- Home

- »

- Processed & Frozen Foods

- »

-

White Mushroom Market Size, Share & Growth Report, 2030GVR Report cover

![White Mushroom Market Size, Share & Trends Report]()

White Mushroom Market (2023 - 2030) Size, Share & Trends Analysis Report By Form (Fresh, Canned/Jarred), By Branding (Private-label, Branded), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-088-3

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

White Mushroom Market Summary

The global white mushroom market size was valued at USD 40.0 billion in 2022 and is expected to reach USD 68.0 billion by 2030, growing at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2030. Mushrooms are gaining popularity among consumers owing to their culinary adaptability and nutritional properties.

Key Market Trends & Insights

- The Asia Pacific region held a dominant revenue share of 89.74% in 2022.

- China emerged as a dominant market in the Asia Pacific region with a revenue share of 97.2% in 2022.

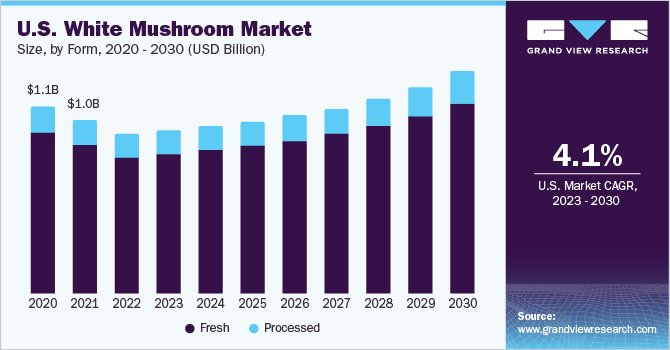

- By form, the fresh white mushrooms segment led the market with a revenue share of 83.1% in 2022.

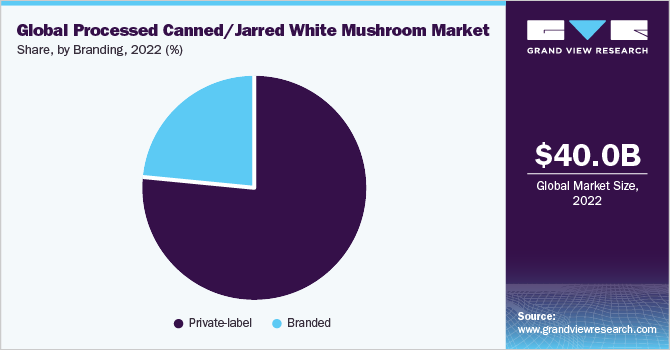

- By branding, private labels dominated the global processed canned/jarred white mushroom market with a share of 76.5% in 2022.

- By end-use, the retail segment dominated the global processed canned/jarred white mushroom market with a share of 49.1% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 40.0 Billion

- 2030 Projected Market Size: USD 68.0 Billion

- CAGR (2023-2030): 6.8%

- Asia Pacific: Largest market in 2022

Furthermore, white mushrooms are easy to grow and harvest in small and local areas. In addition, white mushrooms are a low-calorie, fat-free, and nutrient-rich food option. The rising popularity of plant-based diets has further boosted their market growth, as white mushrooms are often used as a meat substitute. The growing food service sector, improved production efficiency, and enhanced supply chain infrastructure have increased the popularity of white mushrooms.

