- Home

- »

- Biotechnology

- »

-

Whole Genome Bisulfite Sequencing Market Report, 2030GVR Report cover

![Whole Genome Bisulfite Sequencing Market Size, Share & Trends Report]()

Whole Genome Bisulfite Sequencing Market (2025 - 2030) Size, Share & Trends Analysis Report By Product & Service (Kits & Reagents), By Workflow, By Application (Drug Development, Stem Cell Research), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-518-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

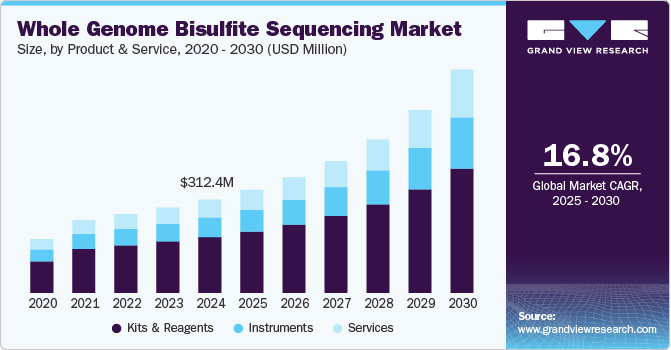

The global whole genome bisulfite sequencing market size was estimated at USD 312.4 million in 2024 and is projected to grow at a CAGR of 16.8% from 2025 to 2030. As researchers continue to explore the role of DNA methylation in gene regulation, cancer biology, and developmental processes, whole genome bisulfite sequencing has emerged as the gold standard for comprehensive methylation profiling at a single-base resolution. The increasing recognition of epigenetics in disease mechanisms has propelled the adoption of whole genome bisulfite sequencing across academic institutions, pharmaceutical companies, and biotechnology firms.

Rapid advancements in sequencing technologies have also contributed significantly to market expansion. The development of high-throughput sequencing platforms by companies such as Illumina and PacBio has improved the efficiency, accuracy, and affordability of whole genome bisulfite sequencing, making it more accessible for a wider range of applications. Continuous improvements in bisulfite conversion chemistry, library preparation kits, and sequencing workflows have enhanced the quality and reproducibility of whole genome bisulfite sequencing data, reducing errors caused by DNA degradation during bisulfite treatment.

DNA methylation plays a crucial role in tumorigenesis, and whole genome bisulfite sequencing provides unparalleled insights into methylation changes associated with different cancer types. Researchers and clinicians are leveraging whole genome bisulfite sequencing to identify novel biomarkers for early cancer detection, prognosis, and personalized treatment strategies. The surge in cancer genomics studies, coupled with increasing funding for precision medicine initiatives, is fueling demand for whole genome bisulfite sequencing solutions. Pharmaceutical companies are also integrating whole genome bisulfite sequencing into drug discovery and development pipelines to assess epigenetic modifications in response to therapeutic interventions. The expansion of epigenomics research beyond oncology into areas like neurodegenerative disorders, autoimmune diseases, and metabolic conditions further strengthens the market potential for whole genome bisulfite sequencing.

Market Concentration & Characteristics

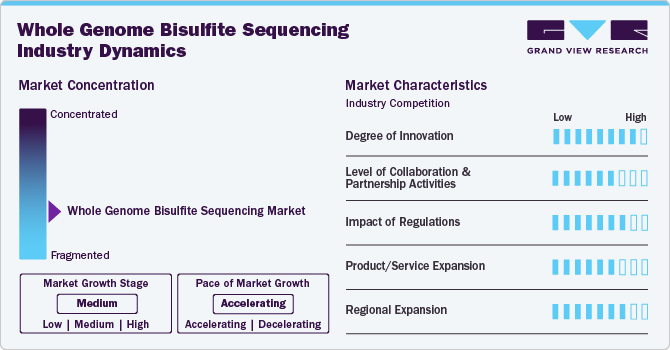

The whole genome bisulfite sequencing industry demonstrates a moderate to high degree of innovation, driven by advancements in bisulfite conversion chemistry, high-throughput sequencing platforms, and AI-powered bioinformatics tools. Continuous improvements in accuracy, cost-efficiency, and data interpretation enhance its adoption across research and clinical applications, expanding its potential in epigenetics, disease biomarker discovery, and personalized medicine.

The whole genome bisulfite sequencing industry exhibits a high level of collaboration and partnership. Strategic alliances drive innovation, improve workflow integration, and enhance data analysis capabilities. Public-private partnerships and academic collaborations further accelerate advancements, expanding applications in epigenetics, disease research, and clinical diagnostics.

Regulations significantly impact the whole genome bisulfite sequencing industry by ensuring data accuracy, ethical use, and compliance with genomic privacy laws. Stringent guidelines for clinical applications, such as those from the FDA and EMA, influence product development and validation. Regulatory hurdles can slow market growth, but standardization efforts enhance credibility, fostering broader adoption in research and diagnostics.

