- Home

- »

- Next Generation Technologies

- »

-

Video As A Sensor Market Size, Share, Industry Report, 2030GVR Report cover

![Video As A Sensor Market Size, Share & Trends Report]()

Video As A Sensor Market (2025 - 2030) Size, Share & Trends Analysis Report By Offerings (Hardware, Software, Services), By Product (Video Surveillance, Hyperspectral Imaging), By Application, By End User, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-592-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Video As A Sensor Market Summary

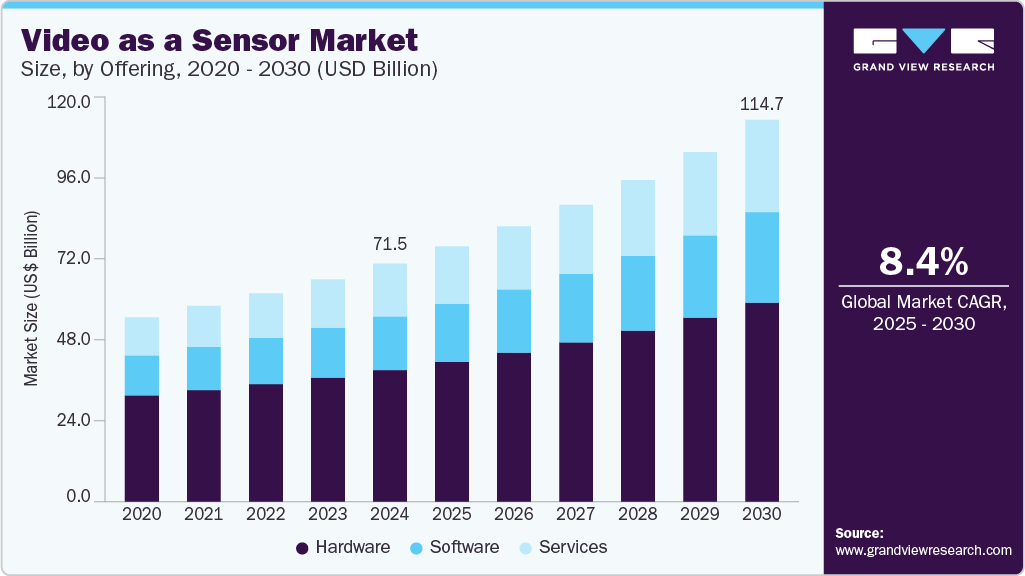

The global video as a sensor market size was estimated at USD 71.50 billion in 2024 and is projected to reach USD 114,664.7 million in 2030, growing at a CAGR of 8.4% from 2025 to 2030. The market is driven by rapid technological advances, which have transformed traditional video systems and recording tools into powerful, intelligent decision-making tools.

