- Home

- »

- Advanced Interior Materials

- »

-

Centrifugal Pump Market Size, Share, Industry Report, 2030GVR Report cover

![Centrifugal Pump Market Size, Share & Trends Report]()

Centrifugal Pump Market (2025 - 2030) Size, Share & Trends Analysis Report By Configuration (Single Stage, Multistage), By Design (Radial, Axial), By End Use (Agriculture, Chemical), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-082-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Centrifugal Pump Market Summary

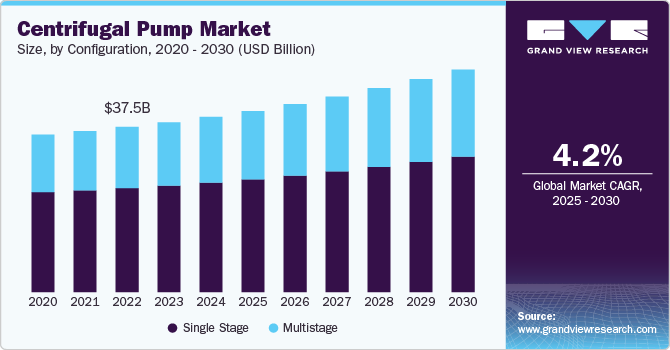

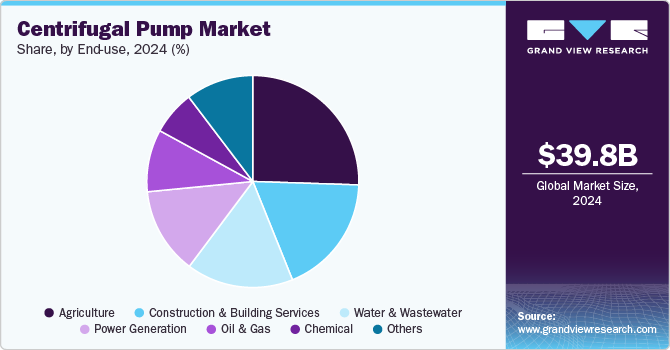

The global centrifugal pump market size was estimated at USD 39.80 billion in 2024 and is projected to reach USD 50.54 billion by 2030, growing at a CAGR of 4.2% from 2025 to 2030. The centrifugal pumps industry is witnessing several noteworthy trends that are contributing to its growth.

Key Market Trends & Insights

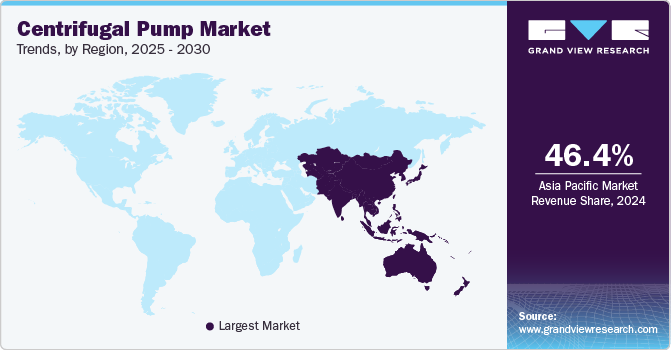

- Asia Pacific dominated the centrifugal pump market with a revenue share of 46.4% in 2024.

- China’s centrifugal pump market led Asia Pacific, with a 35.4% revenue share in 2024.

- By configuration, the single-stage configuration segment led the market, with a 60.4% revenue share in 2024.

- By design, the radial flow pump design segment led the market, with a 62.6% revenue share in 2024.

- By end use, the agriculture segment led the market, with a 24.7% revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 39.80 Billion

- 2030 Projected Market Size: USD 50.54 Billion

- CAGR (2025-2030): 4.2%

- Asia Pacific: Largest market in 2024

One significant trend is the increasing emphasis on energy efficiency and sustainability, prompting manufacturers to develop pumps that consume less energy while maintaining high performance. In addition, advancements in technology, such as the integration of IoT and smart monitoring systems, are enhancing operational efficiency and allowing for predictive maintenance, thus reducing downtime.