Product and service expansion in the whole genome bisulfite sequencing industry is accelerating. Companies are broadening their range with faster, cost-effective workflows and cloud-based data analysis tools. Expansion into clinical diagnostics and personalized medicine further enhances market growth and adoption.

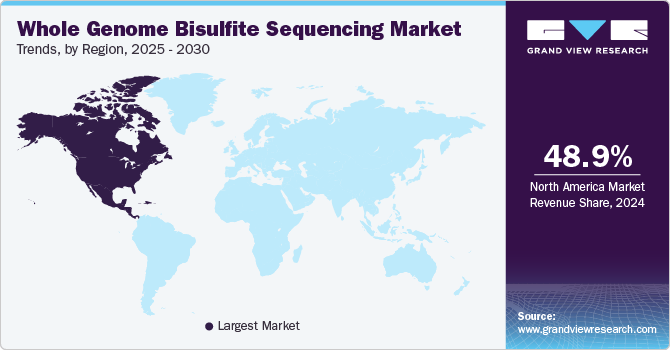

Regional expansion in the whole genome bisulfite sequencing industry is fueled by increasing research investments, rising adoption of sequencing technologies, and growing healthcare infrastructure in emerging markets. North America and Europe dominate due to established genomics research, while Asia-Pacific experiences rapid growth driven by government initiatives, expanding biotech industries, and increasing demand for clinical applications.

Product & Services Insights

Kits & reagents dominated the market and accounted for a share of 59.9% in 2024. The rising demand for high-quality bisulfite conversion, library preparation, and DNA extraction kits is fueling the market. Continuous innovation, improved efficiency, and increased adoption in research and clinical settings further drove growth, making these consumables essential for reliable whole-genome methylation analysis.

Services segment is expected to register the highest CAGR of 19.4% over the forecast period. The growing outsourcing of sequencing processes to specialized providers is minimizing the need for in-house sequencing infrastructure. Rising demand for bioinformatics analysis, cloud-based data interpretation, and cost-effective sequencing services further fuels growth, making whole genome bisulfite sequencing more accessible for research and clinical applications.

Workflow Insights

The sequencing segment accounted for the largest market revenue share of 37.0% in 2024. Advancements in high-throughput sequencing platforms, increasing adoption of next-generation sequencing (NGS) technologies, and the rising demand for whole-genome methylation analysis have driven its dominance. Additionally, ongoing innovations in read length, accuracy, and cost efficiency have enhanced sequencing capabilities, making it the most critical and resource-intensive stage in the whole genome bisulfite sequencing workflow.

The data analysis & interpretation segment is expected to register a significant CAGR over the forecast period. The growing adoption of AI-driven bioinformatics tools, cloud computing, and machine learning algorithms is enhancing the speed and accuracy of data interpretation. Additionally, the rising demand for personalized medicine, biomarker discovery, and epigenetic research require advanced analytical solutions, driving the need for sophisticated bioinformatics platforms and expertise.

Application Insights

The drug development segment accounted for the largest market revenue share of 50.5% in 2024. Drug development held the largest share of the whole genome bisulfite sequencing market due to its critical role in identifying epigenetic biomarkers, understanding disease mechanisms, and optimizing targeted therapies. Pharmaceutical and biotech companies increasingly rely on whole genome bisulfite sequencing for preclinical research, biomarker discovery, and personalized medicine, driving significant demand for sequencing and data analysis solutions.

The stem cell research segment is expected to register a significant CAGR over the forecast period. Whole genome bisulfite sequencing enables precise mapping of DNA methylation patterns in stem cells, aiding regenerative medicine, disease modeling, and therapeutic advancements. Increasing investments in stem cell research, coupled with technological advancements in sequencing and bioinformatics, further accelerating the market growth. Additionally, the potential applications of stem cells in personalized medicine and tissue engineering drive demand for comprehensive epigenetic analysis, positioning whole genome bisulfite sequencing as a vital tool for future breakthroughs.

End-use Insights

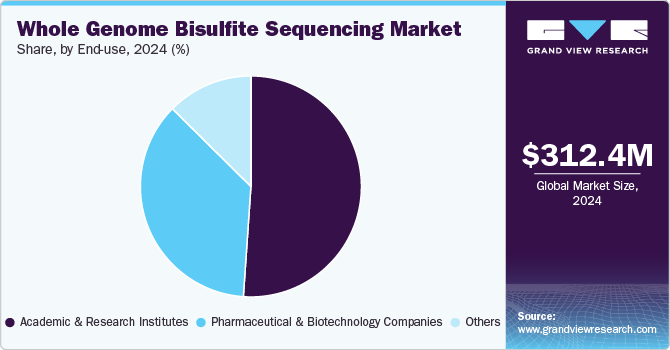

The academic and research institutes segment accounted for the largest market revenue share of 51.1% in 2024. This dominance is attributed to their extensive involvement in epigenetics research, disease mechanism studies, and genome-wide methylation analysis. With increasing government and private funding, these institutions drive innovation in whole genome bisulfite sequencing applications, contributing to advancements in oncology, neuroscience, and developmental biology.

