- Home

- »

- Animal Health

- »

-

Veterinary Stem Cell Therapy Market, Industry Report, 2033GVR Report cover

![Veterinary Stem Cell Therapy Market Size, Share & Trends Report]()

Veterinary Stem Cell Therapy Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Autologous Stem Cell, Allogeneic Stem Cell), By Animal Type (Small Animals, Large Animals), By Application (Orthopedics, Soft Tissue Repair), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-831-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Veterinary Stem Cell Therapy Market Summary

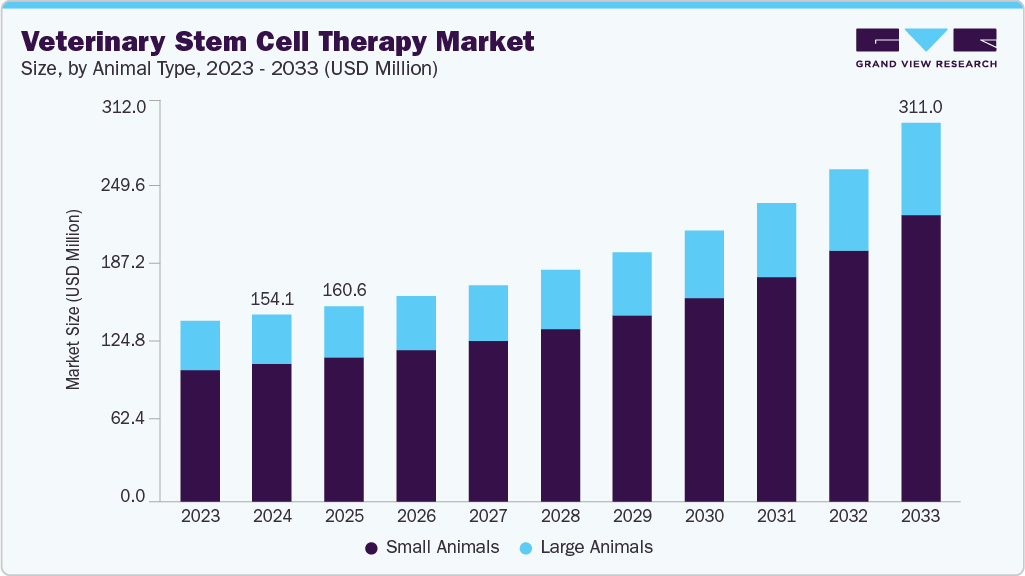

The global veterinary stem cell therapy market size was estimated at USD 154.07 million in 2024 and is projected to reach USD 311.03 million by 2033, growing at a CAGR of 8.62% from 2025 to 2033. The industry is witnessing significant growth driven by the increasing incidence of chronic and degenerative conditions in pets, continuous advancements in stem cell therapy technologies, rising pet humanization, and a greater willingness among owners to invest in advanced veterinary care.

