- Home

- »

- Next Generation Technologies

- »

-

U.S. Smart Cities Market Size, Share, Industry Report, 2033GVR Report cover

![U.S. Smart Cities Market Size, Share & Trends Report]()

U.S. Smart Cities Market (2025 - 2033) Size, Share & Trends Analysis Report By Application, By Smart Governance, By Smart Utilities, By Smart Transportation, By Smart Healthcare, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-312-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Smart Cities Market Summary

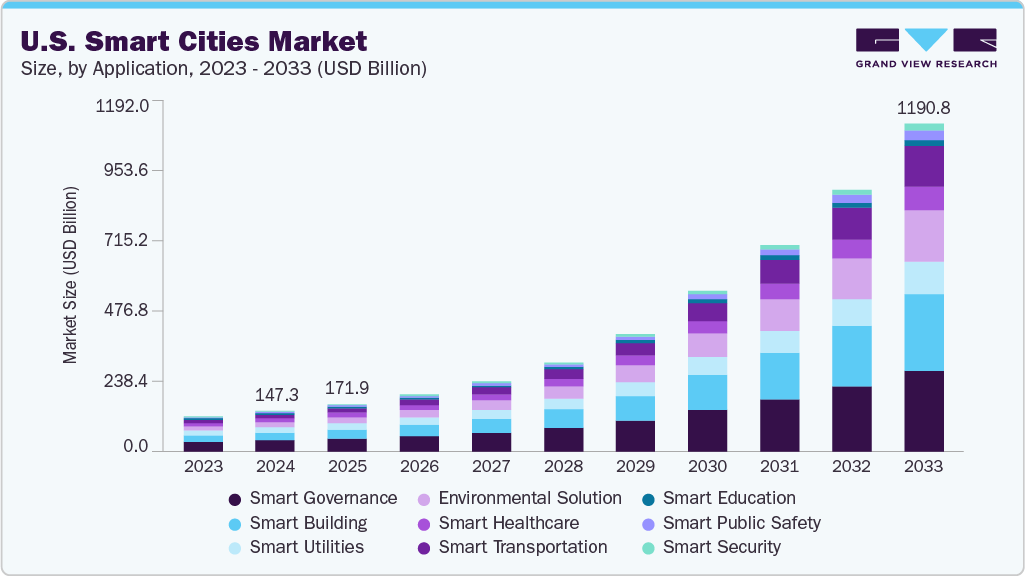

The U.S. smart cities market size was estimated at USD 147.30 billion in 2024 and is expected to grow at a CAGR of 27.4% from 2025 to 2033. Market growth is primarily driven by increasing urbanization and cities' need for efficient resource management. Investments in infrastructure modernization and digital technologies, such as IoT, AI, and cloud computing, are helping cities enhance public safety, transportation, energy management, and environmental monitoring. In addition, government initiatives that promote sustainable development and smart governance significantly contribute to market expansion.

The rising demand for an improved quality of life, combined with the integration of advanced data analytics for real-time decision-making, also supports this growth. As a result, the market is expected to experience substantial development, fueled by technological adoption and urban planning strategies that focus on sustainability and efficiency. A notable trend in the global market is the integration of advanced data analytics and AI to facilitate real-time monitoring and predictive maintenance. This trend enables cities to optimize utilities, manage traffic flow, and enhance emergency response capabilities. Increasing collaboration between technology providers and city authorities is helping to deploy scalable smart city platforms. Furthermore, the growing use of edge computing allows for faster data processing at the source, improving the responsiveness of smart city applications worldwide.

Another significant trend is emphasizing sustainable and green technologies in smart city development. Governments and organizations focus on energy-efficient solutions such as smart grids, renewable energy integration, and intelligent building management systems. This shift aligns with global efforts to reduce carbon emissions and combat climate change. The focus on sustainability promotes the adoption of electric mobility, innovations in waste management, and water conservation technologies, all of which contribute to more resilient and eco-friendly urban environments.

Key companies active in the market include Cisco Systems, IBM, Siemens, Microsoft, and Amazon Web Services. These companies provide a variety of solutions, including network infrastructure, AI-driven analytics, cloud platforms, and smart transportation systems. They often partner with city governments to implement large-scale projects to enhance urban services, public safety, and energy management. Continuous investments in research and development and expansion into new geographic areas strengthen their positions in the smart cities ecosystem and support the ongoing transformation of urban centers across the U.S.

Application Insights

The smart governance segment dominated the market and accounted for a market share of over 28% in 2024, owing to increased efforts by federal and local governments to digitize public services, improve administrative efficiency, and enhance citizen engagement. Investments in digital infrastructure, such as smart lighting, e-governance platforms, and surveillance systems, have become central to urban planning. The focus on improving transparency, data-driven decision-making, and public safety through connected systems has further supported growth. Moreover, the need to streamline city operations, reduce costs, and improve service delivery across sectors like transportation and utilities has pushed municipalities to adopt integrated governance technologies, contributing to this segment’s leading position.

