- Home

- »

- Animal Health

- »

-

Veterinary In Vitro Fertilization Market Size Report, 2033GVR Report cover

![Veterinary In Vitro Fertilization Market Size, Share & Trends Report]()

Veterinary In Vitro Fertilization Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Instruments, Reagents/Consumables, Services), By Animal (Bovine, Swine), By Technique (Artificial Insemination, Embryo Transfer), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-812-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Veterinary In Vitro Fertilization Market Summary

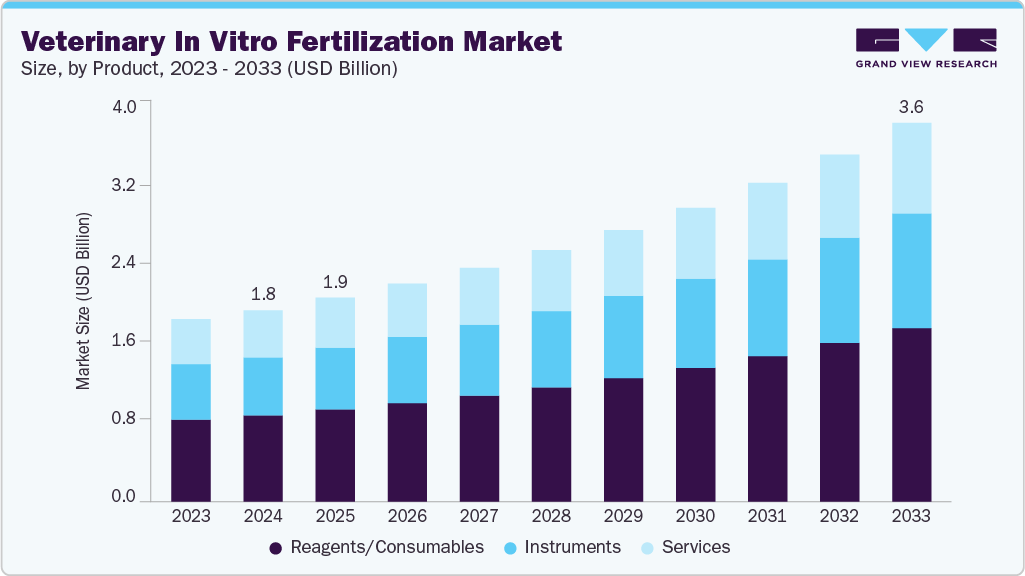

The global veterinary in vitro fertilization market size was estimated at USD 1.82 billion in 2024 and is projected to reach USD 3.60 billion by 2033, growing at a CAGR of 8.04% from 2025 to 2033. The market is experiencing growth driven by rising demand for genetically superior livestock, increasing adoption of advanced reproductive technologies in cattle, equine, and exotic species, and government initiatives supporting animal breeding and conservation programs, which collectively enhance productivity and biodiversity.

Key Market Trends & Insights

- North America veterinary in vitro fertilization industry held the largest revenue share of 31.03% in 2024.

- The U.S. veterinary in vitro fertilization industry dominated with the largest revenue share in 2024.

- By product, the reagents/consumables segment held the largest share of 45.06% in the market in 2024.

- By animal, the bovine segment dominated the market in 2024.

- Based on technique, the embryo transfer segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.82 Billion

- 2033 Projected Market Size: USD 3.60 Billion

- CAGR (2025-2033): 8.04%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The veterinary in vitro fertilization (IVF) industry is being significantly driven by technological advancements and the launch of more affordable products. For instance, in September 2024, Indian Immunologicals Limited, in collaboration with the National Dairy Development Board (NDDB), developed “Shashthi,” an indigenous IVF media, which has reduced the cost per embryo by 33% compared to imported media and has enhanced accessibility for farmers. Innovations such as Ovum Pick Up (OPU) and In Vitro Embryo Production (IVEP) are replacing traditional in vivo techniques, improving embryo quality and genetic multiplication in livestock. These advancements, coupled with the availability of cost-effective IVF solutions, are accelerating adoption across veterinary hospitals and fertility clinics, boosting productivity and fostering widespread acceptance of assisted reproductive technologies.

