- Home

- »

- Food Additives & Nutricosmetics

- »

-

Walnut Ingredients Market Size, Share, Industry Report, 2030GVR Report cover

![Walnut Ingredients Market Size, Share & Trends Report]()

Walnut Ingredients Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Walnut Kernels, Walnut Oil), By Application (Food Industry, Cosmetics & Personal Care), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-599-7

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Walnut Ingredients Market Summary

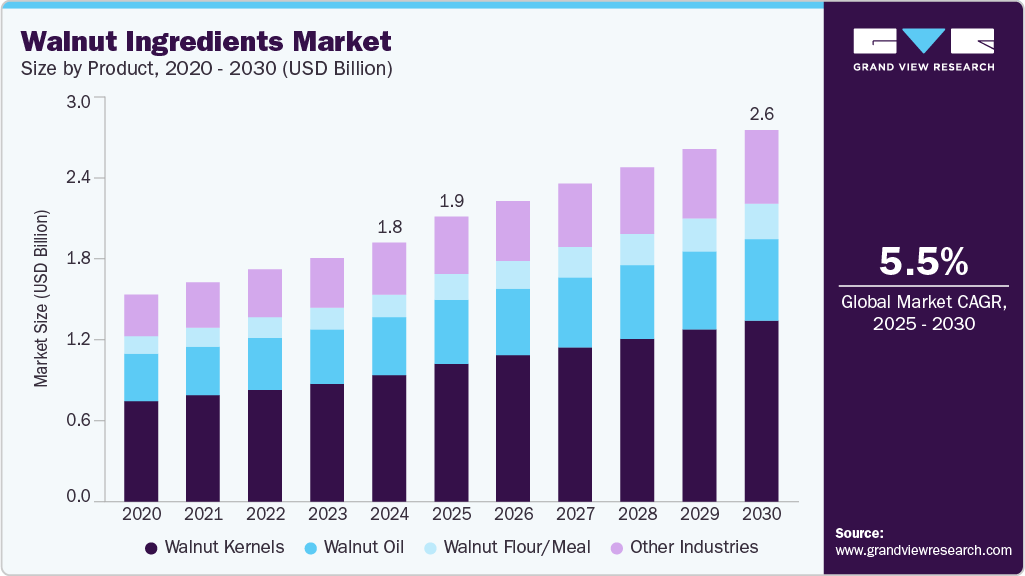

The global walnut ingredients market size was estimated at USD 1.80 billion in 2024 and is projected to reach USD 2.59 billion by 2030, growing at a CAGR of 5.5% from 2025 to 2030. The market is gaining traction due to increasing consumer inclination toward plant-based, nutritious food products.

