- Home

- »

- Medical Devices

- »

-

U.S. Small Molecule Innovator CDMO Market Report, 2033GVR Report cover

![U.S. Small Molecule Innovator CDMO Market Size, Share & Trends Report]()

U.S. Small Molecule Innovator CDMO Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Small Molecule API, Small Molecule Drug Product), By Stage Type, By Therapeutic Area, By Customer Type, And Segment Forecasts

- Report ID: GVR-4-68040-703-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Small Molecule Innovator CDMO Trends

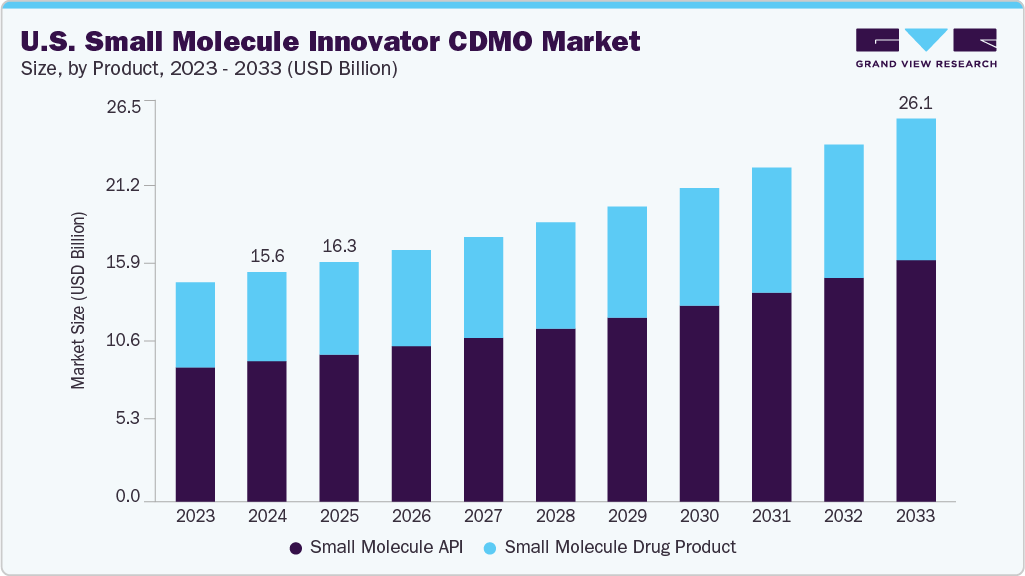

The U.S. small molecule innovator CDMO market size was estimated at USD 15.58 billion in 2024 and is projected to reach USD 26.06 billion by 2033, growing at a CAGR of 6.04% from 2025 to 2033. The growth of the market is due to the rising demand from emerging and mid-sized pharmaceutical companies developing novel chemical entities. These firms often lack in-house manufacturing infrastructure and are increasingly relying on CDMOs for API synthesis, formulation development, and early-phase clinical supply. As innovation in small molecule pipelines continues across oncology, neurology, metabolic disorders, and anti-infectives, CDMOs with strong capabilities in handling complex chemistry, high-potency APIs, and oral solid dosage forms are witnessing increased project volumes. Cost pressures, the need for speed-to-clinic, and regulatory support for accelerated pathways are further fueling outsourcing decisions.

Furthermore, the market is primarily driven by the surge in novel chemical entity (NCE) development, particularly from small and mid-sized pharmaceutical firms. These companies increasingly seek outsourced partners to manage process development, scale-up, and GMP manufacturing as they move from discovery to clinical testing. The complexity of today's small molecule drug candidates, including highly potent APIs (HPAPIs), chiral compounds, and poorly soluble molecules demand specialized technical capabilities that CDMOs are uniquely positioned to provide. Moreover, regulatory flexibility for first-in-human and fast-track pathways is encouraging innovators to compress development timelines, further elevating demand for CDMOs with integrated early-phase services.