In addition, expanding the scope of IVF beyond livestock and companion animals into wildlife conservation is expected to boost market demand. It is also expected to drive increased investment, innovation, and cross-disciplinary research in veterinary reproductive technologies, solidifying IVF’s role in species preservation and global biodiversity initiatives. For instance, in January 2024, Scientists from the BioRescue consortium, led by Germany’s Leibniz Institute for Zoo and Wildlife Research, achieved the world’s first successful embryo transfer in southern white rhinos - a major milestone toward saving the nearly extinct northern white rhino. Using IVF, embryos created from preserved sperm and eggs are now stored in Germany and Italy, with plans to implant the first northern white rhino embryo into a surrogate in Kenya. Though the initial pregnancy ended prematurely, the achievement proves that rhino IVF and embryo transfer can work, marking a breakthrough in large-mammal reproduction science.

IVF techniques used for different species

Species

IVF Technique

Overview

Bovine

Ovum Pick-Up (OPU) + In Vitro Embryo Production (IVEP), Embryo Transfer (ET)

Used in elite cattle breeding in Brazil, India, and U.S.; increases milk and meat yield.

Equine

OPU + ICSI (Intracytoplasmic Sperm Injection), ET

Applied for high-value racehorses; overcomes low sperm motility issues.

Pigs

IVF + ET

For research and commercial genetics, helps improve litter size and growth traits.

Sheep & Goat

OPU + IVEP + ET

Used for dairy and meat breeds; supports genetic improvement programs.

Canine

OPU + IVF + ICSI

Used in high-value breeds, rare breeds, or endangered species; low natural fertilization rates.

Feline

OPU + IVF + ICSI, Stem Cell Derived Oocytes

Used in domestic and endangered wild cats; supports disease research and conservation.

Equids & Exotic Species

OPU + IVF + ET, Stem Cell Assisted IVF

Applied in wildlife conservation (e.g., rhinos, zebras); used to preserve endangered species.

Porpoises & Marine Mammals

IVF + ET

Rare applications for conservation often involve surrogate species.

In veterinary medicine, different species utilize personalized IVF techniques, driving the growth of the market. Bovine species dominate with Ovum Pick-Up (OPU) combined with In Vitro Embryo Production (IVEP) and Embryo Transfer (ET), widely applied in elite cattle breeding to enhance milk and meat productivity. Equine IVF often incorporates OPU with Intracytoplasmic Sperm Injection (ICSI) and ET for high-value racehorses, while porcine and small ruminants like goats and sheep use IVF and ET to improve litter size, growth traits, and genetic potential. Canine and feline IVF, including ICSI and stem cell-derived oocytes, supports breeding of rare or endangered breeds and conservation programs. Exotic and endangered species such as rhinos and zebras employ stem cell-assisted IVF and surrogate ET to preserve genetic diversity. The adoption of these species-specific IVF techniques has expanded market demand for specialized reagents, instruments, and laboratory services, driving technological innovation, higher investment in veterinary fertility clinics, and rapid market growth globally.

Market Concentration & Characteristics

The global veterinary in vitro fertilization industry exhibits a moderate level of industry concentration, characterized by a mix of established multinational players and numerous regional service providers. Major companies such as IMV Technologies, Genus PLC, SEMEX, CRV, and Select Sires Inc. collectively account for roughly 50-55% of the global market share, primarily due to their advanced technologies, extensive distribution networks, and integrated breeding programs. Despite this concentration at the top, the industry remains fragmented at the service level, with many small and mid-sized veterinary clinics and laboratories offering IVF and embryo transfer services to local breeders. High infrastructure costs, technical expertise requirements, and regulatory barriers have reinforced the dominance of leading firms while limiting the entry of new players, resulting in a stable oligopolistic structure with regional diversification.

The veterinary IVF industry is witnessing high innovation, driven by advanced reproductive technologies such as Ovum Pick Up (OPU), in vitro embryo production (IVEP), and stem cell-derived gametes for endangered species. The integration of AI and precision instruments enhances embryo selection and improves transfer success rates. Innovations like indigenous IVF media in India and cutting-edge embryo transfer techniques for rhinos in Africa exemplify the market’s rapid technological evolution.

