- Home

- »

- Healthcare IT

- »

-

Wearable AI Market Size And Share, Industry Report, 2033GVR Report cover

![Wearable AI Market Size, Share & Trends Report]()

Wearable AI Market (2026 - 2033) Size, Share & Trends Analysis Report By Type (Smartwatches, Smart Eyewear, Smart Earwear), By Application (Consumer Electronics, Healthcare), By Operations, By Component, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-967-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Wearable AI Market Summary

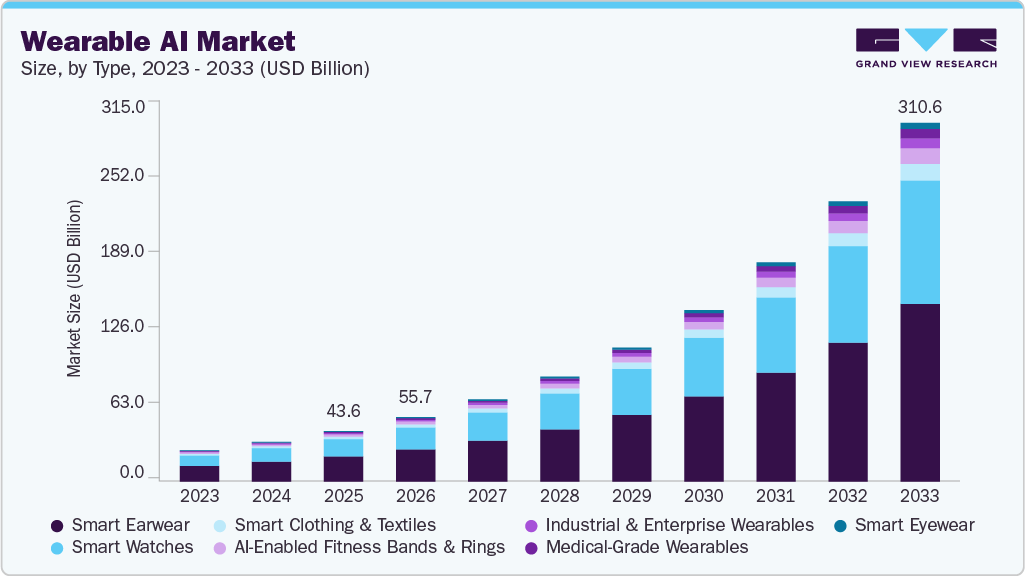

The global wearable AI market size was estimated at USD 43.64 billion in 2025 and is projected to reach USD 310.56 billion by 2033, growing at a CAGR of 27.83% from 2026 to 2033. Growing adoption of real-time health tracking and personalized wellness solutions, coupled with technological advancements in AI and sensor technologies are significant factors contributing to market growth.

Key Market Trends & Insights

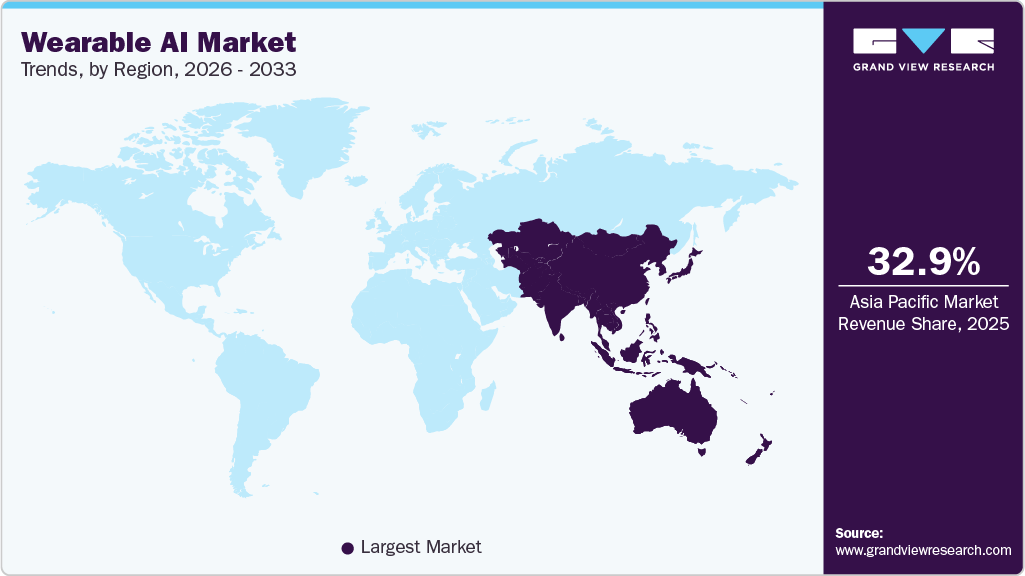

- Asia Pacific dominated the wearable AI industry with the largest revenue share of 32.93% in 2025.