Increasing investments in the exploration and production activities by the oil & gas companies are anticipated to boost the demand for centrifugal pumps in the oil & gas industry. The rising number of infrastructure upgrades, in terms of changing or the installation of new pipelines, is expected to have a positive impact on the growth of the market. Furthermore, in addition, the United Nations Sustainable Development Goal 6 aims at ensuring access to water and sanitation for all people across the globe by the year 2030 and is nudging governments to take steps in the right direction. Rising government initiatives to provide safe drinking water are anticipated to have a positive impact on the growth of the centrifugal pump industry over the forecast period.

Drivers, Opportunities & Restraints

The growth of the centrifugal pump industry is primarily driven by the increasing demand for efficient water and wastewater management systems. As urban populations expand and industries seek to optimize their processes, the need for reliable and high-performance pumping solutions has surged. In addition, advancements in technology and automation within pump design are further enhancing operational efficiency, making centrifugal pumps a preferred choice for various applications across sectors like construction, agriculture, and manufacturing.

One of the significant restraints for the centrifugal pump industry is the high initial capital investment required for deployment. Many industries may be deterred by the costs associated with purchasing and installing these pumps, especially in regions where budgets are constrained. Furthermore, the maintenance and operational costs over time can be a concern, particularly for smaller companies that may lack the technical expertise to manage these systems effectively, potentially limiting market growth.

The centrifugal pump industry presents numerous opportunities, especially with the growing emphasis on sustainability and energy efficiency. Innovations in pump technology, such as the development of smart pumps equipped with IoT capabilities, can enhance operational efficiency and reduce energy consumption. In addition, the ongoing investments in renewable energy projects and sustainable infrastructure initiatives present a significant opportunity for the centrifugal pump sector to expand its footprint in emerging markets, catering to the increasing demand for more environmentally friendly solutions.

Configuration Insights

The single stage configuration segment led the market and accounted for 60.4% of the global revenue share in 2024. The single-stage segment is expected to grow progressively during the forecasted years owing to stable working performance in installation and requires low pressure with a high flow rate. The single-stage centrifugal pump primarily finds its application in industrial pumping, slurry pumping, and sewage pumping. The single-stage centrifugal pump is also preferred for applications with low-to-moderate dynamic heads. These pumps are mainly employed in water pumping stations because of their low maintenance cost and better reliability.

The multi-stage centrifugal pump is available in different proportions based on application, volume, and budget. The small-size pumps are appropriate for applications such as water supply piping, heating plants, firefighting operations, agriculture, autoclaves, boiler feed, irrigation, and others. This particular segment is expected to grow progressively over the forecast period owing to high energy efficiency, easy installation, lower internal friction losses of these variants, and optimized operation.

Design Insights

The radial flow pump design segment led the market and accounted for 62.6% of the global revenue share in 2024. Radial flow pumps work by pushing water toward the outside edge of a revolving impeller. The discharge is then caught by the pump casing, where the kinetic energy is transformed into pressure energy before leaving the pump.

The mixed flow pump segment is expected to be propelled by benefits such as high low rates with low-pressure requirements, improved discharge rates with relatively low head velocities, and the ability to be adjusted to operate effectively and efficiently with little aerodynamic loss.

End Use Insights

The agriculture end use segment led the market and accounted for 24.7% of the global revenue share in 2024. The centrifugal pump industry is anticipated to be driven by an expanding application scope due to benefits including reduced harmful gas emissions, wear and corrosion protection, electrical resistance, and thickness capacity. A favorable effect on the centrifugal pump industry is anticipated from the expansion of the aerospace industry, notably civil aviation, in Asia Pacific, including India and China, due to the rising consumer disposable income.

Centrifugal pumps play a crucial role in the chemical industry due to their efficiency and versatility in handling various fluids. These pumps are designed to move liquids by converting rotational energy, which allows for a continuous flow of chemicals, slurries, and other viscous materials. They are widely used for processes such as mixing, transferring, and circulation in reactors, storage tanks, and pipeline systems. The ability to finely adjust flow rates and pressure makes centrifugal pumps ideal for both large-scale production and precise laboratory applications, ensuring the safe and effective handling of corrosive, hazardous, or sensitive substances while maintaining operational reliability.

Regional Insights

The centrifugal pump market in North America accounted for a market share of 16.1% in 2024. In North America, centrifugal pumps are integral to industries such as oil and gas, water treatment, and power generation. With the rise of shale oil production in the U.S., there is an increasing demand for pumps used in fluid transfer, well drilling, and hydraulic fracturing operations. In addition, the growth in renewable energy sectors, including geothermal power plants and biofuel production, is contributing to the demand for energy-efficient centrifugal pumps.

