- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Xylene Market Size, Share, Growth & Trends Report, 2030GVR Report cover

![Xylene Market Size, Share & Trends Report]()

Xylene Market (2023 - 2030) Size, Share & Trends Analysis Report By Additives (Solvents, Monomers), By Type (Ortho-Xylene, Meta-Xylene, Mixed Xylene), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-112-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

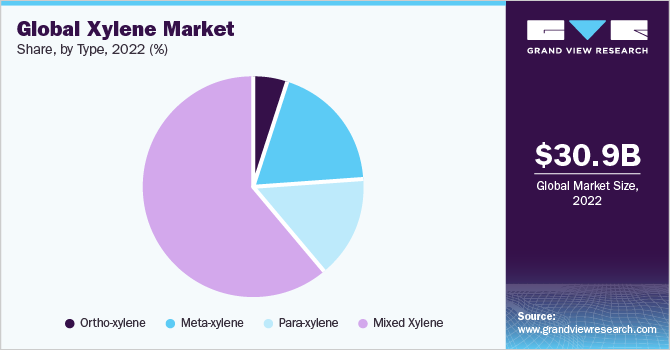

The global xylene market size was estimated at USD 30.9 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 8.0% from 2023 to 2030. Xylene is a solvent and raw material widely utilized across various industries including paints and coatings, adhesives and sealants, pharmaceuticals, plastics, and textiles. The increasing demand for products and advancements within these industries plays a pivotal role in driving the growth of the market. In the paints and coatings industry, the market holds significant importance as it is extensively employed in formulating solvent-based paints, varnishes, and enamels. Its versatility as a solvent is crucial for achieving the desired performance characteristics in these coatings. Similarly, the adhesives and sealants industry heavily relies on these products as a solvent for bonding additives. Its ability to dissolve and facilitate the adhesion of different materials is instrumental in the formulation of high-quality adhesives and sealants.

Furthermore, the market plays a vital role in the production of various plastics, including polyesters and polyethylene terephthalate (PET). These plastics have widespread use in industries such as packaging, textiles, and automotive, further contributing to the demand for products. The growing demand for end-use products in these industries serves as a catalyst for the growth of the market. As industries continue to innovate and advance, the demand for the market is expected to rise in tandem with the market's evolving needs and requirements.

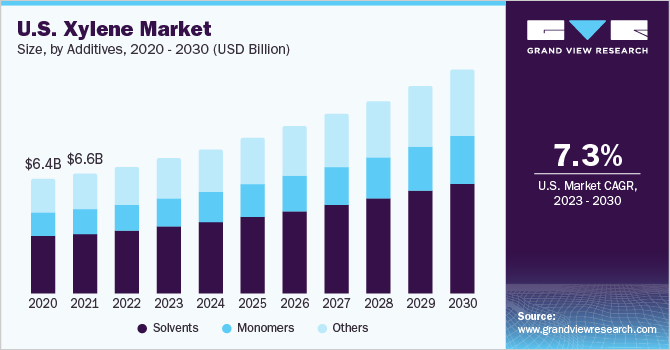

The demand for additives in the U.S. market is primarily fueled by their use as a solvent and as a constituent in various additives, such as monomers. The product serves as an important solvent in industries spanning from paints and adhesives to chemical manufacturing due to its exceptional solvency properties, making it highly effective in dissolving and mixing other substances.

Furthermore, the market plays a significant role in the production of monomers, which are essential building blocks for a wide range of polymers and plastics. It is commonly utilized in the synthesis of polyester resins like polyethylene terephthalate (PET). PET is extensively employed as a thermoplastic polymer in various applications, including packaging materials, textiles, and beverage containers. Consequently, the increasing demand for PET and other polymers contributes to the growing demand for xylene as a crucial additive in their production.

Overall, the U.S. market, encompassing solvents and monomers, thrives because of the diverse industrial applications and the surging demand for polymers like PET. These additives serve indispensable roles across various industries, and their demand is expected to continue rising in response to market advancements, emerging technologies, and sustainability initiatives.

