- Home

- »

- Animal Health

- »

-

Veterinary Assistive Reproduction Technology Market Report 2030GVR Report cover

![Veterinary Assistive Reproduction Technology Market Size, Share & Trends Report]()

Veterinary Assistive Reproduction Technology Market (2024 - 2030) Size, Share & Trends Analysis Report By Conception Method (MOET, IVF), By Animal Type (Bovine, Swine), By Distribution Channel (Private, Public), By Product, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-168-7

- Number of Report Pages: 146

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

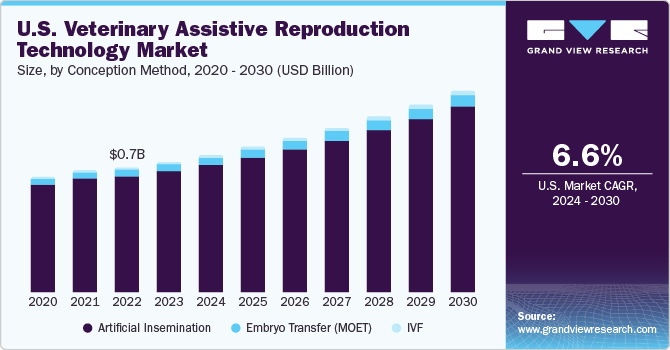

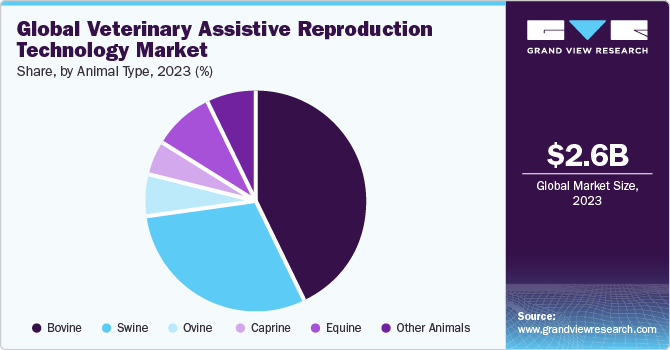

The global veterinary assistive reproduction technology market size was estimated at USD 2.61 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 7.42% from 2024 to 2030. Key factors driving market growth include increasing demand for animal protein, advancements in animal reproduction technology, uptake of assistive reproduction technologies in developed and developing markets, the need for sustainable food production, and supportive initiatives by key players. For instance, in September 2023, Guyana’s Livestock and Development Authority (GLDA) reported a successful continuation of its artificial insemination (AI) program with an estimated 200+ cattle expected to be inseminated by the end of 2023 in Region Nine.

The market was notably affected by the COVID-19 pandemic and diseases, such as African Swine Fever and macroeconomic headwinds, from 2020 to 2022. It resulted in a dampened growth rate, supply chain challenges, and operational hurdles. In 2021, Genus Plc reported a high impact of African Swine fever and COVID-19, leading to volatility in supply & demand in global markets, among other impacts. However, the company continued its strategic activities toward furthering gene editing, reproductive biology, and data strategy. For example, to improve its system for IVF, Genus continued to harnessnew techniques and technologiesto enhance the quality and quantity of embryos produced internally and within licensed laboratories.

During 2022, the company reported sales of about USD 340 million from ABS Global, its bovine genetics division. These sale figures included an increase of 3% to 25.1 million units in bovine (semen and embryo) volumes, with an 18% increase in sexed semen volumes. In 2022-2023, Genus Plc reported an increase in its market share in North America and sales in Latin America owing to price hikes and a transition from conventional to sexed genetics across the region. Genus reported a rise in overall volume in Asia and double-digit growth in sales of sexed genetics in China, Australia, and India.