- The wearable AI industry in the U.S. and Europe is experiencing significant growth.

- Based on type, the smart earwear segment led the market with the largest revenue share of 50.02% in 2025.

- Based on application, the consumer electronics segment led the market with the largest revenue share of 32.02% in 2025.

- Based on operations, the on-device AI segment led the market with the largest revenue share of 59.10% in 2025.

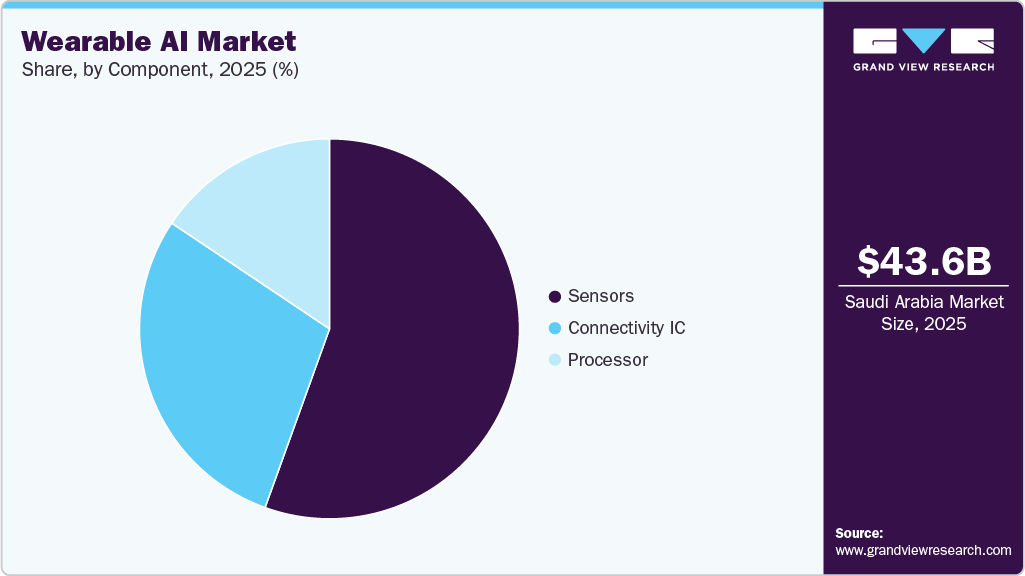

- Based on component, the sensors segment led the market with the largest revenue share of 56.51% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 43.64 Billion

- 2033 Projected Market Size: USD 310.56 Billion

- CAGR (2026-2033): 27.83%

- Asia Pacific: Largest market in 2025

In addition, growing enterprise adoption and augmented reality applications are some other factors fueling market growth further. The increasing demand for health monitoring and fitness tracking, coupled with rising interest in personalized digital wellness, is a primary driver in the global wearable AI industry. AI-powered wearable devices enable continuous, real-time monitoring of physiological metrics such as heart rate, sleep patterns, blood oxygen saturation, and walking steps, providing actionable data for consumers and healthcare professionals.

Moreover, wearable devices are increasingly being utilized in disease prevention and management of chronic conditions. The Cardiosense CardioTag is a significant example of this trend. It is an FDA-cleared, multimodal wearable sensor for cardiac monitoring, combining ECG (electrocardiogram), PPG (photoplethysmogram), and SCG (seismocardiogram) signals. In addition, healthcare ecosystems increasingly integrate wearable AI devices with telemedicine and remote patient monitoring programs. Industry partnerships, such as the alliance between Philips and Masimo in September 2025, are developing AI wearables equipped with medical-grade sensors for comprehensive cardiovascular and respiratory monitoring.

These collaborations demonstrate growing clinical acceptance and regulatory progress for wearable technologies, underscoring their roles in preventive care, chronic disease management, and emergency response.

Furthermore, advances in artificial intelligence, machine learning, and sensor miniaturization have significantly enhanced the functionality and accuracy of wearable devices. Advancements in sensor technology, such as those that track heart rate, glucose levels, and motion, make wearables more compact, efficient, and capable of continuous monitoring. For instance, in August 2024, Singapore launched a new hydrogel-based wearable sensor capable of tracking health data related to diabetes and stroke risk. The device utilizes advanced analytics and continuous monitoring, enabling the early detection and intervention of metabolic and cardiovascular conditions.