Additives Insights

In terms of additives, the solvents segment dominated the market with a revenue share of 48.96% in 2022. This is attributable to the excellent solvency properties that make it a preferred choice in industries such as paints, adhesives, printing inks, and coatings. It acts as a powerful solvent, facilitating the dissolution and mixing of different substances. The ability to dissolve various materials effectively makes xylene an essential component in manufacturing processes across these industries.

A significant application of additives is their role as a constituent in monomer production. Monomers are vital building blocks for the synthesis of polymers and plastics. The product is commonly used in the production of polyester resins, including polyethylene terephthalate (PET). PET is widely utilized in packaging materials, textiles, and beverage containers. Xylene acts as a crucial additive in the production of PET, ensuring the desired properties and performance of the resulting polymers.

Additives also have applications in specialty uses. For instance, in the chemical industry, xylene is utilized as a raw material in the production of various chemicals, including phthalic anhydride, which serves as a precursor for plasticizers, dyes, and other chemical compounds. Xylene's versatility and compatibility with different processes enable its incorporation into a range of chemical applications.

Type Insights

Based on type, the mixed-xylene segment dominated the market in 2022 with a revenue share of more than 60.0 %. This is attributable to mixed xylene, as the name suggests, is a combination of the three isomers - ortho-xylene, meta-xylene, and para-xylene. It is primarily employed as a solvent in various applications such as paints, coatings, adhesives, and thinners. These product offers a balance of solvency power and evaporation rate, making it suitable for a wide range of industrial applications.

Ortho-xylene is a colorless liquid with a strong aromatic odor. It is primarily used as a solvent in various industries such as printing, rubber, leather, and pharmaceuticals. It also serves as a raw material to produce phthalic anhydride, which finds use in the manufacturing of alkyd resins, plasticizers, and polyester resins.

Meta-xylene is a colorless liquid with a pronounced aromatic scent. It is primarily utilized as a solvent and as an intermediate in the production of isophthalic acid, which is used in the manufacturing of resins, coatings, and polymers. It also finds application in the production of herbicides and various pharmaceutical compounds.

Furthermore, para-xylene, another isomer of xylene, is a colorless liquid that exhibits a sweet odor. It is extensively utilized as a feedstock to produce purified terephthalic acid (PTA) and dimethyl terephthalate (DMT). These compounds are vital in the manufacturing of polyester fibers, resins, and films that are widely employed in the textile, packaging, and automotive industries.

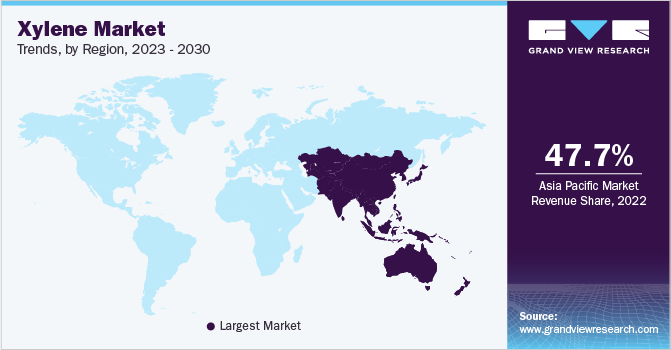

Regional Insights

The Asia Pacific region dominated the market in 2022 with a revenue share of 47.7%. This is attributable to the significant growth of the industrial sectors in this region. The demand for solvents and monomers in countries like China, Japan, India, and Malaysia contributes to the overall market growth. The region's booming manufacturing sector, including paints, coatings, adhesives, and automotive industries, generates substantial demand for xylene as a solvent. In addition, the rapid growth of the polyester industry, particularly in China, fuels the demand for the product as a key monomer in PET production.

In North America, the demand for additives, particularly solvents and monomers, remains robust. The manufacturing sector in the U.S. and Canada relies on the product as a solvent for various applications, ranging from paints and coatings to pharmaceuticals and plastics. Moreover, the region's strong focus on sustainability and recycling initiatives drives the demand for xylene as a component in the chemical recycling of PET and other plastics.

