- Home

- »

- Advanced Interior Materials

- »

-

Water Pump Market Size & Share, Industry Report, 2030GVR Report cover

![Water Pump Market Size, Share & Trends Report]()

Water Pump Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Centrifugal Pump, Positive Displacement Pump), By Business (Pumps, Aftermarket), By Distribution Channel, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-531-3

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Water Pump Market Summary

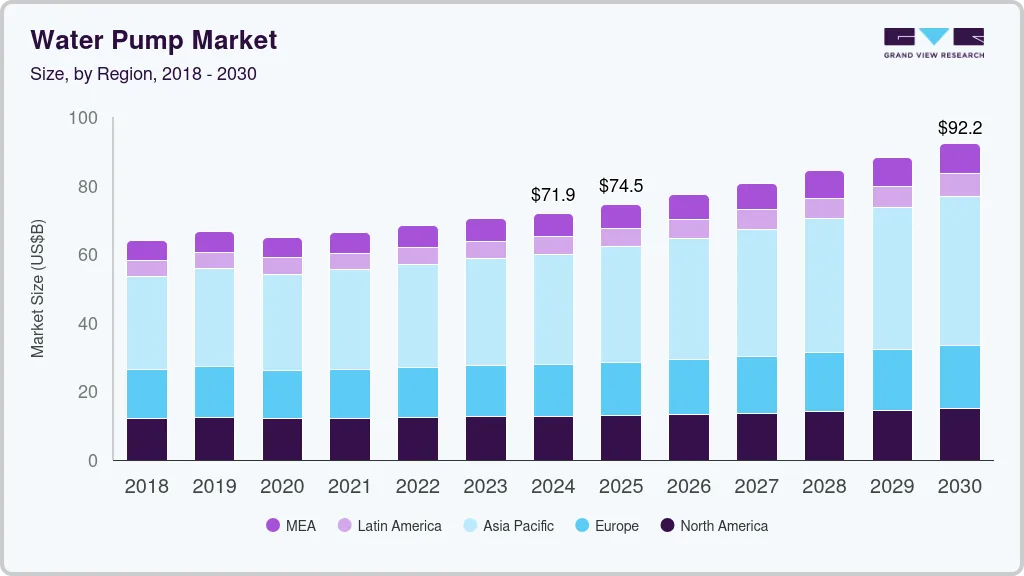

The global water pump market size was estimated at USD 71,862.2 million in 2024 and is projected to reach USD 92,217.4 million by 2030, growing at a CAGR of 4.4% from 2025 to 2030. The market has been witnessing significant growth due to the rising demand for efficient water management systems across various sectors, including agriculture, industrial, and municipal applications.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, pumps accounted for a revenue of USD 45,362.3 million in 2024.

- Pumps is the most lucrative business segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 71,862.2 Million

- 2030 Projected Market Size: USD 92,217.4 Million

- CAGR (2025-2030): 4.4%

- Asia Pacific: Largest market in 2024

One of the key trends shaping the market is the increasing adoption of smart water pumps. These pumps are integrated with IoT technology, allowing for remote monitoring, predictive maintenance, and improved energy efficiency. Smart pumps are particularly beneficial in urban water supply and wastewater management systems, where operational efficiency is crucial.

Additionally, the water pumps market benefits from expanding infrastructure development in emerging economies. As industries, agriculture, and residential areas grow, the demand for water pumping solutions to address issues such as water scarcity, irrigation, and water supply increases. The rise in desalination projects, especially in regions with limited freshwater resources, is also a contributing factor. Furthermore, technological advancements such as the development of solar-powered water pumps are creating opportunities for growth in remote and off-grid areas, where traditional power sources are unavailable. These trends, combined with ongoing innovations, are expected to drive the market for water pumps in the coming years.

