- Home

- »

- Next Generation Technologies

- »

-

U.S. Sovereign Cloud Market Size, Industry Report, 2033GVR Report cover

![U.S. Sovereign Cloud Market Size, Share & Trends Report]()

U.S. Sovereign Cloud Market (2025 - 2033) Size, Share & Trends Analysis Report By Functionality (Data Sovereignty, Technical Sovereignty, Operational Sovereignty), By Deployment, By Enterprise Size, By End-use (Government & Defense, BFSI), And Segment Forecasts

- Report ID: GVR-4-68040-643-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Sovereign Cloud Market Size & Trends

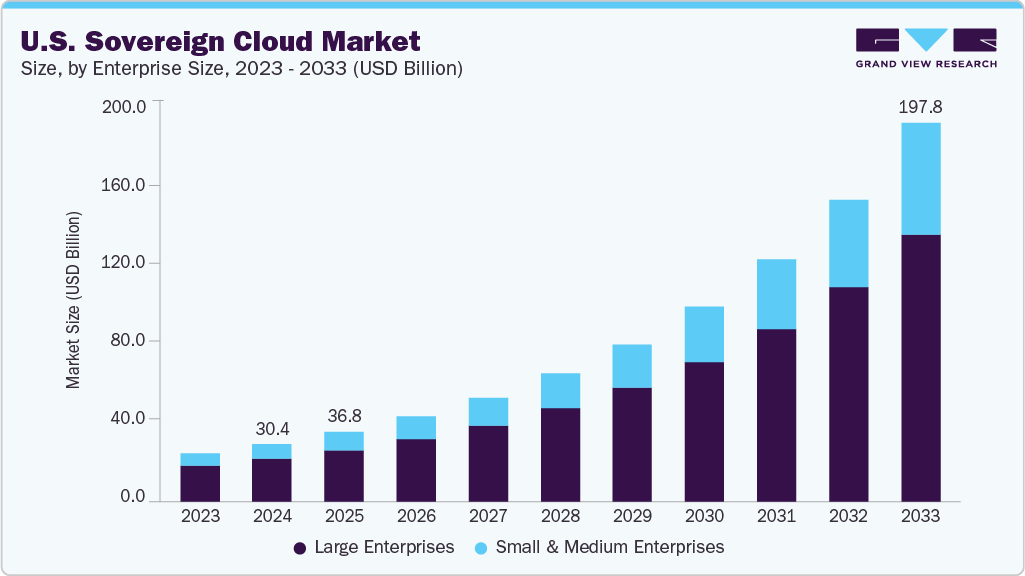

The U.S. sovereign cloud market size was estimated at USD 30.43 billion in 2024 and is projected to reach USD 197.81 billion by 2033, growing at a CAGR of 23.4% from 2025 to 2033. Rising concerns over data sovereignty, cybersecurity, and regulatory compliance drive market growth. Government agencies and enterprises are adopting sovereign cloud solutions to ensure that data remains within national borders and complies with domestic regulations.

Strategic shifts in federal cloud adoption have accelerated the market, with agencies adopting multi-cloud architectures and integrating advanced technologies such as AI to enhance operational efficiency and security. Leading cloud providers, including Google in partnership with Worldwide Technology, deliver tailored sovereign cloud offerings to meet the high-security demands of government clients. AWS, Microsoft, and Oracle are investing in U.S. government cloud regions, highlighting the critical role of sovereign cloud infrastructure in supporting national security and sensitive workloads.

For instance, Amazon Web Services (AWS) invested USD 10 billion in North Carolina to expand its cloud and AI infrastructure, aiming to bolster regional digital capabilities. Such investments not only enhance service delivery but also address concerns related to data residency and sovereignty. Therefore, the U.S. market is poised for continued expansion, supported by a regulatory environment emphasizing data protection. As organizations prioritize digital transformation while adhering to stringent compliance requirements, the demand for sovereign cloud solutions is expected to rise.