Key Market Trends & Insights

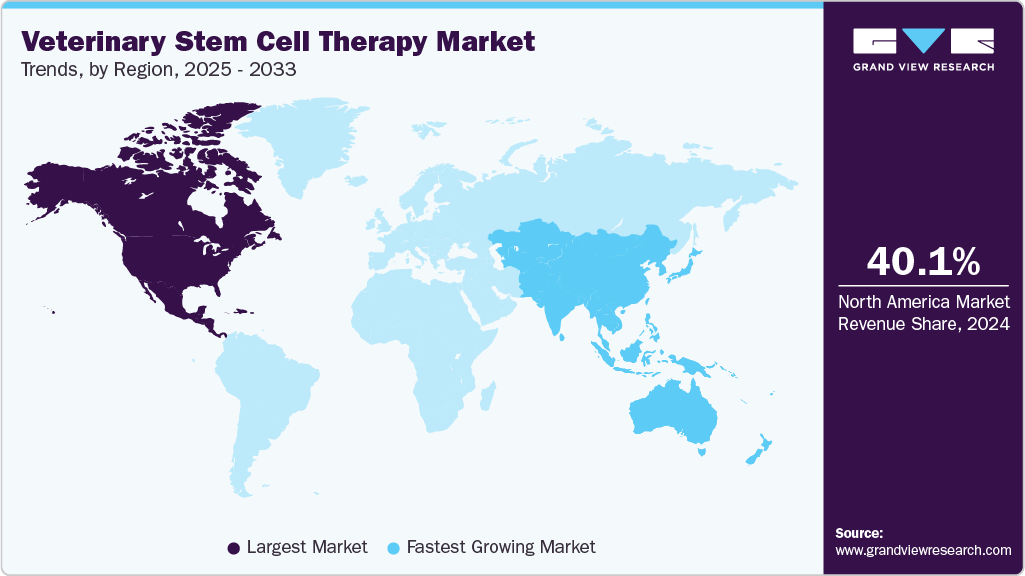

- North America veterinary stem cell therapy market held the largest revenue share of 40.14% in 2024.

- U.S. dominated the North America region with the largest revenue share in 2024.

- By product, autologous stem cell segment held the largest share of 53.03% of the market in 2024

- By animal type, the small animals held the largest share in the market in 2024.

- Based on application, the orthopedics segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 154.07 Million

- 2033 Projected Market Size: USD 311.03 Million

- CAGR (2025-2033): 8.62%

- North America region: Largest market in 2024

- Asia Pacific region: Fastest growing market

The market is further supported by the growing demand for advanced, disease-modifying therapies in veterinary care. Stem cell-based drugs provide the unique advantage of relieving clinical symptoms as well as targeting the root cause of many chronic conditions. For instance, VET CELL TECH is helping drive this shift by building a strong pipeline using its own iPSC technology, which allows it to produce stem cell treatments on a large scale with reliable quality and smoother distribution. The company is developing regenerative therapies for major pet health problems like Feline Chronic Gingivostomatitis, chronic kidney disease in cats, atopic dermatitis in dogs, osteoarthritis, and several future conditions. Because these treatments are standardized, scalable, and designed for real clinical needs, they fill important gaps in care for older and chronically sick pets. This is expected to encourage more veterinarians to adopt stem cell therapies and increase overall spending on advanced regenerative care in the market.

In addition, initiatives undertaken to bring advanced, evidence-based regenerative therapies into mainstream veterinary care are significantly shaping market growth. For instance, according to an article published by The Indian Express, in June 2025, Gallant’s stem cell therapy for a serious and painful condition in cats is expected to receive U.S. FDA approval in 2026. Getting this approval would be a big step forward, showing that the treatment is safe and truly works, which would boost confidence among veterinarians and pet owners. Once FDA-approved stem cell products become available, more clinics are likely to use them, investors may put more money into the field, and overall acceptance of regenerative treatments would grow, helping push the industry forward.

Furthermore, rising pet spending is giving a strong boost to the industry, because more pet owners now treat their animals like family and are willing to pay for advanced, high-quality medical care to keep them healthy. For instance, according to APPA, the rise in U.S. pet spending from USD 151.9 billion in 2024 to a projected USD 157 billion in 2025 shows that owners are consistently allocating more money toward premium and advanced veterinary care. This growing financial commitment directly supports the adoption of high-value treatments like stem cell therapy, which can be more expensive than traditional options but offer superior outcomes for chronic conditions such as osteoarthritis, dysplasia, and inflammatory diseases.

Market Concentration & Characteristics

The industry is highly concentrated, dominated by key global players such as Boehringer Ingelheim International GmbH, Cell Therapy Sciences, Magellan Stem Cells, DS Pharma Animal Health Co., Ltd., Gallant, and others. These companies strengthen their market position by using strong R&D, wide global distribution networks, and partnerships with local players to reach more customers and bring better products to the market. By combining scientific innovation with broad market reach and localized support, they are able to accelerate product commercialization, enhance customer access, and maintain a competitive advantage across the veterinary stem cell therapy landscape.

The degree of innovation in the industry is high, driven by rapid advancements in cell science, processing technologies, and regenerative treatment applications for pets and large animals. Companies are moving beyond traditional autologous stem cell procedures toward more scalable, standardized, and clinically robust solutions, including allogeneic therapies, iPSC-derived cells, and advanced scaffolding systems that enhance tissue repair.