Furthermore, the increasing use of wearable AI technologies in enterprises is a key driver of the global wearable AI industry. Organizations in manufacturing, logistics, healthcare, retail, and field services are adopting these devices to enhance operational efficiency and workforce safety. For instance, in October 2024, P&G, A*STAR, and NTU Singapore developed HapSense, the country's first wearable sensor for real-time skin feel measurement. Shaped like a signet ring, HapSense captures skin friction and pressure data on the fingertip, delivering objective, rapid analysis for skincare product testing and enabling personalized consumer and R&D applications at scale.

"HapSense is an innovative wearable skin sensor designed to revolutionize skin care product analysis. Its primary role is to provide scientists with precise, objective measurements of tactile sensations, such as friction and pressure, on the skin."

-Prof Chen Xiaodong, NTU Singapore

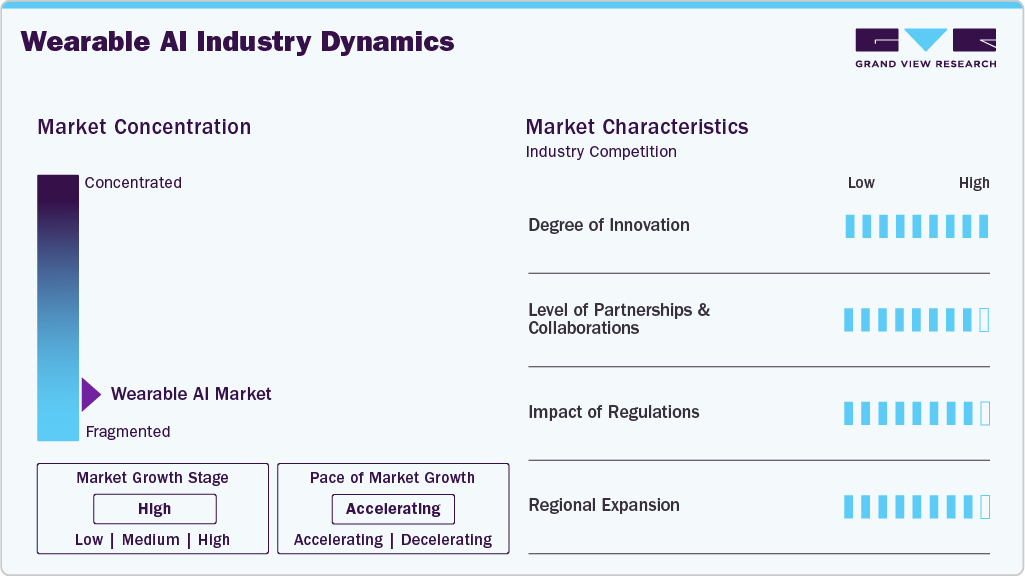

Market Concentration & Characteristics

The chart below illustrates the relationship between industry concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, level of partnerships & collaboration activities, degree of innovation, impact of regulations, and regional expansion. The wearable AI industry is highly fragmented. Moreover, several emerging players are entering the market, thereby contributing to increased fragmentation within the market. The degree of innovation, the level of partnerships & collaborations, the impact of regulations, and the regional expansion of industry is high.

The wearable AI industry is characterized by constant innovation, with a strong focus on launching new platforms and devices to leverage administrative tasks, improve diagnostic accuracy, and enhance care delivery. Prominent players are launching advanced solutions to sustain a competitive advantage. For instance, UC San Diego researchers have developed a wearable, stretchable gesture sensor that uses AI to remove motion noise and reliably detect user gestures even during high activity (e.g., running, driving, rough seas). Worn as a soft patch on an armband, it tracks muscle impulses and movements, transmitting data for real-time deep learning signal processing. The system enables robust, hands-free machine and robot control for rehabilitation, mobility assistance, industrial, and first responder use, even in highly dynamic or hazardous environments. This innovation expands interaction modalities beyond touchscreens, enabling intuitive control over smart devices in various settings, from healthcare to entertainment.

The industry is experiencing a high level of partnerships & collaborations undertaken by several key players. This is due to the desire to gain a competitive advantage in the industry, enhance technological capabilities, and consolidate in a rapidly growing market. For instance, in June 2025, Sphere Technology Holdings partnered with Vuzix Corporation to integrate its AI-powered mixed reality (MR) platform with Vuzix M400 and M4000 AR smart glasses.

Regulations, such as the HIPAA in the U.S. and the GDPR in Europe, establish standards for safeguarding patient data privacy and security. Compliance with these regulations is crucial for AI applications in healthcare to ensure the safe and secure handling of patient information, reducing the risk of data breaches and unauthorized access.

The industry is witnessing high geographical expansion. Companies within the wearable AI industry seek geographic expansion strategies to maintain their foothold in emerging markets and attract customers from these regions. In addition, the increasing prevalence of chronic diseases fosters demand for continuous health monitoring and remote diagnostics. For instance, recent collaborations in October 2024, such as Incor’s development of the TRAda AI platform for advanced arrhythmia detection, underscore innovative applications tailored to regional healthcare challenges. These technologies help improve clinical outcomes and reduce healthcare costs by enabling early diagnosis and continuous health tracking, especially in underserved areas.