Key Market Trends & Insights

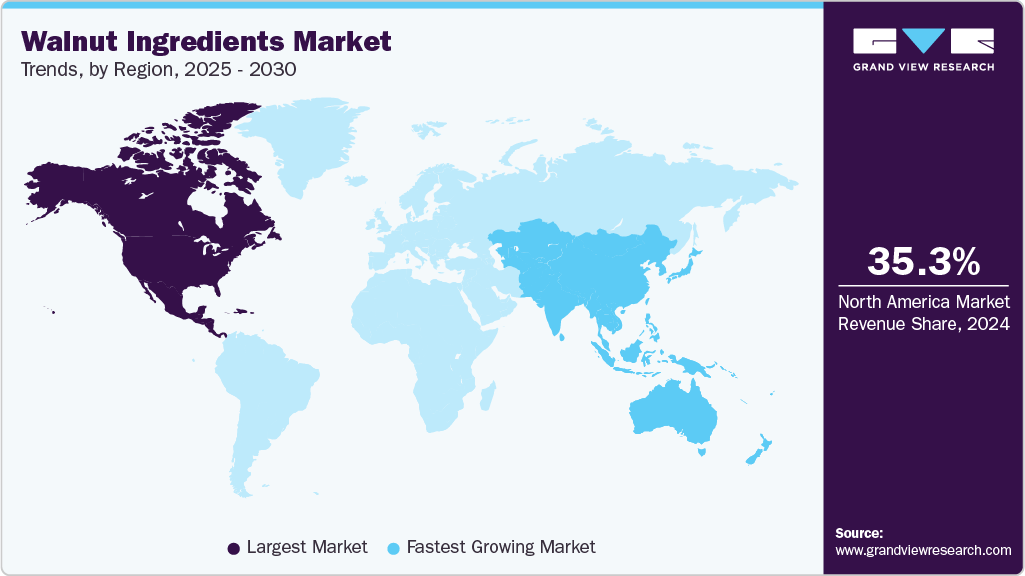

- North America dominates the global walnut ingredients market with a 35.3% market share in 2024.

- The walnut ingredients market in the U.S. remains the core growth engine within the North American market.

- By product, the walnut kernels, with a dominant share of 48.7% in 2024, remain the staple form used in baked goods, cereals, and direct consumption, especially in North America and Europe.

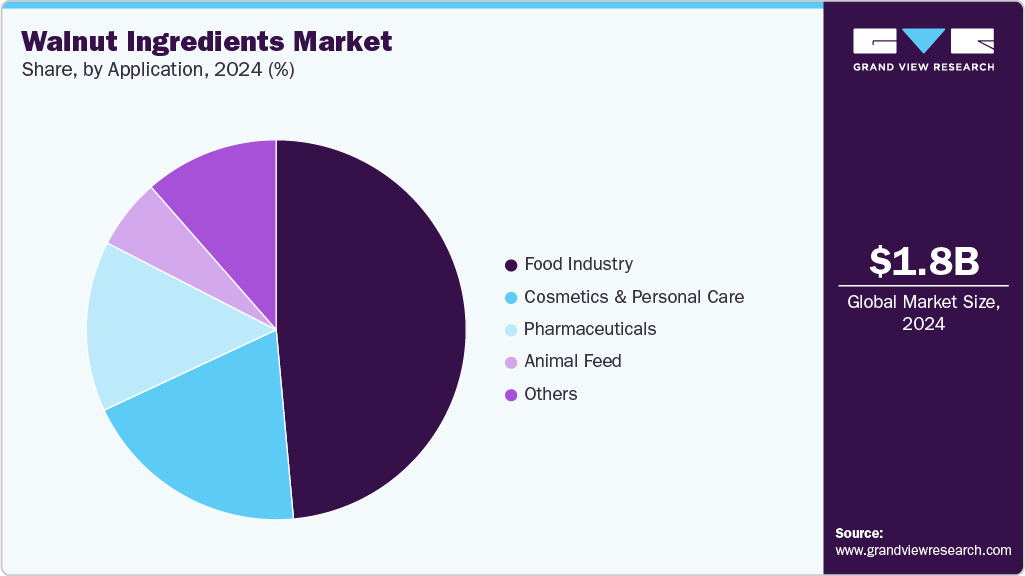

- By application, the food Industry segment led the market with a revenue share of 48.6% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.80 Billion

- 2030 Projected Market Size: USD 2.59 Billion

- CAGR (2025-2030): 5.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Walnuts are rich in omega-3 fatty acids, antioxidants, and protein, making them an attractive ingredient in food, nutraceutical, and cosmetic formulations. The growing demand for functional and fortified food products drives manufacturers to incorporate walnut-based ingredients such as flour, oil, and meal into their product portfolios. Furthermore, as consumers globally pursue healthier lifestyles and dietary habits, the adoption of walnut ingredients in vegan snacks, gluten-free baked goods, and superfood blends continues to accelerate.

Innovation in cold-pressed walnut oil and high-protein walnut flour enhances the market scope. These developments are supported by rising disposable incomes, urbanization, and evolving food preferences. Particularly in emerging economies, rapid retail penetration and the popularity of clean-label food products are propelling segment growth.

Global players are increasingly investing in sustainable sourcing, organic certifications, and region-specific processing facilities to address the demand for traceability and transparency. This shift is expected to create additional market value, especially in regions with growing awareness of allergen-free and natural health ingredients.

