- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Wood Coatings Market Size & Share, Industry Report, 2030GVR Report cover

![Wood Coatings Market Size, Share & Trends Report]()

Wood Coatings Market (2025 - 2030) Size, Share & Trends Analysis Report By Resin Type (Polyurethane, Acrylic, Nitrocellulose, Unsaturated Polyester), By Technology (Solvent Borne, Waterborne), By Application (Furniture, Flooring & Decking), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-141-4

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Wood Coatings Market Summary

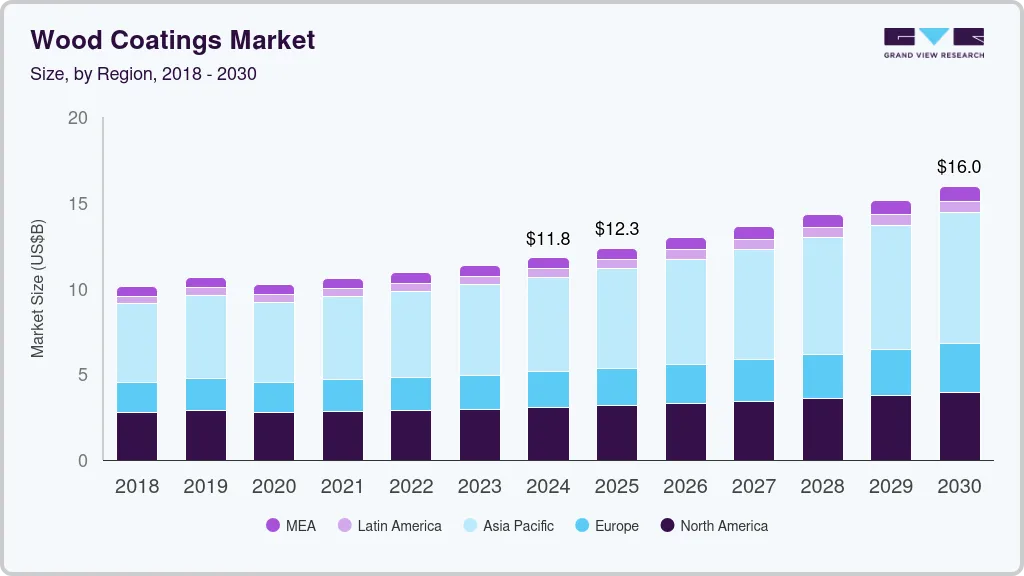

The global wood coatings market size was estimated at USD 11.8 billion in 2024 and is projected to reach USD 15.96 billion by 2030, growing at a CAGR of 5.3% from 2025 to 2030. The growth of the market can be attributed to several key factors, including the surging demand for home furniture and a growing consumer emphasis on aesthetics.

Key Market Trends & Insights

- Asia Pacific wood coatings market dominated the global market and accounted for a revenue share of 46.7% in 2024.

- The U.S. wood coatings market is one of the most mature and innovation-driven segments globally.

- Based on resin type, polyurethane segment accounted for the maximum revenue share of over 40.7%.

- Based on application, Furniture segment accounted for the maximum revenue share of over 58.5% in 2024.

