- Home

- »

- Plastics, Polymers & Resins

- »

-

Water Soluble Polymers Market Size, Industry Report, 2030GVR Report cover

![Water Soluble Polymers Market Size, Share & Trends Report]()

Water Soluble Polymers Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Polyacrylamide, Polyvinyl Alcohol, Guar Gum), By Application (Water Treatment, Food, Personal Care & detergents), By Region, And Segment Forecasts

- Report ID: 978-1-68038-533-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Water Soluble Polymers Market Trends

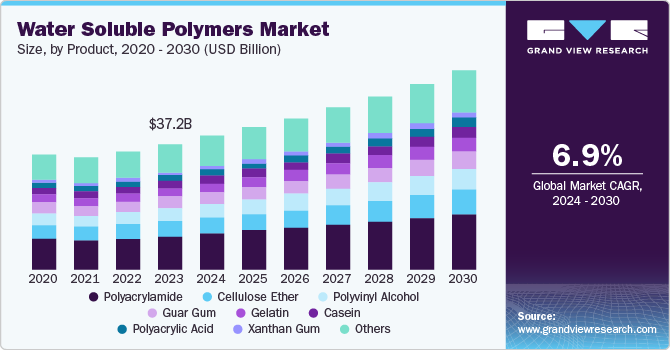

The global water soluble polymersmarket size was valued at USD 37.17 billion in 2023 and is projected to grow at a CAGR of 6.9% from 2024 to 2030. As water scarcity becomes a global issue, there is an increasing emphasis on recycling and treating wastewater to meet the growing demand. Water-soluble polymers are widely used in water treatment processes to remove suspended particles and contaminants in industrial and municipal treatment systems.

Rising global support for sustainable water management practices, coupled with stringent environmental regulations, is driving the adoption of these polymers to ensure the efficient removal of contaminants from water, promoting market expansion. These materials are extensively utilized in industries such as textiles, paints, paper, personal care, and construction, leading to a steady growth in their demand. Sustainability concerns have led companies to focus on developing bio-based products, strengthening the industry's growth prospects. For instance, in February 2022, Kemira started the global full-scale production of its polyacrylamide polymer from bio-based feedstock.

The pharmaceutical sector, driven by the increasing prevalence of chronic diseases, an aging population, and the demand for more effective drug delivery systems, has become a major end-user of water soluble polymers. They are used to develop drug formulations and controlled drug delivery systems. They enable enhancements in the bioavailability of active pharmaceutical ingredients and are used to produce hydrogels for wound care and tissue engineering. Water-soluble polymers are popular as an encapsulation method for drugs in nanoparticles or microspheres for targeted drug delivery. They also effectively perform the role of binders in tablet formulations to improve the tablet's cohesiveness and disintegrants to improve drug dissolution in the gastrointestinal tract. Such a wide range of functions has driven the appeal of these materials in this industry. Moreover, innovations in drug delivery mechanisms in oral and injectable formulations are expected to enhance the growth prospects of this market.

Companies developing water-soluble polymers increasingly invest in mergers, acquisitions, and strategic partnerships to enhance their technological capabilities and expand their market reach. These investments aim to integrate advanced technologies, such as bio-based and biodegradable polymers, among other mechanisms, into their portfolios to address the growing demand for innovative solutions. For instance, in December 2023, Ecopol S.p.A. announced a strategic investment in JRF Technology LLC. The latter specializes in undertaking research & development activities and innovations in water-soluble polymers and edible film technology. Ecopol aims to scale up the development of next-generation sustainable delivery systems and commercialize them for markets such as healthcare and personal care through this approach.

Product Insights

The polyacrylamide segment accounted for a leading revenue share of 26.8% in the global market in 2023. Polyacrylamide is widely used in water treatment due to its flocculating and coagulating properties, which aid in removing suspended particles from water. As water scarcity and water pollution rise globally, there is an increasing focus on wastewater treatment and water recycling initiatives, particularly in the industrial and municipal sectors. Regulations mandating the reduction of pollutants in water bodies have further driven the demand for polyacrylamide as an effective solution in treating wastewater. Additionally, this material's versatility, solubility, and biocompatibility have increased its usage in the pharmaceutical sector, as they are used in drug delivery systems, tissue engineering, wound healing, and diagnostic applications.

The guar gum segment is expected to witness significant growth over the forecast period. The growth of the processed food industry, driven by changing lifestyles and dietary preferences, particularly in emerging markets, is significantly aiding the demand for guar gum in this industry. Guar gum is extensively used as a thickener, stabilizer, and emulsifier in various food products, including dairy items, sauces, soups, and baked goods. Its ability to improve texture, enhance viscosity, and maintain product stability under varying temperatures makes it an essential ingredient in processed and convenience foods. As consumer demand for gluten-free and low-fat products grows, guar gum is increasingly considered a viable natural and healthy alternative to other thickeners. Additionally, the product can be utilized in gut health formulations, owing to its benefits as a soluble dietary fiber.

