- Home

- »

- Consumer F&B

- »

-

U.S. Vitamin Supplements Market Size, Industry Report 2033GVR Report cover

![U.S. Vitamin Supplements Market Size, Share & Trends Report]()

U.S. Vitamin Supplements Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Multivitamin, Vitamin A, Vitamin B), By Form (Powder, Tablets), By Distribution Channel (Offline, Online), And Segment Forecasts

- Report ID: GVR-4-68040-831-2

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Vitamin Supplements Market Summary

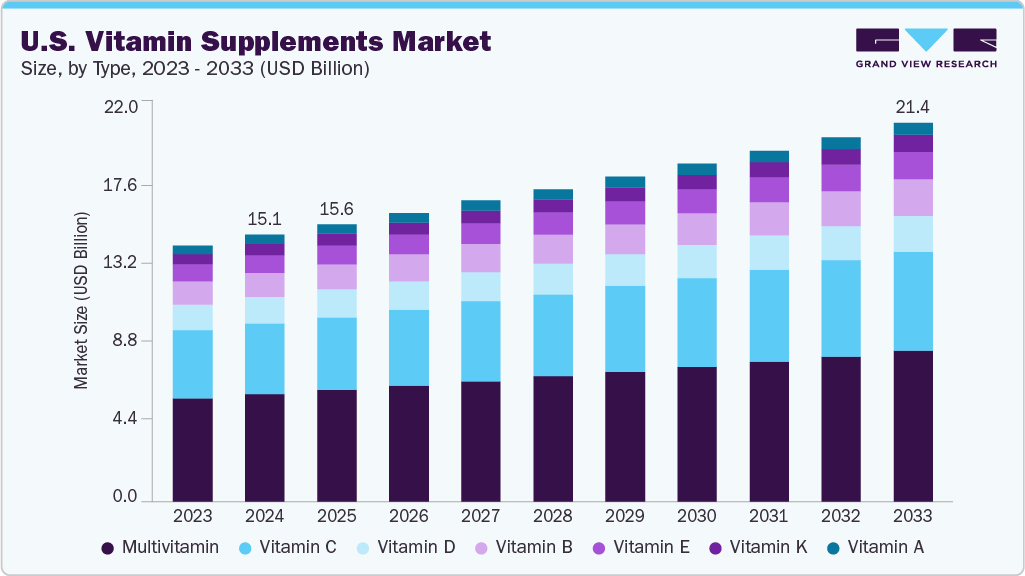

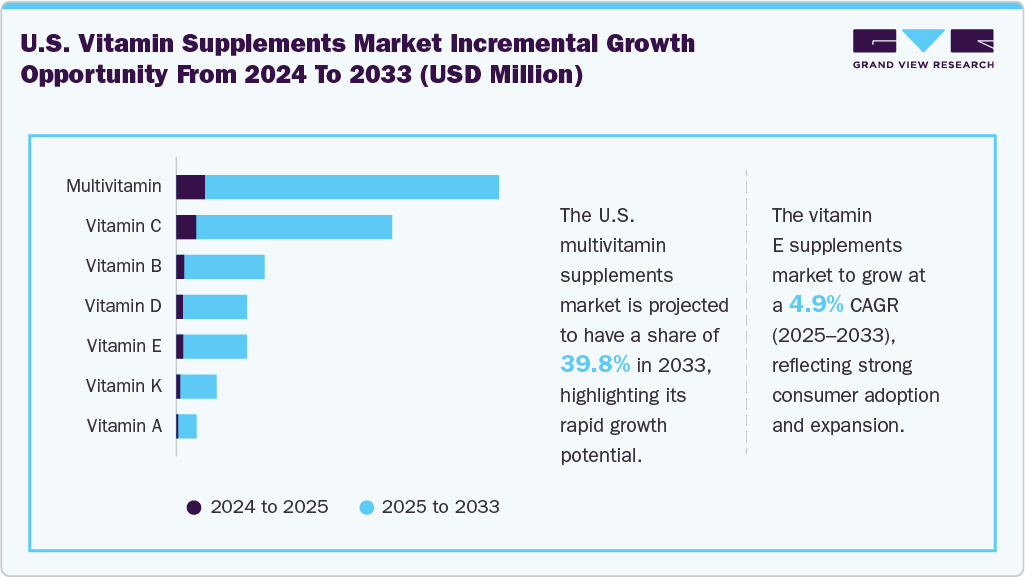

The U.S. vitamin supplements market size was estimated at USD 15,063.2 million in 2024 and is projected to reach USD 21,367.4 million by 2033, growing at a CAGR of 4.0% from 2025 to 2033. Several factors, including increasing health-oriented consumer trends, concerns about nutrient deficiencies, an aging population, and rising interest in preventative healthcare, drive the market growth.

