- Home

- »

- Medical Devices

- »

-

U.S Wound Gel Market Size & Share, Industry Report, 2033GVR Report cover

![U.S. Wound Gel Market Size, Share & Trends Report]()

U.S. Wound Gel Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Dressings, Gels), By Antimicrobial Properties (Silver (Ag+), Non-Silver), By Application, By End-use, By Mode Of Purchase, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-621-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S Wound Gel Market Size & Trends

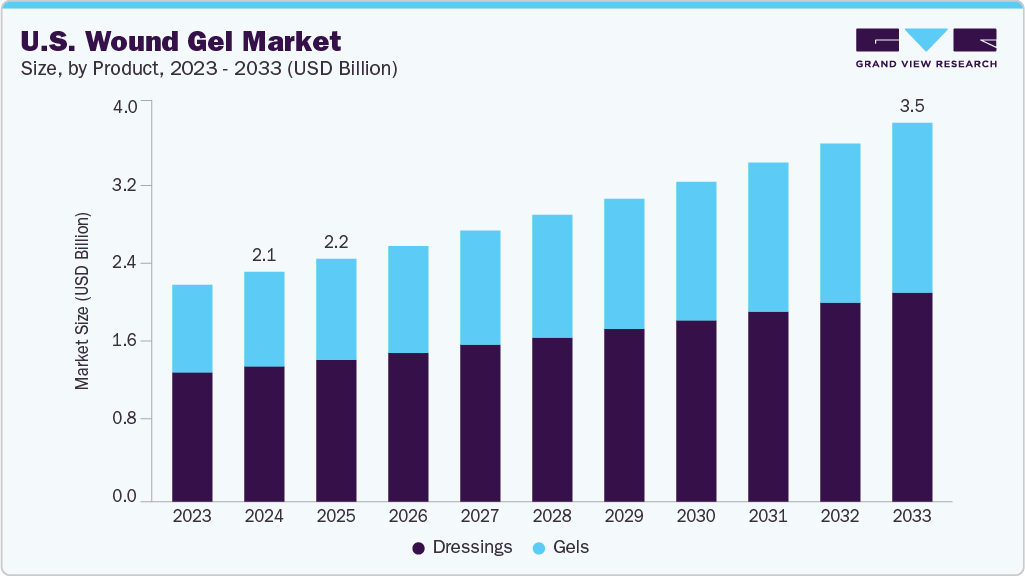

The U.S. wound gel market size was estimated at USD 2.11 billion in 2024 and is expected to grow at a CAGR of 5.71% from 2025 to 2033 to reach USD 3.47 billion by 2033. This growth is attributed to the rising prevalence of chronic wounds, increasing demand for advanced wound care solutions, a growing elderly population, and continuous innovations in hydrogel formulations that enhance healing outcomes. In addition, the shift toward outpatient and home-based care and supportive reimbursement policies is further accelerating market expansion.

According to data from the U.S. Census Bureau, by 2025, the population's average age is expected to reach 40 years, with approximately 60 million individuals aged 65 years or older accounting for 18% of the total population. Among them, 4% will be 80 years or older. By 2050, the number of elderly individuals is projected to rise to 80 million, representing 25% of the population aged 65 and above, while those aged 80 and over will comprise 8%.

The increasing demand for wound gel products from the U.S. military and defense sector is emerging as a significant market driver, primarily due to combat and field operations' unique and high-risk nature. Military personnel are frequently exposed to traumatic injuries, including lacerations, burns, and deep wounds, which require immediate, efficient, and infection-resistant treatment in austere environments where traditional surgical care is not readily available. In such scenarios, wound gels offer a practical solution-they are portable, easy to apply, and provide moisture-retentive healing environments that promote faster tissue regeneration while minimizing infection risks.