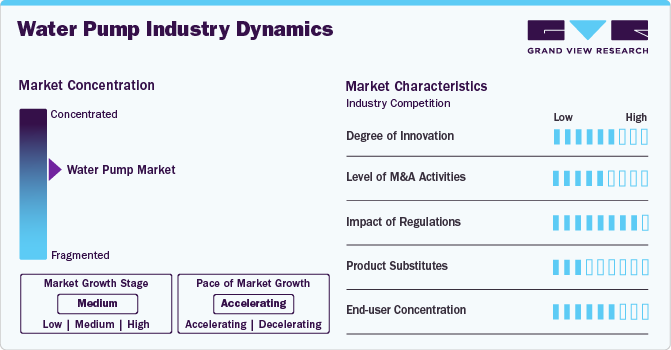

Market Concentration & Characteristics

The water pumps market is characterized by its focus on energy-efficient and sustainable solutions. It caters to a broad range of industries, including residential, commercial, industrial, and agricultural sectors, each seeking to optimize water usage while minimizing energy consumption. The growing demand for efficient water management systems is driven by factors like increasing urbanization, industrialization, and the need for solutions to water scarcity. As the market moves toward greener technologies, manufacturers are increasingly offering pumps that are energy-efficient, reliable, and capable of integrating with smart infrastructure, such as IoT-enabled devices, to monitor and optimize performance.

The market is moderately concentrated, with a mix of well-established global players and smaller, specialized manufacturers. Major brands such as Grundfos, Xylem, and KSB dominate the global market, offering a broad range of water pumps, from standard models to advanced, energy-efficient systems. These companies focus on developing high-quality products that meet international environmental standards and regulations, while also investing in innovation to enhance performance and reduce operational costs. They are increasingly incorporating smart technologies like IoT and variable frequency drives (VFDs) to provide more energy-efficient solutions to the market.

Despite the dominance of a few large players, the water pumps market also sees competition from regional and local manufacturers, particularly in emerging markets. These smaller companies often offer competitive pricing, more localized customer service, and tailored solutions to meet specific regional needs, such as pumps for agricultural irrigation or municipal water supply. Many of these players are focusing on providing affordable, customized solutions to cater to diverse customer needs, which allows them to capture a significant share of their respective markets.

Concentration levels vary by region, with North America and Europe experiencing more competition among established players due to their developed infrastructure and stringent environmental regulations. However, markets in the Asia-Pacific region and other developing regions tend to be more fragmented, with both global and local players competing for market share. As these regions continue to develop and urbanize, there is considerable growth potential, with governments increasingly emphasizing water efficiency and sustainability.

Drivers, Opportunities & Restraints

The growing demand for efficient water management systems across industries like agriculture, construction, and municipal services is a key driver for the water pumps market. Increasing concerns over water scarcity, combined with rapid urbanization and industrialization, are pushing the need for reliable and energy-efficient water pumping solutions. Technological advancements, such as the integration of IoT and smart controls, are also driving the market as they help optimize performance and reduce operational costs.

High initial installation and maintenance costs for advanced water pump systems can be a significant restraint, especially in developing regions with cost-sensitive consumers. Additionally, the complexity of integrating new technologies into existing infrastructure may pose challenges for certain industries. The market is also hindered by the limited availability of skilled labor to maintain and operate advanced pump systems, which could impact their adoption in some regions.

The increasing focus on sustainability and energy efficiency presents a significant opportunity for innovation in the water pumps market. Solar-powered water pumps and pumps with variable frequency drives (VFD) are gaining popularity, especially in off-grid and remote areas. The rising demand for water treatment, desalination plants, and water infrastructure in emerging economies also opens vast opportunities for growth in these regions. Additionally, the growing trend toward smart cities provides prospects for integrating water pumps with digital solutions for enhanced performance and monitoring.