The level of merger and acquisition activity within the market is moderate. Key players tend to pursue targeted acquisitions to strengthen their technological capabilities, expand regenerative therapy portfolios, or gain access to specialized manufacturing and distribution assets. For instance, in April 2025, Vetirus Pharmaceuticals acquired Kansas-based Enso Discoveries, enhancing its regenerative medicine portfolio and expanding capabilities to deliver innovative, cost-effective biologic therapies for animals and humans globally.

Regulations have a significant impact on the market, shaping product development, commercialization timelines, and overall market adoption. Clear regulatory pathways from agencies such as the USDA, FDA, or regional veterinary authorities help establish quality, safety, and manufacturing standards, which in turn build trust among veterinarians and pet owners. However, compliance requirements for cell processing, sterility, potency testing, and clinical validation can increase development costs and lengthen approval timelines, slowing the entry of new products.

Product substitutes have a notable influence on the market by shaping treatment preferences, adoption rates, and competitive positioning. Traditional alternatives such as NSAIDs, corticosteroids, physical therapy, surgery, platelet-rich plasma (PRP), and newer biologics often offer lower upfront costs and quicker availability, making them appealing options for pet owners seeking immediate relief for conditions like osteoarthritis or inflammation. These substitutes can slow the adoption of stem cell therapies, especially in cases where owners are concerned about price, procedural complexity, or treatment timelines.

Regional expansion significantly impacts the market by broadening access to advanced regenerative treatments in both established and emerging markets. By entering new regions, companies can tap into growing pet populations, rising disposable incomes, and increasing awareness of innovative veterinary care, which collectively drive higher demand for premium therapies.

Product Insights

On the basis of product, the autologous stem cell segment held the largest revenue share of 53.03% in 2024, primarily because it offers safer, faster, and more personalized treatment outcomes, with minimal risk of immune rejection since the cells are sourced from the animal’s own body. Veterinarians often choose autologous stem cell therapies because they work well for common problems like osteoarthritis in dogs, tendon injuries in horses, and other joint issues. These treatments are convenient since the cells can be collected and processed quickly, allowing vets to reinject them the same day or within a short period, which helps speed up healing. Techniques such as using fat-derived stem cells in dogs or bone-marrow stem cell injections in horses have become routine in many modern clinics because they show good results and are easier to use under current regulations than donor-derived (allogeneic) products. This strong clinical trust, combined with fewer safety concerns, is why autologous therapies remain the leading choice in the market.

The allogeneic stem cell segment is expected to grow at the fastest rate over the forecast period. Allogeneic stem cells are helping the veterinary stem cell therapy market grow because they are ready-made, consistent, and easy for clinics to use. Unlike autologous treatments, which require collecting cells from the animal, processing them, and waiting for them to be ready, these off-the-shelf products can be used right away. This makes them especially useful for treating sudden injuries and common orthopedic problems in dogs, cats, and horses. They can also be produced in larger batches, which lowers costs and gives veterinarians a reliable, high-quality option. Companies such as eQcell are already supplying equine cord-blood stem cells that vets can use immediately, and Medrego’s Canicell and EquiCell products are becoming popular for treating joint and tendon issues. Because they save time, reduce costs, and deliver consistent results, allogeneic stem cells are becoming one of the main drivers of growth in the market.