The pharmaceutical and biotechnology segment is expected to register a significant CAGR during the forecast period. This growth is driven by the extensive use of whole genome bisulfite sequencing in drug discovery, biomarker identification, and personalized medicine. Companies leverage whole genome bisulfite sequencing to study epigenetic modifications linked to disease progression, enabling targeted therapy development. Increasing investments in precision medicine and oncology research further fuel demand for advanced sequencing technologies.

Regional Insights

North America whole genome bisulfite sequencing market dominated in 2024 and accounted for the market share of 48.91%. The region's pharmaceutical and biotechnology companies extensively utilize whole genome bisulfite sequencing for drug discovery, biomarker identification, and personalized medicine. Additionally, the high adoption of sequencing technologies in oncology and epigenetics research, along with robust sequencing infrastructure and favorable regulatory frameworks, further drive market growth. Increasing investments in precision medicine continue to enhance the region’s dominance.

U.S. Whole Genome Bisulfite Sequencing Market Trends

The U.S. whole genome bisulfite sequencing market dominated the global market in 2024. The U.S. market is driven by strong government funding, cutting-edge genomic research, and a high concentration of key industry players. Leading pharmaceutical and biotechnology companies leverage whole genome bisulfite sequencing for drug discovery and precision medicine. Additionally, growing investments in oncology and epigenetics research, along with advanced sequencing infrastructure, further fuel market expansion in the country.

Europe Whole Genome Bisulfite Sequencing Market Trends

Europe whole genome bisulfite sequencing market registered significant growth in 2024. Countries like Germany, the U.K., and France lead in epigenetics and oncology research. Increasing collaborations between research institutions and biotech firms, along with advancements in sequencing technologies, further boost market growth.

The whole genome bisulfite sequencing market in the UK held a significant share in 2024 due to a strong biopharmaceutical sector and advanced research infrastructure. The country’s focus on epigenetics, oncology, and personalized medicine drives demand for whole genome bisulfite sequencing. Initiatives like the UK Biobank and Genomics England accelerate genomic research, while collaborations between academia and industry enhance technological advancements, positioning the U.K. as a major hub for epigenetic sequencing innovations.

France whole genome bisulfite sequencing market is experiencing significant growth. The country’s market growth is driven by government-backed genomic research initiatives, strong academic institutions, and a growing biotechnology sector. The country’s focus on cancer research, regenerative medicine, and precision therapies fuels demand for whole genome bisulfite sequencing. Collaborations between research centers, hospitals, and biotech firms, along with increasing investments in sequencing technologies, further contribute to market expansion.

The whole genome bisulfite sequencing market in Germany is growing due to a combination of factors. Government initiatives like the German Human Genome Project and collaborations between academia and industry foster innovation. Increasing investments in sequencing technologies and expanding biopharmaceutical R&D further support market growth, positioning Germany as a key player in epigenetic research.

Asia Pacific Whole Genome Bisulfite Sequencing Market Trends

Asia Pacific whole genome bisulfite sequencingmarket is anticipated to witness significant growth in the whole genome bisulfite sequencing market. The market is expanding due to increasing government funding, expanding genomics research, and rising demand for precision medicine. Countries like China, Japan, and India are investing heavily in sequencing technologies for cancer research, stem cell studies, and clinical diagnostics. Growing collaborations between academic institutions and biotech companies, along with improving healthcare infrastructure and regulatory support, further accelerate market expansion.

China whole genome bisulfite sequencing market is rapidly expanding. China's market is fueled by extensive government-funded genomic initiatives and rising adoption in clinical and agricultural research. The country’s expanding biotechnology sector and increasing collaborations with sequencing providers are accelerating market expansion. Additionally, advancements in bioinformatics and cost reductions in sequencing technologies are making whole genome bisulfite sequencing more accessible to research institutions and biotech companies.

Whole genome bisulfite sequencing market in Japan is steadily advancing, driven by its strong focus on precision medicine, aging population research, and regenerative medicine. The country’s advanced healthcare infrastructure and significant government funding for epigenetics research support market growth. Japanese pharmaceutical companies are increasingly integrating whole genome bisulfite sequencing for biomarker discovery and drug development. Additionally, collaborations between academic institutions and biotech firms are fostering innovation.