Type Insights

The centrifugal pumps segment accounted for a revenue share of 66.6% in 2024. Centrifugal water pumps are widely used for moving large volumes of water at low to moderate pressures. They operate by converting rotational kinetic energy from a motor into fluid energy through a rotating impeller. These pumps are ideal for applications in water supply, irrigation, and industrial processes, offering high efficiency and smooth operation. Their simple design and cost-effectiveness make them suitable for a variety of general-purpose applications.

Positive displacement water pumps operate by trapping a fixed amount of water and forcing it through the pump with each cycle, which results in a constant flow regardless of pressure changes. These pumps are ideal for high-pressure applications, such as in oil and gas industries or for pumping highly viscous fluids. They offer precise flow control and are often used when a steady, reliable flow is required, even in challenging conditions. Their design is more complex but provides ideal performance in specialized applications.

Business Insights

The pumps segment accounted for a revenue share of 60.7% in 2024. The pumps segment of the water pumps market is experiencing growth due to increasing demand for energy-efficient, high-performance solutions across various sectors. Technological innovations, such as IoT integration and smart controls, are enhancing pump efficiency and operation monitoring. Additionally, the shift toward sustainability is driving demand for pumps that consume less energy and have longer operational lifespans.

The aftermarket segment of the water pumps market is expanding as maintenance and repair services become increasingly vital for extending the life and performance of water pumping systems. The growing adoption of advanced pump technologies has led to an increase in the demand for replacement parts, upgrades, and retrofitting services. As industries focus on reducing downtime and maintaining efficiency, the aftermarket sector is evolving to offer more comprehensive solutions, including predictive maintenance and remote monitoring services.

Distribution Channel Insights

The direct sales distribution channel segment accounted for a revenue share of 53.2% in 2024. Direct sales remain a key distribution channel in the water pumps market, especially for customized and high-value solutions. Manufacturers often engage in direct sales to provide tailored support, technical advice, and after-sales services for complex systems. This model is prevalent in industrial, agricultural, and municipal sectors, where customers require specific product configurations and expert installation.

Online sales and e-commerce are rapidly growing in the water pumps market, driven by the increasing adoption of digital platforms for purchasing industrial equipment. E-commerce offers convenience, price comparison, and access to a wide range of products, making it an attractive option for both small businesses and individual consumers. Online platforms also provide valuable resources, such as detailed product specifications, reviews, and user guides, helping customers make informed decisions.

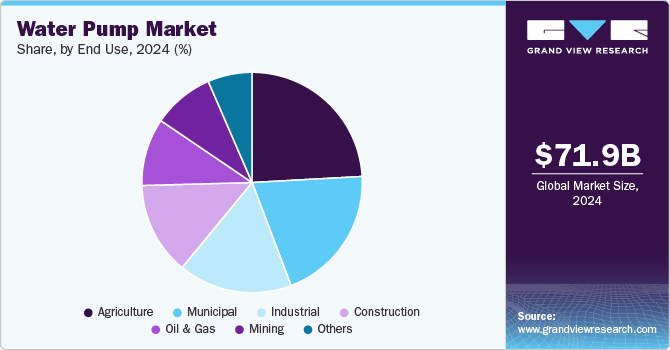

End Use Insights

The agriculture end use segment accounted for a revenue share of 24.1% in 2024. Water pumps in agriculture are essential for irrigating crops, ensuring consistent water supply during dry periods. They help in efficient water distribution across large fields, improving crop yield. Additionally, pumps are used for draining excess water in areas prone to flooding, maintaining healthy soil conditions.

In the industrial sector, water pumps are crucial for a wide range of applications, including cooling systems, wastewater treatment, and process water management. Industries such as manufacturing, oil and gas, and chemical processing rely on water pumps to maintain efficient operations, ensure safe production environments, and manage resources.

Regional Insights

The North American water pump market is experiencing steady growth, driven by increasing demand for energy-efficient solutions in industrial, municipal, and agricultural sectors. Regulatory pressures for sustainable water management and infrastructure modernization are further fueling the market. The U.S. and Canada are leading the adoption of advanced water pump technologies, particularly in water treatment and irrigation systems.

