- Home

- »

- Medical Devices

- »

-

Wound Closure And Advanced Wound Care Market Report, 2020-2027GVR Report cover

![Wound Closure And Advanced Wound Care Market Size, Share & Trends Report]()

Wound Closure And Advanced Wound Care Market Size, Share & Trends Analysis Report By Product (Fibrin-based Sealants, Hydrocolloids-based Sealants), By Application, By End Use, And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68038-659-2

- Number of Report Pages: 115

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Healthcare

Report Overview

The global wound closure and advanced wound care market size was valued at USD 1.19 billion in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 4.5% from 2020 to 2027. The market growth is attributed due to the rising incidence of chronic diseases and the increasing usage of advanced wound care products due to the rising incidence of chronic and acute wounds. Moreover, rising demand for wound dressing, advanced wound care management, traditional wound care, and wound and tissue management products due to increasing cases of sports injuries and accidents across the globe are likely to boost the market growth.

Increasing prevalence of diabetes (both type I and type II) across the globe is expected to drive the market. For instance, as per the International Diabetes Federation, the global prevalence of diabetes is expected to increase from 366.0 million in 2011 to 552.0 million by 2030. Since prolonged diabetes leads to diabetic foot ulcers, rising prevalence of diabetes is expected to have a positive impact on the market growth over the forecast period.

Furthermore, growing geriatric population across the globe is anticipated to propel the market growth. For instance, as per the World Health Organization (WHO), the global geriatric population is anticipated to rise from 84.0 million in 2014 to 2.0 billion by 2050. Since the geriatric population is prone to chronic diseases and chronic ulcers, growing geriatric population is also expected to surge the market growth over the forecast period.

Increasing number of accidents and trauma cases, such as burns, is expected to positively contribute to market growth. Traumatic events are most common in low and middle-income countries in comparison to high-income countries. According to the report published by the World Health Organization, in 2018, around 180,000 deaths were recorded every year due to burns. Therefore, increasing number of burn cases is projected to boost the demand for wound dressing, traditional wound care, wound sealants, and advanced injury care products, thereby propelling the market growth over the forecast period.

Number of surgeries is increasing globally owing to which the incidence rate of surgical site infection is also anticipated to rise. According to the report published by the Health Research Educational Trust (HRET), in 2018, around 15.0 million surgeries are performed in the U.S. every year and approximately 2.0% to 5.0% of patients develop surgical site infection. Wound closure, traditional wound care, and advanced wound care products provide better hydration to deep surgical site and injuries. These advanced wound care products also allow precise removal of cellular debris and surface pathogens from the wound exudates. Since wound closure and advanced wound care products allow rapid healing of surgical site infection, rising number of surgical procedures is anticipated to surge the demand for these injury care products, thereby propelling the market growth.

Constant initiatives by the major players in the market are also anticipated to promote market growth. Key players are also adopting various strategies to strengthen their position in the market. F

or instance, in December 2018, ConvaTec Group plc gained support from the U.K. government for advancing in the wound care industry owing to which its customer base was anticipated to expand. Moreover, in February 2016, Mölnlycke Healthcare acquired Sundance Solutions, a market leader in developing innovative solutions for prevention of pressure ulcers. This move was expected to expand the company’s product range for the treatment of pressure ulcers, thus increasing its market share. Thus, such initiatives by the key players are anticipated to propel the market growth over the forecast period.

Product Insights

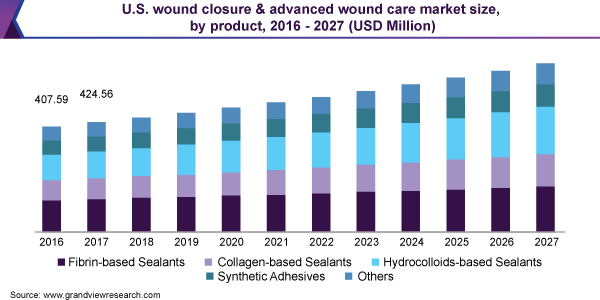

On the basis of product, the market is categorized into fibrin-based sealants, collagen-based sealants, hydrocolloids-based sealants, synthetic adhesives, and others. The fibrin-based sealants segment held the largest share of 28.9% in 2019 owing to increase in the usage of these advanced care products for the treatment of chronic and acute injuries. The fibrin-based sealants comprise two components: thrombin and fibrinogen. These are majorly used for treating chronic and acute injuries. According to the report published by the National Center for Biotechnology Information, fibrin-based sealants allow several positive effects on surgical outcomes, such as reduced blood loss and complications and improved time to hemostasis

Hydrocolloids-based sealants are anticipated to witness the fastest growth over the forecast period. Hydrocolloid-based sealants are made up of gel-forming agents, such as carboxy methylcellulose (CMC) and gelatin. These materials are occlusive in nature that help in moisture retention. These sealants allow rapid healing and are impermeable to any type of bacterial infection. Thus, it helps in protecting the wound internally as well as externally. Rising cases of diabetes across the globe are expected to promote the segment growth over the forecast period. For instance, as per the CDC, in 2015, around 5.0% of the people in the U.S. were diagnosed with Type 1 diabetes and approximately around 15.0% of this diabetic population suffers from diabetic wounds or diabetic ulcers. Hence, such instances are expected to surge the demand for hydrocolloid-based sealants over the forecast period.

