- Home

- »

- Consumer F&B

- »

-

U.S. Small Kitchen Appliances Market, Industry Report, 2030GVR Report cover

![U.S. Small Kitchen Appliances Market Size, Share & Trends Report]()

U.S. Small Kitchen Appliances Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Coffee Makers, Toasters, Deep Fryers), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-522-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

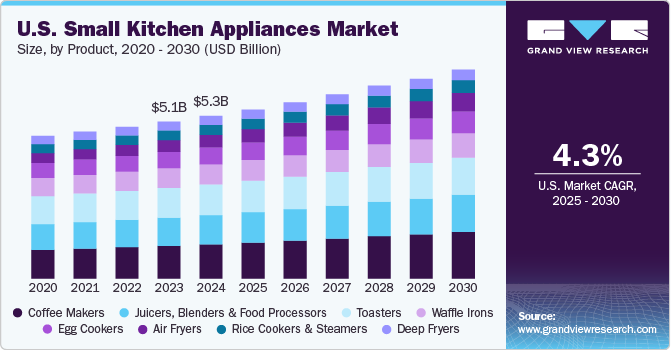

The U.S. small kitchen appliances market size was estimated at USD 5.32 billion in 2024 and is expected to expand at a CAGR of 4.3% from 2025 to 2030. Consumers are increasingly seeking appliances that streamline meal preparation, driving the growing popularity of multi-functional and automated kitchen appliances in the region. Moreover, the rising number of single-person households and the prevalence of smaller living spaces are fueling demand for compact, space-efficient appliances designed to fit within limited kitchen areas. As lifestyles continue to evolve and technological advancements reshape the market, the demand for small kitchen appliances is expected to experience steady growth in the coming years.

The market for small kitchen appliances in the U.S. is experiencing significant growth due to evolving consumer preferences and lifestyle changes. With Americans leading increasingly busy lives, the demand for convenient and time-saving kitchen solutions has surged. Small appliances such as air fryers, coffee makers, and multi-functional cookers have become essential for quick meal preparation, allowing consumers to cook efficiently without spending excessive time in the kitchen. As a result, convenience remains one of the primary factors driving market expansion.

Another key reason behind the rising demand is the growing trend of home cooking and health-conscious eating. Many Americans are opting to prepare meals at home to maintain a balanced diet and save money compared to dining out. Appliances such as blenders, juicers, and food processors facilitate the preparation of nutritious meals and beverages, encouraging healthier lifestyles. The rising popularity of plant-based diets and specialty beverages like smoothies and fresh juices has further fueled the demand for these appliances.

Technological advancements have also played a crucial role in shaping the market. Smart and connected kitchen appliances equipped with features like Wi-Fi connectivity, app control, and voice assistance have attracted a tech-savvy consumer base. Devices such as smart coffee makers and programmable pressure cookers provide greater ease of use and enhanced cooking precision, making them highly desirable among modern consumers. In addition, multi-functional appliances that save space and serve multiple purposes, such as toaster ovens with air-frying capabilities, are gaining traction, especially in urban homes with compact kitchens.

A significant trend in the industry is the rising popularity of cordless appliances. These devices operate without the need for direct power connections, relying instead on rechargeable batteries for power. This trend is driven by consumers' desire for convenience, mobility, and safety in the kitchen. Manufacturers are launching new products aligning with this trend. For instance, in January 2024, Drew Barrymore's kitchenware line "Beautiful" launched new affordable appliances, featuring a single-serve coffee maker with a built-in grinder (USD 99), a 12-piece personal blender set (USD 30), and a compact 3-quart air fryer (USD 30). The collection emphasizes style and functionality, with appliances featuring signature pearly finishes and gold accents. The line also includes established products like a water filtration pitcher (USD 40), electric kettle (USD 40), stand mixer (USD 99), and various cookware sets, all designed to make kitchen routines easier while adding aesthetic appeal to countertops.

The rise of e-commerce and subscription-based shopping has also made small kitchen appliances more accessible to consumers. Online retail platforms offer competitive prices, extensive product reviews, and fast delivery options, making it easier for Americans to purchase these appliances from the comfort of their homes. Furthermore, growing environmental awareness has led consumers to seek energy-efficient and sustainable kitchen appliances that minimize electricity consumption and waste, further shaping purchasing decisions.

