- Home

- »

- Medical Devices

- »

-

U.S. Stethoscope Market Size & Share Report, 2028GVR Report cover

![U.S. Stethoscope Market Size, Share & Trends Report]()

U.S. Stethoscope Market (2021 - 2028) Size, Share & Trends Analysis Report By Technology Type (Electronic/Digital, Smart, Traditional Acoustic), By Sales Channel (Distributors, E-commerce), By End Use, By State, And Segment Forecasts

- Report ID: GVR-4-68038-336-2

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2016 - 2019

- Forecast Period: 2021 - 2028

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

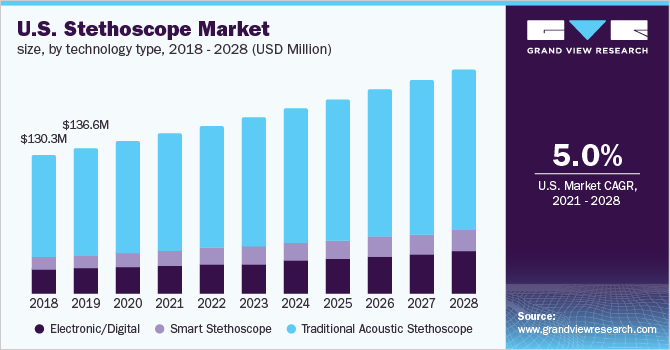

The U.S. stethoscope market size was valued at USD 143.42 million in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 5.0% from 2021 to 2028. Increasing cardiovascular and respiratory diseases and the growing aging population are the major factors expected to drive the U.S. market. In addition, the adoption of technologically advanced products, such as Bluetooth integrated stethoscopes, and various government initiatives are few more factors contributing to the growth of the market. Moreover, the recent outbreak of COVID-19 has increased the demand for modern digitized stethoscopes in the country. This pandemic has also led to the implementation and use of telemedicine and telehealth platforms and wearable devices as part of current standards of care in many healthcare facilities to avoid the risk of cross-contamination. Since auscultation of the lungs is generally the first procedure to determine whether the lungs are infected with COVID-19 infection or not, therefore, it is increasing the demand for stethoscopes among the end-users, starting from physicians to hospitals or home care providers. This has triggered a sudden surge in the market growth in the U.S., creating infinite prospects for market players.

The rapidly increasing geriatric population has increased the demand for stethoscopes for the primary diagnosis of numerous chronic health ailments. As per the CDC, it has been recognized that people aged above 65 years are at a higher risk of developing severe health problems, such as heart disease, common cold and flu, asthma, chronic obstructive pulmonary disease (COPD), and other conditions. According to the U.S. Census Bureau 2019 report, there are more than 54 million older adults aged 65 and older living in the U.S. This number is estimated to double to 95 million by 2060. This factor is anticipated to be one of the high growth rendering factors for the U.S. market.

The rising prevalence of heart-related diseases and various respiratory illnesses, such as asthma, acute bronchitis, cystic fibrosis, and emphysema, is propelling the market growth in the U.S. According to the American Heart Association 2016, Heart Disease and Stroke Statistics-2019 Update, almost 121.5 million adults had some form of cardiovascular disease. Similarly, as per the CDC, 4.6% of adults were diagnosed with COPD, emphysema, or chronic bronchitis in 2019. For the primary diagnosis of cardiac dysfunction and phlegm in the respiratory tract, a stethoscope is widely used to primarily examine such conditions. Thus, an increasing number of patients suffering from cardiovascular and numerous types of respiratory diseases is majorly driving the market in the U.S.

Furthermore, an increasing number of initiatives and programs being undertaken by the government of the U.S. to improve public awareness and treatment related to chronic disorders is expected to fuel the market growth over the forecast period. For instance, a national initiative called “Million Hearts 2022” is taken to prevent 1 million heart attacks within 5 years. It is a combined initiative led by the Centers for Medicare & Medicaid Services (CMS) and the Centers for Disease Control and Prevention (CDC). Similarly, the National Heart, Lung, and Blood Institute has launched a national campaign: Learn More, Breathe Better, to raise awareness and understanding of COPD and its risk factors. Moreover, this campaign helps in the early detection and treatment in slowing the disease and improving the quality of life. Thus, rising awareness among the general population regarding the treatment and initiatives taken by the government to prevent the rate of associated disorders is likely to boost the market growth.

The growing prevalence of respiratory and cardiovascular diseases, the presence of established infrastructure, and favorable reimbursement structure are among the key factors driving the stethoscope market in the U.S. As projected by the American Heart Association, by 2035, more than 130 million adults or 45.1% of the U.S. population are estimated to suffer from some form of cardiovascular disease. In addition, according to the CDC, about 655,000 Americans die from heart disease annually, representing one in every four deaths. Thus, the incidence of cardiovascular diseases is rising in the U.S., which, in turn, is likely to boost the demand for stethoscopes in the country. Moreover, rapid technological advancements, coupled with the frequent launch of new and innovative products, are among the key factors expected to fuel the market growth during the forecast period.