Application Insights

Based on the application, the wound closure and advanced wound care market is segmented into chronic wounds and acute wounds. The acute wounds segment held the largest share of 60.0% in 2019. The acute wounds comprise surgical and traumatic wounds and burns. The surgical and traumatic wounds segment held the largest share in 2019 and is anticipated to witness the fastest growth over the forecast period owing to increasing cases of trauma across the globe.

The chronic wounds segment is anticipated to witness the fastest growth over the forecast period. Increasing cases of chronic diseases, especially diabetes, and growing geriatric population across the globe are the major factors driving the segment. For instance, as per the journal published by Intermountain Healthcare, in 2017, around 6.50 million people in the U.S. suffered from chronic injuries. The segment is further subdivided into diabetic foot ulcers, pressure ulcers, venous leg ulcers, and others.

End-Use Insights

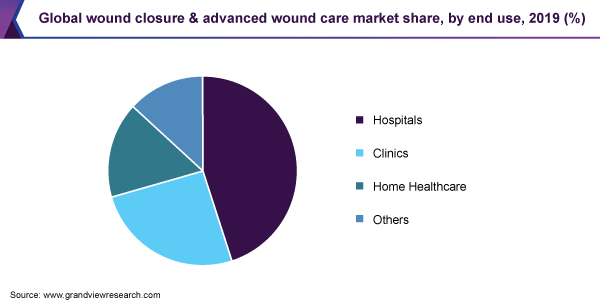

On the basis of end use, the market for wound closure and advanced wound care is fragmented into hospitals, clinics, home healthcare, and others. The hospital segment market held the largest market share of 45.0% in 2019. Increasing number of surgical procedures and rising cases of diabetic foot ulcers and venous foot ulcers are the major factors fueling the segment growth. For instance, as per the Eurostat statistics, in 2016, around 935.4, 216.2, 70.9, and 39.8 people per 100,000 inhabitants in Italy underwent cataract surgery, transluminal coronary angioplasty, appendectomy, and laparoscopic appendectomy, respectively. The rate of hospital admissions and the chance of getting surgical wounds are expected to increase with the rise in the number of surgeries, thus boosting the segment growth over the forecast period.

The home healthcare segment is anticipated to witness the fastest growth over the forecast period. Growing geriatric population across the globe may increase the demand for home healthcare settings. Conditions such as diabetic foot ulcers, venous leg ulcers, and surgical wounds generally require prolonged hospital stays, which often becomes challenging for aged patients. Wound closure, advanced wound care, and traditional wound care products are majorly used for home care settings as these products are easy to use. Hence, such factors are anticipated to surge the segment growth over the forecast period.

Regional Insights

North America dominated the market for wound closure and advanced wound care in 2019 with a share of 45.2% and is expected to witness considerable growth over the forecast period. Increasing road accidents and sports injuries and presence of several key players in the region are anticipated to fuel the market growth. In addition, presence of adequate skilled professionals and highly developed healthcare infrastructure is expected to drive the regional market over the forecast period.

Asia Pacific is anticipated to witness the fastest growth over the forecast period. Presence of developing countries such as China, Japan, and India is anticipated to boost the market growth in Asia Pacific. In addition, key players are making constant efforts to penetrate into the untapped areas of Asia Pacific owing to which market growth is anticipated over the forecast period.

Key Companies & Market Share Insights

Key players are involved in adopting strategies such as merger & acquisitions, product launch, partnerships, and agreement to strengthen their position in the market. For instance, in May 2019, 3M entered into a definitive agreement to acquire advanced wound care and specialty surgical product segments of Acelity and its KCI Subsidiaries, with an aim to expand the company’s product portfolio. Some of the prominent players in the wound closure and advanced wound care market include:

-

Smith & Nephew Plc.

-

Mölnlycke Health Care AB

-

Acelity (KCI Licensing, Inc.)

-

Convatec Group PLC.

-

Baxter

-

Ethicon Inc. (Johnson & Johnson)

-

Coloplast Corp

-

Medtronic

-

3M

-

Medline Industries, Inc.

Wound Closure And Advanced Wound Care Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 1.24 billion

Revenue forecast in 2027

USD 1.69 billion

Growth Rate

CAGR of 4.5% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Revenue in USD million and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; China; India; Brazil; Mexico; South Africa; Saudi Arabia

Key companies profiled

Smith & Nephew Plc.; Mölnlycke Health Care AB; Acelity (KCI Licensing; Inc.); Convatec Group PLC.; Baxter; Ethicon Inc. (Johnson & Johnson); Coloplast Corp; Medtronic; 3M; Medline Industries, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global wound closure and advanced wound care market report on the basis of product, application, end use, and region:

-

Product Outlook (Revenue, 2016 - 2027 (USD Million))

-

Fibrin-based Sealants

-

Collagen-based Sealants

-

Hydrocolloids-based Sealants

-

Synthetic Adhesives

-

Others

-

-

Application Outlook (Revenue, 2016 - 2027 (USD Million))

-

Chronic Wounds

-

Diabetic Foot Ulcer

-

Venous Leg Ulcer

-

Pressure Ulcer

-

Others

-

-

Acute Wounds

-

Surgical & Traumatic

-

Burns

-

-

-

End-Use Outlook (Revenue, 2016 - 2027 (USD Million))

-

Hospitals

-

Clinics

-

Home Healthcare

-

Others

-

-

Regional Outlook (Revenue, 2016 - 2027 (USD Million))

-

North America

-

The U.S.

-

Canada

-

-

Europe

-

The U.K.

-

Germany

-

-

Asia Pacific

-

China

-

Japan

-

-

Latin America

-

Brazil

-

Mexico

-

-

MEA

-

South Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."