- Home

- »

- Biotechnology

- »

-

Viral Vector Production (Research-use) Market, Industry Report, 2030GVR Report cover

![Viral Vector Production (Research-use) Market Size, Share & Trends Report]()

Viral Vector Production (Research-use) Market (2024 - 2030) Size, Share & Trends Analysis Report By Vector Type (Adeno-Associated Virus, Lentivirus), By Application, By Workflow, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-359-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Viral Vector Production (Research-use) Market Summary

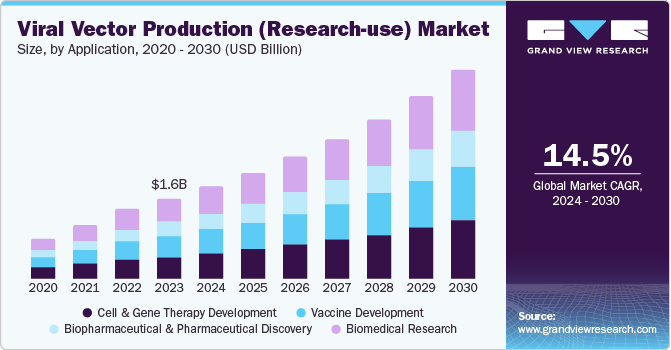

The global viral vector production (research-use) market size was valued at USD 1.56 billion in 2023 and is projected to reach USD 4.06 billion by 2030, growing at a CAGR of 14.5% from 2024 to 2030. The increased focus on advanced therapy research has led to the widespread use of viral vectors in the research domain.

Key Market Trends & Insights

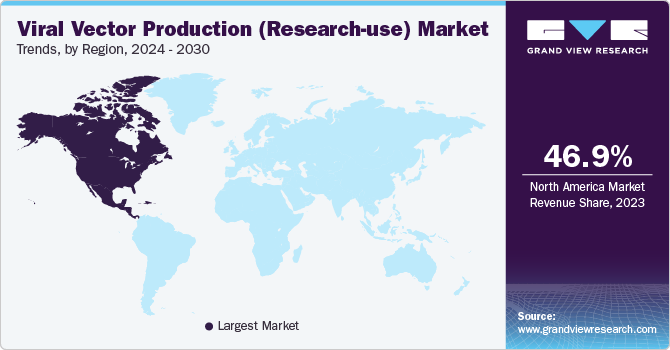

- North America viral vector production (research-use) market accounted for 46.9% in 2023.

- Europe viral vector production (research-use) market is poised to grow at a rapid CAGR of 13.7% in the forecast period.

- By vector type, the adeno-associated virus (AAV) segment accounted for a leading position with a market share of 23.6% in 2023.

- By application, the gene and cell therapy development segment accounted for a leading position at the market share of 27.5% in 2023.

- By workflow, the downstream processing segment held a leading revenue share of 52.5% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1.56 Billion

- 2030 Projected Market Size: USD 4.06 Billion

- CAGR (2024-2030): 14.5%

- North America: Largest market in 2023

Furthermore, the COVID-19 pandemic has further stimulated investment in developing vaccines against highly contagious diseases. In pre-pandemic times, the research communities have been focusing extensively on viral vectors for their effectiveness in gene and cell therapies. However, with the emergence of the COVID-19 outbreak, the application of viral vectors shifted towards vaccine production. Additionally, developers of technology and platforms are actively working towards streamlining the manufacturing process, aiming to overcome the challenges related to scale and efficiency in viral vector production.

The market is influenced by the rising occurrence of genetic disorders, cancer, and infectious diseases, the growing number of clinical studies, and the availability of funding for gene therapy development. Additionally, there is potential for novel drug delivery approaches. The manufacturing services are expected to encounter hindrances in the form of high costs associated with advanced therapies and the technological challenges related to financial sustainability. Nevertheless, the market for viral vector production is projected to witness significant growth during the forecast period. This growth can be attributed to improved clinical outcomes and favorable regulatory bodies, despite the numerous challenges faced.

Vector Type Insights

The adeno-associated virus (AAV) segment accounted for a leading position with a market share of 23.6% in 2023. The major applications of AAV vectors include vaccinology, genome editing, and gene therapy. Clinical research on adeno-associated viruses has been significant in the past few years. The growing number of emerging players and a robust pipeline for vaccines and gene therapies focused on vaccine development have fueled the segment growth. The participation of various universities and clinical institutes for research in gene therapy contributes to the development.

