- Home

- »

- Network Security

- »

-

Virtualization Security Market Size, Industry Report, 2030GVR Report cover

![Virtualization Security Market Size, Share, & Trends Report]()

Virtualization Security Market Size, Share, & Trends Analysis Report By Component (Solutions, Services), By Deployment, By Enterprise Size, By End Use, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-373-9

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Virtualization Security Market Size & Trends

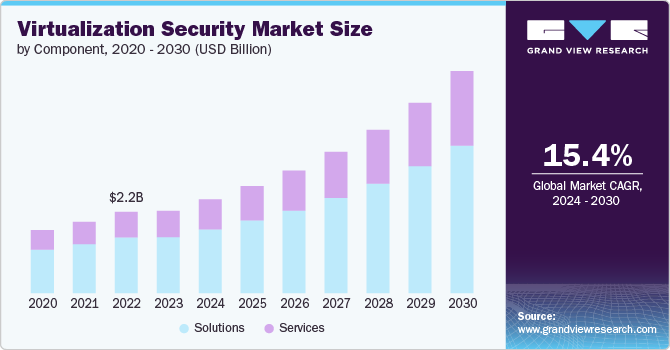

The virtualization security market size was estimated at USD 2.23 billion in 2023 and is anticipated to expand at a CAGR of 15.4% from 2024 to 2030. Several key factors are driving the growth of the virtualization security market. The increasing adoption of virtualization technologies across various industries necessitates robust security measures to protect virtualized environments. As organizations migrate to cloud-based infrastructures, safeguarding sensitive data and ensuring compliance with regulatory standards becomes paramount.

Additionally, the rise in sophisticated cyber threats targeting virtual machines and hypervisors underscores the importance of specialized security solutions. Furthermore, the proliferation of remote work and the expansion of digital enterprises contribute to the demand for scalable and efficient virtualization security tools. Advanced technologies such as artificial intelligence and machine learning are also being integrated into security solutions, enhancing their ability to detect and mitigate threats in real time. Consequently, these developments collectively foster the expansion and innovation within the virtualization security market.

The proliferation of remote work and the expansion of digital enterprises significantly drive the market by necessitating advanced security measures to protect increasingly dispersed and complex IT environments. As remote work becomes more prevalent, organizations must ensure that their virtualized infrastructures are secure against a wide array of cyber threats that exploit remote access vulnerabilities. This shift demands robust solutions to protect sensitive data transmitted across various networks and devices.

Similarly, the growth of digital enterprises, characterized by extensive reliance on virtualized and cloud-based systems, requires sophisticated security frameworks to manage and mitigate risks associated with virtual environments. The need to secure virtual machines, containers, and hypervisors against evolving cyber threats further underscores the importance of specialized virtualization security solutions. Consequently, these factors collectively stimulate the development and adoption of advanced security technologies, driving the growth of the virtualization security market.

The increasing adoption of virtualization technologies is a pivotal factor driving the virtualization security market. As organizations across various sectors leverage virtualization to enhance operational efficiency, reduce costs, and improve scalability, the need for comprehensive security solutions becomes paramount. Virtualized environments, while offering significant benefits, also introduce unique security challenges, such as hypervisor vulnerabilities, inter-VM threats, and complex network configurations.

To address these challenges, enterprises are investing in advanced virtualization security measures to protect their virtual assets and ensure compliance with industry regulations. The demand for solutions that can provide robust protection, real-time threat detection, and seamless integration with existing IT infrastructure is growing with the widespread implementation of virtualization technologies. Consequently, this surge in virtualization adoption fuels innovation and expansion within the virtualization security market.

Component Insights

The solutions segment accounted for the largest market share, over 68%, in the market in 2023. The growth of virtualization security solutions is driven primarily by the widespread adoption of virtualization technologies across various industries. Organizations increasingly utilize virtualized environments to enhance operational efficiency and scalability; they encounter unique security challenges such as hypervisor vulnerabilities, inter-VM threats, and complex network configurations. This necessitates developing and implementing advanced virtualization security solutions that can provide robust protection, real-time threat detection, and seamless integration with existing IT infrastructure.