Animal Type Insights

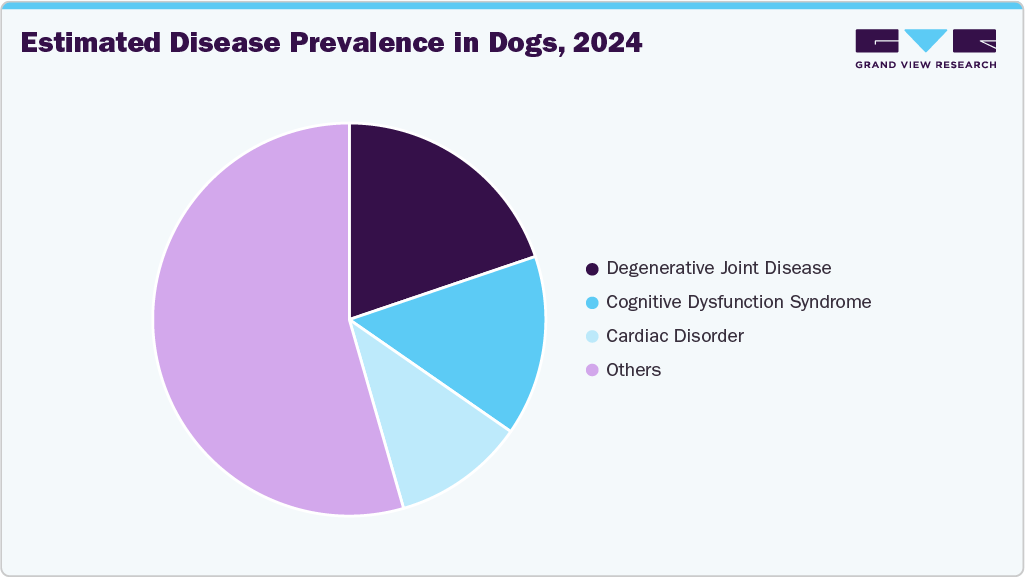

On the basis of animal type, the small animals segment dominated the market with the largest revenue share in 2024 and is anticipated to grow at the fastest CAGR over the forecast period. The segment growth is attributed to the rising prevalence of chronic diseases in companion animals such as dogs and cats. For instance, according to an article published by Morris Animal Foundation, in July 2024, osteoarthritis is a major health problem for pets in the U.S., with an estimated 14 million adult dogs living with the condition. Cats are also widely affected-research shows that about 90% of cats over 12 years old have signs of arthritis on X-rays. Because this disease is long-lasting and often painful, many pets need better treatment options than what is currently available. This has pushed more owners to look for advanced solutions, including stem cell therapies that can ease pain and help pets move more comfortably. With so many affected animals and growing interest in higher-quality care, demand for veterinary stem cell treatments continues to rise.

The large animals segment is driven by the presence of prominent players providing stem cell-based therapies for large animals, particularly horses. For instance, Boehringer Ingelheim International GmbH offers RenuTend, an advanced stem cell therapy designed to enhance the repair and recovery of tendon and suspensory ligament injuries. These focused, proven treatments meet important veterinary needs and encourage more clinics to use regenerative therapies for horses. They also set high standards for results and quality, helping the overall market grow.

Application Insights

On the basis of application, the orthopedics segment dominated the market with the largest revenue share in 2024, owing to the high prevalence of degenerative joint disorders in companion animals. For instance, according to Boehringer Ingelheim International GmbH, approximately one in five dogs (20%) experience joint problems during their lifetime, leading to pain, reduced mobility, and diminished quality of life, with even higher rates observed in breeds genetically predisposed to joint disorders. In cats, the prevalence of degenerative joint disease is estimated to range between 40% and 92%, reflecting a substantial portion of the population affected by chronic musculoskeletal conditions. As pet owners increasingly seek treatments that alleviate symptoms and promote healing and mobility, the veterinary stem cell therapy market is poised to experience substantial growth driven by this large and growing patient population.

The other applications segment is expected to grow with the fastest CAGR over the forecast period. Stem cell treatments offer potential regenerative solutions for heart disease, spinal cord injuries, and nerve damage, addressing conditions that traditionally have had limited therapeutic options. In dentistry, stem cells can aid in periodontal regeneration and small animal tissue repair, while preclinical and research applications help to develop new protocols, improve safety standards, and expand the range of treatable indications. The exploration and adoption of these additional applications broaden the clinical utility of stem cell therapies as well as stimulate innovation, attract investment, and create new revenue streams, collectively contributing to market growth.