Furthermore, the U.S. Department of Defense has collaborated with biotechnology firms to develop advanced hydrogel formulations, including enzyme-based or antimicrobial wound gels designed specifically for battlefield use. For instance, in November 2024, the U.S. Army partnered with SolasCure, a Cambridge-based biotechnology company, to evaluate the company's investigational wound care hydrogel, Aurase Wound Gel, in military settings. Aurase wound gel features a recombinant enzyme, tarumase, derived initially from maggots. This enzyme is highly effective in enzymatic debridement, removing dead tissue and preparing the wound bed, offering a biologically inspired solution for wound management that supports natural and alternative healing approaches.

Top 15 State as of June 2024, Active Duty Members of the Armed Forces U.S.

STATE

ACTIVE DUTY

ARMY

NAVY

MARINE CORPS

AIR FORCE

SPACE FORCE

COAST GUARD

TOTAL

CALIFORNIA

6,541

75,039

56,941

15,805

1,595

4,825

160,746

VIRGINIA

19,222

74,938

10,195

12,320

1,001

4,011

121,687

TEXAS

66,266

6,142

2,255

33,837

368

1,690

110,558

NORTH CAROLINA

42,963

4,186

39,866

6,243

2

1,453

94,713

FLORIDA

5,622

28,452

3,548

22,023

296

4,908

64,849

GEORGIA

47,294

6,094

1,172

7,951

15

465

62,991

WASHINGTON

25,955

21,654

723

6,589

2

1,596

56,519

HAWAII

18,445

12,709

6,540

5,428

158

1,467

44,747

COLORADO

24,635

865

278

6,466

4,113

47

36,404

SOUTH CAROLINA

11,501

6,589

7,886

8,553

3

1,217

35,749

KENTUCKY

31,753

12

99

239

0

159

32,262

MARYLAND

7,822

9,701

2,435

8,468

259

879

29,564

ALASKA

10,234

41

8

8,567

13

1,755

20,618

ILLINOIS

955

14,842

307

4,263

3

89

20,459

OKLAHOMA

11,387

1,602

369

6,253

8

21

19,640

Sources: Active Duty Master File, Reserve Common Components Personnel Data System (RCCPDS) File, Appropriated Fund (APF) Civilian Master File

The increasing prevalence of chronic wounds is a major market driver, significantly contributing to the growing demand for advanced wound care products. Chronic wounds such as diabetic foot ulcers, venous leg ulcers, and pressure ulcers fail to progress through the normal phases of healing and persist for months, requiring specialized care. In the U.S., this issue is particularly demanding of wound gel due to the high and rising incidence of diabetes, obesity, and vascular diseases. For instance, the Centers for Disease Control and Prevention (CDC) reports that more than 38 million Americans have diabetes (about 1 in 10), and about 90% to 95% of them have type 2 diabetes. These diabetic wounds are highly susceptible to infection and complications, increasing the need for effective, non-invasive treatment options.

Wound gels, particularly hydrogels, are uniquely suited to manage chronic wounds by maintaining a moist environment, promoting autolytic debridement, and accelerating granulation tissue formation. Their ability to conform to irregular wound surfaces and reduce pain during dressing changes makes them ideal for long-term wound management. As the burden of chronic wounds grows alongside an aging population and rising healthcare costs, healthcare providers adopt wound gels as a cost-effective and clinically effective solution, fueling market growth. A study published by the American Medical Association in November 2023 indicates that approximately 33.33% of people with diabetes will experience a foot ulcer at some point, affecting about 1.6 million individuals annually in the U.S.

The table below highlights diabetes prevalence across U.S. states, ranging from 7.8% in Utah to 18.2% in West Virginia. Southern states show significantly higher rates, indicating regional health disparities and a greater burden of chronic disease.