In addition, the growing preference for domestic manufacturing in response to supply chain vulnerabilities and geopolitical uncertainty is also driving the market growth. Innovator pharmaceutical companies are increasingly shifting away from offshore production, particularly in India and China, due to concerns around quality assurance, long lead times, and regulatory compliance issues. This trend has been further reinforced by government incentives such as the U.S. FDA’s support for onshore advanced manufacturing and funding through the BARDA and ASPR programs. As a result, U.S.-based CDMOs with cGMP-compliant facilities, strong quality track records, and proximity to clinical sites are being prioritized for both early-phase and commercial production.

Technological Advancements

The technological landscape of the U.S. small molecule innovator CDMO market is defined by the integration of continuous manufacturing, high-potency API containment, and advanced process automation. Continuous manufacturing is gaining ground for its ability to streamline production, reduce costs, and ensure consistent product quality, making it a preferred choice for fast-tracked and commercial-scale drug programs. CDMOs are also investing in state-of-the-art containment systems to safely handle potent compounds, particularly in oncology and specialty therapeutics. In parallel, the adoption of process analytical technology (PAT), real-time monitoring, and data analytics is enabling better control over critical parameters, improving yields and regulatory compliance. The use of green chemistry and biocatalysis is advancing sustainable synthesis routes, while AI and machine learning are starting to enhance process development and optimization workflows. These innovations are transforming CDMOs into technologically agile partners capable of supporting complex small molecule programs from discovery to market.

Pricing Analysis

In the U.S. Small Molecule Innovator CDMO market, pricing is typically based on a multi-variable cost-plus and value-based hybrid model, influenced by project complexity, development phase, volume, regulatory requirements, and customization level. CDMOs apply tiered pricing structures across early-phase development, clinical trial material manufacturing, and commercial production. Early-phase projects (e.g., preclinical to Phase I) often have higher per-unit costs due to small batch sizes, non-standardized processes, and intensive analytical development. As volume scales in later phases (Phase III and commercial), cost efficiencies increase, leading to more competitive per-unit pricing.

Product Insights

On the basis of product segment, the market is classified into small molecule API and small molecule drug product. The small molecule API segment accounted for the largest revenue share in the small molecule innovator CDMO industry of 61.25% in 2024. The growth of the segment is due to the increasing complexity of active pharmaceutical ingredients, rising demand for high-potency APIs (HPAPIs), and the expanding pipelines of innovator pharmaceutical companies targeting oncology, infectious diseases, and rare disorders. As drug developers prioritize the outsourcing of chemically complex and resource-intensive API synthesis, CDMOs with advanced capabilities in multi-step synthesis, containment, and regulatory compliance are witnessing increased contract volumes.

The small molecule drug product segment is anticipated to grow at a considerable CAGR during the forecast period. The segment growth is driven due to the increasing demand for oral solid dosage forms, the rising number of novel drug approvals, and the need for advanced formulation technologies. Innovator pharmaceutical companies are increasingly outsourcing formulation development, clinical trial material production, and commercial-scale manufacturing to CDMOs to accelerate time-to-market and reduce internal infrastructure costs.

Stage Type Insights

On the basis of stage type segment, the market is segregated into preclinical, clinical, and commercial. The clinical segment held the largest market share in 2024 due to the rising number of small molecule candidates advancing into clinical development, coupled with the increasing reliance of pharmaceutical innovators on CDMOs for GMP-compliant manufacturing, formulation development, and supply of clinical trial materials across Phases I to III.

The commercial segment is anticipated to grow at the fastest CAGR over the forecast period. The growth of the segment is due the increasing number of small molecule drug approvals, rising demand for large-scale production capabilities, and the shift toward long-term strategic partnerships between pharmaceutical innovators and CDMOs. As more investigational drugs successfully progress through clinical trials and receive regulatory approvals, innovators are turning to CDMOs for cost-effective, scalable, and compliant commercial manufacturing solutions.