MEA Whole Genome Bisulfite Sequencing Market Trends

The MEA whole genome bisulfite sequencing markethas experienced considerable growth in recent years, driven by several factors. Countries like the UAE and Saudi Arabia are investing in advanced sequencing technologies to support national healthcare strategies. South Africa is emerging as a regional hub for genetic and epigenetic studies, particularly in oncology and infectious diseases. Limited funding and infrastructure challenges in some regions may slow widespread adoption.

Saudi Arabia whole genome bisulfite sequencing market is growingdue to government-driven genomic initiatives, increasing investments in biotechnology, and a growing focus on precision medicine. Programs like the Saudi Human Genome Project are boosting demand for sequencing technologies. The country's Vision 2030 strategy emphasizes healthcare innovation, fostering research in genetic diseases and epigenetics. Collaborations between research institutes and global biotech firms are further driving adoption.

Whole genome bisulfite sequencing market in Kuwait is emerging, driven by increasing investments in healthcare research, genetic disease studies, and precision medicine initiatives. Government-backed programs and collaborations with global biotech firms are fostering advancements in genomic research. However, limited local sequencing infrastructure and reliance on international partnerships may slow market expansion.

Key Whole Genome Bisulfite Sequencing Company Insights

Key companies are growing their market revenue by launching new products, collaborations and adopting various other strategies.

Key Whole Genome Bisulfite Sequencing Companies:

The following are the leading companies in the whole genome bisulfite sequencing market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific, Inc.

- Illumina, Inc.

- Danaher

- Merck KGaA

- Zymo Research

- QIAGEN

- Agilent Technologies

- BGI

- Hologic Inc.

- New England Biolabs

Recent Developments

-

In November 2024, Wasatch Biolabs (WBL) partnered with Oxford Nanopore Technologies (ONT) to develop a Direct Whole Methylome Sequencing product. This collaboration aimed to overcome limitations of traditional bisulfite sequencing and methylation microarrays using ONT’s nanopore-based molecular sensing technology.

-

In February 2024, Wasatch Biolabs (WBL), a subsidiary of Renew Biotechnologies and a certified Oxford Nanopore Technologies laboratory, introduced a proprietary Targeted DNA Methylation Sequencing Service. This amplification- and bisulfite-free approach overcomes common limitations in targeted methylation analysis, enabling custom panels that target hundreds to thousands of genomic loci with 400-2300x enrichment.

-

In May 2022, Twist Bioscience Corporation introduced the Twist Human Methylome Panel, designed to enhance research in cancer metastasis, human development, and functional genetics. This panel enables the identification of key CpG sites and methylation markers across the human genome, providing insights into biologically relevant epigenetic modifications.

Whole Genome Bisulfite Sequencing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 345.2 million

Revenue forecast in 2030

USD 749.4 million

Growth rate

CAGR of 16.8% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product & services, workflow, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; KSA; UAE; South Africa; Kuwait.

Key companies profiled

Thermo Fisher Scientific, Inc.; Illumina, Inc.; Danaher; Merck KGaA; Zymo Research; QIAGEN; Agilent Technologies; BGI; Hologic Inc.; New England Biolabs

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Whole Genome Bisulfite Sequencing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the whole genome bisulfite sequencing market report based on product & service, workflow, application, end-use, and region:

-

Product & Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

Kits & Reagents

-

Bisulfite Conversion Kits & Reagents

-

Library Preparation Kits & Reagents

-

DNA Extraction & Purification Kits & Reagents

-

PCR & Amplification Kits & Reagents

-

Sequencing Kits & Reagents

-

Others

-

-

Services

-

-

Workflow Outlook (Revenue, USD Million, 2018 - 2030)

-

Sample Preparation & Bisulfite Conversion

-

Library Preparation & Amplification

-

Sequencing

-

Data Analysis & Interpretation

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Drug Development

-

Stem Cell Research

-

Developmental Biology

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Academic & Research Institutes

-

Pharmaceutical & Biotechnology Companies

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global whole genome bisulfite sequencing market size was estimated at USD 312.4 million in 2024 and is expected to reach USD 345.2 million in 2025.

b. The global whole genome bisulfite sequencing market is expected to grow at a compound annual growth rate of 16.77% from 2025 to 2030 to reach USD 749.4 million by 2030.

b. North America dominated the whole genome bisulfite sequencing market with a share of 48.91% in 2024. This is attributable to the high adoption of sequencing technologies in oncology and epigenetics research, along with robust sequencing infrastructure and favorable regulatory frameworks.

b. Some key players operating in the whole genome bisulfite sequencing market include Thermo Fisher Scientific, Inc., Illumina, Inc., Danaher, Merck KGaA, Zymo Research, QIAGEN, Agilent Technologies, BGI, Hologic Inc., New England Biolabs

b. Key factors driving market growth include growing epigenetics research, rising precision medicine demand, technological advancements, increasing funding, cancer biomarker discovery, and expanding pharmaceutical and biotechnology applications.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.