- Home

- »

- Animal Health

- »

-

U.S. Veterinary Sterilization Container Market Report, 2030GVR Report cover

![U.S. Veterinary Sterilization Container Market Size, Share & Trends Report]()

U.S. Veterinary Sterilization Container Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Sterilization Containers, Accessories), By Type (Perforated, Non-perforated), By Material (Stainless Steel, Aluminium), By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-538-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

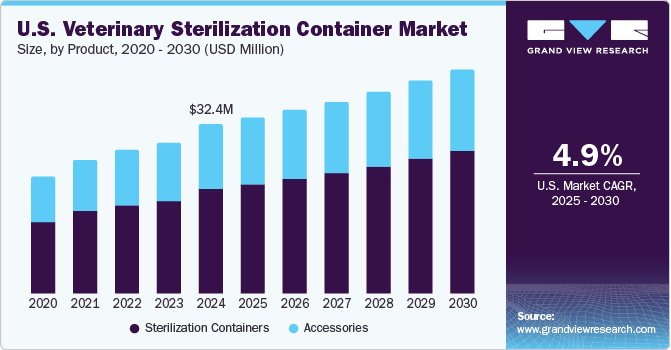

The U.S. veterinary sterilization container market size was valued at USD 32.41 million in 2024 and is expected to grow at a CAGR of 4.95% from 2025 to 2030. Key factors driving the industry include increasing pet ownership, rising demand for advanced surgical procedures, and stringent regulations on sterilization in veterinary practices. Furthermore, technological advancements, such as durable aluminum containers with better airflow and filtration, enhance efficiency and safety. Additionally, the growing trend of animal welfare and high adoption rates of sterilization procedures in clinics and hospitals boost market growth. For example, companies like Aesculap and Medline offer innovative sterilization solutions customized for veterinary use.

Furthermore, according to a review published in veterinary microbiology, multidrug-resistant infections in veterinary settings are a significant concern, with over 80% of U.S. veterinary teaching hospitals reporting nosocomial infection outbreaks. Common infections include surgical site infections, wound infections, and catheter-associated urinary tract infections. Key pathogens such as methicillin-resistant staphylococci, extended-spectrum beta-lactamase-producing E. coli, and multidrug-resistant Salmonella are responsible for these infections. These infections affect animals and pose risks to human health through zoonotic transmission. Effective infection control in veterinary clinics, including the use of advanced sterilization technologies, is crucial to mitigate these risks. This drives the demand for veterinary sterilization containers, which enhance infection control by ensuring the effective sterilization of medical instruments and reducing the spread of resistant pathogens.

Various materials are used in manufacturing veterinary sterilization containers, each offering unique benefits in terms of durability, sterility, and ease of use. The table below highlights the key materials, their advantages, and examples of products available in the market.

Material Type

Advantages

Example Products

Stainless Steel

Highly durable, corrosion-resistant, withstands high temperatures, reusable

Aesculap Sterilization Containers, Medline Steel Trays

Aluminum

Lightweight, excellent heat conductivity, resistant to corrosion, long-lasting

Hu-Friedy Sterilization Containers, Ritter Aluminum Trays

Plastic (Ultem Polymer)

Lightweight, transparent options available, durable, suitable for autoclave & ethylene oxide sterilization

Fine Science Tools Plastic Containers

Polycarbonate

High impact resistance, chemical-resistant, lightweight, cost-effective

Patterson Veterinary Polycarbonate Sterilization Trays

Titanium

Extremely strong, lightweight, non-corrosive, bio-compatible

Limited veterinary applications, mostly in surgical trays

Hybrid Materials (Aluminum + Plastic)

Combines durability of metal with lightweight plastic properties, customizable design

VetSpectrum EverGreen Filtered Containers

These materials are selected based on factors such as sterilization compatibility, durability, and ease of handling to ensure maximum efficiency in veterinary practices.

Market Concentration & Characteristics

The U.S. veterinary sterilization container market is moderately concentrated, with key players including B. Braun, Vimian Group AB (Movora), and Jewel Precision leading the industry. These industry leaders are focused on expanding their market share through technological advancements and strategic acquisitions. However, the market also includes a range of smaller and emerging firms offering niche products and specialized solutions, contributing to a competitive landscape with opportunities for new entrants and innovation. Market concentration is also driven by stringent sterilization standards, increasing pet ownership, and the rising demand for advanced veterinary surgical instruments.

The industry is experiencing significant innovation, with advancements in reusable, airtight containers featuring advanced filtration, tamper-proof locks, and sterilization indicators. Technologies like the SteriCUBE system and EverGreen Containers enhance sterility and efficiency, driving market growth and setting new infection control standards.