Key Market Trends & Insights

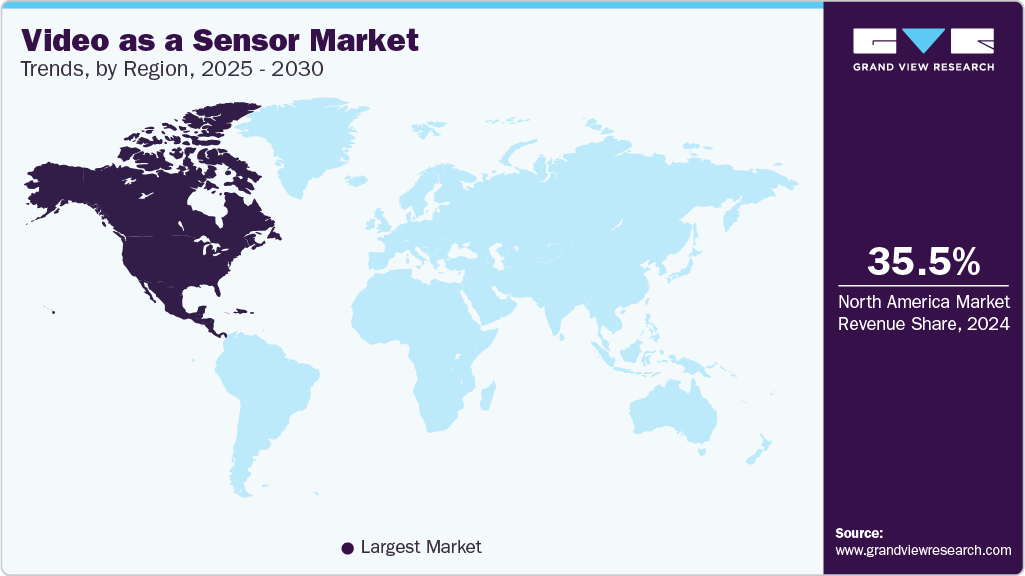

- North America dominated the market and accounted for a 35.5% share in 2024.

- The video as a sensor market in the U.S. is growing, as is the demand in the region.

- By offering, the hardware segment accounted for the highest revenue share of 55.3% in 2024.

- By product, the video surveillance accounted for the largest market revenue share in 2024.

- By application, security & surveillance segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 71.50 Billion

- 2030 Projected Market Size: USD 114,664.7 Million

- CAGR (2025-2030): 8.4%

- North America: Largest market in 2024

Video as a sensor (VaaS) combines video cameras with AI-driven analytics to collect, analyze, and deliver actionable insights from visual data across various applications. These systems can recognize patterns, detect movement, and track objects in real time. This evolution is driven by integrating artificial intelligence (AI) and machine learning (ML), which facilitates large-scale automated video analysis. For instance, in January 2025, SundaySky launched the latest version of its enterprise video platform, featuring enhanced AI avatars, integrated screen recording, and advanced AI-powered media creation tools.

The major driver of VaaS adoption is technology’s capability to provide real-time insights, including facial recognition, anomaly detection, and behavior prediction. These capabilities make it highly suitable for today’s security and surveillance systems, where early threat detection is essential. In addition to security, the adaptability of video sensors is increasing in other areas. In smart cities, they are instrumental in enhancing urban infrastructure by contributing to public safety, energy efficiency, and waste management efforts.

Various sectors, including defense and healthcare, are incorporating video sensors into their infrastructure to enable intelligent monitoring. This enhances safety measures and supports data-driven decision-making, as AI-integrated sensors convert video footage into actionable insights. This transformation is a key factor driving the growing adoption of VaaS in today’s evolving market. For instance, in September 2024, Hanwha Vision launched new AI-powered surveillance solutions at GSX 2024, including advanced multi-directional cameras, the AI Box, and cloud-based tools like HealthPro and SightMind, enhancing detection, analytics, and remote management.

Offering Insights

The hardware segment accounted for the highest revenue share of 55.3% in 2024. Advancements in AI, edge computing, and camera technology drive this segment. The hardware segment encompasses high-resolution cameras equipped with capabilities such as low-light performance and wide-angle lenses. It also includes edge processors for real-time data analysis, scalable storage systems, and reliable networking infrastructure to ensure efficient data transmission. Cameras are the core component and are available in different types, including hyperspectral, machine vision, and thermal cameras.

Services registered a CAGR of 10.0% from 2025 to 2030. This segment is driven by increasing demand for advanced security and real-time monitoring across industries such as retail, transportation, and critical infrastructure. VaaS provides cloud-based remote monitoring, enhancing both accessibility and operational efficiency. Installation and maintenance services also play a role in ensuring systems function at their best. Continued advancements in AI, ML, edge computing, and video management software accelerate service adoption by enhancing threat detection, enabling intelligent analytics, and facilitating smooth hardware and software integration. Also, supportive government policies, smart city initiatives, and the growing need for automated surveillance further fuel the services segment's expansion.

