- Home

- »

- Animal Health

- »

-

Veterinary Bone Grafts And Substitutes Market Report, 2030GVR Report cover

![Veterinary Bone Grafts And Substitutes Market Size, Share & Trends Report]()

Veterinary Bone Grafts And Substitutes Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Autografts, Allografts, Xenografts), By Animal Type, By Form, By Application, By Material, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-446-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Veterinary Bone Grafts And Substitutes Market Summary

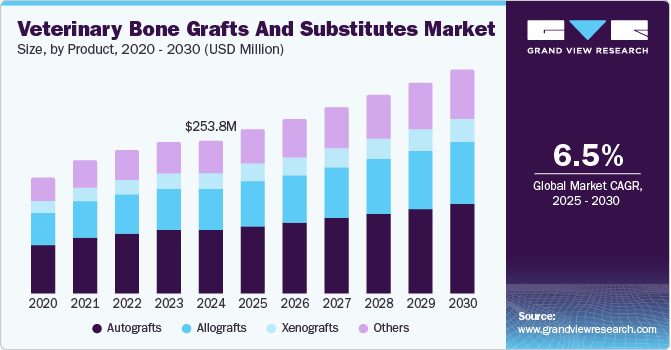

The global veterinary bone grafts & substitutes market size was estimated at USD 253.8 million in 2024 and is projected to reach USD 371.4 million by 2030, growing at a CAGR of 6.48% from 2025 to 2030. The increasing demand for advanced orthopedic solutions, rising pet ownership, growing awareness of veterinary surgical options, and increasing product launches are expected to drive market growth.

Key Market Trends & Insights

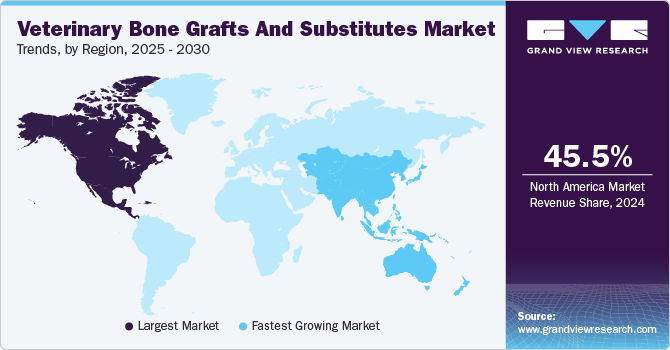

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, China is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, autografts accounted for a revenue of USD 114.0 million in 2024.

- Autografts is the most lucrative product segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 253.8 Million

- 2030 Projected Market Size: USD 371.4 Million

- CAGR (2025-2030): 6.48%

- North America: Largest market in 2024

For instance, in May 2024, Biomendex introduced the patented biodegradable Adaptos bone substitute, designed for orthopedic and dental applications. This innovative product has been successfully utilized in over 1,000 surgeries, primarily on small animals like dogs and cats.

Furthermore, increasing supportive initiatives and growing awareness about veterinary bone grafts and substitutes drive market growth. Additionally, increased educational programs, such as TheraVet's Osteosarcoma Program and rising outreach efforts at veterinary conferences, boost awareness of innovative treatments like BIOCERA-VET OSTEOSARCOMA RTU. These initiatives are expanding the adoption of advanced bone grafts and substitutes by demonstrating their benefits, including minimally invasive options and improved outcomes for conditions like osteosarcoma. This increase in awareness is leading to a rise in market demand and accelerating the development and distribution of these products. For instance, in June 2023, TheraVet reported a 300% increase in centers participating in its Osteosarcoma Program within six months, highlighting growing interest and adoption of its BIOCERA-VET OSTEOSARCOMA RTU solution. This minimally invasive treatment option is positioned as a viable alternative to traditional limb amputation or invasive surgeries, addressing a significant medical need for canine osteosarcoma. The program's success is further evidenced by a 33% increase in participating centers since its official launch and a threefold rise in web traffic to its dedicated information site.

