- Home

- »

- Animal Health

- »

-

Veterinary Scales Market Size, Share & Trends Report, 2030GVR Report cover

![Veterinary Scales Market Size, Share & Trends Report]()

Veterinary Scales Market (2024 - 2030) Size, Share & Trends Analysis Report By Configuration (Platform, Portable), By Technology (Electronic, Mechanical), By Animal Type, By Purchasing Channel, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-154-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Veterinary Scales Market Size & Trends

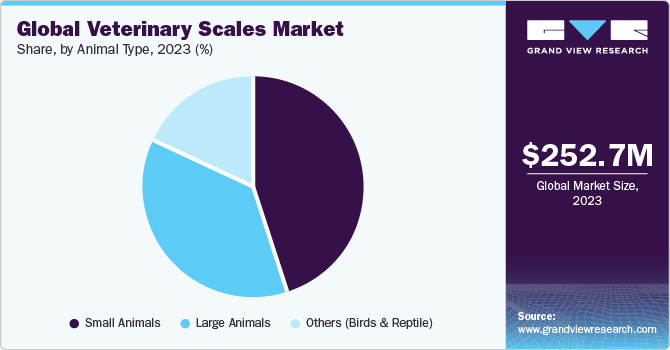

The global veterinary scales market size was estimated at USD 252.69 million in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 5.15% from 2024 to 2030. Some of the key drivers of the market include growing technological advancement in veterinary scales, availability of a broad range of products, initiatives by key companies, increasing expenditure on animals, and demand for weight monitoring devices to improve animal health outcomes. Similarly, several key players are expanding their product offerings, which is expected to boost demand for veterinary scales during the forecast period.

For instance, In January 2022,SR Instruments expanded its range of popular mobile veterinary scales, the SRV94X series, by including integrated wall mount displays. This scale now provides a pet-friendly option for in-practice use with the integration of a wall-mounted readout.

The COVID-19 pandemic affected the human lifestyle in a significant manner. However, it also had considerable effects on the eating habits, exercise levels, and weight of pets, affecting their quality of life. In June 2021, Windermere Veterinary Services released research stating that overweight pets increased by 108% until 2020. According to a January 2022 Washington Post article, through November 2020, Americans paid USD 21.4 billion on non-medical pet products. According to a People's Dispensary for Sick Animals post from August 2021, 38% of dogs only walked once daily due to the lockdown, compared to 33% in February 2020. This is a decrease in daily walks compared to pre-pandemic levels. As a result, the pandemic has increased pet obesity rates, further fueling market growth.

In addition, the increasing incidence of diseases and animal deaths caused by drug overdoses and excessive food consumption is expected to drive the market growth. For instance, The American Society for the Prevention of Cruelty to Animals (ASPCA) states that overfeeding or consuming more food than the body needs is one of the most frequent concerns pet owners should have. Changing the pet's nutrition is the main way to address this expanding issue. The veterinary scale plays an important role in monitoring pets’ diets; thus, demand for veterinary scales has increased after the pandemic.

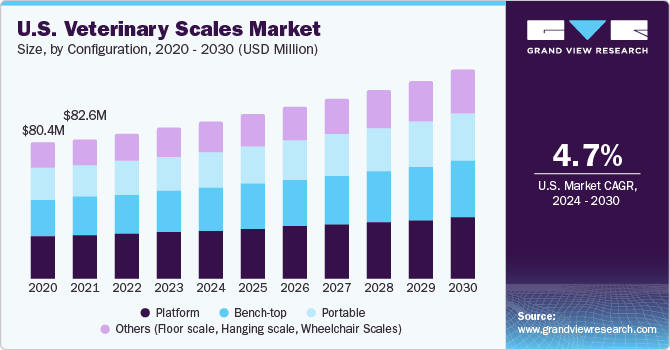

Configuration Insights

The bench-top segment dominated the market in 2023 with a revenue share of 32.15%, while the portable segment is estimated to grow at the fastest CAGR of about 6.2%. Veterinary professionals prefer compact benchtop scales for their ease of use and versatility. Some benchtop scales are designed for specific veterinary applications, such as those used for exotic animals, birds, or small rodents. These specialized scales cater to the specific needs of veterinarians dealing with different types of animals.