Product Insights

The video surveillance accounted for the largest market revenue share in 2024. The market is majorly driven by rising security concerns across residential, commercial, and public domains, coupled with rapid advancements in technologies like AI-driven analytics, cloud computing, and high-resolution imaging. AI integration enables advanced capabilities such as real-time monitoring, facial and object recognition, and behavioral analysis, improving threat detection and operational efficiency. Furthermore, smart city developments and government infrastructure initiatives are in demand, and video surveillance is being used for public safety, traffic control, and regulatory compliance.

The machine vision and monitoring is projected to grow significantly over the forecast period. The market is driven by integrating advanced computer vision technologies with powerful video management systems, allowing real-time object detection, tracking, and automated security responses. Deep learning-based analytics enhance capabilities such as accurate crowd counting, behavioral analysis, and pattern recognition, which are important for ensuring public safety and improving resource management. In addition, applications like automated traffic and parking monitoring, facial recognition, and license plate recognition (LPR) drive further growth by delivering actionable insights for law enforcement, urban development, and facility operations.

Application Insights

The security & surveillance segment accounted for the largest market revenue share in 2024. The market is driven by the ability to automate real-time threat detection, minimize false alarms, and handle large volumes of video footage significantly reduces the burden on security staff. AI-driven analytics in video footage provide instant alerts for events such as suspicious behavior, intrusions, fires, or unauthorized access, while also supporting advanced features like facial and license plate recognition to strengthen security measures. Furthermore, integration with other security systems and remote monitoring functionality enhances overall operational efficiency and responsiveness of video as a sensor in the market.

The retail analytics segment is projected to grow significantly over the forecast period. The market is driven by the use of AI-powered video analytics that convert traditional surveillance systems into valuable sources of operational work. Major drivers include the ability to analyze customer movement for optimizing store layouts, monitor employee productivity, and detect theft in real time to enhance loss prevention. These analytics also support better customer service by identifying peak shopping times and workflow inefficiencies, allowing retailers to optimize staffing and improve processes. It helps retailers make more informed decisions, improving store performance and increasing customer satisfaction.