Key Market Trends & Insights

- By type, the U.S. multivitamin supplements market segment held the largest share of 40.3% in 2024.

- By form, the U.S. gummy vitamin supplements market segment is experiencing significant growth, projecting a CAGR of 4.5%.

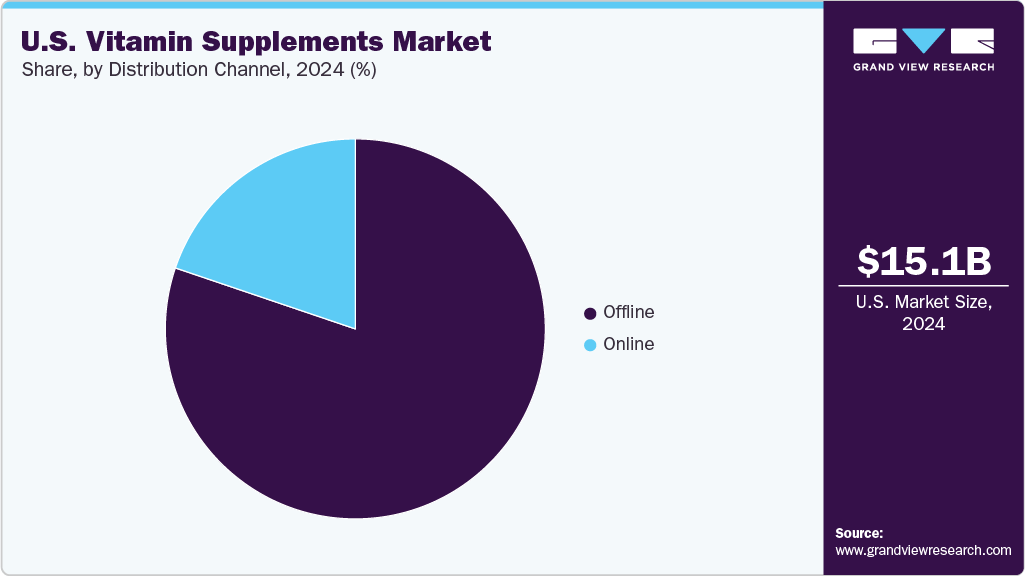

- The U.S. vitamin supplements market through the offline channel held the largest share of 80.2% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 15,063.2 Million

- 2033 Projected Market Size: USD 21,367.4 Million

- CAGR (2025-2033): 4.0%

Increased awareness of nutritional deficiencies, hectic lifestyles, and a desire for convenient ways to ensure adequate nutrient intake are driving the growth of the U.S. vitamin supplements industry.In the U.S., consumers are seeking customized vitamin supplements tailored to their specific health needs, lifestyle, and genetic factors. This trend is being facilitated by advancements in technology, such as genetic testing and data analytics, which allow manufacturers to create more personalized supplement formulations. Companies are investing in research and development to offer unique, personalized vitamin supplements that could address individual deficiencies and optimize health outcomes.

In February 2023, GenoPalate launched a new line of personalized supplements called GenoVit. The company utilizes DNA analysis to create a personalized formula tailored to an individual's genetics, age, gender, and current dietary habits. The goal is to optimize vitamin and supplement intake according to specific nutrient needs. The company acknowledges common deficiencies in vitamin D, omega-3 fatty acids, and vitamin B12, and aims to provide a solution for individuals who may not be able to obtain all necessary micronutrients from their diet alone.

Another significant trend in the U.S. vitamin supplements industry is the focus on clean and natural ingredients. Consumers are becoming increasingly aware of the ingredients in their supplements and are seeking products that are free from artificial additives, fillers, and preservatives. Manufacturers are responding by using natural and organic ingredients, as well as transparent labeling practices. Additionally, there is a growing emphasis on sustainability and ethical sourcing of ingredients, which appeals to environmentally conscious consumers.

Quality and safety are paramount concerns in the manufacturing of vitamin supplements. Regulatory bodies, such as the Food and Drug Administration (FDA) in the U.S., are implementing stricter quality control measures and good manufacturing practices (GMPs) for supplement manufacturers. This trend is leading to greater transparency and accountability within the industry, with companies investing in rigorous quality assurance and testing protocols to ensure the safety and efficacy of their products.

