- Home

- »

- Communication Services

- »

-

Video Conferencing Market Size, Share, Growth Report, 2030GVR Report cover

![Video Conferencing Market Size, Share & Trends Report]()

Video Conferencing Market Size, Share & Trends Analysis Report By Component (Hardware, Software), By Deployment (On-premise, Cloud), By Enterprise Size, By Application, By End-use, By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-3-68038-081-1

- Number of Pages: 171

- Format: Electronic (PDF)

- Historical Range: 2018 - 2020

- Industry: Technology

Report Overview

The global video conferencing market size was valued at USD 6.28 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 12.5% from 2022 to 2030. The major factors contributing to the growth are the emerging trend of remote working, geographically scattered business operations, and increased globalization. Besides, the mounting demand for video conferencing solutions in the education and healthcare sectors is also stimulating the market expansion. The industry gained massive momentum in recent years, especially during the COVID-19 pandemic following the lockdown restrictions due to the dynamic rise in the adoption of video and teleconferencing solutions.

The sudden transition of various businesses to the work-from-home culture increased the demand for video conferencing software and services such as Zoom, Microsoft Teams, and Google Workspace. These platforms are witnessing a significant rise in the number of active users. In January 2022, Microsoft Teams recorded 270 million monthly active users, representing a 20 million rise as compared to that in July 2021.

The introduction of conferencing platforms based on machine learning and artificial intelligence (AI) is providing lucrative growth prospects for the market. These technologies are enabling companies to optimize the usage of collaboration platforms and enhance meeting efficiency by deploying facial recognition and virtual assistant technologies. AI in conferencing solutions helps organizations gain insights into the ideal number of participants, the optimal length of a meeting, and the appropriate time of the day to conduct a meeting. In October 2020, NVIDIA Corporation launched the NVIDIA Maxine platform, which offers a cloud-based range of GPU-powered AI video conferencing software to improve the streaming video.

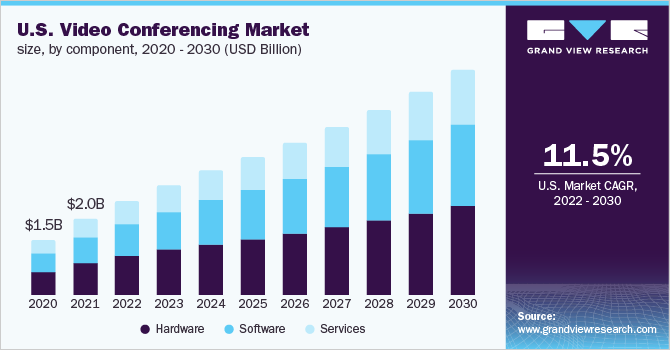

Component Insights

The hardware segment accounted for a sizeable revenue share of around 47.0% in 2021 which can be credited to the increasing adoption of endpoints, including smartphones, laptops, and desktops equipped with high-resolution cameras, speakers, and microphones. As various organizations have adopted the remote working model in 2020, demand for enterprise-based hardware has reduced.

The hardware segment is further bifurcated into cameras and microphones/headphones. Among these, the microphones/headphones segment recorded momentous growth in 2020 owing to the increasing product demand during the pandemic driven by the rapid adoption of video conferencing solutions for team collaboration. Besides, the ongoing technological developments in the field of augmented reality and the Internet of Things (IoT) have accelerated the development of headsets with advanced features, which is expected to drive the segment growth further.

Deployment Insights

In terms of deployment, the on-premise segment dominated the market in 2021 by accounting for a revenue share of around 59.0%. This is majorly due to the increasing adoption of this deployment model across large organizations amid the growing data security concerns. However, the growing proclivity toward cloud technologies is expected to slow down the segment growth over the upcoming years.