U.S. Centrifugal Pump Market Trends

The centrifugal pump market in the U.S. held a significant share in 2024. The U.S. remains one of the largest markets for centrifugal pumps, driven by a combination of industrial demand and infrastructure development. The oil and gas sector, especially in states like Texas and North Dakota, uses these pumps extensively in oil exploration, production, and refining. In addition, centrifugal pumps are crucial in municipal water supply systems, HVAC applications in commercial buildings, and large-scale agricultural irrigation systems. As the U.S. moves towards a greener future, centrifugal pumps used in water treatment plants and renewable energy facilities are experiencing increased demand for their energy efficiency and sustainability.

The centrifugal pump market in Canada is expected to grow at a CAGR of 2.8% over the forecast period. Canada’s centrifugal pump industry is largely driven by the mining, oil and gas, and water treatment industries. With the country’s vast mineral resources, centrifugal pumps are essential in the mining industry for slurry handling, dewatering, and chemical processing. The oil sands production in Alberta also requires large-scale centrifugal pumps for fluid transfer in oil extraction processes.

The centrifugal pump market in Mexico is expected to grow at a CAGR of 4.3% over the forecast period. In Mexico, centrifugal pumps are essential in various sectors, including agriculture, mining, and manufacturing. The demand is particularly high in the agricultural sector, where pumps are used for irrigation in the country’s key farming regions. The mining industry, especially in northern Mexico, also relies heavily on centrifugal pumps for fluid transfer in mineral processing and dewatering operations.

Europe Centrifugal Pump Market Trends

The centrifugal pump market in Europe is one of the leading regions for the use of centrifugal pumps, primarily due to its diverse industrial landscape. The chemical, pharmaceutical, and food processing industries across countries like Germany, France, and Italy make extensive use of centrifugal pumps for fluid handling in production lines. The demand for pumps in municipal water systems, particularly in Western Europe, is high due to aging infrastructure and increased focus on water conservation.

Germany's centrifugal pump market held a 19.2% share in 2024 in the European market. Germany, as Europe’s industrial powerhouse, uses centrifugal pumps extensively in sectors such as chemical manufacturing, automotive production, and power generation. Pumps are used for fluid handling, including in cooling systems, water treatment plants, and wastewater management facilities.

UK’s centrifugal pump market held a 9.8% share in 2024 in the European market. In the UK, centrifugal pumps are widely used in the water and wastewater industries, where they play a crucial role in pumping and treating water for both industrial and municipal applications. The ongoing efforts to modernize aging water infrastructure, along with initiatives to improve flood prevention systems, are driving demand. The centrifugal pump market is also expanding in the oil and gas sector, particularly in offshore platforms where they are used for fluid transfer and separation.

Asia Pacific Centrifugal Pump Market Trends

Asia Pacific centrifugal pump market dominated globally in 2024 with a 46.4% revenue share. The Asia Pacific region, driven by rapid industrialization in countries like India, China, and Japan, is experiencing strong growth in the centrifugal pump industry. The increasing demand for water treatment and wastewater management systems in these densely populated regions is a key driver. In addition, the chemical, petrochemical, and power generation industries in countries like Japan and South Korea rely heavily on centrifugal pumps for fluid handling, cooling, and chemical processes. The expanding agriculture sector in countries like India also contributes to the demand for centrifugal pumps for irrigation systems, particularly in rural areas.

China’s centrifugal pump market held 35.4% share in 2024 in the Asia Pacific market. China is a major consumer of centrifugal pumps due to its large-scale industrial activities, including in the chemical, oil, and gas, and power sectors. The country’s booming manufacturing sector, driven by its position as a global factory hub, heavily relies on centrifugal pumps for fluid handling, particularly in applications like HVAC systems, water treatment, and petroleum refining.

India’s centrifugal pump market held a 17.6% share in 2024 in the Asia Pacific market. In India, centrifugal pumps are widely used across industries such as water treatment, agriculture, and manufacturing. The demand for these pumps has surged due to the government's focus on improving irrigation systems and water infrastructure under schemes like the Pradhan Mantri Krishi Sinchayee Yojana (PMKSY). In addition, rapid industrialization, especially in the chemical, petrochemical, and food processing sectors, is driving the need for reliable and efficient centrifugal pumps.