The market is witnessing moderate M&A activity as companies seek to expand geographic reach and technological capabilities. Strategic acquisitions of IVF labs, biotech firms, and reproductive technology startups help firms enhance their service offerings and R&D pipelines. For example, global players have partnered with regional IVF labs in Latin America and Asia to strengthen market presence and access advanced embryo production technologies.

Regulations significantly influence the veterinary IVF industry by ensuring animal welfare, biosecurity, and ethical use of reproductive technologies. Stringent government guidelines on embryo transfer, gamete handling, and genetic manipulation affect market entry and operational costs. For instance, India’s Rashtriya Gokul Mission and Kenya’s oversight of northern white rhino IVF projects highlight how regulatory frameworks guide both innovation and adoption of IVF techniques.

In the veterinary IVF industry, natural breeding and artificial insemination (AI) act as primary substitutes for advanced IVF techniques. While AI is cost-effective and widely used for cattle and other livestock, it offers lower genetic precision and limited success with endangered or high-value animals. For example, elite bovine embryos produced via IVF provide superior genetic traits compared to conventional AI, driving IVF adoption despite the availability of these substitutes.

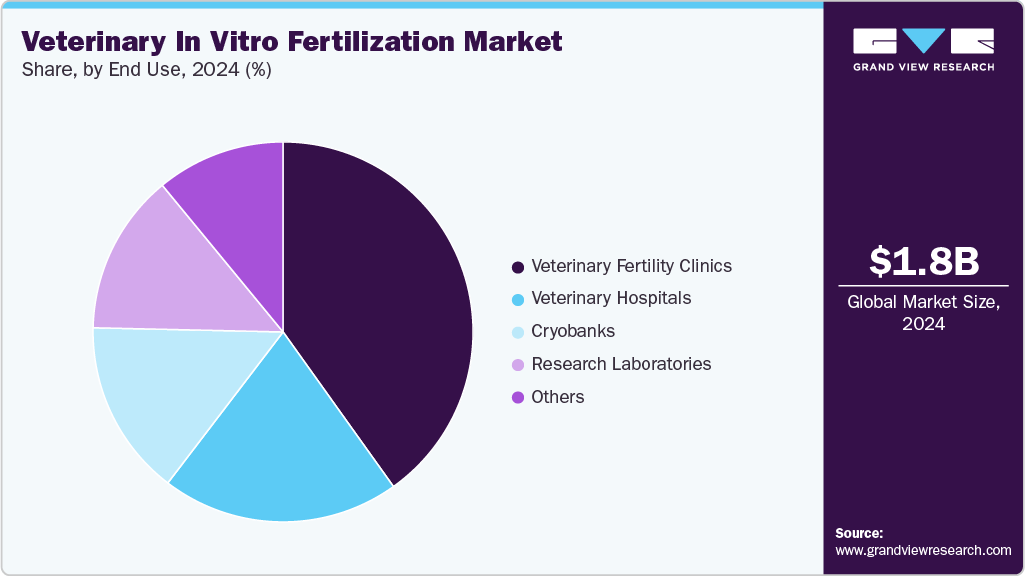

The veterinary IVF industry shows a concentrated end user base, dominated by specialized fertility clinics, veterinary hospitals, and research institutions that handle advanced reproductive technologies. High setup costs, technical expertise requirements, and regulatory compliance limit widespread adoption among general veterinary practices. For example, countries like India and Brazil rely heavily on fertility clinics and veterinary hospitals for large-scale bovine IVF and embryo transfer programs.

Product Insights

Based on product, the reagents/consumables segment held the largest revenue share of 45.06% in 2024 and is the fastest growing segment over the forecast period,, due to their essential role in successful IVF procedures, including embryo culture, oocyte handling, and embryo transfer. The rising adoption of techniques such as Ovum Pick Up (OPU) and in vitro embryo production in bovines, equines, and endangered species has increased demand for high-quality media, pipettes, and cryopreservation supplies. For instance, Indian Immunologicals’ launch of indigenous IVF media has reduced dependency on imports and expanded IVF accessibility, exemplifying how consumables drive market growth.

