- Home

- »

- Animal Health

- »

-

Veterinary Antimicrobial Susceptibility Testing Market Report 2033GVR Report cover

![Veterinary Antimicrobial Susceptibility Testing Market Size, Share & Trends Report]()

Veterinary Antimicrobial Susceptibility Testing Market (2025 - 2033) Size, Share & Trends Analysis Report By Animal, By Product (Accessories & Consumables, Automated AST Instruments), By End-use (Veterinary Reference Lab, Vet Research Institutes), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-330-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Veterinary Antimicrobial Susceptibility Testing Market Summary

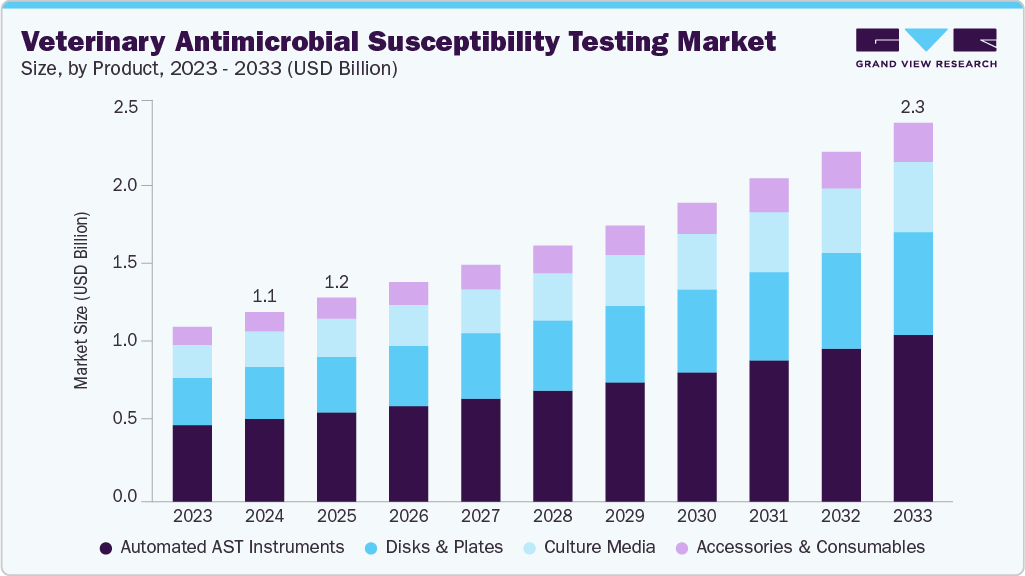

The veterinary antimicrobial susceptibility testing market size was estimated at USD 1.13 billion in 2024 and is projected to reach USD 2.26 billion by 2033, growing at a CAGR of 8.06% from 2025 to 2033. The market is experiencing growth driven by rising regulatory & training initiatives among leading veterinary organizations, the growing potential of Artificial Intelligence (AI) in AST, growth in companion animal ownership and veterinary care, and growing Antimicrobial Resistance (AMR) among animals.

