- Home

- »

- Next Generation Technologies

- »

-

Video Processing Platform Market Size, Industry Report, 2033GVR Report cover

![Video Processing Platform Market Size, Share & Trends Report]()

Video Processing Platform Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (Platform, Services), By Deployment, By Content Type, By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-772-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Video Processing Platform Market Summary

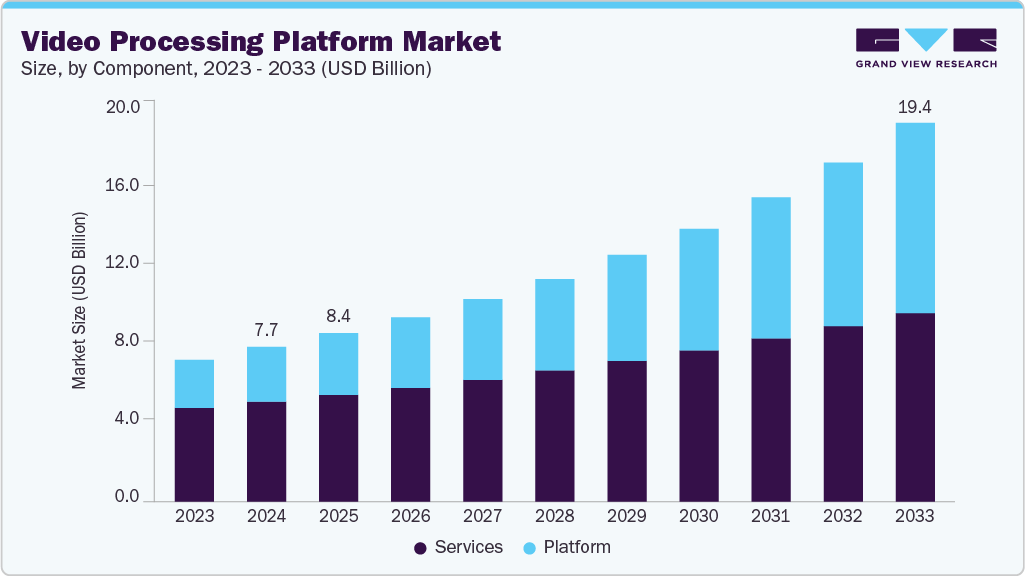

The global video processing platform market size was estimated at USD 7.73 billion in 2024 and is projected to reach USD 19.35 billion by 2033, growing at a CAGR of 10.9% from 2025 to 2033. The market growth is driven by various factors such as rising OTT and live-streaming demand, cloud-based deployment adoption, increasing use of AI-driven video analytics, rapid growth in short-form content, and enterprises’ focus on improving video quality, personalization, and viewer experience.

Key Market Trends & Insights

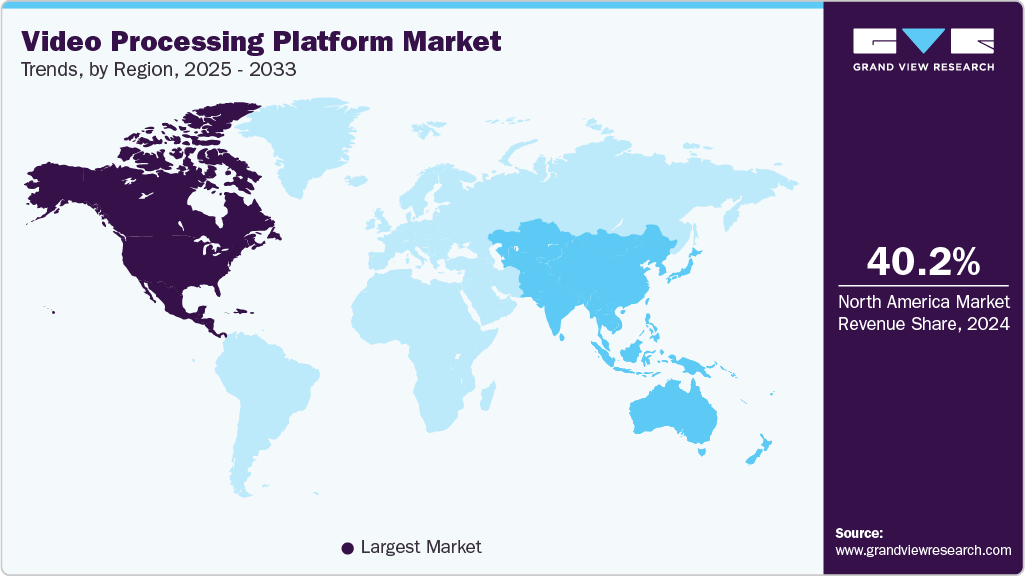

- North America dominated the global video processing platform market with the largest revenue share of 40.2% in 2024.

