- Home

- »

- Medical Devices

- »

-

U.S. Sexual Wellness Market Size And Share Report, 2030GVR Report cover

![U.S. Sexual Wellness Market Size, Share & Trends Report]()

U.S. Sexual Wellness Market (2023 - 2030 ) Size, Share & Trends Analysis Report By Product (Sex Toys, Condoms, Personal Lubricants), By Distribution Channels (E-Commerce, Retailers, Mass Merchandisers), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-261-7

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

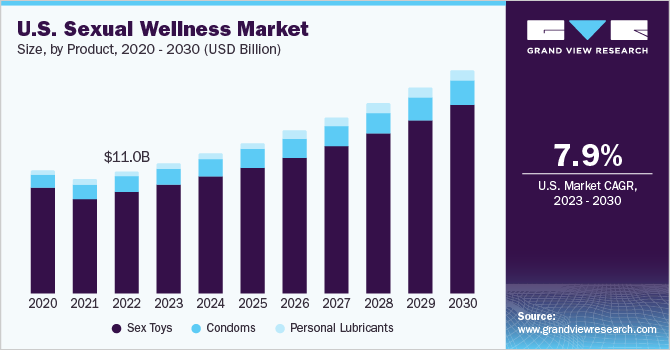

The U.S. sexual wellness market size was valued at USD 11.0 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.91% from 2023 to 2030. The market is anticipated to exhibit lucrative growth in the coming years due to the rising prevalence of Sexually Transmitted Diseases (STDs) and HIV infection. Increasing government initiatives and NGOs participating in promoting the use of contraceptives is expected to boost market growth. The increasing childbearing population of women in the U.S. and the ease of online shopping and e-commerce are expected to further facilitate the sales of sexual wellness products. The NYC Health Department recommended masturbation as the safest form of sexual activity to minimize contact with others and reduce the spread of COVID-19. Since the pandemic has reduced the stigma around masturbation, an increasing number of customers in the country are opting for various sex toys to improve their sexual experience.

The stigma attached to sexual activities & experimenting is reducing due to liberalization and growing acceptance of homosexuality. Sex-positive movements have helped clear the stereotypes related to gender, age, and social construct of people. The banks and investors who were reluctant to fund ventures in sexual wellness products are now investing in this space. In recent times, the stereotypical perception has witnessed some change, and angel investors are also increasingly investing with manufacturers. For Instance, in March 2021, PLBY Group, Inc spent USD 25 million, to buy a TLA acquisition firm selling sex toys through a subsidiary. Major brands in the U.S. market for sexual wellness are expected to witness lucrative demand due to the growing use of sex toys among both men and women.

The U.S. government is also taking initiatives toward sexual wellness by promoting safe sex, propelling the growth of the market. For instance, In June 2020, the New York health department started a home delivery service called “Door 2 Door” to promote the practice of safe sex. The service provides delivery of condoms, lubricants, and HIV tests via an online platform. Before the onset of the COVID-19 pandemic, the people in New York had access to complimentary condoms and lubricants from over 3,500 non-profit organizations that were authorized by the health department to dispense these products throughout New York City.

Product Insights

The U.S. sexual wellness market has been segmented into sex toys, condoms, and personal lubricants. Sex toys held the largest share of 83.6% of the product segment. Liberalization and an increasing number of individuals embracing their sexuality have led both young women and men to experiment and explore. Adult vibrators are now a part of mainstream personal care products to promote healthy sexual lives. Increased spending capacities and improved standards of living in developing economies are expected to drive market growth during the forecast period.

The condom market in the U.S. is positively impacted by changing lifestyles and the increasing trend of having multiple sex partners. Thus, there has been an increase in condom use for pregnancy and STI/HIV prevention. Sex education, ethnicity, and sexual orientation are some of the key factors, which impact the usage of condoms in the U.S. among people aged between 15 and 44. The condom segment is further divided into male and female condoms.

The personal lubricants segment is expected to witness the highest CAGR during the forecast period. The use of lubricants can alleviate the problem and is preferred by the older cohort. Water-based lubricant is the most used lubricant by consumers worldwide. These lubricants are affordable and compatible with condoms and other sexual wellness products such as vibrators. They provide the feel of natural vaginal lubricants and are easy to wash off, which makes them popular among consumers for masturbation and penetrative sex.

