- Home

- »

- Animal Health

- »

-

U.S. Veterinary Services Market Size, Industry Report, 2033GVR Report cover

![U.S. Veterinary Services Market Size, Share & Trends Report]()

U.S. Veterinary Services Market (2025 - 2033) Size, Share & Trends Analysis Report By Animal (Companion, Production), By Service (Medical, Non-medical), Consumer Behavior, Key Companies, Competitive Analysis, And Segment Forecasts

- Report ID: GVR-4-68040-746-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Veterinary Services Market Trends

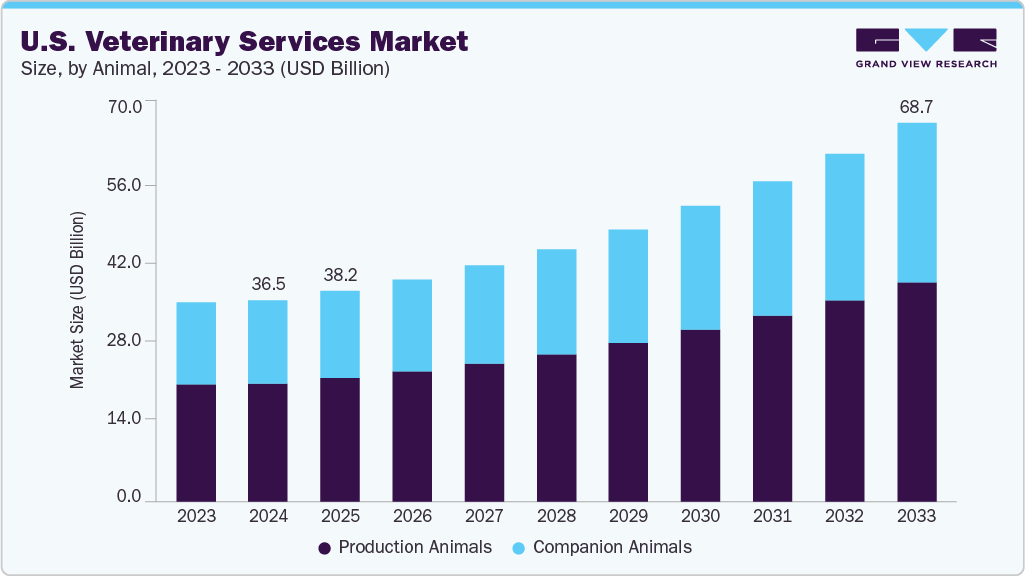

The U.S. veterinary services market size was estimated at USD 36.52 billion in 2024 and is projected to reach USD 68.67 billion by 2033, growing at a CAGR of 7.59% from 2025 to 2033. The U.S. veterinary services industry is continuously growing, driven by advancements in veterinary technology, growing demand for specialty and preventive care, andexpansion of corporate veterinary networks.

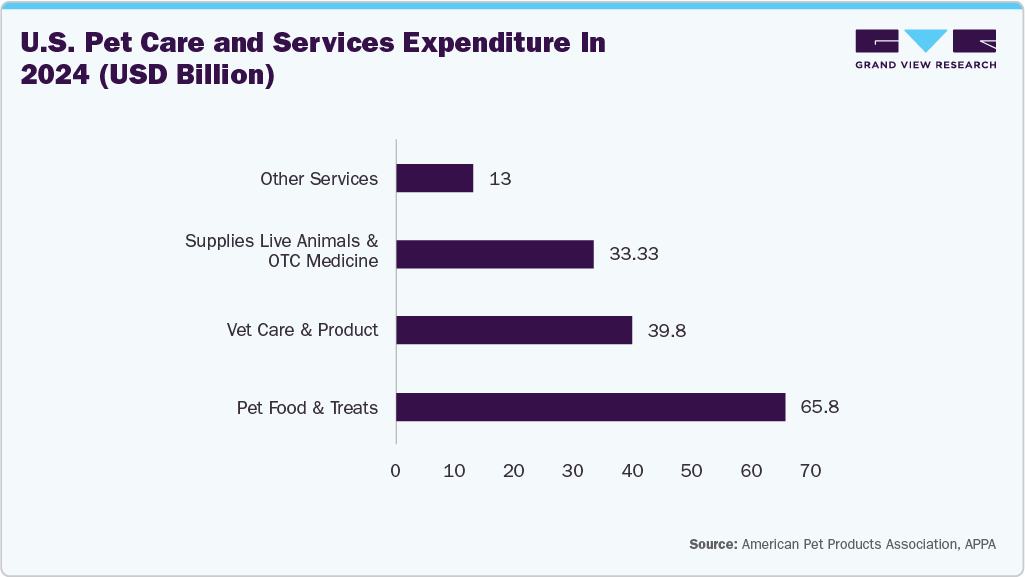

Adoption of advanced medical technologies such as digital imaging, telemedicine platforms, AI-powered diagnostics, and minimally invasive surgical methods is propelling the market growth. According to the American Pet Products Association report of 2024, pet owners in the U.S. spent an average of USD 152 billion on pets for healthcare and services. Hence, the market is witnessing growth driven by rising expenditure on veterinary care and related services.