The advancements in graft technologies and ongoing clinical research are also expected to contribute to market growth. Options like allografts, autografts, and recombinant bone growth factors such as Bone Morphogenetic Protein-2 (rhBMP-2) are crucial in treating mandibular defects. rhBMP-2, a human recombinant protein that promotes new bone formation, has seen increased clinical use since its initial veterinary application in 2004. In addition, the US FDA released draft guidance for dental bone grafting device manufacturers on March 2024, Titled “Animal Studies for Dental Bone Grafting Material Devices - Premarket Notification (510(k)) Submissions,” which outlines the necessary conditions under which preclinical studies are required and offers recommendations to meet regulatory requirements for these Class II devices. Ongoing studies at leading institutions and recent product launches, such as Zoetis's TruScient for the European market, highlight the expanding availability and adoption of innovative bone grafting solutions, further driving market growth.

Market Concentration & Characteristics

The veterinary bone grafts and substitutes market is highly concentrated. The market is in a medium growth stage, and the rate of expansion is rapidly increasing. Rapid advancements in veterinary bone surgical procedures, as well as the introduction of innovative products by key manufacturers, are key market drivers. Market concentration is impacted by the rate of technical improvements. Companies invest in R&D to introduce novel products with improved features and efficacy can gain a competitive advantage and expand their market penetration.

The veterinary bone grafts and substitutes market is characterized by a high degree of innovation driven by the need for advanced solutions in orthopedic care for animals. Innovations include the development of products with enhanced osteoconductive and osteo-integrative properties. For Instance, in May 2023, TheraVet launched BIOCERA-VET Combo-Clean, a bone substitute that provides sustained local antibiotic delivery for up to 30 days, making it highly effective in preventing and managing bone infections. Combined with the seven most commonly used antibiotics, this product offers unique osteoconductive and osteo-integrative properties, enhancing its use in orthopedic surgeries. Additionally, ready-to-use injectable bone cement and customized grafts designed for specific animal breeds and types of fractures are becoming more common, reflecting the market's focus on improving treatment outcomes and reducing recovery times.

The level of collaborations and partnership activities in the market is high, reflecting a strategic focus on expanding market reach and enhancing product availability. Key collaborations often involve distribution agreements with established veterinary product companies. For instance, in November 2023, Biomendex and Prevett Oy entered into a partnership to distribute AdaptosVet bone graft material in Finland. Prevett now offers this product through its wholesale system, allowing Finnish veterinary clinics and hospitals to easily order AdaptosVet directly from their webshop.

Regulations significantly impact the market by ensuring product safety, efficacy, and quality through rigorous approval processes and adherence to manufacturing standards. Compliance with these regulations can increase market entry barriers and development costs and enhance product credibility and trust among veterinary professionals. Ultimately, robust regulatory frameworks drive market growth by advancing innovation and ensuring high standards of care.

Product launches in the market significantly impact market dynamics by introducing innovative solutions that address specific orthopedic needs. New products often drive market growth by enhancing treatment options, improving surgical outcomes, and increasing competition. They also stimulate interest among veterinary professionals and can lead to broader adoption of advanced technologies in clinical practice. For Instance, In March 2024, TheraVet launched BIOCERA-VET Equine as an innovative treatment in dental applications and oral/maxillofacial surgery in horses. The product has an exclusive property needed for minimally invasive cementoplasty.

Regional expansion is a key growth strategy in the market, allowing companies to tap into new and emerging markets. Companies can significantly boost their market presence by entering regions with high pet ownership and increasing demand for advanced veterinary care. For Instance, in February 2023, TheraVet signed an exclusive distribution agreement with Vetpharma to distribute its BIOCERA-VET product line across 24 countries, including Scandinavia, Brazil, South Africa, Australia, and Japan. This agreement marks a significant expansion, making BIOCERA-VET available on all continents and tapping into high-potential markets where the demand for advanced animal healthcare solutions is growing.

