- Home

- »

- Sustainable Energy

- »

-

Voluntary Carbon Credit Market Size And Share Report, 2030GVR Report cover

![Voluntary Carbon Credit Market Size, Share & Trends Report]()

Voluntary Carbon Credit Market Size, Share & Trends Analysis Report, By Project (Renewable Energy, Energy Efficiency), By Application (Energy, Agriculture), By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-322-0

- Number of Report Pages: 219

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

Market Size & Trends

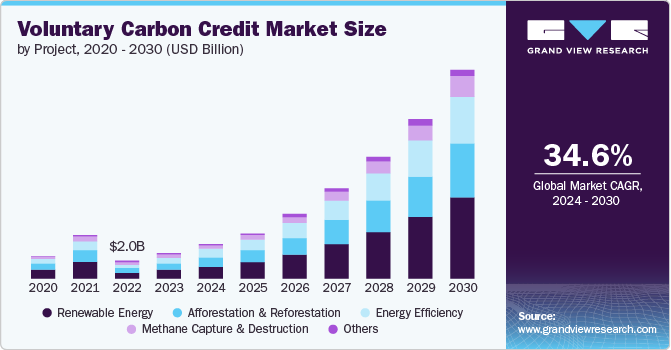

The global voluntary carbon credit market size was estimated at USD 2.97 billion in 2023 and is projected to grow at a CAGR of 34.6% from 2024 to 2030. The market growth is driven by companies pledging to achieve net-zero emissions and the need for offsets to compensate for emissions that cannot be fully eliminated. The market is expected to shift from focusing on reducing emissions to removing them altogether, with removal credits expected to account for 35% of the market by 2030.

The market growth is also driven by the increasing importance of carbon credits in achieving sustainability goals. Companies and governments recognize the need for credible incentives for emissions reductions. The market is expected to continue to evolve, with the focus on quality and verifiability of credits becoming increasingly important.

Corporate net-zero commitments are a major driver of the market's growth. As companies pledge to achieve net-zero emissions, they increasingly turn to the voluntary carbon market to offset the emissions they cannot fully eliminate through their decarbonization efforts.This surge in demand is being driven by the urgency for companies to act on climate change and demonstrate their commitment to sustainability. The voluntary carbon market provides a mechanism for companies to compensate for their residual emissions and contribute to global emissions reduction efforts.

The market offers several opportunities for companies and individuals to reduce their carbon footprint and contribute to a more sustainable future. The market allows for the purchase and sale of carbon credits, which represent the reduction or removal of one tonne of carbon dioxide or its equivalent from the atmosphere.Key opportunities in the market include the development of new carbon offset projects, the growth of carbon trading platforms, and the increasing adoption of carbon credits by companies and governments.

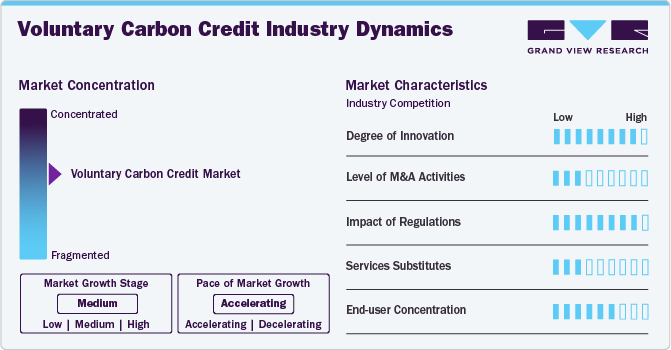

Industry Dynamics

The market is a rapidly growing sector, driven by the increasing pressure on businesses to reduce their global greenhouse gas emissions and meet the ambitions of the 2015 Paris Agreement.Carbon credits are used to offset emissions, and there are two main types: carbon removal projects, which remove carbon from the atmosphere, and carbon avoidance projects, which prevent carbon from being released.