- The U.S. video processing platform industry led North America, with the largest revenue share in 2024.

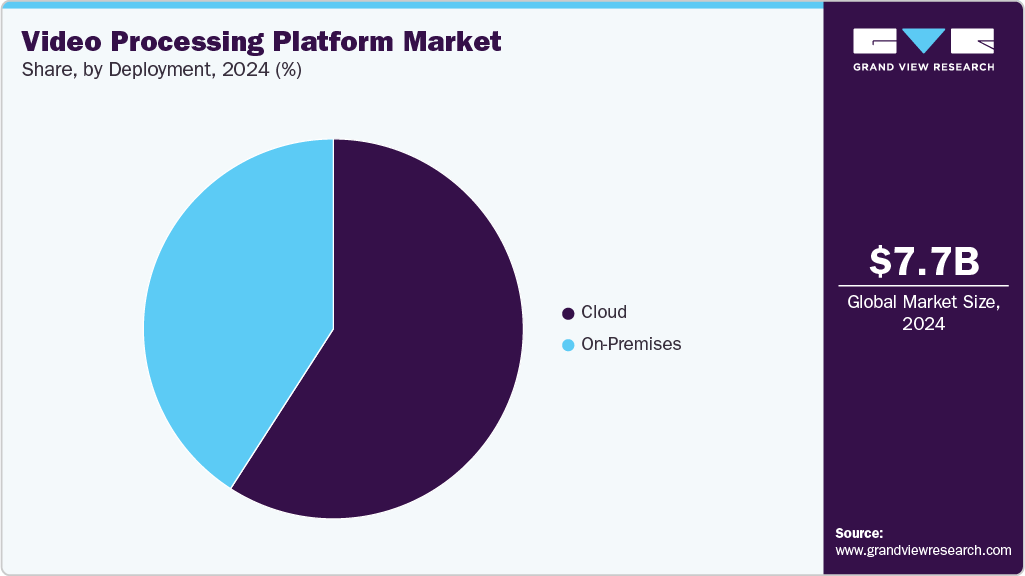

- By deployment, the cloud segment led the market, with the largest revenue share of 59.1% in 2024.

- By component, the service segment held the dominant market position in 2024.

- By content type, the live streaming video segment held the dominant market position in 2024.

Market Size & Forecast

- 2024 Market Size: USD 7.73 Billion

- 2033 Projected Market Size: USD 19.35 Billion

- CAGR (2025-2033): 10.9%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The global video processing platform industry’s growth is primarily driven by the exponential growth in online video consumption across OTT, social media, and live-streaming platforms. Increasing internet penetration, the surge in mobile device usage, and higher network bandwidth have significantly expanded the reach of high-quality video content. Additionally, the growing shift toward digital entertainment and remote communication has accelerated the demand for scalable, cloud-based video processing solutions. Businesses are adopting these platforms to ensure seamless video delivery, adaptive bitrate streaming, and efficient content distribution across multiple devices and geographies, thereby enhancing user experience and optimizing content monetization.Technological advancements such as Artificial Intelligence (AI), Machine Learning (ML), and edge computing are transforming the video processing landscape. AI-enabled tools help automate video editing, content tagging, compression, and real-time analytics, enabling faster and more efficient workflows. Edge computing allows processing closer to the data source, reducing latency and bandwidth consumption. Moreover, the increasing integration of video analytics and Quality-of-Experience (QoE) monitoring tools helps enterprises optimize performance and understand viewer behavior. These innovations collectively drive the adoption of intelligent, real-time video processing platforms across industries, including media, e-commerce, and education.

Another key growth driver is the rising enterprise focus on content personalization and security. Video processing platforms are increasingly used to deliver customized viewing experiences through AI-driven recommendation engines and adaptive streaming technologies. The growing need for content protection, digital rights management (DRM), and secure video transmission has further fueled platform adoption among enterprises and service providers. In addition, industries such as healthcare, BFSI, and education are leveraging video platforms for remote consultations, training, and communication. The combination of scalability, automation, and data-driven insights continues to make video processing platforms an essential part of digital transformation strategies globally.

