- Home

- »

- Animal Health

- »

-

U.S. Veterinary Telehealth Market, Industry Report, 2030GVR Report cover

![U.S. Veterinary Telehealth Market Size, Share & Trends Report]()

U.S. Veterinary Telehealth Market Size, Share & Trends Analysis Report By Animal Type (Canine, Feline, Equine), By Service Type (Telemedicine, Teleconsulting, Telemonitoring), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-222-7

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

U.S. Veterinary Telehealth Market Trends

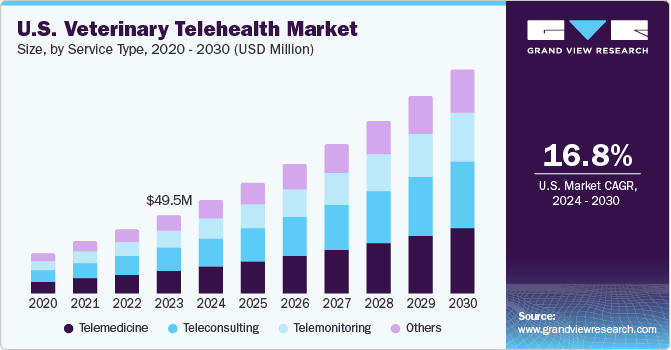

The U.S. veterinary telehealth market size was estimated at USD 49.5 billion in 2023 and is expected to grow at a CAGR of 16.8% from 2024 to 2030. The growing adoption of veterinary telehealth is due to the constant improvements in veterinary information & management systems for early disease detection. Furthermore, the widespread occurrence of zoonotic and chronic diseases in animals, coupled with the growing usage of Internet of Things (IoT) & artificial intelligence (AI) by pet owners, are key factors propelling the market. The increasing incidence of conditions like diabetes, obesity, kidney ailments, spinal disc issues, and blood pressure-related problems further fuel the market.

The U.S. accounted for over 32.9% of the global veterinary telehealth market in 2023. The rising prevalence of obesity in pets, linked to conditions like joint diseases and osteoarthritis, is increasing the need for improved treatment methods. In addition, disease outbreaks in livestock can pose significant socioeconomic risks, leading to disruptions in local, international, and rural markets, as well as production losses. These factors are propelling the veterinary market. Moreover, COVID-19 pandemic had a positive impact on the market. As per a 2020 article by the Veterinary Medical Association, the application of telemedicine has expanded to safeguard the health of veterinary teams and their patients. In response to the COVID-19 pandemic, TeleTails introduced a new software solution in May 2020, known as TeleTails Instant, a video conferencing tool. The growing awareness and benefits associated with telehealth platforms are bolstering their growth.

The increasing prevalence of zoonotic diseases & chronic animal diseases, and the awareness of these diseases in pet owners are also contributing to the market growth. As per the World Health Organization’s 2021 data, zoonotic diseases are responsible for millions of deaths and approximately 1 million illnesses annually. This surge in infections is leading pet and farm animal owners to turn to telehealth services to enhance and track the health of their animals. The market is expected to be further propelled by the increasing spending on animal healthcare. The American Pet Products Association’s (APPA’s) 2021 report indicates that total spending in the U.S. pet industry rose by 1.06% from 2019 to 2020.

The escalating concern of pet owners for their animals’ well-being has led to a rise in pet care spending, thereby driving market growth. In 2021, pet-related expenditure in the U.S. was approximately USD 1,09,600 million, up from USD 1,03,600 million in 2020. The growing investment in animal healthcare is also stimulating market expansion. In addition, the high demand and increasing consumption of animal-based products are expected to fuel the market. This surge in demand is subsequently heightening the necessity to safeguard animals from diseases. As per the International Service for the Acquisition of Agri-biotech Applications (ISAAA), the demand for meat and milk production is projected to double by 2050 in developing nations. These factors are driving the adoption of telehealth in animal healthcare.

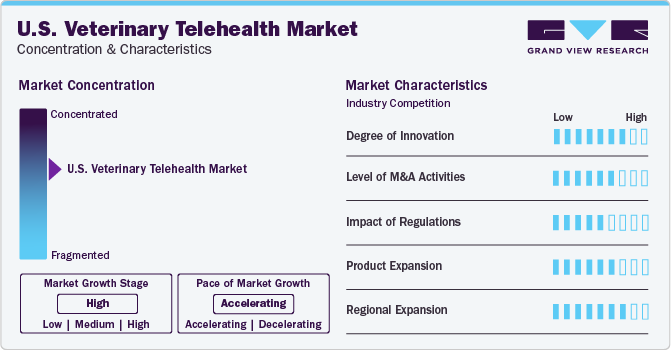

Market Characteristics & Concentration

U.S. veterinary telehealth industry is highly competitive. Leading players deploy various strategic initiatives that include competitive pricing strategies, partnerships, product and service expansion, sales & marketing initiatives, and mergers & acquisitions. For instance, in November 2020, FirstVet secured funding of USD 35 million in a round spearheaded by Mubadala Capital, facilitating the company’s expansion into the U.S. industry.