The industry is witnessing moderate M&A activity, driven by the demand for eco-friendly and efficient sterilization solutions. Companies are acquiring innovative technologies to expand their portfolios and reduce biohazardous waste. For example, in April 2024, HealthpointCapital acquired a majority stake in SteriCUBE, an FDA-cleared reusable sterilization system that replaces disposable blue wraps, enhancing efficiency and sustainability in veterinary healthcare.

Regulations in the U.S. veterinary sterilization container market drive product innovation, quality standards, and compliance with FDA and EPA guidelines. Strict sterilization and infection control mandates push manufacturers to develop reusable, eco-friendly containers that meet safety and sustainability requirements. For example, the FDA-cleared SteriCUBE system complies with sterilization protocols, replacing disposable blue wraps with a filtered metal container to reduce waste and enhance efficiency in veterinary practices.

The product substitutes include disposable blue wraps, which have traditionally been used for instrument sterilization but are less sustainable and prone to perforation. Other alternatives are chemical sterilization methods and reusable textile wraps. While these substitutes can offer lower initial costs or specific use-case advantages, they often fall short in terms of durability, efficiency, and environmental impact compared to advanced sterilization containers like SteriCUBE, which provide enhanced safety, reduced waste, and improved workflow efficiency.

Key players in the industry are driving growth through initiatives that raise awareness about hospital-associated infections (HAIs). Companies are launching educational programs and certifications to promote best practices in sterilization and infection control. For example, in February 2023, Virox Technologies and NAVTA introduced the Infection Prevention Leader Certificate Program, providing RACE-approved courses to help veterinary professionals enhance sterilization protocols and reduce HAIs, supporting market expansion.

Product Insights

By product, the sterilization containers segment dominated the market with a share of 62.0% in 2024 and is expected to grow at the fastest CAGR of 5.43% during the forecast period due to their higher efficiency in maintaining sterility, compliance with stringent infection control regulations, and durability for repeated use. Unlike single-use alternatives, sterilization containers are designed for multiple uses, contributing to cost savings and reducing environmental waste. Their durable construction ensures long-term performance, making them a more economical and sustainable option.

Also, veterinary practices are increasingly required to adhere to stringent infection control regulations. Sterilization containers meet these regulatory standards by providing reliable and consistent sterilization, thus making them a preferred choice in compliance with hygiene protocols.

Material Insights

Based on material, the aluminum segment dominated the market in 2024 with a market share of 50.3%. Aluminum-based containers are widely used for their durability, excellent heat conductivity, and corrosion resistance. Their robust construction ensures reliable protection and effective sterilization of instruments while being reusable and cost-effective compared to disposable alternatives.

Whereas the other material segment is expected to be the fastest-growing segment with the highest CAGR of 6.02% over the forecast period. Other materials, such as polycarbonate and high-grade plastic composites, are expected to gain popularity in the market. These materials are valued for their lightweight nature, resistance to chemical corrosion, and cost-effectiveness. They offer an alternative to traditional metals, providing effective sterilization and durability while being easier to handle and maintain.

Type Insights

Based on type, perforated containers held the largest share of 68.4% in 2024 and are estimated to grow at the highest CAGR of 5.05% over the forecast period. Perforated containers are preferred due to their superior efficiency in the sterilization process. They allow steam and other sterilizing agents to reach all surfaces of the instruments more effectively, ensuring thorough disinfection. This design reduces the risk of infection and contamination, enhances the effectiveness of sterilization, and supports better airflow and drying, making them the preferred choice in animal hospitals.

On the other hand, non-perforated containers do not have these openings and rely on external sterilization methods. They often provide better protection against contamination during storage and transport, as they create a sealed environment. However, they may not be suitable for all sterilization methods and require additional processing steps to ensure complete sterilization.

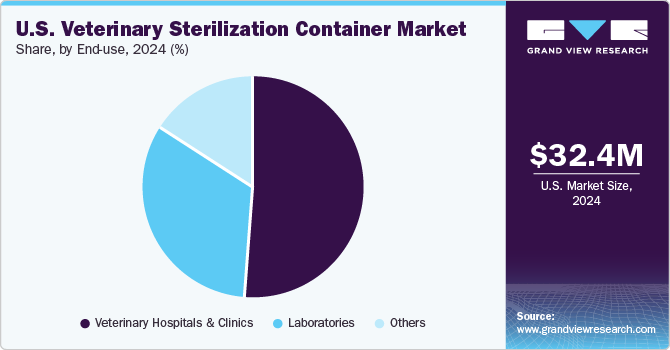

End-use Insights

Based on end use, the veterinary hospitals and clinics segment held the largest share of 51.0% in 2024 due to their high volume of surgical procedures and the need for stringent infection control practices. These facilities frequently use sterilization containers to maintain a sterile environment for surgical instruments, reducing the risk of hospital-acquired infections and ensuring the safety of both patients and staff. The continuous demand for effective sterilization solutions in these settings drives the significant market share of this segment.