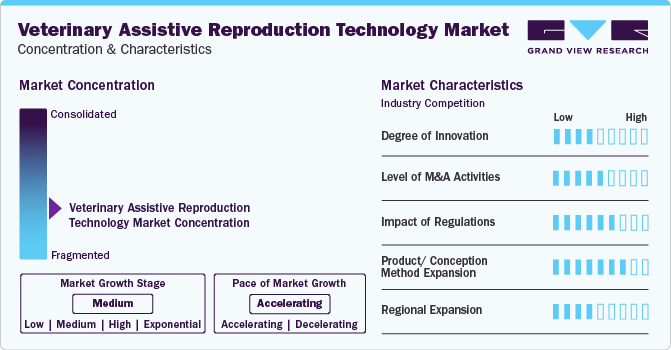

Market Concentration & Characteristics

Innovation in reproductive technologies, particularly in embryo transfer (ET) and in vitro fertilization (IVF), is significant in driving advancements and growth within the veterinary medicine market. These innovations contribute to improving success rates, expanding range of applicable species, and enhancing the efficiency and effectiveness of reproductive procedures.

Level of mergers & acquisitions in the market is low to medium. These strategies are deployed by key players to expand their portfolio, regional presence, or capabilities.

Companies are investing substantial resources in clinical trials and regulatory submissions to obtain regulatory approval for pipeline products. This may result in an increased cost of developing novel tumor ablation technologies.

There are currently no product substitutes for normal and sexed semen. Thus, demand for these products is anticipated to increase in the coming years. In terms of conception method, artificial insemination is the method of choice owing to its affordability and ease of use. However, R&D in ET and IVF is expected to increase notably in the coming years.

Industry players are focusing on regional expansions through partnerships and establishment of facilities to increase their revenue. Rising consumption of meat, milk, and dairy products, as well as a high livestock population in Asia, presents lucrative opportunities for companies to expand regionally.

Animal Type Insights

By animal type, the bovine segment accounted for the highest revenue share in 2023 due to increasing demand for dairy & beef products, advancements in bovine reproduction technologies, need for sustainable food production, and supportive measures implemented by government organizations & industry participants. For instance, Genus Plc reported sales of about USD 338 million from Genus ABS, its bovine division, in 2022. This revenue increased to USD 396 million in 2023, indicating the demand and adoption of its bovine genetic solutions.

The other animals segment, comprising dogs, cats, etc., is estimated to grow at the fastest CAGR from 2024 to 2030 owing to a rise in demand for AI among dog breeders and owners, coupled with the international exchange of companion animal semen. Breeders often aim to produce animals with specific traits, such as temperament, appearance, or health characteristics. Assistive reproduction technologies allow for more controlled and precise breeding, enabling breeders to select and propagate desirable traits. Furthermore, increasing efficiency of assistive reproduction techniques encourages breeders to adopt these techniques, knowing that they are more likely to achieve successful pregnancies and healthy offspring.

Regional Insights

North America held the largest revenue share of 31.20% in 2023. This is owing to the presence of key industry players including, URUS Group LP, Semex, Select Sires Inc., Swine Genetics International, and STgenetics; wide-scale adoption of veterinary reproductive techniques; increasing demand for sustainable animal protein; and growing need for reproduction technology to improve animal breeding. Asia Pacific is anticipated to grow at the highest CAGR from 2024 to 2030 due to rising awareness about assistive reproduction technologies, high livestock population, and supportive government initiatives.As per FAO and internal GVR estimates, the global cattle and pig population in 2022 was estimated to be 1.5 billion and 930 million, respectively; out of this, an estimated 475 million cattle and 506 million pigs were in Asia Pacific alone.

Thus, a high population of livestock is expected to propel the demand for artificial insemination, ET, and IVF techniques to improve breeding outcomes. The demand for veterinary assistive reproduction technologies is also expected to increase in Latin America and Middle East & Africa as these regions have the highest population of leading livestock animals (e.g., cattle, pigs, goats) after Asia Pacific and currently low penetration of advanced reproduction techniques in animal husbandry. industry players have thus begun to focus their strategies on improving their presence in these emerging regions. For instance, Semen Cardona S.L. is exploring opportunities in Mexico, Colombia, etc., to expand their business. The company distributed more than 0.7 million doses of semen in Mexico in 2022. Similar initiatives are expected to drive market growth in the coming years.