The lentivirus vectors are expected to grow faster at a CAGR of 16.2% in the forecast period. The widespread applications of lentivirus vectors include regenerative medicine, treatment of genetic disorders, and cancer immunotherapy. These are the most commonly used vector types in clinical research. Therefore, their efficiency and versatility in gene therapy are significant to the clinical trials.

Application Insights

The gene and cell therapy development segment accounted for a leading position at the market share of 27.5% in 2023. Gene and cell therapy has experienced a rapid evolution in the past few years. The number of clinically approved vaccines driven by viral vectors is growing due to the high success in clinical and preclinical studies. Extensive research has been conducted on viral vectors in different animal models, leading to the exploration of various viruses as vaccine vectors with high clinical success. Adeno-associated viruses and lentivirus are among the popular choices for vaccine development due to their ability to trigger immune responses against antigens.

The vaccine development segment is expected to witness a fast-growing CAGR of 14.1% in the forecast period. Viral vector is an extremely crucial stage in vaccine development and an interest in production technologies is driven by the regulatory approvals in gene therapy and vaccines. The large clinical pipeline for drug development significantly focuses on AAV and lentiviruses. The use of AAV has grown to a larger extent in cell and gene therapy in the past few years. Therefore, vaccine development is focused on production scale and efficiency.

Workflow Insights

The downstream processing segment held a leading revenue share of 52.5% in 2023. With the rising demand for vectors in gene and cell therapy production, it is imperative to prioritize the processing and supply of viral vectors in the research setting to maintain product quality and maximize output. As a result, companies are actively assessing advanced platforms to overcome manufacturing bottlenecks and optimize their operations.

The upstream processing is expected to register a fast-growing CAGR of 14.3% in the forecast period. The upstream process encompasses a series of crucial phases that are significant to the success of viral vector production. It forms the basis for the production process, directing to the point where viral vectors are harvested from host cells. The objective of upstream processing is to optimize the conditions for the host and substantially produce viral vectors. The segment growth is attributed to the significance of upstream processing in gene therapies. Moreover, technological advancements, increasing investments, and partnerships encourage the demand for upstream processing in the forthcoming years.

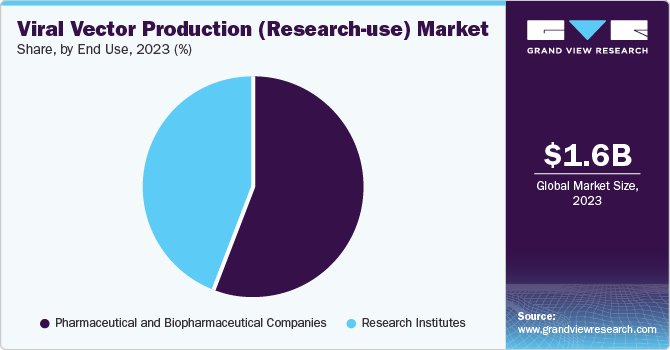

End-use Insights

The pharmaceutical and biopharmaceutical segment accounted for the largest revenue share of 17.4% in 2023. The growing number of pharmaceutical players can be attributed to the significance of research in gene therapies. The contribution of the research community in developing advanced treatments for a range of genetic and acquired diseases is paramount to clinical success.

The emergence of the COVID-19 pandemic has prompted the scientific community to redirect their efforts towards expediting the development of a vaccine against this infectious disease. There has been a surge in the demand for viral vectors from various research institutions. In addition to combating COVID-19, researchers are actively involved in vaccine research and development for diseases such as HIV and Hepatitis B. Developing biotechnology and pharmaceutical companies are currently focused on advancing gene and cell therapies for numerous severe diseases. Biopharmaceutical companies are highly engaged in the Research and Development of viral vectors for therapeutic production.

Regional Insights

North America viral vector production (research-use) market accounted for 46.9% in 2023. The market growth is attributed to an increasing number of advanced therapy products in clinical trials for vaccine production. In addition, the demand for viral vectors is high owing to the rapid need for viral vector based vaccines that cater to several life-threatening diseases. Viral vectors are used in clinical research, vaccine development, and biomedical research for cancer treatment and several other diseases. Moreover, there is a growing need for gene therapy and research and development in advanced therapies.

