- Home

- »

- Food Safety & Processing

- »

-

Paper Packaging Market Size, Share, Industry Report, 2033GVR Report cover

![Paper Packaging Market Size, Share & Trends Report]()

Paper Packaging Market (2026 - 2033) Size, Share & Trends Analysis Report By Grade (Recycled, Virgin), By Product (Corrugated Boxes, Folding Cartons, Paper Bags & Sacks), By Application (Food & Beverages, Healthcare), By Region, And Segment Forecasts

- Report ID: 978-1-68038-174-0

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Paper Packaging Market Summary

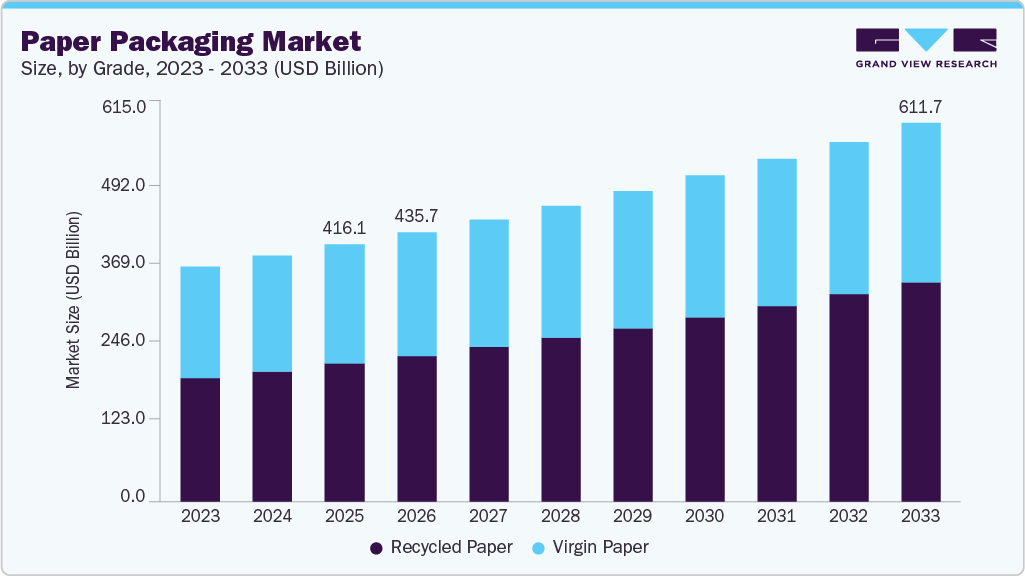

The global paper packaging market size was estimated at USD 416.07 billion in 2025 and is expected to reach USD 611.66 billion by 2033, growing at a CAGR of 5.0% from 2026 to 2033. This growth is driven by a rising demand for sustainable packaging solutions as consumers and businesses increasingly prioritize eco-friendly options.