Key Market Trends & Insights

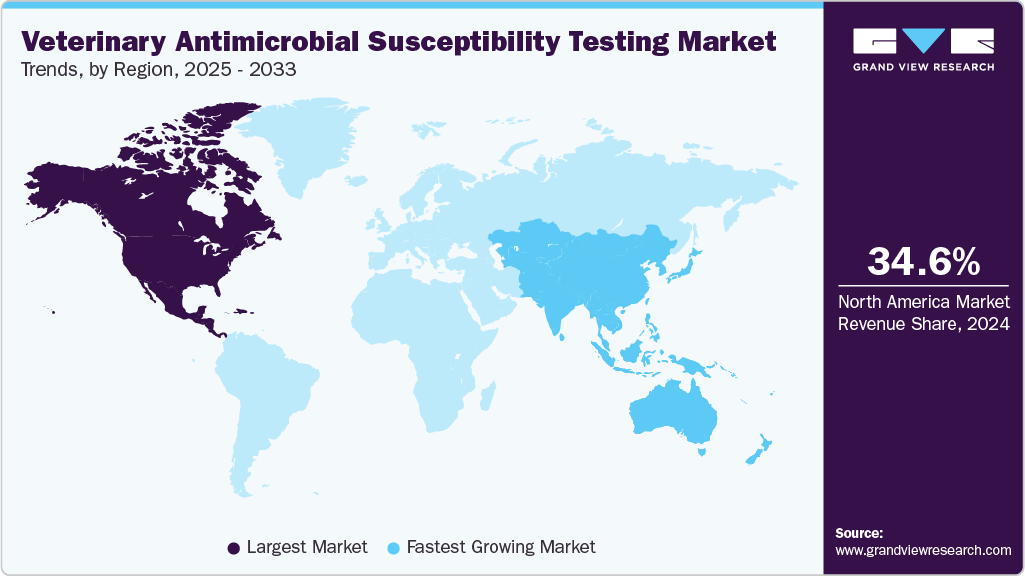

- North America dominated the veterinary antimicrobial susceptibility testing market with the largest revenue share of 34.59% in 2024.

- The veterinary antimicrobial susceptibility testing market in the U.S. accounted for the largest market revenue share in North America in 2024.

- By product, the automated AST instruments segment led the market with the largest revenue share of 43.33% in 2024.

- Based on animal, the production animal segment accounted for the largest market revenue share of 65.86% in 2024.

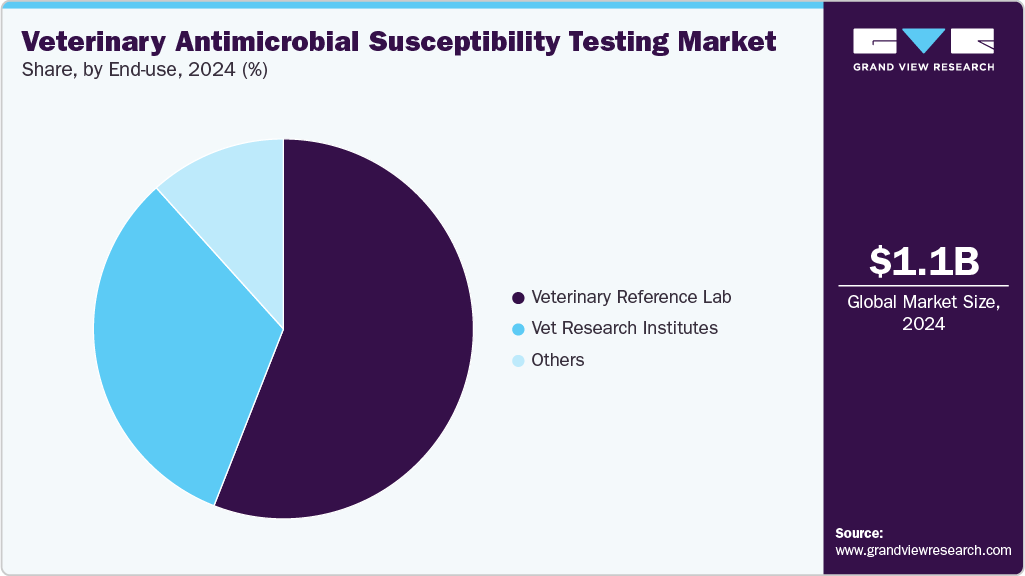

- By end-use, the veterinary reference lab segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.13 Billion

