- Home

- »

- Animal Health

- »

-

Veterinary AI Diagnostics Market Size, Industry Report, 2033GVR Report cover

![Veterinary AI Diagnostics Market Size, Share & Trends Report]()

Veterinary AI Diagnostics Market (2025 - 2033) Size, Share & Trends Analysis Report By Solution (Hardware, Software & Services), By Animal (Production Animals, Companion Animals), By Application (Imaging, Pathology), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-817-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Veterinary AI Diagnostics Market Summary

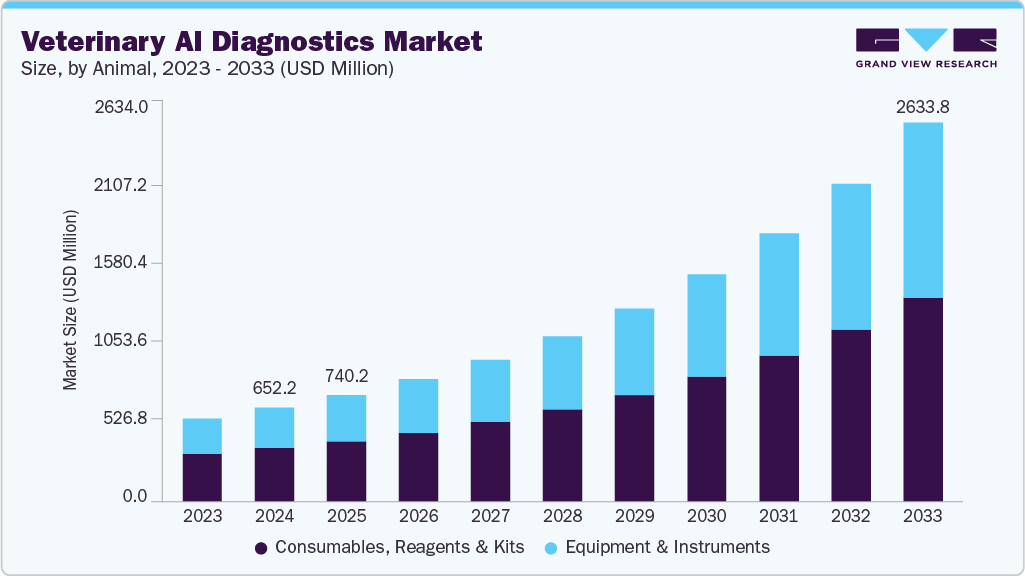

The global veterinary AI diagnostics market size was estimated at USD 652.23 million in 2024 and is projected to reach USD 2,633.8 million by 2033, growing at a CAGR of 17.2% from 2025 to 2033. The market is propelling due to factors such as rapid digital transformation of veterinary workflows, surge in animal health data & connectivity, utilization of advanced AI algorithms enabling precision diagnostics, and growing demand for early detection & preventive care in animals.

