- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Zero Friction Coatings Market Size & Growth Report, 2030GVR Report cover

![Zero Friction Coatings Market Size, Share & Trends Report]()

Zero Friction Coatings Market (2022 - 2030) Size, Share & Trends Analysis Report By Type (Polytetrafluoroethylene, Molybdenum Disulfide), By Application (Aerospace, Energy), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-991-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2020

- Forecast Period: 2022 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Zero Friction Coatings Market Summary

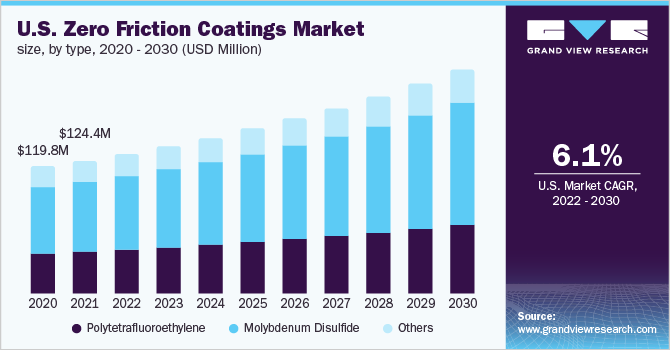

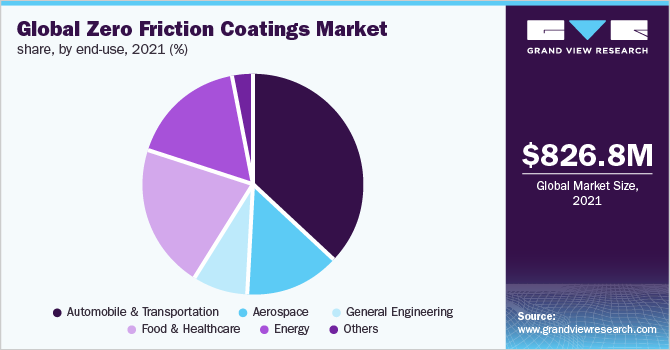

The global zero friction coatings market size was valued at USD 826.8 million in 2021 and is estimated to reach USD 1,346.00 million by 2030, growing at a CAGR of 5.6% from 2022 to 2030. The growing demand for zero friction coatings is attributed to their lubricating and corrosion protection properties which increase the wear life of a component across industries such as automotive, energy, and aerospace.

Key Market Trends & Insights

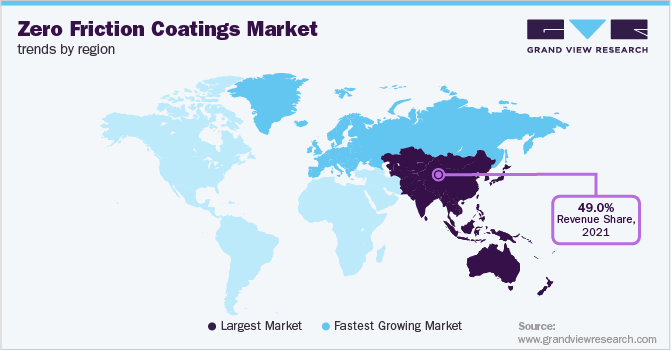

- Asia Pacific dominated region and accounted for a revenue share of 49.0% in 2021.

- Europe accounted for a revenue share of 16.8% in 2021 and is predicted to witness a CAGR of 5.5% over the forecast period.

- Based on type, the molybdenum disulfide (MoS2) segment dominated the market with a revenue share of over 50% in 2021.

- Based on formulation, the solvent-based segment dominated the market and accounted for revenue share of over 40% in 2021.

- Based on end-use, the automobile and transportation segment dominated the market and accounted for revenue share of over 35.0% in 2021.

Market Size & Forecast

- 2021 Market Size: USD 826.8 Million

- 2030 Projected Market Size: USD 1,346.00 Million

- CAGR (2022-2030): 5.6%

- Asia Pacific: Largest market in 2021

- Europe: Fastest growing market

Low friction coatings can also avoid noises thus making them suitable for use on any kind of material. The product improves performance, safety, and reliability by extending lubrication intervals, controlling wear and friction, preventing component failures, and reducing operating and production costs these coatings are generally applied at 10-20 µm dry film thickness. Zero friction coatings are applied either by dipping, spraying or using paint drums and centrifuges depending on the nature of the component being treated.