Percentage of Adults who Reported ever being told by a Health Professional that they had Diabetes, 2023

Rank

State

Diabetes Prevalence (%)

1

Utah

7.80%

2

Colorado

8.60%

3

Alaska

8.70%

4

Vermont

9.30%

5

Montana

9.40%

6

North Dakota

9.50%

7

Washington

9.60%

8

Idaho

9.80%

8

Massachusetts

9.80%

8

New Hampshire

9.80%

11

Connecticut

9.90%

12

Minnesota

10.50%

12

New Jersey

10.50%

14

Nebraska

10.60%

14

New York

10.60%

16

Wyoming

10.80%

17

Oregon

10.90%

18

Hawaii

11.30%

18

Iowa

11.30%

18

Wisconsin

11.30%

21

Arizona

11.40%

21

Kansas

11.40%

21

Maine

11.40%

24

California

11.50%

25

Rhode Island

11.80%

25

South Dakota

11.80%

25

Virginia

11.80%

28

Nevada

11.90%

29

Illinois

12.20%

29

Maryland

12.20%

31

Missouri

12.30%

32

Michigan

12.40%

32

North Carolina

12.40%

32

Oklahoma

12.40%

35

Florida

12.50%

35

New Mexico

12.50%

37

Georgia

12.70%

37

Texas

12.70%

39

Indiana

13.20%

39

Ohio

13.20%

41

Delaware

13.30%

42

Arkansas

14.50%

42

Tennessee

14.50%

44

South Carolina

14.90%

45

Alabama

15.70%

46

Louisiana

16.10%

47

Mississippi

17.00%

48

West Virginia

18.20%

Source: U.S. Department of Health and Human Services, Centers for Disease Control and Prevention, Behavioral Risk Factor Surveillance System, 2023

FDA approval plays a pivotal role in driving the U.S. market by ensuring product safety, efficacy, and credibility, which in turn fosters widespread adoption among healthcare providers and patients. The U.S. Food and Drug Administration (FDA) regulates wound gels under classifications such as medical devices or drugs, depending on their composition and intended use. Gaining FDA approval or clearance, through pathways like 510(k) or Premarket Approval (PMA), demonstrates that a product meets stringent quality and performance standards. This regulatory endorsement instills trust among clinicians, hospitals, and purchasing bodies, encouraging the integration of approved wound gels into treatment protocols, especially in critical care, chronic wound management, and surgical recovery.

In July 2024, Kane Biotech Inc. announced that the U.S. Food and Drug Administration (FDA) had eliminated the previous usage limitation on its 510(k) cleared Revive Antimicrobial Wound Gel. Previously, the administration of Revyve was limited to 90 grams per month per patient. With this limitation removed, the company can now introduce and extend the use of Revyve in larger quantities, including developing a spray format suitable for application on large wounds.

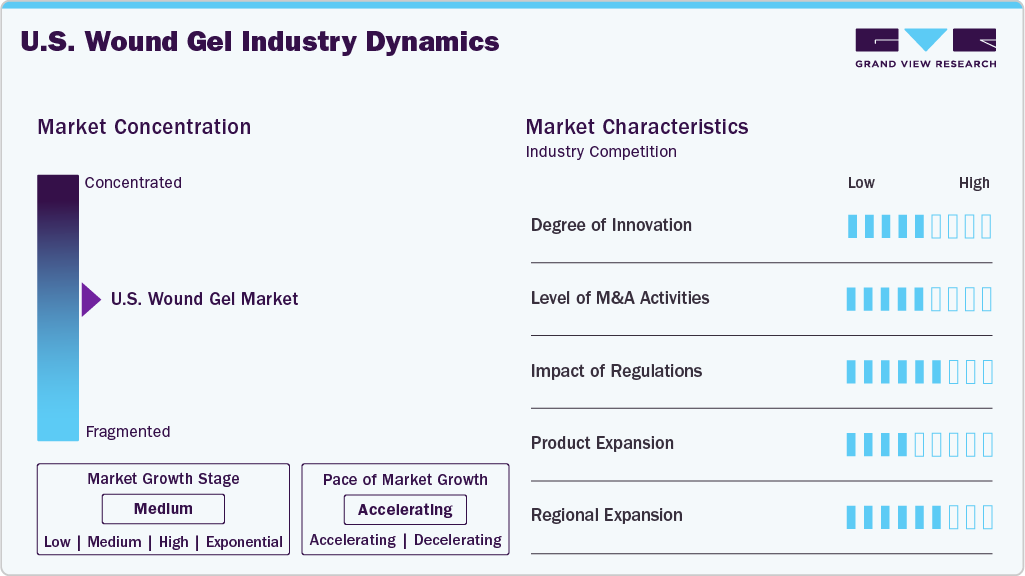

Market Concentration & Characteristics

The U.S. wound gel industry is in a high-growth phase, with an accelerating pace of expansion. This growth is driven by several key factors, including the increasing prevalence of chronic wounds, a rapidly aging population, a rising volume of surgical procedures, and continuous technological advancements in wound gel formulations.