According to Adtaxi's 2024 E-commerce Consumer Survey, 78% of Americans are now comfortable purchasing major appliances online, an increase from 73% reported the previous year. This growing acceptance reflects broader trends in online shopping, where convenience and the ability to compare products and prices easily have become paramount. With 93% of American adults engaging in online shopping and a notable increase in daily online shoppers, the online channel has become a critical platform for household appliances, including small appliances, offering an efficient way to reach a vast audience. For instance, in November 2024, PowerXL announced the launch of their innovative Stirmax Multi-Cooker, which became available at Walmart stores and Walmart.com. This advanced kitchen appliance features automatic stirring and shredding technology for hands-free cooking. It combines multiple cooking functions, including stirring, shredding, and searing capabilities. The product aims to revolutionize home cooking by offering enhanced convenience and efficiency in meal preparation.

Consumer Insights

Consumers worldwide are increasingly seeking convenience, efficiency, and versatility in their kitchens, driving market growth. As lifestyles become more fast-paced, there is a heightened demand for appliances that save time and effort. For instance, owning a coffee machine allows individuals to quickly prepare their preferred beverages at home, eliminating the need for coffee shop visits and reducing time spent in queues or detours during commutes.

Moreover, compact and multifunctional appliances like air fryers, slow cookers, and instant pots have become essential in many households. These devices enable quick and easy meal preparation, aligning with consumers' busy schedules. Health-conscious individuals are also driving demand for appliances that facilitate healthy cooking, such as blenders, juicers, and yogurt makers, which support incorporating fresh, nutritious ingredients into daily diets. The increase in home cooking activities has further propelled the demand for small kitchen appliances, a trend expected to continue in the foreseeable future.

The frequency of home-cooked meals decreased slightly from 10.9 to 10 per week between 2018 and 2022. About 44% of Americans regularly meal prep, with the main motivators being time savings (26.9%), healthier eating (22.2%), and cost reduction (19.1%). The microwave remains the most commonly used cooking appliance, and Mexican cuisine tops the list of popular homemade foods. Americans increasingly turn to home cooking, with 78% eating at home more frequently to save money amid rising food costs. The average household spends USD 148 weekly on groceries, down from USD 161 during the pandemic peak. People spend approximately 400 hours annually in the kitchen, averaging 67 minutes per day, with women spending more time (57.2 minutes) compared to men (41.5 minutes).

Furthermore, different generations show distinct cooking patterns. Baby boomers lead in home cooking, with 70% preparing dinner from scratch every Sunday, compared to 40% of Gen Z adults. Millennials are 37% more environmentally conscious about their food choices than baby boomers. Generation Z strongly prefers American cuisine, while millennials favor Mexican food.

Product Insights

Coffee makers accounted for a revenue share of 21.07% in 2024. Coffee remains one of the most popular beverages in the U.S., with consumption growing. This sustained demand for coffee naturally leads to a higher demand for coffee makers as consumers seek to brew their favorite beverages at home. Modern coffee machines have incorporated advanced technologies, such as programmable settings, touch-screen interfaces, and smartphone connectivity, enhancing user convenience. These innovations make it easier for consumers to brew their preferred coffee styles at home, contributing to the growing demand.

Leading kitchen appliance manufacturers are at the forefront of product innovation, introducing a wide array of coffee makers to cater to consumers' evolving preferences. For instance, in April 2024, Fellow launched their first automatic drip coffee brewer. This high-end machine is priced at USD 365 and features advanced temperature control technology, WiFi connectivity for sharing brew profiles, and dual filter holders for single-serve and batch brewing.