Additionally, medical device manufacturers are focused on product development with the adoption of smart sensors that help in the introduction of wireless products with advanced features. Companies are investing in new technologies and launching new products to cater to the growing needs of consumers. These technologies will help cater to the needs of patients suffering from various respiratory and cardiovascular disorders in a better way. For instance, Eko Devices, Inc.’s DUO ECG + Digital Stethoscope is a two-in-one electronic stethoscope, which tracks electrical activity and can be integrated with hospital electronic health records. Similarly, Thinklabs One stethoscope by Thinklabs allows monitoring of patients in ICU and biocontainment units and is safe and recommended for use on COVID-19 patients. Since the Ebola crisis, hospitals across the U.S. have adopted Thinklabs One for the care of patients suffering from infectious diseases. Thus, stethoscopes with advanced features and modern technology have the strongest growth potential in the U.S. market.

Technology Type Insights

In 2020, the traditional acoustic stethoscope segment dominated the market with a revenue share of 72.79%. A traditional acoustic stethoscope in comparison to advanced stethoscopes is comparatively inexpensive, simple to use, and widely available for use by paramedics and nurses. In developing countries where sophisticated medical imaging penetration in rural areas is limited, this stethoscope plays an important role in the diagnosis of cardiac and pulmonary disorders. Moreover, smart stethoscopes are not within the reach of all small healthcare facilities and hospitals in the Sub-Saharan African region. These factors are anticipated to boost the demand for traditional acoustic stethoscopes over the forecast period. Based on technology type, the U.S. market is segmented into electronic/digital stethoscopes, smart stethoscopes, and traditional acoustic stethoscopes.

The smart stethoscopes segment is expected to expand at the highest revenue-based CAGR of 5.8% from 2021 to 2028. High patient volume suffering from cardiac and lung disorders and incorporation of smart technologies, like AI into stethoscopes, will upsurge the espousal of smart stethoscopes over the forecast period. Moreover, continuous R&D investments to innovate and develop the latest smart stethoscopes are anticipated to boost market growth during the forecast period. For instance, Sonavi Labs, formed by Johns Hopkins University researchers, has designed an AI-powered clever, creative, and cutting-edge stethoscope. This latest stethoscope features smart noise-filtering technology that improves the sound level of chest readings.

Sales Channel Insights

In 2020, the distributors' segment dominated the market with a revenue share of 43.03%. Hospitals and clinics, usually, have long-term contracts and tie-ups with distributors and manufacturers. Stethoscope manufacturers are adopting long-term contracts with end users as a strategy to expand their reach and strengthen their foothold in the market. This is anticipated to boost the growth of this segment over the forecast period. Based on the sales channel, the market is segmented into distributors, e-commerce, and direct purchase.

The e-commerce segment is expected to expand at the highest revenue-based CAGR of 5.8% from 2021 to 2028. Rising online and e-commerce accessibility of stethoscopes is likely to aid in the market expansion. eHealth is a fast-growing part of e-commerce. Medical product sale through online networks is rapidly increasing as it allows the end-users to compare and select suitable products based on their type, brand, price, and point of sales. Additionally, these online stores offer product warranty with product support, access to exclusive deals, and a return policy if any product does not meet the expectations of end-users. Thus, the easy availability of different stethoscopes on online platforms is expected to fuel the segment growth in the coming years.

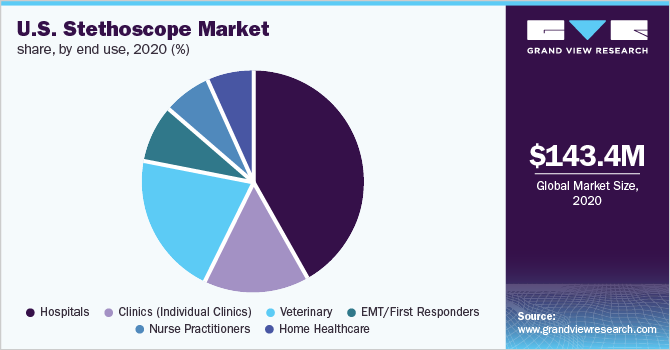

End-use Insights

In 2020, the hospitals' segment dominated the market with a revenue share of 41.99% and is expected to expand at the highest CAGR in terms of revenue from 2021 to 2028. This is attributed to the growing number of patient admissions in hospitals for various medical illnesses and treatments for COVID-19. In terms of the sheer volume of stethoscopes, hospitals are observed to be the largest consumer of related products and services. In addition, an increase in the number of chronic illnesses that lead to the high hospitalization rate contributes to the high demand for stethoscopes. This is projected to strengthen the segment growth in the coming years. Based on end-use, the market is segmented into hospitals, home healthcare, clinics (individual clinics), nurse practitioners, EMT/ first responders, and veterinary.