Furthermore, the growth of telemedicine in veterinary care has increased the need for remote monitoring. Portable scales enable pet owners to weigh their animals at home and share the data with veterinarians for virtual consultations. Modern portable scales often incorporate advanced technology, such as digital displays, data storage, and wireless connectivity, making data collection and sharing more efficient. Thus, the growing penetration of telemedicine is expected to boost demand for portable veterinary scales over the forecast period.

Technology Insights

The electronic segment held the largest share of the market in 2023 of 76.39%, owing to the electronic systems' accuracy and simplicity of data. In addition, the continuous efforts of market players to improve their product portfolio also increased the demand for the electronic veterinary scales segment. The added features, such as the product, attract the market. For instance, Rice Lake VS-10 Digital Companion Animal Scale offers a unit of measure locking system, automatic shut off for long battery life, and a 1-inch LCD. Moreover, introducing innovative products in the market also leads to a surge in the market. For instance, in March 2022, Marsden Group launched VT-250, a veterinary consulting table that can function as an electronic weighing scale, consulting table, and surgery table. All the above factors and the digitalization trend are expected to increase the demand for the electronic veterinary scales segment.

Purchasing channels Insights

The online segment held the largest market share of 59.10% in 2023 and is estimated to witness the fastest CAGR of about 5% over the forecast period. The ease of purchasing veterinary scales online has made them more accessible to veterinary professionals and pet owners, further driving market growth. Online retailers typically provide detailed product information, specifications, and customer reviews, allowing veterinarians to make informed decisions about the scale's functionality, accuracy, and durability. For example, integrating advanced technology, such as digital displays, data storage, and connectivity features, in benchtop veterinary scales has increased their efficiency and convenience, making them more attractive to veterinarians and pet owners. Moreover, some veterinarians or clinics prefer the convenience and wider selection offered by online sales channels. In contrast, others may prioritize hands-on inspection, personalized assistance, and local support provided by offline retailers.

End-use Insights

The veterinary hospitals & clinics segment held the largest market share of 33.54% in 2023. Veterinary scales are primarily used in vet hospitals and clinics to weigh animals during veterinary health management. Ordinary pet owners can also use veterinary scales to accurately determine the healthy weight of their cats, dogs, and other pets, and vets use them for medical purposes. Weight loss or gain in any animal could indicate a medical condition. Thus, taking measures of weight with this affordable method is crucial. Furthermore, regardless of the pet's size, pet owners must have access to a steady weight indication to provide the appropriate medical treatment.

The veterinary diagnostic centers segment is estimated to witness the fastest CAGR of about 6% over the forecast period. In veterinary diagnostic laboratories, precision and accuracy in measurements are essential for delivering reliable and accurate diagnostic results. Veterinary scales play a pivotal role in ensuring the quality and integrity of laboratory processes, making them indispensable tools in this setting. The need for accuracy, data reliability, and adherence to quality and safety standards in veterinary research and diagnostics drives the high demand for veterinary scales in diagnostic laboratories.

Animal type Insights

The small animals segment held the largest share of the market in 2023 at 45.57%. The growing number of pets, such as cats, dogs, and small animals, has increased demand for veterinary services and equipment, including small animal scales. Pet owners increasingly know the importance of monitoring their pets' health and well-being. Regular weight checks are crucial for detecting issues like obesity, malnutrition, or underlying health conditions, which has led to an increased demand for small animal scales.

The large animals segment is estimated to witness the fastest CAGR of about 5.7% over the forecast period. The demand for large animal veterinary scales is increasing as the agriculture and livestock industries evolve and stakeholders recognize the importance of precise and efficient animal weight management in their operations.

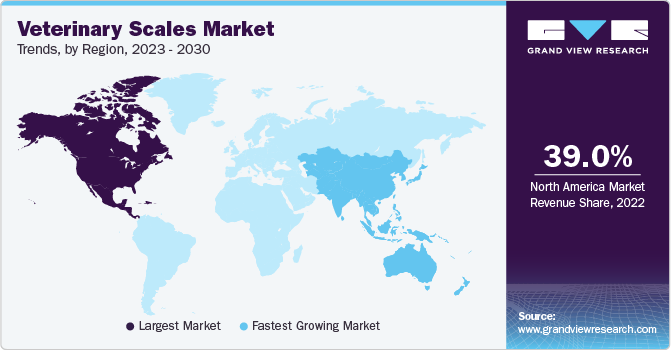

Regional Insights

In terms of region, North America held the largest share of more than 39% of the total market in 2023. There is a growing need for pet care services and products in the region due to the increasing number of pet parents and their high pet expenditures. As per the American Pet Products Association's (APPA) 2021-2022 National Pet Owners Survey, around 70% of American homes had a pet in 2020, a rise from 67% in 2019.