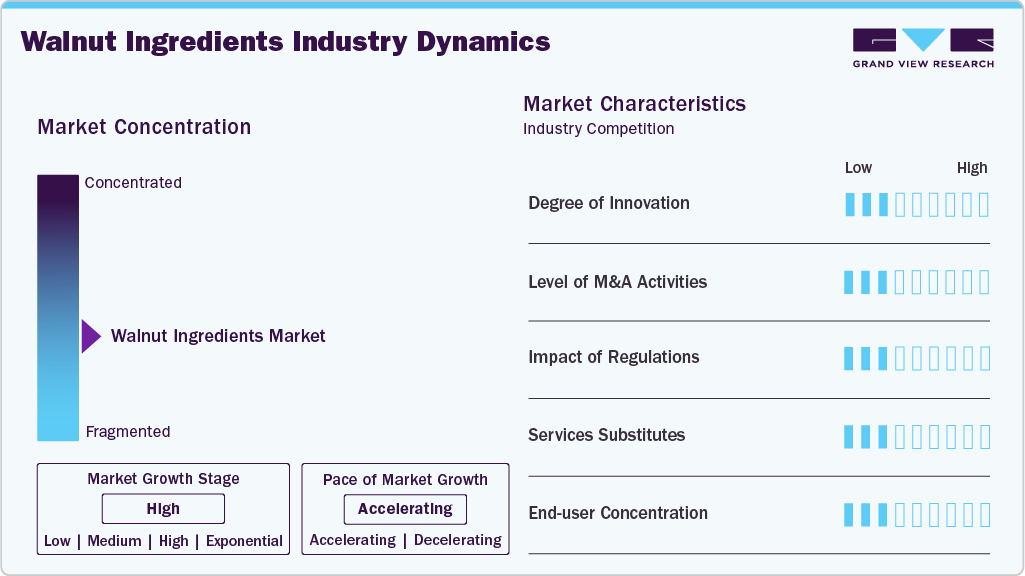

Market Concentration & Characteristics

The walnuts ingredient industry is moderately fragmented, with a mix of global and regional companies competing across different value chain stages. While large players dominate processing capabilities and export volumes, local producers cater to customized formulations and regional preferences.

Supply chain integration remains a priority as companies look to secure access to raw walnut sources and optimize processing logistics. The perishability of walnut kernels and the sensitivity of oil to oxidation necessitate stringent quality control and cold-chain infrastructure, which creates operational complexity, especially for exporters.

Sustainability is emerging as a competitive differentiator, with manufacturers adopting environmentally friendly packaging, energy-efficient processing units, and waste reduction practices. Brands that align these efforts with consumer expectations for ethical sourcing and clean labeling will likely see enhanced loyalty and premiumization potential.

Product Insights

Walnut kernels, with a dominant share of 48.7% in 2024, remain the staple form used in baked goods, cereals, and direct consumption, especially in North America and Europe.

Walnut oil is gaining wider adoption across the gourmet culinary and premium personal care sectors. Its cold-pressed form is especially valued for its high antioxidant concentration, making it a favorable choice in anti-aging creams, therapeutic massage blends, and culinary dressings. The growing consumer interest in multifunctional oils supports their long-term prospects.

Walnut flour and meal are rapidly growing, driven by their utility in gluten-free, keto, and high-protein diets. Used in pancake mixes, protein bars, and health-focused snacks, walnut flour offers a rich texture and nutrient-dense profile. As food manufacturers expand their clean-label offerings, the appeal of walnut meal as a sustainable protein and fiber source continues to rise.

Application Insights

The food Industry segment led the market with a revenue share of 48.6% in 2024. Walnuts are integrated across a variety of product formats, including snacks, cereals, confectionery, plant-based dairy, and baked goods. Their natural positioning as heart-healthy, antioxidant-rich ingredients enhances their appeal in functional food formulations.

Cosmetics and personal care products continue to integrate walnut derivatives like shell powder for exfoliation and walnut oil for its emollient and anti-inflammatory qualities. As consumers gravitate toward botanical and biodegradable skincare, walnut-based ingredients have become increasingly important to sustainable cosmetic formulations.