The method of making a zero-friction coating on the metal surface includes various steps such as forming an encapsulated powder that has grains made from a core of solid lubricants that includes at least MoS2 & graphite and a thin shell of fusable soft metal like copper, zinc, nickel, or others. Further, coating of uniform thickness of about 25-175 microns is then formed.

Type Insights

The molybdenum disulfide (MoS2) segment dominated the market with a revenue share of over 50% in 2021. The growth is attributed to properties such as high load carrying capacity and excellent adhesion. MoS2 is a dry film lubricant that prevents galling, fretting, and seizing to extend the wear life when operating at temperatures in the range of -350°F and +500°F. The coefficient of friction of this type of coating is 0.07. MoS2 coating solution is used for critical equipment and parts and is widely used in corrosion management as it is unreactive to most corrosive agents.

The polytetrafluoroethylene (PTFE) was the second-largest segment and accounted for a revenue share of over 30% in 2021 and is predicted to witness a CAGR of 5.4% in the coming years. The growth is attributed to its properties such as high dielectric strength, heat tolerance, non-sticks, and chemical resistance. The temperature tolerance of PTFE ranges from -518°F to 599°F thus making it suitable for use in bakeware applications. The carbon-fluorine bonds of PTFE are extremely flexible and non-reactive which makes it an excellent electrical insulator. These coatings find applications in the medical field in the manufacturing of medications, in the tech sector for producing high-tech parts and tools, and in other industrial applications.

Formulation Insights

The solvent-based segment dominated the market and accounted for revenue share of over 40% in 2021. The growth is attributed to the less susceptibility of these coatings to environmental conditions including humidity and temperature during the curing phase.

The water-based coating was the second-largest segment and accounted for a revenue share of over 35.0% in 2021 and is predicted to witness a CAGR of 6.1% in the coming years. The growth is attributed to low volatile organic compound (VOC) content, resilience against accelerated aging exposures, and the ability to be pigmented. It also shows lower friction along with extended weathering.

End-use Insights

The automobile and transportation segment dominated the market and accounted for revenue share of over 35.0% in 2021. This is attributed to their ability to reduce noise making them ideal for automotive applications where they are used to reduce cabin noise which is a priority in cars these days. The growing sales of automobiles across the globe coupled with the rising adoption of electric vehicles is anticipated to drive the growth of the automotive industry which in turn is likely to have a positive impact on the zero friction coatings market.

The food and healthcare was the second-largest segment and accounted for a revenue share of over 20.0% in 2021. The growth is attributed due to increased need of coatings for parts used on food packaging and processing equipment for providing non-stick, wear resistant, and non-wetting surfaces. In healthcare sector, low friction coatings are used in analytical and surgical instrumentation, autoclave and sterilization equipment, and packaging of pharmaceutical products.

The energy segment accounted for a revenue share of 17.0% in 2021 and is expected to witness a CAGR of 5.7% in the predicted years. The growth is attributed to the exposure of materials to extremely harsh environments in the oil and gas industry. Properties of the product including temperature resistance, corrosion resistance, UV protection, chemical protection, and others are likely to foster its demand in the energy sector over the forecast period.

Regional Insights

Asia Pacific dominated region and accounted for a revenue share of 49.0% in 2021. The growth is attributed to the presence of automotive manufacturing industries in the countries such as Japan, South Korea, and China. The Association of Southeast Asian Nations is the seventh largest automotive manufacturing hub across the world and produced around 3.5 million vehicles in 2021. The region has a presence of some of the leading automotive manufacturers including Honda, Toyota, Ford, BMW, and others. The growing automobile industry in the region is predicted to fuel the demand for zero friction coatings in the predicted years.

According to the International Trade Administration, China is the largest automotive market across the globe with domestic production of vehicles expected to reach 35 million by 2025. The motor vehicle imports of the country have decreased from 1,246,800 in 2017 to 927,632 in 2020. This is likely to foster the domestic production of vehicles thereby having a positive impact on the market in the coming years.