Key Market Trends & Insights

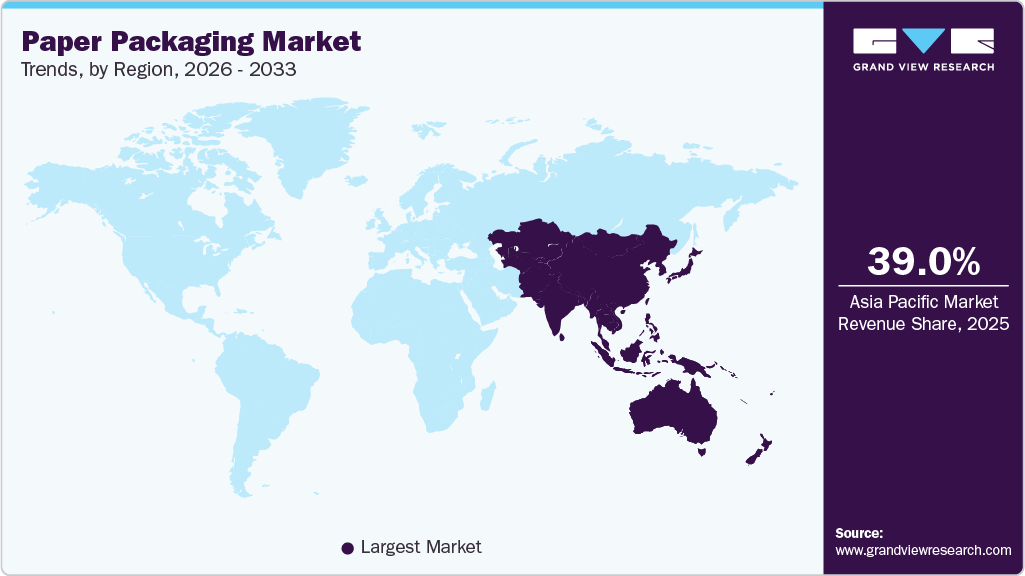

- Asia Pacific dominated the paper packaging market with the largest revenue share of over 39.0% in 2025.

- The paper packaging market in U.S. is expected to grow at a substantial CAGR of 4.1% from 2026 to 2033.

- By grade, the recycled paper segment is expected to grow at a considerable CAGR of 6.0% from 2026 to 2033 in terms of revenue.

- By product, the folding cartons segment is expected to grow at a considerable CAGR of 5.3% from 2026 to 2033 in terms of revenue.

- By application, the e-commerce & retail segment is expected to grow at a considerable CAGR of 6.6% from 2026 to 2033 in terms of revenue.

Market Size & Forecast

- 2025 Market Size: USD 416.07 Billion

- 2033 Projected Market Size: USD 611.66 Billion

- CAGR (2026-2033): 5.0%

- Asia Pacific: Largest & Fastest Growing Market

The paper and paperboard packaging market is primarily driven by the rising shift toward sustainable and eco-friendly packaging alternatives as industries respond to tightening environmental regulations and consumer demand for low-carbon materials. Brands across food, beverage, personal care, pharmaceuticals, and e-commerce are actively replacing plastic formats with renewable fiber-based solutions due to recyclability, biodegradability, and compostability benefits. As a result, the paper packaging material market has become a strategic focus for manufacturers seeking to reduce plastic waste and improve circularity, leading to increased investment in product innovation, automated production technologies, and high-strength lightweight fiber solutions.

Growth in consumption of packaged food and beverages is further accelerating the expansion of the flexible paper packaging market and the flexible paper food beverage packaging market, particularly for pouches, wraps, sachets, and flow-wrap applications. The rising adoption of barrier coated flexible paper packaging market formats that provide moisture, grease, oxygen, aroma, and heat-seal resistance has strengthened the suitability of paper for high-performance food applications that were previously dominated by plastic laminates. Quick-service restaurants, ready-to-eat meal brands, and beverage manufacturers are increasingly transitioning to barrier-enhanced flexible paper structures to meet sustainability objectives without compromising product quality and shelf life.

The rapid expansion of e-commerce and retail distribution networks is strengthening demand for the paper bags packaging market and the recycled paper packaging market, supported by the requirement for durable, lightweight, and curbside-recyclable mailers, shipping bags, and retail carry bags. Corporate net-zero commitments and heightened consumer awareness surrounding single-use plastic elimination are prompting retailers and consumer goods companies to adopt kraft-paper-based alternatives produced from virgin and recycled fibers. In addition, leading brands are incorporating post-consumer recycled (PCR) paper for both secondary and transit packaging to enhance sustainability performance and align with reporting and ESG disclosure targets, which continues to reinforce the long-term growth trajectory of the global paper packaging industry.