The smart transportation solution segment is expected to witness a significant CAGR of 32.1 % from 2025 to 2033. This growth is fueled by increasing traffic congestion in many urban areas, leading to a greater need for efficient transportation options. There is increasing pressure to reduce pollution and enhance road safety. New technologies can help cities better manage traffic flow and make public transportation more convenient for users. As a result, smart transportation solutions are becoming increasingly important and are driving significant market growth.

Smart Transportation Insights

The intelligent transportation system segment accounted for the largest market share in 2024, owing to the increasing number of vehicles on American roads and the urgent need to reduce traffic congestion are key reasons for implementing advanced traffic management systems. By managing traffic more effectively, these systems help minimize travel delays and lower air pollution. They also allow authorities and emergency responders to react quickly to accidents and incidents. Moreover, U.S. government agencies promote intelligent transportation systems to improve road safety, enhance transportation networks' operations, and lessen transportation's environmental impact, contributing to growth in this sector.

The parking management segment is expected to witness the highest CAGR from 2025 to 2033. The segment growth is fueled by the need for better parking space management to accommodate the rising number of city vehicles. Efficient parking management decreases traffic congestion and pollution while enhancing safety and convenience for drivers. U.S. smart city initiatives focus on optimizing the use of parking spaces to alleviate congestion and reduce environmental impacts. As a result, demand for parking management systems is expected to rise in the coming years.

Smart Governance Insights

The smart infrastructure segment dominated the market and accounted for the largest market share in 2024. Government agencies are increasingly working to digitize their operations across various sectors, including finance, healthcare, retail, manufacturing, and food services. This shift is driving demand for smart infrastructure solutions. In the U.S., government investments are focused on modernizing infrastructure to support economic digitalization. Furthermore, regulatory bodies are developing frameworks to manage the evolving payment systems and digital currencies, further promoting the growth of the country's smart infrastructure.

The smart lighting segment is expected to witness a significant CAGR from 2025 to 2033. Smart lighting effectively enhances energy efficiency in cities while reducing energy and maintenance costs. It also supports various smart city functions, such as traffic management, public safety, environmental monitoring, parking systems, and improved wireless communications. The recent adoption of new lighting technologies, including LEDs and organic LEDs, along with human-centric lighting designs, has contributed to the rising popularity of smart lighting solutions.

Smart Healthcare Insights

The medical devices segment accounted for the largest market share in 2024. The increasing use of medical devices within urban health infrastructure is supporting real-time health monitoring, early diagnosis, and faster treatment. These devices help alleviate pressure on hospitals and improve patient care. U.S. government agencies and city planners focus on incorporating smart healthcare solutions into broader smart city initiatives to enhance quality of life, reduce healthcare costs, and address the rising demand for medical services in crowded urban areas. In addition, advances in connected medical technology are contributing to the growth of this sector.

The systems & software segment is expected to witness the highest CAGR from 2025 to 2033. This growth is driven by the increasing demand for electronic health records (EHR) integration, remote diagnostics, and AI-based decision-support tools. These solutions enable healthcare providers to operate more efficiently and deliver better patient care through timely decision-making and accurate diagnoses. As urban populations grow and healthcare systems become more digital, intelligent software to manage workflows and patient care is expected to increase, accelerating the adoption of these solutions.

Smart Utilities Insights

The energy management segment accounted for the largest market share in 2024. The increasing demand for energy and the adoption of virtual power plants utilizing AI, machine learning, and IoT technologies are driving energy security and efficiency improvements. Key companies in the U.S. are investing in research and development to advance energy management systems and to create analytical solutions that integrate new technologies, such as blockchain. These initiatives help strengthen the energy management segment within the smart utilities sector.

The waste management segment is expected to witness the highest CAGR from 2025 to 2033. Local governments are partnering with system integrators, distributors, and original equipment manufacturers (OEMs) to install smart trash bins in urban areas. These smart bins are often monitored through mobile apps that track fill levels, offering convenience for users and enhancing waste management. To deploy smart waste solutions, OEMs and integrators focus on crowded public venues with higher waste volumes. This approach supports the growth of the smart waste management segment in U.S. cities.

Key U.S. Smart Cities Company Insights

Some key players operating in the market include Cisco Systems, Inc., IBM, and Siemens AG.

-

Cisco Systems, Inc. provides network infrastructure and smart city solutions, including smart lighting, traffic management, and city surveillance systems. The company collaborates with various U.S. cities to implement connected urban infrastructure that improves operational efficiency, reduces costs, and enhances digital services for residents and local governments.

-

IBM offers AI, cloud computing, and data analytics platforms for smart city applications such as public safety monitoring, traffic flow management, and utilities optimization. Its technologies support urban governance, decision-making processes, resource management, and operational intelligence in multiple U.S. municipalities.

-

Siemens AG supplies equipment for smart infrastructure, including energy management systems, building automation, and smart grid solutions. In the U.S., Siemens supports large-scale projects that enhance urban energy efficiency, transportation networks, infrastructure modernization, and sustainability efforts.

Some of the emerging market participants are Iteris, Inc., Microsoft Corporation, and Amazon Web Services, Inc.