White mushrooms are popular among consumers worldwide due to their mild flavor, versatile culinary applications, and nutritional benefits. The demand for white mushrooms is expected to continue to grow as they are extensively used in various cuisines and plant-based dishes. According to a February 2023 research article published on ResearchGate, “Exploring Consumer Behavior and Preferences towards Edible Mushrooms in Slovakia,” the most preferred species of mushrooms for consumption are white button mushrooms, followed by oyster mushrooms. Other studies have also confirmed consumers' high preference for white button mushrooms. The research article indicates that white button mushrooms are the most widespread and popular among consumers, followed by oyster, almond, and shiitake mushrooms.White mushrooms are low in calories, fat-free, and cholesterol-free, and provide essential nutrients, such as vitamins, minerals, and dietary fiber. The increasing focus on healthy eating and the awareness about the nutritional benefits of mushrooms drive the product demand as a healthy ingredient. Mushroomscan be used in a wide range of recipes including soups, salads, stir-fries, and pasta dishes and this has contributed to their popularity and increased consumption. The growing product demand, both in fresh and processed forms, is driven by the recognition of its nutritional value and the ability to enhance the flavor and nutritional profile of meals.There is an increasing emphasis on sustainable and organic cultivation practices in the white mushroom industry. Consumers are seeking environmentally friendly and pesticide-free products. As a result, mushroom cultivators are adopting sustainable methods, such as recycling agricultural waste, using organic substrates, and implementing eco-friendly pest and disease management strategies.The growing concerns about animal welfare in the food industry have led to a significant shift in consumer preferences from animal-based food to plant-based alternatives. This factor will also drive the product demand, as mushrooms are considered a good meat substitute. Furthermore, according to The Vegan Society, as of 2021, vegan products are searched on Google three times more than vegetarian and gluten-free products. This illustrates the growing popularity of plant-based food products across countries, such as Australia, the UK, the U.S., Sweden, Israel, New Zealand, Germany, and Austria, which have the highest number of vegans globally.Advancements in cultivation techniques, such as controlled environment agriculture, vertical farming, and improved crop management practices, are enhancing the productivity and efficiency of white mushroom production. These advancements contribute to higher yields, improved quality, and cost-effectiveness in the industry. White mushrooms have a significant presence in international markets, with increasing exports of fresh and processed mushrooms. The growing product popularity in global cuisines and the rising demand for mushroom products present several opportunities for producers and exporters.

Form Insights

The fresh white mushrooms segment led the market with a revenue share of 83.1% in 2022. This dominance is attributed to their superior taste and culinary versatility. Many consumers prioritize fresh ingredients in their cooking and dining experiences. Fresh white mushrooms align with this preference, as they are harvested and consumed naturally without any processing or preservation methods. Therefore, fresh mushrooms are highly valued by consumers and favored for their natural and wholesome attributes, making them the top choice in the market.Processed white mushrooms are expected to witness a steady growth rate of 5.5% from 2023 to 2030 owing to factors, such as demand for convenient & time-saving options, increased adoption by food service providers, improved processing technologies, and extended shelf life.Among the processed white mushrooms, frozen white mushrooms are expected to witness a steady growth rate of 6.0% from 2023 to 2030 owing to the increasing demand for ready-to-cook food. Consumers are increasingly seeking convenience in their food choices, and frozen mushrooms offer a time-saving solution with minimal preparation required. Advancements in freezing techniques, such as Individual Quick Freezing (IQF), help preserve the taste, texture, and nutritional value of frozen white mushrooms, enhancing their quality.

Processed Canned/Jarred White Mushroom Market Branding Outlook

Private labels dominated the global processed canned/jarred white mushroom market with a share of 76.5% in 2022 owing to their competitive pricing and customized options. Retailers are investing in improving the quality and packaging aesthetics of their private-label products, building trust and credibility among consumers.With strategic control over the entire supply chain, from sourcing to distribution, retailers ensure product quality, pricing, and availability. Retailers can enhance the visibility of and preference for their private-label canned/jarred white mushrooms through in-store promotions and by leveraging their strong distribution networks.

Brands are projected to register the fastest CAGR of 5.9% in the global processed canned/jarred white mushroom markets, respectively, from 2023 to 2030. This can be attributed to their established brand reputation, product innovation, strong distribution networks, and effective marketing strategies.

Processed Canned/Jarred White Mushroom Market End-use Outlook

The retail segment dominated the global processed canned/jarred white mushroom market with a share of 49.1% in 2022 owing to its extensive reach, accessibility, and wide distribution networks. Retail stores offer a variety of packaging sizes and options, catering to diverse consumer preferences. Through in-store displays, advertisements, and promotions, retail stores drive consumer awareness and demand for processed canned/jarred white mushrooms. In addition, the convenience of purchasing mushrooms along with other food and grocery items in retail stores contributes to their popularity in the market.The food service sector is expected to exhibit a CAGR of 6.2% from 2023 to 2030. This can be attributed to the increasing demand for convenient ingredients and the versatility of mushrooms in food applications.

Processed Frozen White Mushroom Market Branding Outlook

The private labels segment dominated the global processed frozen white mushroom market with a share of 76.7% in 2022. Private-label brands are typically associated with lower costs compared to national or international brands. Retailers offering private label products can often price them more competitively, attracting cost-conscious consumers who seek value for money. Brands are also projected to register the fastest CAGR of 5.5% in the global processed frozen white mushroom markets from 2023 to 2030. This can be attributed to their established brand reputation, product innovation, strong distribution networks, and effective marketing strategies. Brands invest in research and development to create new and innovative processed frozen white mushroom products that capture consumer attention and cater to evolving preferences. By introducing unique flavors, convenient packaging, and healthier options, brands differentiate themselves and drive consumer interest.