The instruments segment is the second largest segment due to its critical role in procedures such as Ovum Pick Up (OPU), embryo handling, and transfer, requiring specialized equipment such as microscopes, micromanipulators, and incubators. Growing livestock breeding programs in countries such as Brazil and India, and the conservation of endangered species such as northern white rhinos, have increased the demand for advanced IVF instruments. High investment in veterinary hospitals and fertility clinics further supports this segment’s substantial revenue share.

Animal Insights

Based on animal, the bovine segment dominated the market with the largest revenue share in 2024, driven by the high economic value of cattle and widespread adoption of advanced reproductive technologies in both dairy and beef industries. In vitro fertilization and embryo transfer are extensively used to enhance milk yield, improve meat quality, and propagate superior genetics. For example, in Brazil, elite Nelore cows like Viatina-19 undergo IVF and embryo transfer for producing high-value offspring, while in India, programs under the Rashtriya Gokul Mission leverage IVF to improve indigenous cattle breeds. The large global cattle population and strong demand for genetic improvement contributed to the bovine segment’s largest revenue share.

The other animals segment is anticipated to be the fastest-growing segment over the forecast period, due to rising demand for assisted reproductive technologies in equine, porcine, ovine, and exotic species. Increasing interest in breeding high-value horses, endangered species conservation, and pet fertility has driven adoption. For example, Japanese researchers successfully created high-quality feline iPS and embryonic stem cells to advance veterinary care, while BioRescue uses IVF and embryo transfer to preserve northern white rhinos. Expanding applications in pets, wildlife, and specialty livestock are fueling rapid growth in this segment.

Technique Insights

Based on technique, the embryo transfer segment held the largest revenue share in 2024, boosted by its widespread adoption in improving livestock genetics and herd productivity. This technique allows the multiplication of superior-quality embryos from elite animals, enabling faster genetic improvement in dairy and beef cattle. For example, programs in Brazil and the U.S. routinely use embryo transfer to produce multiple calves from prize-winning cows, while in India, initiatives under the Rashtriya Gokul Mission utilize this technique to enhance indigenous cattle breeds. The high success rates, repeatability, and ability to preserve valuable genetic material make embryo transfer the most commercially lucrative IVF method.

The Ovum Pickup (OPU) segment is anticipated to grow significantly over the forecast period as it enables the collection of multiple high-quality oocytes from elite female animals without the need for surgery, enhancing embryo production efficiency. This minimally invasive technique supports repeated cycles and accelerates genetic improvement, making it popular in cattle breeding programs globally. For instance, in India, OPU is used under the Rashtriya Gokul Mission to boost indigenous cattle productivity, while in Brazil, elite Nelore cows such as Viatina-19, undergo OPU to produce multiple embryos for commercial and export purposes. Its growing adoption in both dairy and beef sectors is driving its status as the second-fastest growing IVF technique.

End Use Insights

Based on end use, veterinary fertility clinics accounted for the largest revenue share in 2024 due to their specialized focus on reproductive services such as artificial insemination, embryo transfer, and genetic screening. These clinics cater to both high-value livestock breeding and companion animal reproduction, attracting clients seeking advanced fertility solutions. Their expertise, personalized care, and adoption of innovative IVF technologies drive higher treatment success rates, reinforcing their market dominance.

The veterinary hospitals segment is anticipated to register fastest CAGR over the forecast period, due to the rapid integration of advanced reproductive technologies, such as embryo transfer, oocyte retrieval, and cryopreservation into clinical practice. These facilities offer specialized equipment, skilled veterinarians, and round-the-clock care, enabling higher IVF success rates in both companion and livestock species. In addition, hospitals increasingly collaborate with biotech firms and research institutes, accelerating adoption and commercialization of IVF-based breeding programs.

Regional Insights

North America veterinary in vitro fertilization industry dominated the global market in 2024, with the largest revenue share of 31.03%.The market growth is attributed to technological innovation, expanding breeding programs, and increasing demand for genetic enhancement in livestock. The U.S. leads in AI-assisted embryo assessment, portable reproductive imaging, and lab automation, while Canada is rapidly advancing through strategic partnerships such as Trans Ova Genetics’ collaboration with Evolygen to establish new IVF labs. There is also a growing shift toward on-farm IVF services and cryopreservation, improving accessibility and efficiency for cattle and equine breeders. Collectively, these trends are transforming North America into a center for precision reproductive technologies, emphasizing productivity, sustainability, and global competitiveness in animal genetics.