The U.S. wound gel industry exhibits a high degree of innovation, marked by continuous advancements in bioactive and antimicrobial formulations, enzyme-based gels for debridement, and innovative wound care technologies. Companies invest in R&D to develop next-generation products that enhance healing outcomes, reduce infection risks, and improve patient comfort. Integrating nanotechnology, sustained-release drug delivery systems, and natural or synthetic biomaterials further underscores the market’s innovative landscape.

The industry shows significant mergers and acquisitions (M&A) activity. Key industry players actively engage in strategic acquisitions to expand their product portfolios, enter new therapeutic segments, and strengthen their market presence. These M&A efforts aim to acquire proprietary technologies, enhance R&D capabilities, and accelerate time-to-market for innovative wound care solutions. For instance, in October 2024, Mölnlycke Health Care, a leading Swedish MedTech company specializing in wound care, completed its acquisition of P.G.F. Industry Solutions GmbH, an Austrian manufacturer known for its Granudacyn wound cleansing and moisturizing solutions. The acquisition aims to expand Mölnlycke's Granudacyn business and further develop its growing wound care portfolio.

Regulations significantly impact the U.S. wound gel industry. The U.S. Food and Drug Administration (FDA) plays a central role in overseeing product safety, efficacy, and quality through its classification system for medical devices and drugs. Depending on their formulation and intended use, wound gels incorporating active ingredients or claiming therapeutic benefits must undergo stringent regulatory pathways such as 510(k) clearance, PMA (Premarket Approval), or new drug applications.

The U.S. wound gel industry shows a significant level of end-user concentration, primarily driven by demand from hospitals, specialized wound care clinics, and long-term care facilities. These institutional buyers account for a substantial share of product consumption due to the high volume of chronic and surgical wound cases treated in these settings. In addition, the increasing adoption of advanced wound care products in outpatient settings and home healthcare, particularly among the elderly and diabetic populations, is gradually diversifying the end user base.

Product Insights

The dressings segment dominated the market, accounting for 59.33% of the revenue in 2024 due to their broad applicability, ease of use, and essential role in managing various wound types, from minor cuts to chronic ulcers and post-surgical wounds. Advanced wound dressings, such as hydrocolloids, alginates, foams, and antimicrobial-impregnated variants, offer moisture balance, infection control, and accelerated healing, making them a first-line treatment across clinical and home care settings. Their versatility and continuous innovation drive widespread adoption, positioning dressings as the leading segment in wound care.

The gels segment is expected to witness the fastest growth over the forecast period, driven by its superior wound-healing properties, ease of application, and ability to maintain a moist wound environment. Gels are preferred for chronic wounds, burns, and post-operative incisions due to their cooling effect, infection control capabilities, and compatibility with sensitive skin. Ongoing innovation in antimicrobial and enzyme-based formulations further supports the rapid adoption of wound gels, making this segment a key driver of market expansion.

Antimicrobial Properties Insights

The silver (Ag+) segment dominated the market in 2024 and is expected to witness the fastest growth with a CAGR of 6.12%, owing to the rising incidence of burns, due to its critical role in advanced wound care. Silver ions are well-known for their potent, broad-spectrum antimicrobial properties, effectively targeting a wide range of bacteria, fungi, and even some viruses, which significantly helps prevent and control wound infections. This makes silver-based wound gels especially valuable in managing chronic wounds such as diabetic foot, pressure, and venous leg ulcers, where infection risk is high and healing can be extended. Moreover, silver wound gels are increasingly preferred in burn care and post-surgical wound management due to their ability to reduce microbial load without damaging surrounding healthy tissues. Their sustained release of silver ions ensures prolonged antimicrobial activity, which reduces the frequency of dressing changes, enhances patient comfort, and lowers overall treatment costs.