Processed Frozen White Mushroom Market End-use Outlook

The retail segment dominated the global processed canned/jarred white mushroom market with a share of 49.7% in 2022. Retail outlets, such as supermarkets, grocery stores, and specialty food stores, are essential channels for distributing processed food items to consumers. These retail establishments cater to a wide customer base and provide convenience for individuals looking to purchase frozen food products like processed frozen white mushrooms. In addition, retail channels often offer various frozen food options to consumers, including processed white mushrooms. These retail stores have well-established supply chains, extensive distribution networks, and the ability to reach a large consumer base, which makes them crucial for reaching customers with frozen food products.The food service sector is expected to exhibit a CAGR of 6.1% from 2023 to 2030. Frozen white mushrooms are convenient for food service establishments, providing a longer shelf life and availability throughout the year. They offer cost-efficiency, as purchasing in bulk and their extended shelf life reduce waste and lowers expenses. Moreover, using frozen white mushrooms saves time and labor in food preparation, as they are already cleaned and sliced.Their year-round availability ensures menu consistency, while their versatility allows for a wide range of culinary applications. These factors make the food service sector a key consumer of frozen white mushrooms.

Regional Insights

The Asia Pacific region held a dominant revenue share of 89.74% in 2022 owing to the region’s large production capacity, driven by favorable conditions and agricultural practices. In addition, the region's growing population and changing dietary preferences drive product demand. Mushrooms, including white mushrooms, are ingrained in Asian culinary traditions and key components in various dishes, further bolstering their demand. Moreover, the Asia Pacific region has capitalized on export opportunities, supplying white mushrooms to global markets. The expanding food and beverage industry in China, India, and Australia has created opportunities for incorporating white mushrooms into a variety of products.Furthermore, China white mushroom market emerged as a dominant market in the Asia Pacific region with a revenue share of 97.2% in 2022 owing to a large consumer base, driven by its substantial population and cultural preference for white mushrooms. Australia is expected to grow at a CAGR of 5.3% from 2023 to 2030. India is expected to grow at a CAGR of 5.3% from 2023 to 2030 due to the increasing awareness about the nutritional benefits of the product, the shift toward vegetarian/vegan diets, culinary experimentation, and robust research & development.

North America is expected to grow at a CAGR of 4.1% from 2023 to 2030due to strong market penetration in developed economies like the U.S. and Canada. Consumers in these regions show a willingness to pay premium prices for products made with natural and organic ingredients. Furthermore, the growing preference for vegan diets is expected to boost the demand for white mushroom-based meat substitutes from the food and dietary supplements industries. Furthermore, the U.S. emerged as a dominant market in North America and is expected to grow at a CAGR of 4.1% from 2023 to 2030. Europe is expected to witness a steady growth rate of 6.3% owing to the increasing consumer awareness and demand for nutritious and versatile food options. The shift toward plant-based diets, emphasis on local and sustainable sourcing, culinary traditions, and product innovation have also contributed to the market's expansion in Europe. The rise in the vegan and flexitarian population has led to a surge in the availability of white mushroom-based products in Germany. According to the USDA's Foreign Agricultural Service, Germany has the highest rate of vegetarianism compared to other European countries, with approximately 8 million people, which accounts for around 10% of the population, following a vegetarian diet. The UKwhite mushroom market is expected to grow at a CAGR of 5.8% from 2023 to 2030 owing to increasing availability and rising demand for plant-based alternatives.

Key Companies & Market Share Insights

The global industry is expected to witness moderate competition among companies owing to the presence of numerous players across the industry. Owing to changing consumer trends, numerous companies are expanding their product portfolio to gain a competitive edge in the market. Key players have adopted various new technologies to enhance their cultivation, processing, and packaging capabilities. For instance, companies have implemented advanced Controlled Environment Agriculture (CEA) technologies, such as climate-controlled growing rooms and vertical farming systems, to optimize mushroom cultivation conditions.Manufacturers are increasingly engaged in R&D activities related to white mushrooms. They are also expanding their product lines through product launches, mergers, acquisitions, and partnerships and implementing advanced technologies to meet the growing demand for white mushrooms. For instance, in March 2022, Cornerstone Investment Management, Kartesia, and Okechamp S.A. formed a strategic partnership to establish a dominant player in the white mushroom production industry globally. The venture will involve intricate cross-border transactions between four entities and generate revenues of EUR 180 million annually. The partnership will also involve a substantial investment of EUR 80 million to create a new platform to merge assets from Poland and the Netherlands, the two largest European white mushroom producers.Some of the prominent players in the global white mushroom market include:

-

Bonduelle Group

-

Costa Group

-

Drinkwater Mushrooms

-

Monterey Mushrooms, Inc.