The FDA has introduced a new education initiative called Supplement Your Knowledge to increase the understanding of dietary supplements among the public. The initiative includes videos, fact sheets, and a curriculum to help consumers learn about the regulation and potential benefits & risks of dietary supplements. It also aims to educate high school students on evaluating the accuracy and credibility of information about dietary supplements and to provide healthcare professionals with knowledge through a continuing medical education program.

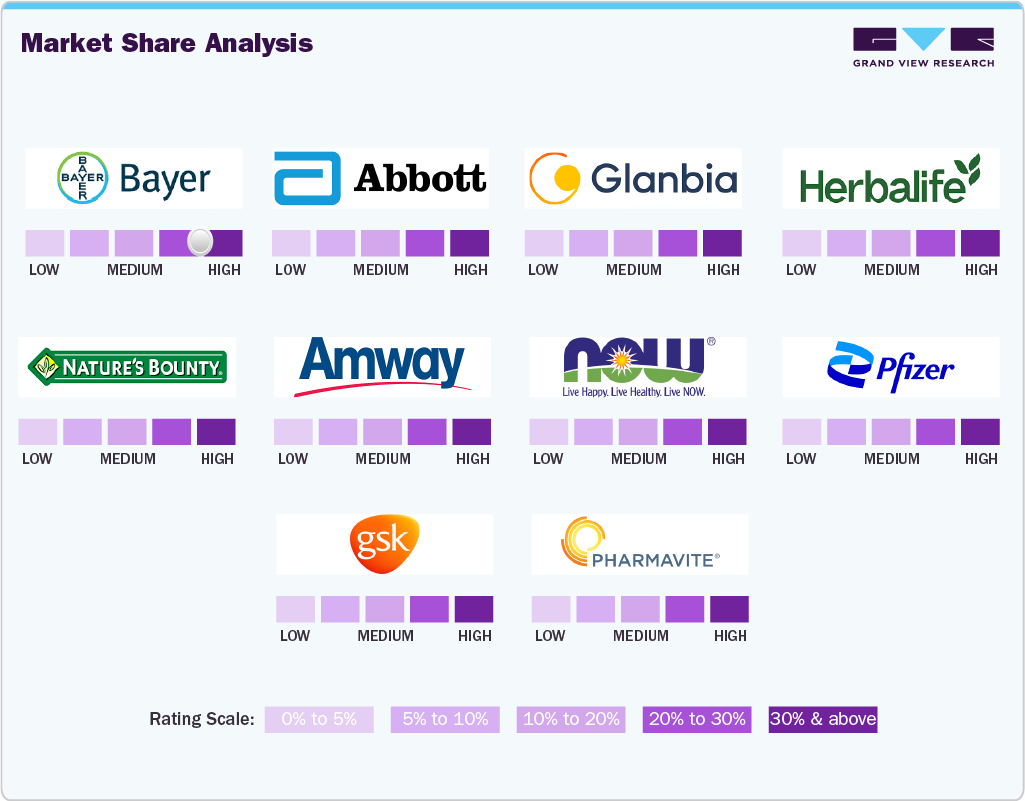

The U.S. vitamin supplement manufacturers are supplying their products in the form of tablets, capsules, powders, gummies, soft gels, and gel caps. Companies like Glanbia plc, Bayer, and Pfizer Inc. have integrated their businesses, manufacturing pharmaceuticals and food ingredients, with the production and distribution of dietary and vitamin supplements to various end-use segments. Long-time market presence and the ability to maintain a stock of raw materials are factors working in favor of the aforementioned integrated companies.

Nutraceutical manufacturers, such as Abbott, Amway, GSK, and Pfizer, are supplying dietary and vitamin supplements through distributors, retail outlets, and e-commerce portals across the U.S. The manufacturers are expected to offer low prices in light of the competitive nature of the market.

Technology has revolutionized the way consumers purchase supplements. Online platforms and mobile apps allow consumers to browse and purchase vitamin supplements with ease, often providing detailed product information, reviews, and subscription options. This shift to e-commerce has also enabled companies to collect valuable data on consumer preferences, helping them tailor their offerings and marketing strategies.