The non-silver market segment is expected to grow at a significant CAGR over the forecast period, driven by increasing demand for alternative antimicrobial and healing agents that address concerns related to silver resistance and potential cytotoxicity. This segment includes gels formulated with natural ingredients such as honey, aloe vera, and plant extracts, and synthetic compounds like iodine, zinc, and growth factors that promote wound healing through anti-inflammatory, antimicrobial, and tissue-regenerating properties. Rising consumer preference for biocompatible, eco-friendly, and hypoallergenic products is fueling the adoption of non-silver wound gels, especially in sensitive patient groups such as pediatrics and those with silver allergies. Furthermore, advancements in bioengineered hydrogels and peptide-based formulations are expanding the scope and effectiveness of non-silver gels in managing complex wounds.

Application Insights

The chronic wounds segment dominated the market and accounted for the largest revenue share in 2024, due to their high prevalence, complex treatment requirements, and significant healthcare burden. Conditions such as diabetic foot ulcers, venous leg ulcers, and pressure ulcers affect millions of patients, especially within aging and diabetic populations, driving sustained demand for advanced wound care products. Chronic wounds are slow to heal and prone to infection, necessitating specialized gels that maintain a moist environment, promote tissue regeneration, and offer antimicrobial protection. The recurring nature and long treatment durations of chronic wounds result in frequent product use, further boosting market consumption. In addition, increasing awareness among healthcare professionals about the benefits of advanced wound gels in improving healing outcomes and reducing complications reinforces the segment’s dominance.

The acute wounds segment is expected to grow at the fastest CAGR over the forecast period, driven by the rising number of surgical procedures, trauma cases, and injuries requiring rapid and effective wound management. Acute wounds, including cuts, abrasions, surgical incisions, and burns, demand timely treatment to prevent infection and promote quick healing, making wound gels an ideal choice due to their ease of application and moisture-retentive properties. Advancements in gel formulations that offer pain relief, antimicrobial protection, and enhanced tissue repair are boosting their adoption in emergency care, hospitals, and outpatient settings.

End-use Insights

The hospital end-use segment dominated the market in 2024 due to the high volume of acute and chronic wound cases treated in these settings. Hospitals handle a wide range of patients requiring advanced wound care, including surgical wounds, trauma injuries, and complex chronic wounds like diabetic ulcers and pressure sores. The availability of specialized medical staff and infrastructure enables the use of sophisticated wound gel products that require clinical expertise for application and monitoring. Moreover, hospitals prefer purchasing through bulk contracts and tenders, leading to higher procurement volumes than other end users. The critical need for infection control, faster healing, and reduced hospital stays further drives the demand for effective wound gels in hospitals..

The homecare settings segment is expected to grow at the fastest CAGR over the forecast period, driven by the rising elderly population and increasing prevalence of chronic diseases such as diabetes and vascular disorders that require long-term wound management. Advances in wound gel formulations, including antimicrobial and enzyme-based products, have made them more effective and easier to use outside hospital settings, encouraging the adoption of in-home care. Additionally, the integration of telemedicine enables remote monitoring and guidance, empowering patients and caregivers to manage wounds effectively at home. The cost-effectiveness of home care, by reducing hospital visits and readmissions, further fuels the shift towards this segment, making it a key market growth driver.

Mode of Purchase Insights

The prescription segment dominated the market and accounted for the largest revenue share in 2024. Prescription wound gels are formulated with advanced active ingredients, such as antimicrobial agents, growth factors, and enzymes, which require professional healthcare oversight to ensure safe and effective use. These products are commonly prescribed for managing difficult-to-heal wounds like diabetic ulcers, pressure sores, and surgical wounds, where tailored treatment protocols are essential. The dominance of this segment is also supported by healthcare providers' preference for prescription products that have undergone rigorous clinical testing and regulatory approval, ensuring higher efficacy and safety standards.