Pharmaceutical and nutraceutical applications are expanding with walnuts being incorporated into omega-3 supplements, anti-inflammatory complexes, and cognitive health products. Walnut extracts are also used in botanical capsule blends, fortifying them with natural polyphenols and fatty acids that support immune and metabolic health.

Regional Insights

North America dominates the global walnut ingredients market with a 35.3% market share in 2024. Driven by health-conscious consumers, a strong processed food sector, and advanced cosmetic product innovation, the U.S. continues to dominate regional demand with widespread retail availability and premium brand positioning.

U.S. Walnut Ingredients Market Trends

The walnut ingredients market in the U.S. remains the core growth engine within the North American market. California is one of the world’s largest walnut-producing regions, and the country enjoys direct access to high-quality raw material, driving both domestic utilization and exports. U.S. food and beverage manufacturers leverage walnut flour and oil in gluten-free, vegan, and high-protein formulations, while cosmetics brands incorporate walnut oil and shell powder into exfoliants, creams, and scalp care products.

Asia Pacific Walnut Ingredients Market Trends

The walnut ingredients market in Asia Pacific is expected to grow significantly over the forecast period. China and India represent the fastest-growing regional cluster. Due to its vast cultivation and processing infrastructure, China is the largest producer and consumer globally. Vertically integrated supply chains and increasing domestic demand for functional food contribute to China's leadership.

Europe Walnut Ingredients Market Trends

The walnut ingredients market in Europe maintains a mature and value-driven market. Walnut ingredients are prominent in organic foods, personal care products, and dietary supplements. Regulatory compliance emphasizes sustainability and safe sourcing, particularly under the REACH and EU Food Safety frameworks.

Latin America Walnut Ingredients Market Trends

The walnut ingredients market in Latin America is gradually increasing its market footprint, supported by emerging demand for protein-rich ingredients in food and wellness categories. Countries like Brazil and Argentina are key growth pockets, with local brands adopting walnut oil in skincare lines.

Middle East & Africa Walnut Ingredients Market Trends

The walnut ingredients market in the Middle East & Africa (MEA) is an emerging market showing promise in natural cosmetics, dietary supplements, and upscale bakery categories. Rising urbanization and disposable incomes in South Africa, UAE, and Egypt fuel demand for plant-based alternatives.

Key Walnut Ingredients Company Insights

Some key players operating in the market include ADM, Olam International, Hammons, Anderson, International Corp., Poindexter Nut Company, Jabsons Foods, and Morada Nut Company.

-

Olam International is a global leader in agri-business and is headquartered in Singapore. The company sources, processes, and distributes walnut ingredients across over 60 countries. Olam’s walnut segment includes in-shell walnuts, kernels, and customized forms for industrial and retail use. With a strong focus on sustainable farming practices and digital traceability tools, Olam has established strategic partnerships with growers in the U.S. and Chile. Its integrated value chain, global reach, and investments in food safety and product innovation make it a key player in the market.

-

Poindexter Nut Company, based in California, USA, is one of the oldest family-owned walnut processors with over 60 years of experience. The company provides high-quality walnut kernels, pieces, and industrial-grade flour to food manufacturers, bakeries, and exporters. Poindexter emphasizes precision sorting, quality certifications (e.g., BRC, Kosher), and traceable sourcing. Their strong domestic distribution network and custom formulation services have made them preferred partners for private label and premium brands.

Key Walnut Ingredients Companies:

The following are the leading companies in the walnut ingredients market. These companies collectively hold the largest market share and dictate industry trends.

- ADM

- Olam International

- Hammons

- Anderson, International Corp.

- Poindexter Nut Company

- Jabsons Foods

- Morada Nut Company

Recent Developments

-

In January 2025, VitaTek entered into a distribution partnership with Chamfr to launch walnut-based VitaCoat hydrophilic coatings on Chamfr’s engineering marketplace. This expands walnut derivatives beyond food into biomedical coatings, showcasing their multifunctionality in pharma-tech applications.