End-use Insights

On the basis of end use, veterinary hospitals/clinics dominated the market with the largest revenue share in 2024, since they serve as the primary points of care for pets requiring advanced regenerative treatments. These facilities combine direct access to patient populations with trained veterinary specialists capable of administering complex procedures, such as stem cell harvesting, processing, and implantation. Hospitals and multi-specialty clinics often have the infrastructure, equipment, and partnerships with stem cell providers to offer standardized, high-quality treatments, which increases adoption rates.

The veterinary academics and research institutes segment is the fastest-growing segment over the forecast period of 2025-2033. It plays a crucial role by advancing scientific knowledge, developing innovative treatment protocols, and validating the safety and efficacy of regenerative therapies. Through preclinical studies, clinical trials, and translational research, these institutions generate the evidence needed to support regulatory approvals and clinical adoption. They also serve as training hubs for veterinarians, equipping practitioners with the skills and expertise to implement stem cell therapies effectively. Additionally, collaborations between research institutes and biotech companies accelerate product development, optimize therapeutic applications, and expand the range of treatable conditions, collectively fostering innovation and fueling market growth in the veterinary stem cell therapy sector.

Regional Insights

North America stem cell therapy market dominated with the largest revenue share of 40.14% in 2024. The market is being propelled by factors such as growing pet ownership, the increasing incidence of osteoarthritis among companion animals, and a rising preference for minimally invasive, disease-modifying treatments. Leading players capitalizing on these trends include VetStem, Boehringer Ingelheim, and Transcend Biologics, which are advancing innovative regenerative solutions to address chronic conditions, improve animal mobility, and meet the evolving expectations of pet owners seeking high-quality, long-term care.

U.S. Stem Cell Therapy Market Trends

The veterinary stem cell therapy market in the U.S.accounted for the highest market share in the North America market, driven by the growing pet population and increasing trends of pet humanization. For instance, according to an article published by APPA, in 2025, approximately 30% of millennials and 25% of Generation X own pets, reflecting a substantial portion of younger and middle-aged adults actively engaged in pet care. This demographic is particularly willing to invest in premium and advanced veterinary treatments, including stem cell therapies, due to their strong emotional attachment to pets and higher disposable income. As these pet-owning cohorts prioritize the health, longevity, and quality of life of their animals, demand for innovative, disease-modifying therapies is expected to rise, thereby driving growth in the market.

Canada veterinary stem cell therapy marketis expected to grow at a significant CAGR during the forecast period, propelled by the presence of veterinary hospitals providing stem cell therapies in companion animals. For instance, Douglas Animal Hospital offers stem cell regenerative treatments for pets with osteoarthritis, ligament injuries, spinal cord injuries, and other chronic conditions, making advanced therapies more accessible to pet owners. By integrating stem cell treatments into routine clinical practice, these hospitals increase awareness and adoption among veterinarians and pet owners, demonstrating the effectiveness and safety of regenerative solutions. This widespread clinical presence accelerates market penetration, encourages investment in new technologies, and ultimately fuels sustained growth in the market.

Europe Veterinary Stem Cell Therapy Market Trends

The veterinary stem cell therapy market in Europe is growing due to the presence of prominent regional players, the growing number of pet owners, and the increasing adoption of pet insurance. Established companies bring advanced technologies, clinical expertise, and trusted brands, which enhance market credibility and expand access to regenerative therapies. At the same time, rising pet ownership enlarges the patient pool, while pet insurance reduces out-of-pocket costs, making premium treatments like stem cell therapy more affordable and appealing to owners. Together, these factors boost treatment adoption, stimulate investment in innovative therapies, and support sustained growth in the market.

The UK veterinary stem cell therapy market is expected to grow significantly over the forecast period. The market is characterized due to its strong veterinary healthcare infrastructure, high standards of clinical practice, and growing emphasis on advanced, minimally invasive treatments for pets. Rising pet ownership, coupled with a deeply established culture of pet humanization, is increasing demand for innovative therapies that offer long-term relief for chronic conditions such as osteoarthritis, ligament injuries, and inflammatory diseases.