-

Iteris, Inc. delivers intelligent transportation system solutions, focusing on traffic signal timing, real-time traffic analytics, and smart mobility services primarily for U.S. transportation departments and municipal governments. They aim to improve road safety, reduce congestion, and optimize traffic operations.

-

Microsoft Corporation provides cloud computing platforms, Internet of Things (IoT) services, and software solutions for smart city applications, including public safety, healthcare management, environmental monitoring, and citizen engagement across urban centers in the U.S.

-

Amazon Web Services, Inc. offers cloud infrastructure, machine learning, and AI services that support data management, IoT deployments, and scalable computing needs for U.S. city governments and utilities.

Key U.S. Smart Cities Companies:

- Cisco Systems, Inc.

- IBM

- Siemens AG

- Quantela, Inc.

- Iteris, Inc.

- Microsoft Corporation

- Amazon Web Services, Inc.

- Intel Corporation

- Hitachi, Ltd.

- Schneider Electric SE

- Honeywell International Inc.

Recent Developments

-

In June 2024, the Texas Department of Transportation awarded Iteris a $2 million IDIQ contract to provide smart mobility and traffic signal timing services. This contract is part of Texas's ongoing efforts to enhance traffic flow and safety through advanced intelligent transportation system solutions, which will help optimize signal timing and alleviate congestion across key transportation corridors in the state.

-

In February 2025, Quantela Inc. announced a strategic partnership with Connected Kerb Inc. The partnership aims to optimize urban infrastructure for micro mobility, IoT applications, electric vehicle (EV) charging, and Digital Out-of-Home (DOOH) advertising, helping cities across the U.S. create future-ready urban environments. This joint effort supports the development of smart cities.

-

In February 2025, Cisco launched its Connect-by-Design Alliance program in the U.S. This initiative involves partnerships with CDA and Ikusi to implement smart lighting, parking, traffic management, and electricity grid digitalization solutions. The program aims to bring innovation and equity to millions of residents in U.S. cities, starting with Cary, North Carolina. It focuses on creating more connected, efficient, and sustainable urban environments by leveraging advanced technologies and collaborative partnerships.

U.S. Smart Cities Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 171.94 billion

Revenue forecast in 2033

USD 1,190.8 billion

Growth rate

CAGR of 27.4% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, smart governance, smart utilities, smart transportation, smart healthcare

Key companies profiled

Cisco Systems, Inc.; IBM; Siemens AG; Quantela, Inc.; Iteris, Inc.; Microsoft Corporation; Amazon Web Services, Inc.; Intel Corporation; Hitachi, Ltd.; Schneider Electric SE; Honeywell International Inc.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet you exact research needs. Explore purchase options

U.S. Smart Cities Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest technology trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. smart cities market report based on application, smart governance, smart utilities, smart transportation, smart healthcare, and region:

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Smart Governance

-

Smart Building

-

Environmental Solution

-

Smart Utilities

-

Smart Transportation

-

Smart Healthcare

-

Smart Public Safety

-

Smart Security

-

Smart Education

-

-

Smart Governance Outlook (Revenue, USD Million, 2021 - 2033)

-

City Surveillance

-

C.C.S.

-

E-governance

-

Smart Lighting

-

Smart Infrastructure

-

-

Smart Utilities Outlook (Revenue, USD Million, 2021 - 2033)

-

Energy Management

-

Water Management

-

Waste Management

-

Meter Data Management

-

Distribution Management System

-

Substation Automation

-

Other Smart Utilities Solutions

-

-

Smart Transportation Outlook (Revenue, USD Million, 2021 - 2033)

-

Intelligent Transportation System

-

Parking Management

-

Smart Ticketing & Travel Assistance

-

Traffic Management

-

Passenger Information

-

Connected Logistics

-

Other Smart Transportation Solutions

-

-

Smart Healthcare Outlook (Revenue, USD Million, 2021 - 2033)

-

Medical Devices

-

Systems & Software

-

Frequently Asked Questions About This Report

b. The U.S. smart cities market was estimated at USD 147.3 billion in 2024 and is expected to reach USD 171.94 billion in 2025.

b. The U.S. smart cities market is expected to grow at a compound annual growth rate of 27.4% from 2025 to 2033 to reach USD 1,190.8 billion by 2030.

b. The smart governance segment dominated the market and accounted for a market share of over 26% in 2024, owing to increased efforts by federal and local governments to digitize public services, improve administrative efficiency, and enhance citizen engagement.

b. The key players in the U.S. smart cities market are Cisco Systems, Inc.: IBM; Siemens AG; Quantela, Inc.; Iteris, Inc.; Microsoft Corporation; Amazon Web Services, Inc.; Intel Corporation; Hitachi, Ltd.; Schneider Electric SE; Honeywell International Inc.

b. Key drivers of U.S. smart cities market growth include increasing government investments in digital infrastructure, rising urban population pressures, demand for efficient energy and utility management, advancements in IoT and AI technologies, and initiatives to improve public safety, transportation, and healthcare services.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.