“We see an opportunity in a significant and untapped market in Brazil to prove a more cost-effective and efficient arrhythmia risk management solution. We believe that this innovative approach will not only contribute to saving lives but also enhance healthcare system resources by helping to reduce costs and improve the quality of care,”

“After successful market validation in Brazil, we plan to expand our solution to new markets in Latin America over the next two years, ensuring that our system is adapted to the specific demographics and regulatory landscape of each region,”

-Ricardo Bloj, President of Lenovo Brazil.

Recent Developments in the wearable AI market include

Company/Institute

Year

Month

Description

New Product Launch

Starkey Laboratories, Inc.

2025

October

Starkey launched Omega AI, its advanced hearing aid line, which integrates deep neural network directionality, 8 dB improved spatial awareness, 51-hour battery life, waterproofing, LED status/find-my-device indicators, TeleHear AI troubleshooting, and new health features such as balance and respiratory rate monitoring.

“Since being the first to introduce AI technology in hearing aids, Starkey has continued to set the speed of innovation for the industry. We are once again excited to push the boundaries of science and raise the bar of expectation for hearing professionals and their patients. Omega AI is an engineering feat only Starkey could accomplish, and it reflects our unwavering commitment to creating advanced technology that connects people back to their lives.”

-Brandon Sawalich, President and CEO of Starkey.

Meta

2025

September

Meta launched its Ray-Ban Display AI Glasses, featuring a full-color, high-resolution in-lens display, for tasks, visual Meta AI prompts, messaging, video calling, navigation, live captions/translation, music playback, photo/video capture, and intuitive EMG gesture control. Available in Black/Sand, with standard/large frames, and up to 6 hours of battery use.

Xiaomi

2025

September

Xiaomi globally launched three devices: the OpenWear Stereo Pro wireless earbuds, featuring a five-unit acoustic system and Harman tuning; the Xiaomi Watch S4; and the Smart Band 10 Glimmer Edition.

Vuzix Corporation

2025

August

Vuzix launched LX1 smart glasses for warehouse operations. Purpose-built for logistics, LX1 enables 10-hour hands-free performance with hybrid voice and vision-picking, a color HD display, Qualcomm processor, 4K camera, and rugged design.

Collaborations & Partnerships

Vuzix Corporation

2025

September

Vuzix Corporation and TCL China Star Optoelectronics Technology (TCL CSOT) announced a long-term partnership to integrate microLED displays with waveguide optics for smart glasses.

"We are excited to enter into this collaboration with TCL CSOT. The combination of microLEDs and waveguide optics is a key enabler for the next generation of smart glasses. This partnership represents not only a nearterm opportunity but also a long-term product and market roadmap."

-Paul Travers, President and CEO of Vuzix

Vuzix Corporation

2025

September

Saphlux and Vuzix formed a strategic collaboration to deliver advanced optical solutions for next-generation AI/AR smart glasses.

Meta

2025

June

Meta partnered with Oakley to launch the Oakley Meta HSTN AI-powered smart glasses. They feature a hands-free high-res camera, open-ear speakers, water resistance, and Meta AI integration.

Starkey Laboratories, Inc.

2025

February

Starkey and Stanford University collaborated to validate Starkey’s Edge AI hearing aid Balance Assessment for fall risk detection. Using onboard motion sensors and AI with the My Starkey app, the tool accurately matches clinician observations. It enables remote self-assessment, making fall prevention more accessible and enhancing patient health monitoring, particularly in underserved regions.

“This research collaboration with Stanford Medicine demonstrates the potential of leveraging artificial intelligence and motion sensor technology to address critical health challenges like fall risk. By validating our Balance Assessment feature, we are taking a significant step toward empowering patients to proactively monitor their health and improve their quality of life."-Achin Bhowmik, Ph.D., Chief Technology Officer and Executive Vice President of Engineering at Starkey.

Regional Expansion

Garmin

2025

November

Garmin announced its plans to establish a factory in Thailand to manufacture smartwatches and other electronic products. This strategic investment aims to expand Garmin’s production capacity, diversify its supply chain, and meet growing demand in the Asia-Pacific wearable technology market.

Apple, Inc.

2025

September

Apple launched the AirPods Pro 3 in India, featuring an upgraded design, improved audio, and twice the noise cancellation. Key features include heart rate tracking, real-time calorie monitoring for workouts, and AI-powered live translation.

Apple, Inc.

2025

September

Apple launched Apple Watch Series 11, SE 3, and Ultra 3 in India.

