- Home

- »

- Paints, Coatings & Printing Inks

- »

-

U.S. Sustained Release Coatings Market Size Report, 2033GVR Report cover

![U.S. Sustained Release Coatings Market Size, Share & Trends Report]()

U.S. Sustained Release Coatings Market (2025 - 2033) Size, Share & Trends Analysis Report By Substrate (Tablets, Capsules, Pills), By Application (In Vitro, In Vivo), By Polymer Material (Ethyl & Methyl Cellulose, Polyvinyl & Cellulose Acetate), And Segment Forecasts

- Report ID: GVR-4-68040-632-4

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Sustained Release Coatings Market Summary

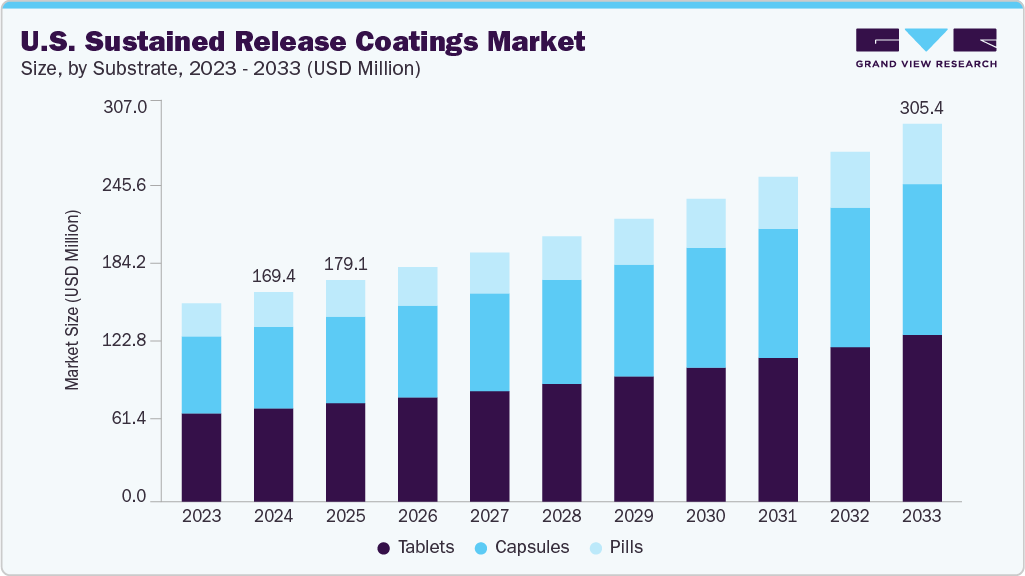

The U.S. sustained release coatings market size was estimated at USD 169.4 million in 2024 and is projected to reach USD 305.4 million by 2033, growing at a CAGR of 6.2% from 2025 to 2033. The market growth is primarily driven by the rising demand for advanced drug delivery systems that improve therapeutic efficacy and patient adherence, particularly in the treatment of chronic conditions such as diabetes, cardiovascular diseases, and neurological disorders.

Key Market Trends & Insights

- By substrate, the tablets segment is expected to grow at a significant CAGR of 6.0% from 2025 to 2033 in terms of revenue.

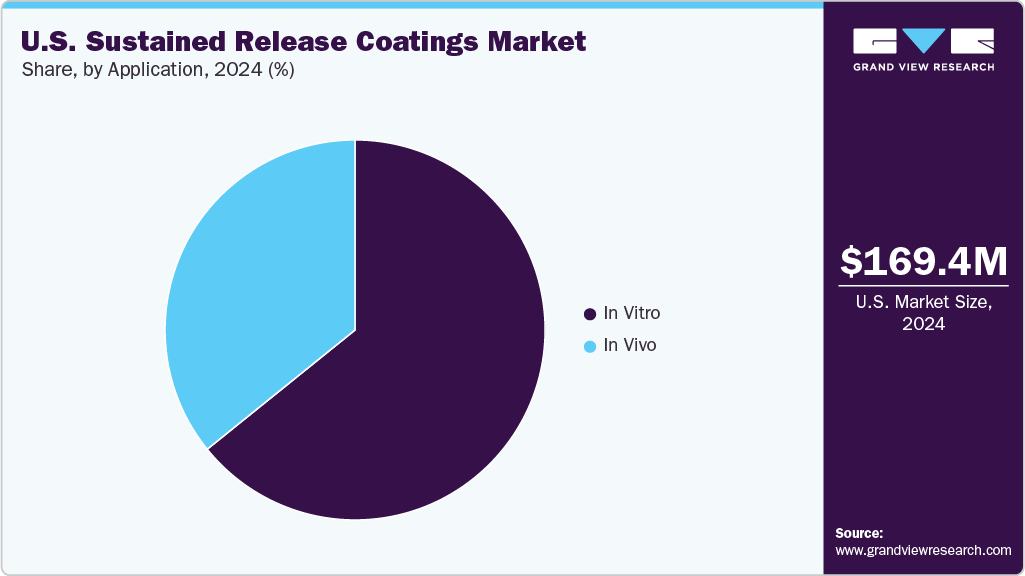

- By application, the in vitro segment held the largest revenue share of 64.2% in 2024 in terms of value.