A supportive regulatory framework in Germany is poised to significantly drive the growth of the veterinary stem cell therapy market by providing clear guidelines for the development, approval, and clinical use of regenerative treatments. Well-defined regulations help ensure product safety, consistency, and ethical standards, which in turn increase confidence among veterinarians, pet owners, and industry stakeholders. Streamlined approval pathways and strong oversight also encourage companies to invest in research, innovation, and the commercialization of new stem cell products within the country.

Asia Pacific Veterinary Stem Cell Therapy Market Trends

The veterinary stem cell therapy market in Asia Pacificis expected to grow at the fastest CAGR over the forecast period. The region's growth can be attributed to the expanding urban lifestyles coupled with improving financial capacity. As more people move into urban areas, pet ownership continues to increase, particularly among younger, higher-income households that view pets as family members. With greater financial stability, these owners are more willing to invest in advanced veterinary care, including regenerative treatments that offer long-term benefits for chronic and degenerative conditions. Urban lifestyles also heighten awareness of modern veterinary solutions through better access to animal hospitals, specialty clinics, and pet health services.

Japan veterinary stem cell therapy marketis witnessing new growth opportunities due to ongoing research studies on stem cells. For instance, according to an article published by THE MAINICHI NEWSPAPERS, in March 2025, a research team in Japan has, for the first time worldwide, successfully developed high-quality feline induced pluripotent stem (iPS) cells and embryonic stem (ES) cells, an achievement that marks a major leap forward for veterinary medicine. This advancement is expected to drive market growth by expanding the scientific foundation for stem cell based therapies in cats, enabling the development of more precise, effective, and standardized treatments for chronic and degenerative conditions. It also encourages greater R&D investment, attracts biotechnology companies to explore new therapeutic applications, and accelerates the commercialization of advanced regenerative products. As clinical confidence increases and new feline-specific therapies enter the market, this innovation will significantly boost adoption and contribute to the overall expansion of the veterinary stem cell therapy sector.

The market for veterinary stem cell therapy in India is expected to grow significantly owing to the rising pet ownership, increasing humanization of companion animals, and a higher incidence of orthopedic and degenerative conditions such as osteoarthritis, hip dysplasia, and ligament injuries that respond well to regenerative treatments. Moreover, supportive research from veterinary universities and emerging applications in equine and livestock health further broaden the market’s potential. As regulatory frameworks gradually become clearer, commercialization will become easier, collectively driving steady, long-term market expansion in India.

Latin America Veterinary Stem Cell Therapy Market Trends

The veterinary stem cell therapy market in Latin American is driven by the expanding network of veterinary hospitals and specialty clinics, particularly in Brazil and Argentina, that are increasingly adopting regenerative medicine as part of their service offerings. These hospitals are investing in modern equipment, partnering with biotech firms, and training veterinarians in stem cell procedures, which is significantly improving accessibility and patient outcomes. The presence of emerging regional biotech companies offering autologous and allogeneic stem cell solutions, along with improving regulatory clarity for veterinary biologics, is accelerating adoption.

Brazil veterinary stem cell therapy marketis gaining momentum, supported by the increasing prevalence of lameness in horses. For instance, according to an article published by the Brazilian Journal of Veterinary Medicine, in May 2025, lameness is a major concern in Brazil’s large and economically important equine industry spanning sports, racing, agriculture, and leisure where performance and mobility are essential. Traditional therapies such as anti-inflammatory drugs or rest often provide only temporary relief, prompting a shift toward regenerative solutions that can repair damaged tissues and restore function. Veterinary hospitals and equine specialty clinics in Brazil are increasingly adopting stem cell therapies due to their proven ability to enhance healing and reduce recovery times, leading to better performance outcomes. As awareness grows among horse owners and more clinics integrate regenerative medicine into their services, demand for equine stem cell products continues to rise, driving market growth in Brazil.