Component Insights

The services segment held the largest share of the video processing platform industry in 2024, driven by the increasing demand for consulting, integration, and managed services to optimize complex video workflows. As organizations migrate to cloud-based and hybrid environments, they rely on specialized service providers to ensure seamless deployment, customization, and maintenance of video processing platforms. The growing need for real-time content delivery, quality assurance, and analytics further fuels demand for managed and professional services. Additionally, the rising focus on scalability, multi-device compatibility, and cost efficiency encourages enterprises to outsource video management operations, thereby accelerating the adoption of video processing services across industries such as media, retail, and education.

The platform segment is expected to register the fastest CAGR over the forecasted period, due to increasing demand for scalable, flexible, and cloud-compatible solutions that enable seamless video content management, processing, and delivery. Businesses across BFSI, healthcare, retail, and media verticals are leveraging platforms to support high-resolution video analytics, live streaming, and AI-driven content enhancement. The adoption of hybrid cloud and edge computing further accelerates platform utilization, offering low-latency processing and improved operational efficiency. Additionally, integration capabilities with third-party tools, strong security frameworks, and customizable APIs position platforms as a crucial enabler for digital transformation and enhanced customer experiences in the video ecosystem.

Deployment Insights

The cloud segment dominated the video processing platform market with a revenue share of over 59.0% in 2024. This can be attributed to the scalability, cost efficiency, and flexibility of cloud deployment. Organizations increasingly prefer cloud-based solutions to manage fluctuating video workloads, support real-time processing, and reduce capital expenditure. Cloud platforms enable seamless integration with Content Delivery Networks (CDNs), facilitating faster video encoding, transcoding, and distribution globally. Moreover, the surge in OTT platforms, live-streaming services, and social media video content has accelerated the demand for cloud-based processing to handle large-scale, high-quality video streams. Cloud deployments also enhance collaboration, remote accessibility, and workflow automation. Additionally, the growing adoption of AI and analytics through cloud-native architectures empowers enterprises to optimize content delivery, ensure uptime, and provide personalized user experiences, further driving market growth.

The on-premises segment is expected to register a significant CAGR over the forecast period, driven by organizations’ need for greater control, data privacy, and security over video content and infrastructure. Enterprises in regulated industries such as BFSI, healthcare, and government prefer on-premises solutions to comply with strict data protection and governance standards. This model ensures low latency, consistent performance, and high reliability for mission-critical video operations. Additionally, companies with existing IT infrastructure investments favor on-premises platforms for seamless integration with legacy systems. The rising demand for customized, high-performance video processing and the need to safeguard intellectual property further strengthen the adoption of on-premises deployments.

Content Type Insights

The live streaming video segment held the largest market share in 2024, driven by the growing demand for real-time content consumption across industries, including gaming, education, corporate communications, and entertainment. Increasing adoption of high-speed internet, 5G connectivity, and advanced video codecs enables seamless, high-quality streaming experiences, boosting user engagement. Businesses are leveraging live streaming for virtual events, product launches, and interactive marketing, enhancing brand visibility. Additionally, the surge in social media platforms supporting live video and the rising preference for on-demand, real-time content among consumers are key factors propelling investments in live streaming video solutions.

The social media content and short-form video segment is expected to register the fastest CAGR over the forecasted period, driven by the explosive growth of digital content consumption and the shift toward mobile-first entertainment. Platforms such as TikTok, Instagram reels, and YouTube shorts are fueling demand for fast, engaging, and shareable video content, pushing creators and brands to adopt advanced video processing tools. Key drivers include the need for real-time editing, AI-based enhancements, automated captioning, and multi-format distribution to optimize reach and engagement. Rising influences of marketing, user-generated content proliferation, and brand storytelling initiatives further accelerate investments in efficient video processing solutions.

Application Insights

The QoE (Quality of Experience) Monitoring and Video Analytics segment held the largest share of the video processing platform market in 2024. The segment is rapidly gaining traction due to the growing emphasis on delivering seamless, high-quality video experiences to end users. Increasing demand from OTT platforms, broadcasters, and enterprises for real-time performance monitoring, content optimization, and personalized insights is driving adoption. Advanced analytics enable operators to identify network issues, optimize streaming quality, and enhance viewer engagement. Additionally, rising investments in AI and machine learning technologies facilitate automated detection of anomalies, user behavior analysis, and predictive maintenance. These factors collectively boost the segment’s growth in the forecasted period.

