- Home

- »

- Animal Health

- »

-

Veterinary Consumables Market Size, Industry Report, 2033GVR Report cover

![Veterinary Consumables Market Size, Share & Trends Report]()

Veterinary Consumables Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Anesthesia Supplies, Ventilator Supplies, Monitoring Supplies, Imaging Supplies), By Animal, By Type, By Distribution Channel, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-819-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Veterinary Consumables Market Summary

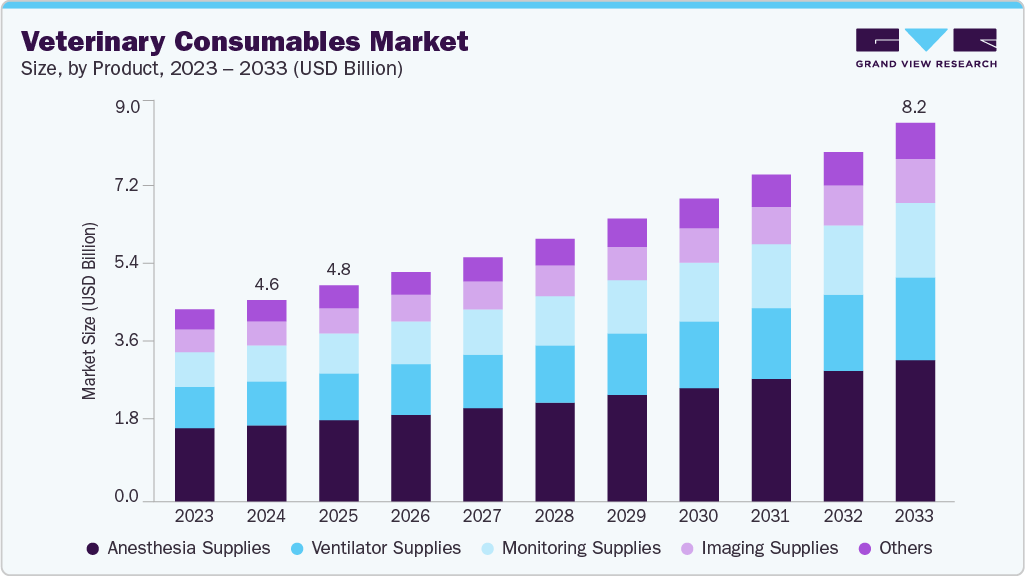

The global veterinary consumables market size was estimated at USD 1.51 billion in 2024 and is projected to reach USD 2.84 billion by 2033, growing at a CAGR of 7.3% from 2025 to 2033. The market is advancing due to expansion of veterinary clinics, hospitals & diagnostic labs, growth of preventive veterinary care & vaccination programs and advancements in veterinary surgical & critical care procedures.

Key Market Trends & Insights

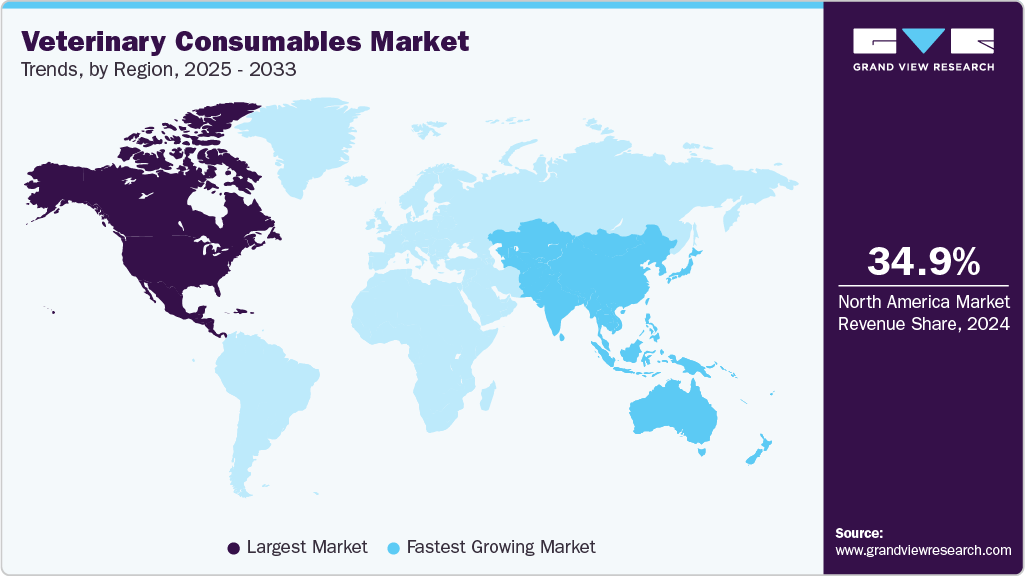

- North America veterinary consumables market held the largest revenue share of 34.87% in 2024.