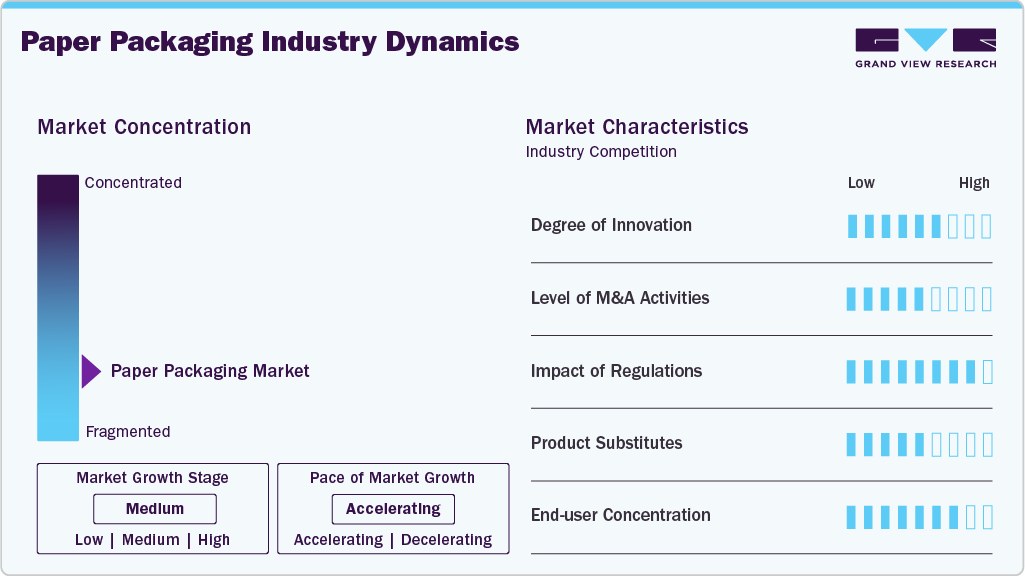

Market Concentration & Characteristics

The paper packaging industry is highly sustainability-driven, with growth strongly influenced by global environmental regulations, brand commitments to reduce plastic usage, and consumer preference for recyclable and biodegradable packaging. Companies across food, beverage, personal care, pharmaceuticals, and e-commerce are prioritizing fiber-based formats to support circular economy goals, increasing demand for both virgin and recycled paper packaging materials.

The industry is innovation-oriented and technology-enhanced, characterized by strong investments in advanced fiber processing, lightweighting, barrier coating, heat-seal functionalization, and printing technologies. The rapid rise of barrier-coated flexible paper solutions is expanding application scope into high-performance food and beverage packaging, creating opportunities for manufacturers with R&D and coating capabilities.

Grade Insights

The recycled paper segment accounted for the largest share of over 53.0% in 2025 and is expected to grow at a CAGR of 6.0% from 2026 to 2033. This outlook is due to the growing emphasis on sustainability and environmental responsibility. Recycled paper packaging is favored for its lower environmental impact, as it reduces the need for virgin materials and minimizes waste. Additionally, advancements in recycling technologies have improved the quality and performance of recycled paper, making it a viable and attractive option for various industries. The demand for eco-friendly packaging solutions, driven by both consumer preferences and regulatory pressures, has significantly contributed to the growth of this segment.

The virgin paper segment is driven by the need for high-strength, hygienic, and food-grade packaging solutions that require consistent fiber quality, superior printability, and optimized barrier performance. Virgin pulp provides enhanced durability, tear resistance, and purity compared to recycled grades, making it the preferred choice for premium foodservice packaging, beverage cartons, medical and pharmaceutical packaging, luxury retail packaging, and high-load transit formats. The segment benefits from rising demand for lightweight yet strong substrates that can replace plastic while meeting regulatory compliance for direct food contact and migration safety.

Product Insights

The corrugated boxes segment dominated the market with over 44.0% revenue share in 2025, driven by its unmatched strength, versatility, and cost-efficiency for shipping, warehousing, and e-commerce logistics. Corrugated formats offer high stacking strength, cushioning, and damage resistance, making them the preferred choice for the transportation of food, consumer goods, industrial products, electronics, and pharmaceuticals. The rapid growth of online retail and last-mile delivery has substantially increased demand for lightweight, recyclable, and custom-print corrugated solutions that support branding, product safety, and sustainability goals.

The folding cartons segment is projected to grow at a fast CAGR of 5.3% over the forecast period, supported by increasing demand for compact, lightweight, and visually appealing packaging across food, beverage, pharmaceuticals, cosmetics, and household product categories. Brand owners are increasingly adopting folding cartons due to their compatibility with high-quality graphics, customization, and sustainability requirements, allowing stronger shelf visibility and consumer engagement. Growth is further reinforced by innovations in recycled fiber content, mono-material paperboard structures, and barrier coatings that enable cartons to replace plastic in dry food, frozen food, and select liquid packaging applications.