-

The Giorgi Companies, Inc.

-

Phillips Mushroom Farms

-

Greenyard

-

GUAN'S MUSHROOM

-

Shangai Fengke

-

Metolius Valley Inc.

-

Okechamp SA

-

Eurochamp

-

Prochamp

-

Scelta

-

Fujian Yuxing

White Mushroom Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 41.8 billion

Revenue forecast in 2030

USD 68.0 billion

Growth rate

CAGR of 6.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in metric tons, revenue in USD million, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Form, branding, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Poland; The Netherlands; China; India; Japan; Australia; South Korea; Brazil; Chile; Argentina; Saudi Arabia; South Africa; Israel

Bonduelle Group; Costa Group; Drinkwater Mushrooms; Monterey Mushrooms, Inc.; The Giorgi Companies, Inc.; Phillips Mushroom Farms; Greenyard; GUAN'S MUSHROOM; Shangai Fengke; Metolius Valley Inc.; Okechamp S.A; Eurochamp; Prochamp; Scelta; Fujian Yuxing

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global White Mushroom Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this report, Grand View Research has segmented the global white mushroom market report based on form, branding, end-use, and region:

-

Form Outlook (Revenue, USD Million; Volume, Metric Tons, 2017 - 2030)

-

Fresh

-

Processed

-

Canned/Jarred

-

Frozen

-

Dried

-

Powdered

-

Other

-

-

-

Processed Canned/Jarred White Mushroom Branding Outlook (Revenue, USD Million; Volume, Metric Tons, 2017 - 2030)

-

Private-label

-

Branded

-

-

Processed Canned/Jarred White Mushroom End-use Outlook (Revenue, USD Million; Volume, Metric Tons, 2017 - 2030)

-

Retail

-

Food Service

-

Food & Beverage Industry

-

Other

-

-

Processed Frozen White Mushroom Branding Outlook (Revenue, USD Million; Volume, Metric Tons, 2017 - 2030)

-

Private-label

-

Branded

-

-

Processed Frozen White Mushroom End-use Outlook (Revenue, USD Million; Volume, Metric Tons, 2017 - 2030)

-

Retail

-

Food Service

-

Food & Beverage Industry

-

Other

-

-

Regional Outlook (Revenue, USD Million; Volume, Metric Tons, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Poland

-

The Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

Chile

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

Israel

-

-

Frequently Asked Questions About This Report

b. The global white mushroom market size was estimated at USD 40.0 billion in 2022 and is expected to reach USD 41.9 billion in 2023.

b. The White mushroom market is expected to grow at a compound annual growth rate of 6.8% from 2023 to 2030 to reach USD 68.0 billion by 2030.

b. The Asia Pacific market held a dominant revenue share of 89.74% in 2022 owing to the region’s large production capacity, driven by favorable conditions and agricultural practices. Additionally, the region's growing population and changing dietary preferences drive the demand for white mushrooms. White mushrooms, including white mushrooms, are ingrained in Asian culinary traditions and key components in various dishes, further bolstering their demand. Moreover, the Asia Pacific region has capitalized on export opportunities, supplying white mushrooms to global markets.

b. Some of the key market players in the white mushroom market are Bonduelle Group; Costa Group; Drinkwater White mushrooms; Monterey White mushrooms, Inc.; The Giorgi Companies, Inc.; Phillips White mushroom Farms; Greenyard; GUAN'S WHITE MUSHROOM; Shangai Fengke; Metolius Valley Inc.; Okechamp S.A; Eurochamp; Prochamp; Scelta; Fujian Yuxing, among others.

b. The rising popularity of plant-based diets has boosted the market growth, as white mushrooms are often used as a meat substitute. The growing food service sector, improved production efficiency, and enhanced supply chain infrastructure have increased the popularity of white mushrooms. White mushrooms are easy to grow and harvest in small and local areas. In addition, white mushrooms are a low-calorie, fat-free, and nutrient-rich food option.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.