- U.S. dominated the North America region with the largest revenue share in 2024.

- By product, anesthesia supplies segment held the largest share of 38.01% of the market in 2024.

- By animal, companion animal segment held the largest share in 2024.

- By type, reusable segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.51 Billion

- 2033 Projected Market Size: USD 2.84 Billion

- CAGR (2025-2033): 7.3%

- North America region: Largest market in 2024

- Asia Pacific region: Fastest growing market

The rapid expansion of veterinary healthcare infrastructure spanning specialty hospitals, multi-clinic networks, mobile units, and advanced diagnostic laboratories is a major driver increasing demand for consumables. For instance, in December 2024, DCC Animal Hospital inagurated its first advanced Jaipur facility, built to Japanese standards and equipped with modern technology, marking a major step in premium pet care and expanding its global preventive and surgical services presence.

In addition, in April 2025, Arista Advanced Pet Care opened its first specialty and 24/7 emergency hospital in Atlanta, introducing a veterinarian-led model and care navigation system to support growing demand for advanced, coordinated pet healthcare. As facilities adopt modern surgical, imaging, and diagnostic technologies, they require higher volumes of associated consumables such as anesthesia accessories, fluid delivery sets, biopsy kits, and monitoring disposables. The rise of corporate chains enhances procurement consistency and standardization, leading to bulk purchases of consumables. Moreover, increased availability of advanced procedures such as soft-tissue surgery, orthopedics, dentistry, and minimally invasive interventions raises daily consumable usage. This growth in service capacity directly amplifies consumable consumption, supporting long-term market expansion.

In addition, the global shift toward preventive veterinary care is significantly increasing demand for consumables. As pet owners and livestock producers prioritize vaccination, parasite control, routine diagnostics, and wellness programs, clinics require a steady supply of needles, syringes, diagnostic strips, PPE, disinfectants, and sampling consumables. For instance, in October 2025, Boehringer Ingelheim launched a USD 2.5 million, three-year Animal Health Program to support veterinarian wellbeing, strengthen the talent pipeline, and expand access to care in underserved U.S. communities through strategic partnerships and long-term initiatives. In addition, preventive health guidelines promoted by associations further encourage regular checkups and early screening, increasing consumable turnover. Livestock health programs aimed at reducing antimicrobial use and improving productivity also raise the need for vaccination consumables and biosecurity supplies.

Technology Trends in Veterinary Consumables Market

Furthermore, rising adoption of advanced surgical and critical care procedures in veterinary practice is driving substantial growth in consumables demand. As clinics perform more orthopedic surgeries, soft-tissue procedures, endoscopy, dentistry, and emergency care, they require high volumes of sterile disposables, monitoring accessories, fluid therapy sets, wound management materials, and anesthesia consumables. For instance, Intervertebral Disc Disease (IVDD), affects 25% of dachshunds and is prevalent in other short-legged breeds such as French bulldogs in the UK. Such disease conditions can be mitigated with surgical procedures that eventually propels the demand for consumables, including surgical supplies, anesthesia, imaging accessories, and postoperative care products.

Moreover, technological advancements such as minimally invasive surgery, high-precision imaging, and improved anesthesia systems expand the range of treatable conditions, leading to repeated consumption of associated disposables. Thus, increasing demand for post-operative care and chronic disease management elevates usage of bandaging materials and infusion consumables. This transformation toward sophisticated animal care directly accelerates consumables market expansion.

Market Concentration & Characteristics

The veterinary consumables market is fragmented with multiple small and medium players. The regional manufacturers, niche specialty suppliers, and clinic-focused brands contributes to high market fragmentation. Continuous product innovation, device-consumable bundling strategies, and acquisitions intensify competition, while regulatory compliance and quality standards create high entry barriers.