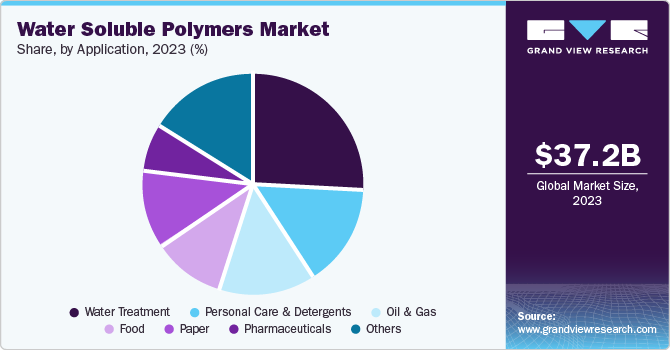

Application Insights

The water treatment segment accounted for the largest revenue share in 2023. As manufacturing, mining, and energy generation industries continuously expand their operations, a corresponding increase in industrial wastewater is generated. This wastewater contains a variety of pollutants, including heavy metals, organic compounds, and particulate matter, which require effective treatment before being released into the environment. Implementing stringent environmental regulations and standards in major economies such as the U.S., the UK, Germany, China, and Japan has driven the usage of such materials in this segment. Water-soluble polymers play an essential role in treating industrial effluents by enhancing the efficiency of sedimentation and filtration processes. For instance, acrylic acid can disperse microcrystals or micro sand of calcium phosphate, calcium sulfate, and calcium carbonate. Meanwhile, chitosan, a biodegradable polymer, is an economical and environment-friendly option for water and wastewater treatment.

The oil & gas segment is anticipated to register a significant growth rate from 2024 to 2030. Water soluble polymers are critical to the oil and gas industry's enhanced oil recovery (EOR) process, particularly as conventional oil reservoirs are depleted. Polyacrylamides are used as water-soluble polymers employed in polymer flooding, a tertiary recovery technique where polymers are injected into the reservoir to increase the viscosity of the injected water. This process improves the sweep efficiency, allowing for the extraction of additional oil that would remain trapped. Some of the commonly used polymers in this sector include xanthan gum, guar gum, hydroxyethylcellulose, and partially hydrolyzed polyacrylamide (HPAM). A growing focus on maximizing output from existing wells, especially in mature fields, drives substantial demand for water-soluble polymers.

Regional Insights

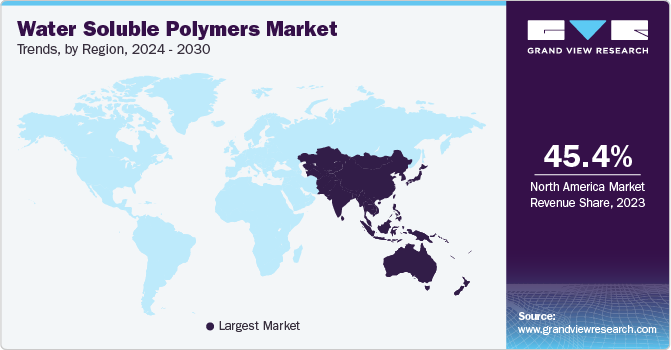

The North American water soluble polymers market is expected to witness significant growth over the forecast period. The extensive presence of major industries, including manufacturing, oil and gas, and mining, has generated substantial volumes of wastewater, which requires efficient treatment solutions to meet environmental regulations implemented by governing bodies in the U.S. and Canada. Water-soluble polymers, particularly polyacrylamides, are extensively used in water treatment processes for their flocculation, coagulation, and dewatering properties. The growing focus on sustainable industrial practices and the need to comply with government standards drive the adoption of these polymers. Additionally, these products have attracted substantial interest in the healthcare sector due to their benefits in drug delivery systems and improving patient compliance with pharmaceutical products.

U.S. Water Soluble Polymers Market Trends

The U.S. water soluble polymers market accounted for a dominant revenue share in the regional market in 2023. The steady growth of the personal care industry has created growth avenues for manufacturers of water-soluble polymers. In personal care products, these polymers are utilized as conditioning agents, thickeners, and stabilizers in formulations for shampoos, conditioners, lotions, and creams. The increasing consumer demand in the U.S. for premium, natural, and sustainable products is driving the use of water-soluble polymers, specifically those derived from natural sources. The Midwest region has several industries in verticals, such as food & beverage, water treatment, and papermaking, while the agricultural sector in this region also extensively utilizes these polymers for soil conditioning and water retention.

Asia Pacific Water Soluble Polymers Market Trends

The Asia Pacific water soluble polymers market accounted for the largest revenue share of 45.4% in 2023. The regional food and beverage industries have become significant water-soluble polymers consumers. These products are widely used as thickeners, stabilizers, and emulsifiers in a range of food products, including dairy, sauces, and processed items. Increasing consumer demand for convenience foods and the rising popularity of clean-label and natural products are driving the use of natural water-soluble polymers such as guar gum and xanthan gum.