The video personalization & recommendation engines segment is expected to register the highest CAGR over the forecasted period, driven by the growing demand for highly tailored and engaging content experiences. Platforms are increasingly leveraging AI and machine learning to analyze viewer behavior, preferences, and engagement patterns, enabling precise content recommendations. Rising consumption of on-demand streaming services and personalized video marketing strategies across industries further fuels adoption. Businesses aim to enhance user retention, increase watch time, and boost monetization through targeted recommendations. Additionally, advancements in data analytics and real-time processing capabilities empower platforms to deliver seamless, context-aware video personalization, making this segment a critical growth driver.

End Use Insights

Media & entertainment accounted for the largest market revenue share in 2024, due to the surge in demand for high-quality digital content, live streaming, and on-demand video services. Increasing adoption of 4K/8K resolution, Virtual Reality (VR), and Augmented Reality (AR) technologies requires robust video processing solutions for seamless content delivery and enhanced viewer experiences. Additionally, the proliferation of OTT platforms, social media video consumption, and interactive media is driving the need for efficient video encoding, transcoding, and real-time analytics. Rising investments in cloud-based video processing and AI-powered content management further fuel market expansion within this segment.

The marketing and advertising agencies’ segment is expected to register the highest CAGR over the forecast period, primarily driven by the increasing demand for personalized and interactive video content to engage target audiences effectively. Agencies are leveraging advanced video analytics, AI-powered editing, and automation tools to optimize campaigns, measure performance, and enhance ROI. The growing adoption of multi-platform marketing strategies, including social media, OTT, and digital advertising, is accelerating the need for scalable and real-time video processing solutions. Additionally, rising competition and the emphasis on creative storytelling are compelling agencies to invest in platforms that enable faster content production, seamless distribution, and high-quality output.

Regional Insights

North America dominated the video processing platform market with a revenue share of over 40.2% in 2024. The market growth is driven by the rapid adoption of advanced technologies such as AI, machine learning, and cloud computing, enabling real-time video analytics and enhanced user experiences. Growing demand for high-quality video content across streaming services, social media, and enterprise communications is fueling investments in scalable, low-latency platforms. Increasing use of video in various sectors such as BFSI, healthcare, retail, and media for surveillance, marketing, and remote collaboration is further propelling market growth. Additionally, rising emphasis on personalized content delivery, efficient content management, and integration with IoT and 5G networks support the sustained adoption of video processing solutions across North America.

U.S. Video Processing Platform Market Trends

The U.S. video processing platform industry is expected to grow significantly, propelled by the rapid adoption of high-definition and ultra-high-definition content across broadcasting, streaming, and social media platforms. Rising demand for real-time video analytics, cloud-based processing, and AI-driven automation is enabling organizations to deliver personalized and interactive content efficiently. The growing popularity of OTT platforms, coupled with increased consumption of video-on-demand services, is pushing broadcasters and enterprises to upgrade infrastructure for seamless encoding, transcoding, and distribution. Additionally, advancements in 5G networks and edge computing are facilitating low-latency streaming, while stringent regulatory standards on content quality and security further drive investment in robust video processing solutions.

Europe Video Processing Platform Market Trends

The Europe video processing platform industry is expected to grow significantly over the forecast period, driven by the growing adoption of advanced video technologies across numerous sectors such as media, entertainment, retail, and BFSI. Rising demand for high-quality video content, coupled with the proliferation of OTT platforms and streaming services, fuels investments in scalable and cloud-based video processing solutions. Regulatory focus on data security and content compliance encourages deployment of efficient video management platforms. Additionally, increasing use of AI and machine learning for real-time video analytics, content moderation, and personalized user experiences supports market growth. Expansion of 5G networks further enhances video delivery capabilities, reinforcing platform adoption across industries.

Asia Pacific Video Processing Platform Market Trends

The Asia Pacific video processing platform industry is anticipated to grow at the fastest CAGR over the forecast period. This strong growth can be attributed to the region’s rapid digital transformation across industries, increasing internet penetration, and rising smartphone and smart device adoption. Growing demand for high-quality video content in media, entertainment, e-commerce, and online education is driving platform adoption. Additionally, the surge in cloud-based services and AI-powered video analytics is enhancing operational efficiency and content personalization. Governments’ initiatives to improve digital infrastructure and support the broadcasting and OTT sectors further boost market expansion. The rising need for real-time video processing and enhanced user experience is a key factor sustaining market momentum.

Key Video Processing Platform Company Insights

Some key companies in the video processing platform market areAkamai Technologies and Amazon Web Services, Inc.