However, the market is plagued by integrity issues, with the quality of projects and credits varying widely. The lack of regulation and standardization has led to concerns over the legitimacy of credits and the potential for reputational risks for companies that purchase them. The Integrity Council for the Voluntary Carbon Market has launched a public consultation on its Core Carbon Principles (CCPs) to establish a definitive and consistent framework for the market. In addition, the Voluntary Carbon Markets Integrity initiative has launched an integrity code to ensure corporations' responsible use of offsets.

One of the most significant areas of innovation in the voluntary carbon credit market is the use of advanced technologies for monitoring, reporting, and verification (MRV) of carbon projects. Remote sensing technologies, such as satellite imagery and drones, enable more accurate and frequent monitoring of project sites, particularly in hard-to-reach areas like dense forests. Additionally, data analytics and machine learning algorithms help process vast amounts of data to verify carbon sequestration and emission reductions more efficiently and accurately.

Large corporations and financial institutions actively acquire smaller companies and startups specializing in carbon credit projects, carbon management solutions, and related technologies. These acquisitions aim to bolster their sustainability portfolios, gain access to high-quality carbon credits, and expand their expertise in the carbon markets.

Regulations for VCMs are still under development. As the market grows, policymakers and industry groups work together to define best practices. This ongoing process is crucial for ensuring that VCMs remain a credible and effective tool against climate change.

Project Insights

Based on project, the market has been segmented into renewable energy, energy efficiency, afforestation & reforestation, methane capture & destruction, and others (soil carbon sequestration, energy efficiency). Renewable energy dominated the market with a share of over 39.08% in 2023. This growth is driven by the increasing pressure on companies to reduce their carbon footprint and meet the ambitions of the Paris Agreement. Renewable energy projects, such as solar and wind farms, are a key area of focus for carbon credits, as they help support the cost of developing clean energy sources and make them more affordable. Carbon credits can also provide additional revenue streams for project developers, promoting the adoption of clean energy technologies.

Methane capture and destruction is expected to grow at a significant CAGR of 34.0% during the forecast period. The demand for voluntary carbon credits in methane capture and destruction projects is significant, driven by the urgent need to reduce greenhouse gas emissions. Methane, a potent greenhouse gas, is produced and emitted by various sources, including landfills, agricultural activities, and coal mining.

Application Insights

Based on application, the market is segmented into industrial, household devices, energy, agriculture, and others. Industrial accounted for the highest revenue share of 32.51% in 2023. Industrial companies are increasingly looking to offset their emissions through carbon credits, representing the reduction or removal of one tonne of carbon dioxide or its equivalent from the atmosphere. The demand for carbon credits in industrial applications is driven by the need to reduce emissions from various industrial processes, such as energy consumption, transportation, and manufacturing.

Household devices is expected to grow at the highest CAGR of 35.6% during the forecast period. Energy applications are a key driver of market growth. Companies invest in renewable energy projects like wind and solar farms that generate credits, while others purchase credits to offset emissions from traditional energy sources. This trend fuels both clean energy development and emissions reduction efforts.

End Use Insights

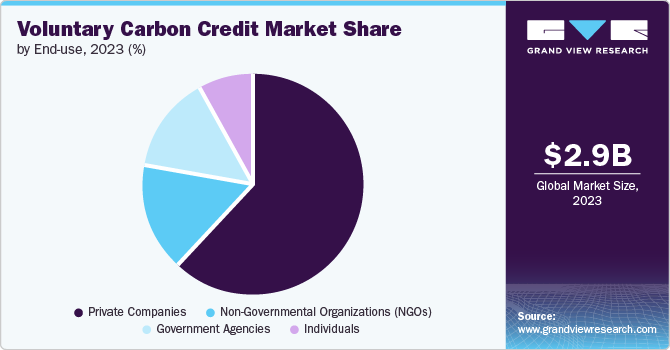

Based on end use, the market is segmented into government agencies, non-governmental organizations (NGOs), private companies, and individuals. Private Companies dominated the market in 2023 and accounted for a share of over 62.15%. The private companies in the market are driven by several factors. Firstly, the growing demand for corporate sustainability initiatives and net-zero targets is a significant driver. Companies are looking to offset their emissions through high-quality credits that align with their environmental and social goals. Secondly, the increasing adoption of carbon credits by governments and regulatory bodies is also driving the market.

