- Home

- »

- Medical Devices

- »

-

U.S. Small Molecule CDMO Market Size, Share Report, 2033GVR Report cover

![U.S. Small Molecule CDMO Market Size, Share & Trends Report]()

U.S. Small Molecule CDMO Market (2025 - 2033 ) Size, Share & Trends Analysis Report By Drug Type (Generics, Innovators), By Product (APIs, Finished Drug Products), By Application (Oncology, CVD, CNS Conditions), And Segment Forecasts

- Report ID: GVR-4-68040-702-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Small Molecule CDMO Market Summary

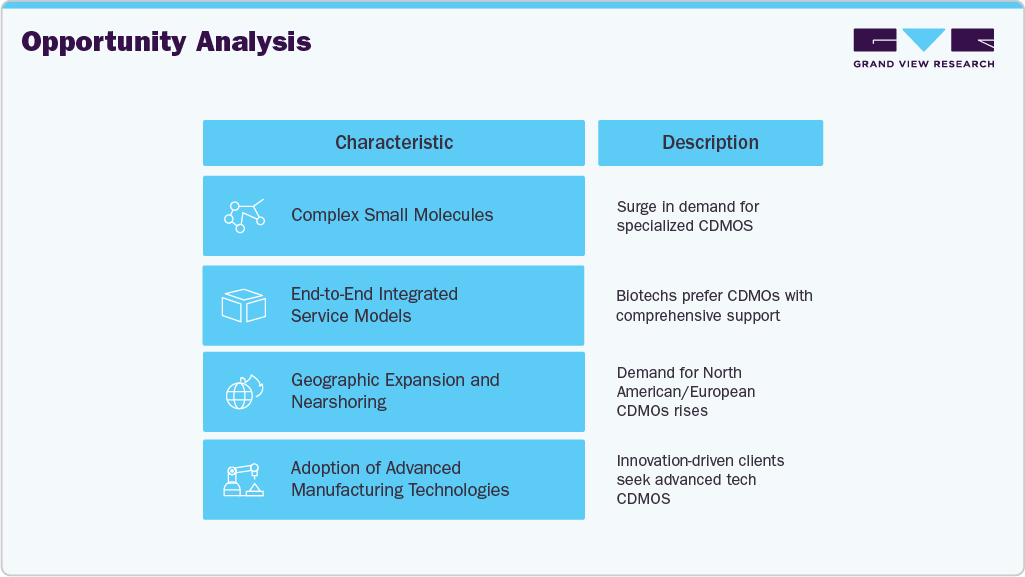

The U.S. small molecule CDMO market size was estimated at USD 26.85 billion in 2024 and is projected to reach USD 47.38 billion by 2033, growing at a CAGR of 6.68% from 2025 to 2033. The growth of the market is due to the rising demand for outsourcing across the pharmaceutical value chain. Pharmaceutical companies, especially small to mid-sized firms and virtual biotech’s, increasingly rely on CDMOs to reduce time-to-market, optimize R&D expenditure, and access specialized capabilities in formulation, process development, and regulatory compliance.

In addition, consolidation in the pharmaceutical industry and growing cost pressures have pushed both innovator and generic drug companies to streamline internal operations and focus on core competencies. This has expanded opportunities for U.S.-based CDMOs to support not only domestic but also clients seeking quality and compliance with stringent FDA regulations. Increasing investments in capacity expansion, continuous manufacturing, and green chemistry processes by leading CDMOs are also contributing to long-term growth.

The U.S. small molecule CDMO market is mainly driven by the ongoing dominance of small molecule drugs in FDA approvals and active pipelines. In 2023, over 60% of the new molecular entities (NMEs) approved by the U.S. FDA were small molecules, including drugs like Ogsiveo (for desmoid tumors) and Zurzuvae (for postpartum depression). This steady trend creates a significant and recurring demand for CDMOs that can provide comprehensive services such as formulation, scale-up, and regulatory batch manufacturing. Small and mid-sized biotech companies, which make up most of the early-stage R&D in the U.S., often lack in-house manufacturing capabilities and instead depend on CDMOs for both preclinical and commercial production. The need to reduce time-to-market for high-value therapeutics-especially in fields like oncology, rare diseases, and CNS disorders-further speeds up outsourcing to flexible, U.S.-based CDMOs with Phase I-III support capabilities.

Moreover, the strategic investment by CDMO companies to expand their U.S. manufacturing and development footprint, catering to both domestic innovators and foreign biopharma looking for U.S. market access. For instance, Cambrex invested over $50 million in its High Point, North Carolina facility to expand process development and API manufacturing capacity for small molecules. Similarly, Thermo Fisher Scientific has been expanding its U.S. capacity through its acquisition of Patheon and subsequent upgrades across its U.S. network. There's also a strong regulatory and logistics advantage for U.S.-based CDMOs, as manufacturing within the U.S. reduces supply chain complexity and supports compliance with FDA current Good Manufacturing Practices (cGMP).