Asia Pacific region, on the other hand, is estimated to grow at the fastest CAGR of more than 6% from 2024 to 2030. The growing awareness about pet health, increasing advancement in veterinary scales, and growing penetration of digital technology in pet health management are anticipated to drive the regional industry’s growth over the forecast period.

Key Companies & Market Share Insights

The market is highly fragmented due to several local players providing various veterinary scales. The extensive distribution networks and competitively low prices of these local players have allowed them considerable market penetration. Competition among veterinary scale manufacturers and the introduction of innovative features and affordable options have made veterinary scales more accessible to a broader range of veterinary practices and animal owners. Furthermore, key players are increasingly targeting emerging markets where the veterinary industry is still developing, further fueling the growth of the market.

Key Veterinary Scales Companies:

- Mettler-Toledo International Inc (OHAUS Corporation)

- Adam Equipment

- Rice Lake Weighing Systems

- Marsden Weighing Machine Group Ltd

- KERN & SOHN GmbH

- Avery Weigh-Tronix, LLC (Brecknell)

- A&D Company, Limited

- SR Instruments, Inc.

- Rusty's Weigh Scales & Service, Inc.

- Avante Animal Health.

Veterinary Scales Market Report Scope

Report Attribute

Details

The market size value in 2024

USD 264.66 million

The revenue forecast for 2030

USD 357.78 million

Growth Rate

CAGR of 5.15% from 2024 to 2030

Base year for estimation

2023

Actual estimates/Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million & CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Configuration, technology, animal type, purchasing channel, end-use, region

Regions covered

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; UK; Germany; Italy; France; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Mettler-Toledo International Inc (OHAUS Corporation); Adam Equipment; Rice Lake Weighing Systems; Marsden Weighing Machine Group Ltd; KERN & SOHN GmbH; Avery Weigh-Tronix, LLC (Brecknell); A&D Company, Limited; SR Instruments, Inc.; Rusty's Weigh Scales & Service, Inc.; Avante Animal Health

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary Scales Market Report Segmentation

This report forecasts revenue growth at the regional & country level and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global veterinary scales market based on technology, configuration, animal type, purchasing channel, end-use, and region:

-

Configuration Outlook (Revenue, USD Million, 2018 - 2030)

-

Platform

-

Bench-top

-

Portable

-

Others (Floor scale, Hanging scale, Wheelchair Scales)

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Electronic

-

Mechanical

-

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Animals

-

Small Animals

-

Others (Birds & Reptile)

-

-

Purchasing Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinary Hospitals & Clinics

-

Veterinary Diagnostic Centers

-

Homecare Settings

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Rest of Europe

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Rest of Latin America

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Rest of MEA

-

-

Frequently Asked Questions About This Report

b. The global veterinary scales market size was estimated at USD 252.69 million in 2023 and is expected to reach USD 264.66 million in 2024.

b. The global veterinary scales market is expected to grow at a compound annual growth rate of 5.15% from 2024 to 2030 to reach USD 357.78 million by 2030.

b. North America dominated the veterinary scales market with a share of 39.41% in 2023. There is a growing need for pet care services and products in the region due to the increasing number of pet parents and their high pet expenditures. As per the American Pet Products Association's (APPA) 2021–2022 National Pet Owners Survey, around 70% of American homes had a pet in 2020, a rise from 67% in 2019.

b. Some key players operating in the veterinary scales market include Mettler-Toledo International Inc (OHAUS Corporation); Adam Equipment; Rice Lake Weighing Systems; Marsden Weighing Machine Group Ltd; KERN & SOHN GmbH; Avery Weigh-Tronix, LLC (Brecknell); A&D Company, Limited; SR Instruments, Inc.; Rusty's Weigh Scales & Service, Inc.; Avante Animal Health

b. Some of the key drivers of the market include growing technological advancement in veterinary scales, the availability of a broad range of products, initiatives by key companies, increasing expenditure on animals, and demand for weight monitoring devices to improve animal health outcomes.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.