Middle East & Africa Veterinary Stem Cell Therapy Market Trends

The veterinary stem cell therapy market in the Middle East & Africa is anticipated to grow at a lucrative growth rate, attributable to increasing awareness among veterinarians and pet owners about advanced regenerative treatments, coupled with the expansion of veterinary healthcare infrastructure and specialty clinics in the region. Rising investments by key players in technology transfer, training, and local partnerships are enhancing the availability and accessibility of stem cell therapies. Additionally, growing emphasis on high-quality veterinary care, along with supportive regulatory developments, is encouraging adoption of innovative treatments for chronic and degenerative conditions in companion and large animals. Collectively, these factors are driving the uptake of stem cell therapies and fueling sustained market growth across the Middle East and Africa.

South Africa veterinary stem cell therapy market is expanding, due to its relatively advanced veterinary healthcare infrastructure and increasing adoption of innovative treatments for chronic and degenerative conditions in pets and large animals. The presence of specialized veterinary clinics and hospitals, combined with growing awareness among veterinarians and pet owners about the benefits of regenerative therapies, is enhancing market penetration.

Key Veterinary Stem Cell Therapy Companies Insights

Key players operating in the veterinary stem cell therapy market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Veterinary Stem Cell Therapy Companies:

The following are the leading companies in the veterinary stem cell therapy market. These companies collectively hold the largest Market share and dictate industry trends.

- Boehringer Ingelheim International GmbH

- Vetherapy

- Vetstem, Inc.

- Ardent

- Cell Therapy Sciences

- Medrego

- StemcellX

- Magellan Stem Cells

- eQcell Inc

- Gallant

Recent Developments

-

In July 2025, Gallant raised USD 18 million in Series B funding to advance off-the-shelf stem cell therapies, including treatment for refractory feline chronic gingivostomatitis, using mesenchymal stem cells from the uterus.

-

In March 2025, VetStem secured funding to complete regulatory submissions for StemStat Ortho, aiming for FDA conditional approval as the first allogeneic stem cell therapy for canine osteoarthritis.

-

In April 2025, Vetirus Pharmaceuticals acquired Kansas-based Enso Discoveries, enhancing its regenerative medicine portfolio and expanding capabilities to deliver innovative, cost-effective biologic therapies for animals and humans globally.

Veterinary Stem Cell Therapy Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 160.57 million

Revenue forecast in 2033

USD 311.03 million

Growth rate

CAGR of 8.62% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, animal type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Thailand; South Korea; Australia; Brazil; Argentina; South Africa; UAE; Saudi Arabia; Kuwait; Qatar; Oman

Key companies profiled

Boehringer Ingelheim International GmbH; Vetherapy; Vetstem, Inc.; Ardent; Cell Therapy Sciences; Medrego; StemcellX; Magellan Stem Cells; eQcell Inc; Gallant

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary Stem Cell Therapy Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global veterinary stem cell therapy market report based on product, application, animal type, end-use, and region.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Autologous stem cell

-

Allogeneic stem cell

-

-

Animal Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Small Animals

-

Large Animals

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Orthopedics

-

Soft Tissue Repair

-

Other Applications

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Veterinary Hospitals/Clinics

-

Veterinary Academic & Research Institutes

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

Saudi Arabia

-

Kuwait

-

Qatar

-

Oman

-

-

Frequently Asked Questions About This Report

b. The global veterinary stem cell therapy market size was estimated at USD 154.07 million in 2024 and is expected to reach USD 160.57 million in 2025.

b. The global veterinary stem cell therapy market is expected to grow at a compound annual growth rate of 8.62% from 2025 to 2033 to reach USD 311.03 million by 2033.

b. North America dominated the veterinary stem cell therapy market with a share of 40.14% in 2024. This is attributable to factors such as growing pet ownership, the increasing incidence of osteoarthritis among companion animals, and a rising preference for minimally invasive, disease-modifying treatments

b. Some key players operating in the veterinary stem cell therapy market include Boehringer Ingelheim International GmbH, Vetherapy, Vetstem, Inc., Ardent, Cell Therapy Sciences, Medrego, StemcellX, Magellan Stem Cells, eQcell Inc, and Gallant

b. Key factors that are driving the market growth include increasing incidence of chronic and degenerative conditions in pets, continuous advancements in stem cell therapy technologies, rising pet humanization, and a greater willingness among owners to invest in advanced veterinary care.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.