On the other hand, the laboratories segment is expected to grow at the highest CAGR of 5.97% during the forecast period. Veterinary laboratories increasingly use sterilization containers to enhance infection control and prevent contamination in diagnostic and research settings. These containers ensure proper sterilization of equipment and samples, supporting accurate test results and reliable research. The growing adoption is driven by advanced diagnostic procedures and the need for a sterile environment to prevent cross-contamination.

Country Insights

The veterinary sterilization container market in the U.S. is expected to grow at a significant pace over the forecast period. The rise in veterinary hospitalizations, driven by higher pet ownership and more complex surgical procedures, has increased the need for effective decontamination solutions. The prevalence of MDR pathogens such as methicillin-resistant Staphylococcus aureus (MRSA) and extended-spectrum beta-lactamase (ESBL)-producing bacteria is rising. These pathogens are a major concern in veterinary settings, necessitating enhanced sterilization protocols. For instance, a study in the U.S. found that over 40% of bacterial infections in veterinary hospitals were caused by MDR pathogens, highlighting the urgent need for effective sterilization solutions. Hospital-acquired infections in veterinary hospitals have also been increasing. According to the Centers for Disease Control and Prevention (CDC), about 10% of infections in veterinary hospitals are classified as HAIs. These infections are often linked to inadequate disinfection practices, prompting a greater focus on advanced sterilization containers.

Key U.S. Veterinary Sterilization Container Company Insights

The market is competitive, with key players striving to innovate and capture market share. Companies like Movora are leading this trend with new product launches such as advanced disinfection systems that enhance efficiency and safety. Additionally, companies are focusing on improving product features, expanding their portfolios, and establishing strategic partnerships to gain a competitive edge.

Key U.S. Veterinary Sterilization Container Companies:

- B. Braun SE (B. Braun Vet Care USA)

- Vimian Group AB (Movora)

- Fine Science Tools, Inc.

- Jewel Precision

- Integra LifeSciences Holdings Corporation

- Narang Medical Limited.

- Hu-Friedy Mfg. Co., LLC.

- Andersen Sterilizers, Inc.

- Midmark Corporation

- Case Medical

Recent Developments

-

In May 2024, Movora launched EverGreen Filtered Sterilization Containers with cost-effective and sustainable solutions for veterinary practices.

-

In April 2024, HealthpointCapital acquired a majority stake in SteriCUBE Holdings, Inc., known for its innovative SteriCUBE Multiple Tray Sterilization (MTS) System. The system reduces waste, cuts costs, and enhances hospital workflow, with significant implications for sterilizing surgical instruments.

U.S. Veterinary Sterilization Container Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 33.66 million

Revenue Forecast in 2030

USD 42.86 million

Growth rate

CAGR of 4.95% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Product, material, type, end-use

Key companies profiled

B. Braun SE (B. Braun Vet Care USA); Vimian Group AB (Movora); Fine Science Tools, Inc.; Jewel Precision; Integra LifeSciences Holdings Corporation; Narang Medical Limited.; Hu-Friedy Mfg. Co.; LLC.; Andersen Sterilizers, Inc.; Midmark Corporation; Case Medical

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Veterinary Sterilization Container Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. veterinary sterilization container market report based on product, material, type, and end-use.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Sterilization Containers

-

Accessories

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Stainless Steel

-

Aluminium

-

Other Material

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Perforated

-

Non-Perforated

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinary Hospitals & Clinics

-

Laboratories

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. veterinary sterilization container market size was estimated at USD 32.41 million in 2024 and is expected to reach USD 33.66 million in 2025.

b. The U.S. veterinary sterilization container market is expected to grow at a compound annual growth rate of 4.95% from 2025 to 2030 to reach USD 42.86 million by 2030.

b. By product, the sterilization containers segment dominated the market with a share of 62.0% in 2024 and is expected to grow at the fastest CAGR of 5.43% during the forecast period due to their higher efficiency in maintaining sterility, compliance with stringent infection control regulations, and durability for repeated use. Unlike single-use alternatives, sterilization containers are designed for multiple uses, contributing to cost savings and reducing environmental waste. Their durable construction ensures long-term performance, making them a more economical and sustainable option.

b. Some key players operating in the U.S. veterinary sterilization container market include B. Braun SE (B. Braun Vet Care USA), Vimian Group AB (Movora), Fine Science Tools, Inc., Jewel Precision, Integra LifeSciences Holdings Corporation, Narang Medical Limited., Hu-Friedy Mfg. Co., LLC., Andersen Sterilizers, Inc., Midmark Corporation, Case Medical

b. Key factors driving the U.S. veterinary sterilization containers market include the increasing pet ownership, rising demand for advanced surgical procedures, and stringent regulations on sterilization in veterinary practices. Additionally, the growing trend of animal welfare and high adoption rates of sterilization procedures in clinics and hospitals boost market growth. For example, companies like Aesculap and Medline offer innovative sterilization solutions customized for veterinary use.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.