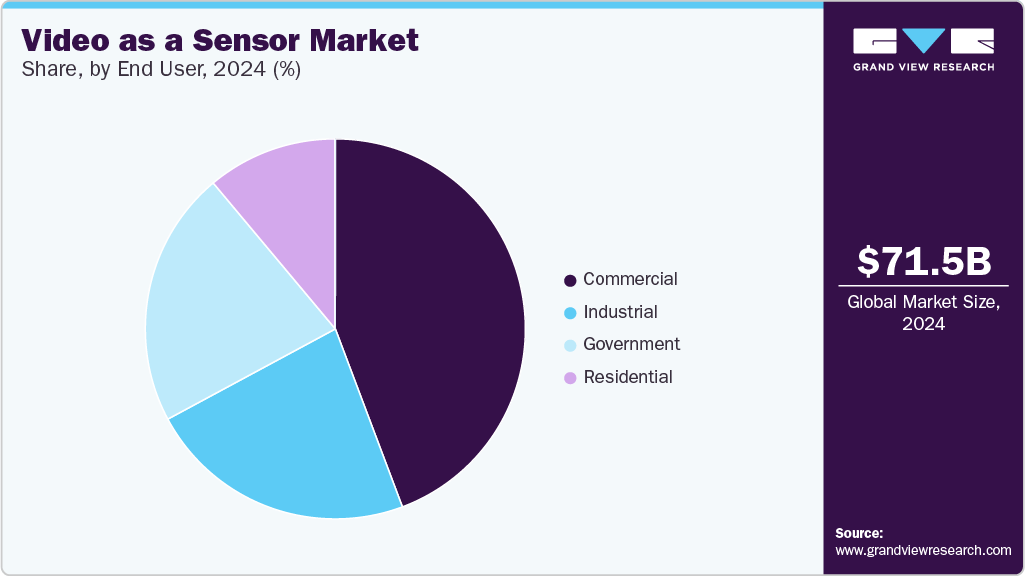

End Use Insights

The commercial segment accounted for the largest market revenue share in 2024. The market is driven by rising demand for improved security and surveillance in commercial spaces, including office buildings and retail establishments, to safeguard assets and ensure safety. Advancements in high-resolution cameras, AI, machine learning, and edge computing have made real-time threat detection, facial recognition, and anomaly detection more effective, enhancing overall security performance. In addition, expanding smart city initiatives and increased government investment in surveillance infrastructure further drive adoption within commercial settings. For instance, the UK government has installed millions of CCTVs nationwide to prevent crime, ensuring public safety. These include threat detection, night vision for capturing footage in low-light conditions, high-resolution imaging for clear visuals, and seamless integration capabilities to boost overall system efficiency.

The government segment is projected to grow significantly over the forecast period. The market is being propelled by growing security concerns linked to rising crime rates and terrorism threats, leading to increased investments in advanced surveillance technologies. Innovations in AI, edge computing, 5G, and cloud-based video storage are improving real-time monitoring, threat detection, and data management. The expansion of smart city projects and government support for public safety infrastructure also drives adoption. Moreover, strict regulatory requirements and the demand for integrated security solutions across critical infrastructure, transportation hubs, and public areas are playing a key role in the growth of this market segment.

Regional Insights

North America dominated the market and accounted for a 35.5% share in 2024. The market is driven by significant investments in advanced surveillance systems and the early adoption of emerging technologies such as AI and machine learning. Public safety efforts, smart city developments, and widespread use in sectors like retail and transportation support high demand. The market also benefits from the presence of major tech companies and ongoing advancements in cloud-based and edge computing solutions, which continue to accelerate growth.

U.S. Video As A Sensor Market Trends

The video as a sensor market in the U.S. is growing, as is the demand in the region. The increasing pace of industrialization and the adoption of advanced technologies have driven the expansion of this market. In response to increased national security concerns, U.S. security agencies are deploying video sensors for extensive surveillance, threat detection, and tactical monitoring.

Europe Video As A Sensor Market Trends

The video as a sensor market in Europe is driven by strict regulations surrounding public safety and data protection, leading to widespread adoption of advanced surveillance systems across various countries. Progress in AI and ML is improving the accuracy and efficiency of video analytics, supporting use cases in public safety, retail, transportation, and critical infrastructure. The rise of smart city initiatives and increased government funding further boosts demand, while the move toward cloud-based solutions and IoT integration enables scalable and real-time monitoring capabilities. For instance, in April 2025, Axis Communications introduced the Axis Camera Station S1228 rack AI, an AI-optimized recording server built to deliver exceptional performance for AI-driven video analytics tasks, including free text search in high-traffic surveillance settings.

Asia Pacific Video As A Sensor Market Trends

The video as a sensor market in Asia Pacific is experiencing rapid growth due to urbanization, rising public safety concerns, and strong government efforts to advance smart city projects in countries such as China, India, Japan, and South Korea are key drivers of growth. Major initiatives like China’s “Safe City” and Singapore’s “Smart Nation” are accelerating the implementation of advanced surveillance technologies. The use of AI-powered video analytics, edge computing, and IoT integration supports real-time monitoring, efficient traffic control, and crime prevention, further boosting demand.

Key Video As A Sensor Company Insights

Prominent firms have used product launches and developments, followed by expansions, mergers and acquisitions, contracts, agreements, partnerships, and collaborations as their primary business strategy to increase their market share. The companies have used various techniques to enhance market penetration and boost their position in the competitive industry.

-

Axis Communications operates in network video surveillance and intelligent security solutions. Offering a wide range of cameras, video management software, analytics, and access control systems, Axis helps businesses and cities use video as a sensor to gain real-time insights, enhance safety, and improve operational efficiency. Committed to innovation, sustainability, and collaboration through its strong partner ecosystem, Axis aims to build a smarter and safer world.