Conception Method Insights

By conception method, the artificial insemination segment dominated the market with a share of over 90% in 2023. The IVF segment is projected to grow at the fastest CAGR from 2024 to 2030. Artificial insemination has been available to the companion and livestock sector for decades. However, ET and IVF were developed and introduced recently into veterinary. For instance, in March 2018, the National Dairy Development Board established an Ovum Pick-up and In Vitro Embryo Production (OPU-IVEP) facility in India for R&D and training. It intended to make the technology affordable to dairy farmers in India.

Artificial insemination has widespread usage globally. However, ET and IVF are niche and emerging technologies with limited adoption in 2023.As per a study published by Elsevier, Inc. and Fass, Inc. in December 2022, the usage of assisted reproduction technologies, such as IVF, was increasing, especially in dairy cattle. The study analyzed a phenotypic database of about 0.32 million Holstein animals in Québec, Canada, between 2012 and 2019. During the period, about 0.30 million cows were conceived via artificial insemination, 12,993 through multiple ovulation embryo transfer (MOET), and 732 through IVF.

Product Insights

The normal semen segment accounted for the largest share in 2023, while the sexed semen segment is expected to grow at the fastest CAGR from 2024 to 2030. The lower price of normal sperm compared to sexed sperm and high fertility rates contribute to high share of the segment. Superior results can be achieved using frozen sperm, retaining high genetic merit bulls at sperm stations, and providing quality AI sperm dosages. Sexed semen, on the other hand, allows for more precise control over gender of the offspring, enabling farmers to focus on economically valuable traits.

For instance, in dairy farming, female calves are generally more valuable than males because they can eventually become milk-producing cows. Sexed semen helps dairy farmers increase female calves, improving the overall efficiency and profitability of their operations. According to an April 2023 report published by the National Herd Improvement Association of Australia, approximately 38% of total semen sales in 2022 in Australia were attributed to sexed semen. This is due to increasing reliability of sexed semen, awareness among dairy breeders, and a growing live dairy export market.

Distribution Channel Insights

The private segment held the highest revenue share in 2023. It is also estimated to grow at the highest CAGR from 2024 to 2030. An increasing number of market participants are employing direct or indirect sales strategies to reach customers and maximize profits. For example, Genex (Urus Group) facilitates online purchasing for various herd care products and bovine genetics. Customers can browse the company's web catalog for alternative products. STgenetics simplifies shopping experience for clients by offering online catalogs, such as the Colored Breeds Specialist Catalogue and Beef Add-on Specialist Catalogue.

The public segment also held a notable share of the industry due to supportive initiatives by governments.For instance, the Rashtriya Gokul Mission (RGM) was deployed by the Government of India's Department of Animal Husbandry and Dairying in 2014. It is expected to continue till 2026under the ‘Rashtriya Pashudhan Vikas Yojna’ umbrella scheme. The RGM focuses on four objectives:

-

Improvement of bovine productivity and increasing milk production sustainably using advanced technologies

-

Propagation of use of high-genetic-merit bulls for breeding

-

Increasing coverage of artificial insemination via strengthening breeding network and delivery of doorstep artificial insemination services

-

Promotion of indigenous bovine breeds conservation and rearing in a scientific and holistic manner

Key Companies & Market Share Insights

The market is competitive owing to numerous industry players (both public and private) offering normal and sexed semen to customers for use in animal reproduction via artificial insemination, ET, and IVF.These players are initiating various strategic actions to enhance their market presence and share. These include partnerships and collaborations, portfolio or regional expansions, R&D, and sales & marketing activities. Companies seek to broaden their product offerings by providing comprehensive reproductive solutions. These include a range of AI tools, IVF kits, and ET equipment & services along with semen. A diverse product portfolio allows companies to cater to varying needs of farmers and breeders. Companies also invest in R&D to enhance efficiency and success rates of reproductive technologies.