U.S. Water Pump Market Trends

The water pumps market in the U.S. is expected to grow at a CAGR of 2.5% from 2025 to 2030. Increasing demand for energy-efficient water management systems, particularly in agriculture, industrial, and municipal sectors, is driving market expansion. As climate change accelerates, there is a higher demand for water pumps in regions prone to droughts and floods.

The water pump market in the Canada is expected to grow at a CAGR of 3.2% from 2025 to 2030. Demand for water pumps is increasing as the country focuses on improving infrastructure and water efficiency in both urban and rural areas. Additionally, stringent regulations on water use and sustainability are driving the adoption of energy-efficient pumps in industrial and municipal applications.

Europe Water Pump Market Trends

Europe is a significant market for water pumps, driven by strong regulatory pushes towards sustainability and water conservation. Countries like Germany and the UK are leading the way in adopting water-efficient technologies, including advanced pumping systems for residential, commercial, and industrial use. Increasing emphasis on reducing water wastage and energy consumption is fueling the demand for smart, energy-efficient pumps across Europe.

Germany water pump market held 21.7% share in the European market, driven by robust green building initiatives and policies focused on water and energy efficiency. The country's industrial and municipal sectors are the largest consumers of advanced water pump systems, especially those focusing on sustainability and reduced energy consumption.

Water pump market in the UK is driven by country’s focus on energy efficiency in both residential and commercial sectors. The UK government’s strict regulations on water use and waste management are encouraging the adoption of high-efficiency water pumps in various applications. Municipal and industrial sectors are particularly adopting energy-efficient pumps to meet sustainability goals and reduce operational costs.

Asia Pacific Water Pump Market Trends

Asia Pacific region led the market and accounted for 44.8% of the global water pumps market in 2024. Rapid urbanization, growing industrialization, and the need for improved water management systems are driving the demand for water pumps in the region. Countries like China and India are seeing a rise in demand for advanced water pumps for agricultural irrigation, industrial processes, and municipal water supply. The push for more sustainable solutions in developing regions is fueling the adoption of energy-efficient and innovative water pumping systems.

China water pump market held a significant share in the Asia Pacific market, driven by its rapid urbanization and industrial expansion. As the country seeks to improve water management systems, reduce water wastage, and address environmental concerns, there is a growing demand for high-performance water pumps. The Chinese government’s initiatives to promote sustainable water use and smart water management systems are supporting the market growth.

The water pump market in the India is expected to grow at a CAGR of 6.1% from 2025 to 2030. India is experiencing rapid urbanization and agricultural expansion, driving the need for water pumps in irrigation, water supply, and industrial applications. The growing demand for energy-efficient and low-maintenance pumps is fueled by the need to manage water resources efficiently in agriculture and industry.

Middle East & Africa Water Pump Market Trends

The Middle East and Africa are emerging markets for water pumps, driven by rapid urbanization, industrial growth, and the need for water-efficient systems in arid climates. Countries like Saudi Arabia are investing heavily in water management technologies to address water scarcity issues. The region’s extreme climate conditions make efficient water pumping solutions crucial for managing water resources, particularly in agriculture, desalination, and industrial applications.

Saudi Arabia water pump market entities are investing in sustainable water management practices, driving the adoption of advanced water pump systems. The country’s extreme climate and reliance on desalination for freshwater are increasing the demand for efficient pumping solutions in water supply, irrigation, and wastewater treatment.

Latin America Water Pump Market Trends

The water pumps market in Latin America is gradually expanding due to increasing construction activities and a growing focus on energy-efficient water management solutions. Countries like Brazil are witnessing rising demand for pumps in industrial, agricultural, and municipal sectors. As the region works toward sustainability goals, the adoption of energy-efficient water pumps is gaining traction.