The individual segment emerged as the fastest-growing segment, with a CAGR of 37.5% during the forecast period. Individuals can participate by purchasing carbon credits to offset their flights, energy consumption, or other activities that generate significant emissions. This can be done through various platforms, such as carbon offset programs offered by airlines or companies. The market is driven by the desire to reduce carbon emissions and support sustainable projects, with many individuals seeking to impact the environment positively.

Regional Insights

North America dominated the global voluntary carbon credit market and accounted for the largest revenue share of 37.18% in 2023. The market is experiencing significant growth in this region, driven by increasing demand for carbon offsetting and the need for companies to meet their sustainability goals.

U.S. Voluntary Carbon Credit Market Trends

The voluntary carbon credit market in the U.S. dominated North America and accounted for a share of 81.22% in 2023. The surge in demand is largely attributed to companies and individuals seeking to reduce their carbon footprint and contribute to climate change mitigation efforts.

The voluntary carbon credit market in Canada is expected to grow at the fastest CAGR of 34.9%. The demand for carbon credits in Canada's market has grown significantly, driven by increasing corporate and individual demand for carbon offsetting.

Europe Voluntary Carbon Credit Market Trends

The voluntary carbon credit market in Europe has seen significant growth, driven by strong demand from corporate buyers seeking high-quality credits.

Germany voluntary carbon credit market accounted for the largest share of 27.23% in 2023. The market is driven by strong demand from German corporations seeking to offset their emissions and meet their sustainability goals.

The voluntary carbon credit market in Spain is expected to progress with a CAGR of 36.2% over the forecast period. The Spanish voluntary carbon credit market is growing, driven by increasing demand from corporations and government initiatives. Nature-based credits, particularly forestry and land-use projects, are in high demand due to their ability to sequester carbon and offer co-benefits like biodiversity conservation and ecosystem restoration.

Asia Pacific Voluntary Carbon Credit Market Trends

The voluntary carbon credit market in the Asia Pacific is driven by government initiatives and corporate sustainability goals. Forestry and land-use projects are emerging as pivotal players in carbon sequestration and ecological benefits.

China voluntary carbon credit market dominated the Asia Pacific region with the highest revenue market share in 2023. The market aims to supplement China's compulsory Emissions Trading Scheme (ETS) and support the country's goal of peaking carbon emissions by 2030 and achieving net zero emissions by 2060.

The voluntary carbon credit market in India is expected to grow at the highest CAHR of 37.7% during the forecast period. This growth is driven by increasing corporate demand for sustainability initiatives and favorable government policies.

Central & South America Voluntary Carbon Credit Market Trends

The voluntary carbon credit market in Central and South America is projected to grow significantly over the forecast period. Driven by increasing demand and favorable policies, the market is expected to emerge as a significant player in the global carbon credit market.

Brazil voluntary carbon credit market accounted for the largest share of 49.47% in 2023 in the region. The country is a leader in this market due to its vast forests and renewable energy projects.

Middle East & Africa Voluntary Carbon Credit Market Trends

The voluntary carbon credit market in the Middle East and Africa is expected to grow significantly. The market is on the rise, fueled by initiatives like the UAE's $450 million commitment to African credits and the first-ever regional auction in Saudi Arabia.