Key Market Trends & Insights

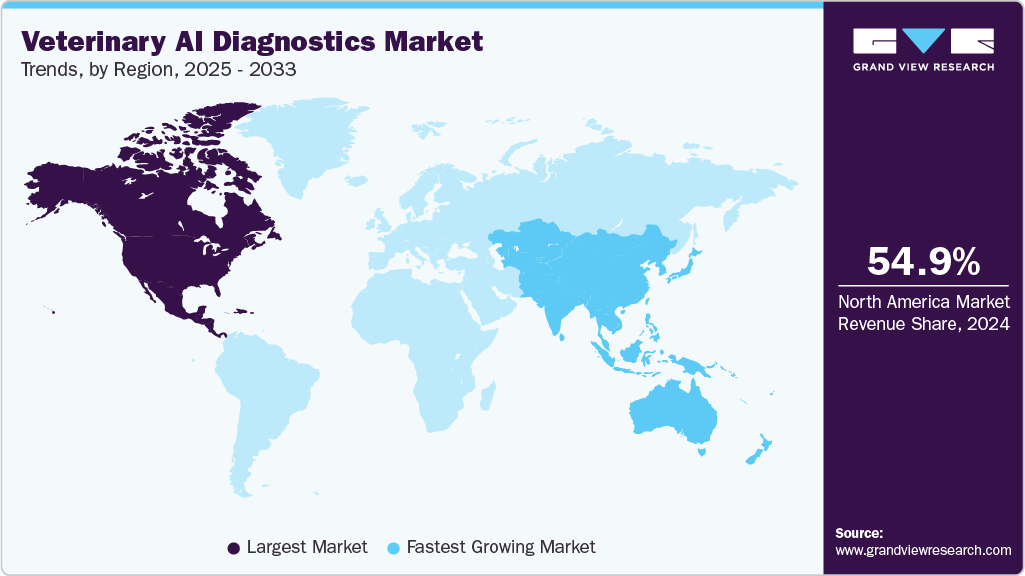

- North America veterinary AI diagnostics industry held the largest revenue share of around 54.85% in 2024.

- The U.S. dominated the North America region with the largest revenue share in 2024.

- By solutions, the software & services segment held the largest share of about 58% of the market in 2024.

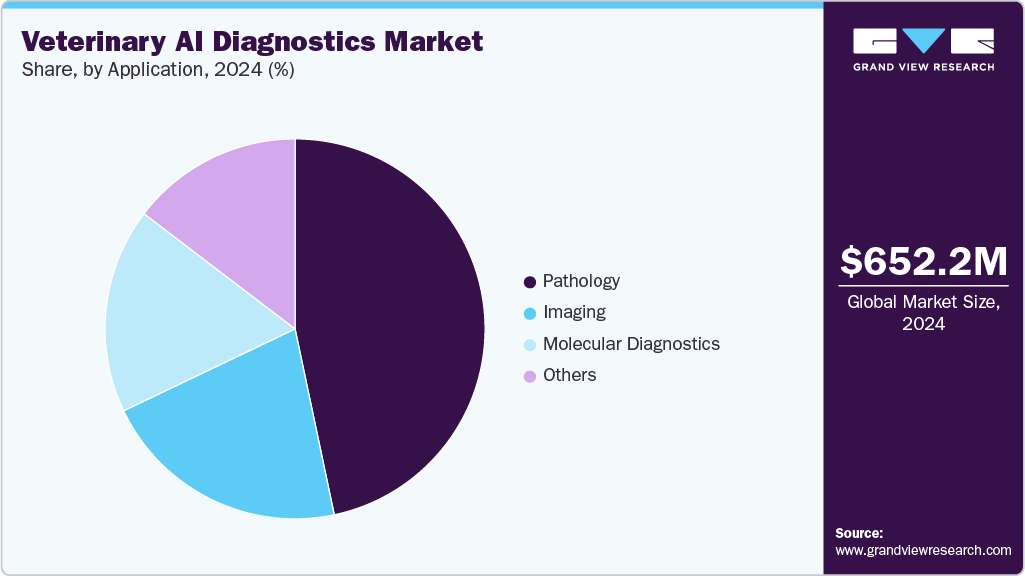

- By application, the pathology segment held the largest market share in 2024.

- Based on animal, the companion animals segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 652.23 Million

- 2033 Projected Market Size: USD 2,633.8 Million

- CAGR (2025-2033): 17.2%

- North America region: Largest market in 2024

- Asia Pacific region: Fastest growing market

Rising clinic caseloads, staff shortages, expanding diagnostic data, faster model performance, and stronger demand for early detection are adding steady momentum to AI adoption in veterinary diagnostics. Clinics are facing heavier daily volumes and reduced specialist availability, so AI tools that speed up image review, cut repeat tests, and support routine triage are becoming part of core clinical work. Reference laboratories are managing larger sample counts each year, and AI automation is raising throughput, lowering per-test cost, and improving consistency across technicians, which drives wider acceptance in high-volume settings.Research groups are adding further momentum by showing that practical model performance is possible even with focused datasets. A 2025 University of Edinburgh study trained algorithms on about 500 CT scans and produced stable readings, and results like this build trust among clinicians who want tools that work with real-world data rather than large experimental datasets. Farm systems are also generating pressure for adoption. Wearables, cameras, and this information into alerts that prompt earlier testing and faster intervention, which links herd surveillance continuous monitors are producing round-the-clock data on movement and feeding patterns, and AI converts directly to diagnostics.