Innovation in the market is driven by advancements in diagnostics, minimally invasive surgery, smart monitoring tools, and species-specific products. Some of the companies are integrating digital technologies, automated workflows, and sustainable materials.

M&A activity remains strong as global players acquire regional manufacturers, distributors, and technology startups to expand portfolios and geographic reach. Companies focus on strengthening diagnostic capabilities, securing supply chains, and integrating complementary consumables. For instance, in January 2025, Millpledge Veterinary partnered with Eickemeyer Canada to streamline distribution of its surgical consumables, wound care products, and other veterinary supplies across Canada.

Regulations significantly influence product development, approval timelines, and market entry. Authorities enforce strict standards for safety, quality, sterility, and traceability of consumables. Compliance with device guidelines, pharmacovigilance requirements, and import controls shapes manufacturing processes and distribution strategies.

Substitutes include reusable instruments, generics, alternative wound-care materials, and traditional treatment methods, especially in cost-sensitive markets. However, increasing demand for accuracy, sterility, and higher clinical standards often limits substitution, favoring specialized consumables that provide superior performance and improved clinical outcomes.

Regional expansion is driven by rising animal health spending in emerging markets, development of infrastructure, and growing awareness of preventive care. Companies expand through distributor partnerships, local manufacturing, and customized product lines for species and regional disease profiles. Asia-Pacific, Latin America, and Africa offer high-growth opportunities for consumable manufacturers.

Product Insights

Anesthesia supplies segment dominated the market with largest revenue share of 38.01% in 2024. The segment is driven by their essential role in routine surgeries, diagnostic procedures, and emergency interventions across companion animals and livestock. The segment includes breathing circuits, masks, tubes, monitoring accessories, and anesthetic delivery components. In addition, rising surgical volumes, increased adoption of advanced anesthesia equipment, and growing emphasis on safety and precision drive demand.

The monitoring supplies is the fastest growing segment over the forecast period, driven by rising demand for real-time patient care, enhanced safety during surgeries, and preventive health management. This segment includes devices and consumables for vital signs monitoring, ECG, pulse oximetry, blood pressure, and temperature tracking. Growth is also fueled by increasing adoption of advanced monitoring technologies in animal care hospitals, clinics, and mobile practices, alongside rising awareness of animal welfare and regulatory emphasis on accurate, continuous patient monitoring.

Animal Insights

Companion animal segment dominated with largest revenue share in 2024 and is estimated to be the fastest growing segment over the forecast period. This segment comprises dogs, cats, horses and other companion animals. The segment is driven by rising pet ownership, urbanization, and increased spending on preventive and specialized care. According to American Pet Product Association report, about USD 39.8 billion was spent on vet care and product sales in 2024. In addition, this segment witness’s growth by expanding infrastructure, awareness of pet health and welfare, and technological advancements in treatment and monitoring.

The livestock animal segment is growing at a significant CAGR over the forecast period. This segment includes poultry, swine, cattle, sheep & goats and fish. The market is fueled by expanding dairy, poultry, and meat production across emerging economies. According to National Dairy Development Board report, 239.3 million tonnes of milk was produced for the year 2023-24 in India. Moreover, increasing awareness of animal health, disease prevention, and productivity optimization drives demand for diagnostics, vaccines, surgical consumables, and monitoring products. Government livestock programs, stringent disease control regulations, and rising investments in modern farming practices further accelerate growth.

Type Insights

Reusable segment held the largest revenue share in 2024, owing to its cost-effectiveness, durability, and environmental benefits. The segment is also witnessing growth due to increasing procedures, rising adoption of sustainable practices, and the need to optimize operational costs in clinics and hospitals. Veterinary clinics and hospitals prefer reusable items such as surgical instruments, drapes, gowns, and diagnostic tools because they reduce recurring expenses while maintaining high-quality standards.

The disposable segment represents the fastest CAGR over the forecast period, driven by increasing demand for infection control, hygiene, and convenience in veterinary practices. It includes single-use syringes, gloves, masks, catheters, wound dressings, and diagnostic consumables. Furthermore, growth is fueled by rising surgical and diagnostic procedures, increased awareness of cross-contamination risks, and the expansion of companion animal and livestock healthcare.