Innovation is a key driver in the industry, significantly influencing its growth and future trajectory. The introduction of innovative products and services, such as cutting-edge diagnostic tools and telecommunication platforms, enhances the standard of care for animals. Technological advancements empower veterinarians to remotely diagnose and monitor animals, thereby reducing the necessity for in-person clinic visits. This results in heightened efficiency, cost reductions, and improved client satisfaction.

The level of mergers and acquisitions in the industry plays a crucial role in shaping the industry dynamics. Companies aim to increase their presence, expand their service offerings, and consolidate resources, by stepping up their digital capabilities and improving customer experience. For instance, in January 2021, AmerisourceBergen Corporation entered into a strategic agreement with Walgreens Boots Alliance, Inc. to acquire its Alliance Healthcare Businesses among other commercial agreements. This is expected to boost AmerisourceBergen’s distribution capabilities, scale, and margin profile.

Regulations are one of the key factors that determine industry growth. The American Veterinary Medical Association Model Veterinary Practice Act is one such regulatory body intended to assist with a set of guiding principles for those who are now, or will be in the future, preparing or revising a practice act under the codes and laws of an individual state. It is designed to provide guidance on how veterinarians should operate their practices, including licensing requirements, standards of care, and other important aspects of running a successful veterinary business.

The industry's competitive landscape drives key industry players to implement strategic initiatives aimed at increasing their industry share. These strategies often involve the introduction of new products and continuous product development efforts. For instance, in March 2021, PetsApp launched PetsApp Widget and PetsApp Web to onboard more clients and to enable users to experience the app features on their desktop computers, respectively. These new additions were strategically designed to attract a larger client base and enhance user experience.

Geographic expansion can significantly impact the industry by influencing access to services, demand for veterinary care, and delivery of healthcare. This can address barriers like cost and accessibility regarding pet healthcare in many countries and in turn enhance the overall healthcare outcomes for animals. Companies often opt for regional expansion to identify different customer needs and cater to them by developing their services. For instance, in March 2021, Airvet expanded to Canada to increase its reach and customer base.

Service Type Insights

Teleconsulting dominated the market with the largest revenue share of 29.9% in 2023. Teleconsulting is being utilized by veterinarians to connect with veterinary experts through telehealth tools. This enables them to receive valuable advice and insights about animal care. As a result, teleconsultation offers timely and suitable medical guidance for animals in need, enhancing their treatment. It also helps in cutting down transportation and other related costs. Furthermore, it allows for immediate access to expert advice, eliminating the need for long waiting periods. This allows them to obtain expert advice and insights on animal care. These benefits are contributing to the expansion of the segment.

Telemedicine is anticipated to be the fastest-growing segment with a CAGR of 15.9% from 2024 to 2030, due to the increased internet penetration. The rise in internet users has resulted in a surge in the adoption of telehealth for animals. The market growth of this segment is expected to be driven by the growing initiatives from industry players. For instance, in April 2021, Guardian Vets, a leading company in veterinary client communication technology and telemedicine, introduced three innovative services - Virtual CRS, Overflow Protection, and Callback Support. These services have helped to alleviate the workload on veterinary practices.

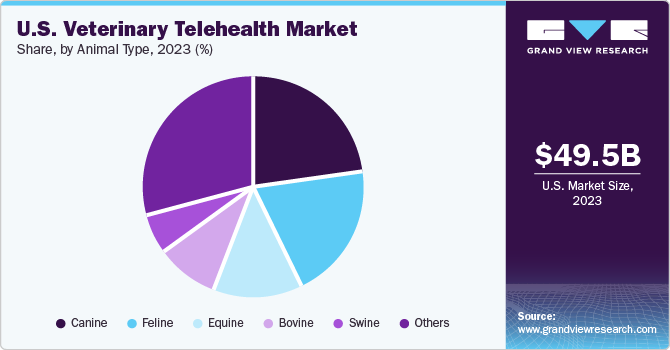

Animal Type Insights

Others dominated the market and accounted for the largest revenue market share of 28.9% in 2023. Others segment includes animals such as poultry, sheep, and goats. The daily high consumption of poultry and cattle products is a significant factor driving this segment’s growth. The growth of the segment can be attributed to an increase in production of pork worldwide. Pork, the meat of a domestic pig, is widely consumed as a staple food. Sheep also contribute to the production of other goods like wool. Moreover, the rising occurrence of chronic diseases in sheep and goats is a major influence promoting this segment. This could lead to increased use of veterinary telehealth for preventive measures and disease management.