Manufacturers are responding to these shifts by embedding AI tools inside scanners, analyzers, and cloud portals so clinicians receive processed results without extra effort. Product teams are mapping full diagnostic pathways and creating guided workflows that help users move from sample collection to interpretation in one integrated flow. Companies that package AI inside existing hardware are gaining quicker uptake among clinics that trust those devices, while cloud platforms are gaining stable subscription revenue from groups that value remote access and automatic updates. Demand is rising fastest when AI reduces reading time, raises repeatability, and sorts routine cases from complex ones, as these gains shape purchasing decisions across clinics and laboratories.

Many stakeholders are currently utilizing narrow datasets that may generalize across breeds, ages, and production systems, and overlook the variation in image quality and disease expression across populations. Others assume stable broadband and modern lab information systems everywhere, which ignores rural clinics and farms with limited connectivity. Some groups assume that AI will replace specialist judgment, but experienced clinicians note that AI acts as a support layer that highlights patterns, flags edge cases, and standardizes routine assessments while leaving complex reasoning to trained professionals.

Regulatory systems are moving slower than technical progress, and uneven rules across regions can limit scale. To capture growth, companies will need multi-site validation, simple offline modes, and partnerships with laboratories that hold deep archives of labeled data. As these steps advance, AI in veterinary diagnostics is moving from early trials into routine use, and the sector is growing where tools shorten workflows, steady interpretation quality, and turn diagnostic output into clear clinical action. The market is on the brink of transformation and organizations that align with these trends are set to shape the future of care.

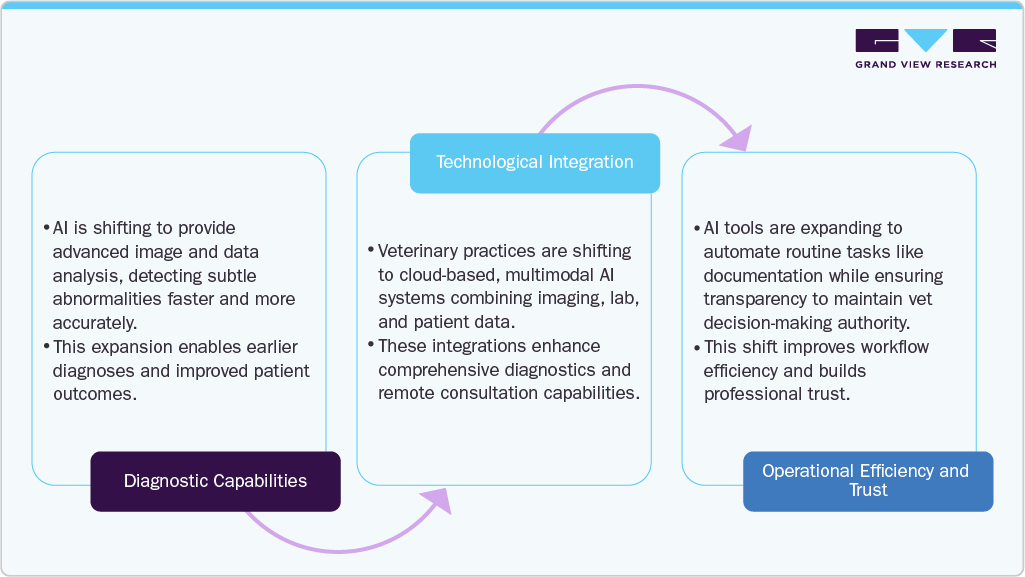

Evolution Of AI In Veterinary Diagnostics

AI-powered diagnostics and decision support tools are expanding to analyze patient data, suggest conditions, and recommend treatments, thereby improving diagnostic accuracy and operational efficiency.

The evolution of AI in veterinary diagnostics illustrates a shift towards smarter, data-driven veterinary practices where AI acts as an empowering partner-enhancing diagnostics, improving client communication, and optimizing patient outcomes without replacing the crucial veterinarian expertise.