Distribution Channel Insights

Hospital/clinic pharmacy segment is the largest in 2024, driven by the high volume of procedures, treatments, and preventive care provided in facilities. Veterinary hospitals and clinics maintain in-house pharmacies to ensure timely access to essential medications, vaccines, surgical supplies, and diagnostics. In addition, expanding infrastructure, rising companion animal ownership, and increasing adoption of advanced therapies are boosting the segment’s growth. Centralized procurement and ready availability of consumables make hospital and clinic pharmacies the dominant distribution channel.

E-commerce is the fastest growing segment over the timeframe of 2025-2033, driven by increasing internet penetration, convenience, and rising awareness of animal health products. Online platforms enable animal clinics, pharmacies, and pet owners to access a wide range of consumables such as diagnostics, surgical supplies, medications, and preventive care products. Moreover, faster delivery, competitive pricing, and broader product availability, particularly in remote or underserved regions propel market growth. The digital shift also supports subscription models and bulk purchasing, accelerating adoption across companion animal and livestock segments.

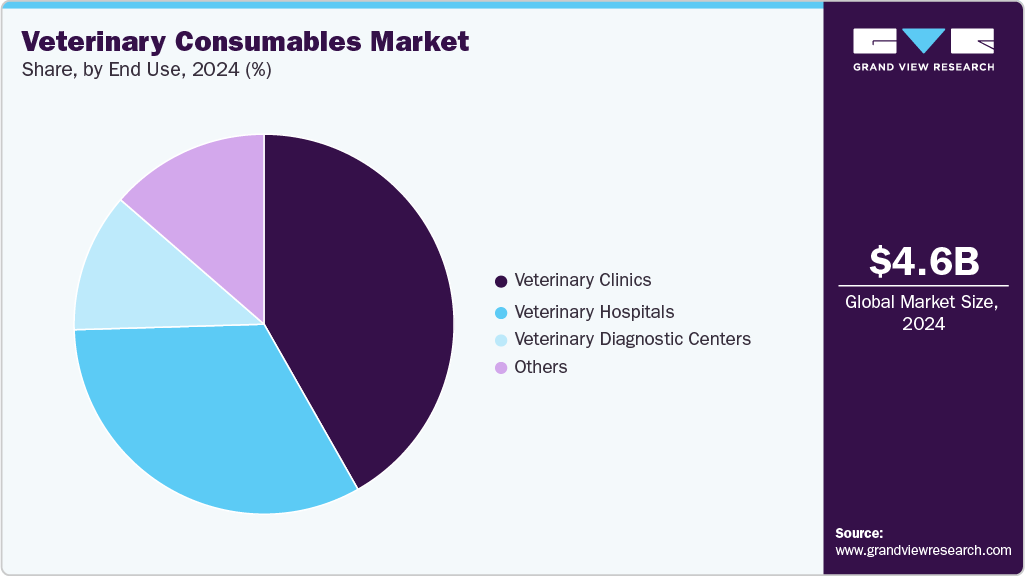

End Use Insights

Veterinary clinics constituted the largest revenue share in 2024. The segment’s dominance can be attributed to factors related to their central role in providing routine care, diagnostics, surgeries, and preventive treatments for companion animals and livestock. Clinics require a consistent supply of consumables, including anesthesia supplies, monitoring devices, surgical tools, and wound care products.

The veterinary diagnostic center is the fastest growing segment over the forecast period, driven by rising demand for accurate and timely disease detection in companion animals and livestock. These centers rely heavily on consumables such as diagnostic kits, reagents, blood collection supplies, and laboratory instruments. Growth is fueled by increasing pet ownership, expanding livestock production, and the adoption of advanced diagnostic technologies. The emphasis on preventive care, early disease detection, and regulatory requirements for animal health further accelerates the consumption of diagnostic products.

Regional Insights

North America veterinary consumables market dominated the overall global market with the largest revenue share of 34.87% in 2024. The market is driven rising pet ownership, increasing companion animal healthcare expenditure, and growing demand for advanced diagnostic and surgical products. In addition, technological advancements in consumables, such as disposable syringes, surgical instruments, and diagnostic kits, further fuel growth. Key players such as IDEXX Laboratories, Zoetis, Patterson Companies, and Henry Schein, which compete via product innovation, distribution networks, and acquisitions.