Huawei Technologies Co. Ltd.

2025

June

Huawei launched Band 10 in India, featuring advanced health and fitness tracking, AI-powered swim stroke and lap recognition (with 95% accuracy), Pro-Level sleep analysis, and an emotional well-being assistant.

Type Insights

Based on type, the smart earwear segment held the largest market share of 50.02% in 2025, driven by rising demand for intelligent audio interfaces and hands-free digital interaction. The increasing adoption of remote work and virtual communication has accelerated the demand for AI-enhanced earwear, which supports clear audio communication, language translation, and smart virtual assistance. For instance, in May 2025, Acer launched the AI TransBuds earphones featuring real-time, two-way voice translation in 15 major languages, live captioning, and transcription. Furthermore, healthcare applications addressing hearing impairments and cognitive health are driving market growth by combining consumer convenience with medical-grade functionality.

The medical grade wearables segment is expected to grow at the fastest CAGR during the forecast period. The medical-grade wearables segment is rapidly expanding, driven by the rising prevalence of chronic diseases, demand for non-invasive continuous health monitoring, and advances in sensor accuracy and AI analytics. This segment includes AI-powered continuous monitoring devices such as ECG patches, glucose monitors, and rehabilitation trackers. These medical-grade wearables enable real-time, precise monitoring of vital signs and biochemical parameters, facilitating early disease detection, personalized treatment, and remote patient management.

Application Insights

Based on application, the consumer electronics segment held the largest market share of 32.02% in 2025. This growth is driven by increasing consumer demand for technologically advanced devices such as smartwatches, fitness bands, and smart earphones that offer integrated health monitoring and personalized AI-driven experiences. The segment is characterized by rapid innovation, fueled by advancements in AI algorithms, sensor integration, and connectivity, which cater to lifestyle enhancement and wellness management. The growing consumer preference for seamless integration with smartphones and smart home ecosystems further accelerates demand.

The healthcare segment is anticipated to register the fastest growth from 2026 to 2033. This segment is rapidly expanding, driven by the integration of AI-powered sensors and analytics in medical wearables. These devices enable continuous, real-time monitoring of vital signs, facilitate chronic disease management, and the early detection of health anomalies. Their role in telehealth and remote patient monitoring enhances healthcare accessibility, reduces hospitalization rates, and facilitates proactive interventions, significantly improving patient outcomes. For instance, in December 2023, Best Buy Health and Biobeat partnered to integrate Biobeat's remote patient monitoring (RPM) wearables into Best Buy Health solutions. The company’s technology utilizes an AI-powered Early Warning Score system, which provides clinicians with real-time alerts when a patient’s condition indicates possible deterioration.

Operations Insights

Based on operations, the on-device AI segment held the largest market share of 59.10% in 2025. In addition, this segment is anticipated to grow at the fastest CAGR during the forecast period. On-device AI in wearable technology executes artificial intelligence algorithms directly on the device’s hardware, using specialized processors such as neural processing units (NPUs), digital signal processors (DSPs), and application-specific integrated circuits (ASICs). This approach reduces reliance on cloud computing, minimizes latency, and enhances data security by keeping sensitive user data on the device.

For instance, in September 2025, Brilliant Labs partnered with Liquid AI to integrate Liquid’s lightweight vision-language foundation models into the next-gen Halo AI glasses. These open-source wearables offer real-time scene understanding, conversational AI, agentic memory, and Vibe Mode while ensuring privacy and fast on-device intelligence.

The cloud-based AI segment is projected to grow at a significant CAGR from 2026 to 2033. The cloud-based AI segment enables real-time data processing, storage, and advanced analytics by leveraging cloud infrastructure. This segment supports continuous health monitoring, personalized fitness insights, and remote diagnostics by transmitting large volumes of biometric data to cloud servers for AI-driven analysis. The scalability and flexibility of cloud platforms enable seamless integration with multiple wearable devices, thereby enhancing user experience and system interoperability.

Component Insights

Based on component, the sensors segment held the largest market share of 55.51% in 2025. In addition, this segment is projected to grow at the fastest CAGR over the forecast period. The sensors segment is crucial for enabling continuous, real-time monitoring of physiological, environmental, and contextual data. Technological advances focus on miniaturization, energy efficiency, and flexibility, facilitating seamless integration into diverse wearable forms, including wristbands, smart clothing, and medical patches. For instance, in June 2023, scientists from the National University of Singapore (NUS) and the Agency for Science, Technology and Research (A*STAR) developed PETAL, a paper-thin, AI-powered wearable patch for wound monitoring. The patch tracks five biomarkers—temperature, acidity, uric acid, moisture, and trimethylamine—using color-changing sensors.