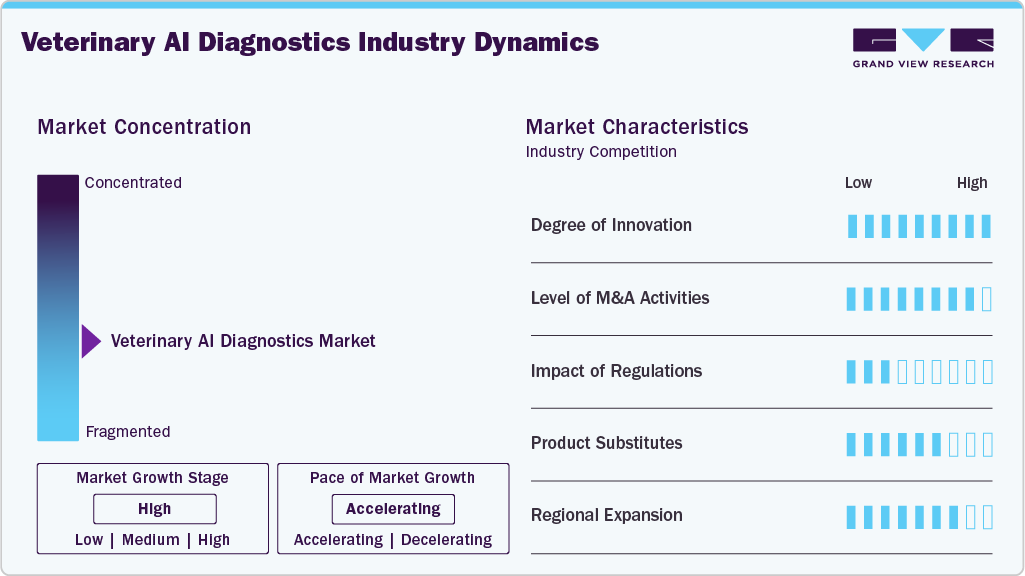

Market Concentration & Characteristics

The veterinary AI diagnostics industry has historically been fragmented, with small AI startups experimenting alongside established diagnostic firms. Today, the market is becoming moderately concentrated as major players like IDEXX, Zoetis, and advanced imaging/lab platforms gain an advantage through large proprietary datasets, integrated devices, and strong clinic networks. Over the next few years, concentration is expected to deepen as these leaders expand cloud ecosystems and acquire niche AI companies, while smaller firms increasingly rely on partnerships to access data and achieve validation at scale.

Innovation in veterinary AI diagnostics is accelerating as imaging, cytology, and workflow-automation models become more accurate, faster, and embedded directly into diagnostic hardware. Breakthroughs like Zoetis’ June 2025 AI-enabled cytology capability illustrate how intelligent systems are shifting from optional add-ons to core diagnostic functions. As algorithms improve in real-world performance and support broader case types, clinics and labs increasingly treat AI as an essential diagnostic layer rather than an experimental tool.

Industry consolidation is steadily rising as companies pursue AI expertise, proprietary datasets, and integrated diagnostic ecosystems. Partnerships such as the October 2025 Scribble Vet-Vetology agreement reflect a market that is moving toward interoperable, AI-driven radiology and pathology workflows. As competitive pressure grows, more firms are expected to acquire specialized AI startups to strengthen imaging automation, expand cloud-based platforms, and accelerate market penetration.

Regulatory impact remains limited, with inconsistent standards around model validation, ethical data use, performance auditing, and integration with medical devices. This low-moderate influence is expected to increase as authorities develop structured frameworks to ensure transparency, algorithmic fairness, and species-specific accuracy. As guidelines mature, they will play a larger role in shaping product design, clinical adoption timelines, and cross-border commercialization.

Traditional diagnostics such as manual cytology, conventional imaging reads, or basic herd monitoring, etc. remain available but offer limited scalability and consistency compared with AI-powered workflows. Substitution pressure is declining as AI demonstrates reproducible interpretation, lower per-case time, and better triage accuracy. As costs fall and integration becomes seamless, AI is expected to progressively displace manual or semi-automated diagnostic approaches across both companion animal and livestock settings.