Central & South America Centrifugal Pump Market Trends

The centrifugal pump market in Central & South America is driven mainly by the extensive use of centrifugal pumps in industries such as mining, agriculture, and water treatment. The mining sectors in countries like Chile, Brazil, and Peru depend on centrifugal pumps for dewatering, slurry handling, and chemical processing applications. In Brazil, centrifugal pumps are also used extensively in the oil and gas industry, particularly in offshore oil rigs and refineries. Agriculture, being a significant part of the economy in countries like Argentina and Mexico, drives demand for centrifugal pumps for irrigation and water management. Additionally, urbanization and the need for improved infrastructure in Latin America’s growing cities are contributing to the rising demand for centrifugal pumps in municipal water and wastewater treatment.

Brazil centrifugal pump market sees strong demand for centrifugal pumps, particularly in agriculture, oil and gas, and mining. The agricultural sector relies on centrifugal pumps for irrigation, while the oil and gas industry requires pumps for fluid handling, drilling, and refining operations.

Middle East & Africa Centrifugal Pump Market Trends

The centrifugal pump market in the Middle East and Africa is mainly driven by the fact that centrifugal pumps are critical in industries such as oil and gas, water desalination, and agriculture. Countries like Saudi Arabia, UAE, and Qatar are investing heavily in desalination plants to meet growing water demand, which is driving the use of centrifugal pumps for seawater intake and brine discharge. The oil and gas sector, especially in countries like Saudi Arabia and UAE, relies on centrifugal pumps for fluid transfer and extraction processes.

The centrifugal pump market in Saudi Arabia is mainly driven by the use of centrifugal pumps extensively in the oil and gas sector for fluid transfer, drilling, and refining processes. In addition, the country’s efforts to address water scarcity have led to significant investments in desalination plants, where centrifugal pumps play a vital role in seawater intake and brine discharge systems. With the Saudi Vision 2030 plan focusing on diversifying the economy and improving infrastructure, centrifugal pumps are becoming increasingly important in sectors such as wastewater management, industrial cooling, and agricultural irrigation

Key Centrifugal Pump Company Insights

Some of the key players operating in the industry include Grundfos, Xylem, Flowserve, and ITT Corporation.

-

Grundfos Holding A/S is renowned for its innovative and efficient water solutions that cover a wide range of applications, including water supply, wastewater treatment, and heating & cooling systems. The company’s portfolio includes a variety of pump types, such as circulator pumps (used in heating and air conditioning), submersible pumps, and centrifugal pumps. These products serve both residential and commercial markets, providing solutions for a myriad of purposes, including irrigation, water treatment, and municipal water supply. The company has a wide network of partners, distributors, and sub-dealers that are directly accessible in about 56 countries through 83 operational companies globally.

-

Xylem specializes in the design and production of highly engineered products and solutions tailored for critical applications, primarily within the water industry. It offers a comprehensive array of products, services, and solutions that are designed to cater to water scarcity, resilience, quality, and affordability through the entire water cycle. The company occupies distinctive market positions in key application sectors, such as water transport, treatment, dewatering, analytical instrumentation and measurement, sophisticated metering technologies, evaluation services for infrastructure, and digital and software solutions for utilities. It has a wide customer base in roughly 150 countries catered by the distinct global distribution network consisting of independent channel partners and direct sales forces.

Flowserve and Kirloskar Brothers Limited are some of the emerging market participants in the market.

-

Flowserve Corporation manufactures comprehensive flow control systems and provides aftermarket services. The company has a strong operational presence in more than 50 countries. Currently, it operates 206 facilities, including manufacturing and quick response centers (QRS), around the globe and provides an array of aftermarket services such as installation, advanced diagnostics, retrofitting, and repair. The company has been supplying more than 10,000 customers globally, including OEMs. power, chemical, water, oil & gas, and general industries.

-

Kirloskar Brothers Limited (KBL) is a prominent Indian engineering company established in 1888, renowned for its expertise in fluid management systems. Headquartered in Pune, it specializes in the manufacturing of pumps, valves, and other fluid-handling equipment, catering to diverse sectors such as water supply, irrigation, power generation, and industrial applications. With a legacy of innovation and commitment to quality, KBL has expanded its operations globally, establishing a strong presence in various international markets. The company's focus on sustainable practices and technological advancement has solidified its reputation as a leader in the engineering sector.