The U.S. sovereign cloud industry is poised for substantial growth, fueled by federal directives emphasizing data localization, national security, and autonomy from foreign influence. Government agencies across defense, intelligence, and civilian domains increasingly adopt sovereign cloud solutions that align with stringent compliance frameworks such as FedRAMP High and ITAR. Furthermore, the Department of Defense’s Joint Warfighting Cloud Capability (JWCC) initiative intensifies demand by mandating secure, multi-vendor cloud environments for handling mission-critical operations. These developments are playing a pivotal role in accelerating the adoption and expansion of sovereign cloud infrastructure in the U.S.

Deployment Insights

Cloud dominated the market and accounted for the revenue share of over 83.0% in 2024 due to the rising need for secure and scalable infrastructure that complies with strict national data sovereignty and privacy regulations. In addition, U.S. federal mandates like FedRAMP and state-level compliance frameworks accelerated the shift to sovereign cloud solutions that provide localized data residency. Moreover, major cloud providers such as AWS, Microsoft, and Oracle have established dedicated sovereign cloud offerings and U.S.-based data centers to cater specifically to these requirements For instance, in December 2023, Microsoft announced the general availability of Microsoft Cloud for Sovereignty, enabling U.S. government agencies to meet strict compliance, security, and policy requirements while leveraging public cloud capabilities through configurable Sovereign Landing Zones (SLZs) and localized data residency options. Therefore, these initiatives by key players highlight the role of cloud infrastructure in addressing the U.S. market's demand for secure and sovereign cloud solutions.

On-premise is anticipated to grow at a CAGR of 19.6% during the forecast period due to concerns around data residency, security, and control, among government agencies. In addition, organizations with strict compliance mandates prefer on-premise deployments to ensure full control over infrastructure, data access, and customization, avoiding reliance on third-party cloud providers. Moreover, the growth is also supported by technological advancements in on-premise infrastructure, enabling organizations to implement sovereign cloud capabilities such as advanced encryption, localized access controls, and secure identity management within their data centers. Subsequently, the above-mentioned factors contribute significantly to bolstering the market growth of the on-premise segment.

Functionality Insights

Data sovereignty dominated the market in 2024, as organizations prioritize strict compliance with national data laws that require data to be stored, processed, and managed within their country’s borders. Moreover, stricter privacy regulations and growing concerns over foreign surveillance and unauthorized data access have made data sovereignty a critical requirement for public and private sector entities. For instance, in August 2023, AWS reinforced its commitment to secure and compliant cloud services by expanding its AWS Digital Sovereignty Pledge, offering customers advanced sovereignty controls and launching initiatives to support regulated industries with localized infrastructure and partner networks. AWS introduced Dedicated Local Zones, a type of infrastructure fully managed by AWS but built for exclusive use by a customer or community in a customer-specified location, enabling compliance with national data residency laws. This move significantly strengthens the appeal of sovereign cloud solutions by addressing operational control and regulatory alignment, further driving growth in the data sovereignty segment.

Technical sovereignty is expected to register the fastest growth over the forecast period as national security and strategic control over critical infrastructure become top government priorities. Furthermore, in response to concerns over foreign influence in digital supply chains, U.S. federal agencies are investing in cloud platforms that allow full control over software, hardware configurations, data access, and lifecycle management. Moreover, the U.S. government's push for secure-by-design systems and the development of domestically managed cloud stacks and open-source initiatives reinforces the need for technically sovereign cloud environments. Furthermore, this segment is also gaining traction due to the rise of open-source cloud platforms, sovereign DevOps tools, and edge computing frameworks that offer greater customization, transparency, and national control over digital architecture.

Enterprise Size Insights

Large enterprises dominated the U.S. sovereign cloud industry in 2024 due to their high exposure to cybersecurity risks and operational complexity, necessitating secure and compliant cloud infrastructures. These organizations manage vast volumes of data and therefore require cloud solutions that guarantee legal compliance and jurisdictional control within the U.S. In addition, their substantial financial and technical resources enable them to adopt sovereign cloud environments that align with internal governance and operational requirements. For instance, in December 2023, Microsoft launched Microsoft Cloud for Sovereignty, a solution designed to help governments implement policies containing their data and applications within preferred geographic boundaries. Therefore, the increasing adoption of sovereign cloud offerings from major U.S. providers drives dominance in this segment.