Product Insights

By product, autografts segment dominated market with a share of over 41.38% in 2024. Autografts are highly and commonly used in veterinary bone surgeries because they perfectly match the recipient's tissue, minimizing the risk of immune rejection. They are harvested from the same animal, ensuring compatibility and promoting faster healing. Additionally, autografts contain live bone cells and growth factors that enhance bone regeneration and integration, making them highly effective for repairing fractures, bone defects, and other orthopedic conditions. This natural compatibility and biological activity make autografts a preferred choice for many veterinarians.

Others segment is expected to grow at fastest CAGR of 7.34% during forecast period. It includes synthetic bone graft substitutes, growth factor-based grafts, and antibiotic-loaded bone graft substitutes. Synthetic bone grafts and substitutes, particularly those made from materials like tricalcium phosphate (TCP) and hydroxyapatite, have gained popularity in recent years. These synthetic options are favored due to their biocompatibility, ease of availability, and lower risk of disease transmission compared to allografts and autografts. Additionally, they provide a scaffold that promotes natural bone growth and healing, making them a popular choice for treating fractures, bone defects, and orthopedic conditions in various animals.

Animal Type Insights

Based on animal type, dogs segment dominated market in 2024 with a market share of 56.95%. The increasing prevalence of orthopedic injuries in dogs participating in agility competitions is expected to be one of the key factors driving the market due to the growing need for specialized care. For instance, according to a February 2024 Frontiers in Veterinary Science publication, orthopedic injuries (32.9%) were the most common health complication among dogs participating in the Yukon Quest International Sled Dog Race. The data further suggests that these injuries were the most common reason for participant dogs withdrawing (75%) from the competition. As more dogs engage in these activities, the demand for veterinary orthopedic services such as bone graft and substitute surgeries increases.

Cats segment is expected to be fastest-growing segment with the highest CAGR of 7.76% over the forecast period. Globally, the second-most popular pet choice is cats. According to the American Pet Products Association report from 2024, approximately 40 million U.S. households own cats, and cat ownership increased among younger generations, especially millennials. Moreover, advancements in treatment options, including minimally invasive techniques and novel bone grafts and substitutes, contribute to the evolving landscape of the market. As pet owners increasingly seek advanced care for their cats, the market will likely continue growing and adapting to meet the specific needs of feline orthopedic patients.

Form Insights

Based on form. injectables segment held the largest share of 34.98% in 2024. In the veterinary bone grafts and substitutes market, injectable forms are increasingly popular due to their minimally invasive nature, which reduces surgical trauma and post-operative recovery time. Injectable bone grafts allow for precise application to irregular bone defects, enhancing the integration and healing process. This form also minimizes the risk of infection and provides ease of use for veterinarians, making it a preferred option for treating bone injuries and defects in animals. The ability to fill complex bone cavities and adapt to various surgical needs drives the demand for injectable veterinary bone grafts and substitutes.

Pellets segment is estimated to grow at the highest CAGR of 7.4% over the forecast period. Pellet forms are gaining popularity due to their ease of handling and precise placement. Pellets provide controlled delivery and consistent dosing of graft material, enhancing application accuracy in bone defects. They offer better adaptability to the shape and size of the defect, leading to improved integration and healing. Additionally, pellet form can be easily packed into irregular spaces and allows for straightforward manipulation during surgery, making it a favored choice in veterinary orthopedic and dental procedures.