-

In March 2024, Olam Food Ingredients (OFI) announced the expansion of its walnut ingredient processing plant in Rheinberg, Germany. The expansion aims to enhance production capacity for clean-label and organic walnut ingredients targeted at the European bakery and confectionery sectors. This move aligns with the growing demand for traceable, sustainable nut products in the EU.

Walnut Ingredients Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.98 billion

Revenue forecast in 2030

USD 2.59 billion

Growth rate

CAGR of 5.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons, revenue in USD billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea

Key companies profiled

ADM; Olam International; Hammons; Anderson, International Corp.; Poindexter Nut Company; Jabsons Foods; Morada Nut Company

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Walnut Ingredients Market Report Segmentation

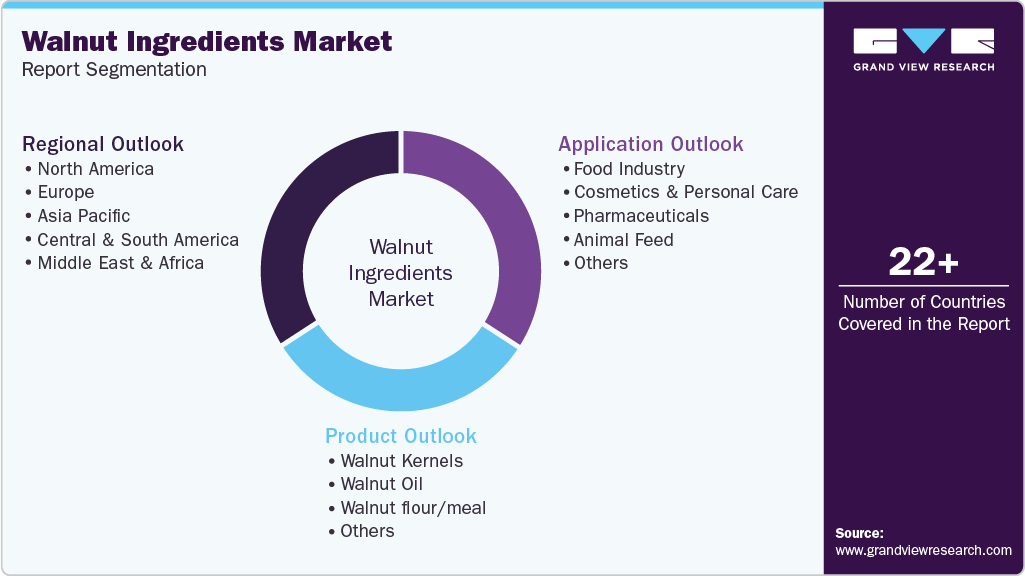

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global walnut ingredients market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons, Revenue, USD Billion, 2018 - 2030)

-

Walnut Kernels

-

Walnut Oil

-

Walnut flour/meal

-

Others

-

-

Application Outlook (Volume, Kilotons, Revenue, USD Billion, 2018 - 2030)

-

Food Industry

-

Cosmetics & Personal Care

-

Pharmaceuticals

-

Animal Feed

-

Others

-

-

Regional Outlook (Revenue, USD Billion, Volume, Kilotons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

Chile

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global walnuts ingredient market size was estimated at USD 1.80 billion in 2024

b. The global walnuts ingredient market is expected to grow at a compound annual growth rate of 5.5% from 2025 to 2030 to reach USD 2.59 billion by 2030.

b. North America dominates the global walnuts ingredient market with 35.30% market share in 2024. Driven by health-conscious consumers, a strong processed food sector, and advanced cosmetic product innovation. The U.S. continues to dominate regional demand with widespread retail availability and premium brand positioning.

b. Some key players operating in the walnut ingedient market include ADM, Olam International, Hammons, Anderson, International Corp., Poindexter Nut Company, Jabsons Foods, Morada Nut Company

b. The growing demand for functional and fortified food products is driving manufacturers to incorporate walnut-based ingredients such as flour, oil, and meal into their product portfolios. Furthermore, as consumers globally pursue healthier lifestyles and dietary habits, the adoption of walnut ingredients in vegan snacks, gluten-free baked goods, and superfood blends continues to accelerate.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.