Innovations such as wearable health monitors, in-clinic diagnostic platforms, and cloud-based practice management systems also enable faster, more accurate diagnosis and treatment. These technologies increase access to care, decrease wait times, and boost clinic efficiency. Better patient outcomes are also fostered by enhanced data analytics, which enables veterinarians to anticipate health hazards and customize therapies. Nationwide, increased confidence and dependence on veterinary services are fueled by this technology revolution.

The increasing prevalence of chronic and lifestyle-related diseases in companion animals, including diabetes, obesity, arthritis, and cancer, drives demand for specialized veterinary services. U.S. pet owners are increasingly investing in oncology, cardiology, dermatology, and orthopedic services to manage complex conditions. With routine immunizations, dental cleanings, parasite control, and wellness screenings becoming commonplace, preventive care is also becoming more and more important. Comprehensive preventive packages are being added to the service offerings of hospital networks and veterinary clinics. Strong growth in the usage of veterinary services is maintained by the increased focus on preventative and specialist care, which guarantees early identification, efficient treatment, and enhanced animal well-being.

Service delivery is changing as a result of the corporate veterinarian chains and group practices' lucrative growth throughout the U.S. Stronger national networks are being created by the consolidation of smaller clinics by major businesses, like as Banfield Pet Hospitals, National Veterinary Associates, Mars Veterinary Health, and VCA. These organizations provide high-quality, standardized care that is backed by centralized data systems, sophisticated diagnostic instruments, and increased purchasing power for medical goods. In order to improve the overall quality of services, corporate networks also make significant investments in consumer interaction, research, and training. Their size and effectiveness increase market penetration and pet owners' trust in dependable and consistent care by making veterinarian services more accessible and reasonably priced.

Market Concentration & Characteristics

The U.S. veterinary services industry demonstrated moderate to high industry concentration, with large corporate groups like Mars Veterinary Health, National Veterinary Associates, and Airpets International operating extensive clinic networks nationwide. These players leverage economies of scale, advanced technology adoption, and strong branding to consolidate market share. However, independent clinics and regional practices remain significant, catering to local communities and offering personalized services. Growing consolidation through mergers, acquisitions, and private equity investments continues to reshape competition, driving standardization, service diversification, and expanded access to specialized veterinary care.

Wearable monitoring devices, AI-powered diagnostics, telemedicine platforms, and minimally invasive surgical methods are emerging innovations in the U.S. veterinary services industry. For instance, TelaVets introduced a countrywide virtual veterinary platform in July 2025, offering reasonably priced online consultations for USD 65, which helps pet owners and pets avoid stress and wait periods. The quality of animal care is improved by these developments, which also support preventive healthcare, increase treatment precision, and streamline workflow.

Consolidators are growing networks by purchasing individual practices, and the U.S. veterinary services industry is quite active in mergers and acquisitions. Stronger national presence is fostered by this trend, which also promotes scalability, operational efficiency, and resource accessibility. Vimian's Movora and VerticalVet collaborated in July 2024 to increase access to innovative orthopedic goods and services to help veterinarians, clinics and provide better animal care across the country. In addition, the two companies introduced extensive in-person and online education programs.

Regulations in the U.S. veterinary sector emphasize animal welfare, drug safety, and professional standards. While safeguarding quality and accountability, they increase compliance costs for practices, particularly regarding controlled drugs, medical records, and licensing.

Pet wellness products, teleconsultation platforms, and over-the-counter medicines act as substitutes for veterinary services. However, their limitations in addressing complex diagnostics, surgeries, or emergencies ensure veterinarians remain indispensable for advanced animal healthcare.

In the U.S. veterinary services industry, pet owners are the main customer group, and their increasing spending on preventive care and pet humanization is fueling demand. Producers of livestock also make a substantial contribution, focusing on productivity and herd health management.

Animal Insights

The production animals segment led the market with the largest revenue share of 58.77% in 2024, driven by the sizeable livestock and poultry industries in the nation. To maintain herd health, productivity, and food safety, cattle, pigs, and poultry need ongoing veterinarian care. Disease prevention, immunization, reproductive control, diagnostics, and emergency treatment are among the services offered. Through creative waterline application, IFF introduced Enviva DUO, a poultry-focused direct-fed microbial product that improves gut health, increases immunity, and improves bird performance while maintaining efficacy even when feed intake is reduced in January 2025. The necessity for specialist veterinary skills is further highlighted by growing worries about antibiotic resistance and zoonotic infections.

The companion animals segment is anticipated to grow at the fastest CAGR over the forecast period, fueled by rising pet ownership, increasing humanization of pets, and higher spending on advanced care. Pet owners increasingly seek preventive healthcare, wellness programs, diagnostics, and specialized treatments for dogs and cats. Growth is further supported by innovations such as telehealth platforms, wearable health monitors, and minimally invasive surgical techniques. Expanding insurance coverage for pets is also making high-quality veterinary care more accessible. In May 2024, BARK Air, founded by dog toy company BARK with a jet charter partner, launched as the world’s first airline for dogs, offering luxury, comfort, and VIP treatment for pets and owners.