U.S. Veterinary Consumables Market Trends

The veterinary consumables market in the U.S. accounted for the largest market share in the North America market, owing to increasing demand for companion animal healthcare, and growth in livestock and poultry sectors, which require advanced consumables for diagnostics, surgery, and routine care. For instance, in May 2024, Phoenix-Micron introduced the MICRON Animal Stand Pro, integrating inhalation anesthesia delivery with small animal ocular imaging, enhancing ease, safety, and imaging quality while reducing interference from masks and tubing.

The Canada veterinary consumables market is expected to grow at a significant CAGR during the forecast period, propelled by increasing companion animal healthcare expenditure and growing awareness of preventive care. Regulatory surveillance is governed by Health Canada and the Canadian Food Inspection Agency ensures quality, safety, and efficacy of veterinary consumables, including medical devices and pharmaceuticals, requiring compliance with licensing, labeling, and reporting standards.

Europe Veterinary Consumables Market Trends

The veterinary consumables market in Europe is expected due to growing government and EU initiatives, awareness of zoonotic diseases and increasing livestock production. According to European Center for Disease Prevention and Control, in 2023, campylobacteriosis and salmonellosis were the two most frequently reported zoonotic diseases in humans, ranking first and second, respectively. Moreover, initiatives promoting animal welfare, antimicrobial stewardship, and traceability drive adoption of high-quality consumables, supporting sustained growth across Europe.

The veterinary consumables market in UK is expected to grow significantly over the forecast period. The market is characterized by rising expansion of veterinary clinics and hospitals and increasing technological adoption. The UK veterinary consumables market is highly competitive, with global players like Zoetis, IDEXX, and Covetrus competing alongside domestic manufacturers. Moreover, companies differentiate through product innovation, quality, pricing, and distribution networks.

The Germany veterinary consumables market held a significant share in 2024. The country’s growth is influenced by rising livestock health focus, increasing demand for advanced diagnostic and surgical products and veterinary service expansion. For instance, in October 2025, Viromed Medical AG advanced its product launches, expanded strategic partnerships, and achieved promising preclinical and clinical results for veterinary applications.

Asia Pacific Veterinary Consumables Market Trends

Veterinary consumables market in Asia Pacific is expected to grow at the fastest CAGR over the forecast period. The region's growth can be attributed to rising e-commerce & online distribution, expansion of infrastructure and increasing companion animal adoption. Regulatory frameworks vary across countries but generally follow strict guidelines on animal safety, product quality, and import controls. Compliance with local veterinary authorities, labeling standards, and ISO certifications is critical, while harmonization efforts under regional trade agreements are gradually shaping the regulatory landscape.

The veterinary consumables market in China held the largest revenue shareandis witnessing new growth opportunities due rising demand for animal care that drives domestic medical device makers to expand into pet healthcare, with increasing adoption of smart diagnostics and high-end animal medical equipment. The market is competitive, with domestic manufacturers and global companies vying through product innovation, cost efficiency, and extensive distribution networks.

India veterinary consumables market is advancing due to rising pet ownership, expanding livestock farming, and increasing awareness of animal health and preventive care. In addition, growing government initiatives supporting livestock productivity and vaccination programs further boost demand. The country witness’s advancements such as development of high-quality vaccines, diagnostic kits, surgical instruments, and digital tools for inventory and treatment management.

Latin America Veterinary Consumables Market Trends

The market in Latin America is driven by its growing companion animal segment and growing awareness of animal health and preventive care. Growth is supported by adoption of advanced diagnostics, surgical tools, and digital monitoring solutions. The market is moderately fragmented, with regional manufacturers competing alongside multinational players on price, quality, and distribution networks, while partnerships and acquisitions enhance market reach.

Brazil veterinary consumables market is gaining momentum, large livestock sector, increasing collaborations within the country and growing demand for dairy, meat, and poultry products. In addition, rising awareness of animal welfare and preventive care, alongside adoption of modern diagnostic and surgical consumables, supports market expansion. For instance, in September 2025, IMV Imaging and Asto CT formed a strategic partnership to advance veterinary diagnostic imaging, combining expertise and innovative technologies like weight-bearing CT scanners to improve accuracy and workflow in equine and mixed practices.