- 2033 Projected Market Size: USD 2.26 Billion

- CAGR (2025-2033): 8.06%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Veterinary professionals rely on Antimicrobial Susceptibility Testing (AST) to choose the most effective treatment for animal diseases. This testing identifies bacterial pathogens and determines antimicrobial agents that will deliver the best therapeutic outcomes, reducing the risk of antimicrobial resistance (AMR). For instance, in April 2025, Almaty hosted Kazakhstan’s first FAO-led veterinary AST training, equipping specialists with international-standard skills to enhance AMR surveillance and strengthen national laboratory capacity, advancing One Health-driven animal and public health security. Such initiatives reinforce countries' laboratory capabilities, aligning veterinary practices with global One Health standards for sustainable health security.Some of the leading veterinary organizations are driving improvements in AST by releasing standardized reference materials and practical resources. These initiatives empower veterinarians to make data-driven treatment decisions, enhance diagnostic accuracy, and promote responsible antimicrobial use, ultimately improving clinical outcomes and supporting sustainable animal health practices. For instance, in January 2024, the American Veterinary Medical Association (AVMA) strengthened its leadership in antimicrobial stewardship by publishing more than six comprehensive documents on animal antimicrobial susceptibility testing. These resources guide veterinary professionals in selecting the most effective antimicrobial therapies and predicting treatment outcomes for a wide range of bacterial infections.

The documents provide standardized guidelines for assessing pathogen sensitivity and resistance across multiple antimicrobial agents, enabling veterinarians to make rapid, evidence-based decisions for various animal species, including dogs, cats, cattle, poultry, and pigs. In addition, AVMA’s antimicrobial stewardship program promotes responsible antimicrobial use, aiming to optimize treatment efficacy, improve patient outcomes, and reduce the spread of antimicrobial resistance and multidrug-resistant infections.

The growing integration of Artificial Intelligence (AI) in Antimicrobial Susceptibility Testing (AST) is transforming veterinary diagnostics by improving accuracy, efficiency, and standardization. AI-driven platforms, such as the launch of CarbConnect’s ZOI VET automates zone of inhibition analysis in disk diffusion tests in May 2025, minimize human error and enable rapid, consistent interpretation of results. This advancement enhances antimicrobial selection, supports real-time data sharing, and strengthens resistance monitoring across veterinary networks. As livestock health systems embrace digitization, AI-powered AST tools are addressing labor shortages, improving diagnostic accessibility in rural areas aligning with global AMR surveillance efforts.

Rising pet ownership and increasing expenditure on companion animal health are driving demand for advanced diagnostic and therapeutic solutions. According to a report published in January 2025, approximately 66% of U.S. households, representing about 86.9 million households, own a pet. Pet owners are drawn towards advanced, evidence-based healthcare for their animals. Veterinarians rely on AST to accurately diagnose bacterial infections and select effective antimicrobial therapies. Veterinarians are increasingly using antimicrobial susceptibility testing to ensure targeted and effective treatment for bacterial infections in pets. This improves recovery rates, reduces antimicrobial misuse, and enhances client satisfaction.

Furthermore, rising misuse and excessive use of antibiotics in both livestock and companion animals have resulted in the development of multidrug-resistant bacterial strains. This highlights the necessity for efficient antimicrobial stewardship and diagnostic tools to promote proper antibiotic usage. Veterinary antimicrobial susceptibility testing (AST) allows for the identification of resistance patterns and aids in making informed treatment choices.

Consequently, veterinary clinics, research institutions, and diagnostic laboratories are increasingly implementing AST solutions to track resistance patterns, ensure animal welfare, and adhere to global antimicrobial resistance (AMR) containment efforts established by organizations such as the World Health Organization (WHO), the World Organisation for Animal Health (OIE), and the Food and Agriculture Organization of the United Nations (FAO).

Influence of AI in Veterinary Antimicrobial Susceptibility Testing (AST)

Aspect

AI Influence and Innovation

Standardization

AI tools provide standardized, accurate zone of inhibition measurement, reducing user variation.

Accessibility

AI platforms lower skill and cost barriers, expanding AST access in resource-limited veterinary settings and livestock farms.