Distribution Channel Insights

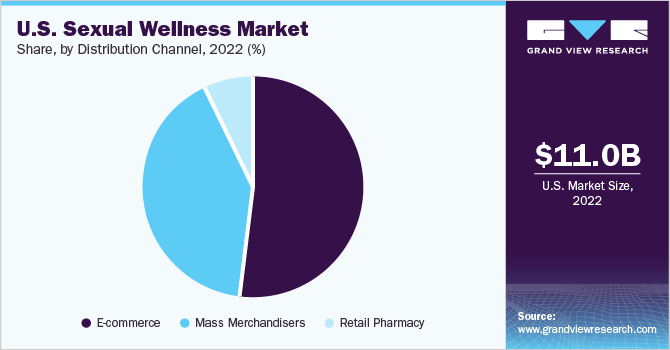

Based on distribution channels, the U.S. sexual wellness market is further divided into mass merchandisers, retail pharmacies, and e-commerce. The e-commerce segment held the largest revenue share of 51.6% and it is expected to witness the fastest growth owing to the increasing penetration of the Internet and the availability of a wide product portfolio on e-commerce platforms. The anonymity maintained in product delivery is an added advantage for customers opting for online purchases over brick-and-mortar stores, especially in the case of sex toys.

The convenience of viewing, selecting, and ordering through online shopping websites, without revealing one’s identity, removes the barrier of judgment in most cases and thus boosts the use of sexual wellness products. The most frequently ordered products include vibrators, rubber penis, and lubricants. Freedom to select any lubricant from the variety of products available under different brands has enabled e-commerce platforms to gain popularity among customers. Moreover, the assurance of delivering the packages discreetly via e-commerce platforms has increased purchases among women of all age groups.

Retail grocery stores, hypermarkets, and supermarkets are categorized as mass merchandisers for the distribution of sexual wellness products. In the U.S., mass merchandisers are witnessing increased sales of sexual wellness products. The availability of sex toys, sexual enhancement products, condoms, lubricants, sex games, apparel, and lingerie has increased, as supermarkets are allocating more shelf space for these products. Retailers, such as Walmart, 7-Eleven, and Costco Wholesale Corporation, have started the trend of displaying sexual wellness products in the wellness aisle along with other products such as pregnancy tests, sanitary napkins, and other female & male care products.

Region Insights

The Western region held the largest market share of almost 30% in 2022 owing to the growing demand for these products in the states and rising initiatives by the government to raise awareness regarding STDs and HIV. People are spending more on sex products in the region, which can be attributed to the reducing stigma around sexual wellness & health, and sexual health is becoming part of mainstream discussions. According to a survey of 2,300 people conducted by the BespokeSurgical, California ranks 2nd for spending on sex products, around 28.1% higher than the national average. Nevada ranks 3rd with spending around 23.8% higher than the national average.

The demand for sex toys in the Northeast region increased rapidly amid the COVID-19 pandemic, especially for sex dolls. For instance, in 2020, the sales of Silicon Wives in New York City increased by around 65% compared to 2019. In addition, SexDollGennie, a Miami-based company, reported a 218% increase in sales compared to 2019, which was majorly seen in Brooklyn, Manhattan, Bronx, Queens, and Staten Island.

The Southwest region is expected to witness a lucrative growth rate owing to the reduction of social stigma surrounding the purchase of these products due to the growing reach and penetration of online retailers as well as e-commerce websites. Moreover, the government and authorities in the region are focused on raising awareness regarding the use of condoms to prevent HIV/AIDS and/or STDs. For instance, Texas Wears Condoms and the Condom Distribution Network are the two programs that provide free condoms online.

Key Companies & Market Share Insights

Online portals such as Amazon, Lovehoney, Drugstore.com, and Adam and Eve play an important role in the supply chain. Retail store chains such as Walmart, Target, CVS Pharmacy, and Kroger Pharmacy offer sexual wellness products similar to mainstream products. These retail chains have also launched their brands of personal lubricants and condoms through white-label products and contract manufacturing.