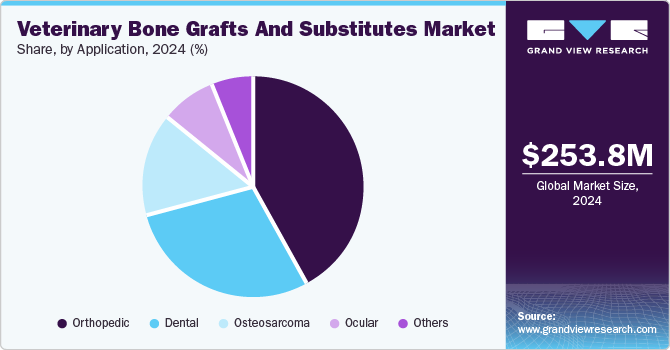

Application Insights

Orthopedic segment held the highest market share in 2024. Veterinary bone grafts and substitutes are commonly used in orthopedic treatments compared to other indications due to their critical role in addressing fractures, bone defects, and joint problems, which are prevalent in animals. These materials provide structural support and facilitate bone healing, making them essential for repairing traumatic injuries, degenerative conditions, and congenital deformities. The high success rates of bone grafts in restoring mobility and function in animals make them a preferred choice in veterinary orthopedics over other medical applications, where the need for bone regeneration and repair is less common.

Dental segment is expected to grow at the fastest CAGR over the forecast period. Veterinary bone grafts and substitutes are gaining popularity in veterinary dentistry due to their effectiveness in treating periodontal disease, jaw fractures, and bone defects caused by dental extractions or tumors. These materials help regenerate bone and provide structural support, improving the stability and function of the jaw. For example, bone grafts are increasingly used in treating mandibular defects in dogs, allowing for better outcomes in dental surgeries and enhancing the overall health and quality of life of the animals. This growing application in dentistry highlights the versatility and importance of bone grafts in veterinary care.

Material Insights

Based on material, the tricalcium phosphate (TCP) segment dominated the market in 2024 with a market share of 40.70%. The demand for Tricalcium Phosphate (TCP) based veterinary bone grafts and substitutes is higher due to TCP's excellent biocompatibility and osteoconductive properties, which promote natural bone regeneration. TCP is resorbable and thus gradually dissolves and is replaced by new bone, making it ideal for healing fractures and defects. Its ability to support the growth of new bone tissue while minimizing the risk of immune reactions or complications makes TCP-based grafts a preferred choice in veterinary surgeries. Additionally, TCP's versatility allows it to be used in various forms, such as granules, blocks, or putty, catering to different surgical needs.

Bioglass segment is expected to be fastest-growing segment with the highest CAGR of 7.76% over the forecast period. Bioglass-based veterinary bone grafts and substitutes are rapidly gaining popularity in veterinary surgeries due to their unique ability to bond directly with bone and support bone regeneration. Bioglass stimulates cellular activity that enhances healing and provides a scaffold for new bone growth. Its bioactive properties encourage the formation of a strong bone-implant interface, reducing healing time and improving surgical outcomes. Additionally, bioglass is resorbable, allowing it to integrate seamlessly with the host bone, making it an effective and reliable option for treating fractures and bone defects in animals.

End-use Insights

Based on end use, the veterinary hospitals & clinics segment held the largest share in 2024 and is expected to grow at the highest CAGR during the forecast period. This growth is attributed to the extensive use of these products for a wide range of orthopedic procedures. These facilities often handle complex cases requiring advanced bone grafting techniques, making them key users of these technologies. Additionally, the high volume of surgeries performed in these settings, combined with their access to the latest technologies and expertise, drives demand for bone grafts and substitutes, solidifying their dominant market position.

Hospitals and clinics also report the largest footfall of patients making these a preferred choice of care for pet parents. Furthermore, the growing need to increase clinic revenue is expected to propel the segment in the near future. By expanding service lines to include orthopedic surgeries, clinics can access new revenue streams, increasing weekly revenue by about USD 40,000 to 80,000, as estimated by Vimian.

Regional Insights

North America dominated the veterinary bone grafts & substitutes market. Key players in the market are engaging in strategic initiatives, such as product launches, collaborations, and acquisitions, to strengthen their market presence in North America, propelling market growth. For instance, in March 2024, Movora acquired Veterinary Transplant Services (VTS), a leader in veterinary grafts and tissue, enhancing its offerings in the market. This acquisition is expected to expand Movora’s portfolio with VTS’s unique graft materials, supporting advanced healing solutions and continuing education for veterinary professionals.