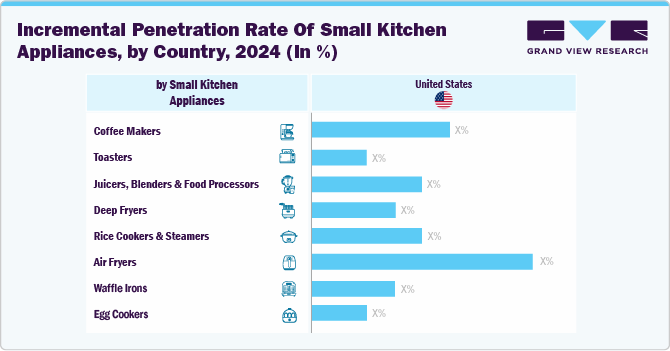

The air fryers market for small kitchen appliances in the U.S. is expected to grow at a CAGR of 7.2% from 2025 to 2030. Consumers are increasingly seeking healthier cooking methods that require less oil. Air fryers cater to this demand by offering a way to prepare crispy foods with significantly reduced fat content. Beyond frying, air fryers can bake, roast, and grill, making them versatile kitchen appliances. This multifunctionality enables consumers to experiment with a variety of recipes, enhancing their appeal.

With growing concerns about health and nutrition, many people are seeking ways to enjoy their favorite fried foods without the guilt of consuming excessive oil. Air fryers offer a healthier alternative by using little to no oil in the cooking process. According to the Morbidity and Mortality Weekly Report (May-July 2022) by the U.S. Department of Health and Human Services/Centers for Disease Control and Prevention, more than half (54.0%) of respondents reported utilizing alternative appliances alongside or instead of conventional ovens for cooking frozen stuffed chicken products. These alternative appliances included air fryers (29.7%), microwaves (29.0%), toaster ovens (13.7%), and other small kitchen appliances (3.8%). This trend is expected to drive the growth of the air fryer market during the forecast period.

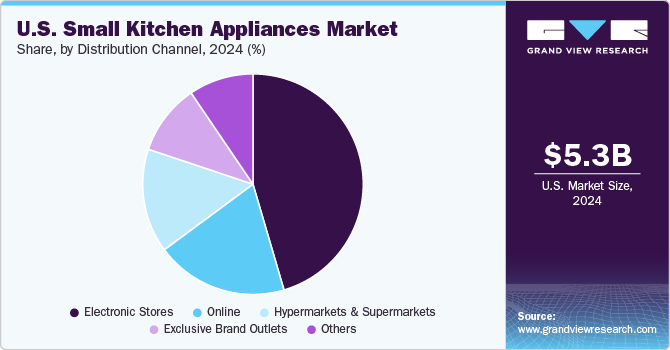

Distribution Channel Insights

Sales through electronic stores accounted for a revenue share of 45.46% in 2024 in the market. Electronic stores offer a wide selection of small kitchen appliances, including coffee makers, blenders, air fryers, and toaster ovens, allowing customers to compare brands, features, and prices conveniently in one place. These stores also stock premium and high-end appliances that may not be readily available through other retail channels, attracting consumers looking for advanced or luxury kitchen solutions.

The growing adoption of smart technology in small kitchen appliances has further contributed to increased sales through electronic stores. Features such as Wi-Fi connectivity, voice control, and app integration have made appliances like smart coffee makers and multi-cookers highly appealing to tech-savvy consumers. Electronic stores leverage these innovations by offering live demonstrations and in-store experiences, enabling customers to see these technologies in action and boosting their confidence in purchasing.

Sales of U.S. small kitchen appliances through online channels are expected to grow with a CAGR of 5.1% from 2025 to 2030. The growing preference for online shopping is a key driver of the increasing demand for small kitchen appliances in the U.S. Consumers are increasingly turning to e-commerce platforms and official brand websites due to their convenience, including flexible return policies, cash-on-delivery options, and comprehensive customer support services. Online portals and company-specific websites have become the preferred purchasing channels for premium small kitchen appliances, as they provide added benefits such as seamless return processes, centralized customer service, and exclusive deals. In addition, the competitive pricing and extensive product variety available through online vendors further enhance their appeal to shoppers.

Key U.S. Small Kitchen Appliances Company Insights

Numerous well-established and emerging players characterize the market. Key manufacturers are working toward increasing the availability of small kitchen appliances in retail and online stores. Moreover, these manufacturers constantly strive to develop new and improved products that offer enhanced functionality, energy efficiency, and ease of use. This has led to the emergence of smart appliances, which can be controlled and monitored through smartphones or other connected devices, providing users with greater control and convenience.