Europe Viral Vector Production (Research-use) Market Trends

Europe viral vector production (research-use) market is poised to grow at a rapid CAGR of 13.7% in the forecast period. The growing emphasis on gene therapy and vaccines is expected to remain vital for the clinical industry in Europe. Viral vectors have shown significant results in preclinical studies for treating diseases such as HIV/AIDS and Hepatitis C. These studies have demonstrated successful feasibility studies against Ebola and Influenza as these vaccines deliver viral DNA into cells, that trigger an immune response.

Asia Pacific Viral Vector Production (Research-use) Market Trends

Asia Pacific viral vector production (research-use) market is expected to witness substantial growth in the forecast period. This is attributed to the rising incidences of target conditions, diseases, and the effectiveness of viral vectors in gene therapy. The availability of private funding for research projects for the advancement of gene therapy is expected to boost the regional market growth. The ongoing research and development on genes and cell therapies dependent on viral vectors fuels the market growth. Moreover, high levels of engagement in public-private partnerships directed at research and manufacturing is expected to boost the need for viral vectors in the region.

Key Viral Vector Production (Research-use) Company Insights

With the continuous growth of companies engaged in gene and cell therapy development, and vaccine development, the market competition in this domain is projected to become more intense. Moreover, contract research organizations are witnessing a substantial surge in service demand, augmenting their revenue generation.

-

Avid Bioservices, Inc. launched the analytical and process development (AD/PD) suites in June 2022 as a part of their new, cutting-edge viral vector development and Current Good Manufacturing Practice (CGMP) manufacturing facility.

Key Viral Vector Production (Research-Use) Companies:

The following are the leading companies in the viral vector production (research-use) market. These companies collectively hold the largest market share and dictate industry trends.

- Merck KGaA

- Lonza

- FUJIFILM Diosynth Biotechnologies U.S.A., Inc.

- Charles River Laboratories.

- Thermo Fisher Scientific

- Waisman Biomanufacturing

- Genezen

- Yposkesi,Inc.

- Advanced BioScience Laboratories, Inc. (ABL, Inc.)

- Orgenesis Inc.

Recent Developments

-

In October 2022, ABL organization and RD-Biotech established a strategic partnership in GMP manufacturing for cell and gene therapy, providing developers with a more efficient pathway to plasmid DNA and viral vector manufacturing.

Viral Vector Production (Research-use) Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.80 billion

Revenue forecast in 2030

USD 4.06 billion

Growth rate

CAGR of 14.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

December 2024

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segment coverage

Vector type, workflow, application, End-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; South Korea; Thailand; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Companies profiled

Merck KGaA; Lonza; FUJIFILM Diosynth Biotechnologies.; Cobra Biologics Ltd; Thermo Fisher Scientific, Inc.; Waisman Biomanufacturing; Genezen; YPOSKESI, Inc; Advanced BioScience Laboratories, Inc. (ABL, Inc); Novasep Holdings SAS; Orgenesis Biotech Israel Ltd (formerly ATVIO Biotech ltd.); Vigene Biosciences, Inc.

Customization scope

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of the customization

Pricing and purchase options

Avail customized purchase options to meet your exact research needs.

Global Viral Vector Production (Research-use) Market Report Segmentation

The report presents a comprehensive forecast of revenue growth at the global, regional, and country levels. It also offers an in-depth analysis of the latest industry trends within each sub-segment from 2018 to 2030. For the purpose of this study, the report has been segmented, The global viral vector production (research-use) market report on the basis of vector type, application, workflow, end-use, and region:

-

Vector Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Adeno-associated Virus (AAV)

-

Lentivirus

-

Adenovirus

-

Retrovirus

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cell & Gene Therapy Development

-

Vaccine Development

-

Biopharmaceutical & Pharmaceutical Discovery

-

Biomedical Research

-

-

Workflow Outlook (Revenue, USD Million, 2018 - 2030)

-

Upstream Processing

-

Vector Amplification & Expansion

-

Vector Recovery & Harvesting

-

-

Downstream Processing

-

Purification

-

Fill-finish

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical and Biopharmaceutical Companies

-

Research Institutes

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.