Customer Type Insights

On the basis of customer type segment, the market is segregated into pharmaceutical and biotechnology. The pharmaceutical segment held the largest market share in 2024 due to the extensive outsourcing of small molecule development and manufacturing activities by large and mid-sized pharmaceutical companies aiming to streamline operations, reduce costs, and focus on core competencies such as drug discovery and commercialization. These companies maintain broad pipelines across multiple therapeutic areas, requiring robust CDMO support for API synthesis, formulation development, clinical trial material supply, and commercial production.

The biotechnology segment is anticipated to grow at a considerable CAGR over the forecast period. The growth of the segment is due the increasing number of small and mid-sized biotech firms developing novel small molecule therapeutics, particularly in niche and high-value therapeutic areas such as oncology, rare diseases, and neurology. These companies often operate with limited in-house manufacturing infrastructure and rely heavily on CDMOs for end-to-end development and production support from preclinical synthesis and formulation to clinical trial material supply and commercialization.

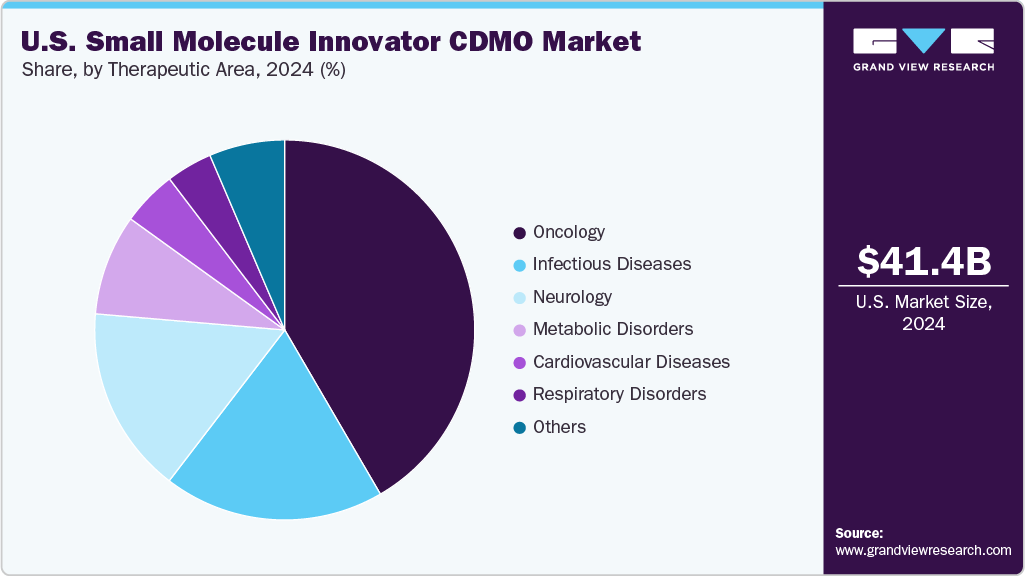

Therapeutic Area Insights

On the basis of therapeutic area segment, the market is segregated into cardiovascular diseases, oncology, respiratory disorders, neurology, metabolic disorders, infectious diseases, and others. The oncology segment held the largest market share in 2024 due to the growing prevalence of cancer and the continuous introduction of novel targeted therapies and small molecule anticancer drugs. The high unmet medical need for effective and personalized cancer treatments has driven significant investment in oncology drug development, resulting in a robust pipeline of innovative molecules requiring specialized CDMO services.

The infectious diseases segment is anticipated to grow at a considerable CAGR over the forecast period. The growth of the segment is due to the ongoing focus on pandemic preparedness, the emergence of drug-resistant pathogens, and the continuous demand for antiviral and antibacterial small molecule therapies. Pharmaceutical and biotech companies are accelerating R&D efforts to develop novel therapeutics targeting infections such as COVID-19, influenza, tuberculosis, and multidrug-resistant bacterial strains.