- By polymer material, ethyl & methyl cellulose segment held the largest revenue share of 33.9% in 2024 in terms of value.

Market Size & Forecast

- 2024 Market Size: USD 169.4 Million

- 2033 Projected Market Size: USD 305.4 Million

- CAGR (2025-2033): 6.2%

The country’s robust pharmaceutical R&D ecosystem, supported by significant investments from both innovator and generic drug manufacturers, fosters continuous development of sophisticated coating technologies. The market presents strong growth opportunities driven by the rising adoption of personalized and precision medicine, increasing demand for once-daily or long-acting formulations, and growing use of sustained release technologies in both branded lifecycle management and generics differentiation. Advancements in polymer science, such as the development of biodegradable, plant-based, and smart polymers, are opening new avenues for innovation in drug delivery.

Despite its maturity, the market faces challenges including high formulation development costs, complex regulatory compliance requirements, and the technical difficulty of achieving consistent drug release across diverse patient populations. The need for specialized manufacturing infrastructure and skilled expertise adds to the capital intensity of bringing sustained-release products to the market.

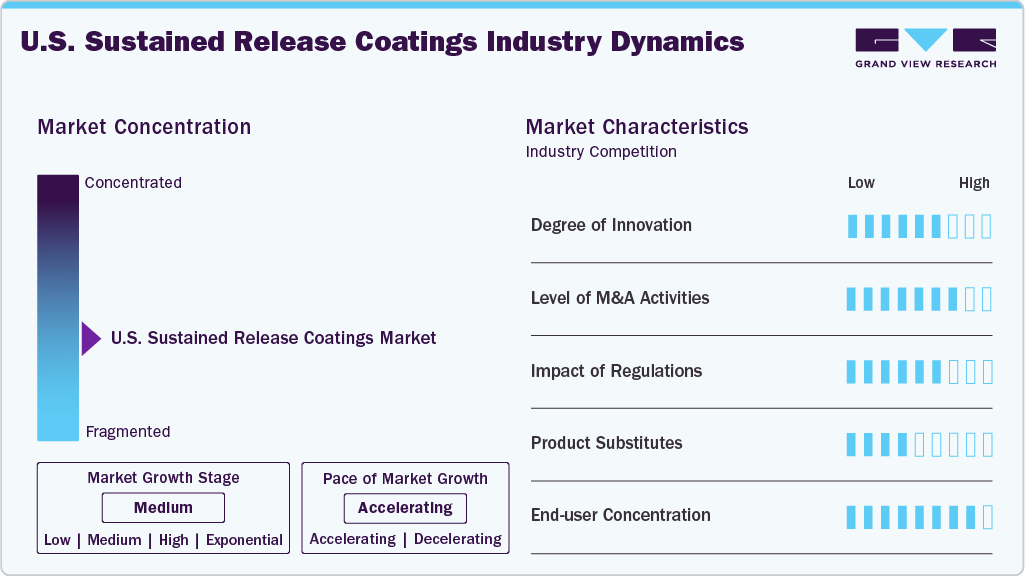

Market Concentration & Characteristics

The market is moderately fragmented, with a few global players, such as BASF SE, Evonik, Colorcon, Coating Place, Inc., dominating the competitive landscape. These companies benefit from their scale of operations, competitive pricing, and diversified product offerings. They are actively investing in research and development, expanding production capacities, and focusing on sustainable practices to strengthen their positions in the competitive market.

Leading players in the market are adopting a range of strategic initiatives to strengthen their market position, including continuous innovation in polymer technologies to develop advanced, patient-centric drug delivery solutions. Companies are investing heavily in R&D to enhance coating functionality, reduce production complexity, and ensure regulatory compliance.

Substrate Insights

The tablets segment led the market with the largest revenue share of 44.5% in 2024, due to its superior scalability, cost-efficiency, and ease of formulation customization. Tablets offer robust stability, controlled drug layering, and compatibility with a wide range of sustained release polymers, making them the most preferred dosage form among pharmaceutical manufacturers. Their simpler packaging, better shelf life, and wide patient acceptance further solidify their commercial appeal. In addition, tablets are well-suited for both high-volume generic production and complex modified-release branded drugs, which contributes significantly to their market dominance.

The capsules segment is anticipated to grow at the fastest CAGR during the forecast period, particularly in the development of multi-particulate and dual-release formulations where multiple actives or layered beads are required. Capsules are increasingly adopted in high-potency and targeted drug delivery applications due to their precision dosing and ability to mask taste or odor. Meanwhile, pills, though representing a smaller share, continue to be used in niche therapeutic areas and traditional medicine formats. However, their limited capacity for sustained release coating and manufacturing complexities compared to tablets and capsules make them less commercially attractive in large-scale pharmaceutical applications.

Polymer Material Insights

The ethyl & methyl cellulose segment led the market with the largest revenue share of 33.9% in 2024, owing to its excellent film-forming capabilities, pH-independent release characteristics, and widespread regulatory acceptance. These polymers are highly compatible with a broad range of active pharmaceutical ingredients (APIs), making them ideal for use in both branded and generic formulations. Their ability to provide consistent and predictable drug release profiles across various physiological conditions positions them as the preferred choice among formulation scientists. In addition, their cost-effectiveness and ease of processing further enhance their commercial appeal in high-volume pharmaceutical manufacturing.