Speed & Efficiency

Automated AI-based image analysis enables faster, high-throughput interpretation and sharing of AST results.

Clinical Application

AI supports tailored interfaces and drug panels for livestock, improving diagnostic decision-making and antimicrobial stewardship.

Surveillance & Public Health

AI-enhanced AST strengthens surveillance, research, and population-level antimicrobial resistance control efforts in livestock.

Market Concentration & Characteristics

The veterinary antimicrobial susceptibility testing industry is moderately concentrated, with a few global players like bioMérieux, Danaher, and Thermo Fisher dominating key segments. Smaller regional players exist but have limited scale. Competition is mainly based on product quality, accuracy, and laboratory support services. Entry barriers are moderate due to regulatory approvals and technical expertise required. Market consolidation is gradual, maintaining a mix of global and regional influence.

Companies offering veterinary antimicrobial susceptibility testing products such as disks & plates, culture media, and AST instruments are branching out into novel areas to exploit developing markets and increase their clientele. For instance, in July 2025, UK’s Veterinary Medicines Directorate (VMD) launched world’s first surveillance system to monitor antibiotic-resistant bacteria in healthy pets, enhancing understanding and strengthening efforts to protect both animal and human health.

M&A activity is moderate, with strategic acquisitions targeting technology enhancement, geographic expansion, or portfolio diversification. Larger firms often acquire smaller specialized diagnostic companies to strengthen veterinary offerings. Partnerships with regional distributors are common to increase market reach. Consolidation trends are expected to grow as demand for integrated AST solutions rises. Activity is influenced by the need to comply with global regulatory standards and expand service offerings.

Adhering to regulatory frameworks that guarantee the safety, efficacy, and quality of products utilized in testing antimicrobial susceptibility is vital for the veterinary antimicrobial susceptibility testing industry. The acceptance and approval of products are contingent upon complying with the regulations specific to each country regarding these diagnostic testing products. Major regulatory bodies are creating guidance documents to help veterinary practitioners uphold rapid and precise testing standards.

Substitutes include traditional culture-based testing, molecular diagnostics (PCR), and rapid pathogen identification kits. While AST remains essential for antimicrobial stewardship, some rapid diagnostic tests reduce reliance on conventional AST. Substitutes can offer faster results but often at higher costs or lower pathogen coverage. The choice depends on veterinary practice size, urgency, and pathogen type. Continuous innovation in molecular alternatives can gradually shift some market segments.

The veterinary antimicrobial susceptibility testing industry is experiencing strong regional expansion, driven by increasing awareness of antimicrobial resistance and government-supported surveillance initiatives. Emerging markets in Asia Pacific, Latin America, and the Middle East are investing in modern veterinary laboratories and AI-based diagnostic technologies, whereas North America and Europe continue leading through regulatory harmonization and advanced testing infrastructure.

Animal Insights

The production segment led the market with the largest revenue share of 65.86% in 2024, due to the high demand for livestock health management and disease prevention. Intensive farming practices in cattle, poultry, and swine increase the need for regular antimicrobial susceptibility testing. Governments and industry stakeholders emphasize preventive care to ensure food safety and productivity. Larger herd sizes and frequent veterinary interventions drive consistent testing volumes. In addition, higher economic stakes in production animals compared to companion animals make this segment more lucrative.

The companion segment is estimated to grow at the fastest CAGR from 2024 to 2033, owing to a rise in antimicrobial resistance (AMR) among them. For instance, a study published by Advances in Canine and Feline Nephrology and Urology in May 2025, antimicrobial susceptibility testing (AST) revealed Escherichia coli as the most frequently isolated bacterial species in both dogs of about 52.8% and cats of about 45.7%.Moreover, the rise in pet adoption globally leads to increased veterinary care expenditure. This rise in expenditure entails spending on pharmaceuticals, diagnostic services, etc. All these factors contribute towards higher chances of a rise in AMR among these companion animals, which promotes an increase in AST among them to select the best possible antimicrobial agent for treatment without the possibility of AMR.