The connectivity IC segment is projected to grow at a significant rate over the forecast period. It is essential for seamless communication and data exchange between wearable devices, smartphones, and cloud platforms. It includes wireless technologies such as Bluetooth, Wi-Fi, NFC, and 5G modules, which enable real-time synchronization, remote monitoring, and low-latency interaction. Deploying Bluetooth 5.3 and advanced Wi-Fi standards in wearables improves interoperability, power efficiency, and data transmission speed, making connectivity ICs vital for uninterrupted AI-based functions.

Regional Insights

North America Wearable AI Market Trends

North America wearable AI industry is expected to grow significantly over the forecast period. This growth is driven primarily by technological advancements and innovation in artificial intelligence integrated into wearable devices. Moreover, the robust technology infrastructure and extensive R&D investments in the U.S. play a pivotal role in driving market expansion, alongside government initiatives that support the development of AI. For instance, in July 2025, Meta Platforms Inc. purchased a nearly 3% stake in EssilorLuxottica SA, the maker of Ray-Ban and Oakley, investing approximately USD 3.5 billion to enhance its commitment to AI-powered smart glasses.

U.S. Wearable AI Market Trends

The U.S. wearable AI industry held the largest market share in 2025 in the North American region, driven by its strong emphasis on advanced health monitoring and personalized wellness solutions. In addition, this growth is attributed to the widespread integration of AI wearables into clinical healthcare workflows, especially for remote patient monitoring and chronic disease management. Moreover, consumer behavior and market dynamics shape the U.S. wearable AI industry. The mature and competitive market supports rapid adoption of new product categories, including smart clothing and AI-enabled rings. In May 2025, RingConn launched its Gen 2 Smart Ring for sleep apnea monitoring at Target.com, marking its U.S. retail debut.

Europe Wearable AI Market Trends

Europe wearable AI industry is primarily driven by the widespread adoption of smartwatches, smart hearing aids, AI-enabled fitness bands, and medical-grade wearables in response to growing health awareness. Consumers increasingly seek devices that enable continuous health monitoring, early detection of chronic conditions, and personalized wellness insights. For instance, according to the two studies published in January 2023, researchers from University College London (UCL) used wearable motion sensors and AI to track progression in movement disorders, including Friedreich's ataxia and Duchenne muscular dystrophy. This technology identifies disease-specific movement patterns, predicts disease progression, and enhances trial efficiency and precision, enabling faster drug development, particularly for rare conditions with small patient populations.

The UK wearable AI industry is positioned for sustained high growth, driven by technological innovation, regulatory support, and diverse end-user adoption. In addition, the National Health Service (NHS) accelerates the adoption of innovative wearable solutions through digital health initiatives and funding. For instance, in July 2025, UK-based AI wearables startup Movetru secured USD 1.9 million in pre-seed funding. Movetru’s technology focuses on real-time motion tracking and personalized AI-driven insights for sports and rehabilitation, aiming to enhance technique, prevent injuries, and improve performance through wearable devices combined with advanced analytics.

Germany’s wearable AI industry is primarily driven by a robust healthcare sector that emphasizes preventive care and remote patient monitoring. In addition, the country’s market is significantly driven by an active and health-conscious population, including fitness enthusiasts and sports professionals. Strong consumer interest in fitness tracking devices such as AI-enabled fitness bands, smartwatches, and smart clothing fuels demand. For instance, in September 2025, Garmin partnered with Meta to offer Oakley Meta Vanguard AI glasses, featuring real-time training insights through the Meta AI app available in the Garmin Connect IQ Store. Athletes can access live fitness metrics, receive audible AI feedback, and view LED status updates hands-free, with automatic workout video capture and performance summaries integrated into the Meta AI mobile app.

"We are thrilled to team up with Meta to support the Vanguard line of AI glasses with real-time fitness metrics and post-activity insights. The ability to receive personalized Garmin data while working out hands-free will help athletes optimize their performance and stay in the zone."

-Susan Lyman, Garmin Vice President of Consumer Sales and Marketing

Asia Pacific Wearable AI Market Trends

The Asia Pacific wearable AI industry held the largest market share of 32.93% in 2025. This growth is driven by increasing consumer health awareness and the rising adoption of smartwatches, fitness bands, and medical-grade wearables. Countries such as China, India, Japan, and South Korea are major contributors due to their large populations and growing middle-class incomes. In addition, technological advancements in AI, machine learning, and the rollout of 5G infrastructure significantly enhance device capabilities in the Asia Pacific region. For instance, in February 2025, Singapore-based BUZUD and Tan Tock Seng Hospital (TTSH) launched the CARB-CGM system, an AI-powered mobile app combined with a wearable continuous glucose monitoring device, to simplify diabetes management. The system enables real-time glucose tracking, AI-driven dietary analysis via meal photos, and personalized insulin dosing, thereby reducing the risks of hyper- and hypoglycemia.