-

Akamai Technologies leads the video processing platform market with its extensive global CDN infrastructure, enabling ultra-fast, secure, and reliable video delivery. Its advanced media compression, adaptive bitrate streaming, and real-time analytics optimize viewer experience. Akamai Technologies’ scalability and partnerships with major OTT platforms strengthen its leadership in global content distribution.

-

Amazon Web Services, Inc. dominates through its powerful cloud-based video processing and streaming solutions. Its scalable infrastructure supports live and on-demand content processing, encoding, and delivery globally. AI-driven analytics, automation, and integration across Amazon Web Services, Inc., enables cost-efficient, high-quality video workflows, making it a preferred choice for broadcasters and OTT providers.

Key Video Processing Platform Companies:

The following are the leading companies in the video processing platform market. These companies collectively hold the largest market share and dictate industry trends.

- Akamai Technologies

- MediaKind

- Harmonic Inc.

- Synamedia

- Brightcove Inc.

- Kaltura

- ATEME

- Imagine Communications

- Amazon Web Services, Inc.

- NVIDIA Corporation

Recent Developments

-

In September 2025, Bitmovin Inc., a video technology and streaming infrastructure company, partnered with StreamShark, a video streaming and live event platform provider, to deliver seamless, high-quality live and on-demand streaming experiences at scale at the International Broadcasting Convention (IBC) 2025. StreamShark introduced its new Video Player, integrating Bitmovin Inc.’s industry-leading playback technology with StreamShark’s advanced engagement features such as live polls, reactions, calls-to-action, switchable captions, and multi-audio tracks.

-

Gray Media, Inc., a broadcast television and media company, partnered with Google, a technology company, and Quickplay, a cloud-native video streaming technology company, to provide a comprehensive, end-to-end cloud-based solution that will transform the viewer experience. This collaboration leverages Google Cloud’s AI infrastructure and Quickplay’s cloud-native platform to enable highly personalized content delivery.

-

In April 2025, Kaltura partnered with Synthesia Limited, an AI video generation company, to integrate hyper-realistic AI avatars into its video platform. This enables organizations using Kaltura to produce avatar-based, AI-generated content at scale for training, education, marketing, and compliance, increasing engagement while reducing production costs.

Video Processing Platform Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.43 billion

Revenue forecast in 2033

USD 19.35 billion

Growth rate

CAGR of 10.9% from 2025 to 2033

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Deployment, component, content type, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

Akamai Technologies; MediaKind; Harmonic Inc.; Synamedia; Brightcove Inc.; Kaltura; ATEME; Imagine Communications; Amazon Web Services, Inc.; NVIDIA Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Video Processing Platform Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global video processing platform market report based on deployment, component, content type, application, end use, and region:

-

Deployment Outlook (Revenue, USD Billion, 2021 - 2033)

-

On-Premises

-

Cloud

-

-

Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Platform

-

Services

-

-

Content Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Live Streaming Video

-

Video on Demand (VOD)

-

Social Media Content and Short-form Video

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Video Ingest and Capture

-

Video Delivery and Distribution

-

Video Editing and Enhancement

-

Video Hosting and Publishing

-

Content Creation and Post-production

-

Content Protection

-

QoE Monitoring and Video Analytics

-

Video Personalization and Recommendation Engines

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

BFSI

-

Manufacturing

-

Travel and Hospitality

-

Media and Entertainment

-

Retail and E-commerce

-

Marketing and Advertising Agencies

-

Healthcare and Life Sciences

-

Education

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global video processing platform market size was estimated at USD 7.73 billion in 2024 and is expected to reach USD 8.43 billion in 2025.

b. The global video processing platform market is expected to grow at a compound annual growth rate of 10.9% from 2025 to 2033 to reach USD 19.35 billion by 2033.

b. North America dominated the video processing platform market with a share of 40.2% in 2024. This is attributable to the rapid adoption of advanced technologies such as AI, machine learning, and cloud computing, enabling real-time video analytics and enhanced user experiences. Growing demand for high-quality video content across streaming services, social media, and enterprise communications is fueling investments in scalable, low-latency platforms.

b. Some key players operating in the video processing platform market include Akamai Technologies; MediaKind; Harmonic Inc.; Synamedia; Brightcove Inc.; Kaltura; ATEME; Imagine Communications; Amazon Web Services, Inc.; and NVIDIA Corporation.

b. Key factors that are driving the video processing platform market growth include rising OTT and live-streaming demand, cloud-based deployment adoption, increasing use of AI-driven video analytics, rapid growth in short-form content, and enterprises’ focus on improving video quality, personalization, and viewer experience.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.