Product Insights

The automated AST instruments segment accounted for the largest market revenue share in of 43.33% 2024. The market's expansion is diluted by the rising adoption of these instruments in various veterinary laboratories and their higher cost than other products. Also, these devices are subject to technological advancements like improvement in turnaround time and identification time, fueling growth. Furthermore, these instruments are increasingly penetrating newer markets, increasing product availability and penetration. This can be highlighted by the fact that bioMérieux, in their 2022 - 2023 investor presentation reported a 5% revenue growth due to AST instruments between 2017 - 2022.

The disks & plates segment is expected grow at the fastest CAGR over the forecast period. This market growth is expected due to its essential role in routine antimicrobial susceptibility testing. These consumables are widely used in both small and large veterinary laboratories, ensuring steady demand. Technological improvements in disk formulations and media compatibility enhance testing accuracy and efficiency. Growth in livestock and companion animal healthcare drives increased usage of these products. In addition, their relatively low cost and ease of use make them a preferred choice for veterinary diagnostics worldwide.

End-use Insights

The veterinary reference laboratories segment accounted for the largest market revenue share in 2024. This growth can be attributed to a maximum number of AST samples being tested in these facilities. These laboratories employ the latest diagnostic kits, culture media & advanced AST devices available for use in companion and production animals for activities such as government programs, research collaborations, etc. AST provides essential information to the veterinarian for selecting the most appropriate antimicrobial agent for a specific disease.

The veterinary research institutes segment is expected to grow at the fastest CAGR from 2025 to 2033. Increased expenditure on veterinary services, alongside the growing issue of antimicrobial resistance (AMR) in both companion and production animals, are driving the growth of this sector. These organizations are crucial in utilizing and advancing antimicrobial stewardship (AST) products. The primary roles of these institutions include pinpointing, implementing, and evolving innovative diagnostic methods and procedures for research and monitoring of new and existing animal diseases, as well as minimizing the excessive use of antibiotics.

Regional Insights

North America dominated the global veterinary antimicrobial susceptibility testing market with the largest revenue share of 34.59% in 2024. The market is growing due to rising pet ownership, antimicrobial resistance awareness, and stringent regulatory frameworks. Key players Thermo Fisher Scientific, Bio-Rad Laboratories, and IDEXX Laboratories lead with advanced, automated, and AI-enabled AST solutions. Continuous innovations in rapid diagnostics, cloud-based data integration, and standardized testing protocols strengthen market adoption and improve antimicrobial stewardship across veterinary practices.

U.S. Veterinary Antimicrobial Susceptibility Testing Market Trends

The veterinary antimicrobial susceptibility testing market in the U.S. accounted for the largest market revenue share in North America in 2024, owing to stringent regulatory control of FDA & USDA over AST in livestock for food safety, animal owners in the country adopting advanced diagnostic testing technologies for their production or companion animals, and livestock owners across the country. The National Antimicrobial Resistance Monitoring System (NARMS), established in 1996, tracks resistance in humans, food animals, and retail meats, providing critical data for FDA regulatory decisions and guiding veterinarians in effective antimicrobial use.

Europe Veterinary Antimicrobial Susceptibility Testing Market Trends

The veterinary antimicrobial susceptibility testing market in Europe is expanding steadily and is quite dynamic. The region is home to the largest standardization and guidance body, EUCAST which performs antimicrobial susceptibility testing. This provides first preference to the region’s AST guidance documents and novel methods, boosting the market growth. Furthermore, EU regulations on antimicrobial use in food animals require extensive testing, propelling the market growth.

The Germany veterinary antimicrobial susceptibility testing market is expected to grow at a significant CAGR over the forecast period. The market is highly competitive, driven by AI-enabled diagnostic instruments, advanced molecular testing techniques, and substantial investment in laboratory modernization. Stricter regulatory standards and integration into One Health surveillance systems further promote judicious antimicrobial use. The country has a strong research and development ecosystem to foster the creation of advanced testing products.