“We’re reimagining diabetes management through AI technology, focusing on reducing complications and enhancing the quality of life. This aligns with our mission to leverage technology for superior healthcare outcomes,”

- Frankie Fan, CEO of BUZUD

India’s wearable AI industry is experiencing significant growth driven by increasing health awareness and technological advancement. The rising adoption of smartwatches, AI-enabled fitness bands, and medical-grade wearables is driven by a growing middle class that prioritizes preventive healthcare and fitness tracking. Moreover, technological innovations from major domestic and international players are propelling India’s wearable AI industry. In 2025, companies such as Fastrack, boAt, and Noise launched AI-driven smartwatches offering personalized health tracking, adaptive coaching, and biometric authentication. In addition, initiatives such as Lenskart’s smart glasses platform and the launch of Meta’s AI-powered Ray-Ban glasses in India enhance product diversity and accessibility. Such variety of offerings appeals to tech-savvy Indian consumers seeking multifunctional devices.

The Japan wearable AI industry is driven by the country’s advanced digital infrastructure and rapidly aging population, creating demand for health monitoring and assisted living solutions. Smartwatches, AI-enabled fitness bands, and medical-grade wearables are increasingly deployed for remote monitoring of elderly patients, fall detection, and chronic disease management. For instance, according to an article published in the Interesting Engineering Journal in November 2025, Japanese researchers and companies are pioneering advanced AI-driven wearables that feature gesture control and noise-tolerant voice recognition, enhancing the user experience in challenging environments.

In addition, the country’s market is strongly supported by a significant innovation ecosystem, supported by major industry events such as the WEARABLE EXPO held annually in Tokyo. This expo serves as a significant platform showcasing the latest AI-enabled wearable devices, attracting global participants focused on advancing sensor technology, AI integration, and novel interfaces.

Latin America Wearable AI Market Trends

Latin America’s wearable AI industry is driven by increasing consumer engagement with smartwatches, smart earwear, and AI-enabled fitness bands, reflecting rising health consciousness and digital lifestyle adoption. The growing penetration of smartphones and improvements in internet infrastructure enhance the accessibility and usage of AI-driven wearables.

Brazil’s wearable AI industry is experiencing accelerated growth, driven by rising consumer health awareness and the adoption of smart wearables, including smartwatches, AI-enabled fitness bands, and medical-grade devices. In addition, technological advancements and diversification of product offerings further propel market growth.

Middle East and Africa Wearable AI Market Trends

The Middle East and Africa (MEA) wearable AI industry is driven by the increasing demand for smartwatches, smart eyewear, and AI-enabled fitness bands, supported by the adoption of urban tech and digital lifestyles. Moreover, healthcare is a key growth area, with government and private sector initiatives adopting AI-enabled medical wearables for early detection and chronic disease monitoring. Virtual hospitals, such as SEHA, utilize wearable AI devices in telemedicine to support remote patient monitoring and enhance access to care. These advances are supported by significant funding and policies focused on digitalizing healthcare with AI-enhanced wearables.

Saudi Arabia’s wearable AI industry is growing rapidly, driven by increasing health awareness and government initiatives aligned with Vision 2030, which aims to promote active and preventive healthcare. The market is witnessing a widespread adoption of smartwatches, AI-enabled fitness bands, and medical-grade wearables, driven by the increasing prevalence of chronic diseases and a tech-savvy young population adopting health monitoring technologies. Initiatives promoting digital health integration, remote patient monitoring, and wellness tracking are other key contributors to growth.

Key Wearable AI Company Insights

Key players operating in the wearable AI industry are undertaking various initiatives to strengthen their market presence and increase the reach of their products and services. Strategies such as new product launches and partnerships play a key role in propelling market growth.

Key Wearable AI Companies:

The following are the leading companies in the wearable AI market. These companies collectively hold the largest market share and dictate industry trends.

- Samsung Electronics Co. Ltd.

- Meta

- Fitbit, Inc. (Google, Inc.)

- Garmin Ltd.

- Google, Inc.

- Huawei Technologies Co. Ltd.

- Xiaomi

- Motorola Solutions, Inc.

- Starkey Laboratories, Inc.

- Apple, Inc.

- Sony Corporation

- Hexoskin

- Sensoria

- Oura Health Oy

- Ultrahuman Healthcare Pvt Ltd.

- Zepp INC. (Amazfit India)

- RealWear Inc.

- Ultrahuman Healthcare Pvt Ltd.

- Vuzix Corporation

- F. Hoffmann-La Roche Ltd.