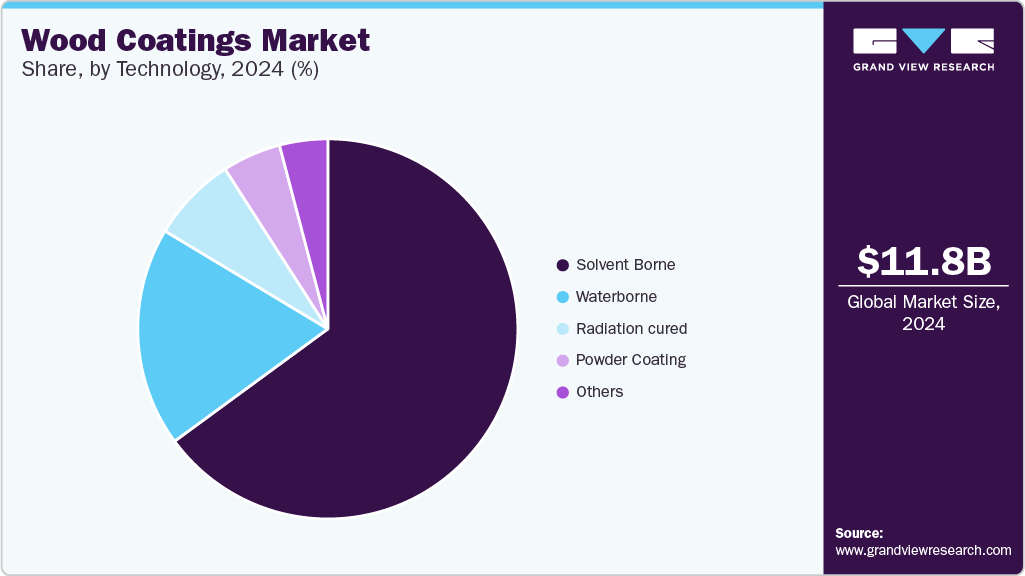

- Based on technology, Solvent-borne segment accounted for the maximum revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 11.8 Billion

- 2030 Projected Market Size: USD 15.96 Billion

- CAGR (2025-2030): 5.3%

- Asia Pacific: Largest market in 2024

Factors such as the rise in global population and the recovery of the housing market have led to a heightened need for various furniture items such as beds, chairs, shelves, tables, and cabinets, among others. Furthermore, the escalating demand for interior design and decoration, particularly in residential spaces, hotels, and corporate offices, is contributing to increased furniture demand, thereby driving growth in the wood coatings market. Wood coatings are extensively used in the refinement and protection of wooden products. These coatings help increase the lifespan of wooden products by providing aesthetic appeal and protective layers that shield wood surfaces from various environmental factors, such as UV radiation, temperature fluctuations, moisture, and abrasion. This protection aids in improving the lifespan of wooden products or furniture. Wood coatings can significantly enhance the durability of wood products by reducing the likelihood of warping, rot, and decay, and by preventing wear and tear. This is particularly important for outdoor applications, such as fences and decks.

Various companies are incorporating low VOC (volatile organic compound) content and non-toxic products into their wood coating formulations, making them environmentally friendly. The demand for such eco-friendly products is increasing due to the growing consumer focus on sustainability. In response, numerous companies are launching bio-based and environmentally friendly wood coating products. For example, in February 2022, Synthos, a Poland-based manufacturer of chemical raw materials, announced the launch of its first bio-based acrylic dispersion, SYNEXIL AW90CX. This product is specifically designed for use in transparent and pigmented wood coatings.

Market Concentration & Characteristics

The wood coatings market exhibits a moderate to high level of concentration, with a few multinational players accounting for a significant share of global revenues. Leading companies such as Sherwin-Williams, AkzoNobel, PPG Industries, Axalta Coating Systems, and Nippon Paint Holdings dominate the market due to their extensive product portfolios, strong R&D capabilities, and well-established distribution networks. These top-tier firms often secure large B2B contracts with furniture manufacturers, cabinetry producers, and construction firms, creating high entry barriers for new players.

The wood coatings market is defined by several key characteristics that influence product development, customer preferences, and competitive dynamics. One of the primary traits is application-specific demand, as coatings must meet distinct requirements for various uses such as furniture, flooring, cabinetry, paneling, and joinery. Each of these segments demands tailored performance features like scratch resistance, water repellency, and UV stability. The market also displays product type differentiation, encompassing solvent-based, water-based, UV-cured, and polyurethane formulations. Increasing environmental regulations and customer preferences for greener alternatives have accelerated the shift toward water-based and UV-cured products.

Resin Type Insights

Polyurethane emerged as the leading resin type segment and accounted for the maximum revenue share of over 40.7% of the overall revenue in 2024. The majority of wooden furniture manufacturers incorporate polyurethane as a coating material in their furniture manufacturing. This is due to the ready availability of the product and numerous advantages of polyurethane over other counterparts. Polyurethane offers exceptional durability, good chemical resistance, ultraviolet protection, and longevity.