The cloud deployment segment is anticipated to observe a significant growth rate of nearly 14.0% over the forecast period. Cloud technology offers higher accessibility by enabling easy access to video conferencing services through multiple channels, such as mobile devices and laptops. Moreover, the increasing adoption of the Software as a Service (SaaS) platform, which has attracted numerous small- and medium-scale enterprises is strongly supporting the segment growth. According to the estimates of Amazon Web Services, Inc., small and medium enterprises are expected to drive their cloud business in India in 2022.

Enterprise Size Insights

The large enterprises segment had held a revenue share of more than 77.0% in 2021 as these organizations are predominantly adopting video conferencing solutions for business communications across geographies. As a result, the major market players are focusing on developing offerings that can cater to the needs of multinational enterprises. In 2020, Google LLC introduced an enhanced video conferencing tool- Google Workspace for businesses. It combines the tools for communication and collaboration, including email, chat, video and voice calling, and content management.

The Small and Medium Enterprises (SMEs) segment is estimated to witness a notable CAGR of around 15.0% over the next few years as these businesses realize the significance of conferencing and collaboration, especially after the COVID-19 outbreak. Various market players are developing strategies to capitalize on this segment and gain a competitive edge. For instance, Plantronics, Inc. redeveloped its SD video conferencing system- QDX 6000 for the Asian market, designed for small and medium-sized meeting rooms.

Application Insights

The enterprise segment had captured a revenue share of more than 85.0% in 2021 due to the higher demand for conference video endpoints that are room-based hardware solutions deployed and configured in meeting rooms. The growth prospects for enterprise-based video conferencing solutions were expected to be higher before the pandemic, considering the increased product adoption as a mode for communication and collaboration among employees.

However, the pandemic stimulated a rise in the purchases of consumer-grade solutions, which encouraged the market players to introduce enhanced features to their products and services to attract a larger customer base. For instance, in September 2021, Logitech launched its first set of TWS earphones designed especially for the expanding work from home market. The new TWS earphones can simultaneously pair with computers and smartphones.

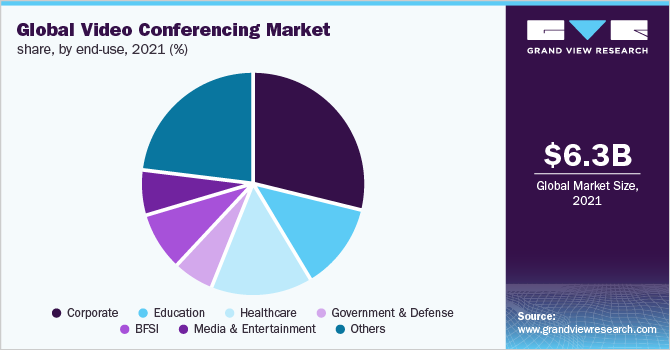

End-use Insights

The corporate segment had dominated the market by acquiring a revenue share of over 28% in 2021. This can be attributed to the growing consumer interest in cloud-based communication and collaboration solutions. The growing number of geographically dispersed teams has stimulated the usage of cloud-based platforms for seamless data sharing, collaboration, and communication. These platforms allow remote teams to streamline business processes and manage projects of all sizes while increasing the organization’s overall productivity.

The government and defense sector accounted for around 6.0% revenue share in 2021 and is emerging as a promising segment as the public sector companies are now adopting conferencing solutions to enhance efficiency and productivity. These services are enabling the government organizations to engage more people, which, in turn, is helping in faster decision-making. Cloud-based solutions are anticipated to gain massive traction in this sector as the government bodies emphasize cost control, seek to replace conventional telecom equipment, and demand better connectivity with their mobile workforce.

Regional Insights

North America video conferencing market held a revenue share of approximately 39.0% in 2021 due to the higher adoption rate in the region. The mounting demand for high-quality internet and visual meeting services is expected to propel market growth. Besides, the strong presence of various major players in the region coupled with the growing trend of Bring Your Own Device (BYOD) solutions, leading to increased demand for webcams and headphones, are driving the market growth further.