The services segment is anticipated to grow at the fastest CAGR over the forecast period. The expansion of virtualization security services is propelled by the growing complexity and sophistication of cyber threats targeting virtualized environments. As cybercriminals exploit vulnerabilities in virtual machines and hypervisors, organizations require specialized expertise to manage and mitigate these risks. This demand for expert support and managed security services drives the growth of virtualization security services. Additionally, the proliferation of remote work and the expansion of digital enterprises further amplify the need for comprehensive security services to protect dispersed IT assets and sensitive data transmitted across various networks and devices.

Deployment Insights

The on-premises segment accounted for the largest market share in 2023. The on-premise adoption of virtualization security is driven by the need for organizations to maintain direct control over their IT infrastructure and data. Organizations prefer on-premise solutions to ensure stringent security measures and compliance with industry standards in sectors where data sensitivity and regulatory compliance are paramount, such as healthcare, finance, and government. Additionally, on-premise virtualization security allows customized and tailored security protocols to address specific organizational needs and mitigate unique threats within a controlled environment.

The cloud segment is anticipated to expand at a compound annual growth rate of over 16% during the forecast period. The cloud adoption of virtualization security is fueled by the increasing shift towards cloud-based services and infrastructure. Securing these virtualized cloud environments becomes critical as businesses seek the scalability, flexibility, and cost-efficiency offered by cloud computing.

Cloud adoption is particularly appealing for organizations looking to leverage the latest advancements in security technologies, such as AI and machine learning, which are often integrated into cloud-based security solutions. Furthermore, cloud service providers offer robust security frameworks and managed services that ensure continuous monitoring, real-time threat detection, and rapid response capabilities, making cloud-based virtualization security an attractive option for organizations aiming to enhance their security posture while benefiting from the efficiencies of the cloud.

Enterprise Size Insights

The large enterprises segment accounted for the largest market share of over 64% in 2023. Large enterprises' adoption of virtualization security is driven primarily by the scale and complexity of their IT environments. Large enterprises often operate extensive networks of virtualized infrastructure, encompassing numerous virtual machines, containers, and hypervisors. This complexity necessitates robust security measures to protect against sophisticated cyber threats and ensure compliance with stringent regulatory requirements. Additionally, large enterprises are frequently targeted by advanced persistent threats (APTs) and other high-level attacks, compelling them to invest in comprehensive virtualization security solutions that offer advanced threat detection, real-time monitoring, and rapid incident response capabilities.

The small & medium enterprises segment is anticipated to expand at the fastest CAGR during the forecast period. The adoption of virtualization security by small and medium enterprises (SMEs) is driven by the need to safeguard their digital assets while maintaining cost-effectiveness and operational efficiency. SMEs increasingly turn to virtualization to optimize resource utilization and reduce IT costs.

However, transitioning to virtualized environments introduces new security challenges requiring effective and affordable security solutions. Virtualization security enables SMEs to protect their virtual infrastructure from cyber threats without requiring extensive in-house security expertise. Additionally, the rise of managed security services and cloud-based security solutions offers SMEs access to advanced security capabilities, ensuring they can maintain a strong security posture despite limited resources and budgets.