Veterinary AI diagnostics are expanding rapidly across North America and Europe, supported by advanced clinic networks and strong digital infrastructure, while Asia-Pacific growth is fueled by large patient volumes and government-backed innovation programs. Partnerships such as the September 2025 Aiforia-Siemens Healthineers signal broader European scaling of AI-pathology tools, and emerging markets are adopting AI for disease surveillance, imaging automation, and herd productivity. This widening geographic adoption reflects a sector transitioning from early pilots to globally distributed clinical and agricultural deployment.

Solution Insights

The software & services segment dominated the market with the largest revenue share of around 58% in 2024 and is expected to grow at the fastest CAGR over the forecast period. The dominance can be attributed to the fact that core diagnostic value comes from the algorithms, cloud platforms, and interpretation tools that sit behind each test rather than from the hardware that captures the image or sample. Clinics depend on subscription-based AI tools that read cytology slides, flag abnormalities on radiographs, and streamline pathology workflows, and these systems update often, learn from new datasets, and improve accuracy over time. This creates steady recurring revenue and keeps software at the center of adoption. Service layers such as model training, remote expert review, integration support, and workflow setup strengthen this position by helping clinics use the tools without adding staff time. Hardware devices follow slower replacement cycles and produce lower long-term spend, so their share grows at a slower pace. As test volumes rise and AI becomes routine in screening and triage, the pull toward cloud analytics, automated reporting, and continuous model upgrades keeps software and services in the dominant position and sets the stage for the fastest future growth.

The hardware segment is the second largest segment because most clinics still rely on imaging systems, digital cytology devices, analyzers, and sensor-based tools that capture the raw data needed for AI interpretation. These devices anchor the workflow and shape the quality of each scan or sample, so clinics continue to invest in upgraded cameras, scanners, and point-of-care units. Replacement cycles are slower than software spending but remain steady because better hardware improves resolution and feeds cleaner inputs into AI models. As more clinics adopt AI-ready machines, hardware keeps a strong share, though its growth stays below the faster pace of software and services.

Animal Insights

The companion animals segment held the largest revenue share in 2024, owing to rising pet ownership, higher spending on preventive and advanced care, and a steady shift toward early diagnosis for chronic and acute conditions. Clinics are seeing more imaging, cytology, and lab testing requests for dogs and cats, which creates strong demand for AI tools that speed up reads and raise accuracy. Pet owners expect quicker answers and are willing to pay for tests supported by AI-assisted reporting, so clinics invest in these systems to improve service quality and manage growing caseloads. Insurers are also covering a wider range of diagnostic procedures, which raises testing volumes and pushes companion animal practices to adopt AI to keep turnaround times short and maintain consistent readings across routine and complex cases.

The production animals segment is anticipated to register the fastest CAGR over the forecast period, because farms are expanding the use of digital monitoring, automated imaging, and sensor-based health tracking that produce large data streams suited for AI analysis. Producers want earlier detection of respiratory, metabolic, and reproductive issues, since even small delays raise economic losses, and AI tools turn continuous field data into quick diagnostic signals that guide targeted testing. Large herds also push demand for scalable systems that cut labor pressure and standardize decisions, and AI supports this by screening high-volume samples and flagging cases before clinical signs appear. Growing interest in herd-level surveillance, trade compliance, and welfare reporting further adds momentum, making production settings a key driver of future AI diagnostic adoption.

End Use Insights

The veterinary clinics segment held the largest revenue share in 2024 because most AI diagnostic tools are deployed at the point of care, where daily case volumes are highest and faster decisions matter most. Clinics rely on AI to read images, flag abnormalities, and cut routine interpretation time, which helps them manage rising caseloads with limited staff. Many vendors design software that fits directly into clinic workflows, so adoption is faster than in other settings. Clinics also run frequent tests for chronic and acute cases, which raises recurring use of AI-supported platforms and keeps this segment ahead in revenue.