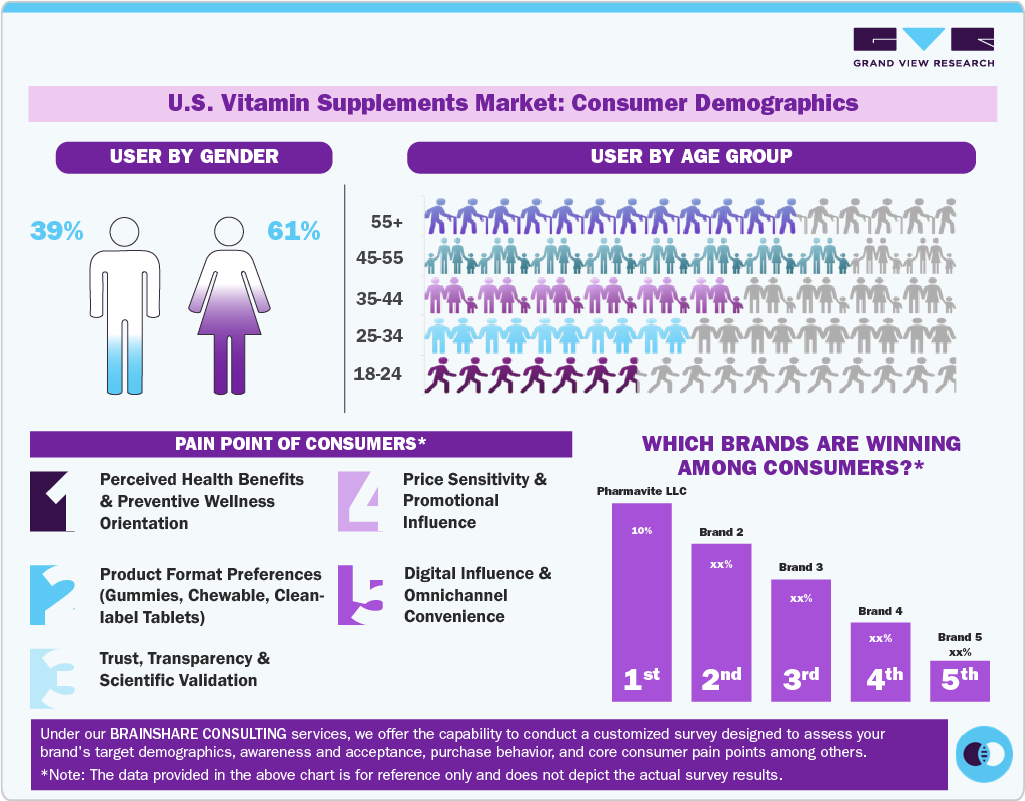

Consumer Insights for the U.S. Vitamin Supplements Market

Type Insights

The multivitamin supplements segment led the U.S. vitamin supplements market, accounting for the largest revenue share of 40.3% in 2024. Demand for multivitamins is driven by consumer preference for consolidated nutritional formats that combine several essential nutrients into a single daily dose. Lifestyle patterns and persistent gaps in vitamin D, folate, magnesium, and iron intake among adults have reinforced this preference. There has been a shift toward simplified supplementation routines as consumers aimed to avoid purchasing multiple single-nutrient products.

Multifunctionality is a crucial trend in the U.S. vitamin supplements industry, exemplified by companies such as Nature Made, Vitacost, and Thorne HealthTech, among others. Multifunctional products offered by these companies are centered on a holistic approach to health, addressing various aspects of well-being simultaneously. This comprehensive approach appeals to consumers seeking a one-stop solution to their health needs, further boosting the demand for multivitamins.

The U.S. vitamin E supplements industry is projected to grow at the fastest CAGR of 4.9% from 2025 to 2033. An increasing number of skincare products currently available on the market rely on natural ingredients to maintain healthy and glowing skin, including various vitamins and minerals. This has created an immense demand for vitamin E in skincare supplements. Vitamin E is renowned for its antioxidant properties. Antioxidants help protect the skin from damage caused by free radicals, which are unstable molecules that can harm skin cells. Exposure to environmental factors such as pollution and UV rays can lead to the production of free radicals, making vitamin E a valuable addition to skincare.

Form Insights

The U.S. tablets vitamin supplements market accounted for the largest revenue share of 40.0% in 2024. Growth in tablet-based vitamins has been supported by cost-efficient manufacturing, high nutrient stability, and strong consumer trust in traditional dosage forms. Tablets have been positioned as a value-driven option, particularly for adult and senior consumers seeking higher-dose formulations for supporting metabolic health, immunity, and bone strength. U.S. manufacturers such as Pharmavite (Nature Made) and Bayer (One A Day) emphasized in their 2023-2024 corporate communications that tablets remain the preferred method for delivering complete micronutrient profiles, including iron, B-complex vitamins, and fat-soluble vitamins, where higher compression stability is required.

The U.S. gummy vitamin supplements industry is projected to grow at the fastest CAGR of 4.5% from 2025 to 2033. Gummy vitamins have gained substantial traction due to their palatability, convenience, and improved adherence rates, particularly among millennials, Gen Z, and families. There has been a growing preference for chewable, sugar-controlled formulations positioned around energy, immunity, and women’s wellness. Market expansion has also been driven by advancements in pectin- and tapioca-based gummy technologies, allowing the inclusion of more micronutrients without compromising texture or stability. A shift toward clean-label, gelatin-free, and naturally flavored gummies has been observed across U.S. retail channels.