Brazil’s water pump market is driven by the country’s expanding infrastructure and increasing emphasis on sustainability in both residential and commercial sectors. The need for efficient water management systems in agriculture and industrial applications is rising, with a focus on irrigation systems, water treatment, and supply.

Key Water Pump Company Insights

Some of the key players operating in the market include KSB SE & Co. KGaA, Xylem, among others.

-

KSB SE & Co. KGaA operates through three business segments, namely, pumps, valves, and services. The pumps segment offers single-stage and multistage pumps as well as related drive and control systems. This segment caters to numerous industries, such as manufacturing, transport, chemical, petrochemical, water & wastewater treatment, and construction. The valves segment includes butterfly, gate, globe, control, ball, and diaphragm valves as well as related actuators and control systems. The service segment deals with the installation, inspection, commissioning, servicing, and maintenance & repair of pumps, valves, and related systems. The company operates 190 service centers and over 3,500 maintenance & service staff globally.

-

Xylem specializes in the design and production of highly engineered products and solutions tailored for critical applications, primarily within the water industry. It offers a comprehensive array of products, services, and solutions, which are designed to cater to water scarcity, resilience, quality, and affordability through the entire water cycle. The company is occupying distinctive market positions in key application sectors, such as water transport, treatment, dewatering, analytical instrumentation and measurement, sophisticated metering technologies, evaluation services for infrastructure, and digital and software solutions for utilities. It has a wide customer base in roughly 150 countries catered by the distinct global distribution network consisting of independent channel partners and direct sales forces.

Key Water Pump Companies:

The following are the leading companies in the water pump market. These companies collectively hold the largest market share and dictate industry trends.

- KSB SE & Co. KGaA

- Flowserve

- ITT Inc.

- Gorman-Rupp

- Pentair

- Xylem

- WILO SE

- Grundfos

- EBARA CORPORATION

- ANDRITZ AG

Recent Developments

-

In January 2024, Atlas Copco has completed the acquisition of Kracht GmbH. Kracht GmbH, a global manufacturer specializing in external gear pumps, fluid measurement systems, valves, hydraulic drives, and dosing systems, is now part of the Atlas Copco Group.

Water Pump Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 74.46 billion

Revenue forecast in 2030

USD 92.22 billion

Growth rate

CAGR of 4.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Type, business, distribution channel, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; Italy; Sweden; UK; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

KSB SE & Co. KGaA; Flowserve; ITT Inc.; Gorman-Rupp; Pentair; Xylem; WILO SE; Grundfos; EBARA CORPORATION; ANDRITZ AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Water Pump Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global water pump market report based on type, business, distribution channel, end use, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Centrifugal Pumps

-

Positive Displacement Pumps

-

-

Business Outlook (Revenue, USD Billion, 2018 - 2030)

-

Pumps

-

Aftermarket

-

Parts & Components

-

Repair & Maintenance

-

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Direct Sales

-

Distributor Sales

-

Online Sales & E-Commerce

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Municipal

-

Construction

-

Agriculture

-

Mining

-

Oil & Gas

-

Industrial

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Sweden

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global water pump market size was estimated at USD 71.86 billion in 2024 and is expected to reach USD 74.46 billion in 2025.

b. The global water pump market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.4% from 2025 to 2030 and reach USD 92.22 billion by 2030.

b. The agriculture end use segment accounted for a revenue share of 24.1% in 2024. Water pumps in agriculture are essential for irrigating crops, ensuring consistent water supply during dry periods. They help in efficient water distribution across large fields, improving crop yield.

b. Some of the key players operating in the water pump market include KSB SE & Co. KGaA, Flowserve, ITT Inc., Gorman-Rupp, Pentair, Xylem, WILO SE, Grundfos, EBARA CORPORATION, ANDRITZ AG.

b. The water pumps market has been witnessing significant growth due to the rising demand for efficient water management systems across various sectors, including agriculture, industrial, and municipal applications.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.