The veterinary antimicrobial susceptibility testing marketin UK is expected to grow at a significant CAGR over the forecast period. The country’s growth is influenced by technological advancements and one health initiatives. The Veterinary Medicines Directorate’s world-first study as reported in July 2025, on antibiotic resistance in healthy dogs and cats exemplifies efforts to generate critical AMR data, improve evidence-based veterinary interventions, and strengthen national antimicrobial stewardship practices.

Asia Pacific Veterinary Antimicrobial Susceptibility Testing Market Trends

The veterinary antimicrobial susceptibility testing market in Asia Pacific is expected to grow at the fastest CAGR over the forecast period. This can be attributed to the fact that this region is home to the world's highest number of livestock population. The region fulfills the world's demand for milk and animal-based protein. Governments are actively involved in ensuring the region maintains its dominance over livestock production, propelling the region's market growth. Moreover, a boost in pet adoption, increasing pet health expenditure, and a rise in the usage of antibiotics in animals are the factors driving the market in Asia Pacific countries, such as India and China.

The China veterinary antimicrobial susceptibility testing market is witnessing new growth opportunities due to public and industry awareness of AMR and rising technological adoption. The market growth can be attributed to the country’s decision to join the European Committee on Antimicrobial Susceptibility Testing (EUCAST). This organization is a body that provides standard methods and guidance for antimicrobial susceptibility testing.

The veterinary antimicrobial susceptibility testing market in India is poised for strong growth, driven by expanding livestock and poultry industries: and rising awareness of antimicrobial resistance. According to Department of Animal Husbandry and Dairying report of October 2024, India’s total livestock population comprises approximately 514.11 million in rural areas and 22.65 million in urban regions, highlighting the predominance of livestock in rural communities. Hence, this ensures mass adoption of AST products and services across the country, boosting the market.

Latin America Veterinary Antimicrobial Susceptibility Testing Market Trends

The veterinary antimicrobial susceptibility testing market in Latin America is growing rapidly, fueled by increasing pet ownership, and government policies and regional surveillance programs. Key players such as Thermo Fisher Scientific, Bio-Rad Laboratories, and IDEXX Laboratories lead with AI-assisted, automated AST platforms and rapid molecular diagnostics. These advancements enhance data accuracy, standardize testing, and support evidence-based antimicrobial stewardship across veterinary practices regionwide.

The Brazil veterinary antimicrobial susceptibility testing marketis gaining momentum, supported by its dependence on livestock production animals. A large livestock population increases demand for AST products like culture media, test kits, and AST instruments. In addition, the country’s Ministry of Agriculture (MAPA) is actively involved in scraping outdated regulations and introducing new guidelines to limit AMR among the animals in the country.

Middle East & Africa Veterinary Antimicrobial Susceptibility Testing Market Trends

The veterinary antimicrobial susceptibility testing market in the Middle East and Africa is growing, driven by rising livestock production, increasing awareness of antimicrobial resistance, and expanding companion animal ownership. Key players, including Thermo Fisher Scientific, Bio-Rad Laboratories, and IDEXX Laboratories, are introducing AI-enabled, automated, and molecular diagnostic platforms. These advancements enhance testing accuracy, standardization, and AMR surveillance across veterinary laboratories and farms.

The South Africa veterinary antimicrobial susceptibility testing marketaccounted for the largest market revenue share in Middle East & Africa in 2024, largely fueled by increasing antimicrobial resistance awareness, and growing demand for evidence-based veterinary care. Government initiatives and regional AMR surveillance programs encourage standardized testing practices. Adoption of automated and AI-enabled diagnostic platforms enhances testing accuracy, efficiency, and antimicrobial stewardship, supporting sustainable animal health management across farms and veterinary clinics.