For instance, CC Wellness, one of the largest white-label manufacturers of intimate wellness and personal care formulas, shares retail know-how (achieved via its own lubricant brands, LubeLife and JO), with white-label partners to help them navigate omnichannel retail and scale-up on Amazon. The stigma previously extended to investors that were reluctant to fund ventures in sexual wellness products has changed in recent times. The stereotypical perception has witnessed a massive shift leading to angel investors increasingly investing in sexual wellness products and their manufacturers.

The market for sexual wellness is also impacted by strategic alliances such as partnerships and mergers and acquisitions. For instance, in April 2023, Tabu Group, a company based in Santa Barbara that specializes in creating scientifically-backed sexual wellness products tailored to women's changing bodies, recently announced that its brand will now be sold on Sephora.com.

Since its inception in November 2020, Tabu has emerged as a frontrunner in the wellness industry, catering to women in their 30s, 40s, 50s, 60s, and 70s, and promoting sexual wellness as an integral component of a healthy lifestyle. This move is expected to further strengthen Tabu's market presence and brand recognition. Similarly, in August 2021, Wow Tech and Lovehoney announced a merger, and the combined group will be led by Wow Tech to achieve new heights in sexual wellness. Some prominent players in the U.S. sexual wellness market include:

-

Church & Dwight Co., Inc.

-

Reckitt Benckiser Group plc

-

Veru Inc.

-

Doc Johnson Enterprises

-

Mayer Laboratories, Inc.

-

LifeStyles Healthcare Pte Ltd

-

BioFilm, Inc.

-

LELO

-

Trigg Laboratories Inc.

-

Unbound

-

CC Wellness

U.S. Sexual Wellness Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 20.1 billion

Growth Rate

CAGR of 7.91 % from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Country scope

U.S.

Region Scope

Northeast; Southeast; Southwest; Midwest; West

Key companies profiled

Church & Dwight Co., Inc.; Reckitt Benckiser Group plc; Veru Inc.; Doc Johnson Enterprises; Mayer Laboratories, Inc.; LifeStyles Healthcare Pte Ltd; BioFilm, Inc.; LELO; Trigg Laboratories Inc.; Unbound; CC Wellness

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Sexual Wellness Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. sexual wellness market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Sex Toys

-

Vibrators

-

Dildos

-

Penis Rings

-

Anal Toys

-

Masturbation Sleeve

-

Bondage

-

Sex Dolls

-

Others

-

-

Condoms

-

Male Condoms

-

Female Condoms

-

-

Personal Lubricants

-

Water-based

-

Silicone-based

-

Oil-based

-

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

E-commerce

-

Retailers

-

Mass Merchandisers

-

-

Region Outlook (Revenue, USD Billion, 2018 - 2030)

-

West

-

Northeast

-

Southeast

-

Midwest

-

Southwest

-

Frequently Asked Questions About This Report

b. The U.S. sexual wellness market size was estimated at USD 11.0 billion in 2022 and is expected to reach USD 11.8 billion in 2023.

b. The U.S. sexual wellness market is expected to grow at a compound annual growth rate of 7.91% from 2023 to 2030 to reach USD 20.1 billion by 2030.

b. Sex toys dominated the U.S. sexual wellness market with a share of 83.6% in 2022. Initiatives such as sex-positive movements are helping break the stereotypes of age, gender, and social construct. Acceptance of sexual minorities i.e. LGBTQ+ individuals is also promoting the use of vibrators and other sex accessories in the society.

b. Some key players operating in the U.S. sexual wellness market include Church & Dwight Co., Inc.; Reckitt Benckiser Group plc; Veru Inc.; Mayer Laboratories, Inc.; Ansell (LifeStyles Healthcare Pte Ltd); BioFilm, Inc.; LELO; Amazon; Lovehoney; Drugstore.com; Adam & Eve; Walmart; Target; CVS Pharmacy; and Kroger Pharmacy.

b. Key factors that are driving the U.S. sexual wellness market growth include increasing government initiatives and NGOs participating in promoting the use of contraceptives along with growing acceptance of sexual exploration.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.