The non-prescription segment is expected to grow at the fastest CAGR over the forecast period, fueled by increasing consumer awareness, rising prevalence of minor wounds and injuries, and growing demand for convenient, over-the-counter wound care solutions. Non-prescription wound gels are widely accessible without a doctor’s prescription, making them popular for the self-care of cuts, abrasions, burns, and other minor wounds. The expansion of retail pharmacies, e-commerce platforms, and convenience stores has made these products more readily available to consumers seeking quick and easy wound management options at home.

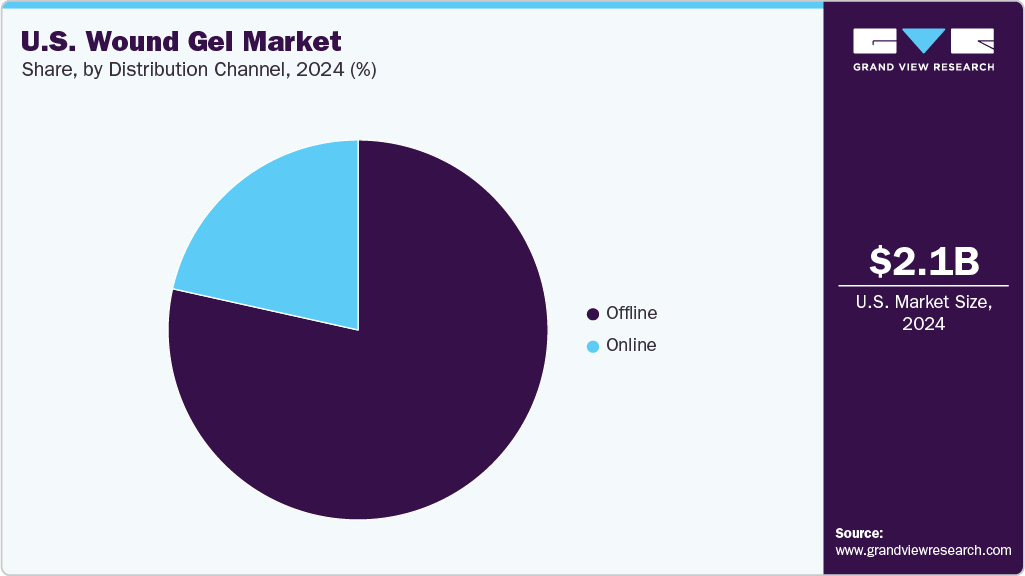

Distribution Channel Insights

The offline segment dominated the market and accounted for the largest revenue share in 2024, owing to hospitals, clinics, and healthcare providers' preference to procure products through established, trusted supply chains that ensure product authenticity, timely availability, and regulatory compliance. These channels include medical wholesalers, distributors, and direct sales representatives who maintain strong relationships with healthcare institutions and facilitate bulk purchases. The preference for offline channels is also driven by the need for personalized customer support, product demonstrations, and professional training offered by sales teams, which is crucial in a clinical setting. In addition, many healthcare facilities rely on group purchasing organizations and tenders that operate predominantly through offline networks to negotiate better pricing and secure reliable supplies.

The online distribution channel is expected to grow at the fastest CAGR over the forecast period, driven by increasing internet penetration, rising consumer awareness, and the growing preference for convenient, direct-to-consumer purchasing. Patients and caregivers managing chronic wounds or minor injuries at home turn to online platforms for easy access to a wide range of wound gel products, benefiting from detailed product information, reviews, and competitive pricing.

Key U.S. Wound Gel Company Insights

Medline Industries, LP, Coloplast Corp, Mölnlycke Health Care AB, Solventum, Convatec Inc., Cresilon, Smith+Nephew, and B. Braun SE are some of the major players in the U.S. market. The industry players are undertaking several strategic initiatives such as acquisitions, partnerships, and collaborations. Moreover, the launch of novel products is anticipated to boost the competitive rivalry in the U.S. market.