Technological Advancements

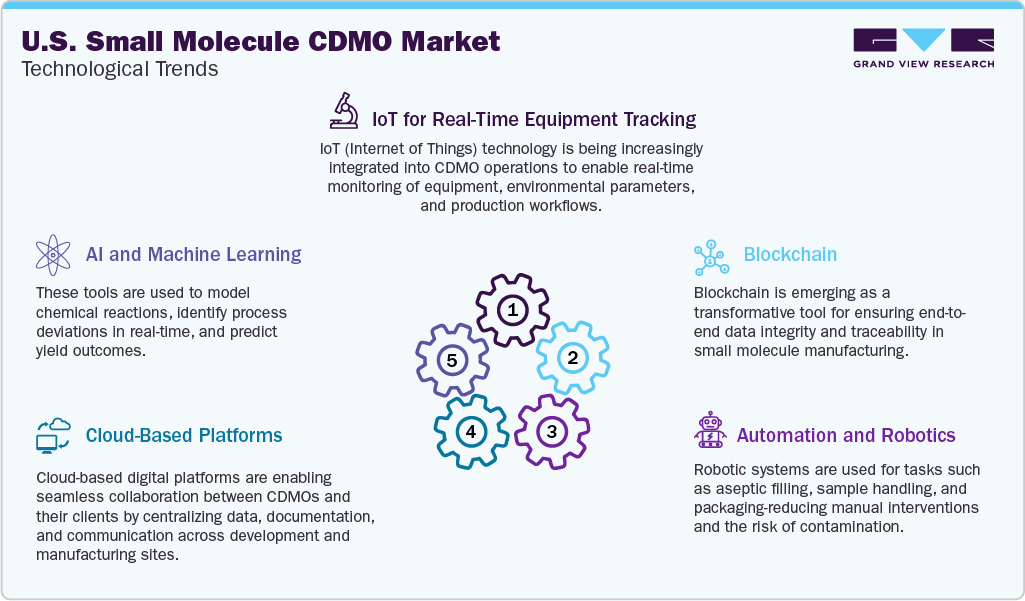

The technological landscape in the U.S. small molecule CDMO market is rapidly changing, driven by the need for faster, safer, and more cost-effective drug development. CDMOs are increasingly adopting continuous manufacturing, flow chemistry, and process intensification technologies to improve scalability, reduce waste, and meet regulatory standards for quality and efficiency. Automation and digital process control systems, including PAT (Process Analytical Technology) and real-time release testing (RTRT), enhance batch consistency and reduce manual work. Advanced data analytics, AI-driven modeling, and digital twins are used to optimize process parameters, predict yield variations, and speed up tech transfer. Additionally, demand for sustainable production has led to investment in green chemistry techniques like solvent recycling and bio-catalysis. These technological advances not only enable faster time-to-market but also help CDMOs act as innovation partners, especially for clients developing complex APIs, personalized medicine, and fast-tracked therapeutics.

Pricing Analysis

A pricing analysis model in the U.S. small molecule CDMO market typically includes multiple cost-driving factors, such as molecule complexity, development stage, volume needs, regulatory compliance, and service scope (e.g., standalone API manufacturing versus full end-to-end development). For early-phase projects, pricing often follows a milestone-based approach with fixed fees for preclinical development, formulation, and initial GMP batch production. In later stages, cost-plus or FTE (full-time equivalent) pricing models become more prevalent, especially when long-term partnerships are involved. High-potency APIs, specialized containment, or accelerated timelines command premium prices due to higher operational and compliance challenges. Additionally, geographic location, manufacturing capacity utilization, and quality track record impact a CDMO’s ability to set competitive prices. CDMOs providing integrated services and digital transparency often justify higher rates by reducing overall time-to-market and minimizing tech transfer risks.

Product Insights

Based on product segment, the market is divided into Active Pharmaceutical Ingredients (API) and Finished Drug Products. The Active Pharmaceutical Ingredients (API) segment held the largest revenue share in the Small Molecule CDMO industry at 61.8% in 2024. The segment's growth is driven by increasing demand for complex and high-potency small molecule therapies across various therapeutic areas, especially oncology, infectious diseases, and cardiovascular disorders. As pharmaceutical pipelines focus more on innovation, drug developers are outsourcing API manufacturing to CDMOs with advanced synthetic capabilities, containment infrastructure for HPAPIs, and a strong regulatory track record.

The finished drug products segment is expected to grow at a significant CAGR during the forecast period. period. The segment growth is driven due to increasing pharmaceutical industry trends toward outsourcing formulation development, aseptic filling, and packaging to specialized CDMOs. Rising complexity in drug delivery systems, such as controlled-release formulations, biologics combination products, and personalized medicines, requires advanced expertise and state-of-the-art manufacturing facilities that many pharma companies prefer to access via outsourcing.