U.S. Veterinary In Vitro Fertilization Market Trends

The veterinary in vitro fertilization industry in the U.S. accounted for the largest market share in the North American market. The market is witnessing strong adoption of advanced reproductive technologies such as ovum pick-up (OPU) and in vitro embryo production (IVEP) to enhance cattle and equine breeding efficiency. There is a growing trend toward automation, AI-based embryo grading, and non-invasive imaging for embryo assessment. Companies like IMV Technologies and Hamilton Thorne are expanding their precision imaging and reproductive equipment portfolios, while research institutions such as UC Davis are pioneering breakthroughs in equine IVF using frozen semen. These developments reflect a shift toward technology-driven, high-efficiency breeding programs in U.S. animal agriculture.

The Canada veterinary in vitro fertilization industry is expected to grow at a significant CAGR during the forecast period. The market is driven by the rising implementation of advanced reproductive technologies and increased investment in domestic IVF infrastructure. A key example is Trans Ova Genetics’ partnership with Evolygen in September 2025, to establish a state-of-the-art IVF lab in Quebec, which marks a major step in localizing embryo production and strengthening Canada’s livestock genetics sector. In addition, there is a growing trend toward on-farm reproductive tools and portable imaging technologies, enabling veterinarians to perform real-time diagnostics and ovum pick-up (OPU) procedures efficiently.

Europe Veterinary In Vitro Fertilization Market Trends

The Europe veterinary in vitro fertilization industry is driven by the adoption of advanced assisted-reproduction tools (portable on-farm scanners, species-specific protocols, and lab automation) is accelerating clinical throughput and field OPU/IVF workflows. For example, IMV Technologies’ rugged ImaGo scanners are designed for farm use. At the same time, strategic consolidation among ART equipment and consumables suppliers (notably Astorg’s combination of Hamilton Thorne and Cook Medical’s Reproductive Health assets) is creating larger, integrated suppliers that can scale distribution and R&D across Europe. Demand is supported by growing industry focus on genetic improvement, cryopreservation services and standardized IVP protocols, while regulatory and animal-welfare frameworks are shaping cross-border embryo movement and lab accreditation-all contributing to steady market expansion and faster commercialization of novel IVF workflows across major European dairy and beef regions.

The Germany veterinary in vitro fertilization industry held the largest market share in the European region in 2024. This expansion is driven by strong investments in animal biotechnology and reproductive research. Institutions like the Leibniz Institute for Zoo and Wildlife Research are pioneering IVF applications for wildlife conservation, exemplified by the BioRescue project’s breakthroughs in rhino embryo development. In addition, the growing demand for genetic enhancement in cattle and companion animals supports the expansion of specialized IVF labs and precision breeding services across the country.

The UK veterinary in vitro fertilization industry is expected to grow significantly over the forecast period. The country’s growth is influenced by the increasing demand for advanced reproductive solutions in the cattle, equine, and companion animal sectors. Veterinary clinics and research centers are adopting innovative IVF and embryo transfer techniques to enhance breeding outcomes and genetic preservation. For instance, equine fertility programs across major breeding hubs in Newmarket and Yorkshire are integrating IVF to overcome fertility challenges in high-value horses. In addition, advancements in cryopreservation and lab automation are improving success rates and accessibility of veterinary IVF services in the UK.

Asia Pacific Veterinary In Vitro Fertilization Market Trends

Asia Pacific veterinary in vitro fertilization industry is expected to grow at a significant CAGR over the forecast period. This expansion is attributed to an increase in government-backed breeding programs, technological advancements, and rising demand for high-yield livestock. In addition, growing adoption of assisted reproductive technologies across countries like China, Australia, and South Korea. In China, expanding dairy operations and government initiatives for superior cattle breeding have increased demand for IVF and embryo transfer services. Australia’s livestock sector is rapidly integrating IVF and embryo transfer to enhance beef and dairy genetics, while South Korean research institutions are investing in reproductive biotechnology to improve animal fertility and conserve endangered species. These developments highlight the region’s focus on productivity, genetic preservation, and advanced veterinary science.