Key Veterinary Assistive Reproduction Technology Companies:

- Genus Plc

- URUS Group LP

- CRV

- SEMEX

- Select Sires, Inc.

- Swine Genetics International

- National Dairy Development Board

- STgenetics

- VikingGenetics

- Geno SA

Recent Developments

-

In January 2023, BullWise and CRV announced a collaboration, under which BullWise became the leading distributor for CRV genetics in Ireland & Northern Ireland, offering farmers access to CRV's top bulls from New Zealand's grazing breeding program, as well as bulls specifically selected for the Irish market from CRV's breeding programs. The partnership aims to improve the quality and productivity of herds in the region

-

In March 2022, Hypor BV-specializing in swine genetics, entered into a long-term partnership with a leading pork producer in the Czech Republic-Zemspol Dešná. With this, the latter became Hypor’s multiplication partner as a nucleus farm to supply swine genetics to the Eastern & Central European countries

-

In June 2021, Genus Plc’s bovine division-ABS, collaborated with World Wide Sires Deutschland GmbH to operate jointly as World Wide Sires Deutschland in Austria, Luxembourg, and Germany as ABS’ distribution partner

-

In December 2020, three crucial cooperatives within cattle breeding namely-VikingGenetics, Evolution, and Masterrind-partnered to form Arcowin, a dairy and beef genetic cooperative. Arcowin aims to ensure the highest possible and the most sustainable genetic progress. This partnership enabled the three stakeholders to use their genetic resources and investments better

Veterinary Assistive Reproduction Technology Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.78 billion

Revenue forecast in 2030

USD 4.27 billion

Growth rate

CAGR of 7.42% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Animal type, product, conception method, distribution channel, region

Regions covered

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; U.K.; Germany; Italy; France; Spain; Netherlands; Norway; Denmark; Sweden; Japan; China; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Genus Plc; URUS Group LP; CRV; SEMEX; Select Sires, Inc.; Swine Genetics International; National Dairy Development Board; STgenetics; VikingGenetics; Geno SA

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary Assistive Reproduction Technology Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global veterinary assistive reproduction technology market report based on animal type, product, conception method, distribution channel, and region:

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Bovine

-

Swine

-

Ovine

-

Caprine

-

Equine

-

Other Animals

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Normal Semen

-

Sexed Semen

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Private

-

Public

-

-

Conception Method Outlook (Revenue, USD Million, 2018 - 2030)

-

Artificial Insemination

-

Embryo Transfer (MOET)

-

IVF

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

The Netherlands

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global veterinary assistive reproduction technology market size was estimated at USD 2.61 billion in 2023 and is expected to reach USD 2.78 billion in 2024.

b. The global veterinary assistive reproduction technology market is expected to grow at a compound annual growth rate of 7.42% from 2024 to 2030 to reach USD 4.27 billion by 2030.

b. By region, the North American veterinary assistive reproduction technology market held the largest share of the global market in 2023. This share is attributed to the presence of key market players, wide-scale adoption of veterinary reproductive techniques, increasing demand for sustainable animal protein, and growing need for reproduction technology to improve animal breeding.

b. Some key players operating in the veterinary assistive reproduction technology market include Genus Plc; URUS Group LP; CRV; SEMEX; Select Sires Inc.; Swine Genetics International; National Dairy Development Board; STgenetics; VikingGenetics; and Geno SA.

b. Key factors that are driving the market growth include increasing demand for animal protein, advancements in animal reproduction technology, uptake of assistive reproduction technologies in developed as well as developing markets, the need for sustainable food production, and supportive initiatives by key players operating in the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.