Key U.S. Small Kitchen Appliances Companies:

- Ninja (SharkNinja, LLC)

- Hamilton Beach

- GE Appliances (a Haier Company)

- Panasonic Corporation

- Cuisinart

- SMEG USA, Inc

- Tefal S.A.S. (T-fal)

- Bella Housewares (Gather)

- Russell Hobbs (Spectrum brands)

- Kenmore (Transform Holdco LLC)

Recent Developments

-

In March 2024, KitchenAid unveiled its latest appliance, the automatic grain and rice cooker, which introduces a convenient solution for cooking grains and beans. With 21 presets available, users can prepare a variety of grains effortlessly, eliminating the need for constant measuring or supervision. The appliance accurately dispenses the required amount of water based on the grains added, streamlining the cooking process.

-

In March 2024, Midea introduced its latest innovations at the Inspired Home Show (IHS) 2024 in Chicago, Illinois. Midea showcased its diverse range of small appliances, featuring air fryers, multi-cookers, blenders, kettles, heaters, and more. Among the highlights are introducing cutting-edge products such as the Double Decker Dual-Zone Air Fryer, the Barista Brew Smart Coffee Maker, and the Easy Sauté Multicooker.

-

In May 2024, Bosch Home Appliances announced their new 800 Series Fully Automatic Espresso Machine. The machine features an Aroma Max System with four key innovations: a ceramic grinder, smart water pump, intelligent flow heater, and high-tech brewing unit. It includes a user-friendly 5" Active Select Display for customizing beverages and Home Connect functionality, offering over 35 beverage options through Coffee World. The product line is set to launch in mid-2024, demonstrating Bosch's commitment to combining premium coffee quality with smart home technology.

-

In September 2023, KitchenAid introduced its KitchenAid Go Cordless System. This innovative system comprises six small cordless appliances, including the KitchenAid Go Cordless Hand Mixer, Food Chopper, Hand Blender, Coffee Grinder, Personal Blender, and Kitchen Vacuum. To declutter kitchen spaces from cords, each tool in the KitchenAid Go Cordless System operates using a single removable, rechargeable battery.

U.S. Small Kitchen Appliances Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.54 billion

Revenue forecast in 2030

USD 6.84 billion

Growth rate (revenue)

CAGR of 4.3% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Volume in thousand units, revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Country scope

U.S.

Key companies profiled

Ninja; Hamilton Beach; GE Appliances; Panasonic Corporation; Cuisinart; SMEG USA Inc.; Tefal S.A.S.; Bella Housewares; Russell Hobbs; Kenmore

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options U.S. Small Kitchen Appliances Market Report Segmentation

This report forecasts volume & revenue growth at the country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. small kitchen appliances market report based on product, and distribution channel:

-

Product Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Coffee Makers

-

Toasters

-

Juicers, Blenders & Food Processors

-

Deep Fryers

-

Rice Cookers & Steamers

-

Air Fryers

-

Waffle Irons

-

Egg Cookers

-

-

Distribution Channel Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Electronic Stores

-

Exclusive Brand Outlets

-

Online

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. small kitchen appliances market size was valued at USD 5.32 billion in 2024 and is expected to reach USD 5.54 billion in 2025.

b. The U.S. small kitchen appliances market is expected to expand at a compound annual growth rate (CAGR) of 4.3% from 2025 to 2030 to reach USD 6.84 billion by 2030.

b. Coffee makers accounted for a revenue share of 21.1% in 2024. Coffee remains one of the most popular beverages in the U.S., with consumption continuing to grow. This sustained demand for coffee naturally leads to a higher demand for coffee makers as consumers seek to brew their favorite beverages at home. Modern coffee machines have incorporated advanced technologies, such as programmable settings, touch-screen interfaces, and smartphone connectivity, enhancing user convenience. These innovations make it easier for consumers to brew their preferred coffee styles at home, contributing to the growing demand.

b. Some of the key players operating in the market include: Ninja (SharkNinja, LLC), Hamilton Beach, GE Appliances (a Haier Company), Panasonic Corporation, Cuisinart and others.

b. Consumers are increasingly seeking appliances that streamline meal preparation, driving the growing popularity of multi-functional and automated kitchen appliances in the region. Additionally, the rising number of single-person households and the prevalence of smaller living spaces are fueling demand for compact, space-efficient appliances designed to fit within limited kitchen areas. As lifestyles continue to evolve and technological advancements reshape the market, the demand for small kitchen appliances is expected to experience steady growth in the coming years.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.