Key Centrifugal Pump Companies:

The following are the leading companies in the centrifugal pump market. These companies collectively hold the largest market share and dictate industry trends.

- Grundfos

- Xylem

- Flowserve

- ITT Corporation

- CIRCOR International

- Baker Hughes

- Gardner Denver

- Ebara Corporation

- Kirloskar Brothers Limited

- Tsurumi Manufacturing

Recent Developments

-

In March 2023, KSB SE & Co. KGaAannounced the acquisition of technology from Bharat Pumps and Compressors (BP&CL). BP&CL is an important manufacturer of centrifugal pumps and reciprocating pumps. With this new technology acquisition, KSB SE &Co. KGaA is likely to expand its product line in both the new pump and aftermarket markets.

-

In November 2023, Xylem launched an e-80SCXL vertical in-line centrifugal pump. This new pump is equipped with a modular pump condition monitoring system. This system analyses the pump temperature & vibrations and recommends predictive maintenance before the pump fails.

Centrifugal Pump Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 41.15 billion

Revenue forecast in 2030

USD 50.54 billion

Growth Rate

CAGR of 4.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Stage, design, end use, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa

Country Scope

U.S.; Canada; Mexico; France; Germany; Italy; UK; China; India; Japan; Australia; Brazil; Argentina; Saudi Arabia; UAE

Key companies profiled

Alfa Laval; Sulzer; KSB; Grindex; PSP Pumps; Grundfos; Xylem; Flowserve; ITT Corporation; CIRCOR International; Baker Hughes; Gardner Denver; Ebara Corporation; Kirloskar Brothers Limited; Tsurumi Manufacturing

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Centrifugal Pump Market Report Segmentation

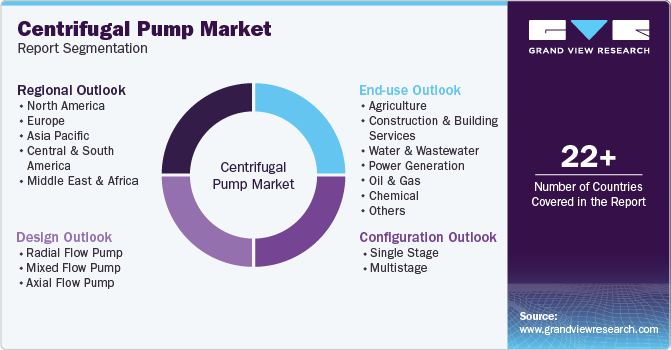

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global centrifugal pump market report based on configuration, design, end use, and region:

-

Configuration Outlook (Revenue, USD Billion, 2018 - 2030)

-

Single Stage

-

Multistage

-

-

Design Outlook (Revenue, USD Billion, 2018 - 2030)

-

Radial Flow Pump

-

Mixed Flow Pump

-

Axial Flow Pump

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Agriculture

-

Construction & Building ServicesWater & Wastewater

-

Power Generation

-

Oil & Gas

-

Chemical

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

France

-

Germany

-

Italy

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global centrifugal pump market size was estimated at USD 39.80 billion in 2024 and is expected to reach USD 41.15 billion in 2025.

b. The global centrifugal pump market is expected to grow at a compound annual growth rate of 4.2% from 2025 to 2030 to reach USD 50.54 billion by 2030.

b. The radial flow pump design segment led the market and accounted for 62.6% of the global revenue share in 2024. Radial flow pumps work by pushing water toward the outside edge of a revolving impeller. The discharge is then caught by the pump casing, where the kinetic energy is transformed into pressure energy before leaving the pump.

b. Some of the key players operating in the centrifugal pump market include Alfa Laval; Sulzer; KSB; Grindex; PSP Pumps; Grundfos; Xylem; Flowserve; ITT Corporation; CIRCOR International; Baker Hughes; Gardner Denver; Ebara Corporation; Kirloskar Brothers Limited; Tsurumi Manufacturing.

b. The key factors that are driving the centrifugal pump market include rapid urbanization and population growth, strict water treatment regulations, and increasing demand for new water resources, are some of the factors driving the growth of the centrifugal pump market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.