The Japan veterinary in vitro fertilization industry is advancing through innovations in reproductive and stem cell technologies, emphasizing precision breeding and animal health research. Recent breakthroughs, such as Osaka Metropolitan University’s creation of feline iPS and embryonic stem cells, highlight Japan’s leadership in veterinary biotechnology and regenerative medicine. These developments are enhancing fertility solutions, expanding IVF applications beyond livestock to companion animals, and driving progress in disease modeling and genetic improvement across species.

The India market for veterinary in vitro fertilization is experiencing notable growth, driven by government initiatives like the Rashtriya Gokul Mission and advancements in reproductive biotechnology. The launch of indigenous IVF media “Shashthi” by Indian Immunologicals Ltd and NDDB in September 2024 has reduced dependency on imports and lowered production costs, making IVF more accessible to farmers. In addition, successful projects such as the first IVF calf in Puducherry and new laboratories in Assam highlight India’s growing focus on genetic improvement and dairy productivity through advanced reproductive technologies.

Latin America Veterinary In Vitro Fertilization Market Trends

The veterinary in vitro fertilization industry in Latin America is driven by the increasing momentum in veterinary IVF and broader reproductive-technology adoption as livestock producers are increasingly using embryo transfer (ET) and in vitro fertilization (IVF) to boost herd genetics and meat/dairy productivity. For example, exporters in Brazil are leveraging high-throughput IVF pipelines for elite beef cattle, and Argentina is enhancing its service infrastructure around labs and cryopreservation to support IVF/ET workflows. In addition, smaller markets such as Mexico and Peru are expanding IVF-adjacent services and equipment in livestock clinics as reproduction-technology access spreads beyond large ranches into mid-sized operations.

Brazil veterinary in vitro fertilization industryis witnessing notable growth due beef cattle sector’s push for genetic improvement and higher-yield production through embryo transfer and in vitro embryo production (IVP). For example, according to study published in September 2023 in Animal reproduction journal, IVP in dairy herds showed a slight drop in recent years, the beef segment experienced a 5% rise in in vitro embryo production and a 25.8% increase in in vivo embryo collection. Meanwhile, large-scale operations are adopting advanced reproductive technologies, including cloning and high-genetic-merit donors to meet global export demand and reinforce Brazil’s position as a genetics powerhouse in livestock breeding.

Middle East & Africa Veterinary In Vitro Fertilization Market Trends

The Middle East & Africa veterinary IVF industry is getting increasingly specialized. Gulf countries focus on high-value species (camels, performance horses) using IVF, embryo transfer and even cloning to preserve elite lines and win races, while clinics and research centres in Saudi and the UAE offer dedicated embryo-transfer services. In Africa, Kenya’s BioRescue and partner labs are applying advanced IVF and stem-cell techniques for rhino conservation, demonstrating wildlife-focused uses of assisted reproduction. Commercial livestock reproduction remains strong in South Africa, where established providers and labs (e.g., Embryo Plus) run large-scale IVP/ET operations and cryostorage for export-oriented genetics programs. Overall, the region shows a dual trajectory-luxury and conservation applications in the Gulf and East Africa, alongside robust, production-oriented IVF/ET services for beef and dairy in southern Africa.

South Africa veterinary in vitro fertilization industry is the anticipated to register the fastest CAGR over the forecast period, propelled by increasing adoption of embryo flushing and transfer in commercial beef and dairy herds to accelerate genetic gain, for example, a study found that oocytes from slaughtered Bovelder cows produced 11 embryos and resulted in 7 live births (a 64% calving rate). Moreover, service providers such as Embryo Plus are expanding in advanced reproduction technologies (IVP, semen/embryo exports) across livestock and wildlife species. Finally, despite infrastructure and cost challenges, South Africa leads the region in embryo-based reproductive services, with efforts now extending into wildlife species and export-oriented genetics programs.