Distribution Channel Insights

The U.S. vitamin supplements market through the offline channel accounted for the largest revenue share of 80.2% in 2024. The demand for vitamin supplements through pharmacies and drugstores, and hypermarkets/supermarkets is experiencing significant growth due to a combination of evolving consumer preferences and healthcare trends. The hypermarkets/supermarkets segment has experienced increased popularity within the vitamin supplements market. This growth can be attributed to several key factors, including the well-organized and carefully curated product displays, as well as detailed customer sentiment analysis aimed at understanding consumer preferences regarding specific products and brands.

The U.S. vitamin supplements industry through online channels is projected to grow at a significant CAGR of 4.7% from 2025 to 2033. The expansion of the online channel has been driven by a rapid shift toward digital purchasing behavior, reinforced by increasing smartphone penetration, secure payment ecosystems, and accelerated adoption of e-commerce following the pandemic. It has been observed that U.S. consumers increasingly prefer online wellness purchases due to convenience, subscription discounts, and access to a wider range of personalized formulations.

Key U.S. Vitamin Supplements Company Insights

The U.S. vitamin supplements market is dominated by a small set of multinational and large domestic players alongside a broad base of regional brands and private-label manufacturers. Pharmavite (Nature Made), Haleon (Centrum; formerly GSK Consumer Health), Nestlé Health Science/The Bountiful Company (Nature’s Bounty, Solgar), Bayer, Abbott, Herbalife, Amway (Nutrilite), NOW Foods, and Glanbia (sports-nutrition overlap) are commonly cited as top incumbents and account for the majority of national distribution in pharmacies, mass-retail, and e-commerce channels.

Key U.S. Vitamin Supplements Companies:

- Abbott

- The Nature's Bounty Co.

- NOW Foods

- Herbalife Nutrition

- Glanbia plc

- Pfizer Inc.

- Bayer AG

- Amway Corp.

- GlaxoSmithKline plc.

- Pharmavite LLC

Recent Developments

-

In June 2025, Vitafusion released its Power Plus Multivitamins Gummies (strawberry & watermelon), delivering 100% DV of 10 essential nutrients, in partnership with chef Brad Leone.

-

In March 2025, Pharmavite (Nature Made) launched Nature Made Probiotic + Prebiotic Fiber Gummies (with Lactospore and 3 g prebiotic fiber) and a 1 B CFU probiotic capsule.

U.S. Vitamin Supplements Market Report Scope

Report Attribute

Details

Market value size in 2025

USD 15,638.9 million

Revenue forecast in 2033

USD 21,367.4 million

Growth rate

CAGR of 4.0% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, form, distribution channel

Country scope

U.S.

Key companies profiled

Abbott; The Nature's Bounty Co.; NOW Foods; Herbalife Nutrition; Glanbia plc; Pfizer Inc.; Bayer AG; Amway Corp.; GlaxoSmithKline plc.; Pharmavite LLC

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Vitamin Supplements Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. vitamin supplements market report based on type, form, and distribution channel:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin E

-

Vitamin K

-

-

Form Outlook (Revenue, USD Million, 2021 - 2033)

-

Powder

-

Tablets

-

Capsules

-

Softgels

-

Gummies

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Offline

-

Pharmacies & Drugstores

-

Hypermarkets/Supermarkets

-

Others

-

-

Online

-

Frequently Asked Questions About This Report

b. The U.S. vitamin supplements market size was estimated at USD 15,063.2 million in 2024 and is expected to reach USD 15,638.9 million in 2025.

b. The U.S. vitamin supplements market is expected to witness 4.0% revenue growth from 2025 to 2033 to reach USD 21,367.4 million by 2033.

b. The U.S. tablets vitamin supplements market accounted for the largest share of 40.0% of the revenue in 2024 due to cost-efficient manufacturing, high nutrient stability, and strong consumer trust in traditional dosage forms.

b. The key market players in the U.S. vitamin supplements market includes Abbott; The Nature's Bounty Co.; NOW Foods; Herbalife Nutrition; Glanbia plc; Pfizer Inc.; Bayer AG; Amway Corp.; GlaxoSmithKline plc.; Pharmavite LLC.

b. Growth in the U.S. vitamin supplements market is being primarily driven by increasing health-oriented consumer trends, concerns about nutrient deficiencies, an aging population, and rising interest in preventative healthcare.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.