U.S. Veterinary Bone Grafts & Substitutes Market Trends

The veterinary bone grafts & substitutes market in the U.S. is expected to grow significantly over the forecast period, driven by the expansion of veterinary facilities and increasing demand for advanced orthopedic solutions, including bone grafts and substitutes. For instance, in April 2024, UC Davis Veterinary Medical Teaching Hospital launched the Advanced Veterinary Surgery Center, a cutting-edge facility dedicated to orthopedic procedures. The center features 25 rooms and three advanced operating rooms to address the increased demand for orthopedic surgeries and expand training for future specialists.

Europe Veterinary Bone Grafts & Substitutes Market Trends

European veterinary bone grafts & substitutes market is influenced by several trends, driven by increasing pet ownership and awareness of advanced veterinary care, advancements in bone graft technologies, and rising demand for innovative orthopedic solutions. Additionally, the expansion of distribution networks and collaborations with local partners enhance market access and product availability across diverse regions in Europe.

Similarly, increased canine & feline population and pet care expenditure fuel market growth. For instance, the number of pet owners is growing, with 166 million out of Europe's 352 million pets being owned by 50% of European households. However, steady growth in the dog population is expected to propel the demand for related products and services, driving the market. Chronic conditions, such as joint disorders, fractures, and trauma, which require surgical interventions, fuel the market. According to findings of the Royal Veterinary College, trauma injuries and obesity are one of the most common disorders affecting cats. While joint diseases, obesity, and limb lameness commonly affect dogs.

Germany held the largest share in the European veterinary bone grafts & substitutes market in 2024. In Germany, the rise in the pet dog population, prevalence of pet obesity, expenditure on pet health, well-equipped pet health infrastructure, and technological advancements have put pressure on players to innovate new veterinary bone grafts & substitutes for pet surgery, benefiting their health. This factor has led companies to shift their focus to product innovations. In addition, growing pet health concerns, rising product offerings by companies, and well-established veterinary care facilities are expected to boost the number of orthopedic surgeries performed in the country. For instance, in January 2024, TheraVet launched BIOCERA-VET products in Germany. To support this launch, the company mentioned attending the Leipzig Veterinary Congress. The TheraVet and AWEX (Wallonia Export & Investment Agency) participated in this event, which was dedicated to animal health. Therefore, growing product offerings of key companies will likely drive the market.

UK is anticipated to grow at a constant rate due to an increase in partnerships between key players to expand distribution networks and improve product accessibility for veterinary clinics across the UK. For instance, in September 2023, Biomendex entered into collaboration with N2 (UK) Ltd to distribute AdaptosVet in the UK and Northern Ireland. By collaborating with established distributors like N2 (UK) Ltd, companies can utilize thier existing networks and market presence to enhance product availability and reach a broader customer base.

Asia Pacific Veterinary Bone Grafts & Substitutes Market Trends

The Asia Pacific veterinary bone grafts & substitutes market is expanding rapidly, driven by factors such as rising number of orthopedic issues in animals, including osteosarcoma and arthritis, is fueling demand for bone grafts and substitutes to aid in effective treatment and recover. Canine osteosarcoma is a common and aggressive bone cancer affecting dogs in the Asia-Pacific region. Estimates suggest that it accounts for approximately 85% of all primary bone tumors in dogs. Bone grafts and substitutes are increasingly used in limb-sparing surgeries for canine osteosarcoma, allowing for more effective treatment options that preserve the limb and improve quality of life. Veterinary bone grafts are often used in conjunction with chemotherapy or radiotherapy, providing a comprehensive approach to managing osteosarcoma and addressing the limitations of traditional treatments.