Application Insights

Food & beverages segment emerged as a dominating application for paper packaging application segment with a market share of over 35.0% in 2025. Food & beverages segment emerged as a dominating application for the paper packaging market with a share of over 35.0% in 2025, due to the rapid transition from plastic to recyclable and biodegradable paper formats for packaged meals, bakery products, snacks, dairy, beverages, and ready-to-eat foods. The expansion of quick-service restaurants, takeaway delivery, and online grocery ordering continues to boost consumption of paper cups, wraps, trays, folding cartons, and pouch-style formats, reinforcing the segment’s leadership.

The e-commerce and retail application is expected to witness a CAGR of 6.6% over the forecast period, driven by the continued expansion of online shopping, omnichannel retail distribution, and last-mile delivery services that require durable, lightweight, and curbside-recyclable packaging formats. Rising adoption of corrugated boxes, paper mailers, padded mailers, protective wraps, and retail carry bags is accelerating demand as brands shift away from plastic to improve sustainability credentials and customer experience. Technological innovations in recycled fiber integration, digital printing, and high-strength lightweight paperboard are further enabling paper packaging to deliver performance, branding, and cost efficiency across fast-moving e-commerce supply chains.

Regional Insights

Asia Pacific held the largest market share of over 39.0% in 2025 and is witnessing strong growth as it is expected to grow at the fastest CAGR of 5.3% during the forecast period. The region leads the paper packaging market due to its large-scale manufacturing ecosystem, rapidly expanding consumer markets, and high dependence on packaged food, beverages, personal care, and electronics. Strong growth in e-commerce and retail networks across China, India, Japan, and Southeast Asia continues to drive consumption of corrugated boxes, folding cartons, and paper bags. Increasing urbanization and rising disposable incomes are fueling demand for sustainable and modern packaging formats across FMCG and food delivery platforms, pushing brands to adopt paper-based alternatives over plastic.

China Paper Packaging Market Trends

China drives the APAC paper packaging market due to its high-volume production capacity, strong consumer base, and fast-growing retail and e-commerce sectors. With companies like Alibaba and JD.com scaling their logistics infrastructures, the demand for corrugated boxes, folding cartons, and paper mailers has multiplied. Growth in packaged foods, pharmaceuticals, and consumer electronics also adds momentum, with manufacturers prioritizing durable and cost-efficient paper solutions.

North America Paper Packaging Market Trends

The rapid rise of e-commerce and subscription commerce in the U.S. and Canada has accelerated the use of corrugated boxes, paper mailers, padded mailers, and recycled shipping cartons. Consumer preference for eco-friendly packaging is compelling major brands such as Amazon, Walmart, and Starbucks to integrate fiber-based alternatives across primary, secondary, and tertiary packaging. Innovation in barrier coatings, high-performance paperboard, and digital printing is further strengthening the region’s leadership in premium and functional paper formats for food, beverages, cosmetics, healthcare, and pet supplies.

The U.S. paper packaging market benefits from strong innovation capabilities, particularly in lightweight paperboard, molded fiber, and functional barrier-coated food packaging. Recycling infrastructure is continuously improving, with manufacturers scaling post-consumer recycled (PCR) content in products to satisfy both regulatory guidelines and sustainability certifications. The result is a robust environment for continuous capacity expansion and technology investment in the paper packaging sector.

Europe Paper Packaging Market Trends

Europe’s packaging ecosystem is characterized by robust fiber recovery and recycling infrastructure, supporting high post-consumer recycled (PCR) content in packaging materials. Companies across Germany, UK, Italy, and France are heavily investing in R&D to develop water-based, heat-sealable, and grease-resistant coatings for packaged foods, ready-to-eat meals, and bakery products. Adoption of digital printing for personalization and branding is further strengthening the region’s paper packaging demand.