The veterinary antimicrobial susceptibility testing market in UAE is experiencing growth due to expanding livestock and companion animal populations, and government-backed AMR initiatives. Key advancements include AI-enabled and automated AST platforms, molecular diagnostics, and integrated surveillance systems. One of the remarkable instance of December 2023 in which UAE-UK One Health AMR Biosecurity Consortium highlight international collaboration and knowledge exchange, strengthening evidence-based antimicrobial stewardship across veterinary, agriculture, and public health sectors.

Key Veterinary Antimicrobial Susceptibility Testing Company Insights

Some key players operating in the market include Becton, Dickinson, and Company, Thermo Fisher Scientific, Bio-Rad Laboratories, and Danaher Corporation. Market participants in the veterinary antimicrobial susceptibility testing industry are taking part in various initiatives to improve the range of products they offer and enhance their market share. These activities encompass strategic partnerships or collaborations for exclusive distribution rights, product portfolio diversification through acquisitions, recognitions from leading industry organizations, and the launch of innovative products. Furthermore, businesses are concentrating on developing testing methods that address particular demands in this industry.

Key Veterinary Antimicrobial Susceptibility Testing Companies:

The following are the leading companies in the veterinary antimicrobial susceptibility testing market. These companies collectively hold the largest market share and dictate industry trends.

- BioMérieux SA

- Becton, Dickinson and Company

- Synbiosis

- Thermo Fisher Scientific

- Bruker Corporation

- Mast Group Ltd

- Condalab

- Bioguard Corporation

- Liofilchem S.r.l.

- HiMedia Laboratories

- Bio-Rad Laboratories

Recent Developments

-

In July 2025, In May 2025, CarbGeM launched ZOI VET, an AI-powered app automating veterinary AST by detecting and measuring inhibition zones and providing S/I/R classifications per CLSI VET01S standards. The platform enabled cloud-based data storage, standardized workflows, and enhanced diagnostic accuracy. This innovation streamlined AST and improved antimicrobial stewardship in veterinary laboratories.

-

In April 2025,FAO conducted Kazakhstan’s first veterinary AST training in Almaty, focusing on EUCAST standards. Laboratory specialists received hands-on instruction in bacterial isolation, disc-diffusion AST, resistance interpretation, and biosafety. The program strengthened practical AMR monitoring skills and advanced the establishment of a national AMR surveillance system in the agri-food sector.

-

In March 2025, bioMérieux received FDA 510(k) clearance for VITEK COMPACT PRO, an automated system for microorganism identification and AST. The device improved laboratory workflow, accelerated routine ID/AST results, and supported AMR management in clinical and industrial settings. This advancement enhanced diagnostic efficiency and strengthened antimicrobial resistance mitigation efforts.

Veterinary Antimicrobial Susceptibility Testing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.22 billion

Revenue forecast in 2033

USD 2.26 billion

Growth rate

CAGR of 8.06% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Animal, product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Thailand; South Korea; Australia; Brazil; Argentina; South Africa; UAE; Saudi Arabia; Kuwait; Qatar; Oman

Key companies profiled

BioMérieux SA; Becton, Dickinson and Company; Synbiosis; Thermo Fisher Scientific; Bruker Corporation; Mast Group Ltd; Condalab; Bioguard Corporation; Liofilchem S.r.l.; HiMedia Laboratories; Bio-Rad Laboratories

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary Antimicrobial Susceptibility Testing Market Report Segmentation