In addition, polyurethane coatings are available in various formulations, including water-based and oil-based options, as well as different finishes such as high-gloss, semi-gloss, matte, and satin. This versatility allows consumers to choose the type of polyurethane that suits their specific needs and desired appearance. Polyurethanes are easy to apply and have quick-drying capabilities. Furthermore, polyurethane adheres well to wood surfaces, creating a strong bond that ensures the coating stays in place and provides long-lasting protection.

In 2021, AkzoNobel India Ltd. launched its first polyurethane wood coating, Sadolin Luxurio PU. This product offers luxurious aesthetics and exceptional performance and protection. It provides a range of superior benefits, including up to 7X enhanced protection, outstanding resistance against scratches, stains, and cracks, a fast drying time, and is available in both clear gloss and clear matte finishes.

The nitrocellulose segment is expected to grow at a CAGR of 5.5% over the forecast period. Nitrocellulose is one of the most commonly used resin types in the wood coating industry. Nitrocellulose coatings are relatively easy to apply, making them a preferred choice for do-it-yourself enthusiasts and small-scale woodworkers. They can be sprayed, brushed, or wiped onto the wood surface with ease. Nitrocellulose coatings have high reparability; they are relatively easy to repair or touch up. If a part of the coating gets damaged, it can be repaired without the need to strip the entire surface. Additionally, these coatings are more budget-friendly compared to some high-end polyurethane coatings.

Application Insights

Furniture emerged as the leading Application segment and accounted for the maximum revenue share of over 58.5% in 2024. The demand for furniture is increasing due to numerous factors such as rising urbanization, expanding residential spaces, a growing number of nuclear families, and an increasing consumer focus on home décor and aesthetics. According to Invest India (National Investment Promotion & Facilitation Agency), the furniture market in India is expected to reach USD 37 billion by 2026, up from USD 17 billion in 2021. This growth in the furniture industry in developed and developing economies is expected to drive the wood coatings market.

The flooring and decking segment is expected to grow at a CAGR of 4.5% over the forecast period. The increasing demand for eco-friendly flooring products is gaining considerable attention and is anticipated to create opportunities for the expansion of the wooden decking market. Consequently, this growth in the wooden decking market is expected to drive the wood coatings market.

Technology Insights

Solvent-borne emerged as the leading technology segment and accounted for the maximum revenue share in 2024. Solvent-borne coatings are very popular in the paints and coatings industry. Solvent-borne coatings are easy to apply and have been traditionally thought to provide a better finish. Solvent-borne coatings often provide superior performance characteristics compared to water-based coatings. They offer excellent durability, adhesion, and resistance to wear, chemicals, and environmental factors. In addition, they typically offer faster drying times compared to waterborne coatings. This rapid drying enables quicker turnaround times in manufacturing and construction, reducing labor and energy costs. Solvent-borne coatings are known for their ability to withstand harsh environmental conditions, such as exposure to extreme temperatures, UV radiation, and moisture.

However, the release of VOCs during the application of solvent-borne coatings has led to an increased focus on the development and adoption of environmentally friendly, low-VOC alternatives like water-borne and powder coatings. This shift towards eco-friendly options may pose potential challenges to the future growth of the solvent-borne coatings market.

The waterborne segment is expected to grow at the fastest CAGR of 5.5% over the forecast period. Waterborne coatings contain lower levels of VOCs and are considered environmentally friendly compared to solvent-borne coatings. In addition, waterborne coatings have a milder odor compared to their counterparts, creating a more pleasant working environment for applicators and reducing indoor air pollution. Waterborne solvents have fewer hazardous chemicals, typically containing 70% water, 20% solids, and only 10% solvent. As a result, they are generally safer to handle and store due to their reduced flammability.

Regional Insights

Asia Pacific wood coatings market dominated the global market and accounted for a revenue share of 46.7% in 2024. The market is being driven by the increasing demand for home furnishings in countries such as India, China, Japan, and South Korea. Furthermore, the regional market is experiencing growth due to rising disposable incomes, expanding populations, and rising living standards, particularly in countries like India and China. According to Invest India (National Investment Promotion & Facilitation Agency), India's furniture exports during April-January 2022-23 have tripled compared to the same period in 2013-14, underscoring the robust growth in the region's market.

