b. The key players in the U.S. seed packaging market include SÜDPACK; Amcor plc; Berry Global Inc.; ProAmpac; Jam Jams Group; NNZ; LC Packaging International; JBM Packaging; Smith Seed Services; and Deluxe Packaging.

b. The U.S. seed packaging market is driven by growing urban and home gardening trends combined with rising demand for eco-friendly, biodegradable, and moisture‑controlled smart packaging solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.