Key Paper Packaging Company Insights

The competitive environment of the paper packaging market is characterized by the presence of global manufacturing leaders, regional converters, and specialized niche players competing on sustainability performance, product innovation, cost efficiency, and supply reliability. Companies are increasingly investing in lightweight high-strength paperboard, barrier-coated flexible papers, and recycled fiber solutions to differentiate themselves amid rising demand for plastic alternatives.

Strategic priorities include expanding production capacity, integrating backward into pulp sourcing, advancing digital and flexographic printing technologies, and forming partnerships with brand owners and recyclers to strengthen circularity. Competitive intensity continues to rise as packaging and material science companies shift portfolios toward fiber-based solutions, and as e-commerce, foodservice, and FMCG brands push suppliers to deliver superior printability, durability, and functional performance while aligning with global environmental standards and ESG commitments.

-

In May 2025, Pregis LLC expanded its EasyPack on-demand paper packaging portfolio by introducing the white version of GeoTerra paper, a curbside-recyclable, paper-based wrapping solution that provides light cushioning and interleaving protection for products. The new white GeoTerra offers a sleek, premium alternative to the original kraft option, aligning with minimalist design trends favored by high-end beauty, wellness, and lifestyle brands. This addition allows brands to elevate their packaging presentation while maintaining eco-friendly and protective qualities.

-

In January 2025, International Paper completed its USD 7.2 billion acquisition of DS Smith, creating a global leader in sustainable packaging solutions with a strong presence in North America and Europe. The combined company aims to accelerate growth, improve profitability, and enhance customer offerings with an expected synergy.

-

In May 2024, ProAmpac acquired UP PAPER LLC, a Michigan-based producer of recycled kraft paper. This acquisition is expected to enhance the company’s portfolio of sustainable packaging products and strengthen its presence in the U.S.

Key Paper Packaging Companies:

The following are the leading companies in the paper packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Amcor plc

- International Paper

- Smurfit WestRock

- DS Smith

- Mondi

- ProAmpac

- Packaging Corporation of America

- Sonoco Products Company

- Georgia-Pacific

- Nippon Paper Industries Co., Ltd.

- Huhtamaki

Paper Packaging Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 435.73 billion

Revenue forecast in 2033

USD 611.66 billion

Growth rate

CAGR of 5.0% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million, Volume in Kilotons, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Grade, product, application region

Regional Scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Key companies profiled

Amcor plc; International Paper; Smurfit WestRock; DS Smith; Mondi; ProAmpac; Packaging Corporation of America; Sonoco Products Company; Georgia-Pacific; Nippon Paper Industries Co., Ltd.; Huhtamaki

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Global Paper Packaging Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the paper packaging market report on the basis of grade, product, application and region:

-

Grade Outlook (Revenue, USD Million, 2021 - 2033)

-

Recycled Paper

-

Virgin Paper

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Corrugated Boxes

-

Folding Cartons

-

Paper Bags & Sacks

-

Liquid Packaging Cartons

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Food & Beverages

-

E-commerce & Retail

-

Industrial Packaging

-

Healthcare

-

Personal Care & Cosmetics

-

Consumer Goods

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Turkey

-

Netherlands

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Indonesia

-

Thailand

-

Vietnam

-

Philippines

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global paper packaging market was estimated at around USD 416.07 billion in the year 2025 and is expected to reach around USD 435.73 billion in 2026.

b. The global paper packaging market is expected to grow at a compound annual growth rate of 5.0% from 2026 to 2033 to reach around USD 611.66 billion by 2033.

b. Food & beverages emerged as the dominating application segment for paper packaging due to the strong shift toward sustainable, safe, and high-performance packaging formats that preserve product freshness while replacing single-use plastics.

b. The key players in the paper packaging market include International Paper; Smurfit WestRock; DS Smith; Mondi; ProAmpac; Packaging Corporation of America; Sonoco Products Company; Georgia-Pacific; Nippon Paper Industries Co., Ltd.; and Huhtamaki.

b. The market is driven by rising sustainability demand, regulatory restrictions on plastics, growth in e-commerce and packaged foods, and increasing brand preference for recyclable, biodegradable, and lightweight packaging solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.