Key U.S. Small Molecule Innovator CDMO Company Insights

Several key players are acquiring various strategic initiatives to strengthen their market position offering diverse services to customers. The prominent strategies adopted by companies are service launches, mergers & acquisitions/joint ventures merger, partnership & agreements, expansions, and others to increase market presence & revenue and gain a competitive edge drives the market growth.

Key U.S. Small Molecule Innovator CDMO Companies:

- Piramal Pharma Solutions

- CordenPharma International

- Wuxi AppTec

- Cambrex Corporation

- Recipharm AB

- Thermo Fisher Scientific, Inc.

- Lonza

- Catalent Inc.

- Siegfried Holding AG

- Boehringer Ingelheim

- Labcorp

Recent Developments

-

In October 2024, Thermo Fisher Scientific, Inc. launched its Accelerator Drug Development offerings designed to support both emerging biotech firms and major pharmaceutical companies. This comprehensive suite encompasses manufacturing, clinical research, and supply chain services across various modalities, including small molecules covering the entire journey from preclinical stages through to commercial launch.

-

In June 2024, Siegfried plans to acquire an early-phase CDMO site in Wisconsin, U.S., specializing in highly potent APIs. The site will serve as a hub for early-phase development and manufacturing services, strengthening Siegfried's global capabilities.

U.S. Small Molecule Innovator CDMO Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 16.30 billion

Revenue forecast in 2033

USD 26.06 billion

Growth rate

CAGR of 6.04% from 2025 to 2033

Actual data

2018 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, stage type, customer type, therapeutic area

Country scope

U.S.

Key companies profiled

Piramal Pharma Solutions; CordenPharma International; Wuxi AppTec; Cambrex Corporation; Recipharm AB; Thermo Fisher Scientific, Inc.; Lonza; Catalent Inc.; Siegfried Holding AG; Boehringer Ingelheim; Labcorp

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Small Molecule Innovator CDMO Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global U.S. small molecule innovator CDMO market report based on product, stage type, customer type, and therapeutic area.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Small Molecule API

-

Small Molecule Drug Product

-

Oral Solid Dose

-

Semi-Solid Dose

-

Liquid Dose

-

Others

-

-

-

Stage Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Preclinical

-

Clinical

-

Phase I

-

Small

-

Medium

-

Large

-

-

Phase II

-

Small

-

Medium

-

Large

-

Phase III

-

-

Small

-

Medium

-

Large

-

-

-

Commercial

-

-

Customer Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmaceutical

-

Small

-

Medium

-

Large

-

-

Biotechnology

-

-

Therapeutic Area Outlook (Revenue, USD Million, 2021 - 2033)

-

Cardiovascular Diseases

-

Oncology

-

Respiratory Disorders

-

Neurology

-

Metabolic Disorders

-

Infectious Diseases

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. small molecule innovator CDMO market size was estimated at USD 15.58 billion in 2024 and is expected to reach USD 16.30 billion in 2025.

b. The U.S. small molecule innovator CDMO market is expected to grow at a compound annual growth rate of 6.04% from 2025 to 2033 to reach USD 26.06 billion by 2033.

b. Small Molecule API dominated the U.S. small molecule innovator CDMO market with a share of 61.25% in 2024. This is attributable to the increasing complexity of active pharmaceutical ingredients, rising demand for high-potency APIs (HPAPIs), and the expanding pipelines of innovator pharmaceutical companies targeting oncology, infectious diseases, and rare disorders.

b. Some key players operating in the U.S. small molecule innovator CDMO market include Piramal Pharma Solutions; CordenPharma International; Wuxi AppTec; Cambrex Corporation; Recipharm AB; Thermo Fisher Scientific, Inc.; Lonza; Catalent Inc.; Siegfried Holding AG; Boehringer Ingelheim; Labcorp

b. Key factors that are driving the market growth include Increasing Demand for Small Molecule Drugs, Increasing Outsourcing Trends Among Pharmaceutical Companies, and Surge In Number of Clinical Trials

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.