The research & academic institutes segment is projected to witness the fastest CAGR over the forecast period. Institutes are investing heavily in AI-enhanced diagnostic tools and imaging systems to improve veterinary research and training. They are leveraging larger datasets and deep-learning models to increase accuracy, speed up validation, and streamline study workflows. Government and private grants are supporting these initiatives, while partnerships with veterinary clinics provide opportunities for real-world testing and data collection. Rising demand for faster, high-quality diagnostics across companion and production animals is driving the segment’s strong growth. Together, these factors are positioning academic and research institutes at the forefront of veterinary AI diagnostics.

Application Insights

The pathology segment dominated with the largest revenue share in 2024. This dominance is because digital and AI-assisted pathology reads offer high value, rapid turnaround, and quality improvements compared to manual techniques. Use of whole-slide imaging and machine-learning models for tissue, cytology, and hematology cases increased significantly, enabling pathologists to handle higher volumes and support referral workflows. Clinics and labs are increasingly investing in AI-enabled pathology platforms to meet rising demand for early disease detection, particularly in companion animals, where pet owners favor advanced diagnostics and are willing to pay a premium. As logistic and labor pressures mount, pathology workflows became a priority for AI vendors and adopters alike, securing the largest revenue share for the segment.

The imaging segment is expected to achieve the fastest CAGR during the forecast period. The growth is driven by increasing deployment of AI-enhanced radiography, CT, MRI and ultrasound tools in veterinary clinics and hospitals. Increasing industry partnerships are expanding access to advanced imaging diagnostics. Larger datasets and deep-learning models for image interpretation are now becoming increasingly available, helping reduce turnaround times, improve detection rates of fractures, masses and organ abnormalities, and streamline workflows. Rising demand from both companion-animal and production-animal sectors for faster, high-quality imaging, combined with the push for real-time diagnostics, positions this segment for strong growth.

Regional Insights

North America veterinary AI diagnostics industry dominated the global market with the largest revenue share of 54.85% in 2024.This dominance can be attributed to the high adoption of advanced diagnostic technologies in clinics and hospitals. Strong funding from government programs and private investors supports AI research and implementation. Well-established veterinary infrastructure and large companion and production animal populations drive demand for faster, accurate diagnostics. Collaborations between research institutes, tech companies, and veterinary networks accelerate AI deployment. Increasing awareness of animal health and preventive care further boosts adoption. These combined factors make North America the largest and most advanced market in the region.

U.S. Veterinary AI Diagnostics Market Trends

The veterinary AI diagnostics industry in the U.S. accounted for the highest market share in the North America market, owing to a combination of strong investment, advanced infrastructure and high demand for modern tools. Clinics and diagnostic labs are adopting AI‑enhanced imaging and software systems to improve accuracy and reduce turnaround times. Research institutions and tech firms are collaborating to develop large datasets and deep‑learning models tailored to U.S. companion and livestock animals. Funding from both government and private sources is supporting these developments and accelerating innovation. All of these elements are working together to make the U.S. the dominant force in the veterinary AI diagnostics market.

The Mexico veterinary AI diagnostics industry is expected to grow at a significant CAGR during the forecast period.Rising pet ownership and the expansion of affordable veterinary clinic chains are driving demand for smarter diagnostic tools. Meanwhile, increasing investment in AI‑based services and software is enabling clinics to adopt advanced imaging and predictive analytics. Growing awareness of livestock health and export requirements is also pushing diagnostics upgrades in production‑animal sectors. This combination of demand and investment sets the stage for notable market growth.

Europe Veterinary AI Diagnostics Market Trends

The veterinary AI diagnostics industry in Europe is growing steadily because regional players are rolling out new, AI‑enhanced diagnostic tools such as the September 2025 launch of AI‑powered hematology analyzer by Zoetis. The region is receiving more investment in image‑based diagnostics and deep‑learning platforms, while veterinary clinics and hospitals are updating equipment and workflows to support real‑time analysis. At the same time, regulatory support and the presence of strong veterinary research networks in countries like Germany and the UK are helping build large datasets and standards for AI use. Growing demand for high‑accuracy diagnostics in companion animals and livestock is driving adoption across Europe. These factors are combining to push the European market toward a leading position in veterinary AI diagnostics.