Service Insights

The medical services segment led the market with the largest revenue share of 70.57% in 2024, due to the rising demand for specialized treatments, improved diagnostics, and preventative care. The demand for services like surgery, cancer, cardiology, dermatology, and internal medicine has increased due to rising pet ownership and growing knowledge of animal health. A sizable portion are companion animals, as owners place a greater emphasis on superior medical care and innovative treatments. Segment expansion is further supported by the rising incidence of chronic illnesses as well as technical advancements in diagnosis and treatment. Medical services remain the foundation of the veterinary services sector, as clinics and hospitals make investments in state-of-the-art facilities.

The increased demand for grooming, boarding, daycare, training, and pet wellness programs is driving the non-medical services segment to become the fastest-growing segment of the U.S. veterinary services industry. As the number of pet owners rises, more people see their animals as members of the family, placing more value on comfort, behavior, and general health than just medical attention. Due to rising disposable incomes and changing consumer demands for convenience and all-encompassing care, premium grooming, upscale boarding facilities, and specialist training services are all growing quickly.

Key U.S. Veterinary Services Company Insights

The U.S. veterinary services industry is shaped by leading players such as Mars Inc. and National Veterinary Associates, holding strong networks and advanced care models. Global players like CVS Group Plc and Pets at Home Group PLC also influence competition, leveraging innovation, consolidations, and client-focused services to strengthen market presence. For instance, in May 2025, Mars launched GREENIES Canine Dental Check, an AI-powered tool that uses smartphone photos to detect early oral health issues. Advancements in telehealth, diagnostics, and minimally invasive procedures further strengthen service quality, while consolidation and acquisitions expand networks, enhancing access and efficiency across companion and production animal care.

Key U.S. Veterinary Services Companies:

- Mars, Incorporated

- National Veterinary Associates

- Fetch! Pet Care

- A Place for Rover, Inc

- PetSmart LLC

- Airpets International

- Chewy, Inc.

- Trupanion

- The Animal Medical Center

- GOODVETS

Recent Developments

-

In April 2025, Tractor Supply Company introduced Tractor Supply Rx, a digital pet and animal pharmacy platform offering prescriptions, autoship delivery, and rewards for 38 million Neighbor’s Club members, expanding affordable, convenient veterinary pharmacy access nationwide.

-

In January 2025, Covetrus unveiled its Covetrus Platform, integrating advanced technology with the VetSuite network to empower U.S. veterinary practices, enhancing clinical and financial outcomes while helping veterinarians meet rising costs, competition, and evolving pet parent expectations.

-

In October 2024, VCA Animal Hospitals launched an innovative 3D Printing Lab for orthopedic surgeries, offering personalized surgical models to improve precision, recovery outcomes, and pet quality of life, reinforcing Mars Veterinary Health’s commitment to innovative, personalized pet care.

U.S. Veterinary Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 38.23 billion

Revenue forecast in 2033

USD 68.67 billion

Growth rate

CAGR of 7.59% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Animal, service

Country scope

U.S.

Key companies profiled

Mars, Incorporated; National Veterinary Associates; Fetch! Pet Care; A Place for Rover, Inc.; Petsmart LLC; Airpets International; Chewy, Inc.; Trupanion; The Animal Medical Center; GOODVETS.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Veterinary Services Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. veterinary services market report based on animal, and service.

-

Animal Outlook (Revenue, USD Million, 2021 - 2033)

-

Companion Animals

-

Dogs

-

Cats

-

Horses

-

Others

-

-

Production Animals

-

Cattle

-

Poultry

-

Swine

-

Others

-

-

-

Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Medical Services

-

Diagnosis

-

In-Vitro Diagnosis

-

In-Vivo Diagnosis

-

-

Preventative Care

-

Treatment

-

Consultation

-

Surgery

-

Others

-

-

-

Non-Medical Services

-

Pet Services

-

Livestock Services

-

-

Frequently Asked Questions About This Report

b. The U.S. veterinary services market size was estimated at USD 36.52 billion in 2024 and is expected to reach USD 38.23 billion in 2025.

b. The U.S. veterinary services market is expected to grow at a compound annual growth rate of 7.59% from 2025 to 2033 to reach USD 68.67 billion by 2033.

b. By Service type, medical services accounted for 70.57% of total revenue share in 2024, mostly due to the rising demand for specialized treatments, improved diagnostics, and preventative care. The demand for services like surgery, cancer, cardiology, dermatology, and internal medicine has increased due to rising pet ownership and growing knowledge of animal health.

b. Some key players operating in the U.S. veterinary services market include Mars, Incorporated, National Veterinary Associates, Fetch! Pet Care, A Place for Rover, Inc, Petsmart LLC, Airpets International, Chewy, Inc., Trupanion, The Animal Medical Center, GOODVETS.

b. The U.S. veterinary services market is continuously growing driven by advancements in veterinary technology, growing demand for specialty and preventive care and expansion of corporate veterinary networks. Medical advancement in technologies and adoption of these such as digital imaging, telemedicine platforms, AI-powered diagnostics, and minimally invasive surgical methods is propelling the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.