The Asia Pacific wood coatings market is experiencing rapid growth, driven by strong expansion in the construction, furniture manufacturing, and interior design sectors across countries like China, India, Vietnam, Indonesia, and Malaysia. As urbanization accelerates and disposable incomes rise, the demand for wood-based furniture, flooring, and cabinetry has surged, fueling increased consumption of wood coatings across both residential and commercial projects.

North America Wood Coatings Market Trends

North America wood coatings market is driven by technological adoption in precision farming and sustainable nutrient management practices. The demand for specialty fertilizers is increasing due to environmental regulations encouraging low-runoff solutions and enhanced nutrient efficiency. The U.S. and Canada are leading markets, particularly for fertigation and controlled-release products.

U.S. Wood Coatings Market Trends

The U.S. wood coatings market is one of the most mature and innovation-driven segments globally, supported by a well-established construction, furniture, and cabinetry industry. Demand is driven primarily by the residential and commercial real estate sectors, as well as by renovation and remodeling activities, which remain robust across states.

Europe Wood Coatings Market Trends

The Europe wood coatings market is mature, sustainability-focused, and heavily influenced by stringent environmental regulations, especially related to VOC emissions and chemical safety standards. Demand is largely driven by the construction, interior design, and furniture industries in countries such as Germany, Italy, France, and the UK.

Middle East & Africa Wood Coatings Market Trends

The Middle East & Africa (MEA) wood coatings market is relatively smaller in size. Still, it offers significant growth potential, particularly in the Gulf Cooperation Council (GCC) countries, South Africa, and North African nations. Market demand is primarily driven by infrastructure development, luxury real estate, and interior design trends, especially in the UAE, Saudi Arabia, and Qatar, where high-end wooden furnishings, doors, and panels are extensively used in commercial and residential projects.

Key Wood Coatings Company Insights

Some key players operating in the market include The Sherwin-Williams Company, PPG Industries, Inc., Akzo Nobel N.V., Nippon Paint Holdings Co., Ltd., among others.

-

Founded in 1866 and headquartered in Cleveland, Ohio, The Sherwin-Williams Company is a global manufacture, distribution, and sale of paints, coatings, and related products. With operations spanning over 120 countries, the company serves a wide range of sectors, including construction, industrial, automotive, and marine.

-

Nippon Paint Holdings Co., Ltd., established in 1881 and headquartered in Osaka, Japan, is one of the oldest and most prominent paint and coatings companies in Asia and globally. It offers a comprehensive range of products across decorative paints, automotive coatings, industrial finishes, marine coatings, and functional chemicals.

Key Wood Coatings Companies:

The following are the leading companies in the wood coatings market. These companies collectively hold the largest market share and dictate industry trends.

- The Sherwin-Williams Company

- PPG Industries, Inc.

- Akzo Nobel N.V.

- Nippon Paint Holdings Co., Ltd.

- RPM International Inc.

- Diamond Paints

- KANSAI HELIOS

- BASF SE

- Axalta Coating Systems, LLC

- Asian Paints

- Eastman Chemical Company

Wood Coatings Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 12.35 billion

Revenue forecast in 2030

USD 15.96 billion

Growth rate

CAGR of 5.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, volume in kilo tons and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Resin type, technology, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; Netherlands; Turkey; China; Japan; India; South Korea; Australia; Malaysia; Indonesia; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

The Sherwin-Williams Company; PPG Industries, Inc.; Akzo Nobel N.V.; Nippon Paint Holdings Co., Ltd.; RPM International Inc.; Diamond Paints; BASF SE; Axalta Coating Systems, LLC; KANSAI HELIOS; Asian Paints; Eastman Chemical Company

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Wood Coatings Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global wood coatings market based on resin type, technology, application, and region:

-

Resin Type Outlook (Volume in Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Polyurethane

-

Acrylic

-

Nitrocellulose

-

Unsaturated Polyester

-

Others

-

-

Technology Outlook (Volume in Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Waterborne

-

Solvent-borne

-

Powder Coating

-

Radiation Cured

-

Others

-

-

Application Outlook (Volume in Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Furniture

-

Joinery

-

Flooring & Decking

-

Siding

-

Others

-

-

Regional Outlook (Volume in Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Turkey

-

Netherlands

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

Indonesia

-

Malaysia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.