Small and medium enterprises is expected to register the fastest growth during the forecast period, driven by increasing digitalization, cost-effective cloud solutions, and the need for enhanced security and compliance. SMEs increasingly adopt cloud services to improve operational efficiency, scalability, and competitiveness. For instance, in March 2023, according to a report by Public First, states that 85% of cloud-using small and medium enterprises (SMEs) in the U.S. believed cloud services made it easier for them to compete with larger firms, while also reporting average annual cost savings of USD 34,000 and an additional revenue gain of USD 24,000 from adopting cloud technologies. Therefore, these trends highlight the growing importance of sovereign cloud solutions tailored to the unique needs of SMEs, thereby driving the growth of small and medium enterprises in the U.S. market.

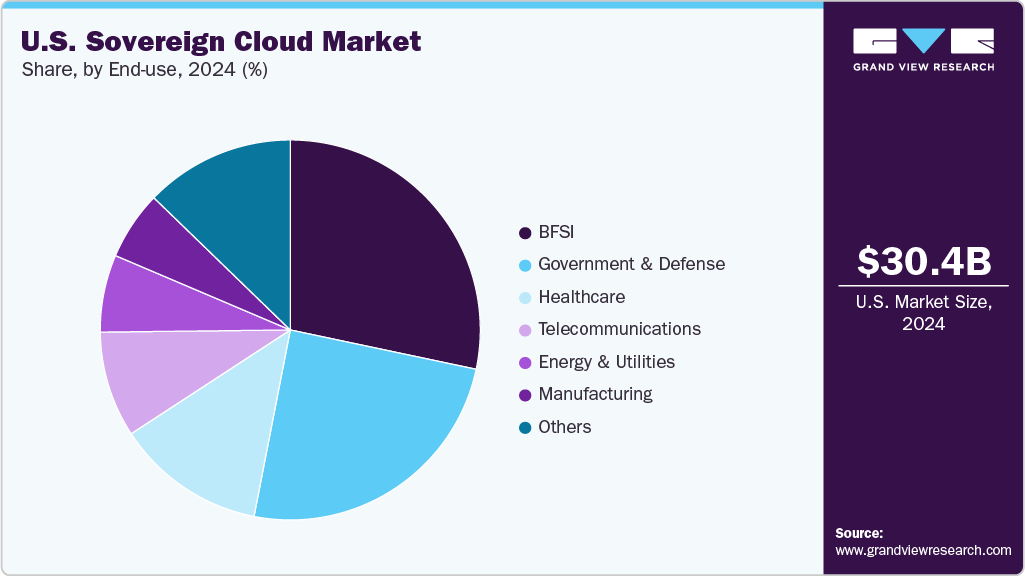

End-use Insights

The BFSI segment dominated the market in 2024 due to stringent regulatory requirements, heightened cybersecurity concerns, and the necessity for data sovereignty. Financial institutions are mandated to comply with various regulations, including the Gramm-Leach-bliley Act, the Federal Financial Institutions Examination Council (FFIEC) guidelines, and the New York State Department of Financial Services (NYDFS) cybersecurity requirements. These regulations compel BFSI entities to adopt cloud solutions that ensure data is stored and processed within U.S. jurisdictions, maintaining strict control over sensitive information. Also, the increasing digitization of financial services has further propelled the BFSI sector towards sovereign cloud adoption. For instance, in November 2024, Santander Bank, N.A. announced the expansion of its digital cash management solutions, introducing new products and services to enhance the commercial client experience while reducing operational costs. These innovations raise the need for secure, compliant, and localized data storage, driving the demand for sovereign cloud solutions in the BFSI sector.