Key U.S. Wound Gel Companies:

- Medline Industries, LP.

- Coloplast Corp

- Mölnlycke Health Care AB

- Solventum

- Convatec Inc.

- Cresilon

- Smith+Nephew.

- B. Braun SE

- DermaRite Industries, LLC.

- Integra LifeSciences Corporation.

- Sanara MedTech Inc.

Recent Developments

-

In February 2025, the South Carolina Burn Center at the Medical University of South Carolina (MUSC) and the Zucker Institute for Innovation Commercialization (ZI) announced a strategic partnership with Chitozan Health to develop advanced antimicrobial burn and wound gels to improve patient outcomes. This collaboration focuses on creating innovative gel formulations designed to rapidly control infections, maintain wound moisture, and support natural healing processes. The gels are intended for easy application over burn surfaces, forming an immediate protective barrier against contaminants and infection.

-

In January 2025, Cresilon, a biotechnology company specializing in hemostatic medical device innovations, launched TRAUMAGEL in the U.S. market. This plant-based hemostatic gel is designed to rapidly control bleeding within seconds when applied directly to wounds at the point of care. Following U.S. FDA 510(k) clearance for temporary external use in managing moderate to severe bleeding, TRAUMAGEL is commercially available nationwide.

U.S. Wound Gel Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.22 billion

Revenue forecast in 2033

USD 3.47 billion

Growth rate

CAGR of 5.71% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends, and volume analysis

Segments covered

Product, antimicrobial properties, application, end-use, mode of purchase, distribution channel

Country Scope

U.S.

Key companies profiled

Medline Industries, LP; Coloplast Corp; Mölnlycke Health Care AB; Solventum; Convatec Inc.; Cresilon; Smith+Nephew; B. Braun SE; DermaRite Industries, LLC.; Integra LifeSciences Corporation; Sanara MedTech Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Wound Gel Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. wound gel market report based on product, antimicrobial properties, application, distribution channel, mode of purchase, and end-use:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Dressings

-

Hydrogel dressing

-

Gelling fiber dressings

-

Others

-

-

Gels

-

-

Antimicrobial Properties Outlook (Revenue, USD Million, 2021 - 2033)

-

Silver (Ag+)

-

Non-Silver

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Chronic Wounds

-

Diabetic Foot Ulcers (DFUs)

-

Pressure Ulcers

-

Stage 1

-

Stage 2

-

Stage 3

-

Stage 4

-

-

Leg Ulcers

-

-

Acute Wounds

-

Surgical Incisions

-

Burns

-

1st Degree

-

2nd Degree

-

3rd Degree

-

-

Lacerations, Abrasions

-

-

-

Mode of Purchase Outlook (Revenue, USD Million, 2021 - 2033)

-

Prescription

-

Non-prescription

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Offline

-

Online

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Specialty Clinics

-

Ambulatory Surgery Centers

-

Homecare Settings

-

Long-Term Care Facilities

-

Others

-

Frequently Asked Questions About This Report

b. The global U.S. wound gel market size was estimated at USD 2.11 billion in 2024 and is expected to reach USD 2.22 billion in 2025.

b. The global U.S. wound gel market is expected to grow at a compound annual growth rate of 5.71% from 2025 to 2033 to reach USD 3.47 billion by 2033.

b. The dressings segment dominated the U.S. wound gel market with a share of 59.33% in 2024. This dominance is attributed to the widespread use of advanced wound dressings that provide an optimal healing environment by maintaining moisture balance, protecting against infections, and facilitating faster tissue regeneration.

b. Some key players operating in the U.S. wound gel market include Medline Industries, LP, Coloplast Corp, Mölnlycke Health Care AB, Solventum, Convatec Inc., Cresilon, Smith+Nephew, B. Braun SE, DermaRite Industries, LLC., Integra LifeSciences Corporation, and Sanara MedTech Inc.

b. The U.S. wound gel market is driven by the rising prevalence of chronic wounds, such as diabetic foot ulcers and pressure sores. These conditions affect millions of Americans and create strong demand for effective wound care solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.