Drug Type Insights

On the basis of the drug type segment, the market is segregated into innovators and generics. The innovators segment held the largest market share in 2024 due to the increasing focus of pharmaceutical companies on developing novel small-molecule drugs with unique mechanisms of action, particularly in high-value therapeutic areas such as oncology, immunology, and rare diseases. Innovator companies typically require extensive R&D support, specialized manufacturing capabilities, and stringent regulatory compliance, which drive significant demand for advanced CDMO services.

The generics segment is anticipated to grow at the fastest CAGR over the forecast period. The growth of the segment is due to the increasing demand for affordable and accessible medications worldwide as healthcare systems focus on cost containment and expanding patient access. Patent expirations of several blockbuster small molecule drugs are creating significant opportunities for generic manufacturers to enter the market, driving a surge in outsourcing needs for large-scale, cost-efficient API and finished product manufacturing.

Application Insights

Based on the application segment, the market is divided into oncology, cardiovascular disease, central nervous system (CNS) conditions, autoimmune/inflammation, and others. The oncology segment held the largest market share in 2024 due to the rapidly increasing prevalence of cancer in the U.S. and the continuous launch of new targeted therapies and small molecule anticancer drugs. The high unmet medical need for effective and personalized cancer treatments has driven significant investment in oncology drug development, resulting in a strong pipeline of innovative molecules that require specialized CDMO services.

The autoimmune/inflammation segment is expected to grow at a significant CAGR during the forecast period. This growth is driven by the increasing prevalence of autoimmune diseases like rheumatoid arthritis, psoriasis, and inflammatory bowel disease, which boost demand for effective small molecule therapies. Advances in understanding immune system pathways have led to the development of new targeted drugs that require specialized manufacturing processes, including complex synthesis and formulation techniques, making outsourcing to experienced CDMOs crucial.

Key U.S. Small Molecule CDMO Company Insights

Several key players are acquiring various strategic initiatives to strengthen their market position, offering diverse services to customers. The prominent strategies adopted by companies are service launches, mergers & acquisitions/joint ventures mergers, partnerships & agreements, expansions, and others to increase market presence & revenue and gain a competitive edge, driving the market growth.

Key U.S. Small Molecule CDMO Companies:

- Lonza, Catalent, Inc

- Thermo Fisher Scientific Inc.

- Cambrex Corporation

- Bellen Chemistry

- Siegfried Holding AG

- Recipharm AB

- Eurofins Scientific

- Aurigene Pharmaceutical Services Ltd.

- CordenPharma International

Recent Developments

-

In October 2024, Thermo Fisher launched its Accelerator Drug Development offerings designed to support both emerging biotech firms and major pharmaceutical companies. This comprehensive suite encompasses manufacturing, clinical research, and supply chain services across various modalities, including small molecules, biologics, and cell and gene therapies-covering the entire journey from preclinical stages through to commercial launch.

-

In June 2024, Siegfried plans to acquire an early-phase CDMO site in Wisconsin, U.S., specializing in highly potent APIs. The site will serve as a hub for early-phase development and manufacturing services, strengthening Siegfried's global capabilities.

U.S. Small Molecule CDMO Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 28.26 billion

Revenue forecast in 2033

USD 47.38 billion

Growth rate

CAGR of 6.68% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, drug type, application

Key companies profiled

Lonza, Catalent, Inc.; Thermo Fisher Scientific Inc.; Cambrex Corporation; Bellen Chemistry; Siegfried Holding AG; Recipharm AB; Eurofins Scientific; Aurigene Pharmaceutical Services Ltd.; CordenPharma International

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Small Molecule CDMO Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. small molecule CDMO market report based on product, drug type, application and region.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Active Pharmaceutical Ingredients (API)

-

Finished Drug Products

-

-

Drug Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Innovators

-

Generics

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Oncology

-

Cardiovascular Disease

-

Central Nervous System (CNS) Conditions

-

Autoimmune/Inflammation

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. small molecule CDMO market size was estimated at USD 26.85 billion in 2024 and is expected to reach USD 28.26 billion in 2025.

b. The U.S. small molecule CDMO market is expected to grow at a compound annual growth rate of 6.68% from 2025 to 2033 to reach USD 47.38 billion by 2033.

b. Active Pharmaceutical Ingredients (API) dominated the U.S. small molecule CDMO market with a share of 61.8% in 2024. This is attributable to the increasing demand for complex and high-potency small molecule therapies across a range of therapeutic areas, particularly oncology, infectious diseases, and cardiovascular disorders.

b. Some key players operating in the U.S. small molecule CDMO market include TLonza, Catalent, Inc.; Thermo Fisher Scientific Inc.; Cambrex Corporation; Bellen Chemistry; Siegfried Holding AG; Recipharm AB; Eurofins Scientific; Aurigene Pharmaceutical Services Ltd.; CordenPharma International

b. Key factors that are driving the market growth include the rising demand for outsourcing across the pharmaceutical value chain. Pharmaceutical companies, especially small to mid-sized firms and virtual biotech’s, increasingly rely on CDMOs to reduce time-to-market, optimize R&D expenditure and access specialized capabilities in formulation, process development, and regulatory compliance.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.