Veterinary AI diagnostics industry in the UK is expected to dominate the European region in 2024. The market is gaining traction because clinics are rolling out advanced AI‑based cytology tools that analyse lymph node and skin lesions in‑house. Industry players are expanding accessible platforms that combine AI and expert review in real time, thereby shortening diagnosis times. Veterinary practices are adapting workflows to integrate AI systems that support more precise decision‑making. Strong demand for rapid, high‑quality diagnostics in companion‑animal practices is accelerating uptake of these innovations. These conditions position the UK to lead the European region in veterinary AI diagnostics.

The Sweden veterinary AI diagnostics industry is expected to grow at the fastest CAGR over the forecast period. The country’s growth is influenced by its strong national push on AI education and research. Through the “AI Competence for Sweden” initiative, universities like Gothenburg are building deep expertise across medicine, computer science, and ethics. The University of Gothenburg’s AI Engineering Lab is working closely with industry to develop practical AI tools for diagnostics. Meanwhile, grants from the Swedish Research Council are fueling projects on AI‑based decision support in healthcare. This rich ecosystem of talent, funding, and collaboration is driving rapid innovation and adoption in veterinary diagnostics.

Asia Pacific Veterinary AI Diagnostics Market Trends

Asia Pacific veterinary AI diagnostics industry is expected to grow at the fastest CAGR over the forecast period.The region's growth can be attributed regional tech leaders scaling up AI tools for animal health. For example, SK Telecom expanding its “X Caliber” AI diagnosis assistant into Southeast Asia, and Australia to serve rapidly growing pet‑care markets. In China and India, governments and private firms are supporting AI solutions for livestock disease surveillance and diagnostics. Meanwhile, Australia is seeing AI tools being used to ease administrative burden in vet clinics, while South Korea continues to lead with advanced imaging‑AI integrations. These country‑level investments and innovations are driving strong regional momentum.

The veterinary AI diagnostics industry in China held the largest revenue share in the region andis witnessing new growth opportunities. Veterinarians in the country are increasingly adopting AI tools for daily clinical work. They are using AI to read images, support diagnosis, and guide dose decisions with growing confidence. Clinics are investing in software that speeds up case review and reduces routine workload. Researchers are expanding training programs that help vets apply AI in real cases. This steady, practical use of AI is opening new growth paths and strengthening the country’s position in the market.

The industry for veterinary AI diagnostics in India is projected to witness the fastest CAGR over the forecast period in the region.The growth is supported by clinics and labs adopting AI-based imaging and software tools to speed up diagnosis of pets and livestock. Digital platforms start supporting remote monitoring and early disease detection for small animals and production herds. Investments from startups and enterprise players are fueling infrastructure upgrades and AI tool deployment. These trends together are driving robust demand and rapid growth in India’s veterinary AI diagnostics space.

Latin America Veterinary AI Diagnostics Market Trends

The veterinary AI diagnostics industry in Latin America is poised for strong growth, driven by rising companion-animal ownership and the growing demand for faster, more accurate diagnostic workflows. Adoption is also accelerating as clinics integrate AI-enabled imaging and pathology tools to offset specialist shortages. Increasing investment from global diagnostic firms and supportive digital-health initiatives further strengthen market momentum.

Brazil veterinary AI diagnostics industry is gaining momentum, due as local researchers and breeders increasingly applying AI models to improve traits, health assessment, and efficiency in livestock and aquaculture. This growing familiarity with AI tools is encouraging wider adoption in clinical diagnostics, particularly in imaging and pathology. Rising digitalization across veterinary practices and demand for faster, more consistent diagnostic support further accelerate market uptake.

Middle East & Africa Veterinary AI Diagnostics Market Trends

The veterinary AI diagnostics industry in MEA is expanding as researchers from countries such as South Africa are using AI to monitor wildlife health and detect disease early, enhancing ecology and conservation management. This growing use of AI in wildlife disease surveillance is paving the way for adoption in broader veterinary contexts, like livestock and companion animals. At the same time, increased investment in digital infrastructure and conservation-driven funding is helping scale diagnostic AI across the region.