The veterinary bone grafts & substitutes market in India is witnessing notable growth due to the increasing incidence of arthritis in dogs and the need for advanced veterinary bone grafting procedures. According to a Times of India article from July 2023, dogs with arthritis often have degenerative joint disease, which results in joint stiffness, discomfort, and inflammation. Although it typically affects older dogs, it can also affect younger dogs for various reasons, including genetics, trauma, or illnesses. The common belief is that arthritis primarily affects older dogs, yet hip dysplasia, which causes malformed hip or femur joints, can cause arthritic changes in dogs as young as 6 months. Veterinary bone grafts and substitutes provide critical solutions in managing this condition by supporting joint repair and enhancing healing processes. It also provide necessary support and stability to affected bones and joints, particularly in complex cases of arthritis.

Latin America Veterinary Bone Grafts & Substitutes Market Trends

Growing pet ownership and expenditure in Latin America drive demand for advanced veterinary treatments, including bone grafts and substitutes. For instance, Mexico and Argentina are experiencing rising rates of pet adoption, leading to increased veterinary care needs. Furthermore, companies are expanding their distribution networks in Latin America to meet the growing demand. For instance, partnerships between global suppliers and local distributors are increasing the availability of advanced bone graft products in the region. For example, according to the 2023 annual report of TheraVet, the company’s products, such as BIOCERA-VET, are available through regional distributors or veterinary networks in Latin American countries.

The Brazil veterinary bone grafts and substitutes market is expanding due to increased awareness and demand for advanced veterinary orthopedic treatments, particularly for managing conditions like osteoarthritis and fractures in pets. Additionally, rising pet ownership and higher expenditure on pet health are fueling the demand for specialized veterinary treatments, including bone grafts and substitutes. There are roughly 59.4 million pet dogs in Brazil and 28.1 million cats. Moreover, the country has approximately 36 million small dogs & pups at home—more per capita than any other country in the world. This is because of Brazil’s rapidly growing middle-class population. Furthermore, according to an article published by PetFood Industry in June 2023, 52% of Brazilian households own a dog, whereas 23% own a cat.

Middle East & Africa Veterinary Bone Grafts & Substitutes Market Trends

The Middle East & Africa veterinary bone grafts & substitutes market is witnessing significant growth, driven by increased bone-related disorders, such as fractures and osteoarthritis in pets, which drive demand for bone grafts and substitutes. Similarly, the development of new veterinary clinics and hospitals across the region presents opportunities for market growth. Improved facilities can support advanced procedures requiring bone grafts and substitutes. For instance, in South Africa, the rise in orthopedic surgeries for pets and the expansion of veterinary hospitals in urban areas are creating significant demand for advanced bone grafts and substitutes. Similarly, in the UAE, increasing investments in veterinary care infrastructure are expected to boost the market for these products, reflecting a broader trend of growth across the region.

Urbanization in Saudi Arabia significantly contributes to the growth of the market. As cities expand and the population of pet owners increases, there is a rising demand for advanced veterinary care. This urban growth drives the establishment of more veterinary clinics and specialized animal hospitals equipped to perform complex procedures, including bone graft surgeries. The increase in urban pet ownership also leads to a higher incidence of bone-related issues in pets, further boosting the need for innovative treatments such as bone grafts and substitutes. Additionally, urban areas tend to have better access to advanced medical technologies and higher awareness of sophisticated veterinary options, supporting the market's expansion.

Key Veterinary Bone Grafts And Substitutes Company Insights

Key players in the veterinary bone grafts & substitutes market are actively engaged in highly competitive market dynamics. These companies emphasize R&D and introduce new products to enhance their market presence. Furthermore, increasing distribution agreements among key players significantly drives the growth of the veterinary bone grafts and substitutes market. These partnerships enhance the availability and accessibility of advanced bone graft products, allowing companies to enter new markets and reach a broader customer base quickly. For instance, TheraVet's agreement with Alcyon Italia to distribute BIOCERA-VET products in Italy has boosted its market presence, demonstrating how such collaborations can lead to greater market penetration and increased sales of veterinary orthopedic solutions.

Key Veterinary Bone Grafts And Substitutes Companies:

The following are the leading companies in the veterinary bone grafts and substitutes market. These companies collectively hold the largest market share and dictate industry trends.- Movora (Vimian Group AB)

- TheraVet SA

- Biomendex

- Integra LifeSciences Corporation.