The polyvinyl & cellulose acetate segment is anticipated to grow at the fastest CAGR during the forecast period, particularly in osmotic and enteric-coated systems, due to its permeability control and film strength. Methacrylic Acid-based polymers are widely utilized for targeted release applications, especially in gastro-resistant and site-specific drug delivery, offering valuable advantages in therapeutic precision. Polyethylene Glycol (PEG), commonly used as a plasticizer or matrix former, supports film flexibility and enhances drug solubility, especially in combination coatings. The Others category, which includes emerging biodegradable and plant-based polymers, is witnessing growing interest in response to rising demand for eco-friendly and biocompatible alternatives. However, their adoption is still at an early stage compared to the dominance of ethyl and methyl cellulose.

Application Insights

The in vitro segment led the market with the largest revenue share of 64.2% in 2024, driven by its critical role in early-stage drug formulation, quality control, and regulatory compliance. In vitro testing offers a cost-effective, high-throughput method for evaluating release profiles, dissolution behavior, and coating performance under simulated physiological conditions. This approach enables pharmaceutical developers to screen formulations efficiently and optimize polymer interactions before proceeding to clinical trials, significantly reducing development time and risk. Regulatory emphasis on robust in vitro dissolution data for filing NDAs and ANDAs further reinforces the segment's dominance.

The in vivo segment is anticipated to grow at the fastest CAGR during the forecast period. While smaller in share, remains essential in validating pharmacokinetics, bioavailability, and therapeutic efficacy in actual biological environments. It plays a pivotal role in bridging in vitro results with real-world performance, especially for complex drug delivery systems and high-risk therapies. However, due to its higher cost, longer timelines, and ethical considerations, in vivo testing is typically reserved for later stages of development or for confirming in vitro–in vivo correlations (IVIVC). Despite its limited use in early formulation phases, it remains indispensable for final regulatory approval and clinical validation of sustained release products.

Key U.S. Sustained Release Coating Company Insights

Key players, such as BASF SE, Evonik, Colorcon, Coating Place, Inc., are dominating the market.

-

BASF SE is a key player in the U.S. sustained release coatings industry, leveraging its extensive expertise in polymer chemistry and pharmaceutical excipients to deliver high-performance coating solutions. Through its Pharma Solutions division, BASF offers a broad portfolio of functional polymers, including ethyl cellulose, methacrylate copolymers, and polyethylene glycols, specifically designed for controlled and sustained drug release applications. The company focuses on innovation-driven product development, regulatory compliance support, and technical collaboration with pharmaceutical manufacturers to enhance formulation efficiency and therapeutic performance.

Key U.S. Sustained Release Coating Companies:

- BASF SE

- Evonik

- Colorcon

- Coating Place, Inc.

- Teva Pharmaceutical Industries Ltd.

- Pfizer, Inc.

- Sun Pharmaceutical Industries Ltd.

- Novartis AG

- AstraZeneca

- GlaxoSmithKline plc

- AbbVie Inc.

U.S. Sustained Release Coatings Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 179.1 million

Revenue forecast in 2033

USD 305.4 million

Growth rate

CAGR of 6.2% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Substrate, application, polymer material, region

Country scope

U.S.

Key companies profiled

BASF SE; Evonik, Colorcon; Coating Place, Inc.; Teva Pharmaceutical Industries Ltd.; Pfizer, Inc.; Sun Pharmaceutical Industries Ltd.; Novartis AG; AstraZeneca; GlaxoSmithKline plc; AbbVie Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Sustained Release Coatings Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the U.S. sustained release coatings market report based on application, substrate, and polymer material.

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

In Vitro

-

In Vivo

-

-

Substrate Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Tablets

-

Capsules

-

Pills

-

-

Polymer Material Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Ethyl & Methyl Cellulose

-

Polyvinyl & Cellulose Acetate

-

Methacrylic Acid

-

PEG

-

Others

-

Frequently Asked Questions About This Report

b. The global U.S. sustained release coating market size was estimated at USD 169.4 million in 2024 and is expected to reach USD 179.1 million in 2025.

b. The U.S. sustained release coating market is expected to grow at a compound annual growth rate of 6.2% from 2025 to 2033 to reach USD 305.4 million by 2033.

b. The tablets segment held the largest revenue share of 44.5% in 2024 due to its superior scalability, cost-efficiency, and ease of formulation customization. Tablets offer robust stability, controlled drug layering, and compatibility with a wide range of sustained release polymers, making them the most preferred dosage form among pharmaceutical manufacturers.

b. Some key players operating in the U.S. sustained release coating market include BASF SE, Evonik, Colorcon, Pfizer Inc., and Novartis AG

b. Key factors driving market growth include the rising demand for advanced drug delivery systems that improve therapeutic efficacy and patient adherence, particularly in the treatment of chronic conditions such as diabetes, cardiovascular diseases, and neurological disorders.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.