UAE veterinary AI diagnostics industry is expanding, fueled by the introduction of advanced AI-enabled digital cytology systems in the country’s diagnostic ecosystem. Growing adoption of deep-learning tools among leading laboratories is creating spillover momentum for veterinary imaging and pathology. Strong national investment in innovation, digital health infrastructure, and rapid technology uptake further accelerates the shift toward AI-driven diagnostics in veterinary settings.

Key Veterinary AI Diagnostics Company Insights

The veterinary AI diagnostics industry is moving toward moderate consolidation as major players such as IDEXX, Zoetis, Antech, SignalPET, and Vetology gain ground through integrated platforms and extensive clinical networks. These companies are strengthening their positions by combining AI with imaging, cytology, and lab workflows, increasing their share of overall diagnostic volumes. Competitive momentum is further shaped by strategic collaborations and selective acquisitions that enhance data access and model performance. Smaller companies are increasingly aligning with larger platforms to scale their technologies and achieve broader market validation. With expanding adoption across established and emerging regions, leading companies are steadily widening their competitive edge.

Key Veterinary AI Diagnostics Companies:

The following are the leading companies in the veterinary AI diagnostics market. These companies collectively hold the largest market share and dictate industry trends.

- IDEXX Laboratories

- Zoetis

- SignalPET

- Radimal

- Vetology

- Aiforia

- Scopio Labs

- Moichor

- Mars, Inc

- Covetrus

- VetCT

- AITEM Solutions

- ImpriMed

- Felcana

- PetPace

- smaXtec

- CattleEye

- AI for Pet

Recent Developments

-

In November 2025, Vetology and dvmGRO have forged a strategic partnership that integrates Vetology’s AI-powered radiology reports and teleradiology services into the dvmGRO member network, enabling independent veterinary practices to access advanced diagnostic tools. This collaboration aims to enhance workflow efficiency and diagnostic accuracy for member clinics by offering scalable AI-enabled support and tailored implementation assistance.

-

In November 2025, Digital Landia Holding Corp released a comprehensive technical whitepaper for its AgenticPet AI Framework after a year of development and stress-testing, detailing a multi-agent architecture with nine diagnostic agents, real-world performance benchmarks, and five patent-pending innovations.

-

In October 2025, MI:RNA, a Scottish veterinary diagnostics company, secured funding to develop an AI-based tool using microRNA biomarkers in blood to enable earlier and non-invasive detection of osteoarthritis in dogs. The initiative aims to reduce reliance on conventional imaging and subjective assessment by pairing biomarker profiling with advanced modelling for more precise diagnosis and staging.

-

In May 2025, Antech Diagnostics (Mars, Inc.) launched RapidRead Dental, an AI-powered radiology interpretation tool designed to evaluate dental radiographs in veterinary settings with approximately 98% accuracy and a turnaround time of about 10 minutes.

Veterinary AI Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 740.17 million

Revenue forecast in 2033

USD 2,633.83 million

Growth Rate

CAGR of 17.2% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Solution, animal, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Thailand; South Korea; Australia; Brazil; Argentina; South Africa; UAE; Saudi Arabia; Kuwait; Qatar; Oman

Key companies profiled

IDEXX Laboratories; Zoetis; SignalPET; Radimal; Vetology; Aiforia; Scopio Labs; Moichor; Mars, Inc; Covetrus; VetCT; AITEM Solutions; ImpriMed; Felcana; PetPace; smaXtec; CattleEye; AI for Pet

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary AI Diagnostics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global veterinary AI diagnostics market report based on solution, animal, application, end use, and region:

-

Solution Outlook (Revenue, USD Million, 2021 - 2033)

-

Hardware

-

Software & Services

-

-

Animal Outlook (Revenue, USD Million, 2021 - 2033)

-

Companion Animals

-

Production Animals

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Imaging

-

Pathology

-

Molecular Diagnostics

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Veterinary Clinics & Hospitals

-

Veterinary Reference Laboratories

-

Research & Academic Institutes

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

Saudi Arabia

-

Kuwait

-

Qatar

-

Oman

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.