Europe also represents a substantial market for xylene additives, including solvents and monomers. The region's manufacturing and automotive industries fuel the demand for the market as a solvent in additives such as paints, adhesives, and inks. In addition, Europe's emphasis on sustainable packaging materials leads to increased demand for PET, further driving the need for xylene as a monomer in PET production.

Key Companies & Market Share Insights

The market for xylene is characterized by intense competition. Major players expanding into different regions are engaged in diversifying their product portfolio and extending their global reach. These manufacturing companies are forming various strategic partnerships and distribution agreements to cater to the growing demand for their products in new geographical markets. In 2023, Reliance Industries Limited (RIL) has decided to maintain the pricing of Mixed Xylene (MX) unchanged in the domestic market of India. Despite the current base price of INR 78/kg (~USD 1/Kg) for mixed xylene, the demand in the Indian market is expected to persist in its upward trajectory. Some prominent players in the global xylene market include:

-

Exxon Mobil Corporation

-

Reliance Industries Limited

-

INEOS

-

Mitsubishi Gas Chemical Company, Inc.

-

CNPC (China National Petroleum Corporation)

-

Chevron Phillips Chemical Company

-

Eastman Chemical Company

-

Honeywell International Inc.

-

Saudi Arabian Oil Co.

-

Royal Dutch Shell plc

Xylene Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 33.1 billion

Revenue forecast in 2030

USD 57.0 billion

Growth Rate

CAGR of 8.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in million tons, revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Additives, type, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Netherlands; Belgium; Russia; China; India; Japan; Malaysia; Vietnam; Indonesia; Australia; New Zealand; Brazil; Argentina; Columbia; Peru; Saudi Arabia; South Africa; UAE; Iran; Oman; Qatar; Kuwait; Nigeria; Angola

Key companies profiled

Exxon Mobil Corporation; Reliance Industries Limited; INEOS; Mitsubishi Gas Chemical Company Inc.; CNPC (China National Petroleum Corporation); Chevron Phillips Chemical Company; Eastman Chemical Company; Honeywell International Inc.; Saudi Arabian Oil Co.; Royal Dutch Shell plc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Xylene Market Report Segmentation

This report forecasts revenue & volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global xylene market report based on additives, type, and region:

-

Additives Outlook (Volume, Million Tons; Revenue, USD Billion, 2018 - 2030)

-

Solvents

-

Monomers

-

Others

-

-

Type Outlook (Volume, Million Tons; Revenue, USD Billion, 2018 - 2030)

-

Ortho-Xylene

-

Meta-Xylene

-

Para-Xylene

-

Mixed Xylene

-

-

Regional Outlook (Volume, Million Tons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Netherlands

-

Belgium

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Malaysia

-

Indonesia

-

Vietnam

-

Australia

-

New Zealand

-

-

Central & South America

-

Brazil

-

Argentina

-

Columbia

-

Peru

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

Iran

-

Oman

-

UAE

-

Qatar

-

Kuwait

-

Nigeria

- Angola

-

-

Frequently Asked Questions About This Report

b. The global xylene market size was estimated at USD 30.9 billion in 2022 and is expected to reach USD 33.1 billion in 2030.

b. The global xylene market is expected to grow at a compound annual growth rate of 8.0% from 2022 to 2030 to reach USD 57.0 billion by 2030.

b. Asia Pacific region dominated market with a revenue share of 47.7% in 2022. This is attributable to the significantly its growing industrial sectors in Asia Pacific.

b. Some key players operating in the xylene market include Exxon Mobil Corporation, Reliance Industries Limited, INEOS, Mitsubishi Gas Chemical Company, Inc., CNPC (China National Petroleum Corporation), Chevron Phillips Chemical Company, Eastman Chemical Company, Honeywell International Inc., Saudi Arabian Oil Co., Royal Dutch Shell plc

b. Key factors that are driving the market growth include that xylene is widely used in solvent and raw materials across various industries, including paints and coatings, adhesives and sealants, pharmaceuticals, plastics, and textiles.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.