Feline is anticipated to be the fastest-growing segment over the forecast period. The growth of this segment is a result of the rise in spending on animal healthcare. Prevalent conditions in felines such as chronic kidney disease, hyperthyroidism, endocrine diseases, and diabetes have raised clinical urgency to adopt veterinary telehealth, acting as high impact rendering drivers for segment growth. Furthermore, corporations are focusing on expanding their product portfolio for felines owing greater sensitivity to diseases in comparison to other companion animals According to data from the APPA, expenditures on pet food and treats for cats amounted to 44,100 million, while 32,300 million were allocated to veterinary care and product sales in 2021.

Key U.S. Veterinary Telehealth Company Insights

Companies in the U.S. veterinary telehealth market are actively engaging in business strategies like forming strategic alliances, launching new products, and expanding into new regions to fortify their market position, as veterinary telehealth is still being adopted in the country. For example, in August 2020, Televet formed a partnership with Cornell University Hospital for Animals. This allowed the company to implement its telehealth platform for the University’s veterinary telehealth services, which helped expand the company’s market presence. Furthermore, in July 2020, Zoetis collaborated with telemedicine firms such as Vet-AI and Video With My Vet.

Key U.S. Veterinary Telehealth Companies:

- Airvet

- Activ4Pets

- PetHub, Inc.

- VitusVet

- Televet

- GuardianVets

- Whiskers Worldwide, LLC

- Animan Technologies Inc.

- Chewy, Inc.

- Petzam

- BabelBark, Inc.

- TeleTails

Recent Developments

-

In April 2023, PetHub, Inc., a platform that links pet owners with essential resources, tools, savings, and a centralized location for storing crucial pet information, has unveiled its new product, Wellness Tools, powered by VetInsight. This new offering equips subscribers with a range of cutting-edge features such as round-the-clock veterinary telehealth services, an extensive AI-driven symptom checker, and a virtual food and treat finder that delivers personalized suggestions for pets.

-

In August 2022, Vetster, a telehealth service for veterinarians that secured USD 40 million in funding, has just introduced its services in the UK following its successful expansion in the US. This service links certified veterinarians with pet owners via video calls, voice calls, and online messaging to meet the growing need for veterinary care.

-

In June 2020, AirVet, a U.S.-based startup, successfully secured a funding of USD 14 million from its investors. This financial boost is aimed at addressing the growing need for online care services. This will equip the company to effectively handle the surging demand for its telemedicine platform.

-

In March 2020, BabelBark and WhiskerDocs collaborated to provide their services to pet owners for free for 60 days. BabelBark offered free use of its connected care platform, BabelVet, to veterinary practices across the U.S. & Canada.

U.S. Veterinary Telehealth Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 71.56 billion

Revenue forecast in 2030

USD 171.60 billion

Growth rate

CAGR of 16.8% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Animal type, service type

Country scope

U.S.

Key companies profiled

Airvet; Activ4Pets; BabelBark, Inc.; Teletails; PetHub, Inc.; VitusVet; Televet; GuardianVets; Whiskers Worldwide, LLC; Animan Technologies Inc.; Chewy, Inc.; Petzam

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Veterinary Telehealth Market Report Segmentation

This report forecasts revenue growth in the U.S. market and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. veterinary telehealth market report based on animal type, and service type:

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Canine

-

Feline

-

Equine

-

Bovine

-

Swine

-

Others

-

-

Service Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Telemedicine

-

Teleconsulting

-

Telemonitoring

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. veterinary telehealth market size was estimated at USD 49.5 billion in 2023 and is expected to reach USD 71.56 million in 2024

b. The U.S. veterinary telehealth market is expected to grow at a compound annual growth rate of 16.8% from 2024 to 2030 to reach USD 171.60 million by 2030.

b. Teleconsulting dominated the market with the largest revenue share of 29.9% in 2023. Teleconsulting is being utilized by veterinarians to connect with veterinary experts through telehealth tools.

b. Some key players operating in the U.S. veterinary telehealth market include Teladoc; Doctor on Demand; iCliniq; IBM; Intel Corporation; Philips Healthcare; McKesson Corporation; AMD Telemedicine; GE Healthcare; CardioNet Inc.; 3m Health Information Systems; Medic4all; CirrusMD Inc.; Cisco; and American Telecare Inc.

b. The growing adoption of these management systems is due to the consistent emphasis on veterinary telehealth and disease detection. Furthermore, the widespread occurrence of zoonotic and chronic diseases in animals, coupled with the growing usage of Internet of Things (IoT) & artificial intelligence (AI) by pet owners, are key factors propelling the market. The escalating incidence of conditions like diabetes, kidney ailments, spinal disc issues, and blood pressure-related problems further fuel the market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."