The healthcare segment is expected to grow fastest during the forecast period due to rising data privacy concerns and the rapid digitalization of healthcare services. The Health Insurance Portability and Accountability Act (HIPAA) and other federal and state-level healthcare data protection laws require health organizations to store and manage patient data within national borders, driving the need for sovereign cloud infrastructure. Moreover, the increasing use of telemedicine, electronic health records (EHRs), and AI-enabled diagnostics has created large volumes of critical health data that must be securely hosted and processed. Sovereign cloud platforms meet healthcare institutions' data residency and compliance needs. Moreover, as healthcare providers integrate with national health data networks and public health systems, there's a growing push for controlled, localized data environments offering transparency, security, and compliance, making sovereign cloud a strategic necessity in this evolving digital health landscape.

Key U.S. Sovereign Cloud Company Insights

Key players operating in the sovereign cloud industry are Amazon Web Services, Inc., Microsoft Corporation, Google LLC, and others. Companies focus on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In May 2025, Google Cloud updated its sovereign cloud services, including an air-gapped solution authorized to host U.S. government Top Secret and Secret-level data. This enhancement addresses the growing demand for secure and compliant cloud services in the U.S., particularly for customers with strict data security and residency requirements.

-

In January 2025, Oracle and Google Cloud announced plans to add eight new regions and powerful new capabilities for Oracle Database on Google Cloud. This collaboration aims to provide customers with enhanced flexibility, resiliency, and cost optimization, supporting the growing demand for sovereign cloud solutions in the U.S.

Key U.S. Sovereign Cloud Companies:

- Amazon Web Services, Inc.

- Microsoft Corporation

- Google LLC

- Oracle Corporation

- IBM Corporation

- Hewlett-Packard Enterprise Company

- Rackspace Technology, Inc

- CoreWeave, Inc.

- Cisco Systems, Inc.

- VMware, Inc.

U.S. Sovereign Cloud Market Report Scope

Report Attribute

Details

Market size in 2025

USD 36.80 billion

Revenue forecast in 2033

USD 197.81 billion

Growth rate

CAGR of 23.4% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report enterprise size

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Deployment, functionality, enterprise size, end-use

Country scope

U.S.

Key companies profiled

Amazon Web Services, Inc.; Microsoft Corporation; Google LLC; Oracle Corporation; IBM Corporation; Hewlett-Packard Enterprise Company; Rackspace Technology, Inc.; CoreWeave, Inc.; Cisco Systems, Inc.; VMware, Inc.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Sovereign Cloud Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. sovereign cloud market report based on deployment, functionality, enterprise size, and end-use:

-

Deployment Outlook (Revenue, USD Billion, 2021 - 2033)

-

Cloud

-

On-Premise

-

-

Functionality Outlook (Revenue, USD Billion, 2021 - 2033)

-

Data Sovereignty

-

Technical Sovereignty

-

Operational Sovereignty

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2021 - 2033)

-

Large Enterprises

-

Small and Medium Enterprises

-

-

End-use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Government & Defense

-

Healthcare

-

BFSI

-

Telecommunications

-

Energy & Utilities

-

Manufacturing

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. sovereign cloud market size was estimated at USD 30.43 billion in 2024 and is expected to reach USD 36.80 billion in 2025.

b. The U.S. sovereign market is expected to grow at a compound annual growth rate of 23.4% from 2025 to 2033 to reach USD 197.81 billion by 2033.

b. Cloud segment dominated the market and accounted for the revenue share of over 83.0% in 2024 due to the rising need for secure and scalable infrastructure that complies with strict national data sovereignty and privacy regulations.

b. Some of the key companies operating in the U.S. sovereign cloud industry include Amazon Web Services, Inc., Microsoft Corporation, Google LLC, Oracle Corporation, IBM Corporation, Hewlett Packard Enterprise Company, Rackspace Technology, Inc, CoreWeave, Inc., Cisco Systems, Inc., and VMware, Inc.

b. The growth is driven by rising concerns over data sovereignty, cybersecurity, and regulatory compliance. Government agencies and enterprises are adopting sovereign cloud solutions to ensure that data remains within national borders and complies with domestic regulations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.