Saudi Arabia veterinary in vitro fertilization industry is anticipated to experience growth driven by growing emphasis on embryo transfer and gamete cryopreservation in domesticated livestock such as camels, with clinics like Salam Veterinary Group offering dedicated embryo-transfer services to enhance reproductive efficiency in high-value animals. Parallel research into interspecies somatic-cell nuclear transfer (SCNT)-for example, using Arabian oryx cells and cattle oocytes-underscores the country’s investment in advanced reproductive technologies beyond conventional livestock. These trends reflect Saudi Arabia’s strategic shift toward genetic improvement of livestock and wildlife via assisted-reproduction services and biotechnology, supporting both agricultural productivity and conservation goals.

Key Veterinary In Vitro Fertilization Company Insights

Market players in the veterinary IVF sector are deploying several clear strategies: they are pursuing vertical integration and acquisitions to build from genetics through equipment and services, investing heavily in technology innovation (such as genomics, AI-driven diagnostics, and improved embryo culture/cryopreservation systems), and forming partnerships and collaborations globally to access emerging-market distribution channels, local expertise, and breeding networks.

Key Veterinary In Vitro Fertilization Companies:

The following are the leading companies in the veterinary in vitro fertilization market. These companies collectively hold the largest market share and dictate industry trends.

- Zoetis Services LLC

- Kruuse

- Hamilton Thorne, Inc.

- Esco Medical

- Imy Technologies

- Minitube

- Agetech Inc

- Orgensen Laboratories

- Bovine Elite LLC

- Equine Fertility Centre

- Veterinary Group

- Stateline Veterinary Service.

Recent Developments

-

In October 2025, Phase Holographic Imaging (PHI) is expanding its operations into the veterinary IVF sector, leveraging its expertise in quantitative phase imaging (QPI) and live-cell analysis to enhance real-time monitoring of embryo and cell development. This move builds on PHI’s established capabilities in regenerative medicine and cell therapy, aiming to improve precision and outcomes in IVF processes.

-

In August 2025, IMV Technologies introduced the next generation of ImaGo fertility scanners-the ImaGo L/C and ImaGo Flex-designed for durability, portability, and high imaging accuracy in on-farm reproductive diagnostics. These advanced ultrasound devices feature color flow Doppler for early pregnancy detection and species-specific settings, enhancing workflow efficiency for veterinarians.

-

In December 2024, Astorg, a leading European private equity firm, completed the take-private acquisition of Hamilton Thorne and the purchase of Cook Medical’s Reproductive Health division, merging them to form a new global leader in assisted reproductive technology (ART) consumables and equipment. The combined company will operate under a new brand identity launching in 2025.

-

In September 2024, Indian Immunologicals Limited (IIL), in collaboration with the National Dairy Development Board (NDDB), launched “Shashthi”, a suite of indigenously developed IVF media for embryo transfer in livestock. The initiative aims to make veterinary IVF more affordable and self-reliant, reducing dependence on costly imported media by about 33%, and supporting India’s “Atmanirbhar Bharat” vision.

Veterinary In Vitro Fertilization Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.94 billion

Revenue forecast in 2033

USD 3.60 billion

Growth Rate

CAGR of 8.04% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, animal, technique, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Netherlands; Denmark; Sweden; Norway; Japan; China; India; Thailand; South Korea; Australia; Brazil; Argentina; South Africa; UAE; Saudi Arabia; Kuwait; Qatar; Oman

Key companies profiled

Zoetis Services LLC; Hamilton Thorne, Inc.; Kruuse; Esco Medical; Minitube; Imy Technologies; Agetech Inc; Orgensen Laboratories; Equine Fertility Centre; Bovine Elite LLC; Veterinary Group; Stateline Veterinary Service

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary In Vitro Fertilization Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global veterinary in vitro fertilization market report based on product, animal, technique, end use, and region.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Instruments

-

Reagents/Consumables

-

Services

-

-

Animal Outlook (Revenue, USD Million, 2021 - 2033)

-

Bovine

-

Swine

-

Ovine

-

Caprine

-

Equine

-

Other Animals

-

-

Technique Outlook (Revenue, USD Million, 2021 - 2033)

-

Artificial Insemination

-

Embryo Transfer

-

Ovum Pickup

-

In-Vitro Maturation

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Veterinary Fertility Clinics

-

Veterinary Hospitals

-

Research Laboratories

-

Cryobanks

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Netherlands

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

Saudi Arabia

-

Kuwait

-

Qatar

-

Oman

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.