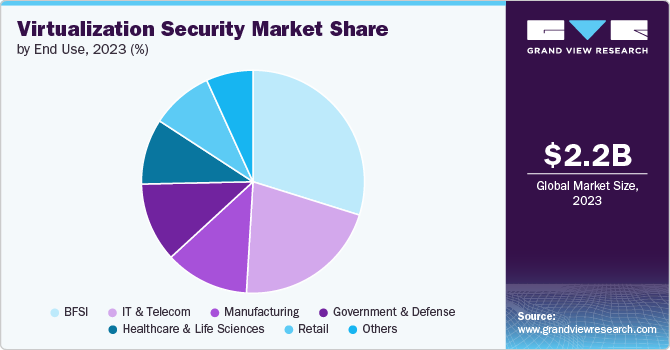

End Use Insights

The BFSI segment accounted for the largest market share of over 29% in 2023 in the virtualization security market. The adoption of virtualization security in the BFSI sector is driven by the need to protect susceptible financial data and comply with stringent regulatory requirements. The BFSI sector is a prime target for cybercriminals due to the valuable nature of the data it handles. Virtualization security solutions provide robust protection for virtualized environments, ensuring financial data's confidentiality, integrity, and availability.

Additionally, regulatory frameworks such as GDPR, PCI DSS, and others mandate rigorous security measures to safeguard customer information, compelling BFSI institutions to invest in advanced virtualization security technologies. These solutions enable BFSI organizations to mitigate risks, prevent data breaches, and maintain trust with their customers and stakeholders.

The IT & telecom segment is anticipated to grow at the highest CAGR during the forecast period. In the IT and telecom sector, the adoption of virtualization security is driven by the need to secure complex and dynamic virtualized infrastructures that support vast networks and numerous applications. The sector's reliance on virtualization for scalability, efficiency, and innovation makes it imperative to implement strong security measures to protect against evolving cyber threats.

Virtualization security solutions help IT and telecom companies ensure the security of their virtual machines, containers, and hypervisors, thereby preventing unauthorized access and data breaches. Furthermore, the sector's rapid adoption of emerging technologies such as 5G and edge computing necessitates advanced security solutions that can keep pace with technological advancements and provide real-time threat detection and mitigation. This drive towards securing next-generation infrastructure further fuels the adoption of virtualization security in the IT and telecom sectors.

Regional Insights

North America virtualization security market held the major share of over 40% in 2023. In the market is characterized by a strong emphasis on advanced threat detection and response capabilities. The region's mature IT infrastructure and high adoption of cloud services drive demand for robust security solutions that safeguard complex virtual environments. Regulatory compliance requirements also play a significant role in shaping the market.

U.S. Virtualization Security Market Trends

The virtualization security market of the U.S. is expected to grow significantly from 2024 to 2030. In the U.S., the focus is on integrating artificial intelligence and machine learning into virtualization security solutions. This integration aims to enhance real-time threat detection and automated response capabilities. Stringent data protection regulations also influence the U.S. market, pushing organizations to adopt comprehensive security measures for their virtualized infrastructures.

Europe Virtualization Security Market Trends

Europe virtualization security market is growing significantly at a CAGR of over 14% from 2024 to 2030. The market in Europe is driven by strict data privacy laws, such as the General Data Protection Regulation (GDPR). Organizations prioritize solutions that ensure compliance with these regulations while protecting sensitive data. Additionally, there is a growing trend towards adopting managed security services to address the complexity of securing virtual environments.

Asia Pacific Virtualization Security Market Trends

The virtualization security market of Asia Pacific is growing significantly at a CAGR of over 16% from 2024 to 2030. In the Asia Pacific region, the rapid digital transformation and increasing adoption of cloud computing are critical drivers for the virtualization security market. Businesses in this region seek cost-effective and scalable security solutions to protect their expanding virtualized environments. Additionally, the growing awareness of cyber threats and the need for robust security measures contribute to the market's growth.

Key Virtualization Security Company Insights

Key players operating in the network emulator market include Check Point Software Technologies Ltd., Cisco Systems Inc., Fortinet, Inc., Gen Digital Inc., International Business Machines Corporation, McAfee, LLC, Palo Alto Networks, Inc., Sophos Ltd., Trend Micro Incorporated, and VMware, Inc. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In June 2024, Trend Micro Incorporated, a global cybersecurity firm, announced plans to demonstrate a new data center solution utilizing NVIDIA technology. This solution is aimed at security-conscious business and government customers who are leveraging the power of AI. This demonstration is part of several AI security solutions being unveiled for the first time at COMPUTEX 2024. Trend Vision One - Sovereign and Private Cloud (SPC) incorporates NVIDIA NIM, a set of user-friendly inference microservices that are part of the NVIDIA AI Enterprise software platform. This platform is devised to expedite the deployment of generative AI around the data centers, cloud, and workstations.