China’s water soluble polymers market accounts for a significant share of the regional market. High levels of industrialization in the economy have resulted in the production of significant amounts of industrial wastewater, necessitating efficient water treatment solutions. Water-soluble polymers are widely used to treat industrial effluents, remove suspended solids, reduce chemical oxygen demand, and improve water quality. Ongoing urbanization in the country, with the construction of new cities and expansion of existing ones, is expected to elevate the demand for municipal wastewater treatment, further driving the need for water-soluble polymers. The presence of companies such as Shijiazhuang Yuncang Water Technology Corporation Limited, SNF, and CHINAFLOC has increased market competition in China, leading to the launch of more advanced and efficient products.

Latin America Water Soluble Polymers Market Trends

Thewater soluble polymers market in Latin America is expected to expand substantially from 2024 to 2030. The increasing pace of industrialization in the region and the subsequent establishment of manufacturing, oil & gas, and food & beverage facilities has created a high risk for pollutants and chemicals being released into water bodies. It has led government bodies and other organizations to encourage the development of advanced water treatment procedures. Government programs such as increased funding for polymer research projects, taxes providing incentives to companies investing in sustainable polymers, and ways to promote biodegradable chemicals and environment-friendly polymers are expected to drive regional expansion.

The water soluble polymers market in Brazil accounted for a leading revenue share in 2023 in the region. The development of large-scale industries and the subsequent growth in the discharge of chemicals and waste materials in rivers and streams has created an urgent need to implement stringent water treatment policies. The steady growth of the country’s food and beverage industry has also aided market expansion, as water-soluble polymers are used as thickeners, stabilizers, and emulsifiers in a wide range of food items. The rising demand for processed and convenience foods among Brazilian consumers and the rising popularity of healthier and cleaner labels drive the use of natural and safe water-soluble polymers in this industry.

Key Water Soluble Polymers Company Insights

Some of the key players involved in the water soluble polymersmarket include BASF, KURARAY, DuPont, and SNF, among others.

-

SNF is a leading global producer of water-soluble polymers specializing in manufacturing polyacrylamides. These polymers are widely used in water treatment, oil and gas, mining, agriculture, and various industrial applications. The company offers products and resources for potable water treatment and wastewater treatment via flocculants, coagulants, dispersants, scale inhibitors, and heavy metal precipitants. The company has a strong direct sales network that reaches around 40,000 global customers and has approximately 850 independent resellers.

-

DuPont is a science and technology company specializing in developing and manufacturing innovative materials, chemicals, and solutions for multiple industries. The company provides separation and purification solutions to several major industries worldwide, including power generation, residential and municipal, oil and gas, healthcare, commercial industries, chemical and petrochemicals, microelectronics, and food and beverage.

Key Water Soluble Polymers Companies:

The following are the leading companies in the water soluble polymers market. These companies collectively hold the largest market share and dictate industry trends.

- BASF

- Ashland

- DuPont

- KURARAY CO., LTD.

- Akzo Nobel N.V.

- SNF

- NITTA GELATIN, INC.

- CP Kelco U.S., Inc.

- Solvay

- Arkema

- LG Chem

- Wacker Chemie AG

- SUMITOMO SEIKA CHEMICALS CO., LTD.

- Kemira

- Anhui Sunsing Chemicals Co., Ltd.

Recent Developments

-

In August 2024, SNF announced that it had signed agreements to acquire Ace Fluid Solutions and PfP Industries. The company aims to offer advanced solutions to its upstream oil and gas customers. PfP Industries specializes in slurry friction reducer technologies and related applications, while Ace Fluid Solutions develops innovative products in fluid management.

-

In February 2024, Kemira announced the expansion of its renewable solutions portfolio via the launch of two biomass-balanced wet strength resins and polyamines with ISCC PLUS certification for the papermaking industry. The wet strength resins are the first ISCC-certified formulations based on PAE (polyamideamine epichlorohydrin) in the market, obtained from renewable feedstocks. The products are being produced at the company’s manufacturing facility in Estella, Spain.

Water Soluble Polymers Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 39.53 billion

Revenue forecast in 2030

USD 58.94 billion

Growth rate

CAGR of 6.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Russia; Denmark; Sweden; Norway; China; India; Japan; Australia; South Korea; Indonesia; Vietnam; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

BASF; Ashland; DuPont; KURARAY CO., LTD.; Akzo Nobel N.V.; SNF; NITTA GELATIN, INC.; CP Kelco U.S., Inc.; Solvay; Arkema; LG Chem; Wacker Chemie AG; SUMITOMO SEIKA CHEMICALS CO.,LTD.; Kemira; Anhui Sunsing Chemicals Co.,Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Water Soluble Polymers Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the water soluble polymersmarket report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Polyacrylamide

-

Polyvinyl Alcohol

-

Guar Gum

-

Cellulose Ether

-

Gelatin

-

Xanthan Gum

-

Casein

-

Polyacrylic Acid

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Water Treatment

-

Food

-

Personal Care & Detergents

-

Oil & Gas

-

Paper

-

Pharmaceuticals

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Indonesia

-

Vietnam

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.