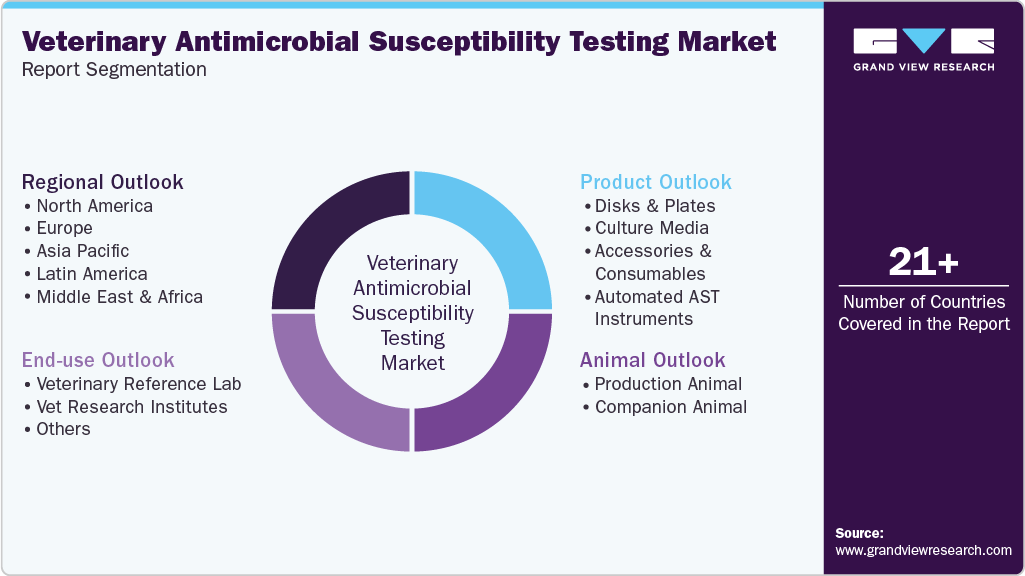

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global veterinary antimicrobial susceptibility testing market report based on animal, product, end-use and region:

-

Animal Outlook (Revenue, USD Million, 2021-2033)

-

Production Animal

-

Cattle

-

Poultry

-

Pigs

-

Others

-

-

Companion Animal

-

Dogs

-

Cats

-

Horses

-

Others

-

-

-

Product Outlook (Revenue, USD Million, 2021-2033)

-

Disks & Plates

-

Culture Media

-

Accessories & Consumables

-

Automated AST Instruments

-

-

End-use Outlook (Revenue, USD Million, 2021-2033)

-

Veterinary Reference Lab

-

Vet Research Institutes

-

Others

-

-

Region Outlook (Revenue, USD Million, 2021-2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

Saudi Arabia

-

Kuwait

-

Qatar

-

Oman

-

-

Frequently Asked Questions About This Report

b. The global veterinary Antimicrobial Susceptibility Testing market size was estimated at USD 1.02 billion in 2023 and is expected to reach USD 1.07 billion in 2024.

b. The global veterinary antimicrobial susceptibility testing market is expected to grow at a compound annual growth rate of 5.8% from 2024 to 2030 to reach USD 1.50 billion by 2030.

b. Asia Pacific held the largest market share of over 34.51% in the veterinary antimicrobial susceptibility testing market owing to the fact that this region is home to highest amount of livestock population in the world. The region fulfills the world’s demand for milk as well as animal-based protein. Governments are actively involved in ensuring the region maintains its dominance over the livestock production and hence propelling the market growth in this region. Moreover, boost to pet adoption, increasing pet health expenditure, and rise in usage of antibiotics in animals are the factors driving the market in Asia Pacific countries, such as India and China.

b. Some key players operating in the veterinary antimicrobial susceptibility testing market are BioMérieux SA, Becton, Dickinson and Company, Synbiosis, Thermo Fisher Scientific, Bruker Corporation, Danaher Corporation (Beckman Coulter Inc.), Condalab, Bioguard Corporation, Liofilchem S.r.l., HiMedia Laboratories, Bio-Rad Laboratories.

b. Key factors that are driving the veterinary antimicrobial susceptibility testing market growth include rising regulatory & training initiatives among leading veterinary organizations, growing potential of Artificial Intelligence (AI) in AST, rising livestock population and growing antimicrobial resistance (AMR) among animals

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.