-

In April 2024, Cisco Systems Inc. announced the completion of its acquisition of Isovalent, a global player in open-source cloud-native security and networking. This acquisition represents a significant advancement in Cisco's commitment to shaping the outlook of secure, multicloud networking. Isovalent's innovative technologies would become integral to the Cisco Security Cloud vision-a cloud-delivered, AI-driven, integrated security platform. This platform is designed to provide advanced threat protection for organizations of any size within a multi-cloud environment.

Key Virtualization Security Companies:

The following are the leading companies in the virtualization security market. These companies collectively hold the largest market share and dictate industry trends.

- Check Point Software Technologies Ltd.

- Cisco Systems Inc.

- Fortinet, Inc.

- Gen Digital Inc.

- International Business Machines Corporation

- McAfee, LLC

- Palo Alto Networks, Inc.

- Sophos Ltd.

- Trend Micro Incorporated

- VMware, Inc

Virtualization Security Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.54 billion

Revenue forecast in 2030

USD 6.01 billion

Growth rate

CAGR of 15.4% from 2024 to 2030

Historical data

2018 - 2022

Base Year

2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, enterprise size, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; and South Africa

Key companies profiled

Check Point Software Technologies Ltd.; Cisco Systems Inc.; Fortinet, Inc.; Gen Digital Inc.; International Business Machines Corporation; McAfee, LLC; Palo Alto Networks, Inc.; Sophos Ltd.; Trend Micro Incorporated; VMware, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Virtualization Security Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the virtualization security market report based on component, deployment, enterprise size, end use, and region.

-

Virtualization Security Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Solutions

-

Host Based

-

Virtual Antivirus and Anti-Malware

-

Virtual Appliance

-

Virtual Intrusion Detection and Prevention Systems (IDPS)

-

Virtual Zone

-

Virtual Infrastructure Protection

-

Others

-

-

Services

-

Managed Security Services

-

Professional Services

-

Consulting

-

-

-

Virtualization Security Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-premises

-

Cloud

-

-

Virtualization Security Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

Virtualization Security End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Government & Defense

-

IT & Telecom

-

Healthcare & Life Sciences

-

Retail

-

Manufacturing

-

Others

-

-

Virtualization Security Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global virtualization security market size was estimated at USD 2.23 billion in 2023 and is expected to reach USD 2.54 billion in 2024

b. The global virtualization security market is expected to grow at a compound annual growth rate of 15.4% from 2024 to 2030 to reach USD 6.01 billion by 2030

b. North America dominated the virtualization security market with a market share of 40.84% in 2023. In North America, the virtualization security market is characterized by a strong emphasis on advanced threat detection and response capabilities. The region's mature IT infrastructure and high adoption of cloud services drive demand for robust security solutions that safeguard complex virtual environments. Regulatory compliance requirements also play a significant role in shaping the market.

b. Some key players operating in the virtualization security market include Check Point Software Technologies Ltd., Cisco Systems Inc., Fortinet, Inc., Gen Digital Inc., International Business Machines Corporation, McAfee, LLC, Palo Alto Networks, Inc., Sophos Ltd., Trend Micro Incorporated, and VMware, Inc.

b. Several key factors are driving the growth of the virtualization security market. The increasing adoption of virtualization technologies across various industries necessitates robust security measures to protect virtualized environments. As organizations migrate to cloud-based infrastructures, safeguarding sensitive data and ensuring compliance with regulatory standards becomes paramount.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."