- SmartCardia Inc.

- Empatica Inc.

- Phonak - A Sonova brand

Recent Developments

-

In July 2025, Sony launched the WF-C710N true wireless earbuds, highlighting their active noise cancellation, AI-powered voice pickup for calls, and long battery life (up to 40 hours).

-

In June 2025, Xiaomi launched advanced AI glasses, which serve as a smart device control center, supporting voice commands, real-time translation, and meeting transcription.

-

In June 2025, Xiaomi launched the Smart Band, featuring AI-powered fitness tracking, heart rate broadcasting, over 150 workout modes, personalized recovery, and deep integration with the Xiaomi ecosystem.

-

In April 2025, Vuzix Corporation acquired an advanced waveguide research and development facility in Milpitas, California. The acquisition strengthens Vuzix’s capability to develop lightweight, high-performance optical solutions for next-generation AI-powered smart glasses, supporting their ODM/OEM partners.

"This facility strengthens our ability to support our partners with the highest-quality waveguide solutions, ensuring they have the technology needed to bring advanced, fashion-forward smart glasses to market. AI and AR are converging rapidly, and Vuzix is positioned to lead the way in this evolution."

- Paul Travers, President and CEO of Vuzix.

-

In February 2025, Vuzix Corporation partnered with TranscribeGlass to launch an AI-powered real-time speech-to-text transcription service using Vuzix Z100 smart glasses.

-

In December 2024, Vuzix Corporation entered a partnership with Augmex, a Netherlands-based one-stop-shop solutions provider, to supply smart glasses bundled with Augmex software to supply chain customers across Europe. The initial six-figure order, shipped in late 2024, targets warehouse, logistics, installation, service, healthcare, and hospital markets.

-

In January 2021, Google completed its acquisition of Fitbit for USD 2.1 billion. The deal aims to advance health and wellness accessibility, strengthen Google’s wearables strategy, and enhance innovation in smart devices.

Wearable AI Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 55.69 billion

Revenue forecast in 2033

USD 310.56 billion

Growth Rate

CAGR of 27.83% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, operations, component, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; Russia; China; Japan; India; South Korea; Australia; Thailand; Singapore; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Samsung Electronics Co. Ltd.; Meta; Fitbit, Inc. (Google, Inc.); Garmin Ltd.; Google, Inc.; Huawei Technologies Co. Ltd.; Xiaomi; Motorola Solutions, Inc.; Starkey Laboratories, Inc.; Apple, Inc.; Sony Corporation; Hexoskin; Sensoria; Oura Health Oy; Ultrahuman Healthcare Pvt Ltd.; Zepp INC. (Amazfit India); RealWear Inc.; Vuzix Corporation; F. Hoffmann-La Roche Ltd.; SmartCardia Inc.; Empatica Inc.; Phonak - A Sonova brand

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Wearable AI Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global wearable AI market report based on type, application, component, operations, and region.

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Smart Earwear

-

Smart Watches

-

Smart Clothing & Textiles

-

AI-Enabled Fitness Bands & Rings

-

Industrial & Enterprise Wearables

-

Medical-Grade Wearables

-

Smart Eyewear

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Consumer Electronics

-

Healthcare

-

Automotive

-

Military and Defense

-

Media and Entertainment

-

Others

-

-

Operations Outlook (Revenue, USD Million, 2021 - 2033)

-

On-Device AI

-

Cloud-based AI

-

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Processor

-

Connectivity IC

-

Sensors

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

Singapore

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global wearable AI market size was estimated at USD 43.64 billion in 2025 and is expected to reach USD 55.69 billion in 2026.

b. The global wearable AI market is expected to grow at a compound annual growth rate of 27.83% from 2026 to 2033 to reach USD 310.56 billion by 2033.

b. The Asia Pacific wearable AI industry held the largest market share of 32.93% in 2025.

b. Some of the key market players operating in the wearable AI market are Samsung Electronics Co. Ltd.; Meta; Fitbit, Inc. (Google, Inc.); Garmin Ltd.; Google, Inc.; Huawei Technologies Co. Ltd.; Xiaomi; Motorola Solutions, Inc.; Starkey Laboratories, Inc.; Apple, Inc.; Sony Corporation; Hexoskin; Sensoria; Oura Health Oy; Ultrahuman Healthcare Pvt Ltd.; Zepp INC. (Amazfit India); RealWear Inc.; Vuzix Corporation; F. Hoffmann-La Roche Ltd.; SmartCardia Inc.; Empatica Inc.; Phonak - A Sonova brand

b. Key factors driving the market growth include growing adoption of real-time health tracking and personalized wellness solutions, coupled with technological advancements in AI and sensor technologies are significant factors contributing to market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.