Middle East & Africa Veterinary Consumables Market Trends

The Middle East and Africa veterinary consumables market is driven by expanding livestock farming, rising pet ownership in urban areas, and growing investment in animal healthcare infrastructure. The demand for advanced diagnostics, surgical instruments, and preventive care products is increasing due to awareness of animal welfare and zoonotic disease control. The market is moderately fragmented, with multinational corporations competing alongside regional suppliers on product quality, pricing, and service networks, while collaborations and distribution partnerships enhance market reach.

South Africa veterinary consumables market held the largest revenue shareand is infrastructure expansion, and rising adoption of digital & smart technologies. The region is advancing due to adoption of modern diagnostics, surgical tools, and digital monitoring systems in veterinary practices. Furthermore, the country comprises both local distributors and global players offering digital inventory management innovative consumables, and surgical supplies, along with strategic partnerships and acquisitions enhancing market presence.

Key Veterinary Consumables Company Insights

The veterinary consumables market is dominated by global players such as Zoetis, IDEXX Laboratories, Covetrus, B. Braun Vet Care, and Heska Corporation. These companies compete through innovation, product quality, and distribution reach, while regional manufacturers focus on cost-effective solutions, niche products, and strategic partnerships to strengthen market presence and share.

Key Veterinary Consumables Companies:

The following are the leading companies in the veterinary consumables market. These companies collectively hold the largest market share and dictate industry trends.

- Shenzhen Mindray Animal Medical Technology Co., LTD.

- Midmark Corporation

- RWD Life Science Co., LTD

- Dispomed Ltd

- Nonin

- Vetland Medical Sales & Services, LLC

- Masimo

- Digicare Biomedical

- IntriQuip

- SunTech Medical, Inc.

- Covetrus

- Medtronic

- B. Braun Vet Care GmbH

- Avante Animal Health

Recent Developments

-

In September 2025, IMV Imaging and Asto CT formed a strategic partnership to advance veterinary diagnostic imaging, combining expertise and innovative technologies like weight-bearing CT scanners to improve accuracy and workflow in equine and mixed practices.

-

For instance, in March 2025, SeQuent Scientific and Viyash Lifesciences merged, for its advanced capabilities, 16 manufacturing facilities, strong R&D, and access to over 150 international markets.

-

In January 2025, Millpledge Veterinary partnered with Eickemeyer Canada to streamline distribution of its surgical consumables, wound care products, and other veterinary supplies across Canada.

Veterinary Consumables Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.61 billion

Revenue forecast in 2033

USD 2.84 billion

Growth rate

CAGR of 7.3% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD Million/Billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, animal, type, distribution channel, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Thailand; South Korea; Australia; Brazil; Argentina; South Africa; UAE; Saudi Arabia; Kuwait; Qatar; Oman

Key companies profiled

Shenzhen Mindray Animal Medical Technology Co., LTD.; Midmark Corporation; RWD Life Science Co., LTD.; Dispomed Ltd; Nonin; Vetland Medical Sales & Services, LLC; Masimo; Digicare Biomedical; IntriQuip; SunTech Medical, Inc.; Covetrus; Medtronic; B. Braun Vet Care GmbH; Avante Animal Health.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary Consumables Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the veterinary consumables market report based on product, animal, type, distribution channel, end use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Anesthesia Supplies

-

Ventilator Supplies

-

Monitoring Supplies

-

Imaging Supplies

-

Others

-

-

Animal Outlook (Revenue, USD Million, 2021 - 2033)

-

Companion Animal

-

Dogs

-

Cats

-

Horses

-

Others

-

-

Livestock Animal

-

Poultry

-

Swine

-

Cattle

-

Sheep & Goats

-

Fish

-

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Disposable

-

Reusable

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospital/ Clinic Pharmacy

-

Retail

-

E-Commerce

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Veterinary Hospitals

-

Veterinary Clinics

-

Veterinary Diagnostic Centers

-

Others

-

-

Region Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

Saudi Arabia

-

Kuwait

-

Qatar

-

Oman

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.