- Progenica Therapeutics, LLC

- BioChange

- Nutramax Laboratories Veterinary Sciences, Inc.

- RITA LEIBINGER GmbH & Co. KG

- VETEREGEN

- AlphaLogix, LLC

Recent Developments

-

In May 2024, TheraVet unveiled plans to launch a range of products for horses by 2027. These products will include BIOCERA-VET OSTEO, with enhanced osteo inductive properties; NUTRA-VET, a range of nutraceuticals; and VISCO-VET Equine, a regenerating gel currently being developed by the company to treat osteoarticular diseases as well as tendon and ligament injuries.

-

In January 2024, Biomendex and Jorgensen Laboratories (Jorvet) entered a collaboration agreement to distribute AdaptosVet across the U.S., Canada, and Mexico.

-

In January 2024, TheraVet signed a partnership agreement with Alcyon Italia to distribute its BIOCERA-VET line of bone substitutes in Italy, using Alcyon’s extensive network and expertise in orthopedic distribution. This collaboration includes the promotion of 13 BIOCERA-VET products, supported by clinical trials and educational initiatives aimed at Italian veterinarians.

Veterinary Bone Grafts And Substitutes Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 271.30 million

Revenue Forecast in 2030

USD 371.35 million

Growth Rate

CAGR of 6.48% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Product, animal type, form, application, material, end-use, region.

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Movora (Vimian Group AB); TheraVet SA; Biomendex; Integra LifeSciences Corporation.; Progenica Therapeutics, LLC; BioChange; Nutramax Laboratories Veterinary Sciences; Inc.; RITA LEIBINGER GmbH & Co. KG; VETEREGEN; AlphaLogix, LLC

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary Bone Grafts And Substitutes Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global veterinary bone grafts and substitutes market report based on product, animal type, form, application, material, end-use, and region.

-

Product Outlook (Revenue, USD Million; 2018 - 2030)

-

Autografts

-

Allografts

-

Xenografts

-

Others

-

-

Animal Type Outlook (Revenue, USD Million; 2018 - 2030)

-

Dogs

-

Cats

-

Horses

-

Others

-

-

Form Outlook (Revenue, USD Million; 2018 - 2030)

-

Powders

-

Putty

-

Pellets

-

Injectables

-

Others

-

-

Application Outlook (Revenue, USD Million; 2018 - 2030)

-

Orthopedic

-

Dental

-

Ocular

-

Osteosarcoma

-

Others

-

-

Material Outlook (Revenue, USD Million; 2018 - 2030)

-

Tricalcium Phosphate (TCP)

-

Ceramic

-

Bioglass

-

Others

-

-

End-Use Outlook (Revenue, USD Million; 2018 - 2030)

-

Veterinary Hospitals & Clinics

-

Other End Use

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

Rest of Europe

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global veterinary bone grafts and substitutes market size was estimated at USD 253.84 million in 2024 and is expected to reach USD 271.30 million in 2025

b. The global veterinary bone grafts and substitutes market is expected to grow at a compound annual growth rate of 6.48% from 2025 to 2030 to reach USD 371.35 million by 2030.

b. North America dominated the veterinary bone grafts and substitutes market with a share of 45.5% in 2024. This is attributable to the expansion of veterinary facilities and increasing demand for advanced orthopedic solutions, including bone grafts and substitutes.

b. Some key players operating in the veterinary bone grafts & substitutes market include Movora (Vimian Group AB); TheraVet SA; Biomendex; Integra LifeSciences Corporation.; Progenica Therapeutics, LLC; BioChange; Nutramax Laboratories Veterinary Sciences; Inc.; RITA LEIBINGER GmbH & Co. KG; VETEREGEN; AlphaLogix, LLC

b. Key factors that are driving the market growth include increasing demand for advanced orthopedic solutions, rising pet ownership, growing awareness of veterinary surgical options, increasing product launches, and an increase in supportive initiatives.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.