-

Hikvision operates in video-centric IoT solutions, focusing on advanced video-as-a-sensor technologies for security and intelligent monitoring. By utilizing state-of-the-art AI, deep learning, and high-performance video analytics, Hikvision delivers real-time surveillance, environmental sensing, and actionable insights across smart cities, transportation systems, and commercial sectors globally.

Key Video As A Sensor Companies:

The following are the leading companies in the video as a sensor market. These companies collectively hold the largest market share and dictate industry trends.

- Axis Communications AB

- Hangzhou Hikvision Digital Technology Co., Ltd.

- Bosch Sicherheits systeme GmbH

- Dahua Technology Co., Ltd.

- Sony Corporation

- Honeywell International Inc.

- Sportradar AG

- i-PRO

- Johnson Controls

- OMNIVISION

Recent Developments

-

In April 2025, OMNIVISION launched the OV50X, a groundbreaking 50-megapixel, 1-inch CMOS image sensor designed for flagship smartphones. It delivers the industry’s highest dynamic range for movie-grade video capture. Featuring TheiaCel™ technology, advanced low-light performance, and premium 8K video capabilities, the OV50X enables professional-quality photos and videos in all lighting conditions and will enter mass production in Q3 2025.

-

In August 2024, Bosch Building Technologies has introduced a new assembly line in India for its FLEXIDOME IP Starlight 5000i cameras, underscoring its dedication to the 'Make in India' initiative and local manufacturing. These smart video solutions, featuring advanced AIoT capabilities and strong cybersecurity measures, are tailored to support the growing need for security and smart city infrastructure throughout India.

Video As A Sensor Market Report Scope

Report Attribute

Details

Market size in 2025

USD 76,728.2 million

Revenue forecast in 2030

USD 114,664.7 million

Growth rate

CAGR of 8.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Offering, product, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Axis Communications AB; Hangzhou Hikvision Digital Technology Co., Ltd.; Bosch Sicherheitssysteme GmbH; Dahua Technology Co., Ltd; Sony Corporation; Honeywell International Inc.; Sportradar AG; i-PRO; Johnson Controls; OMNIVISION

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Video as a Sensor Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global video as a sensor market based on offering, product, application, end use, and regions:

-

Offering Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Video Surveillance

-

Hyperspectral Imaging

-

Machine Vision and Monitoring

-

Thermal Imaging

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Security & Surveillance

-

Traffic Management

-

Retail Analytics

-

Healthcare

-

Manufacturing

-

Mapping

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Government

-

Commercial

-

Industrial

-

Residential

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the video as a sensor market include Key companies profiled Axis Communications AB; Hangzhou Hikvision Digital Technology Co., Ltd.; Bosch Sicherheitssysteme GmbH; Dahua Technology Co., LtdS; Sony Corporation; Honeywell International Inc.; Sportradar AG; i-PRO; Johnson Controls; OMNIVISION

b. Key factors that are driving the market growth enable intelligent monitoring, various sectors including defense and healthcare are incorporating video sensors into their existing infrastructure. This enhances safety measures and supports data-driven decision-making, as AI-integrated sensors convert video footage into actionable insights.

b. The global video as a sensor market size was estimated at USD 71,495.8 million in 2024 and is expected to reach USD 76,728.2 million in 2025.

b. The global video as a sensor market is expected to grow at a compound annual growth rate of 8.4% from 2025 to 2030 to reach USD 114,664.7 million by 2030.

b. North America dominated the Video as a Sensor (VaaS) market with a share of 35.5% in 2024. The market is driven by the rapid technological advances which have transformed traditional video systems and recording tools into powerful, intelligent decision-making tools. VaaS utilizes video cameras combined with AI-driven analytics to collect, analyze, and deliver actionable insights from visual data across various applications

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.