Moreover, no other medical device can have a longer life or more usefulness than a stethoscope. It is used to listen to a patient's cardiac, respiratory, and intestinal sounds during physical examination and assessment. These devices not only simplify treatment procedures but also help provide better, faster, and accurate results. Thus, such high usage of stethoscopes in hospitals may promote segment growth over the forecast period. Additionally, the recent outbreak of the COVID-19 pandemic is anticipated to further catalyze the demand for stethoscopes in hospitals. Thus, the above-mentioned factors are expected to drive the hospitals' end-use segment.

Key Companies & Market Share Insights

Key market players are focusing on the launch of innovative types of medical devices, growth strategies, and technological advancements. For instance, in May 2018, 3M has launched ‘Single-Patient Stethoscope’ to overcome the issues associated with current disposable stethoscope options such as inadequate audibility, lack of durability, and uncomfortableness faced by healthcare professionals. This is a disposable stethoscope intended to provide excellent sound quality and comfort and boost patient care while helping minimize the risk of cross-contamination in an isolation environment. These advancements in the area of the stethoscope market in the U.S. are anticipated to boost the market growth over the forecast period. Some prominent players in the U.S. stethoscope market include:

-

3M

-

Medline Industries Inc.

-

WelchAllyn (Hill-Rom Holdings, Inc.)

-

Eko Devices Inc.

-

GF Health Products, Inc.

-

Rudolf Riester GmbH (HalmaPlc)

-

American Diagnostics Corporation

-

Cardionics

-

Heine Optotechnik GmbH & Co. KG.

U.S. Stethoscope Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 150.42 million

Revenue forecast in 2028

USD 211.06 million

Growth Rate

CAGR of 5.0% from 2021 to 2028

Base year for estimation

2020

Historical data

2016 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million, procedure volume , and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology type, sales channel, end use, state

Country scope

U.S.

State scope

California; New York; Texas; Florida; Pennsylvania; Illinois; Ohio; Michigan; Massachusetts; New Jersey; Rest of USA

Key companies profiled

3M; Medline Industries Inc.; Welch Allyn (Hill-Rom Holdings, Inc.);Eko Devices Inc.; GF Health Products, Inc.; Rudolf Riester GmbH (HalmaPlc); American Diagnostics Corporation; Cardionics; Heine Optotechnik GmbH & Co. KG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country& segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the country and state levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2028. For the purpose of this study, Grand View Research has segmented the U.S. stethoscope market report based on technology type, sales channel, end use, and state:

-

Technology Type Outlook (Revenue, USD Million, 2016 - 2028)

-

Electronic/Digital Stethoscope

-

Smart Stethoscope

-

Traditional Acoustic Stethoscope

-

-

Sales Channel Outlook (Revenue, USD Million, 2016 - 2028)

-

Distributors

-

E-commerce

-

Direct Purchase

-

-

End-use Outlook (Revenue, USD Million, 2016 - 2028)

-

Home Healthcare

-

Hospitals

-

Clinics

-

Nurse Practitioners

-

EMT/ First Responders

-

Veterinary

-

-

State Outlook (Revenue, USD Million, 2016 - 2028)

-

California

-

New York

-

Texas

-

Florida

-

Pennsylvania

-

Illinois

-

Ohio

-

Michigan

-

Massachusetts

-

New Jersey

-

Rest of USA

-

Frequently Asked Questions About This Report

b. The U.S. stethoscope market size was estimated at USD 143.52 million in 2020 and is expected to reach USD 150.42 million in 2021.

b. The U.S. stethoscope market is expected to grow at a compound annual growth rate of 5.0% from 2021 to 2028 to reach USD 211.06 million by 2028.

b. Traditional/ acoustic stethoscope dominated the U.S. stethoscope market with a share of 72.61% in 2020. This is attributable to high patient volume suffering from cardiac and lung disorders.

b. Some of the key players operating in the U.S. stethoscope market include 3M, Medline Industries Inc, Welch Allyn (Hill-Rom Holdings, Inc.), American Diagnostics Corporation, Rudolf Riester GmbH, (Halma Plc), Cardionics, Eko Devices Inc, GF Health Products, Inc., and Heine Optotechnik GmbH & Co. KG

b. Key factors that are driving the market growth include Increasing cardiovascular & respiratory diseases as well as growing aging population are among the major factors driving this market’s growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.