Europe accounted for a revenue share of 16.8% in 2021 and is predicted to witness a CAGR of 5.5% over the forecast period. According to the European Automobile Manufacturers Association, the commercial production of vehicles in Europe grew by 4.9% in 2021 despite supply chain constraints. The U.K. was a leading country in the exports of commercial vehicles from the region in 2021 accounting for a market share of around 29.5%. The automotive sector contributes around 7% of the GDP of the European Union. The growing automobile sector in the country is expected to bolster the demand for zero friction coatings in the region in the near future. Some of the leading automotive manufacturers in the region include Volkswagen, Daimler, BMW, Stellantis.

Key Companies & Market Share Insights

Major manufacturers are engaged in adopting several strategies including joint ventures, business expansions, and new product launches to increase their market presence. For instance, In June 2020, Poeton launched a new low friction coating named Apticote 480A having a remarkably low coefficient of friction with a 75.0% reduction as compared to their previous offerings. Some prominent players in the global zero friction coatings market include:

-

Endura Coatings

-

DuPont

-

VITRACOAT

-

Poeton

-

Bechem

-

ASV Multichemie Private Limited

-

GMM Coatings Private Limited

-

IKV Tribology Ltd.

Zero Friction Coatings Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 868.65 million

Revenue forecast in 2030

USD 1,346.0 million

Growth Rate

CAGR of 5.6% from 2021 to 2030

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, formulation, end-use, region

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Russia; Netherlands; China; Japan; India; South Korea; Indonesia; Thailand; Brazil; Argentina; Colombia; Turkey; South Africa; Morocco

Key companies profiled

Endura Coatings; DuPont; VITRACOAT; Poeton; Bechem; ASV Multichemie Private Limited; GMM Coatings Private Limited; IKV Tribology Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

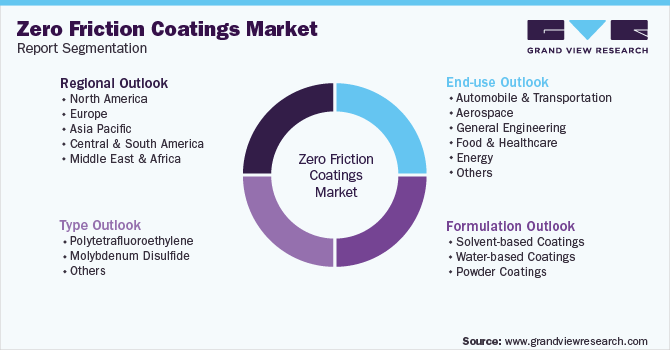

Global Zero Friction Coatings Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global zero friction coatings market report on the basis of type, formulation, end-use, and region:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Polytetrafluoroethylene

-

Molybdenum Disulfide

-

Others

-

-

Formulation Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Solvent-based Coatings

-

Water-based Coatings

-

Powder Coatings

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Automobile & Transportation

-

Aerospace

-

General Engineering

-

Food & Healthcare

-

Energy

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Russia

-

Netherlands

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Indonesia

-

Thailand

-

-

Central & South America

-

Brazil

-

Argentina

-

Colombia

-

-

Middle East & Africa

-

Turkey

-

South Africa

-

Morocco

-

-

Frequently Asked Questions About This Report

b. The global zero friction coatings market size was estimated at USD 826.8 million in 2021 and is expected to reach USD 868.6 million in 2022.

b. The global zero friction coatings market is expected to grow at a compound annual growth rate of 5.6% from 2022 to 2030 to reach USD 1,346.0 million by 2030.

b. Asia Pacific dominated the zero friction coatings market with a share of 49.0% in 2021. This is attributable to the presence of automotive manufacturing industries in the countries such as Japan, South Korea, and China.

b. Some key players operating in the zero friction coatings market include Endura Coatings, DuPont, VITRACOAT , Poeton, Bechem, ASV Multichemie Private Limited, GMM Coatings Private Limited, and IKV Tribology Ltd.

b. Key factors that are driving the market growth include the growing demand for zero friction coatings owing to their lubricating and corrosion protection properties which increases the wear life of a component.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.