Key Voluntary Carbon Credit Company Insights

The market is a highly competitive industry with several key players operating globally. The voluntary carbon credit market is increasingly becoming a vital component of corporate sustainability strategies, with key players demonstrating significant performance and market influence. Players in the space carry out mergers & acquisitions, technological advancement, and partnerships to extend their footprint in the space. Key players in the market, such as South Pole, Verra, Gold Standard, Climate Impact Partners, and Carbon Credit Capital, are leveraging their expertise, extensive project portfolios, and strong reputations to capture significant market shares. Their market performance is bolstered by their ability to deliver high-quality, verifiable carbon credits and innovative solutions that address the needs of a diverse client base, including multinational corporations, small businesses, and individual consumers.

Key Voluntary Carbon Credit Companies:

The following are the leading companies in the Voluntary Carbon Credit Market. These companies collectively hold the largest market share and dictate industry trends.

- Ecosecurities

- BioCarbon Partners

- Combio Energia

- BURN Manufacturing

- Biofílica Ambipar

- Indus Delta Capital Limited

- Terrasos

- EKI Energy Services Ltd. (formerly EnKing International)

- 3Degrees

- Climate Impact Partners

- EcoAct

- Verra

- Puro.earth

Recent Developments

-

In February 2024, Microsoft entered into an agreement with BTG Pactual Timberland Investment Group (TIG) and committed 8 million carbon removal credits. The company also agreed to purchase 40,000 agricultural soil carbon credits from Indigo AG.

-

In June 2023, RVCMC announced the successful sale of over 2.2 million tonnes of carbon credits at the largest-ever voluntary carbon credit auction event in Nairobi, Kenya.

-

In October 2022, PIF partnered with Saudi Tadawul Group Holding Company for expansion in the regional market.

Voluntary Carbon Credit Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.04 billion

Revenue forecast in 2030

USD 24.0 billion

Growth rate

CAGR of 34.6% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in million tons, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors and trends

Segments covered

Project, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; Italy; Spain; France; Netherlands; China; India; Japan; South Korea; Australia; Indonesia; Malaysia; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Ecosecurities; BioCarbon Partners; Combio Energia; BURN Manufacturing; Biofílica; Ambipar; Indus Delta Capital Limited; Terrasos; EKI Energy Services Ltd. (formerly EnKing International); 3Degrees; Climate Impact Partners; EcoAct; Verra; Puro.earth

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Voluntary Carbon Credit Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global voluntary carbon credit market report based on project, application, end use, and region:

-

Project Outlook (Volume, Million Tons; Revenue, USD Million, 2018 - 2030)

-

Renewable Energy

-

Energy Efficiency

-

Afforestation and Reforestation

-

Methane Capture and Destruction

-

Others (soil carbon sequestration, energy efficiency)

-

-

Application Outlook (Volume, Million Tons; Revenue, USD Million, 2018 - 2030)

-

Industrial

-

Household Devices

-

Energy

-

Agriculture

-

Others

-

-

End Use Outlook (Volume, Million Tons; Revenue, USD Million, 2018 - 2030)

-

Government Agencies

-

Non-Governmental Organizations (NGOs)

-

Private Companies

-

Individuals

-

-

Regional Outlook (Volume, Million Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

France

-

Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Indonesia

-

Malaysia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global voluntary carbon credit market size was estimated at USD 2.97 billion in 2023 and is expected to reach USD 4.04 billion in 2024.

b. The global voluntary carbon credit market is expected to grow at a compound annual growth rate of 34.6% from 2024 to 2030 to reach USD 24.0 billion by 2030.

b. Based on the project, renewable energy was the dominant segment in 2023, with a share of about 39% in 2023. This is attributable to the increasing pressure on companies to reduce their carbon footprint and meet the ambitions of the Paris Agreement.

b. Some of the key players operating in this industry include Ecosecurities, BioCarbon Partners, Combio Energia, BURN Manufacturing, Biofílica Ambipar, Indus Delta Capital Limited, Terrasos.

b. Key factors driving the market growth include urgency for companies to take action on climate change and demonstrate their commitment to sustainability. The voluntary carbon market provides a mechanism for companies to compensate for their residual emissions and contribute to global emissions reduction efforts.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."