The Asia Pacific market for video conferencing is expected to witness a CAGR of over 14.0% through 2030 with the adoption of new work styles across the regional businesses. As a result of the COVID-19 pandemic, several companies had to implement remote working which subsequently encouraged the development of high-quality internet infrastructure in the region. This led to a drastic rise in the region’s demand for video conferencing equipment, collaboration tools, and accessories. Moreover, the advancements in mobile broadband technologies, including WiMAX and High-Speed Downlink Packed-Access (HSDPA) networks in the countries such as Japan and India, will accelerate the market growth further.

Key Companies & Market Share Insights

The global outbreak of the COVID-19 pandemic encouraged companies to restructure their business operations and strategies. They are making hefty investments in cloud-based solutions and portfolio diversification to address the need to create a digital workplace for employees working remotely. Google LLC, which is widely known for its video conferencing software solutions, expanded its product range by introducing a meeting room hardware- Series One. This product comprises a Next Hub Max for controlling the activities, an 8-channel speaker with noise cancellation, and a webcam for video meetings.

The market players are also focusing on partnerships, mergers, and acquisitions to gain a strong foothold in the industry. To illustrate, in October 2020, Cisco Systems, Inc. announced the acquisition of BabbleLabs to enhance the functionality of its Cisco WebEx Platform through speech enhancement and noise removal technology. This strategic move helped the company enhance its video meeting experience by improving its conferencing and communications applications.

The growing focus of businesses on controlling communication costs has provided major opportunities for industry players. As a result, they are largely inclined on developing advanced conferencing solutions, such as telepresence and webcasts. Some of the prominent players in the global video conferencing market include:

-

Avaya, Inc.

-

Cisco Systems, Inc.

-

Huawei Technologies Co., Ltd.

-

Logitech International S.A.

-

Microsoft Corporation

-

Polycom Inc.

-

Zoom Video Communications, Inc.

Video Conferencing Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 7.71 billion

Revenue forecast in 2030

USD 19.73 billion

Growth Rate

CAGR of 12.5% from 2022 to 2030

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, enterprise size, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil

Key companies profiled

Avaya, Inc.; Cisco Systems, Inc.; Microsoft Corporation; Plantronics, Inc.; Zoom Video Communications, Inc.; Huawei Technologies Co., Ltd; Polycom Inc.

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global video conferencing market report based on component, deployment, enterprise size, application, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Camera

-

Microphone/Headphone

-

Others

-

-

Software

-

Services

-

Professional Services

-

Managed Services

-

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premise

-

Cloud

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Enterprises

-

Small and Medium Enterprises

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumer

-

Enterprise

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Corporate

-

Education

-

Healthcare

-

Government & Defense

-

BFSI

-

Media & Entertainment

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

-

MEA

-

Frequently Asked Questions About This Report

b. The global video conferencing market size was estimated at USD 6.28 billion in 2021 and is expected to reach USD 7.71 billion in 2022.

b. The global video conferencing market is expected to grow at a compound annual growth rate of 12.5% from 2022 to 2030 to reach USD 19.73 billion by 2030.

b. North America dominated the market for video conferencing in 2021 and acquired a revenue share of over 38%.

b. Some key players operating in the video conferencing market include Adobe Inc.; Array Telepresence Inc.; Avaya Inc.; Cisco Systems, Inc.; Huawei Technologies Co., Ltd.; Logitech International S.A.; Microsoft Corporation; Plantronics, Inc.; Vidyo Inc.; and West Corporation.

b. Key factors that are driving the video conferencing market growth include the rapidly growing demand for video communication on account of the globalization of businesses, geographically scattered business operations, and remote workforce management.

b. The hardware segment dominated the video conferencing market in 2021 with a revenue share of over 47%.

b. The on-premise segment dominated the video conferencing market in 2021 by capturing a revenue share of over 58%.

b. The large enterprise segment captured a revenue share of over 77% in 2021 in the video conferencing market.

b. The enterprise segment dominated the video conferencing market in 2021 by capturing a revenue share of over 85%.

b. The corporate segment dominated the video conferencing market in 2021 and acquired a revenue share of over 28%.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."